Financial markets have come a long way from the days of frenzied open-outcry trading floors, where brokers shouted orders over one another to match buyers and sellers in a swirl of paper slips and ticker tapes. Today, advanced electronic systems handle the brunt of global trading, seamlessly matching billions of shares in microseconds. Yet, behind this polished facade of modern finance lies a fundamental tension: the balance between transparency and discretion in how trades are executed.

Visibility matters.

For most investors—retail or institutional—buying or selling stocks appears straightforward on the surface: you log into a brokerage account, choose your stock, set a price, and click submit. If your order is at or above (for buys) or at or below (for sells) the current market price, it executes swiftly. But in truth, your order’s final resting place can differ. Some orders head to lit exchanges like the New York Stock Exchange (NYSE) or NASDAQ, where prices and volumes are publicly broadcast for all participants to see. Other orders—especially large block trades from institutional entities—may find their way into dark pools, private trading venues where the details of bids and offers are kept hidden until after a trade finalizes.

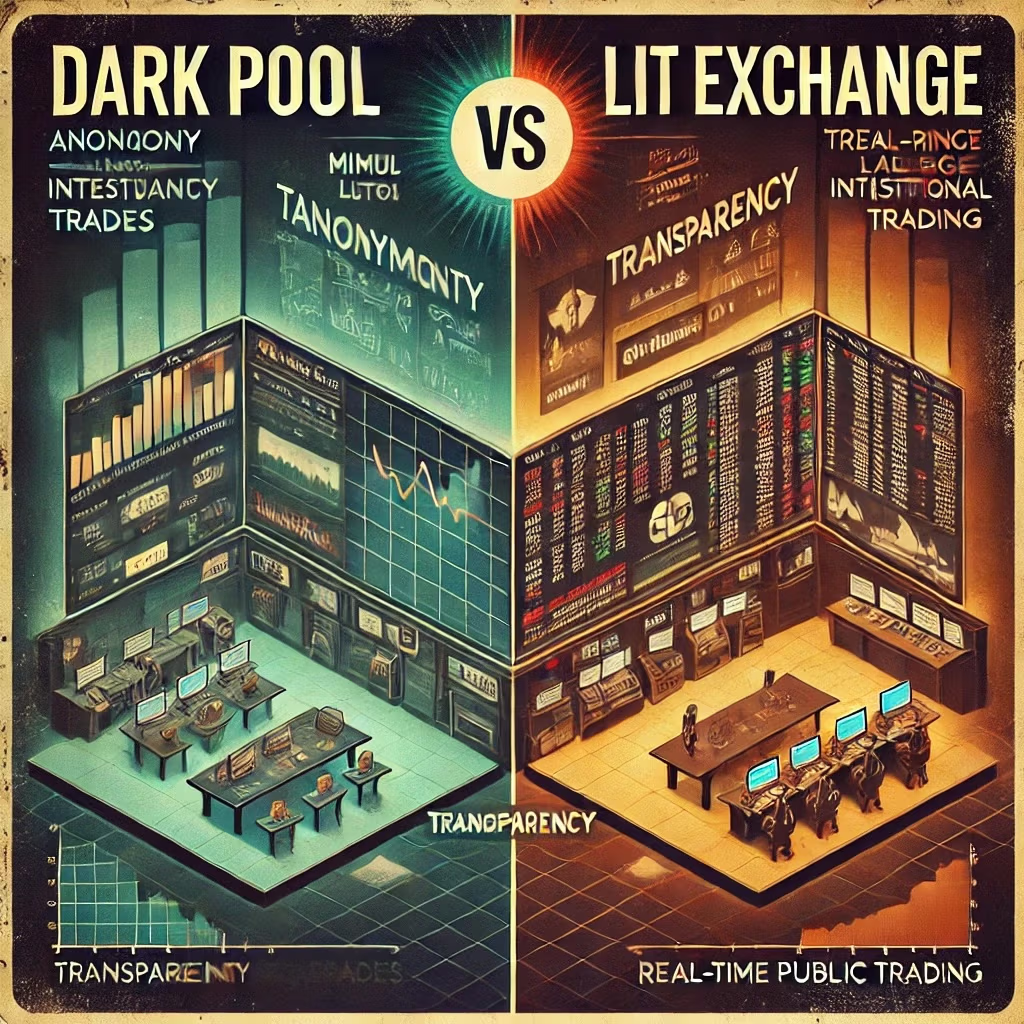

The existence of these two types of trading venues creates an intricate mosaic of market structure. Lit exchanges emphasize open order books and robust price discovery: everyone sees the best bids and asks, and the entire marketplace benefits from the competition for liquidity. Dark pools, conversely, offer stealth and protection for large orders. Institutions can move big positions without alerting front-runners, but the trade-off is reduced transparency for the rest of the market. These competing approaches affect everything from the fairness of markets to how quickly new information gets priced into stocks.

Why This Matters

Understanding the difference between dark pools and lit exchanges is crucial not just for institutional traders who deal in enormous blocks of shares, but also for retail investors aiming to comprehend how markets truly operate. In a market as vast and interconnected as ours, decisions made in dark pools can ripple outward, impacting stock prices, volatility, and liquidity for everyday traders, too. At the same time, lit exchanges can suffer from some of the same challenges that dark pools are meant to solve, such as the potential for front-running large orders.

Both matter to you.

In this blog post, we will dive deeply into what lit exchanges and dark pools are, how they function, and the main differences between them. We will then discuss which types of market participants derive the greatest advantage from each venue, culminating in a broader reflection on whether the balance of transparency and secrecy currently in the market best serves all investors. Our journey will reveal how advanced the ecosystem of modern finance has become, yet also highlight the persistent dilemma of whether darkness fosters unfairness or necessary freedom for big trades to execute.

