Risk Parity is easily one of my favourite asset allocation strategies from a risk meets returns standpoint.

Instead of merely grabbing large slabs of equities and bonds and calling it a day, a risk parity portfolio considers the risk element each line item contributes to a portfolio at large.

It’s a strategy where overall portfolio diversification, balance and correlations between assets is of primary concern.

However, most investors (if they’ve researched risk parity strategies) would be familiar with static only allocations.

Fixed percentages of equities, bonds, gold, commodities and whatever else is included in the mix.

Today we’ll be exploring an adaptive risk parity style of asset allocation where assets systematically expand, contract or temporarily drop out of the equation based upon market conditions and trends.

Hence, I’m thrilled to welcome Daniel Snover of PMV Capital to the “How I Invest” series to unpack his unique adaptive risk parity investment strategy.

His recently minted PMV Adaptive Risk Parity ETF (ticker ARP) is a welcome addition to the alternative asset class marketplace and a fund I’ll enjoy tracking over the coming months.

Without further ado, let’s turn things over to Daniel!

Meet Daniel Snover: PMV Capital

I grew up in Dallas, TX, and still live here with my husband, Bryan, and our dog, Sputnik.

I graduated from college in the middle of the Global Financial Crisis.

In 2009, I began my portfolio management career at an adviser named Fund Architects.

The Chief Investment Officer of Fund Architects pioneered the first allocation funds during his time as the CIO of Morningstar.

My investment approach was heavily shaped by my early experience with Fund Architects.

I wanted to find a way of guarding against the next market crash and, since I worked for an asset allocator, I was searching for a solution on how to diversify.

I’ve spent the past ten years sorting out the complexities of properly diversifying a portfolio.

I still find the topic of portfolio construction fascinating.

You’d imagine more industry consensus would exist after 70 years of research, starting with Markowitz’s seminal paper in 1952.

In 2020, my business partners and I started PMV Capital to bring to market the solution we’ve developed to diversifying across all markets.

We recently launched an ETF on the New York Stock Exchange– the PMV Adaptive Risk Parity ETF (ticker ARP) – to do just that.

How I Invest with Daniel Snover: Adaptive Risk Parity Portfolio Strategy

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

A Systematic, Model-Driven Approach

Who were your greatest influences as an investor when you first started to get passionate about the subject?

I was not initially influenced by well-known investors.

My passion came from the “light bulb” moments while trying to solve the never-ending investment puzzle.

This created a craving for a true understanding about how it all works.

How have your views evolved over the years to where you currently stand?

My views have changed quite a bit.

In the beginning, we would use our discretion to adjust portfolio positions.

This is a very difficult and stressful way to invest.

There are too many variables to analyze, and without a process, no way of knowing if you’ll be able to repeat any successes over time.

There are simply too many opportunities to make mistakes over time, in my opinion.

These complexities drove me to a systematic, model-driven approach that could be tested and repeated.

Initially I was convinced that analyzing economic data was a waste of time, and that trading off this data was guesswork.

I believed the answer was completely within the information that the market gave you.

I later came to realize that financial markets are arbitrary without an understanding of the drivers of asset class returns, which brings you back to the economy.

It wasn’t until I integrated how the economy works with how markets price in that data, that I began to understand what was happening in the markets.

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

- Anything and everything by Ray Dalio. His video, and the supporting information for which is also in pdf form, on ‘How the Economic Machine Works’ is fascinating. Also, his work on the functioning of markets and the drivers of asset class prices is incredible. Dalio’s ‘all-weather’ portfolio is the intellectual foundation for ‘risk parity’ portfolios.

- Andrew Lo has done great work on momentum and factor investing. He has several white papers available on SSRN.

- Marcos Lopez De Prado has written very interesting articles on diversification through a new method, hierarchical risk parity, that deserves more attention.

- Corey Hoffstein has a great podcast on quantitative investing, ‘Flirting with Models’.

- Lyn Alden’s newsletter has great insights and macro-economic content.

There Are Few Things More Humbling Than Managing Other People’s Money

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an

investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

When I began my career at Fund Architects we used our discretion to try and find top stock and bond performers.

This discretionary approach ended up resulting in poor outcomes during market stress.

