Exchange-traded funds (ETFs) have revolutionized the way everyday investors access financial markets. Instead of sifting through individual stocks, trying to build a diversified portfolio that captures wide market exposure, an ETF can bundle hundreds or even thousands of securities into one tradable product. Yet, among the myriad of ETFs out there, few enjoy as much recognition and acclaim as the Vanguard Total Stock Market Index Fund ETF (VTI). Lauded for its simplicity, low cost, and broad diversification, VTI has become a cornerstone investment for countless individuals seeking to grow their wealth steadily over time.

Why is it so popular, though? For many, the allure of VTI lies in its straightforward goal: it aims to provide near-complete exposure to the entire U.S. stock market. This includes large-cap juggernauts like Apple and Microsoft, mid-cap companies that are steadily climbing the ranks, and even small-cap or micro-cap firms that might be tomorrow’s rising stars. In short, it wraps almost all public U.S. equity into a single ticker symbol. That means if you invest in VTI, you effectively purchase a tiny slice of thousands of American companies. Instead of guessing which sector or niche will perform best next year, you’re betting on the overall growth of the U.S. economy.

Of course, no financial product is a silver bullet. VTI’s broad approach offers certain advantages—like simplicity, lower volatility relative to picking a handful of stocks, and minimal hassle—but it also has drawbacks. For instance, by focusing solely on U.S. equities, it excludes international stocks that could provide further diversification. Some also argue that as a cap-weighted fund, it leans heavily toward the largest companies, potentially limiting the influence of smaller, faster-growing firms. Yet for many investors—particularly those seeking a low-maintenance, low-cost vehicle to capture the returns of the U.S. market—VTI stands out as a stellar choice.

We’ll attempt undertake a comprehensive review of VTI. We’ll begin by defining what exactly the ETF is, diving into its structure and the reasons for its rise in popularity. From there, we’ll examine how it’s constructed and what companies fill its portfolio. We’ll also explore historical performance, analyzing how VTI has weathered different market cycles over the past decades. We’ll then outline the main benefits that have endeared VTI to a wide audience: diversification, minimal expenses, and the ease of a single-fund solution. However, we’ll also be candid about potential drawbacks, such as the exclusive focus on U.S. markets and the heavier weighting toward established large-cap corporations.

What Is VTI ETF?

Overview of the ETF

The Vanguard Total Stock Market Index Fund ETF, trading under the ticker symbol VTI, is an exchange-traded fund managed by Vanguard, one of the most respected names in asset management. Vanguard’s commitment to low-cost, index-based investing has made it a favorite among those embracing a passive investment philosophy. Rather than trying to outperform the market by picking and timing individual stocks, VTI aims to match the performance of the entire U.S. equity market. In effect, if the U.S. economy and its corporate sector expand over the long run, VTI should reflect that growth.

Launched in 2001, VTI quickly garnered attention for its simplicity: buy one ETF and instantly own a vast swath of American companies, from mega-caps to micro-caps. This approach spares investors the complexity of juggling multiple funds or painstakingly selecting individual stocks. Instead, VTI’s broad net captures nearly all the publicly listed U.S. equities in a single, cost-effective product.

Key Facts

A few fundamental details highlight what makes VTI unique:

- Inception Date: VTI commenced trading on May 24, 2001, offering more than two decades of performance data to examine.

- Ticker Symbol: VTI, which stands for “Vanguard Total Stock Market.”

- Underlying Index: VTI tracks the CRSP U.S. Total Market Index, developed by the Center for Research in Security Prices. This index aims to encompass nearly 100% of investable U.S. market capitalization.

- Expense Ratio: One of VTI’s biggest draws is its ultra-low expense ratio, typically around 0.03%. That means you pay just $3 per $10,000 invested each year—far cheaper than most actively managed mutual funds.

- Market Capitalization: VTI is one of the largest ETFs by assets under management (AUM), reflecting the trust many investors place in it.

Why VTI ETF Is So Popular

VTI’s popularity stems from multiple factors, not least of which is its brand association with Vanguard—a pioneer in low-fee, index-based investing. Yet there’s more at play:

- One-Stop-Shop for U.S. Stocks: Instead of buying a large-cap fund plus a small-cap fund, or selecting individual names, you can just pick VTI. That’s an unbeatable convenience.

- Cost Efficiency: The minuscule expense ratio ensures more of your returns remain yours, rather than going to fund management.

