Investing like Larry Hite means embracing a blend of systematic strategies, data-driven decisions, and disciplined risk management. As a pioneering figure in the realm of system trading, Larry Hite has demonstrated how removing emotions from trading and relying on robust algorithms can lead to consistent success in financial markets. Whether you’re a novice investor or a seasoned trader, adopting Hite’s principles can significantly enhance your trading approach. In this comprehensive guide, we’ll delve into Larry Hite’s trading philosophy, explore his core strategies, and provide actionable insights to help you emulate his success in system trading.

source: Chat With Traders on YouTube

Larry Hite: A Pioneer in Systematic Trading

Larry Hite stands as a monumental figure in the world of trading, particularly known for his groundbreaking work in system trading. His journey from an aspiring musician to the founder of Mint Investment Management exemplifies the transformative power of disciplined, algorithm-driven trading strategies. Hite’s contributions have not only shaped the way traders approach the markets but have also paved the way for the widespread adoption of systematic trading methodologies.

Understanding System Trading

System trading is a method of trading that relies on predefined rules and algorithms to make trading decisions. Unlike discretionary trading, which depends on a trader’s intuition and experience, system trading emphasizes consistency, objectivity, and the removal of emotional bias. This approach leverages historical data, statistical analysis, and automated processes to execute trades systematically.

We’ll attempt, as best we can, an in-depth exploration of Larry Hite’s trading philosophy and methods. By understanding his approach to system trading, investors can gain valuable insights into creating and implementing their own systematic strategies. From his core principles to his risk management techniques, we’ll cover the multifaceted aspects that make Larry Hite a foundational figure in system trading.

Who is Larry Hite?

Early Life and Background

Larry Hite’s journey to becoming a trading legend is as unconventional as it is inspiring. Born with a passion for music, Hite initially pursued a career as an aspiring musician. However, his path took a dramatic turn when he discovered his innate talent for trading. This pivot from music to finance marked the beginning of a remarkable career that would see him become a pioneer in system trading.

From Music to Trading: Hite’s Unique Journey

Hite’s transition from music to trading wasn’t a straightforward one. His early experiences in the music industry instilled in him a sense of discipline and creativity, which later became invaluable in his trading career. Drawing parallels between composing music and designing trading systems, Hite approached the financial markets with the same creativity and analytical rigor that he once applied to his musical pursuits.

Founding Mint Investment Management

In 1986, Larry Hite founded Mint Investment Management, one of the first hedge funds to implement systematic trading strategies. Mint Investment Management quickly gained recognition for its innovative approach, leveraging algorithms to execute trades based on quantitative models. Under Hite’s leadership, Mint became a benchmark for systematic trading, demonstrating the effectiveness of data-driven strategies in achieving consistent returns.

Key Achievements

- Pioneering System Trading: Larry Hite is credited with being one of the first traders to adopt and advocate for system trading, setting the stage for its widespread adoption in the financial industry.

- Consistent Performance: Mint Investment Management has consistently outperformed the market, delivering robust returns through disciplined, algorithm-driven trading strategies.

- Educational Contributions: Beyond his trading success, Hite has contributed to the education of aspiring traders, sharing his knowledge and experiences to foster a new generation of systematic traders.

The Birth of System Trading

What is System Trading?

System trading is a method that relies on predefined rules and algorithms to make trading decisions. Unlike discretionary trading, which depends on a trader’s intuition and experience, system trading emphasizes consistency, objectivity, and the removal of emotional bias. This approach leverages historical data, statistical analysis, and automated processes to execute trades systematically.

Larry Hite’s Role in Pioneering System Trading

Larry Hite was a trailblazer in the adoption of system trading. In the mid-1980s, when most traders relied heavily on discretionary methods, Hite saw the potential of using quantitative models to drive trading decisions. His belief in the power of data-driven trading led him to develop sophisticated algorithms that could analyze market patterns and execute trades with precision and consistency.

Data-Driven Trading: The Cornerstone of Hite’s Approach

Hite’s approach to trading was firmly rooted in data-driven analysis. He believed that emotions and subjective judgments often led to inconsistent trading outcomes. By relying on empirical data and statistical models, Hite aimed to eliminate the emotional biases that typically hinder traders. This methodology not only enhanced the consistency of his trading but also allowed for scalable and replicable strategies.

