Investing is an intricate blend of strategy, psychology, and disciplined execution. Among the many legends in the trading world, Richard Dennis stands out as a pioneer whose innovative approaches have left an indelible mark. Best known for creating the Turtle Trading System, Dennis transformed the landscape of trend-following strategies. In this comprehensive guide, we’ll delve into Richard Dennis’s life, his groundbreaking Turtle Trading System, and how you can adopt his methods to enhance your own trading endeavors.

source: financial wisdom on YouTube

Who is Richard Dennis?

Richard Dennis is a name synonymous with trading excellence and innovation. Renowned as a commodities trader, Dennis gained fame not only for his personal trading success but also for his unique approach to teaching and mentoring new traders. His influence on the trading world is profound, with the Turtle Trading System being one of his most significant contributions.

The Turtle Trading System: A Game Changer

The Turtle Trading System is a trend-following strategy that emerged from one of the most famous experiments in trading history—the Turtle Experiment. This system emphasizes disciplined entry and exit rules, risk management, and psychological resilience. It’s designed to capitalize on sustained market trends, making it a robust method for both novice and experienced traders.

Let’s explore and understand Richard Dennis’s trading approach. We’ll break down the principles of the Turtle Trading System, examine its core components, and provide practical steps for you to implement these strategies in today’s dynamic markets. Whether you’re looking to refine your trading skills or seeking a structured approach to investing, this guide will equip you with the knowledge to invest like Richard Dennis.

Who is Richard Dennis?

Background and Early Life

Richard Dennis was born in 1949 in Chicago, Illinois. Growing up in a modest household, Dennis showed an early aptitude for numbers and strategy, which later translated into his trading career. He pursued a degree in philosophy at Stanford University, where he honed his analytical and critical thinking skills—traits that would prove invaluable in his future endeavors.

From Pit Trader to Trading Legend

After completing his education, Dennis ventured into the world of commodities trading. He started as a pit trader, working on the trading floors where raw commodities like gold, silver, and wheat were bought and sold. Dennis quickly made a name for himself with his aggressive trading style and remarkable ability to predict market movements.

His success in the pits was just the beginning. Dennis amassed substantial wealth through his trading activities, but what truly set him apart was his desire to teach others his methods. This led to the legendary Turtle Trading Experiment, where he sought to prove that successful trading could be taught systematically.

Key Achievements and Contributions

- Turtle Trading Experiment: In the early 1980s, Richard Dennis partnered with Bill Eckhardt to test his theory that trading success could be taught. They selected a group of novices, known as “Turtles,” and trained them using a set of predefined rules. The experiment was a resounding success, with the Turtles generating significant profits, thus validating Dennis’s belief in systematic trading.

- Author and Educator: Dennis authored several influential books and articles on trading strategies, risk management, and market analysis. His works continue to inspire traders worldwide.

- Mentorship and Legacy: Beyond the Turtle Experiment, Dennis has mentored countless traders, instilling in them the principles of discipline, strategy, and resilience. His legacy is evident in the many successful traders who have adopted his methodologies.

Tip: Understanding Richard Dennis’s journey from a pit trader to a trading legend underscores the importance of discipline, continuous learning, and the willingness to innovate in the world of trading.

The Birth of the Turtle Trading System

The Turtle Experiment: A Bold Hypothesis

In 1983, Richard Dennis and his partner Bill Eckhardt embarked on a groundbreaking experiment to test a simple yet bold hypothesis: “Can great traders be trained?” Dennis believed that trading success wasn’t solely dependent on innate talent but could be taught through a structured system.

Purpose and Outcome of the Experiment

The experiment involved selecting a group of individuals with no prior trading experience—ranging from university students to restaurant managers—and training them intensively over a two-week period. Dennis provided them with a set of clear, rule-based trading strategies, emphasizing discipline and consistency.

The outcome was nothing short of extraordinary. The Turtles, as they came to be known, generated substantial profits, proving that with the right training and systems, anyone could become a successful trader. This experiment not only validated Dennis’s beliefs but also laid the foundation for the Turtle Trading System.

