Evidence based investing strategies are really the bread and butter in terms of what we like to explore here at Picture Perfect Portfolios.

With factor tilts?

Well, that makes things even more intriguing!

I’ve come to realize financial planners and advisors are some of the most well informed and in-the-know investors out there.

It’s been a real pleasure getting to connect with curious investors on Twitter.

Hence, I’m thrilled to welcome Mark Meredith, CFP® to the “How I Invest” series to explore evidence-based investing strategies in greater detail.

I could ramble on further but let’s turn things over to Mark!

Evidence Based Investing Strategies As A Factor Investor: How I Invest with Mark Meredith

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Mark Meredith, CFP®

Mark Meredith, CFP® has been a financial planner for over a decade and is the founder of Meredith Wealth Planning, a flat-fee registered investment advisor located in Southwestern Illinois.

As of December 2022, Meredith Wealth Planning has over $185 million in assets under advice for over 150 client households.

Shoot From The Hip To Evidence Based Investing

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

When I was in high school my father would incentivize me to read different books on investing.

He’d offer me $50 to read certain books.

Once it came time to collect payment, he’d offer to double the amount if I put the money in my investment account as opposed to taking the cash.

It was a good system.

The first one I remember reading was John Bogle’s “Common Sense on Mutual Funds”.

Unfortunately for me, the wisdom from that book did not initially stick. During my college years I decided to trade options between classes (AKA gambling) and pick stocks.

After my semester in Finance Derivatives, I thought I was an expert.

I wasn’t, of course.

I completed my degree in Finance with a concentration in Financial Planning just two weeks after my 22nd birthday, and decided to plunge into a career as a financial planner.

Shortly into my advisory career, I knew it was my job to take the profession seriously as people would be entrusting me with wealth, they spent their lives accumulating.

Further, as a 22-year-old who the hell was going to listen to me unless I really knew my stuff?

That meant ditching my “shoot from the hip” approach to investing.

Since broker-dealers do not give much guidance to evidence-based investing strategies, I decided to revisit the old books my father paid me to read and go from there.

I found a book in his basement called “Wise Investing Made Simple” by Larry Swedroe, and had my epiphany.

Realizing how little I knew while trying to trade options and pick stocks, I became quite obsessed with reading all of Larry Swedroe’s other books (I believe he has now written over 15 of them), as well as his blogs.

I loved his “evidence-based” approach and that all his findings were cited with research, as opposed to personal opinions and guesswork.

Swedroe’s books led me to other great writers such as William Bernstein, Michael Mauboussin, Wes Gray, Nick Murray, and Nassim Taleb which all have helped shape the investment philosophy I have today.

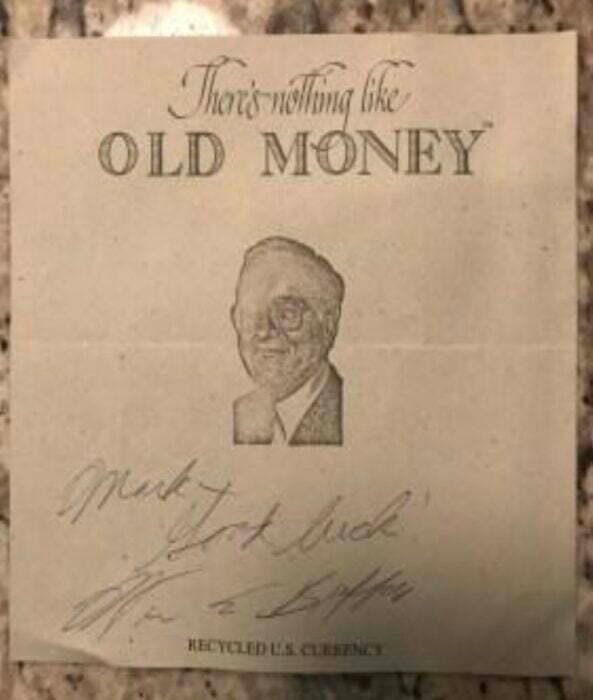

Letter From Warren Buffett: There’s Nothing Like Old Money

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

I learned a lot about money in the household I was raised.