- Diversification: With thousands of holdings across all major sectors, VTI spreads risk so that no single company’s downturn can ruin your portfolio.

- Accessibility: You can buy or sell shares throughout the trading day, just like a stock, making it more flexible than traditional mutual funds.

For many investors, especially those aligned with the “Boglehead” or passive investing philosophies, VTI is almost a default starting point—a foundational core holding in a larger asset allocation scheme. It embodies the ethos of trusting that the U.S. economy, over time, rises, thereby generating corresponding returns for shareholders.

Composition of VTI ETF

Index Tracking

VTI is designed to track the CRSP U.S. Total Market Index, an index that aims to represent virtually the entire spectrum of publicly traded U.S. companies. This includes large-cap giants, mid-cap firms, small-cap innovators, and even micro-cap stocks—albeit in tiny proportions. Such an approach is about as broad as you can get in a single domestic equity fund. By replicating this index, VTI ensures it captures the overall movements of the U.S. stock market without favoring any particular size, style, or sector over the long term.

To do this replication effectively, Vanguard either holds every stock in the underlying index (known as “full replication”) or, in some cases, a representative sample that mirrors the index’s characteristics. This methodology keeps tracking error—any divergence between VTI’s performance and the index—remarkably low.

Sector Breakdown

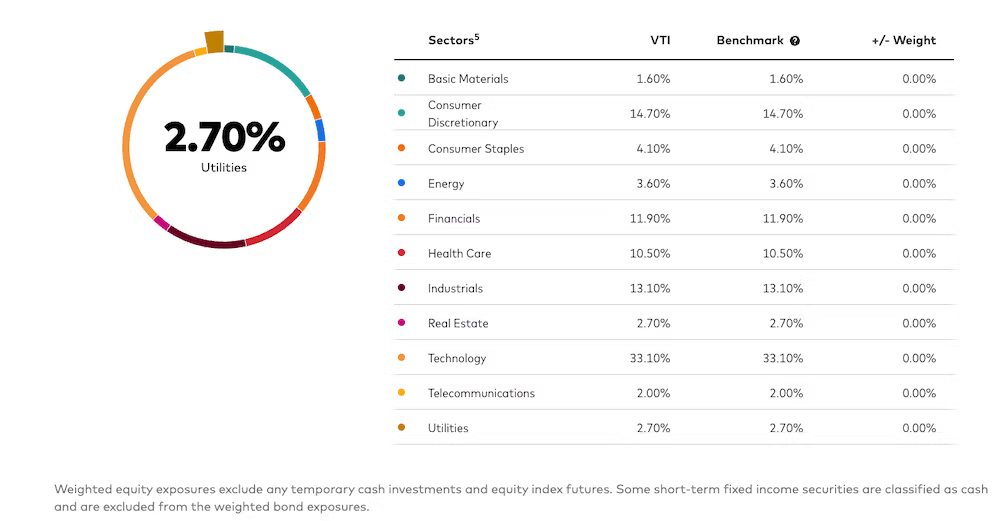

A crucial aspect of understanding VTI lies in its sector allocation. Although it includes nearly all industries, the weighting isn’t evenly spread. Generally, the largest sector is technology, reflecting the dominance of tech giants in U.S. market capitalization. You’ll also see significant allocations to sectors like healthcare, consumer discretionary, financials, and industrials. Meanwhile, smaller percentages might go to energy or materials—sectors which, while essential, are overshadowed by the sheer size of tech or consumer juggernauts.

This sector breakdown evolves over time. For instance, if technology stocks soar for several years, that sector might command an even larger slice of the pie. Conversely, if another sector experiences robust growth, it can shift the balance. Because VTI is cap-weighted, companies that grow larger (like Apple or Google’s parent, Alphabet) naturally occupy bigger chunks of the ETF.