Introduction to the Turtle Trading System

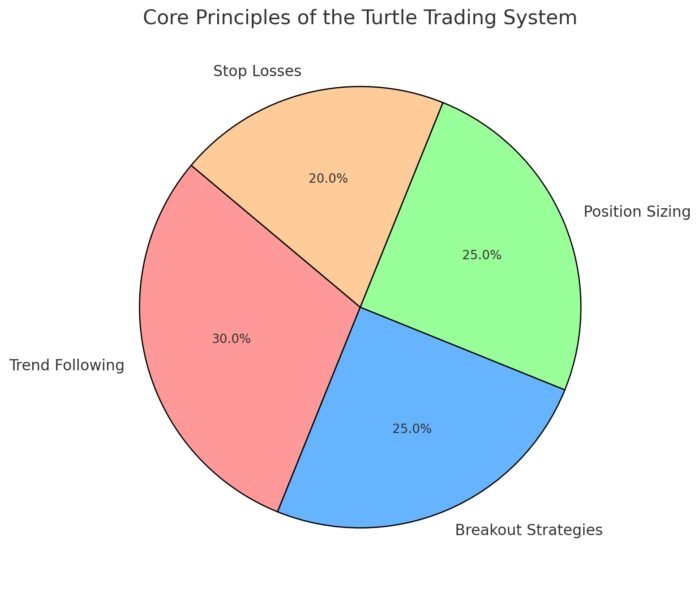

The Turtle Trading System is a trend-following strategy that relies on mechanical rules to identify entry and exit points in the market. Its core principles include:

- Trend Identification: Recognizing sustained market movements.

- Risk Management: Controlling exposure to any single trade.

- Position Sizing: Allocating appropriate capital based on volatility.

- Discipline: Adhering strictly to the trading rules without emotional interference.

Tip: The success of the Turtle Trading System highlights the power of mechanical, rule-based trading. By removing emotions from the equation, traders can make more objective and consistent decisions.

Core Principles of the Turtle Trading System

1. Trend Following: Riding the Market Waves

At the heart of the Turtle Trading System is the trend-following strategy. This involves identifying and capitalizing on sustained market trends—both upward and downward.

- How It Works: The system uses specific indicators to determine the direction and strength of a trend. Once a trend is identified, the system takes positions in the direction of the trend, holding them as long as the trend persists.

- Benefits: Trend following allows traders to ride significant market movements, maximizing potential profits while minimizing the impact of short-term volatility.

2. Breakout Strategies: Seizing Opportunities

Breakout strategies are crucial in the Turtle Trading System. A breakout occurs when the price of a commodity moves beyond a defined support or resistance level.

- Identifying Breakouts: The Turtles used predefined entry points based on historical price data. For example, they might enter a long position when the price breaks above its 20-day high or a short position when it falls below its 20-day low.

- Execution: Once a breakout is confirmed, the system triggers a trade in the direction of the breakout, anticipating that the trend will continue.

3. Position Sizing: Managing Exposure

Position sizing is a critical component of the Turtle Trading System, ensuring that no single trade can significantly impact the overall portfolio.

- Volatility-Based Sizing: The system adjusts the size of each position based on the volatility of the market. Higher volatility leads to smaller position sizes, reducing risk, while lower volatility allows for larger positions.

- Risk Control: By adhering to strict position sizing rules, the Turtles maintained a balanced portfolio, protecting their capital from excessive losses.

4. Stop Losses: Protecting Capital

Stop losses are predefined points at which a position is closed to prevent further losses.

- Setting Stop Losses: The Turtles used stop-loss orders based on market volatility, ensuring that losses on any single trade were limited.

- Importance: Stop losses are essential for risk management, helping traders protect their capital and maintain discipline by preventing emotional decision-making.

Tip: Incorporate robust risk management techniques like position sizing and stop losses to safeguard your portfolio against unexpected market movements.

