Warren Buffett, known as the ‘Oracle of Omaha’, is arguably one of the most successful and respected investors of all time. His incredible track record at Berkshire Hathaway, a conglomerate he has helmed since 1965, and his value investing approach have earned him a dedicated following among investors. Buffett’s wisdom extends beyond his investment acumen and is also evident in his unique approach to communication.

Importance of Shareholder Communication: Warren Buffett’s View

Shareholder communication is often considered a mere corporate requirement, but for Buffett, it’s an essential aspect of business. He views his shareholders as partners in the business and believes in treating them as such. Buffett understands that clear, honest, and regular communication fosters trust, improves investor understanding, and helps shareholders make informed decisions.

Buffett has never shied away from communicating his thoughts, strategies, and company performance—be it good or bad—to his shareholders. His annual letters to Berkshire Hathaway shareholders, filled with investment wisdom, business insights, and humor, are a testament to his commitment to transparent and effective shareholder communication.

In Buffett’s words, “Owners are entitled to hear directly from the CEO as to what is going on and why.” This sentiment encapsulates his belief in the importance of open dialogue with shareholders, setting the stage for a discussion of his unique approach to shareholder communication.

Buffett’s Unique Approach to Shareholder Communication

Buffett’s Annual Shareholder Letters

One of the hallmarks of Buffett’s approach to shareholder communication is his annual letters to the shareholders of Berkshire Hathaway. Every year, Buffett pens a letter detailing the company’s performance, his views on the economy, his investment philosophy, and other thoughts. These letters are highly anticipated and widely read, not just by Berkshire shareholders, but also by the broader investing community and business leaders around the world.

The Significance of the Letters to Berkshire Hathaway Shareholders and the Investing Community

Buffett’s letters provide an insightful peek into the mind of one of the world’s most successful investors. They are filled with valuable insights and principles that have been used as a learning resource for students, investors, and business leaders. For shareholders, these letters are a transparent look at the company’s successes, challenges, and future direction.

The Warren Buffett Style of Communication: Transparency and Honesty

Buffett is known for his candid and honest style of communication. He does not believe in sugarcoating bad news or inflating good news. His letters frequently acknowledge mistakes and discuss lessons learned. This straightforwardness has earned him respect and trust among shareholders and the wider investment community.

Sharing Both Successes and Failures: The Role of Honesty in Building Trust

Buffett’s willingness to openly share both successes and failures is a key aspect of his communication strategy. By discussing failures and lessons learned, he demonstrates accountability and fosters a culture of learning within the organization. This openness has played a significant role in building trust among shareholders.

Warren Buffett’s Simplicity and Clarity in Communication

Buffett’s communication is often noted for its simplicity. He avoids using complex financial jargon and instead communicates in clear, relatable language. This approach makes his messages accessible to investors of all levels and encourages a broader understanding of Berkshire Hathaway’s business.

Buffett’s Ability to Explain Complex Financial Concepts in an Easily Digestible Manner

Not only does Buffett keep his language simple, but he also has a knack for explaining complex financial concepts in an understandable manner. By breaking down these concepts, Buffett empowers shareholders to make informed decisions and encourages a deeper understanding of investing principles and practices. His clarity in communication is a vital tool in making finance more inclusive and accessible.

source: Dividend Date on YouTube

Impact of Buffett’s Communication Style on Corporate America

Warren Buffett’s approach to shareholder communication isn’t just a model for Berkshire Hathaway; it has rippled out to become an aspirational standard for CEOs and business leaders around the globe. His unique blend of simplicity, transparency, and candor in corresponding with shareholders has been heralded as a touchstone in the corporate world.

This isn’t merely about emulating Buffett’s style—it’s about fostering a culture of open dialogue and accountability. From startup founders to Fortune 500 executives, many leaders have attempted to adopt the ‘Buffett style’ of communication, incorporating authenticity and transparency into their messaging. His shareholder letters, in particular, have inspired a new breed of corporate communications that blend business updates with valuable insights and a touch of personal perspective.

Influence on Transparency and Disclosure Practices

More than ever before, Buffett’s unwavering commitment to transparency has left a lasting impact on corporate disclosure practices. By embodying the principle that shareholders deserve honesty, whether the news is good or bad, he has spurred a shift in how businesses communicate.

Previously, many companies would obscure unfavorable news or present their financials in the most positive light possible. But Buffett has shown that candor, even when it hurts, can foster trust, respect, and loyalty among shareholders. As a result, many businesses have made efforts to be more open and forthright about their performance, challenges, and strategies, ultimately leading to an evolution in corporate transparency.

Impact on Investor Relations and Corporate Communication Strategies

The ‘Buffett effect’ extends into the realms of investor relations and corporate communication strategies too. Today’s businesses, under the influence of Buffett’s legacy, understand the critical role of clear, comprehensible, and timely communication with shareholders.