What Are Lit Exchanges?

A lit exchange is what most people think of when they imagine a stock market. It’s a public venue for trading, often regulated by government authorities, that displays the orders (price levels and volumes) in real time. The New York Stock Exchange (NYSE) is a famous example, with its historical trading floor symbolizing capitalism and open commerce. Similarly, the NASDAQ is a quintessential electronic market, known for hosting many technology giants. Yet, beyond these iconic American platforms, other global markets—like the London Stock Exchange or the Tokyo Stock Exchange—also fit the “lit” profile, providing public data about bids, asks, and trade executions.

Lit means visible.

Definition: Public Trading Venues

In a lit exchange, every order—whether a limit order at a particular price or a market order taking whatever price is available—is posted to a central limit order book. Anyone with access to market data can observe:

- Current best bid and ask: The highest price someone is willing to buy a stock at (bid) and the lowest price someone is willing to sell at (ask).

- Order depth: Additional layers of bids and offers at different price points.

- Recent trades: The size and price at which actual transactions just occurred.

This level of transparency undergirds what we call price discovery, the process by which the market collectively arrives at an asset’s fair value. Because lit exchanges allow all participants to see where the market stands, they can adjust their orders in response to new information, ultimately making the stock price a real-time reflection of supply and demand.

Key Features

- Full Price Transparency

- The hallmark of a lit exchange is that all participants are on relatively equal footing regarding the order book.

- Traders can precisely gauge how much supply or demand exists at various price levels.

- Real-Time Market Data

- Exchanges typically disseminate live feeds of bids, asks, and executed trades.

- This data underpins the analytics of countless institutional trading algorithms, as well as the day-to-day decisions of retail investors.

- Regulatory Oversight

- In the U.S., the Securities and Exchange Commission (SEC) imposes rules around fair access, best execution, and market integrity.

- Elsewhere, equivalents like the Financial Conduct Authority (FCA) in the UK or the European Securities and Markets Authority (ESMA) in the EU enforce similar standards.

- Exchanges must comply with requirements to ensure price fairness, manage conflicts of interest, and maintain stable trading platforms.

Benefits

- Strong Price Discovery

- Because so many orders converge in one place, the displayed quotes become a benchmark, showing you the “true” or “consensus” price for a stock at any moment.

- This fosters trust that the quoted price has broad acceptance across buyers and sellers.