Turtle Trading Rules and Execution

Detailed Breakdown of the Turtle Trading Rules

The Turtle Trading System is governed by a set of clear, mechanical rules that dictate when to enter and exit trades. Here’s a detailed breakdown:

- Market Selection:

- Trade a diverse range of markets, including commodities, currencies, and bonds.

- Avoid over-concentration in any single market to diversify risk.

- Entry Rules:

- Breakout Entry: Enter a trade when the price breaks above the 20-day high (for long positions) or below the 20-day low (for short positions).

- Confirmation: Ensure that the breakout is supported by volume or other indicators to confirm its validity.

- Exit Rules:

- Trend Reversal: Exit a position when the price breaks below the 10-day low (for long positions) or above the 10-day high (for short positions).

- Stop Loss: Automatically close a position if it moves against you by a predefined amount based on volatility.

- Position Sizing:

- Determine the size of each position based on the volatility of the market.

- Use a fixed percentage of the portfolio for each trade to maintain consistent risk exposure.

- Risk Management:

- Limit the maximum number of simultaneous positions to avoid overexposure.

- Diversify across different markets to spread risk.

How to Execute Trades According to the System

Executing trades in the Turtle Trading System involves adhering strictly to the predefined rules without deviation. Here’s how to implement the system:

- Identify the Trend:

- Use technical indicators to determine the current trend in a market.

- Look for sustained price movements that indicate a strong trend.

- Monitor Breakouts:

- Keep an eye on key support and resistance levels.

- Enter a trade when the price breaks out of these levels, signaling the start of a new trend.

- Manage Positions:

- Apply position sizing rules to determine how much capital to allocate to each trade.

- Set stop-loss orders based on market volatility to protect your investments.

- Adhere to Exit Rules:

- Close positions when the trend shows signs of reversal.

- Avoid holding onto losing positions beyond the stop-loss threshold.

Examples of Specific Trading Scenarios and Decisions

Scenario 1: Long Position Entry

- Market: Gold

- Current Trend: Upward

- 20-Day High: $1,800

- Breakout: Price rises above $1,800

- Action: Enter a long position at $1,805

- Stop Loss: Set at $1,750 (based on volatility)

Scenario 2: Short Position Entry

- Market: Crude Oil

- Current Trend: Downward

- 20-Day Low: $60

- Breakout: Price falls below $60

- Action: Enter a short position at $59

- Stop Loss: Set at $65 (based on volatility)

Scenario 3: Position Exit

- Market: S&P 500 Futures

- Initial Entry: Long at 3,000

- Current Price: 3,200

- 10-Day Low: 3,150

- Action: Exit the position if the price falls below 3,150

Tip: Use real-life examples to practice and understand how the Turtle Trading System operates in different market conditions, enhancing your ability to execute trades effectively.

Risk Management in Turtle Trading

Importance of Risk Management

Risk management is the cornerstone of the Turtle Trading System. Without proper risk controls, even the best trading strategies can lead to significant losses. The Turtles prioritized preserving capital to ensure long-term success.

- Capital Preservation: Protecting your initial investment is crucial to surviving market downturns and capitalizing on future opportunities.

- Consistent Performance: Effective risk management leads to more consistent trading performance, reducing the likelihood of catastrophic losses.

- Psychological Stability: Knowing that risks are controlled helps maintain emotional balance, preventing panic-driven decisions.

Techniques Used by the Turtles to Manage Risk

The Turtle Trading System employs several key techniques to manage and mitigate risk:

- Position Sizing:

- Adjust the size of each position based on the volatility of the market.

- Use the Average True Range (ATR) to measure volatility and determine the appropriate position size.

- Diversification:

- Trade multiple markets to spread risk across different asset classes.

- Avoid over-concentration in any single market to reduce exposure to specific risks.

- Stop Losses:

- Implement strict stop-loss orders to limit potential losses on each trade.

- Use volatility-based stop losses to adapt to changing market conditions.

- Risk Limits:

- Set daily and overall risk limits to prevent excessive losses.

- Monitor and adjust positions to stay within predefined risk parameters.

Balancing Risk and Reward in Trading Decisions

Balancing risk and reward is essential for optimizing trading performance. The Turtles aimed to achieve high returns while keeping risks at manageable levels.