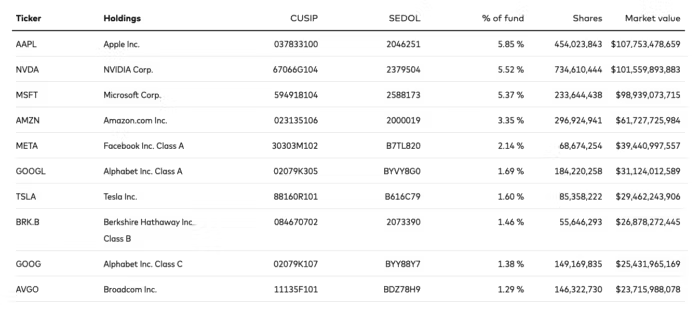

Top Holdings

While VTI’s portfolio spans thousands of companies, a handful of them comprise a significant share of the ETF’s total weight. Typically, you’ll find Apple, Microsoft, Alphabet, Amazon, and other tech behemoths in the top spots—these behemoths alone can account for a sizable portion of VTI’s returns. However, thanks to the sheer number of holdings, no single name dominates as heavily as it might in an S&P 500 index alone, which only includes 500 large-cap stocks. With VTI, you’re also owning mid- and small-caps that collectively add up to a non-trivial share of the fund.

A potential downside is that if a handful of large-cap stocks tumble, the entire ETF can see a noticeable drag on performance. On the flip side, if those companies continue to thrive, they can power significant gains for VTI. It’s a trade-off that essentially mirrors the broader U.S. market dynamic.

Market-Cap Diversification

One of VTI’s distinguishing traits is its market-cap diversification. Traditional large-cap funds ignore the smaller end of the market-cap spectrum—meaning they miss out on the growth potential of emerging businesses. VTI, however, features small and mid-cap stocks in addition to the obvious titans. This layering fosters a more holistic representation of the U.S. equity scene. Historically, small-cap stocks can sometimes deliver outsized returns, albeit with higher volatility.

For those who’d typically buy a large-cap index (like the S&P 500) plus a separate small-cap fund to cover the rest of the market, VTI essentially consolidates that approach. This reduces your administrative overhead—just one ETF to track, one expense ratio to pay, and one holding to manage. However, it also means you can’t precisely tweak your small-cap vs. large-cap weighting. The choice either works for you as a broad reflection of the entire market or it doesn’t. If you crave a heavier tilt to small-caps or have strong views on certain sectors, you might consider additional complementary ETFs.

In sum, VTI’s composition stands out for its near-comprehensive scope of U.S. equities, balanced by a heavily weighted set of top holdings that reflect America’s largest corporate players. If your goal is to own a cross-section of the national economic engine, VTI provides that coverage in a single, convenient package. Next up, we’ll delve into how VTI has historically performed, comparing its returns to other benchmarks and evaluating how it holds up during downturns. That track record can be a make-or-break factor in deciding whether it fits your personal investment goals.