- Greater Liquidity

- Lit exchanges often boast heavy trading volumes, especially for widely followed stocks.

- Depth of liquidity means large orders can be broken down into smaller pieces without incurring excessive price slippage.

- Regulated Fairness

- Mechanisms like circuit breakers, disclosure rules, and the requirement for best execution help maintain an orderly environment.

- Investors can typically see if their order hits the market, merges into the order book, and gets matched at a displayed price.

Orderly, public, and supervised.

Drawbacks

- Front-Running Risk for Large Orders

- Institutions with massive buy or sell intentions might reveal their hand if they place the entire order on the lit book, alerting opportunistic traders.

- High-frequency trading (HFT) firms sometimes detect large orders and trade ahead, pushing prices up or down in ways that disadvantage the original order.

- Market Impact Costs

- Large orders can shift the stock’s price significantly if the supply on the other side of the market is limited.

- This phenomenon can lead to more expensive executions for big players, prompting them to seek quieter avenues.

- Potential Overcrowding

- Popular stocks and busy market sessions can see extremely rapid quote changes, making it complex for less sophisticated participants to navigate.

- Although robust, these platforms can appear daunting or hyper-competitive for smaller traders.

In essence, lit exchanges are the beating heart of modern market transparency, offering robust data and high liquidity that fosters efficient price formation. Yet, for major institutional traders handling large orders, concerns about revealing size or facing front-runners drive them to consider alternatives. That’s where dark pools step in, providing a quieter, more private environment.

What Are Dark Pools?