Gone are the days when corporate communication was purely formal and transactional. Instead, inspired by Buffett’s approach, it’s becoming more engaging and educational. This shift isn’t just about using clear language; it’s about demystifying the business for shareholders, explaining intricate strategies, and maintaining an open dialogue.

Companies are increasingly focusing on imbuing their investor relations strategies with the lessons drawn from Buffett’s communication style. As a result, there’s a growing emphasis on the role of effective communication in investor relations departments across businesses, all thanks to the enduring influence of Warren Buffett.

source: Dale Carnegie on YouTube

Warren Buffett’s Philosophy on Shareholder Engagement

Warren Buffett has always approached his relationship with shareholders from a unique perspective. He doesn’t see them as mere investors or distant figures; instead, he treats them as partners. This philosophy is rooted in his belief that shareholders, like himself, are co-owners of the business, with a shared interest in the company’s prosperity.

This view has shaped the way Buffett communicates and interacts with his shareholders. He doesn’t just disseminate information; he engages in an ongoing conversation, explaining his decisions, discussing his views, and acknowledging their concerns. By treating shareholders as partners, he establishes a stronger, more trusting relationship that fosters loyalty and long-term investment.

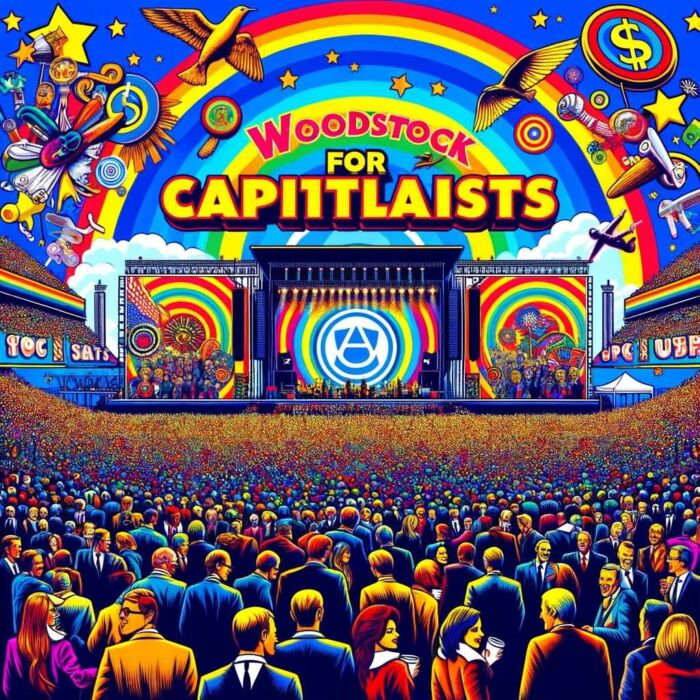

The Berkshire Hathaway Annual Meetings: The ‘Woodstock for Capitalists’

Description and Significance of the Event

Dubbed the “Woodstock for Capitalists,” the Berkshire Hathaway annual meeting is an event unlike any other in the corporate world. Thousands of shareholders from across the globe flock to Omaha, Nebraska, to attend this unique gathering. The meeting is a two-day festival, complete with a shopping expo featuring products from Berkshire-owned companies, a 5K race, and a newspaper-tossing contest—a throwback to Buffett’s childhood paper route.

However, the main event is the question-and-answer session with Buffett and his long-time business partner, Charlie Munger. This session, which can last several hours, is a testament to Buffett’s commitment to shareholder engagement.

Open Dialogue with Shareholders: Q&A Sessions

One of the key features of Berkshire Hathaway’s annual meetings is the extensive Q&A session with Warren Buffett and Charlie Munger. Shareholders have an opportunity to ask any question on their minds, and Buffett and Munger answer with their trademark wisdom, humor, and candor.

These sessions epitomize Buffett’s philosophy of treating shareholders as partners. Rather than sticking to a pre-prepared script or avoiding tough questions, Buffett embraces the opportunity to engage in open dialogue. This approach not only provides shareholders with valuable insights but also reinforces the bond of trust and mutual respect between the leadership of Berkshire Hathaway and its co-owners—the shareholders.

Lessons for Investors and Corporate Leaders from Buffett’s Communication Practices

One of the most distinct aspects of Buffett’s communication approach is his unwavering commitment to transparency. The annual shareholder letters he pens are a masterclass in open, honest, and clear communication. In these letters, Buffett doesn’t merely celebrate successes and downplay challenges. Instead, he offers a candid, forthright assessment of the company’s performance, even when it means acknowledging mistakes or setbacks.