VTI ETF Historical Performance

Long-Term Growth

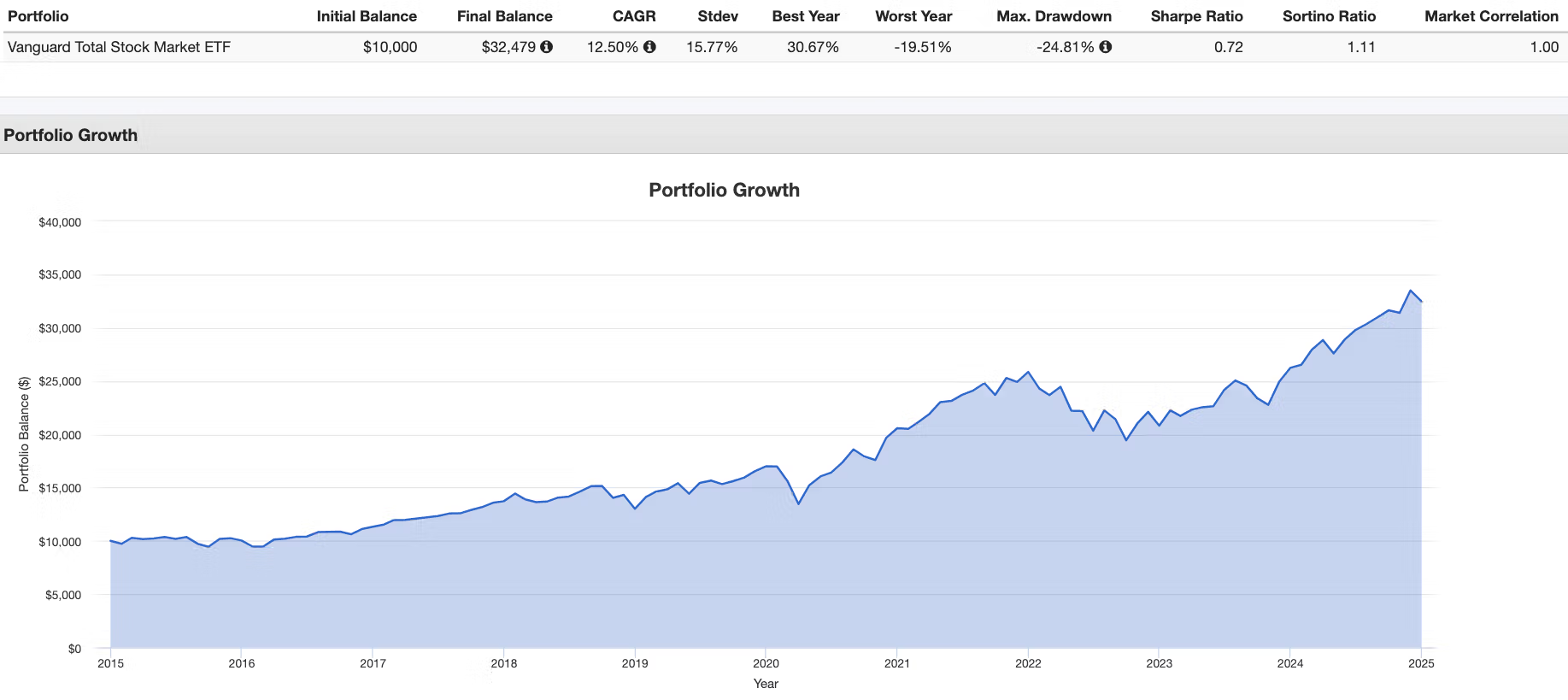

When assessing an ETF like VTI, it’s crucial to examine how it’s performed over multiple market cycles. Since its inception in 2001, VTI has generally delivered returns that closely mirror the overall U.S. stock market—by design. Over long stretches (think 5, 10, or even 20 years), the U.S. equity market has typically trended upward, though not without notable dips along the way.

For instance, if you examine data from the mid-2000s onward, VTI has gone through the 2008 financial crisis, a robust bull run in the 2010s, a sharp pandemic-driven downturn in early 2020, and a subsequent recovery. Throughout these turbulent periods, the fund’s returns, net of fees, have aligned with the broader trajectory of U.S. stocks. In many cases, the average annualized returns over 10+ years have hovered in the high single digits, occasionally dipping or soaring depending on the exact timeframe you measure.

Comparing Benchmarks

You might wonder how VTI fares versus other indexes like the S&P 500. Generally, VTI is slightly more expansive—encompassing not just the 500 biggest companies but also mid- and small-caps. Over certain time spans, this broader coverage can yield marginally higher or lower returns. For instance, in times when small-caps outperform, VTI might surpass the S&P 500. Conversely, when large-caps dominate, the S&P 500 can briefly inch ahead.

However, historically, the performance gap between VTI and the S&P 500 has often been minimal. Both funds revolve around large segments of the U.S. market, and large-caps—given their size—carry the most weight in both indexes. But for a truly apples-to-apples comparison, you’d note that VTI is slightly more diversified, which some interpret as a slight advantage from a risk perspective.

Additionally, there are other U.S. total market ETFs managed by different firms, such as the iShares Core S&P Total U.S. Stock Market ETF (ITOT) or the Schwab U.S. Broad Market ETF (SCHB). Performance among these similarly oriented funds tends to be nearly indistinguishable, with minor variations due to expense ratios or slightly different underlying indexes.

Resilience in Market Downturns

Even though VTI is well-diversified, it’s not immune to market downturns. When a bear market or recession strikes, nearly all equities feel the shock. During the 2008 financial crisis, for instance, VTI endured a steep decline—much like the S&P 500 or other stock-based funds. However, because it spans thousands of companies, it wasn’t as vulnerable to single-sector meltdowns. In contrast, a sector-specific ETF might crater if that niche collapses under the weight of economic stress.

Post-downturn recoveries also highlight VTI’s ability to recoup losses, riding the general recovery of the U.S. economy. For example, after the 2008 crash, those who stayed invested in VTI witnessed substantial gains once the market rebounded in the following years. This pattern repeated in 2020’s pandemic-driven crash and subsequent rally. Essentially, if you hold VTI for the long run, you can weather these storms and potentially benefit from the cyclical nature of equity markets.

