Silver occupies a fascinating niche within the world of precious metals and global finance. For centuries, it served as a recognized medium of exchange, a store of value, and a symbol of wealth and prosperity. It was once used in coins that circulated in daily life, adorning the pockets of merchants and travelers. Over time, as economies modernized and government policies shifted, many countries abandoned silver as circulating currency. Nevertheless, its allure did not fade. Today, silver stands at an intersection of historical reverence and modern industrial demand, continuing to captivate investors seeking both security and opportunity.

Silver holds timeless appeal.

In modern markets, silver is seen as a precious metal comparable to gold but with certain distinct characteristics. While gold often steals the spotlight during economic downturns or inflationary periods, silver exhibits a dual identity: it is valued not only for ornamental and monetary reasons but also for its broad industrial applications. The metal is used in everything from solar panels and electronic components to medical instruments and antimicrobial solutions. This blend of safe-haven appeal and industrial necessity can lead silver prices to react differently to various economic signals—sometimes paralleling gold’s movements, other times tracking broader commodity cycles, and occasionally forging its own path.

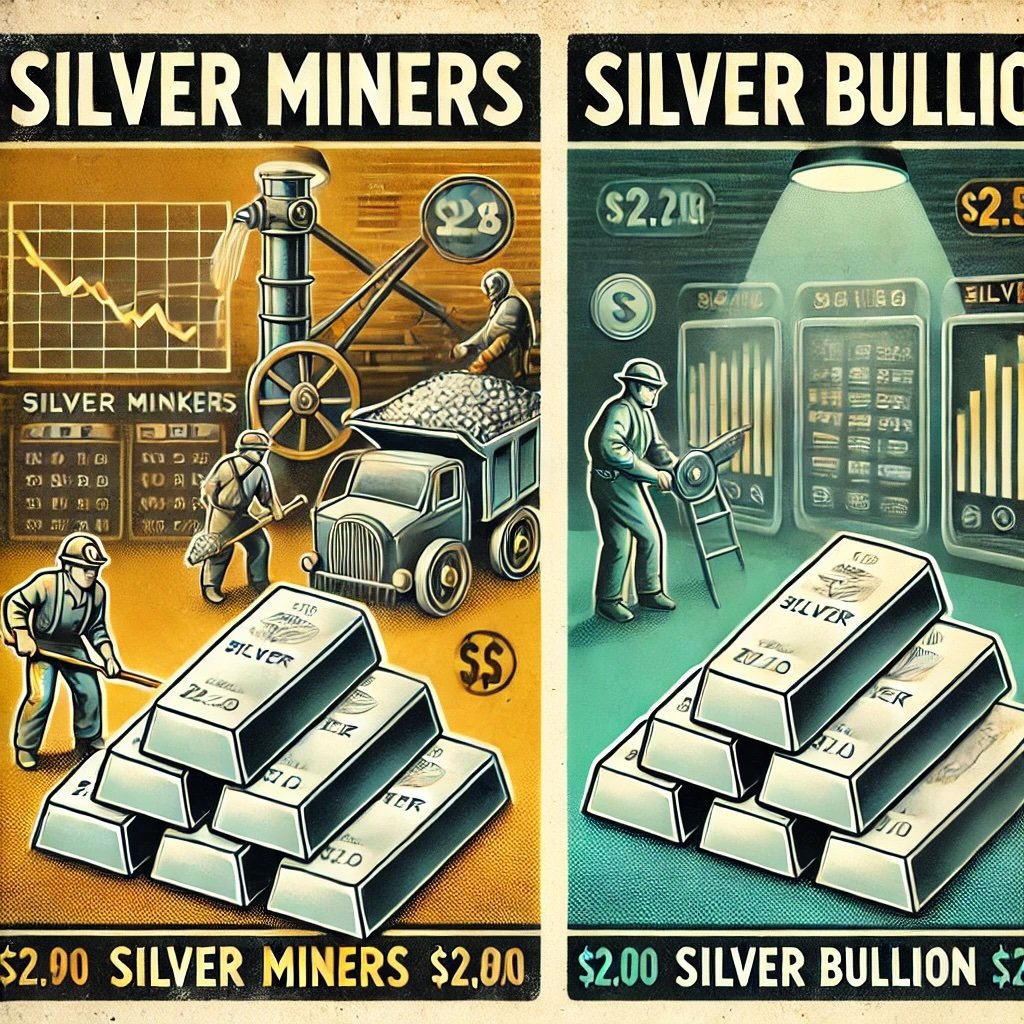

Buy Physical Silver or Invest in Silver Miners

From an investment standpoint, silver can be acquired in two broad ways: one can buy physical silver (commonly called bullion) in the form of bars, coins, or even exchange-traded funds (ETFs) that hold the metal on your behalf, or one can invest in silver miners, i.e., the corporate entities that mine, refine, and sell silver (and often other metals). Each avenue brings unique benefits and potential pitfalls. Bullion ownership grants direct possession of a tangible asset—an often-cited hedge against inflation and currency risks—while investing in miners offers equity-like gains, potential dividends, and operational leverage, albeit with exposure to corporate-level uncertainties.

Two paths, one metal.

Why does this distinction matter? Simply put, silver bullion and silver miners don’t always behave the same way. While they share a fundamental link to silver’s spot price, the performance of a mining stock might deviate from simple moves in the underlying metal due to company-specific factors such as operational costs, debt levels, political risks in mining jurisdictions, and management decisions. On the other hand, holding physical silver involves concerns like storage, insurance, and zero yield—no dividends, no interest, just the hope that prices will appreciate. For many investors, choosing between the tangible safety net of bullion and the growth-oriented equity approach of miners can spark confusion and deliberation.