- Risk-Reward Ratio: Strive for a favorable risk-reward ratio, where potential rewards outweigh potential risks.

- Consistent Profit Targets: Set clear profit targets based on market conditions and trend strength.

- Adaptive Strategies: Adjust risk parameters based on evolving market dynamics to maintain a balanced approach.

Tip: Continuously evaluate and adjust your risk management techniques to ensure they align with your overall trading strategy and market conditions.

Performance and Legacy of the Turtle Traders

Historical Performance of the Turtle Trading System

The Turtle Trading System has a proven track record of delivering impressive returns. During the original Turtle Experiment, the Turtles generated substantial profits, often outperforming professional traders and institutional investors. Their success was attributed to the system’s disciplined approach and effective risk management.

- Consistent Returns: The Turtle Trading System consistently delivered positive returns across various market conditions.

- Outperformance: Compared to the broader market indices, the Turtles often achieved higher returns, validating the effectiveness of trend-following strategies.

- Longevity: The principles of the Turtle Trading System have remained relevant over decades, demonstrating their enduring applicability.

Success Stories of Original Turtle Traders

Many of the original Turtles went on to achieve significant success in their trading careers, leveraging the foundational principles they learned during the experiment.

- Curtis Faith: Often referred to as “The Turtle Professor,” Faith became a renowned trader and educator, applying the Turtle Trading principles to his own successful trading career.

- Linda Bradford Raschke: A prominent trader who credits her success to the disciplined approach instilled by the Turtle Trading System.

- Michael Covel: An author and advocate of trend following, Covel draws heavily from the Turtle Trading principles in his work.

How the System Has Influenced Modern Trading Strategies

The Turtle Trading System has had a lasting impact on the trading world, influencing various modern trading strategies and methodologies.

- Trend Following Popularity: The system popularized trend-following strategies, making them a staple in many traders’ arsenals.

- Algorithmic Trading: The rule-based nature of the Turtle Trading System laid the groundwork for the development of algorithmic trading systems that rely on predefined rules and automation.

- Educational Programs: Numerous trading courses and educational programs incorporate Turtle Trading principles, teaching new generations of traders the importance of discipline and systematic trading.

Tip: Study the success stories of the original Turtle Traders to gain insights into how disciplined application of the system can lead to sustained trading success.

Adapting Turtle Trading to Modern Markets

Challenges of Applying Turtle Trading in Today’s Markets

While the Turtle Trading System has proven effective over time, modern markets present new challenges that require adaptations to the original strategy.

- Increased Market Efficiency: With advancements in technology and widespread access to information, markets have become more efficient, making it harder to identify profitable trends.

- Higher Frequency Trading: The rise of high-frequency trading has increased market volatility and reduced the lifespan of trends, complicating trend-following strategies.

- Globalization: The interconnectedness of global markets means that local trends can be influenced by international events, requiring a broader perspective.

- Regulatory Changes: Evolving regulations impact market dynamics and trading strategies, necessitating continuous adaptation.

Modifications and Adaptations to the Original System

To address these challenges, traders need to modify and adapt the Turtle Trading System while maintaining its core principles.

- Enhanced Technology:

- Utilize advanced trading platforms and algorithms to identify and execute trades more efficiently.

- Implement machine learning and artificial intelligence to refine trend identification and signal generation.

- Diversified Market Selection:

- Expand the range of markets traded to include emerging asset classes like cryptocurrencies and ETFs.

- Incorporate global markets to capture trends influenced by international events.

- Dynamic Risk Management:

- Adapt risk management techniques to account for increased market volatility.

- Use more sophisticated models to assess and manage risk in real-time.

- Flexible Time Frames:

- Adjust the time frames used for trend identification to align with faster-moving markets.

- Incorporate shorter-term trends alongside long-term trends to capitalize on a wider range of opportunities.

Tools and Resources for Implementing a Modern Version of Turtle Trading

Modern traders have access to a plethora of tools and resources that can enhance the implementation of the Turtle Trading System.