Removing Emotions from Trading Decisions

One of the most significant advantages of system trading is the removal of emotions from the trading process. Emotions like fear and greed can cloud judgment, leading to impulsive decisions that deviate from a well-thought-out strategy. Hite’s system trading approach ensured that every trade was executed based on predefined criteria, thereby maintaining discipline and objectivity.

The Significance of System Trading in Financial Markets

System trading has revolutionized the financial markets by introducing a level of consistency and reliability that discretionary trading often lacks. Its significance lies in:

- Consistency: Systematic strategies ensure that trading decisions are consistent, reducing the variability in performance.

- Scalability: Algorithms can handle large volumes of trades efficiently, making it easier to scale trading operations.

- Objectivity: Decisions are based on data and predefined rules, minimizing the influence of emotions and biases.

Core Principles of Larry Hite’s Trading Strategy

Larry Hite’s trading strategy is built upon several core principles that form the foundation of his systematic approach. These principles ensure that his trading remains disciplined, data-driven, and resilient to market fluctuations.

Trend Following: Capitalizing on Market Trends

Trend following is a central tenet of Hite’s trading strategy. This approach involves identifying and capitalizing on sustained movements in market prices. By following the trend, traders can ride the momentum until signs of reversal appear.

Importance of Identifying Trends

Identifying trends is crucial because it allows traders to align their positions with the prevailing market direction. Whether the market is bullish or bearish, trend following strategies seek to maximize gains by staying on the right side of the trend.

How Hite Implements Trend Following

Hite’s trend following involves:

- Data Analysis: Utilizing historical price data to identify consistent patterns and trends.

- Algorithm Development: Creating algorithms that can detect trend signals and execute trades accordingly.

- Momentum Indicators: Employing technical indicators like moving averages and relative strength index (RSI) to confirm trend strength.

Risk Management: Protecting Capital

Effective risk management is paramount in Hite’s trading strategy. Protecting capital ensures that traders can withstand market volatility and continue to trade over the long term.

Emphasis on Protecting Capital

Hite places a strong emphasis on capital preservation. By managing risks meticulously, he ensures that no single trade can significantly impact his overall portfolio.

Key Risk Management Techniques

- Position Sizing: Determining the appropriate amount to invest in each trade based on the level of risk.

- Stop-Loss Orders: Setting predefined exit points to limit potential losses.

- Diversification: Spreading investments across various markets to mitigate risk.

Diversification: Spreading Risk Across Markets

Diversification is a strategy that involves spreading investments across different asset classes and markets to reduce exposure to any single source of risk. Hite’s diversified approach enhances the resilience of his portfolio.

Hite’s Approach to Diversification

- Asset Classes: Investing in a mix of equities, bonds, commodities, and currencies.

- Geographical Regions: Allocating investments across various regions to avoid concentration in any one market.

- Sector Allocation: Diversifying across different sectors to balance sector-specific risks.

Use of Algorithms: Systematic Execution

The use of algorithms is a defining feature of Hite’s trading strategy. Algorithms enable the systematic execution of trades based on predefined rules, ensuring consistency and eliminating emotional bias.

How Hite Implements Algorithms

- Rule-Based Trading: Developing algorithms that follow specific trading rules derived from historical data analysis.

- Automated Execution: Utilizing technology to execute trades automatically when certain conditions are met.

- Continuous Optimization: Regularly updating and refining algorithms to adapt to changing market conditions.

Integration of Core Principles

Hite’s trading strategy integrates these core principles seamlessly. By combining trend following, rigorous risk management, diversification, and algorithmic execution, Hite creates a robust and adaptable trading framework that can navigate various market environments.

Famous Trades and Market Calls

Larry Hite’s career is punctuated with several notable trades that highlight the effectiveness of his systematic approach. These trades not only demonstrate his ability to capitalize on market opportunities but also provide valuable lessons for traders looking to adopt similar strategies.

Analysis of Notable Trades

1. The Commodity Boom of the 1990s

During the late 1980s and early 1990s, the commodities market experienced significant volatility and growth. Hite’s systematic approach allowed him to navigate this boom effectively.

- Strategy: Hite’s algorithms identified upward trends in commodities, leading to profitable long positions in metals and energy sectors.

- Outcome: Consistent gains were realized as the commodity prices surged, showcasing the strength of trend following.