This level of openness is instrumental in fostering an environment of trust and respect between Buffett and his shareholders. For the shareholders, this openness assures them that the company’s leadership is not only accountable but also acts responsibly and ethically. For other corporate leaders, the lesson is unmistakable: adopting a culture of transparency can be a powerful tool in building investor trust and confidence. Transparency, in this context, should not be seen merely as a regulatory obligation but as an ethical imperative that can significantly bolster the reputation and credibility of a business.

Embracing Simplicity and Clarity in Communication

Warren Buffett has long been celebrated for his exceptional ability to distill complex financial principles into simple, digestible insights. His communications are refreshingly devoid of complicated jargon or obfuscating language. Instead, they are filled with engaging stories, vibrant metaphors, and clear explanations that make even the most intricate financial concepts accessible to the average reader.

The implications of Buffett’s communication style are profound for both investors and corporate leaders. For investors, it underscores the importance of thoroughly understanding the businesses in which they invest. As Buffett often asserts, one should never invest in a business they cannot explain. For corporate leaders, it offers a compelling case for adopting a straightforward and clear communication style. By effectively demystifying complex business strategies and operations, leaders can engage more meaningfully with shareholders, bolster investor confidence, and inspire a deeper interest in their companies.

Cultivating Trust with Shareholders and the Wider Investment Community

Trust is the cornerstone of Warren Buffett’s relationship with his shareholders. This trust is painstakingly cultivated through his consistent commitment to transparency, openness, and respect for shareholders. From his comprehensive and forthright annual letters to the extensive Q&A sessions at Berkshire Hathaway’s annual shareholder meetings, every interaction Buffett has with his shareholders is aimed at nurturing and reinforcing this vital trust.

The significance of Buffett’s approach extends far beyond the boundaries of Berkshire Hathaway. For investors, it is a stark reminder of the value of aligning themselves with companies that demonstrate a genuine respect for their shareholders and consistently prioritize their interests. For corporate leaders, it serves as an exemplary model of how to nurture a relationship of trust with their investors. This kind of relationship can not only foster enduring loyalty among shareholders but also attract stable, long-term investment that is crucial for sustained business growth and success. By prioritizing trust-building, leaders can create a loyal investor base that remains supportive even in times of adversity.

source: iValue Investing on YouTube

Conclusion: Warren Buffett’s approach to Shareholder Communication

Warren Buffett’s approach to shareholder communication can be summarized as a paradigm of transparency, simplicity, and trust. His annual letters, candid and comprehensive, provide shareholders with a clear understanding of Berkshire Hathaway’s performance and strategies. Through open dialogue and a commitment to honesty, Buffett treats shareholders as partners, fostering a strong sense of ownership and mutual respect.

Buffett’s Enduring Impact on Corporate Communication

Buffett’s impact on corporate communication cannot be overstated. His commitment to transparency has set a high standard for CEOs and corporate leaders around the world. The lessons drawn from his approach have inspired a shift towards more open, honest, and accessible communication practices. Corporate leaders now recognize that effective shareholder communication is not just a regulatory obligation, but a means to build trust, enhance reputation, and attract long-term investment.

source: CNBC Television on YouTube

Role of Effective Shareholder Communication in Investing and Corporate Governance

Effective shareholder communication is a cornerstone of successful investing and corporate governance. Warren Buffett’s example highlights the importance of transparency, simplicity, and trust-building in fostering a positive relationship between companies and their shareholders. Clear and open communication enables investors to make informed decisions, encourages long-term investment, and promotes a culture of accountability.

For investors, active engagement with shareholder communications empowers them to assess the performance and strategies of companies in which they invest. For corporate leaders, adopting Buffett’s principles of transparency and simplicity can strengthen relationships with shareholders, enhance corporate reputation, and ultimately contribute to long-term success.

In a rapidly evolving business landscape, effective shareholder communication plays an increasingly vital role. It cultivates trust, aligns interests, and fosters a shared vision between companies and their shareholders. Embracing the lessons from Warren Buffett’s approach can empower investors, elevate corporate governance practices, and contribute to a more transparent and responsible business environment.

Important Information

Investment Disclaimer: The content provided here is for informational purposes only and does not constitute financial, investment, tax or professional advice. Investments carry risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future outcomes. Please note that indexes are benchmarks and not directly investable. All examples are purely hypothetical. Do your own due diligence. You should conduct your own research and consult a professional advisor before making investment decisions.

“Picture Perfect Portfolios” does not endorse or guarantee the accuracy of the information in this post and is not responsible for any financial losses or damages incurred from relying on this information. Investing involves the risk of loss and is not suitable for all investors. When it comes to capital efficiency, using leverage (or leveraged products) in investing amplifies both potential gains and losses, making it possible to lose more than your initial investment. It involves higher risk and costs, including possible margin calls and interest expenses, which can adversely affect your financial condition. The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the official policy or position of anyone else. You can read my complete disclaimer here.