My father owned a Heating and Air Conditioning business but was able to find time to educate himself to be a successful DIY investor, after numerous unpleasant encounters with financial advisors.

He knew the power of owning equities in a passive manner over one’s lifetime (while controlling costs and taxes) and even motivated me to do my 5th grade science project on a short-term stock trading strategy compared to buy and hold returns.

He wrote Mr. Warren Buffett to tell him about my project, and Buffett responded with a little note on recycled US Currency:

I was encouraged to get a summer job when I was 15 and began working 40 hours a week at a local horseradish farm.

I was able to put $75 a month into my Vanguard account throughout the year, and continued to regularly save ever since then.

It helped that I was not liable for any household expenses back then.

Given my education about the power of equities at a young age, I knew to never fear the short-term downturns, but my mistake was assuming everyone knew this stuff.

They don’t.

My first week as a financial advisor at a local bank I encountered a customer that refused to invest their money in anything that was not FDIC insured.

At first, I thought that person was an anomaly, but I realized that was the norm within the bank and many people were so risk averse that it caused severe harm to their wealth accumulation and standard of living.

Investments You Make Should Be Viewed As A Lifelong Journey

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

Most investments you make should be viewed as a lifelong journey, or at the very least a multi-decade approach.

Every investment you own will suck at times, sometimes for many years.

This is normal, and it does not mean you should deter from that strategy.

You diversify among different assets because you don’t know what’s going to do well and when.

You should only consider an investment for your portfolio that you will be able to stand behind and continuously plow money into when things are bad.

If you are going to question the methodology of your investment simply because it has been falling in value, it is not a good fit for your portfolio.

Any strategy you implement in your portfolio should have a sensible explanation as to why it will continue to survive and add value in the long-term.

Do not view any potential investment in isolation but in the context of a portfolio and how it fits in and affects everything else.

Gross returns don’t matter, what you keep after taxes and inflation does.

Stop trading options.

Factor Based Investor: Tilts Towards Value And Profitability

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

AVES/DEMSX = 25%

AVDV/IVAL = 25%

AVUV = 50%

My allocation has been pretty static for a number of years now.

The Avantis ETFs shown above were successors to DFA funds I held previously.

When Avantis launched in 2019, they had undercut DFA’s fees by a sizeable amount, offered what I believe is a superior methodology, and threw it all into a tax-efficient ETF wrapper.

It seemed like an easy decision at the time.

I still love DFA and would never hesitate to recommend their funds.

I had been using Alpha Architect for international value as opposed to DFA, and decided they didn’t need to be replaced so I started allocating money to both AVDV and IVAL for my international developed allocation.

DEMSX gets an investor a little more exposure to size in EM, but AVES is where I get most of my EM value exposure.

I am still saving a high percentage of our household income each year into our portfolio, so I have zero cares about short-term performance.

I believe when I originally decided my US/NON-US split the total US market cap was about half of the global market cap so that’s what I’ve used and never really changed it.

I have an overweight to EM, no rhyme or reason behind it, just splitting it equally with international developed.

I have no guess as to why country or region will perform best going forward, and believe in global diversification.

As a factor based investor I wanted to tilt heavily towards value but also incorporate profitability, which all of the funds do.

This portfolio will probably look the best when non-US is outperforming US, and when small cap value stocks are outperforming.

The Biggest Enemy Of A Good Portfolio Is The Perfect Portfolio

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

After you get the big picture of the portfolio right (which is to diversify broadly across asset classes, in a passive, low-cost, tax-efficient manner while tilting towards factors), most of the skill one needs to achieve success will be on the behavioral front and not tinkering the hell out of everything as new funds come along.

The biggest enemy of a good portfolio is the perfect portfolio.

There are added benefits to staying on top of the research to ensure you are not in an approach that no longer works, or to see if another strategy may complement your portfolio.

I found a change that made sense in 2019 by moving from DFA to Avantis but I find major changes like that are few and far between.