2. The 2008 Financial Crisis

The 2008 financial crisis presented unprecedented challenges, but Hite’s system trading strategies provided a buffer against the market downturn.

- Strategy: Hite’s diversified portfolio and risk management techniques limited losses during the crisis.

- Outcome: While the broader market suffered, Hite’s systematic approach ensured capital preservation and positioned the portfolio for recovery.

3. The Bitcoin Surge of 2017

The cryptocurrency market saw a meteoric rise in 2017, with Bitcoin leading the charge. Hite’s system trading framework capitalized on this trend.

- Strategy: Algorithms detected the sustained upward momentum in Bitcoin, resulting in profitable long positions.

- Outcome: Significant returns were achieved as Bitcoin prices skyrocketed, highlighting the adaptability of Hite’s strategies to emerging markets.

Lessons Learned from These Trades

These trades offer several key lessons:

- Adaptability: Hite’s ability to adapt his strategies to different market conditions underscores the importance of flexibility in trading.

- Consistency: The consistent application of systematic strategies leads to sustainable success, even in volatile markets.

- Risk Management: Effective risk management ensures that traders can navigate downturns without significant capital loss.

- Diversification: Spreading investments across various markets and asset classes enhances portfolio resilience and reduces risk.

Relevance of Hite’s Trades Today

The principles demonstrated in Hite’s notable trades remain highly relevant in today’s financial markets. With the advent of new asset classes like cryptocurrencies and the continuous evolution of global markets, the need for systematic, data-driven trading strategies has never been greater. Hite’s approach serves as a timeless blueprint for traders seeking to achieve consistent success through disciplined, algorithmic trading.

Risk Management Techniques

Larry Hite’s Approach to Risk Management

Risk management is the bedrock of Larry Hite’s trading philosophy. His meticulous approach ensures that his capital is protected, and potential losses are minimized. Hite understands that preserving capital is essential for long-term trading success, especially in the unpredictable world of financial markets.

Position Sizing: Allocating the Right Amount

Position sizing involves determining the appropriate amount to invest in each trade based on the level of risk. Hite’s approach to position sizing is both strategic and disciplined.

Key Strategies for Position Sizing

- Fixed Percentage Allocation: Allocating a fixed percentage of the portfolio to each trade, ensuring that no single trade can disproportionately impact the overall portfolio.

- Volatility-Based Sizing: Adjusting position sizes based on the volatility of the asset. More volatile assets receive smaller positions to mitigate risk.

- Risk-Reward Assessment: Evaluating the potential risk and reward of each trade to determine the optimal position size.

Stop-Loss Orders: Limiting Potential Losses

Stop-loss orders are predefined exit points set to limit potential losses on a trade. Hite employs stop-loss orders as a fundamental component of his risk management strategy.

Implementing Stop-Loss Orders

- Technical Levels: Placing stop-loss orders at key technical levels, such as support or resistance points, to ensure that they are not triggered by minor market fluctuations.

- Dynamic Stop-Loss: Adjusting stop-loss levels based on market conditions and the evolving trend, allowing for flexibility while maintaining protection.

- Automated Execution: Utilizing algorithms to automatically execute stop-loss orders when predefined conditions are met, ensuring timely and emotion-free exits.

Diversification: Spreading Risk Across Markets

Diversification is a critical risk management technique that involves spreading investments across various asset classes and markets to reduce exposure to any single source of risk.

Hite’s Diversification Strategies

- Asset Class Diversification: Investing in a mix of equities, bonds, commodities, currencies, and alternative investments to balance risk and return.

- Geographical Diversification: Allocating investments across different regions to mitigate the impact of localized economic downturns.

- Sector Diversification: Spreading investments across various sectors to avoid concentration risk and capitalize on opportunities in different industries.

Balancing Risk and Reward

Balancing risk and reward is essential for optimizing portfolio performance. Hite’s approach ensures that each trade offers a favorable risk-reward ratio, enhancing the potential for sustained profitability.

Strategies for Balancing Risk and Reward

- Risk-Reward Ratio: Targeting trades where the potential reward significantly outweighs the risk, such as aiming for a 2:1 or 3:1 ratio.

- Thorough Analysis: Conducting comprehensive research and analysis to assess the viability and potential returns of each investment.

- Continuous Monitoring: Regularly reviewing and adjusting the portfolio to maintain an optimal balance between risk and reward, responding to changing market conditions.