Understanding Silver Bullion Investments

What Is Silver Bullion?

Silver bullion typically refers to silver in its most investment-ready form—bars, ingots, and coins that meet a specific purity standard (commonly .999 fine, though some products adhere to slightly different gradations). Beyond these physical artifacts, an investor might opt for silver exposure via ETFs such as the iShares Silver Trust (SLV) or the Aberdeen Standard Physical Silver Shares ETF (SIVR). These funds hold physical silver in vaults, issuing shares that represent proportional ownership of the metal. However, many purists feel that, for a truly “safe haven” approach, nothing beats physically holding your own silver.

Bullion is the classic route.

Why People Invest in Bullion

- Inflation Hedge

- Over centuries, silver has been recognized as a shield against inflation, particularly during times when fiat currencies lose purchasing power.

- While the metal’s short-term price can fluctuate violently, in the long run, many see silver as preserving real value compared to paper currencies prone to government-led debasement.

- Safe-Haven Asset

- During geopolitical turmoil, stock market crashes, or economic recessions, investors often rotate into tangible assets.

- Silver’s historical track record as a medium of exchange and a limited resource fosters a sense of security for those anxious about modern banking systems.

- Tangible Ownership

- Holding coins or bars provides a psychological anchor. Some individuals find comfort in physically possessing an item with inherent value, free from the complexities of corporate balance sheets or digital platforms.

- If you prefer a self-reliant approach to wealth storage, bullion can be appealing.

- Simplicity

- Once you acquire silver bullion, you don’t need to study corporate earnings, track management changes, or worry about whether a mine in a distant country might face labor strikes.

- The only “decision” is how much silver to buy and how you’ll store it, plus whether you want to keep adding or reduce your holdings over time.

Options for Investing in Bullion

1. Physical Silver: Coins, Bars, and Rounds

- Coins: Often minted by government entities (like the U.S. Mint or the Royal Canadian Mint), coins such as the American Silver Eagle or Canadian Silver Maple Leaf are revered for their purity and recognized worldwide. These typically command a premium over the spot price, reflecting production costs and collectibility.

- Bars: Companies like Johnson Matthey, Engelhard, and PAMP Suisse produce silver bars in different sizes (e.g., 1 oz, 10 oz, 100 oz), usually at lower premiums than coins. Bars are simpler to mass-produce and less likely to garner numismatic value.

