The older I get, the more I appreciate risk management when it comes to volatility.

It’s not just about dialling up offensive assets to the moon.

Sequence of returns, maximum drawdowns and all-scenario outcomes are paramount.

Today we’re fortunate enough to have Yang Tang join us for the “Strategy Behind The Fund” series to discuss a fund that attempts to do just that.

Arch Indices VOI Absolute Income ETF.

Ticker VWI.

Its mandate is clear: “To create a portfolio that has the most amount of income/returns relative to volatility.”

Let’s turn things over to Yang to find out more!

Meet Yang Tang of Arch Indices

My family immigrated from China when I was 5 and I grew up in Silicon Valley. During the dot-com boom when I was in middle school, I purchased my first stock and have been fascinated with financial markets since. I graduated college and my first job in finance was in equity research where I covered semiconductor stocks. I quickly realized how difficult active management and stock-picking was and took a job on the commodities sales desk at Barclays. I discovered my passion was more in the quantitative and macro side of finance.

I got my MBA from Columbia Business School and was hired into the Morgan Stanley Fixed Income Associate program where I worked in the Global Macro Solutions (GMS) group. I worked with hedge funds and financial institutions on structured derivatives and financing solutions. I moved over to Citi to help build out the Structured Rates group and where I met my co-founder, Dr. Jacob Kuang. Post-Citi I worked at two European banks building out their Solutions Sales desks in the US.

I spent my career focused on structuring and selling derivative and financing solutions to financial institution clients. My clients utilized these products for yield enhancement, asset-liability management, capital management, and tactical hedging opportunities.

Dr. K retired around the time I left Citi and we reconnected during COVID as we talked about the craziness of what people were doing with their money in the markets. We started Arch Indices with the idea of the optimal portfolio and how we would want to manage our own money: getting to the goal with the least amount of volatility.

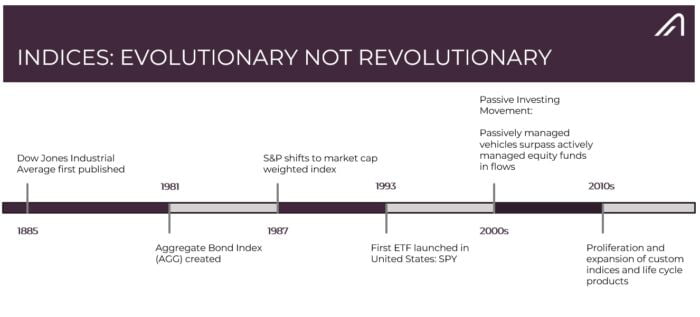

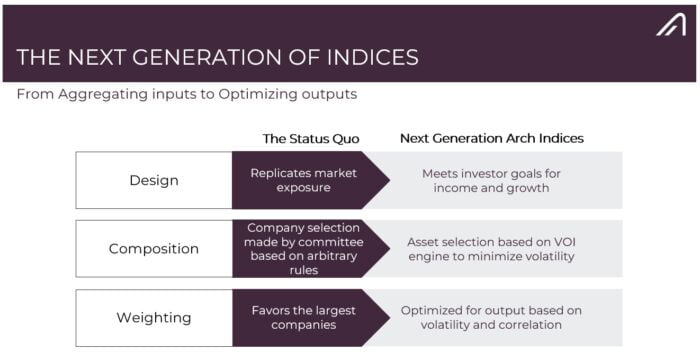

There’s a big gap between passive indices today and active management. An index is a derivative product but how a bank builds a derivative for a client is vastly different from how an index company puts a product out. We believe the opportunity is in the middle: passive, transparent, rules-based products that meet a client goal, minimize volatility to get to that goal, and dynamically rebalance with changing market conditions.

Reviewing The Strategy Behind VWI ETF (Arch Indices VOI Absolute Income) with its creator Yang Tang

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

What’s The Strategy Of VWI ETF?

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

For those who aren’t necessarily familiar with a “maximizing income while simultaneously minimizing volatility” style of investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Our strategy is an optimization: You’re looking for the portfolio that has the most amount of income/returns relative to volatility. This builds off the idea from the Modern Portfolio Theory of the efficient frontier: the portfolio that provides the most risk-adjusted return.