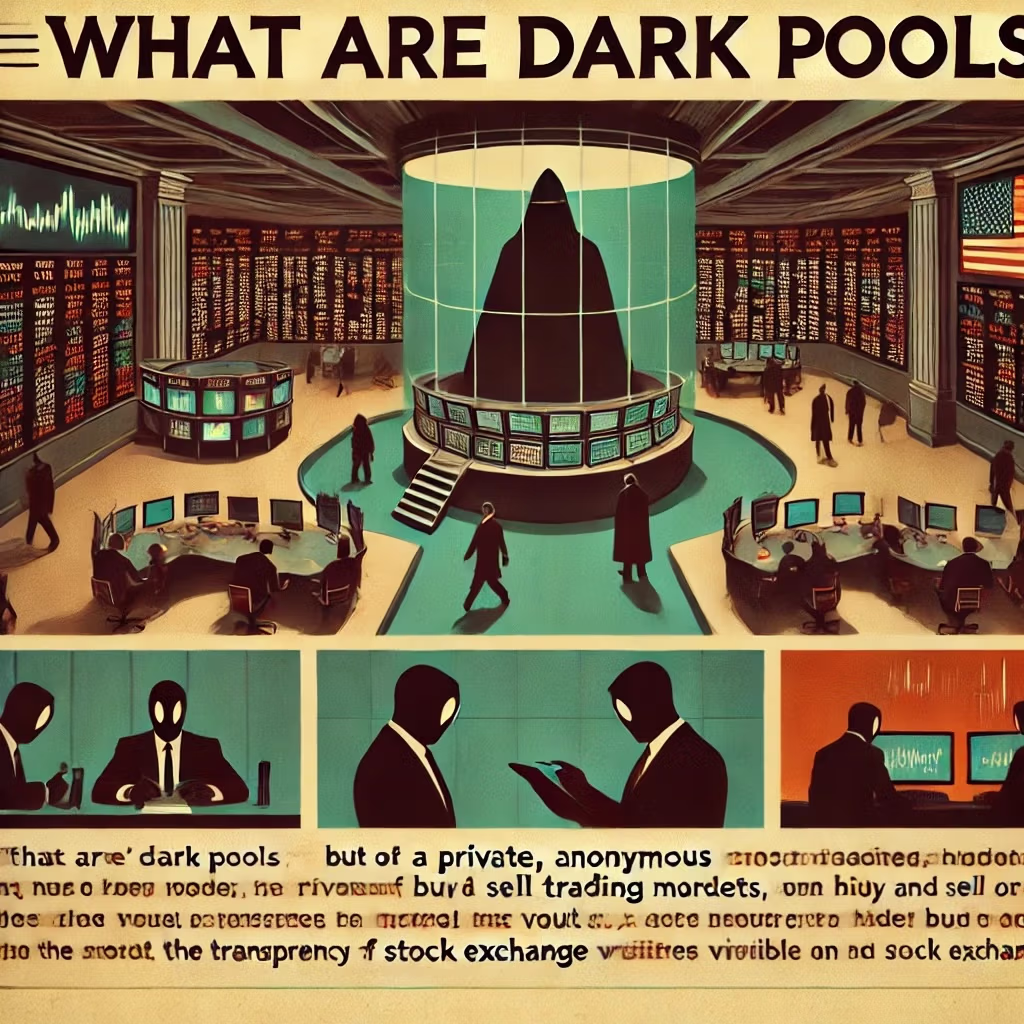

Contrary to what the name might imply, dark pools are not necessarily nefarious hideaways for illicit behavior—though the term “dark” has certainly conjured up suspicion among some policymakers and retail investors. A dark pool is essentially a private trading venue where buy and sell orders remain hidden from public view until a transaction actually occurs. While they’ve become more prominent in recent decades, the concept isn’t entirely new: large institutional trades often needed ways to circumvent the scrutiny and price impact that come from broadcasting big orders on a lit exchange.

Anonymity in the dark.

Definition: Private Trading Venues

The hallmark of a dark pool is that participants can place large orders without publishing them to the broader market. Typically, only the final execution price and volume become known after the trade is matched. This secrecy aims to protect institutional investors—like mutual funds, hedge funds, and pension funds—who want to trade big blocks of shares discreetly to avoid market moves that spike or drop the price before they can complete their trades. Ironically, the existence of dark pools can sometimes serve as a stabilizing influence: fewer giant orders hitting lit exchanges may mean less abrupt volatility for the rest of the market.

Types of Dark Pools

- Broker-Dealer Owned

- Some major investment banks operate their own dark pools for their institutional clients.

- By matching orders “in-house,” they keep trades away from lit markets, preventing external front-runners from spotting large interest.

- Exchange-Owned

- Public exchanges like NASDAQ may operate “dark segments” or offshoots that provide private matching for large trades.

- This helps them capture the institutional flow that might otherwise go to a competitor.

- Independent Operators

- A few dark pools are run by standalone entities not directly affiliated with major broker-dealers or established exchange groups.

- They cultivate liquidity among buy-side participants who wish to keep transactions invisible until completion.

Benefits

- Reduced Market Impact

- Placing large orders into a lit market often pushes prices against the trader. In a dark pool, that big order remains hidden, letting it execute closer to the prevailing “midpoint” or desired level without the entire world adjusting their quotes.

- This is especially appealing to funds transacting millions of shares.

- Anonymity

- Institutions remain shielded from revealing their trading strategy.

- Hedge funds wanting to accumulate or dispose of positions quietly can use dark pools to avoid unwanted speculation.

- Potentially Better Pricing for Block Trades

- When both buyer and seller aim to do large trades, meeting in a dark pool can yield a price that’s fair to both parties—often at the midpoint between the lit exchange’s best bid and best ask.

Privacy fosters big trades.