Looking Beyond the Averages

When analyzing performance, it’s also essential to look beyond just average annual returns. While VTI’s broad coverage can yield stable, market-like results, you’ll still see fluctuations in specific years. Tech booms might inflate returns for certain stretches, while cyclical downturns in areas like energy or real estate might temporarily weigh on performance.

It’s this comprehensive scope that helps ensure that no single industry can overly distort the fund for an extended period. If one sector declines, others can pick up slack or at least mitigate losses. Still, investors with a keen interest in certain thematic or international plays might find VTI lacking. But for those who embrace market-wide exposure, these performance patterns reflect why VTI remains a go-to for achieving balanced growth over time.

Advantages of VTI

VTI, the Vanguard Total Stock Market Index Fund ETF, consistently draws praise and dollars from a wide variety of investors. Let’s break down the key advantages that give it such widespread appeal. By understanding these benefits, you can judge how effectively VTI matches your own investing style and objectives.

Broad Market Exposure

The hallmark of VTI is its exhaustive coverage of the U.S. equity landscape. Purchasing shares in VTI effectively buys you stakes in thousands of publicly listed American companies. This single-ticket approach spares you the effort of painstakingly crafting a domestic portfolio that includes both large and small players. It’s almost like owning a cross-section of the U.S. economy in one fund.

For novice investors, this is a massive plus. You don’t have to analyze individual stocks meticulously or guess which sector might outperform next year. Instead, you lean on the broader growth trajectory of American corporations. If, for instance, small-caps surge one year and large-caps dominate the next, VTI automatically reflects that rotation. This internal rebalancing occurs organically as market valuations change.

Low Expense Ratio

Cost efficiency is a cornerstone of Vanguard’s philosophy, and VTI exemplifies it. With an expense ratio typically around 0.03%, you’re paying a mere $3 for every $10,000 invested annually. That’s almost negligible compared to many actively managed funds, which can charge 1% or more. Over time, these cost differences compound, significantly influencing your net returns. Buffett himself has championed low-cost index funds for everyday investors, noting that high fees often erode much of the returns you’d otherwise earn from the market.

For practical context, imagine you’re investing $50,000: an actively managed fund might charge $500 or $600 a year, while VTI might only cost $15—an enormous discrepancy year after year. This advantage grows in significance if you’re young or if you plan to hold for decades, allowing you to retain more of your returns.

Diversification Benefits

Diversification is the investing world’s version of “don’t put all your eggs in one basket.” Because VTI holds thousands of companies from various sectors—technology, healthcare, finance, consumer staples, industrials, and more—any single company’s decline has a limited effect on the overall fund. If one segment of the market stumbles, others may stabilize or prosper. This naturally smooths out volatility compared to a portfolio heavily concentrated in a few stocks or sectors.

Of course, diversification cannot immunize you from market-wide downturns. If a recession hammers all major industries, VTI will still feel the pain. But it helps contain risk by not hinging your outcome on the fortunes of a narrow slice of the market. Many personal finance gurus stress the need for broad, balanced portfolios; VTI largely meets that criterion in a single product.

Tax Efficiency

ETFs generally boast tax advantages compared to traditional mutual funds, and VTI is no exception. The in-kind creation and redemption process for ETF shares often reduces the likelihood of capital gains distributions, helping shareholders avoid some of the tax hits that can come from frequent portfolio turnover. This structure benefits long-term holders who might otherwise see unexpected taxable events even if they don’t sell their own shares.

VTI’s low turnover, combined with the ETF mechanics, tends to yield minimal capital gains distributions. This is a boon for investors in taxable accounts wanting to maximize after-tax returns. If you hold VTI in a tax-advantaged vehicle like an IRA, the benefits still matter, though they’re less pronounced since IRAs already shelter you from immediate capital gains taxes.

Potential Drawbacks of VTI

While the Vanguard Total Stock Market Index Fund ETF (VTI) packs many advantages, it’s not a universal solution. Like all investing instruments, it comes with nuances that might pose issues for certain investors, depending on their objectives, risk tolerance, or worldview. Let’s walk through some of the major drawbacks and caveats you should weigh before diving into VTI.

Limited International Exposure

Perhaps the most noticeable limitation is VTI’s exclusive focus on U.S. equities. America’s economy has indeed been robust over the long haul, but for investors aiming for a truly global portfolio, VTI alone won’t cut it. You’re missing out on companies headquartered in Europe, Asia, emerging markets, or other regions. This U.S.-only scope can be a double-edged sword: while it captures major domestic growth, it leaves you vulnerable if, for instance, the U.S. market experiences a prolonged downturn relative to other global markets.