- Advanced Charting Software: Platforms like TradingView and MetaTrader offer robust charting tools and indicators to identify trends and breakouts.

- Automated Trading Systems: Use platforms like QuantConnect or NinjaTrader to develop and deploy automated Turtle Trading strategies.

- Data Analytics Tools: Leverage tools like Python with libraries such as Pandas and NumPy for in-depth data analysis and backtesting.

- Educational Platforms: Enroll in courses and webinars that focus on trend-following and quantitative trading strategies to stay updated with the latest developments.

Tip: Embrace modern trading technologies and continuously educate yourself on new tools to enhance your ability to implement and adapt the Turtle Trading System effectively.

Learning from Richard Dennis’s Philosophy

Key Takeaways from Richard Dennis’s Approach to Trading

Richard Dennis’s trading philosophy offers several valuable lessons for both novice and experienced traders:

- Discipline is Paramount: Adhering strictly to predefined rules and strategies is essential for consistent trading success.

- Systematic Approach: A rule-based system reduces emotional interference, promoting objective decision-making.

- Risk Management: Effective risk controls protect capital and ensure long-term sustainability.

- Adaptability: While maintaining core principles, being flexible and adapting to changing market conditions is crucial.

- Continuous Learning: The willingness to learn and evolve strategies based on new data and insights drives ongoing success.

The Psychological and Emotional Aspects of Successful Trading

Successful trading isn’t just about having the right strategies—it’s also about managing the psychological and emotional challenges that come with the territory.

- Emotional Control: Fear and greed can lead to impulsive decisions that undermine trading strategies. Maintaining emotional discipline is crucial for sticking to the system.

- Patience: Trends don’t always develop quickly. Patience allows traders to wait for the right opportunities and ride out short-term volatility.

- Resilience: Facing losses and setbacks is part of trading. Resilience enables traders to recover and continue pursuing their strategies without being derailed by failures.

- Confidence: Trusting in the system and its rules fosters confidence, encouraging traders to make decisions based on strategy rather than speculation.

Tip: Develop strong emotional and psychological resilience through practices like meditation, journaling, and continuous education to enhance your trading performance.

How to Develop Discipline and Consistency Like a Turtle Trader

Discipline and consistency are the bedrock of the Turtle Trading System. Here’s how you can cultivate these essential traits:

- Set Clear Rules:

- Define your trading rules and stick to them without deviation.

- Ensure that your rules cover all aspects of trading, including entry, exit, position sizing, and risk management.

- Automate Your Strategy:

- Use automated trading systems to execute trades based on your predefined rules.

- Automation reduces the influence of emotions and ensures consistent application of your strategy.

- Maintain a Trading Journal:

- Document all your trades, including the rationale behind each decision.

- Reviewing your journal helps identify patterns, strengths, and areas for improvement, fostering continuous learning and discipline.

- Set Realistic Goals:

- Establish achievable trading goals that align with your risk tolerance and investment horizon.

- Avoid setting overly ambitious targets that can lead to impulsive and risky decisions.

- Regularly Review and Adjust:

- Periodically assess the effectiveness of your trading system and make necessary adjustments based on performance data.

- Stay flexible and open to refining your approach as you gain more experience and insights.

Tip: Create a structured trading plan and adhere to it rigorously, ensuring that every trade aligns with your established rules and objectives.

How to Start Trading Like Richard Dennis

Implementing the Turtle Trading System involves a series of well-defined steps. Here’s how you can get started:

Step-by-Step Guide to Implementing Turtle Trading Principles

- Understand the Core Principles:

- Familiarize yourself with the key components of the Turtle Trading System, including trend following, breakout strategies, position sizing, and risk management.

- Select Suitable Markets:

- Choose a diverse range of markets to trade, such as commodities, currencies, and indices. Diversification helps spread risk and capitalize on various market trends.

- Set Up Your Trading Platform:

- Use a reliable trading platform that offers advanced charting tools and the ability to set automated trading rules. Platforms like MetaTrader, TradingView, and NinjaTrader are popular choices.