- Rounds: These are coin-like discs produced by private mints but not considered official legal tender. They often have slightly lower premiums than government-issued coins.

Bars and rounds can be budget-friendly.

Storage Concerns

Physical silver can be bulky and heavy, especially once you accumulate significant amounts. Common storage solutions include:

- Home Safes: Offering direct control but demanding caution regarding burglary or fire threats.

- Bank Safe Deposit Boxes: Typically secure, though limited to bank hours and subject to regulatory considerations.

- Dedicated Vaulting Services: Specialized storage facilities with insurance, usually available through bullion dealers or third-party providers.

Each method involves trade-offs: convenience, cost, and security. Meanwhile, insuring silver might add recurring expenses, slightly eroding long-term returns.

2. Silver ETFs

- iShares Silver Trust (SLV): Among the largest silver ETFs, physically backed by vaults storing silver bars. You buy and sell shares as you would any stock, with the share price aiming to track silver’s spot price minus small fees.

- Aberdeen Standard Physical Silver Shares (SIVR): Similar structure, also physically backed, typically with slightly lower expense ratios than SLV.

- Other ETFs and ETCs (Exchange-Traded Commodities): International markets carry a range of similar products, each with their own fee structures and regulatory contexts.

Benefits of ETFs

- Liquidity: Buying or selling is immediate, executed through brokerage accounts.

- No Storage Hassles: The fund manages vaulting and insurance.

- Small Premiums: Typically, the share price correlates closely with spot silver, so you avoid the sometimes large premiums seen in physical coin markets during supply constraints.

Drawbacks

- Counterparty Trust: You rely on the fund’s custodians to truly hold the claimed silver in a vault, though these ETFs are generally well-audited and regulated.

- Fees: Management fees, though often modest, slowly chip away at your return if you hold the ETF long term.

Pros and Cons of Bullion

Pros

- Simplicity: You don’t need to monitor corporate reports or mining developments.

- Tangible Security: Physical silver offers a tangible safe-haven that won’t vanish due to business failure or digital meltdown.

- Universal Acceptance: Globally recognized, silver is easy to liquidate in many markets when needed.

Cons

- Storage and Insurance: Large or even moderate holdings demand secure storage solutions, incurring costs and logistical hurdles.

- No Yield: Bullion generates no dividends or interest. The only way to profit is if silver’s price rises over your purchase cost.

- Potential Premiums: Physical coins may command high premiums over spot, especially during tight supply conditions.

Bullion is stable but yield-free.

For individuals who deeply value self-custody of a precious asset, bullion fits the bill. Others, however, may see bigger possibilities—albeit with heightened risk—in the realm of silver miners, the corporate gatekeepers of the metal’s supply pipeline. Up next, we’ll delve into the domain of these miners, exploring how they operate, their unique advantages, and the pitfalls an equity investor can face.

Understanding Silver Miner Investments

What Are Silver Miners?

A silver miner is exactly what it sounds like—a corporate entity engaged in discovering silver deposits, developing mines, extracting the ore, refining it to marketable purity, and ultimately selling the produced silver into global markets. Some of these companies concentrate almost entirely on silver, while others maintain diversified portfolios, mining other metals such as gold, copper, or zinc. The more diversified miners can sometimes buffer the impact of a slump in silver prices by relying on the revenue from more profitable metals, whereas pure-play silver miners yield a more direct correlation with silver’s price swings.

Silver plus potential side metals.

Investors typically buy shares of these mining companies on major stock exchanges. When you own these equities, you’re not just getting silver exposure—you’re also partaking in the miner’s operational story: expansions, acquisitions, cost optimizations, management expertise, and so on. If the enterprise thrives, with new discoveries or expansions that cut extraction costs, the stock may rally even if silver prices remain flat. Conversely, if a downturn in silver hits right alongside corporate missteps—like a labor strike or a failed expansion—the stock can tank dramatically, leading to losses greater than any typical move in the silver spot price might indicate.