I came to realize that it wasn’t the choices we made in managers, but instead, it was the choices made to allocate to a limited number of asset class exposures.

This realization resulted in my gaining the insight that it is possible to construct a portfolio that can dynamically adjust to the current market environment by selecting the proper asset classes using a systematic process that could be tested through time and repeated going forward.

There are few things more humbling than managing other people’s money.

I have done so both as a portfolio manager and as an adviser.

Diversification Is The Most Cost-Effective And Efficient Hedge

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

Focus on diversification – it is the most cost-effective and efficient hedge.

Diversification is really about correlation, as risk reduction is maximized when risk is balanced between uncorrelated assets (i.e. risk parity).

To understand correlation, you must think of owning the fundamental drivers of asset prices, not of the assets themselves.

The value of any investment is simply the present value of expected future cash flows1.

The drivers of asset class returns are therefore the things that influence cash flows.

Luckily, when you are analyzing asset classes, there are not hundreds of factors that change future cash flows.

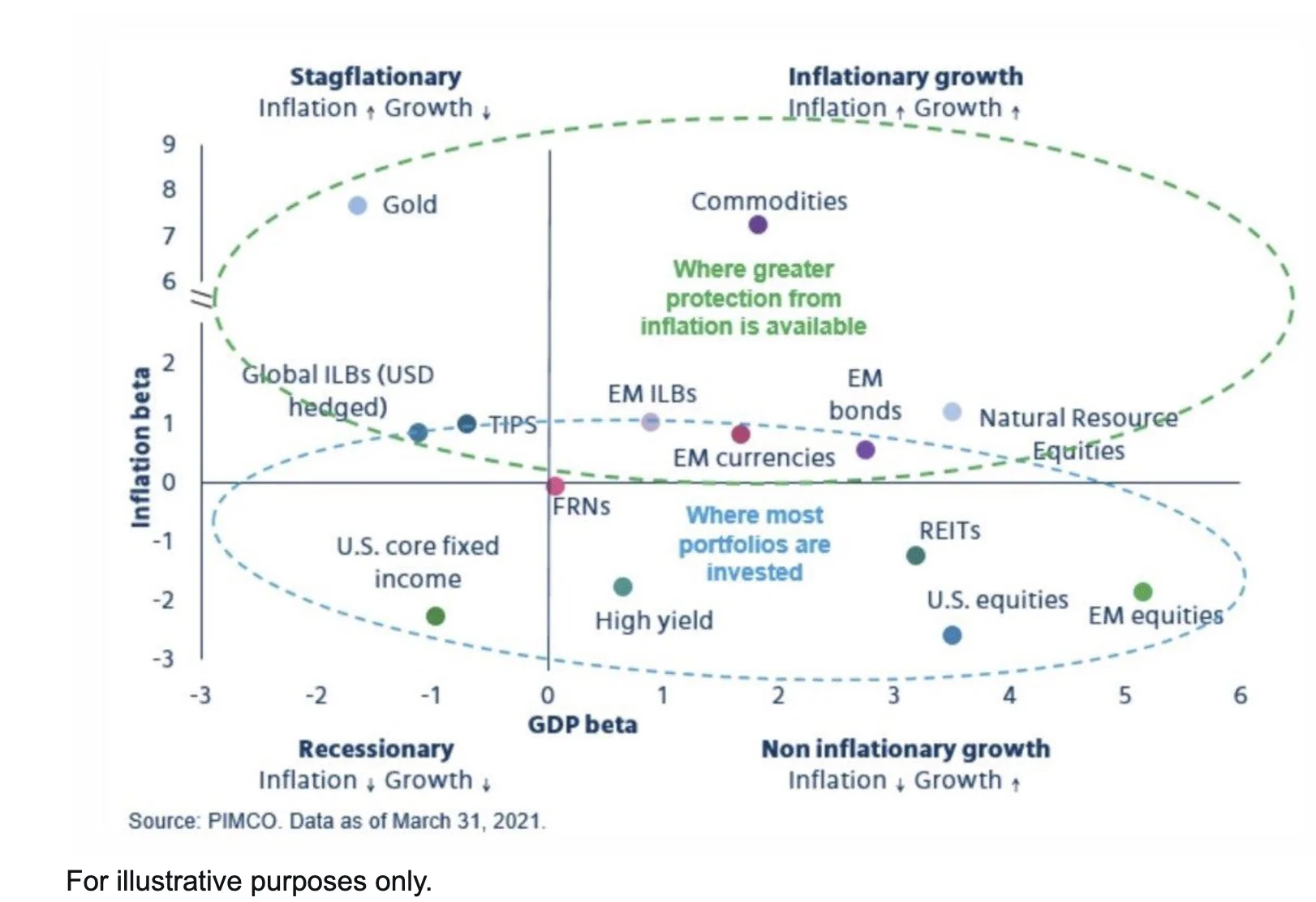

In my view, there are only two primary factors: economic growth and inflation.