Now that DFA has lowered fees and offered ETFs, the differences between them and Avantis are not terribly significant.

All In One Fund vs Extreme Factor Exposure

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

A watered down Mark Meredith portfolio would be an all in one fund like AVGE, that is offered through Avantis.

The tilts are a little bit less extreme, although still impressive.

You can buy one ticker symbol instead of 5-10, be tax-efficient as hell, and keep costs low.

I suspect a targeted exposure to the profitability or momentum factor would help reduce tracking error a bit as well, which is a strategy I incorporate with clients.

My view on factor investing is that Alpha Architect offers the extreme factor exposures through their funds like QMOM, IMOM, QVAL, and IVAL.

This would be the more aggressive approach.

These ETFs are much less diversified than what you would see through Avantis and DFA (Alpha Architect’s factor funds generally will only hold 40-50 stocks compared to 500+ for Avantis), and ideally that would lead to a larger premium being harvested with those funds over time (and premium pain in bad times).

They are not for the faint of heart (which they are happy to admit) and come with more significant tracking error.

I would suggest an investor needs to be rock solid from a behavioral standpoint to ratchet it up to that level and stick with it.

source: Excess Returns on YouTube

Not Quick To Dismiss But Slow To Adopt New Strategies

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

My greatest strengths are that I don’t get worked up about market moves, good or bad, and that I am still in peak accumulation years being a 34-year-old investor.

I have a long runway ahead of me to “compound my face off” (as Mr. Wes Gray likes to say).

Munger famously stated that if you can’t stomach to watch your investments get cut in half about 3-4 times in your life then you deserve the mediocre returns you’re going to get.

My greatest weakness is my general skepticism about many investment strategies.

I am not quick to dismiss any new quant strategy or creative investment idea that I come across but sometimes I am slow to accept them.

Larry Swedroe and Andrew Berkin’s Complete Guide to Factor Based Investing has helped with this weakness a good bit, as they laid out that a factor must meet the following criteria to be considered worthy as an investment:

Persistent – It holds across long periods of time and different economic regimes.

Pervasive – It holds across countries, regions, sectors, and even asset classes.

Robust – It holds for various definitions (there is a value premium measured whether by price to book, earnings, or cash flow).

Investable – It holds up not just on paper, but after considering implementation issues.

Intuitive – There is a logical risk based or behavioral explanation for the premium return and why it should continue.

I find that criteria to be very helpful when evaluating investments, or new factor-based strategies.

Bonds Are Not Safer Than Equities In The Long Run

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

On a real basis, I don’t believe that bonds are safer than equities in the long run.

The long-term real drawdowns of bonds historically have been worse than equities.

Bonds can offer some volatility reduction benefits in the short run, but values can be eroded by inflation in a sustained inflation environment.

We are currently in an environment that has seen negative real returns on bonds on an annualized basis since 2010.

There have been other eras from 1940 – 1960, One-Month US T-Bills trailed inflation by 2.4% annualized which would have erased nearly 40% of one’s wealth.

Return Stacking: Potential To Improve Your Portfolio’s Risk/Reward Profile

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

Return stacking is quite an interesting subject.

Personally, I’ve never had much interest in alts because I’d hate to give up precious portfolio space that could be allocated towards equities and there is the fact that you would need a meaningful allocation to alternative investments to actually make a difference in the risk/reward output.

Given that return stacking does appear to offer a way to have a meaningful impact on your portfolio’s risk/reward profile without allocating a bunch of your precious space towards alts, I find that appealing.

As with everything else, I am interested to see how efficient this would be for a taxable investor.

The Antithesis Of A Well-Rounded Factor Based Investing Approach

What would be the ultimate anti-Mark Meredith portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Small cap unprofitable growth stocks with negative price momentum.

This would be the antithesis of a well-rounded factor based investing approach, and would get you great exposure to the short-leg of many academically accepted factors.

This corner of the market provides a lot of lottery ticket like opportunities for degenerate gamblers (whoops I mean “investors”), which I suppose some people find appealing (because saving and investing for the long haul takes too much patience).