In practice the MPT is largely academic: it’s based on the assumption you can forecast expected returns. The track record of optimizations has been mixed historically due to inability to forecast returns and volatility and using a co-variance matrix for a large number of assets in this process.

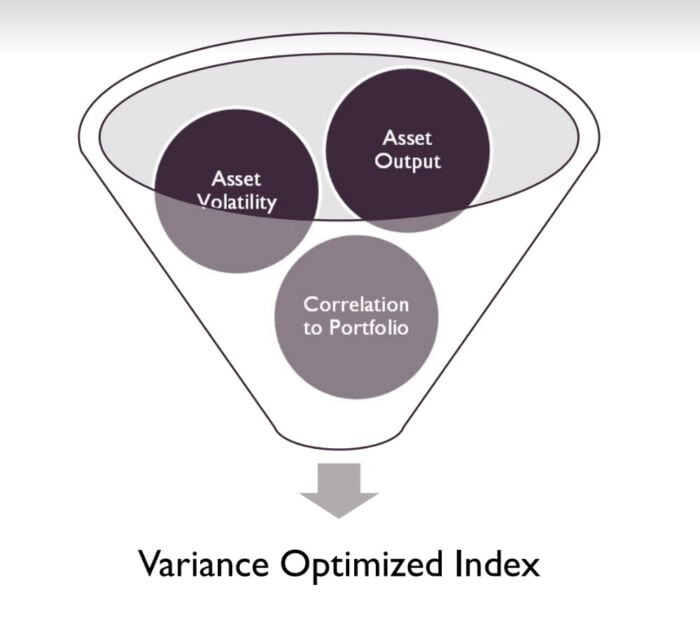

Our approach is different: we focus on an observable output instead of forecasting returns and we built a proprietary approach to get around the limitations of a matrix for portfolio construction. We take into account the asset’s yield and volatility (the performance ratio) and the correlation to the entire portfolio.

What you end up with is a portfolio that meets the criteria for inclusion, has high yield relative to volatility but they don’t move together which is another added layer of volatility reduction.

Our ETF, VWI, seeks to maximize current income. It is composed of dividend stocks that meet the criteria (minimum 2bn mkt cap, 20mm 3m daily avg trading volume, 3% dividend yield, and 5y dividend history) and the 12 bond ETFs that represent the different parts of the bond market. There are close to 600 individual stocks for inclusion but usually you need about 60-110 stocks and 6-9 bond ETFs in this portfolio. It’s about 81% dividend stocks and 19% bond ETFs at the moment. Historically it’s been 70-80% stocks and 20-30% bond ETFs.

source: Schwab Network on YouTube

You can apply this to a number of different goals/factors. For example if you want to build a portfolio of stocks with strong free cash flow. You would simply just change the output target to cash flow yield and look for the portfolio of assets that have high FCF yield relative to its volatility that don’t move together.

The applications of optimized portfolios are sizeable and provide an attractive alternative to static and arbitrary passive indices/weighting regimes and ineffective and costly active management.

Unique Features Of Arch Indices VOI Absolute Income VWI ETF

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

Our fund is quite unique: it is a passive and rules-based ETF that dynamically rebalances quarterly with changing market conditions. We do not use any leverage or derivatives inside: everything comes from how we construct the portfolio.

We believe in as little human inputs as possible: human biases cause errors and reduce performance. We have a transparent criteria for inclusion of stocks which differs from “passive” index companies with a closed-door committee that decides which stocks get to be included when (S&P). We run our optimization according to the index methodology and have a third-party index calculation agent.

The only human discretion is in the design of the index. We don’t believe in making market calls: the error rate of market calls is very high. We believe in a well-designed transparent rules-based approach.

VWI is also unique amongst ETFs that are meant to be “low volatility.” Many of these ETFs just take the lowest volatility percentile but do not give any consideration to how those stocks move together. If these stocks are concentrated and an event happens, they aren’t “low volatility” anymore and the portfolio would have the wrong exposure.

There is the USMV ETF which tracks a MSCI index and uses correlation as an input. We are unique in that we have a goal of income (USMV just looks for the lowest volatility portfolio with no consideration of the goal/factor) and we do not use a matrix optimization approach (USMV does) which has issues for a large number of assets. Just using correlation without a goal misses the factor the portfolio seeks.