Some investors address this gap by pairing VTI with international-focused ETFs, such as VXUS (Vanguard Total International Stock ETF). This approach can yield a more balanced allocation. However, that adds complexity and may slightly increase costs. If you’re strictly seeking a single-fund solution that spans the globe, VTI isn’t it.

Heavy Large-Cap Influence

Though VTI covers small- and mid-cap companies, it remains a cap-weighted fund. This means that the largest corporations—think Apple, Microsoft, Amazon, and similar giants—command a disproportionately large share of the fund’s weight. If these big players stumble, it can drag down the ETF’s performance considerably. Conversely, if smaller companies thrive, their impact might be muted compared to the influence of mega-caps.

For some, this isn’t a deal-breaker because large U.S. companies have historically delivered stable returns. But for those who believe small-cap or niche sectors are primed for outperformance, a fund like VTI might feel too slanted toward the status quo. You might prefer a dedicated small-cap ETF or a custom portfolio that tilts more aggressively toward undervalued segments.

Not Immune to Market Downturns

It’s worth emphasizing: while VTI is diversified, it isn’t a shield against broad market recessions. If the entire U.S. market declines—such as during the 2008 financial crisis, the 2020 pandemic-driven sell-off, or any future systemic shock—VTI’s net asset value will drop as well. It may be less dramatic than the fall of a single concentrated stock, but the risk remains. If your risk tolerance is extremely low, you might need to pair VTI with bonds, stable value funds, or other protective assets to weather severe downturns.

Dividend Yield

Another minor quirk is that VTI’s dividend yield, while present, isn’t necessarily high compared to some dedicated dividend ETFs. Because it covers the whole market spectrum, including growth-oriented tech stocks, the overall yield hovers around 1-2%. For income-focused investors seeking more robust payouts, this can feel underwhelming. You might find specialized dividend funds or REIT-focused funds more aligned with your income goals, albeit at the cost of some of VTI’s broad diversification.

Who Should Invest in VTI?

Given the Vanguard Total Stock Market Index Fund ETF’s (VTI) characteristics—its broad coverage, low cost, and focus on U.S. equities—some investors fit right into its wheelhouse, while others might not. Let’s dissect where VTI shines and when it might leave you craving more specialized solutions.

Beginners

First-time investors often find VTI particularly appealing. If you’re new to the market, building a well-rounded portfolio can seem overwhelming. You may not yet have the experience—or the time—to analyze individual stocks or manage multiple funds. VTI, by virtue of capturing nearly the entire U.S. stock market, gives you comprehensive exposure with a single ticker. Pairing it with a simple bond ETF can form the foundation of a balanced, no-fuss portfolio. The minimal expense ratio also ensures you won’t be eaten alive by fees right from the start.

Moreover, novices benefit from VTI’s resilience: While it won’t negate all volatility, the broad-based approach generally experiences fewer extreme swings than narrower funds. This temperate ride can serve as a good introduction, teaching you how the market moves without subjecting you to the wild ups and downs of, say, a single tech-focused ETF.

Passive Investors

VTI aligns with the ethos of “buy and hold,” championed by index investors who believe that trying to outsmart the market is usually futile. If you want an easy, set-and-forget strategy, VTI fits seamlessly. You don’t have to monitor stock news daily or worry about sector rotations. Instead, you rely on the premise that, over time, the U.S. economy grows and equity values reflect that progress. The low expense ratio further cements its compatibility with a passive stance, enabling you to compound returns over decades rather than hemorrhaging money in management fees.

Many who subscribe to Boglehead principles—a term derived from Vanguard’s founder, John Bogle—opt for a core position in VTI, balancing it with an international total market ETF and some bond holdings. This trifecta covers a lot of ground, offering global diversification and risk mitigation. If you fancy a life free from constant portfolio tinkering, VTI can anchor that philosophy.

Retirement Accounts

Retirement savers often gravitate to VTI for the straightforward reason that it simplifies the process. Within a 401(k) or an IRA, you might only have a handful of fund options. If you see VTI or a similar total market index available, it can serve as a powerful pillar, granting significant exposure to U.S. equities. Over the long run, this fosters compounding that can robustly grow your retirement nest egg.