Implementing Hite’s Risk Management Techniques

To effectively implement Hite’s risk management techniques, traders should:

- Define Risk Parameters: Clearly outline the maximum acceptable loss per trade and overall portfolio risk.

- Utilize Technology: Leverage trading platforms and software to automate risk management measures, ensuring consistent application.

- Regularly Review Strategies: Continuously assess and refine risk management strategies to adapt to evolving market dynamics.

The Role of Psychology in System Trading

Larry Hite’s Views on Trading Psychology

Larry Hite recognizes that psychology plays a pivotal role in trading, even in system trading where algorithms drive decisions. While system trading aims to remove emotions from the equation, the human element remains crucial in designing, implementing, and managing trading systems.

Maintaining Discipline and Sticking to the System

Discipline is essential for the successful execution of system trading strategies. Hite emphasizes the importance of adhering to predefined rules and resisting the urge to deviate based on emotional impulses.

Strategies for Maintaining Discipline

- Strict Adherence to Rules: Following the system’s rules meticulously, without making exceptions based on market sentiments or emotions.

- Routine and Structure: Establishing consistent trading routines that reinforce disciplined behavior and minimize emotional interference.

- Automated Trading Systems: Utilizing automated systems to execute trades according to predefined rules, reducing the likelihood of emotional decision-making.

Techniques for Maintaining Mental Resilience

Maintaining mental resilience is crucial for traders to withstand market volatility and the inevitable losses that accompany trading.

Hite’s Techniques for Mental Resilience

- Mindfulness and Meditation: Engaging in mindfulness practices to enhance focus, reduce stress, and maintain emotional balance.

- Physical Fitness: Maintaining physical health through regular exercise, which contributes to overall mental well-being and resilience.

- Continuous Learning: Staying informed and continuously educating oneself to build confidence and reduce uncertainty in trading decisions.

The Importance of Mental Resilience in System Trading

Mental resilience enables traders to:

- Handle Losses: Accept and learn from losses without becoming discouraged or deviating from the trading system.

- Stay Focused: Maintain focus on long-term goals and strategies, even during periods of market turbulence.

- Adapt to Change: Remain adaptable and open to refining strategies based on new information and evolving market conditions.

Techniques for Enhancing Trading Psychology

Here are some practical techniques to bolster trading psychology:

- Journaling: Keeping a trading journal to document trades, emotions, and reflections can help identify patterns and areas for improvement.

- Setting Realistic Goals: Establishing achievable trading goals to maintain motivation and avoid undue pressure.

- Developing a Support System: Engaging with fellow traders, mentors, or support groups to share experiences and gain insights.

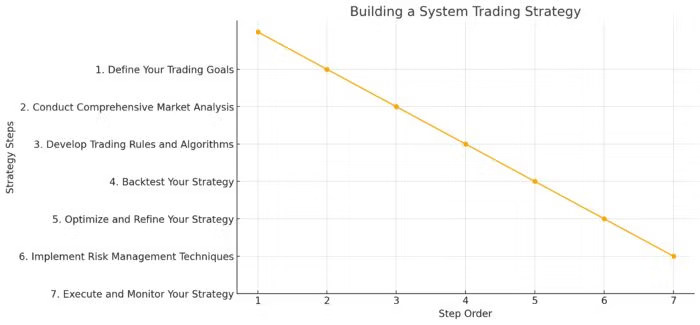

Building a System Trading Strategy

Step-by-Step Guide to Developing a System Trading Strategy Inspired by Hite

Creating a robust system trading strategy requires a structured approach. Here’s a step-by-step guide inspired by Larry Hite’s methodologies:

1. Define Your Trading Goals

- Identify Objectives: Determine what you aim to achieve with your trading strategy, whether it’s capital growth, income generation, or risk mitigation.

- Set Time Horizons: Establish short-term and long-term goals to guide your trading activities.

2. Conduct Comprehensive Market Analysis

- Data Collection: Gather historical price data, economic indicators, and other relevant information.

- Trend Identification: Use statistical tools to identify trends and patterns in the data.

3. Develop Trading Rules and Algorithms

- Rule Creation: Define specific criteria for entering and exiting trades based on your analysis.

- Algorithm Development: Translate your trading rules into algorithms that can execute trades automatically.

4. Backtest Your Strategy

- Historical Testing: Apply your trading strategy to historical data to evaluate its performance.