This is true because asset prices are influenced by debt cycles, and the tradeoff that central banks must manage in a debt cycle is between economic growth and inflation.

How the reality of these factors unfolds versus the expectations that markets have priced in explains the movements of asset prices.

Four Different Economic Environments

Let’s pop open the hood of your portfolio. What kind of goodies do we have inside to showcase?

To build a portfolio, you need (a) an investable universe and (b) the weightings for each position.

Our investable universe is small with only eight or nine positions, but includes global equities, bonds, commodities, and currencies.

We have strategically chosen positions to gain exposure to the underlying drivers of returns.

For position sizing, we use an internal systematic process that we developed for many years.

To determine position weightings, we first identify assets that are positively trending in the current environment, and then we consider how these positions correlate to each other.

Our thesis is that a persistency in the underlying macroeconomic environment creates a persistency in asset class prices (momentum).

For example, high inflationary periods when inflation data is consistently exceeding market expectations can create positive momentum trends in assets positively influenced by inflation, like broad commodities, while assets negatively impacted by inflation, like US Treasuries, will experience negative momentum trends.

This may seem obvious, but we see few (if any) managers explaining momentum in this way.

In fact, many trend following strategies do not even provide an explanation for why they believe momentum trends exist.

I intentionally used this example to illustrate the environment we experienced in 2022.

Trends of both commodities and US Treasuries had been strong since mid-2020, and these trends can be explained by the underlying macroeconomic environment.

Spill the beans.

How much do you have of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if it would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

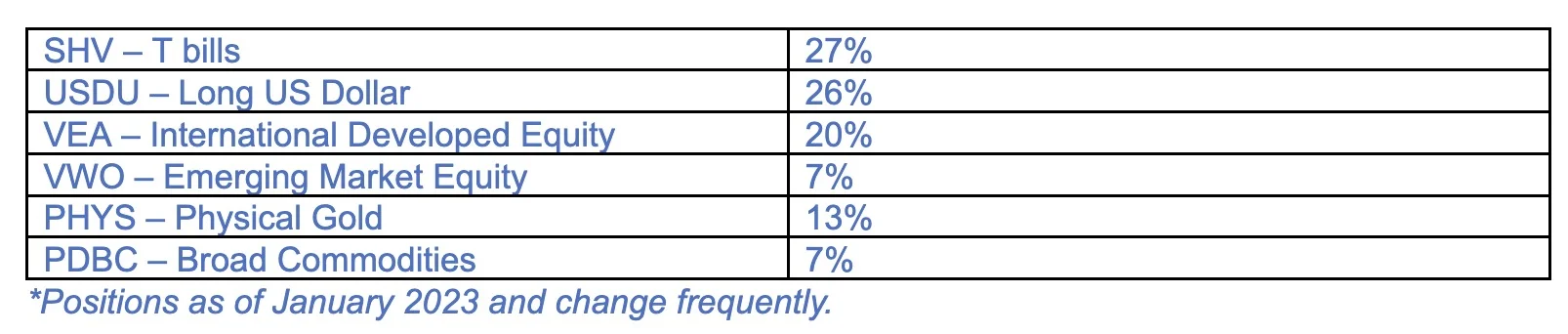

Our portfolio weightings are again determined by our systematic process that adapts to market trends, but here is a snapshot of our current positioning (rounded):

Current Holdings

The relatively high allocations to T bills and the US Dollar are reflective of the tightening liquidity in the market that we have been experiencing.

We are seeing stronger trends in international and emerging stocks as compared to domestic stock.

Also, heading into 2023, I believe the macro environment for gold may be favorable if inflation remains elevated with a slowing economy.