Maybe their odds are a hair better finding a winner in this ugly market segment than in the real lottery.

Also, if I ever tweet or message you that I am excited about a recent investment I made into anything crypto-related, that should be my clear signal that I have been taken hostage and am in immediate danger.

Please contact the authorities and rescue me.

Evidence-Based Factor Investing with Mark Meredith, CFP® — 12-Question FAQ on Tilts, Tracking Error, and Building a Behavior-Proof Portfolio

What does “evidence-based factor investing” mean in practice?

It’s a rules-driven approach that tilts a broadly diversified portfolio toward academically vetted return drivers—like value, size, profitability, and momentum—that are persistent, pervasive, robust, investable, and intuitive. The aim is to improve risk-adjusted returns versus plain market-cap indexing over full cycles.

Which core factors does Mark emphasize—and why?

Mark highlights value (cheap vs fundamentals) and profitability/quality (strong cash flows, margins), often paired with size (smaller companies). These tilts have long-run evidence and complement each other: value seeks re-rating; profitability helps avoid value traps; smaller caps can add diversification and potential premia.

How does his current equity mix look at a high level?

He allocates across US small/value and international developed + emerging value/profitability sleeves, using tax-efficient ETFs. The design spreads factor risk globally while concentrating exposure where expected premia have historically been strongest (e.g., small/value).

Why Avantis (and sometimes DFA or Alpha Architect)?

Avantis (ex-DFA leadership) offers efficient, rules-based tilts in ETF wrappers with competitive fees. DFA remains a stalwart for factor consistency. Alpha Architect provides higher-octane, concentrated factor funds (e.g., deep value or pure momentum) for investors who can stomach more tracking error.

What’s the “toned-down” versus “more aggressive” version of this approach?

Toned-down: a one-ticket, globally diversified factor-aware “all-in-one” ETF (e.g., lighter tilts, broad diversification, lower tracking error).

Aggressive: concentrated factor funds (e.g., 40–50 holdings) with deeper value or momentum exposure—potentially higher long-run payoff and higher tracking error.

What is tracking error—and how should investors think about it?

Tracking error is how much a portfolio’s returns deviate from a benchmark (e.g., MSCI ACWI). Factor tilts can underperform for years, so the main challenge is behavioral: staying the course during “premium pain” instead of abandoning the strategy near a turning point.

When does this portfolio tend to shine—and struggle?

It typically shines when value and small caps lead and when non-US markets outperform the USA. It can lag during mega-cap growth leadership or momentum-driven surges that bypass value/profitability screens.

How does Mark manage the “perfect vs. good” portfolio dilemma?

He prioritizes a durable, low-cost, tax-aware, rules-based framework and resists constant tinkering. He updates only when there’s a clear net benefit (e.g., fee cuts, better implementation), not because of short-term performance.

Where do bonds and “return stacking” fit into this worldview?

He views bonds as useful for near-term volatility control, but warns their long-run real drawdowns can be severe. He’s curious about return stacking (using overlays to add diversifiers without giving up equity space) and weighs its tax/implementation realities for taxable investors.

What are the biggest behavioral guardrails investors should adopt?

Define the investment thesis upfront, fund it automatically, and plan for multi-year underperformance. Judge strategies in-portfolio (how the pieces fit together), not in isolation. Know your sell disciplines and rebalance on rules, not feelings.

Who is this factor approach best suited for?

Investors who value process over prediction, can withstand tracking error, and want global, tax-efficient, rules-based equity exposure with clear rationales for why premia should persist (risk-based and/or behavioral explanations).

What’s the anti-portfolio (and why avoid it)?

A portfolio of unprofitable small-cap growth with negative momentum—the mirror image of preferred tilts—can be a lottery-ticket bet with high volatility and poor expected returns. It’s the opposite of a disciplined, evidence-based process.

Connect With Mark Meredith

Twitter: @marktmeredith

Linkedin: https://www.linkedin.com/in/marktmeredith/

Subscribe to blog at www.meredithwealth.com

Nomadic Samuel Final Thoughts

I want to personally thank Mark for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.