Why People Invest in Miners

- Leveraged Upside to Rising Silver Prices

- When silver’s price climbs, the profit margin for producing each ounce can expand swiftly, propelling miners’ earnings—and often their stock prices—to outsized gains.

- Investors who time a bull market in silver miners can see returns that surpass straightforward bullion gains by two or threefold, or even more.

- Dividends and Cash Flow

- Some established miners distribute dividends to shareholders, offering an ongoing income stream that bullion cannot provide.

- Dividend yields may be modest in less profitable phases or suspended altogether if the miner experiences financial stress.

- Potential Corporate Growth

- Miners can discover new reserves or acquire competitor projects at favorable valuations, expanding their production capacity.

- Operational improvements (like reducing costs per ounce) can boost profitability even if silver’s spot price remains stable.

Corporate growth can outpace metal alone.

Options for Investing in Silver Miners

1. Individual Mining Stocks

- First Majestic Silver: Known for focusing predominantly on silver, operating multiple mines in Mexico, and sometimes considered a pure-play silver stock.

- Pan American Silver: Operates throughout the Americas, producing silver and also gold, giving some diversity.

- Hecla Mining: One of the oldest precious metals miners in the U.S., with significant silver output.

Pros of Picking Individual Stocks

- Tailored Exposure: Choose companies whose strategy aligns with your risk tolerance—pure silver vs. multi-metal diversification.

- Possibility of Outperformance: If a particular miner strikes a major discovery or drastically reduces costs, shareholders might see tremendous gains.

Cons

- Company-Specific Risks: Even if silver prices rise, a poorly managed firm can falter.

- Research Burden: You must read financial statements, track mining developments, and stay updated on local political climates affecting those mines.

2. Mining ETFs

- Global X Silver Miners ETF (SIL): A common choice that invests in multiple silver mining stocks globally, offering a broad swath of the sector’s performance.

- SILJ (Junior Silver Miners ETF): Focuses on smaller or “junior” miners, potentially higher risk but also higher reward.

- iShares MSCI Global Silver Miners: Another option with diversified holdings.

Pros

- Diversification: Spread your bet across various companies, mitigating single-company meltdown risks.

- Easier Access: A single ETF purchase grants exposure to dozens of firms, removing the complexity of picking winners.

Cons

- Fees: ETF management expenses, though often modest, still reduce net returns.

- Diluted Results: Stellar performance by one miner can be offset by mediocrity or losses elsewhere in the portfolio.

Broad exposure, less drama.

Pros and Cons of Miners

Pros

- Leverage: Gains can surpass those from simple silver price moves.

- Income Streams: Dividends or share buybacks can reward patient investors.

- Growth Potential: Operational improvements and expansions can create incremental value.

Cons

- Operational Hazards: Accidents, environmental lawsuits, or mismanagement can severely hurt share prices.

- Volatility: Mining stocks often fluctuate more than the metal itself.

- Complex Research: Evaluating geological data, reserve life, jurisdictional stability, and management track records can be daunting.

Miners swing higher—and lower—than bullion.

Investing in silver miners can be attractive for those who crave the possibility of multiplying gains if silver’s price surges. Yet, these same investors must stomach the amplified volatility, operational uncertainties, and occasional negative surprises. The question remains, therefore, how to decide between bullion’s relative simplicity and miners’ potential for bigger gains. The answer partly lies in evaluating broader market conditions, personal risk preferences, and other core factors, which we’ll address in the following section.

Key Factors to Consider

When deciding between silver bullion and silver miners, you must weigh a host of considerations that shape how each asset might fit into your broader financial strategy. Some revolve around the typical elements of risk tolerance and investment objectives, while others involve practicalities like storage or the potential for operational mishaps. Understanding these concerns can help you pinpoint a strategy that aligns with your comfort level and future aspirations.

Context clarifies choice.

Risk Tolerance

Bullion

- Lower Default Risk: Since physical silver is not tied to a corporation’s balance sheet, it’s essentially immune to corporate bankruptcies or poor executive decisions.