We could also see long-term US Treasuries have a strong year if the economy slows quicker than anticipated.

When do you anticipate this portfolio performing at its best?

And at its worst?

We think the portfolio will perform best when there are clear trends in asset prices.

It is expected to perform worst during a rising interest rates environment (i.e. tightening liquidity) when most of the positions in our investable universe are expected to be negative.

After all, a higher discount rate reduces the present value of future cash flows for all assets.

Also, sideways and choppy markets tend to be tough for momentum strategies.

Combining Economic Theory With Quantitative Investing

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

As you can tell, we are focused on portfolio construction and believe that systematic processes are important for testing and implementing a strategy.

We try and combine economic theory with quantitative investing.

I would say a strong background in the functioning of markets, along with the ability to code a strategy for testing, are the primary skills needed for our style of investing.

We All Want To Optimize Returns But Differ In Our Ability To Handle Risk

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

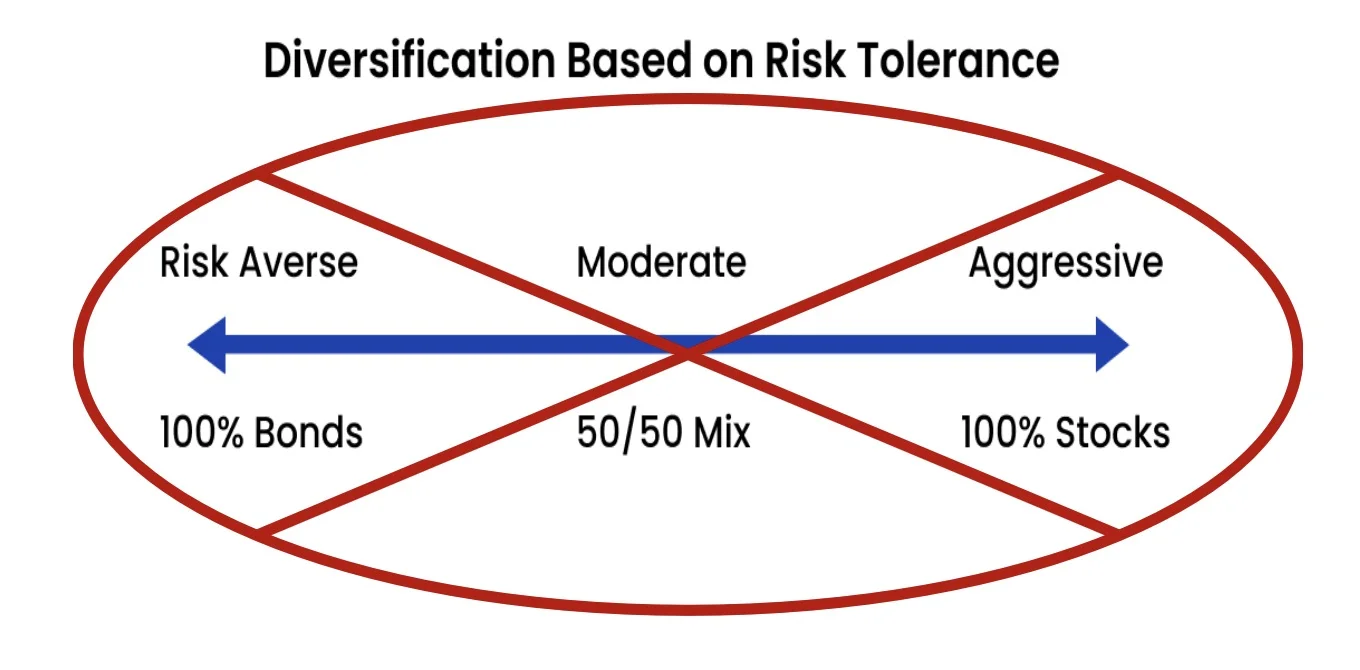

Compared to traditional portfolios that adjust risk through equity exposure (aggressive investors receive a higher equity allocation while conservative investors receive a lower equity allocation), risk parity portfolios adjust risk through leverage.

The idea is that each investor will prefer more or less exposure to the optimal portfolio based on their risk tolerance.

After all, we all want to optimize returns, we only differ in our willingness and ability to tolerate risk.