- Develop Your Trading Rules:

- Define clear rules for entering and exiting trades based on trend and breakout signals.

- Incorporate position sizing and stop-loss rules to manage risk effectively.

- Backtest Your Strategy:

- Use historical data to test your trading strategy’s performance. Backtesting helps you understand how your system would have performed in different market conditions.

- Adjust your rules based on backtesting results to optimize performance.

- Start with a Demo Account:

- Practice your trading strategy in a simulated environment before committing real capital. A demo account allows you to refine your approach without financial risk.

- Implement the Strategy with Real Capital:

- Once you’re confident in your system, start trading with real money. Begin with smaller positions to manage risk effectively.

- Gradually increase your position sizes as you gain experience and see consistent results.

- Monitor and Rebalance:

- Continuously monitor your portfolio and adjust positions based on market trends and performance.

- Regularly rebalance your portfolio to maintain alignment with your trading rules and risk parameters.

- Keep Learning and Adapting:

- Stay updated with market developments and continuously seek to improve your trading strategy.

- Learn from your trading experiences and make necessary adjustments to enhance performance.

Tip: Take a structured approach to implementing the Turtle Trading System, ensuring that each step is thoroughly executed to maximize your chances of success.

Resources for Learning More About Turtle Trading

To deepen your understanding of the Turtle Trading System and enhance your trading skills, explore the following resources:

- Books:

- Way of the Turtle by Curtis Faith: Offers an insider’s perspective on the Turtle Trading Experiment and the principles that guided the Turtles to success.

- The Complete TurtleTrader by Michael Covel: Chronicles the story of the Turtle Traders and delves into the strategies that made them successful.

- Online Courses and Webinars:

- Investopedia Academy: Offers courses on trend following and quantitative trading.

- Coursera and Udemy: Provide courses on algorithmic trading and technical analysis that align with Turtle Trading principles.

- Trading Communities:

- Elite Trader: A forum where traders discuss strategies, share insights, and learn from each other.

- Reddit’s r/algotrading: A community focused on algorithmic trading and quantitative strategies.

- Research Papers and Articles:

- Explore academic journals and financial publications for in-depth analyses of trend-following strategies and the Turtle Trading System.

Tip: Continuously seek out educational resources and engage with trading communities to stay informed and inspired on your trading journey.

Tips for Beginners Looking to Follow Dennis’s Strategies

For those new to trading or the Turtle Trading System, here are some tips to help you get started:

- Start Small:

- Begin with a small portion of your capital to minimize risk as you learn the ropes.

- Gradually increase your investment as you gain confidence and experience.

- Be Patient:

- Trading is a marathon, not a sprint. Allow time for your strategies to develop and mature.

- Avoid the temptation to make impulsive trades based on short-term market movements.

- Stay Disciplined:

- Adhere strictly to your trading rules, even when faced with losses or market volatility.

- Maintain emotional control to ensure consistent application of your strategy.

- Keep a Trading Journal:

- Document every trade, including the rationale behind it and the outcome.

- Use your journal to analyze your performance and identify areas for improvement.

- Seek Mentorship:

- Connect with experienced traders or join trading communities to gain insights and guidance.

- Learning from others can accelerate your understanding and application of the Turtle Trading principles.

- Continuously Learn:

- Stay updated with market trends, new trading strategies, and advancements in trading technology.

- Invest in your education to enhance your trading skills and adaptability.

Tip: Embrace a learning mindset, being open to continuous improvement and adaptation as you navigate the trading landscape.

Richard Dennis & the Turtle Trading System: 12-Question FAQ (Rules, Entries, Exits, Risk)

Who is Richard Dennis and why is he influential?

A Chicago commodities legend, Dennis proved that rules-based trend following could be taught. His Turtle Experiment trained novices to trade a mechanical system with disciplined entries, exits, and risk controls.

What was the Turtle Experiment?

In 1983–84 Dennis and Bill Eckhardt taught a small cohort a strict rule set and bankroll/risk limits. The Turtles’ success showed that process beats intuition when rules are executed consistently.