- Market Volatility: Though silver can experience price swings, physical ownership ensures you’re still holding a precious metal that historically retains some value.

- Psychological Comfort: Many risk-averse or conservative investors prefer tangible assets as a form of wealth insurance.

Miners

- Heightened Risk-Reward: Mining company share prices can double, triple, or even more in a robust bull market, but they can also plummet if production costs spike or silver prices drop.

- Company-Specific Hazards: Even in a rising silver market, a mismanaged firm can tank.

- Equity Market Correlation: In broad stock market downturns, mining equities may decline alongside the rest of the market, irrespective of silver’s fundamentals.

Personal comfort with volatility dictates direction.

Investment Goals

Short-Term Hedging

If you anticipate an impending financial crisis or you’re seeking a near-term hedge against inflation or currency devaluation, physical silver might shine. Historically, silver holds some “crisis premium,” though not as consistently as gold. Yet, in a meltdown scenario, silver bullion remains a recognized asset across the globe. Mining stocks, conversely, might get caught in a broader equity sell-off, delaying or limiting their safe-haven qualities.

Long-Term Growth

For those with a horizon stretching years or decades, silver miners could be appealing if they can use profitable cycles to expand operations, reduce debts, and discover new deposits. Over extended periods, a well-run mining company might outperform the base metal.

Passive Income

Miners might pay dividends. If you appreciate receiving periodic cash flow, silver miners—especially well-established ones with consistent production—could supply that. Bullion has no yield unless you lease out your metal, a niche practice that may not be suitable or widely available for small-scale holders.

Market Conditions

Bull vs. Bear Markets for Silver

- Bull Market: Miners often surge faster than bullion due to operational leverage. As silver’s price climbs, profit margins grow exponentially for miners, fueling stock price hikes.

- Bear Market: In a silver downturn, miners can see their margins vanish or go negative, leading to steep share price declines, sometimes worse than the metal’s own drop.

Historical Correlations

Miners frequently move in tandem with silver, but beta is typically higher. That means if silver goes up 10%, a mining stock might jump 20%, or more, but if silver slides 10%, the miner might fall 20% or 30%. This correlation is not always perfect, though, as individual corporate events can overshadow metal trends.

Cycles matter a lot.

Liquidity and Costs

Physical Silver

- Storage: Large stashes of coins or bars can be unwieldy, requiring home safes or specialized vaulting.

- Insurance: Protecting your metal can become expensive, and not all insurers easily cover bullion.

- Selling Physical Metal: May require dealing with local coin shops or online marketplaces, each taking a margin. In frantic markets, you might secure higher premiums or face difficulties finding a buyer at the price you desire.

Silver Miners

- Brokerage Fees: Acquiring and selling shares is straightforward but subject to commissions, though many brokers now offer zero-commission trades.

- Bid-Ask Spread: For less-liquid mining stocks, wide spreads can hamper quick sales at favorable prices.

- ETFs: Operating expense ratios can steadily erode returns if you hold them for the long haul.

Geopolitical and Industrial Factors

Silver’s dual role as a precious metal and an industrial input means its price can be buffeted by global manufacturing cycles, technology trends (especially in solar power, electronics, or even new medical technologies), and investor sentiment as a safe haven. For miners, add political risk: new environmental regulations or shifting tax regimes in resource-rich nations can significantly affect a mining project’s viability.

Real world events shape real outcomes.

- Industrial Demand: If solar panel production spikes due to green energy initiatives, silver usage may climb, boosting prices. Miners might benefit further if they can ramp up output.

- Regulatory Environment: Governments might impose stricter environmental laws or royalties on precious metals extraction, influencing a miner’s profit margins or strategic decisions.

When you gather these factors—risk tolerance, personal objectives, market conditions, liquidity, cost structures, and real-world industrial drivers—you form a holistic picture guiding your choice between silver bullion or silver miners. However, many find that the most suitable approach is not exclusively one or the other but rather a balance, an idea we’ll examine in the next section.

Which Investment Is Right for You?