A more aggressive version would therefore be achieved through leverage.

A great thing about the investable universe we have chosen is there are 2x and 3x leveraged versions ETFs available for most of our underlying exposures.

This means for clients wanting a more aggressive version, we can trade leveraged ETFs in a separate account and match their risk tolerance.

A watered-down version of our strategy could be achieved through the addition of a static weighting to T bills, up to the desired level of risk reduction.

Not Trapped By Any Particular Investment Style Or Dogma

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

My greatest strength is that I am curious, open-minded and pragmatic.

I am not trapped into any particular investment style or dogma.

I have been searching for a solution to a problem and I am willing to look wherever the answer can be found.

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

A weakness is I see the potential for many different approaches to improve our strategy.

I too want to create a ‘perfect portfolio’ that solves all problems, but, in reality that is unattainable and there are tradeoffs.

No perfect solution exists.

Having a process that allows you to test ideas is the best protection against losing focus.

While a strategy or factor may have validity, it does not necessarily fit into the goals of our fund.

In that way, my greatest strength is also my weakness.

I have to be aware that new ideas or optimization methods may be convincing, but could also potentially over-optimize or add fragility to a system.

There is a delicate balance between complexity and robustness. I believe you should err on the side of simplicity and robustness.

Momentum Trends Are Created By Risk Premiums

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

Momentum trends are created by risk premiums, which are the returns investors require above the risk-free rate for holding a risky asset.

Many don’t believe momentum trends exist at all.

In an efficient market where prices are truly random, they should not exist.

Although, if prices were truly random, their expected return by definition would be zero.

To make the random walk equation resemble reality, a ‘drift’ component must be added.

This drift is really the risk premium.

For example, if you chart the price of the S&P500 equity index, which is a market capitalization weighted index of 500 large listed companies, its drift/trend is upwards over time.

This is because investors are collecting a risk premium for investing in stocks.

The trend is not constant however.

Sometimes it is strongly positive, other times strongly negative, and sometimes somewhere in-between.

What changes the risk premium, and therefore the drift/trend, through time is the macroeconomic environment.

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

The idea that risk tolerance and asset allocation are the same thing. The dogma is that aggressive = stocks and conservative = bonds.

Aggressive investors don’t prefer stocks, they are willing to accept a higher risk for a higher potential reward.

And conservative investors don’t prefer bonds, they are willing to accept a lower return in exchange for less risk.

Separating risk tolerance from asset allocation can open your eyes to a world of possibility for finding investment opportunities and diversifying a portfolio.

Diversification Based On Risk Tolerance

Interested To Learn More About Machine Learning

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

I’m interested in statistics and new developments in machine learning.

I think both have potential to improve the systematic processes we have developed, and we are always open to improving.

No Thanks To A Concentrated Portfolio Of Individual Stocks

What would be the ultimate anti-Daniel Snover portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

Why is it so alluring?

Good question.

A highly concentrated portfolio of individual stocks, especially where an active manager uses their discretion to pick the holdings, seems like a bad idea to me.

In my view, this style of portfolio is maybe the least diversified portfolio.

There is a high degree of company specific (idiosyncratic) risk, a high degree of market (systematic) risk, and a high degree of manager (discretionary) risk.

The odds that this style of portfolio adds value over time when compared to holding a passive, cap-weighted index in the same asset class are not good.

I understand why some investors choose these types of securities.

They want higher returns than boring asset class exposures can provide, and there is always the allure that a star manager has cracked the code.

Adaptive Risk Parity (ARP) Investing with Daniel Snover: Strategy, Signals, Risks & Portfolio Fit — 12-Question FAQ

What is an adaptive risk parity strategy?

An adaptive risk parity strategy balances risk across multiple asset classes (equities, bonds, commodities, currencies) and then adapts those weights based on changing market conditions. Unlike static mixes, it expands, contracts, or temporarily exits exposures as trends and correlations shift, aiming for steadier risk and more consistent return streams over full cycles.

How does adaptive risk parity differ from traditional (static) risk parity?

Static risk parity targets fixed risk weights across assets and rebalances back to them. Adaptive risk parity starts from the same risk-balancing premise but systematically adjusts allocations using signals like trend, volatility, and cross-asset correlations—allowing the portfolio to lean into favorable regimes and de-emphasize assets when conditions deteriorate.