- Performance Metrics: Analyze key metrics such as profitability, drawdowns, and risk-adjusted returns.

5. Optimize and Refine Your Strategy

- Parameter Tuning: Adjust the parameters of your trading rules and algorithms to enhance performance.

- Validation: Test the optimized strategy on out-of-sample data to ensure its robustness.

6. Implement Risk Management Techniques

- Position Sizing: Determine the appropriate size for each trade based on your risk tolerance.

- Stop-Loss Orders: Set predefined exit points to limit potential losses.

- Diversification: Spread investments across various markets and asset classes to mitigate risk.

7. Execute and Monitor Your Strategy

- Automated Execution: Utilize trading platforms that support automated trading to implement your strategy.

- Continuous Monitoring: Regularly review the performance of your trading system and make adjustments as needed.

Identifying and Testing Potential Trading Systems

Identifying and testing potential trading systems involves several key steps:

- Strategy Formulation: Develop multiple trading ideas based on different market conditions and data patterns.

- Backtesting: Rigorously test each strategy against historical data to assess its viability.

- Forward Testing: Apply the strategy in a simulated or live environment with small positions to evaluate real-time performance.

- Performance Evaluation: Compare the strategies based on metrics like profitability, drawdown, and consistency to identify the most promising one.

Tips for Refining and Optimizing Your Strategy Over Time

- Regular Reviews: Periodically assess your trading strategy’s performance and make necessary adjustments.

- Adapt to Market Changes: Be willing to modify your strategy in response to evolving market conditions and new information.

- Continuous Learning: Stay informed about new trading techniques, technologies, and market trends to enhance your strategy.

- Seek Feedback: Engage with other traders or mentors to gain insights and perspectives that can help refine your approach.

Sample System Trading Strategy Inspired by Hite

Here’s an example of a simple trend-following system trading strategy inspired by Larry Hite:

Strategy Overview

- Market: S&P 500 Index Futures

- Time Frame: Daily charts

- Indicators: 50-day Moving Average (MA), 200-day Moving Average (MA)

- Entry Rules:

- Long Position: Enter a long position when the 50-day MA crosses above the 200-day MA (Golden Cross).

- Short Position: Enter a short position when the 50-day MA crosses below the 200-day MA (Death Cross).

- Exit Rules:

- Long Position Exit: Exit when the 50-day MA crosses below the 200-day MA.

- Short Position Exit: Exit when the 50-day MA crosses above the 200-day MA.

- Risk Management:

- Position Sizing: Allocate 2% of the portfolio to each trade.

- Stop-Loss: Set a stop-loss at 1% below the entry price for long positions and 1% above for short positions.

Implementation Steps

- Define Trading Rules: Clearly outline the conditions for entering and exiting trades based on moving average crossovers.

- Develop Algorithm: Program the rules into a trading platform that supports automated trading.

- Backtest: Apply the strategy to historical S&P 500 futures data to evaluate its performance.

- Optimize: Adjust the moving average periods or risk parameters to enhance profitability and reduce drawdowns.

- Forward Test: Implement the strategy in a simulated trading environment to observe real-time performance.

- Execute: Deploy the strategy in a live trading account with proper risk management measures in place.

- Monitor and Refine: Continuously track the strategy’s performance and make adjustments as necessary.

Challenges of System Trading

Potential Pitfalls and Difficulties in Adopting a System Trading Approach

While system trading offers numerous advantages, it also presents several challenges that traders must navigate to achieve success.

1. Overfitting

Overfitting occurs when a trading system is too closely tailored to historical data, capturing noise instead of genuine market patterns. This can lead to poor performance when applied to new, unseen data.

- Risk: Overfitted systems may perform exceptionally well in backtests but fail in live trading.

- Solution: Use out-of-sample testing and cross-validation techniques to ensure that the system generalizes well to different market conditions.

2. Technological Dependence

System trading relies heavily on technology for data analysis, algorithm execution, and trade management.

- Risk: Technical glitches, software bugs, or hardware failures can disrupt trading operations and lead to unintended losses.

- Solution: Implement robust technological infrastructure, conduct regular system maintenance, and have contingency plans in place for technical failures.

3. Market Adaptability

Financial markets are dynamic and continuously evolving. A system trading strategy that works well under certain conditions may become ineffective as market dynamics change.