Every investor walks a unique path, guided by distinct goals, resources, and attitudes toward risk. That’s why the question, “Should I buy silver bullion or silver miners?” rarely yields a uniform response. Instead, it’s more constructive to frame the discussion around potential profiles and scenarios in which bullion or miners might be preferable—or why a blended approach could serve best. Let’s explore those possibilities in detail.

Align strategy with your personal profile.

Silver Bullion is Better If…

- You Seek a Hedge Against Inflation or Economic Crises

- Perhaps you anticipate heightened money printing, currency devaluation, or major geopolitical turmoil. In such instances, history suggests that physical silver can provide resilience.

- Physical metal remains a form of “real money,” recognized for millennia. It doesn’t rely on corporate solvency or good governance.

- You Prefer Tangible Assets with Minimal Complexity

- Some folks find comfort in literally holding silver bars or coins. The knowledge that these items remain in your secure possession is psychologically assuring.

- You won’t need to follow quarterly earning calls, mine expansions, or shifting management. This passive approach is particularly appealing if you desire a set-and-forget strategy.

- Your Main Goal is Wealth Preservation

- If your priority is preserving capital over decades, silver’s track record outshines the ephemeral, intangible nature of modern currency.

- While prices fluctuate short term, many believe that physical silver retains significance in the long run, correlating less with typical equity markets.

- You Dislike Corporate Risk

- If the idea of trusting a management team with your capital makes you uneasy, bullion might be the simpler route. Physical silver can’t suffer from poor executive decisions or labor disputes in a faraway mine.

Bullion suits protectors, not aggressors.

Silver Miners are Better If…

- You Crave Higher Potential Returns

- Historically, miners often exhibit leverage to metal prices. In a raging bull market for silver, mining stocks can skyrocket as profit margins balloon.

- Although riskier, such upside can be extremely appealing for those who have the stomach for volatility.

- You Want Income via Dividends

- Some miners share profits with shareholders, though yields can vary depending on commodity cycles and corporate strategies.

- Dividends, when sustained, might offer a buffer during sideways markets, providing some returns even if silver’s spot price stagnates.

- You’re Skilled at Analyzing Companies

- Investors with background in finance or geology, or those who enjoy dissecting earnings reports and feasibility studies, could uncover undervalued mining plays.

- By identifying top-tier management teams and stable jurisdictions, you might mitigate part of the operational risk.

- You Embrace Higher Volatility

- If your risk tolerance leans high and you’re okay with potential steep drawdowns, miners might deliver the thrill and potential reward you seek.

- Over time, well-chosen mining stocks could outperform the metal itself, especially if they continuously expand production or discover new resources.

Miners suit those seeking growth.

A Blended Approach

For a substantial segment of investors, neither a 100% bullion position nor a 100% miner position feels fully satisfying. That’s where a blended strategy comes in, balancing the security of physical silver (or a silver ETF) with the growth potential of mining stocks. Some individuals split their precious metals budget between, say, 50% bullion and 50% miners, adjusting the ratio according to personal perspectives on where we stand in the commodity cycle or how comfortable they are with corporate risk.

Benefits of a Balanced Portfolio:

- Diversification: Reduces concentration in either the purely tangible or purely equity realm.

- Risk Moderation: If miners falter due to internal challenges, your bullion position remains unaffected. If silver’s price stays flat but a miner thrives due to expansions, that helps offset slow price movement in the metal.

- Tactical Adjustments: Over time, you might shift weight from bullion to miners (or vice versa) as conditions evolve. If you predict a strong bull run in silver, lean more heavily on miners. If you’re anticipating a market crash, emphasize bullion.

Flexibility meets synergy.

Ultimately, your choice should reflect your financial situation, the role silver plays in your overall portfolio (is it a small hedge, a core investment, or a speculative play?), and the confidence you have in either physical metals or corporate equities. Keep in mind that silver, like all investments, experiences cyclical ups and downs. The decision might not be permanent; you could reevaluate yearly or in response to major shifts in market sentiment or personal circumstance.