We have an expense ratio of 0.50% (0.60% with a 0.10% fee waiver) and additionally 0.02% acquired fund costs from the bond ETFs we hold.

VWI is an excellent income product: it has high current income with 7% index portfolio yield, low realized volatility relative to common income products, and has potential for capital appreciation from holding 81% dividend stocks.

source: ETF Central on YouTube

What Sets VWI ETF Apart From Other Funds?

How does your fund set itself apart from other asset allocation funds being offered in what is already a crowded marketplace?

What makes it unique?

What sets us apart is our optimization approach and portfolio construction. Almost all existing funds use an arbitrary and static weighting approach. It’s not that 60/40 is a bad idea, it’s a great idea. But if returns, volatility, and correlation between stocks and bonds change every year, why would you stay with the same weightings.

You can see the results of our approach YTD. In a year where bonds and dividend stocks are down, bond volatility is multi-year highs (stock volatility was not low most of the year), and correlation between S&P and 30y bonds hit a generational high, we have both a positive total return and low realized volatility.

The approach is even more stark when you compare us to just owning dividend stocks. We have run 71% of the realized volatility of the DJDVP (DJ dividend index) but similar total returns over the last 5.5 years. We also provide the higher current income (7% vs 4%) that income investors are seeking.

What Else Was Considered For VWI ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We kept this fund to just dividend stocks and bond ETFs. There’s many interesting things you can build into this which we offer in SMA format. One thing we preach heavily on is tail hedging and we debated for a long time about adding it into the ETF. We ultimately didn’t because it involves a lot of human judgment on what is a cheap and effective tail hedge: it’s more of an art than a science.

This is the biggest concern in correlation strategies: everything moves rapidly down together (correlation “1” aka market crash). Many investors seek to reduce “tails” in terms of outcomes. A great example is Bill Ackman owning a conditional credit spread widener right before COVID hit that provided a huge payout when markets crashed in March 2020. It provided liquidity at a time when it was expensive, reduced the volatility of the portfolio, and gave him firepower to buy assets on the cheap.

Tail hedging is beneficial to an investor because it reduces volatility and downside risk. Less volatility and downside risk gives the investor better ability to stick with strategies in tough markets, source of liquidity when liquidity is scarce, and potentially add more risk to benefit from rising markets.

Over the long run, tail hedging is a net money loser the same way insurance is a net money loser. However a dollar doesn’t always have the same value: a dollar in March 2020 has much more value than a dollar in March 2021. For a tail hedge to work you need to understand the market dynamic of the asset and why this structure has a supply/demand imbalance. Many of the textbook examples of great tail hedges arose from a supply/demand imbalance in derivative markets.

We worked with a lot of our institutional clients over the years on tail hedging and owning downside protection. We really believe in it but it would’ve required us to make human judgment on what is a cheap/effective tail hedge and find two-way liquidity for open-end fund rules. A lot of these trades that worked really well had no two-way liquidity: either it paid off or you lost the premium paid. It’s not clear how to synthesize this in a systematic manner. It doesn’t benefit an investor to buy expensive tail hedges.

We write a lot on this topic, it’s very mentally stimulating for us. We’ll keep working on this for the ETF wrapper and hopefully find a way down the road.

When Will VWI ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

Our index went live in May 23 so this backtest goes back five years. This is a great time period for backtesting because of the events it captured: 1) the moderate hiking cycle pre-COVID, 2) COVID, 3) the most aggressive Fed/global central bank hiking cycle in almost 3 generations, and 4) collapse of 3 major US regional banks.