- Risk: Inability to adapt to new market regimes can lead to reduced performance or losses.

- Solution: Regularly review and update trading systems to align with current market conditions and incorporate new data and insights.

4. Emotional Discipline

Even though system trading aims to minimize emotional involvement, human oversight and decision-making can still introduce emotional biases.

- Risk: Traders may deviate from the system’s rules based on fear, greed, or other emotions, undermining the strategy’s effectiveness.

- Solution: Develop strict adherence protocols, utilize automated trading systems to execute trades, and cultivate emotional discipline through mindfulness practices.

5. Data Quality and Availability

The success of system trading is contingent on the quality and availability of data. Poor data quality or insufficient data can compromise the integrity of trading systems.

- Risk: Inaccurate or incomplete data can lead to erroneous trading decisions and losses.

- Solution: Invest in high-quality data sources, implement data validation processes, and ensure comprehensive data coverage for accurate analysis.

How to Overcome Common Challenges in System Design and Implementation

Overcoming the challenges associated with system trading requires a proactive and disciplined approach. Here are strategies to address common obstacles:

1. Robust Testing and Validation

- Backtesting: Rigorously test trading systems against historical data to evaluate performance and identify potential weaknesses.

- Forward Testing: Implement the system in a simulated environment with live data to assess real-time performance before full-scale deployment.

- Stress Testing: Subject the system to extreme market conditions to evaluate its resilience and adaptability.

2. Continuous Learning and Education

- Stay Informed: Keep abreast of the latest developments in financial markets, trading technologies, and quantitative methods.

- Advanced Training: Pursue advanced courses in quantitative finance, data analysis, and algorithm development to enhance your trading expertise.

- Engage with the Community: Participate in trading forums, attend seminars, and network with other system traders to exchange ideas and insights.

3. Implementing Robust Technological Infrastructure

- Reliable Platforms: Use reputable and reliable trading platforms that offer advanced features and support automated trading.

- Redundancy: Establish redundant systems and backup solutions to ensure uninterrupted trading operations in case of technical failures.

- Regular Maintenance: Conduct routine system checks and updates to maintain optimal performance and security.

4. Emphasizing Discipline and Consistency

- Strict Adherence to Rules: Follow the system’s rules meticulously, avoiding deviations based on emotional impulses or market noise.

- Automated Execution: Utilize automated trading systems to execute trades based on predefined criteria, reducing the potential for emotional interference.

- Routine Reviews: Establish regular review schedules to assess the system’s performance and make necessary adjustments without emotional bias.

The Importance of Continuous Learning and System Refinement

Continuous learning and system refinement are critical for maintaining the effectiveness of system trading strategies. Markets evolve, and what works today may not work tomorrow. By committing to ongoing education and regularly updating trading systems, traders can ensure that their strategies remain robust and adaptive to changing market conditions.

Strategies for Continuous Learning and Refinement

- Stay Updated on Market Trends: Regularly monitor economic indicators, market news, and financial reports to stay informed about market dynamics.

- Incorporate New Data and Insights: Integrate new data sources and analytical techniques into your trading systems to enhance their predictive capabilities.

- Seek Feedback and Insights: Engage with other traders and mentors to gain valuable feedback and incorporate diverse perspectives into your trading strategies.

How to Start Trading Like Larry Hite

Practical Steps for Implementing Hite’s Strategies in Your Own Trading

Emulating Larry Hite’s systematic trading approach involves a structured and disciplined process. Here are practical steps to help you get started:

1. Educate Yourself in System Trading

- Foundational Knowledge: Gain a solid understanding of system trading principles, quantitative analysis, and algorithm development.

- Advanced Studies: Pursue advanced courses or certifications in quantitative finance, data science, and systematic trading strategies.

2. Develop a Comprehensive Trading Plan

- Define Objectives: Clearly outline your trading goals, including desired returns, risk tolerance, and investment horizon.

- Strategy Formulation: Develop trading strategies based on trend following, risk management, and diversification principles.

- Risk Management Protocols: Establish rules for position sizing, stop-loss orders, and portfolio diversification to protect your capital.

3. Start with a Simulated Trading Environment

- Paper Trading: Begin by executing your trading strategies in a simulated environment to gain experience without risking real capital.

- Backtesting: Apply your strategies to historical data to evaluate their performance and identify areas for improvement.