What role do macro trends and momentum play in this approach?

Macro regimes (growth/inflation dynamics, liquidity) often create persistent price trends. Adaptive risk parity uses rules-based momentum and regime detection to identify assets with positive trend and risk-aware correlation profiles, while reducing or exiting those with negative trend or rising co-movement that weakens diversification.

Which asset classes are typically included?

A focused, diversified universe often includes global equities, sovereign bonds across maturities, broad commodities, gold, the U.S. dollar/major currencies, and cash/T-bills. Each line item represents distinct macro drivers so the portfolio can balance risk across different economic environments.

When can an adaptive risk parity portfolio struggle?

Choppy, range-bound markets with frequent trend reversals can whipsaw signals. Broad liquidity tightening and rapidly rising rates can pressure multiple assets at once, compressing diversification benefits. Model risk (signals briefly misfiring) and transaction costs can also detract during fast regime shifts.

How are leverage and cash used responsibly?

Risk parity often employs measured leverage to scale balanced exposures up to a target risk level; conversely, elevated cash or T-bill allocations can de-risk when conditions warrant. Implementation controls (position limits, volatility caps, stop rules) help keep risk within pre-defined bounds.

Is adaptive risk parity a core holding or a satellite?

It can play either role. As a core, it provides diversified, risk-balanced exposure that adapts over time. As a satellite, it can complement a 60/40 or factor sleeve by adding macro diversification and potential drawdown mitigation without relying on equity beta alone.

How does it decide to add, reduce, or drop an asset?

A systematic process evaluates each asset’s trend strength, volatility, and correlation contribution. Assets with positive trend and favorable diversification tend to be sized up; those with deteriorating trend or rising co-movement are reduced; positions can be temporarily removed when signals turn adverse.

What should investors expect in terms of returns and risk?

The objective is smoother risk-adjusted returns—seeking equity-like long-term returns with smaller drawdowns and better balance across regimes. There will still be losing periods; the edge comes from compounding through varied cycles, not from always “beating stocks” year-by-year.

What are the main risks to keep in mind?

Key risks include model risk (signals underperform), regime shift risk (sudden macro turns), leverage and financing costs, potential tracking error versus traditional benchmarks, and liquidity/spread considerations when rebalancing during stress.

How might taxes and trading costs impact results?

Rule-driven adjustments can create taxable events in taxable accounts and incur transaction costs. Using tax-aware wrappers, minimizing unnecessary turnover, and understanding fund-level structures (e.g., derivatives usage, K-1 risk) are practical considerations—consult a tax professional for specifics.

Where could an ETF like ARP fit in a total portfolio?

An adaptive risk parity ETF can serve as a diversified core or a macro-diversifier alongside equities, bonds, and factor sleeves. Position size depends on risk tolerance and goals; conservative investors may pair it with cash/T-bills, while aggressive investors may complement it with equity or alternative risk premia.

Nomadic Samuel Final Thoughts On Adaptive Risk Parity

I want to personally thank Daniel for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to be a part of the interview series feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Disclaimer and Further Information:

- ‘Cash flows’ in this context are meant to be the total amount of dividends, interest, and capital appreciate or capital depreciation realized from investors in an asset class.

The information discussed is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned herein may not be suitable for everyone.

Momentum trends in various asset classes are measured with the assumption that assets that have performed relatively well in the recent past are expected to continue to perform well in the near future, and assets that have performed relatively poorly in the recent past are expected to continue to perform poorly in the near future.

An investment in the fund involves risk, including possible loss of principal. In addition to the normal risks associated with investing, the Fund is subject to Momentum Risk. Therefore, the value of the Fund may decline if, among other reasons, momentum trends believed to be beneficial to the Fund stop, reverse, otherwise behave differently than predicted, or the securities selected for inclusion in the Fund’s portfolio do not perform as anticipated. The Fund may be more heavily invested in particular asset classes and may be especially sensitive to factors and economic risks that specifically affect those asset classes.

To determine if the Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund’s prospectus, which may be obtained by visiting www.pmvcapital.com/arp. Investors should read it carefully before investing.

PMV Adaptive Risk Parity ETF is distributed by SEI Investments Distribution Co. (SIDCO).

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.