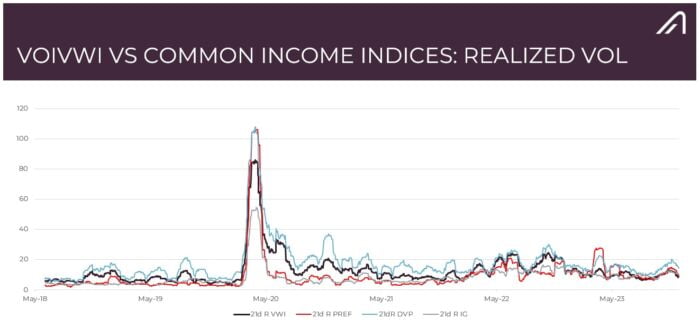

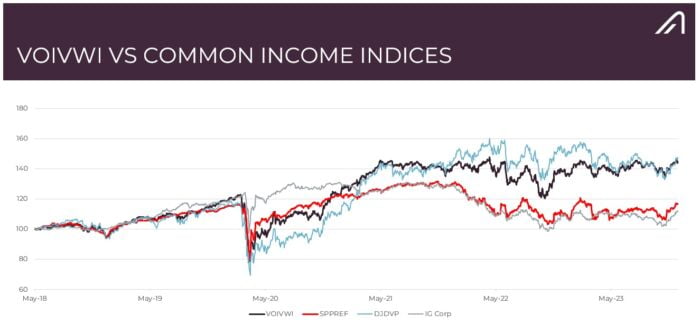

We have a few charts here and we compare our total return and 21d realized volatility to dividend stocks (DJDVP), preferred stocks, and IG corporates.

We did really well for the majority of time: less drawdown during COVID and faster recovery. Where we struggled was in 2022: this is due to the portfolio construction process. We dynamically rebalance every quarter: if things change rapidly intra period, then the portfolio is not “optimal” and needs to be rebalanced. In 2022, the Fed hiked aggressively and things changed rapidly. We refer to this as correlation gamma: the change in correlation.

2023 was much better in performance. This is a year where both bonds and dividend stocks struggled, bond volatility hit multi-year highs, and correlation between S&P500 and 30y bonds hit a generational high. We had both positive total return and low relative volatility. What sets 2022 and 2023 was the pace of change in correlation. The level of correlation itself is not the concern as you already observe this, it’s the rapid change that is concerning.

We stack up well against dividend stocks: similar total returns over this period but we only realize 71p of the volatility.

This stacks up well against preferreds: preferreds are 80% financial issuers and 50% bank issuers. They’re hybrid instruments which means there’s little capital appreciation potential. Many investors think they’re a high income and low volatility asset: a lot of days that is true, just not the days it matters. Preferreds became the most volatile asset class in March 2023. When a bank goes under, there’s no recovery value for preferred holders. SVB/First Republic preferreds have no value. In Europe CS coco went to 0 as well. It’s a very negatively convex asset class.

Why Should Investors Consider Arch Indices VOI Absolute Income VWI ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Almost no investor is investing solely for market exposure: there’s an underlying goal. At the institutional level there is liquidity management for banks, LDI for insurers/pension, and mission support for endowments. At the household level it is saving for retirement, funding kids’ college education, preserving generational wealth.

The current asset allocation models are mostly static and investors are increasingly questioning that. There’s been a lot of debate over 60/40 the last two years and the static nature is not meeting investor needs.

2023 saw active ETFs out-launch passive ETFs by almost 3-1 (we are passive). Investors aren’t turning to active ETFs because they like the idea of paying more or that there is a tide shift to active management, it’s because the current generation of passive indices and static asset allocation do not meet investor needs.

There’s a big gap between active strategies and passive indices today. Our products fill that gap: many mutual funds have a low volatility angle but come with the flaws of human judgment. Fees aren’t everything: it’s one part of the conversation. Investors love the ETF wrapper: many investors we talk to are migrating their entire portfolios to ETF format. They need better IP.

VWI is an income portfolio in a box. It solves for you the optimal asset allocation and dynamically rebalances every quarter in a tax efficient manner. It delivers you high current income, low volatility, and positive convexity through potential for capital appreciation. This comes with a lower expense ratio than many mutual funds that seek to do the same and have no sales loads.

How Does VWI ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

It works in a number of scenarios for income investors. It can be a total portfolio solution especially if you have a smaller portfolio or just want an income portfolio in a box that you can buy and hold to generate income. We’ve actually had a number of conversations with advisors on using it for smaller accounts that don’t meet the minimums for their strategies or are sprinkling in slowly. Advisors like the idea of having market exposure, income, and low volatility instead of holding cash or “TBill and chill.”