4. Gradually Scale Up Your Trading Activities

- Small Positions: Start with small positions to test your strategies in live market conditions without exposing yourself to significant risk.

- Incremental Scaling: Gradually increase your position sizes as you gain confidence and experience in your trading strategies.

5. Implement Automated Trading Systems

- Algorithm Development: Translate your trading rules into algorithms that can execute trades automatically based on predefined criteria.

- Platform Selection: Choose reliable trading platforms that support automated trading and offer robust analytical tools.

6. Monitor and Refine Your Trading Systems

- Performance Tracking: Continuously monitor the performance of your trading systems using key metrics such as profitability, drawdown, and risk-adjusted returns.

- System Refinement: Regularly update and optimize your trading systems based on performance data and changing market conditions.

Resources for Learning More About System Trading Techniques

To deepen your understanding of system trading and enhance your trading skills, consider the following resources:

Books

- Systematic Trading: A Unique New Method for Designing Trading and Investing Systems by Robert Carver

- Quantitative Trading: How to Build Your Own Algorithmic Trading Business by Ernie Chan

- Trade Your Way to Financial Freedom by Van K. Tharp

Online Courses

- Coursera’s Algorithmic Trading and Finance Models with Python, R, and Stata: Offers comprehensive insights into developing and implementing algorithmic trading strategies.

- edX’s Quantitative Methods for Finance: Covers essential quantitative techniques used in systematic trading.

- Udemy’s Automated Trading with Python: Provides hands-on training in developing automated trading systems using Python.

Websites and Journals

- QuantStart: A valuable resource for learning about quantitative trading strategies and algorithm development.

- Algorithmic Traders Association: Offers resources, networking opportunities, and educational materials for systematic traders.

- The Journal of Portfolio Management: Provides in-depth research and analysis on portfolio management and trading strategies.

Tools and Platforms to Support Systematic Trading

Leveraging the right tools and platforms is essential for developing, testing, and executing systematic trading strategies. Here are some recommended options:

Trading Platforms

- MetaTrader 5: Offers advanced charting capabilities, automated trading features, and a user-friendly interface.

- Thinkorswim by TD Ameritrade: Provides comprehensive trading tools, real-time data, and support for automated trading strategies.

- Interactive Brokers’ Trader Workstation (TWS): Known for its extensive range of tradable assets, low commission rates, and robust trading tools.

Analytical Tools

- Bloomberg Terminal: Delivers in-depth financial data, analytics, and trading tools for professional traders.

- TradingView: Offers powerful charting tools, a vibrant community of traders, and the ability to backtest trading strategies.

- QuantConnect: A cloud-based platform that supports algorithmic trading and provides access to historical market data.

Data Sources

- Federal Reserve Economic Data (FRED): A comprehensive database of economic data and indicators essential for macro analysis.

- World Bank Data: Provides global economic data and development indicators useful for understanding macroeconomic trends.

- Quandl: Offers access to a vast array of financial, economic, and alternative datasets for quantitative analysis.

Building Analytical Skills for System Trading

Developing strong analytical skills is crucial for designing and implementing effective system trading strategies. Focus on the following areas:

Economic Analysis

- Understanding Indicators: Learn how to interpret macroeconomic indicators like GDP, inflation, and unemployment rates and their impact on financial markets.

- Market Cycles: Study the different phases of market cycles to anticipate shifts in trends and adjust trading strategies accordingly.

Technical Analysis

- Chart Patterns: Master the identification of chart patterns such as head and shoulders, double tops, and triangles.

- Technical Indicators: Gain proficiency in using technical indicators like moving averages, MACD, RSI, and Bollinger Bands to inform trading decisions.

Quantitative Analysis

- Statistical Methods: Develop a strong grasp of statistical concepts such as regression analysis, hypothesis testing, and probability distributions.

- Programming Skills: Learn programming languages like Python or R to develop and implement trading algorithms.

Geopolitical Analysis

- Political Events: Assess the impact of political events, policy changes, and international relations on financial markets.

- Global Trends: Understand global economic and geopolitical trends to identify opportunities and risks in various markets.

Larry Hite (Founding Father of System Trading): 12-Question FAQ

Who is Larry Hite and why is he influential?

Co-founder of Mint and a pioneer of rules-based, trend-following futures strategies, Hite championed systematic processes, risk caps, and diversification across global markets.