Additionally, the minimal turnover and tax efficiency of VTI align well with retirement accounts. While tax efficiency is less pressing inside these tax-advantaged vehicles, it’s still comforting to know the fund doesn’t often generate large capital gains distributions. This keeps your portfolio streamlined, cutting out the complexity of frequent rebalancing or reinvestment scenarios.

Limitations for Active Traders

On the flip side, VTI might not suit active traders or those wanting a specific sector tilt. If your approach hinges on short-term trading, you could find VTI’s broad coverage too “diluted.” The same is true if you have strong convictions about, say, technology or real estate. In that case, specialized ETFs might be more aligned with your preferences. VTI’s “taste of everything” approach can feel lackluster if you crave distinct bets or aim to exploit market inefficiencies in certain industries.

Summarizing Suitability

Ultimately, VTI appeals to those who value convenience, comprehensive coverage of U.S. equities, cost efficiency, and minimal upkeep. It’s great if you’re a beginner, a fan of passive investing, or planning to hold for the long term in a retirement account. However, the product might not hit the spot if you want to weigh heavier in foreign stocks, chase niche sectors, or engage in frequent trading. In the final section, we’ll wrap up these findings, highlighting VTI’s essential attributes and encouraging you to assess whether it dovetails with your personal financial roadmap.

Before investing, always weigh your broader financial plan and risk tolerance. But if your aim is to harness the growth potential of the entire U.S. equity sphere in a single, user-friendly product, the Vanguard Total Stock Market Index Fund ETF can be a natural fit. It blends the best of a diversified mutual fund with the ease and liquidity of an ETF. In a space cluttered with thousands of products, VTI’s enduring popularity testifies to the power of a straightforward, low-cost approach that respects both your time and your portfolio’s long-term growth.

VTI ETF: 12-Question Expert FAQ for Vanguard Total Stock Market (Ticker: VTI)

What does VTI track, exactly?

VTI seeks to replicate the performance of the CRSP U.S. Total Market Index, giving you exposure to virtually the entire investable U.S. equity market—large-, mid-, small-, and micro-cap stocks in one fund.

How is VTI different from an S&P 500 fund like VOO?

VOO holds ~500 large-cap names, while VTI holds thousands across market caps. In practice, performance can be similar in many periods, but VTI includes more mid/small caps, offering slightly broader diversification.

What is the expense ratio for VTI?

VTI’s expense ratio is among the lowest in the industry (around a few basis points). Low ongoing costs are a primary reason long-term, buy-and-hold investors choose it.

How often does VTI pay dividends, and what’s typical yield?

VTI distributes dividends quarterly. Yield fluctuates with market conditions and the mix of companies in the index; investors should check the latest fund page for the current SEC yield and trailing 12-month figure.

Is VTI tax-efficient in a taxable account?

Generally yes. Like many broad-market ETFs, VTI benefits from the in-kind creation/redemption mechanism and tends to realize fewer capital gains distributions relative to many mutual funds. Your personal tax situation still matters.

Does VTI give me international diversification?

No—VTI is U.S.-only. Many investors pair it with a total international ETF (e.g., VXUS) if they want global equity exposure in a simple two-fund setup.

What are the main risks of owning VTI?

Market risk. If the U.S. stock market declines broadly, VTI will fall. Because it is cap-weighted, large mega-caps can have outsized influence on returns—both up and down.

Who is VTI best for?

Long-term, passive investors who want a simple, low-cost core holding with broad U.S. equity exposure. It often anchors retirement accounts and “set-and-forget” portfolios.

How does VTI compare to other total-market ETFs like ITOT or SCHB?

All three are low-cost, broad U.S. market funds tracking slightly different indexes. Long-run performance and risk profiles have historically been very similar; differences usually come down to index provider, tiny fee nuances, and trading preferences.

Does VTI include small caps meaningfully?

Yes—VTI owns small and micro caps, but because it’s cap-weighted, large caps still dominate the overall weight. You’ll get broad coverage, just not a heavy small-cap tilt.

Is dollar-cost averaging into VTI a good idea?

For many investors, contributing regularly (e.g., each paycheck) helps reduce timing risk and builds discipline. DCA doesn’t guarantee profits, but it’s a time-tested habit aligned with passive investing.

How should I combine VTI with bonds or other assets?

A common approach is pairing VTI with a broad bond ETF for risk control (your stock/bond split reflects risk tolerance and time horizon). Adding international equities or REITs is optional depending on goals and preferences. None of this is investment advice—consider your personal plan.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.