What markets does the Turtle approach target?

Liquid, diversifying futures/FX/commodities and index contracts (and today, liquid ETFs). Breadth across uncorrelated markets is a core edge for trend followers.

How are entries defined?

Classic rules buy breakouts: e.g., a close above the 20-day (or 55-day) high for longs; below for shorts. Use stops/orders so execution is mechanical, not discretionary.

How are exits defined?

Typical exits use a shorter lookback (e.g., 10-day counter-breakout) or a volatility stop. The idea: cut losers, trail winners, and let trends run.

How is position sizing determined?

Volatility-scaled sizing using ATR (N) so each trade risks a similar fraction of equity (e.g., ~0.5–2% per position). Higher volatility ⇒ smaller size; lower volatility ⇒ larger size.

What risk controls are essential?

Per-trade risk caps, portfolio heat limits, correlation/sector caps, and max open positions. Diversify across markets and keep rules pre-committed to avoid emotional overrides.

What are common pitfalls for new Turtle traders?

Overriding signals, crowding illiquid markets, oversizing, curve-fitting parameters, and quitting after normal trend-follower drawdowns. The cure: smaller size and strict adherence.

How do you adapt Turtle rules to modern markets?

Keep the core but refine: liquidity filters, slippage modeling, dynamic portfolio heat, and periodic parameter checks. Consider ETFs for access and automation for discipline.

Which tools help implementation?

Charting/screening, ATR calculators, backtesting platforms, basket/OTO orders, and a rebalancing/journal workflow. Anything that standardizes execution improves outcomes.

What performance profile should I expect?

Lumpy: many small losses and occasional big winners. Long flat periods are normal; edges show over multi-year horizons across many markets.

How do I start trading like a Turtle?

Write an IPS (universe, entries, exits, sizing, heat), backtest with costs, paper trade, then go live small. Review on a schedule—not on headlines.

Summary of Richard Dennis’s Impact on Trading

Richard Dennis’s contributions to the trading world are both profound and far-reaching. Through the creation of the Turtle Trading System, Dennis demonstrated that disciplined, rule-based trading strategies could lead to consistent success. His Turtle Experiment showcased the power of teaching systematic trading principles, proving that trading excellence could be achieved through education and structured methodologies.

Relevance of Turtle Trading Today

In today’s fast-paced and technologically advanced markets, the principles of the Turtle Trading System remain highly relevant. Trend following, breakout strategies, and rigorous risk management are as applicable now as they were during the original Turtle Experiment. While market conditions have evolved, the foundational principles of disciplined and data-driven trading continue to offer valuable guidance for modern traders.

- Technological Integration: Modern tools and platforms enhance the implementation of Turtle Trading strategies, making them more accessible and efficient.

- Global Markets: The diversification of markets offers new opportunities for trend following and breakout trading.

- Advanced Analytics: Enhanced data analysis capabilities allow for more precise and informed trading decisions.

Encouragement for Readers to Explore and Practice the System

If you’re eager to enhance your trading skills and achieve consistent success, exploring and practicing Richard Dennis’s Turtle Trading System is a worthwhile endeavor. Embrace the disciplined approach, adhere to the mechanical rules, and prioritize risk management to build a robust and resilient trading portfolio.

Take Action:

- Educate Yourself: Dive deeper into the Turtle Trading System by reading Way of the Turtle by Curtis Faith and The Complete TurtleTrader by Michael Covel.

- Develop Your Strategy: Define clear trading rules based on trend following, breakout strategies, position sizing, and risk management.

- Practice and Refine: Use demo accounts to practice your strategy, refine your approach, and build confidence before committing real capital.

- Stay Disciplined: Maintain consistency and discipline in your trading, adhering to your system even during challenging market conditions.

- Monitor and Adapt: Continuously monitor your performance, make necessary adjustments, and stay adaptable to evolving market dynamics.

By adopting the Turtle Trading principles, you can navigate the complexities of the financial markets with greater confidence and strategic insight, ultimately achieving your long-term investment goals.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.