This can be a core holding for an investor who needs the income but needs to reduce market volatility. It’s a great alternative to an arbitrary target date fund (almost no investor benefits from those given the wide range of circumstances and arbitrary construction). It’s just dividend stocks and bond ETFs so you can layer additional assets and/or exposures. It’s transparent so you always know what you have and can add/reduce as needed.

We’ve had numerous conversations on VWI replacing “negatively convex” income parts of portfolios. Preferreds, mortgages, covered calls are all great examples. They have limited potential for capital appreciation and are short volatility. An investor who owned a covered call ETF saw no price appreciation this month while VIX is at the lows (which implies next month’s premium should be cut unless they pay out of principal).

Preferreds are heavily exposed to financials (80% exposed to financials) and have no upside given the nature of the asset (ask the SVB preferred holders how their investment is doing .. or even Fannie/Freddie in 08). We have a whole write-up on the issues in the regional banking sector between underwater securities and CRE loan concerns.

Mortgages are very tricky: the homeowner can prepay anytime and while it follows rates, there’s a bunch of factors. It’s quite likely there’s a big refi wave coming when rates drop and you will have to re-invest at lower yields (short convexity because that limits your price appreciation).

The Cons of VWI ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

A lot of the criticism has been around the education process. Admittedly it’s not an easy product to explain and in the beginning we were too technical discussing it. We lost a lot of interest that way. I have to ground myself a bit because I tend to speak in a lot of industry terms that the average investor isn’t familiar with. I’ve been working on simplifying it and letting people know the resources available to learn more.

A few of the criticisms of the fund/process have been: 1) no one has ever shown a bad backtest, 2) the fund is too new, and 3) the fund AUM is too small. Our ETF has great risk-adjusted performance since being live, the index has as well (went live in May). The ETF is performing as we expected and we are hard at work educating investors. The education takes time but we believe strongly in the product for 2024 relative to other income products. There’s also a misconception that smaller ETFs are not liquid: we point out there’s numerous studies that show ETF liquidity is driven by the underlyings, not the AUM of the ETF.

The first couple of months were tough: it takes 30 days to get the SEC 30d yield and we didn’t declare our first dividend until late November. We ask people to follow the ETF and performance. Over time markets are a weighing machine, not a voting machine.

The Pros of VWI ETF

On the other hand, what have others praised about your fund?

People love getting this in a transparent and tax efficient ETF manner. Investors are turning increasingly to ETFs everyday day. They love the concept. They love the performance through a volatile October/November and the price appreciation in December. They love the monthly dividend.

Investors have been shown the same static and arbitrary idea recycled over and over. This is why they are looking for alternatives. I had a conversation with someone who has been in this industry for decades, worked with Jack Bogle at Vanguard, and told me “he wasn’t sure Jack would recognize indices today.” People are questioning passive products today in terms of investment use case: the emergency rebalance of the Nasdaq 100 was a great example.

In the beginning a lot of investors told us the backtest is great but come back when you have a product. We went back to people in October and the conversation changed to I’ll keep an eye on it. Now we see investors telling us what needs to happen for them to buy into it. A lot of work happens behind the scenes to make this accessible to investors.

Learn More About VWI ETF

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

We have a lot cooking for next year. The hardest part for us is that we’re a small team and we have so many ideas: it’s about focus and delivering one product at a time. Investors aren’t impressed by grand ideas, they’re impressed by products that work at the right price.

We love what we do, we love bringing our 40 years of combined capital markets knowledge from working inside big banks to building better accessible products for investors. We love educating people on portfolio construction and optimization. Many investors look at shiny objects in ETF land and not realize how poor those things are over the long run.

We have a lot of resources for investors on our website and Linkedin. We have a weekly newsletter as well with our market thoughts.

It’s very tough to beat the market. It’s much less work to reduce volatility along the way.

Connect With Yang Tang of Arch Indices

Linkedin: https://www.linkedin.com/in/

Arch Indices: https://www.linkedin.com/

Websites: vwietf.com & archindices.com

Twitter: @yangtang & @archindices

YouTube: https://www.youtube.com/

Additional Resources

Schwab Network: https://www.youtube.com/watch?

Nomadic Samuel Final Thoughts

I want to personally thank Yang for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.