With these points in mind, we’ll now tie everything together in our conclusion, ensuring you have a comprehensive vantage point for charting your path forward in the realm of silver investments.

Conclusion

Investing in silver can be an intriguing way to diversify your financial holdings, hedge against inflation, or speculate on the rising demand for this versatile metal. Yet, the form that investment takes—silver bullion or silver miners—makes a significant difference in terms of risks, rewards, and operational considerations. Understanding these differences is essential to align your precious metals allocation with your broader financial goals, time horizon, and personal comfort with volatility.

Clarity empowers decision-making.

Bullion Recap

For those who favor stability, tangibility, and a straightforward means of preserving wealth, silver bullion is the go-to. Bullion gives you a direct claim on the metal, whether in the form of bars or coins, or indirectly through an ETF that physically holds silver. You avoid corporate-level complications such as management failures or operational disasters, and you eliminate reliance on third parties beyond storage and security. However, bullion doesn’t generate dividends or interest, so you rely entirely on price appreciation for returns. Storage complexities—whether that’s a home safe, a bank box, or a specialized vault—add cost and logistical burdens. Liquidity, while generally decent, can involve premiums and the hassle of finding reputable dealers if you’re selling physical pieces. For many conservative or traditionally minded investors, though, these factors are minor compared to the reassurance of holding an asset with centuries of acceptance as real money.

Miners Recap

For those who find themselves intrigued by potential high returns and willing to accept the commensurate risks, silver miners present a more dynamic proposition. These companies can multiply gains when silver’s price rallies, thanks to operational leverage—every dollar increase in the spot price can significantly enlarge a miner’s profits if their production costs remain stable. Some miners even pay dividends, offering a cash flow dimension that bullion never does. But with these upsides come hazards: a management miscalculation, a new environmental regulation, or a sustained slump in silver prices can diminish profits, dragging share prices down. Mining equities also reflect broader stock market sentiment, occasionally plummeting even if silver’s spot price remains stable. The complexity of analyzing corporate reports, geological surveys, and expansions means that deeper due diligence is required.

Your choice is all about trade-offs.

Choosing Based on Your Profile

- Risk-Adverse, Safety-Focused Investor:

- Likely to lean toward bullion as a store of wealth, especially if uninterested in corporate complexities and content with a stable, intangible yield (i.e., no yield, but stable in terms of having the physical asset).

- Potentially invests via physical coins or bars, or uses silver ETFs to avoid storage issues while retaining near-pure exposure to spot prices.

- Growth-Seeking Investor with Risk Appetite:

- Might find miners more attractive, especially if they foresee a bullish period for silver or if they can carefully evaluate a specific miner’s potential.

- Could be drawn by the possibility of outsized gains, plus any dividend income that helps offset short-term market dips.

- Intermediate or Balanced Investor:

- Splits allocations between bullion and mining equities. For example, 70% bullion for safety and 30% in miner stocks for added growth potential.

- Adjusts allocations over time, shifting more into miners if they sense an incoming bull run or into bullion if macro conditions appear precarious.

When Markets Shift

No strategy is static. If silver enters an extended bullish cycle, you might want to increase your weighting in miners to capture leveraged upside—while still holding some bullion to anchor your precious metal exposure. Conversely, if a recession or global uncertainty looms, many reemphasize physical metals to ensure that at least part of their portfolio remains relatively insulated from equity market contagion. These toggles underscore that investing is not a set-and-forget venture; staying informed about silver’s market fundamentals, your own personal finances, and the performance of any corporate holdings is prudent.

Stay flexible and updated.

We hope this illuminates the differences, pros, and cons of silver bullion vs. silver miners, assisting you in making informed decisions that fit your financial blueprint. Consider all the nuances—storage issues, dividends, market beta, operational hazards—and reflect on where you stand in the risk-reward spectrum. Done wisely, silver investing can become a valuable piece of your overall wealth-building puzzle, connecting centuries of tradition with a forward-looking approach to capital growth or preservation.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.