What does “system trading” mean in Hite’s playbook?

Codified, testable rules drive entries, exits, and sizing—executed consistently to remove emotion and rely on statistics, not opinions.

What core principles define his approach?

Cut losses, 2) let winners run, 3) size by volatility, 4) diversify widely, 5) obey the rules—every time.

Which markets fit a Hite-style system?

Liquid futures/FX/commodities, index futures, and (for access) liquid ETFs across regions and sectors to capture many independent trends.

How are entries typically defined?

Simple price signals (e.g., breakouts or moving-average filters) that confirm trend direction; no forecasts—price leads.

How are exits handled?

Shorter-lookback counter signals and ATR-based trailing stops—cut losers fast, trail winners to harvest convex returns.

How is position sizing done?

Volatility scaling (ATR/“N”) so each trade risks a small, similar % of equity (e.g., ~0.5–2%); higher volatility ⇒ smaller size.

What risk controls are essential?

Per-trade loss caps, portfolio “heat” limits, correlation caps, max positions per sector/asset, and hard stops enforced by the system.

Why does psychology still matter if it’s systematic?

Discipline to follow the model, tolerate drawdowns, and avoid tinkering after a few losses. Journals, automation, and scheduled reviews help.

How do I build a basic Hite-style system?

Define universe → entry/exit rules → ATR sizing → risk/heat limits → backtest with costs/slippage → paper trade → deploy small, then scale.

What are common pitfalls?

Overfitting, ignoring costs/liquidity, rule drift after drawdowns, oversized bets, and too-narrow diversification.

How should systems adapt to modern markets?

Keep rules simple but improve execution plumbing: better slippage models, liquidity filters, regime checks, and periodic, methodical parameter reviews.

Key Takeaways from Larry Hite’s Trading Approach

Larry Hite’s systematic trading approach offers a robust framework for achieving consistent success in the financial markets. Here are the key takeaways from his trading philosophy:

- Systematic Approach: Embrace a structured, rule-based trading methodology that relies on data and algorithms to drive decisions.

- Trend Following: Identify and capitalize on sustained market trends to maximize returns.

- Rigorous Risk Management: Prioritize capital preservation through disciplined risk management techniques, including position sizing, stop-loss orders, and diversification.

- Data-Driven Decisions: Utilize historical data and quantitative analysis to inform trading strategies, minimizing emotional bias.

- Continuous Learning: Commit to ongoing education and system refinement to adapt to evolving market conditions and enhance trading performance.

- Discipline and Consistency: Maintain strict adherence to trading rules and routines to ensure consistent execution and performance.

Relevance of System Trading in Today’s Markets

System trading remains highly relevant in today’s dynamic and fast-paced financial markets. The proliferation of advanced technologies, high-frequency trading, and the availability of vast amounts of data have further solidified the importance of systematic, data-driven trading strategies. In an era where markets are increasingly influenced by algorithmic trading and quantitative models, Larry Hite’s pioneering work continues to serve as a valuable guide for traders seeking to achieve consistent and scalable success.

Explore and Develop Your Own Trading Systems

Embarking on a systematic trading journey inspired by Larry Hite is both challenging and rewarding. It requires a commitment to discipline, continuous learning, and the ability to adapt to changing market conditions. However, the potential rewards—consistent profitability, reduced emotional stress, and scalable trading operations—make it a compelling approach for dedicated traders.

As you explore and develop your own trading systems, remember to:

- Stay Disciplined: Adhere strictly to your trading rules and risk management protocols.

- Be Patient: System trading often involves waiting for the right market conditions and opportunities.

- Embrace Technology: Leverage advanced trading platforms and analytical tools to enhance your trading capabilities.

- Continuously Refine: Regularly review and optimize your trading systems to ensure they remain effective and aligned with your trading goals.

By embracing the principles and strategies of Larry Hite, you can navigate the complexities of financial markets with confidence and strategic insight. System trading offers a pathway to disciplined, consistent, and potentially lucrative trading, embodying the essence of Larry Hite’s enduring legacy in the world of finance.

Investing like Larry Hite isn’t just about following a set of rules; it’s about cultivating a mindset that prioritizes data-driven decisions, disciplined risk management, and continuous improvement. By embracing systematic trading principles, you can navigate the financial markets with precision and confidence, unlocking the potential for sustained trading success. Happy trading!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.