Drawbacks

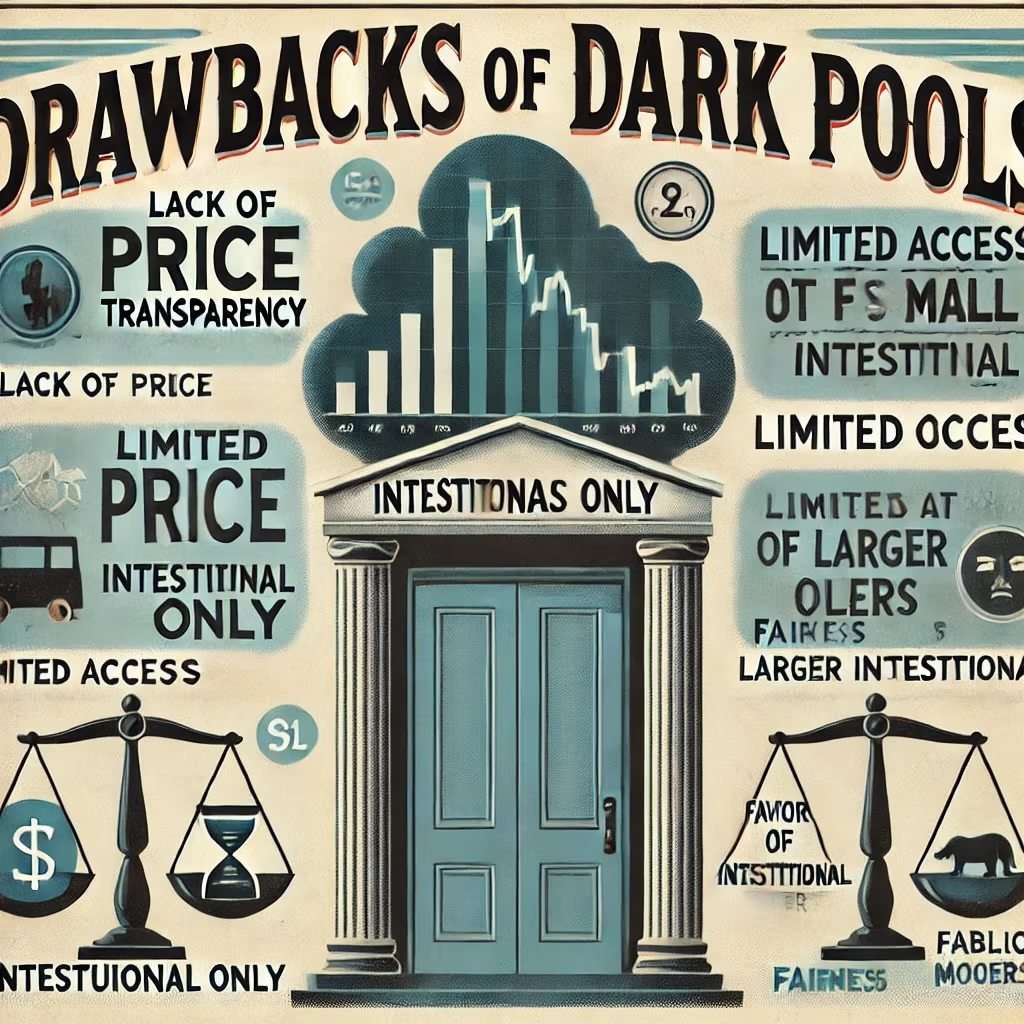

- Lack of Price Transparency

- Because orders are hidden, the overall “true” demand or supply for a stock at any given moment is less visible to the broader marketplace.

- This can undermine price discovery, leading some to claim that dark pools hamper the efficiency of the entire market.

- Limited Access for Retail

- Many dark pools target large institutional players, restricting or disincentivizing smaller orders.

- Retail investors typically rely on their broker’s routing logic, which may or may not include dark pool access—often in ways not fully disclosed.

- Concerns About Fairness

- Some critics argue that dark pools create a two-tier market: one with big players quietly moving blocks, and another for smaller trades forced to show their hands on lit exchanges.

- Potential conflicts of interest arise if a broker-dealer prioritizes matching orders in its own dark pool rather than seeking better prices on a lit exchange.

Dark pools are neither uniformly beneficial nor inherently malicious. They respond to a real market need: enabling block trades without incurring huge costs from “signaling”. Yet, their secrecy inevitably diminishes the public realm’s insight into immediate supply-demand dynamics.

Key Differences Between Dark Pools and Lit Exchanges

The debate over dark pools often returns to a central theme: is it beneficial—or detrimental—to hide large orders from the wider market? While it’s easy to cast dark pools as cunning enclaves that sidestep transparency, the reality is more nuanced. Let’s break down the differences in a structured way, pitting dark pools against lit exchanges across several key dimensions.

Clarity emerges from contrasts.

1. Transparency

- Lit Exchanges: Full price and order book visibility. Anyone can see the current best bid, best ask, and some depth of the order book. This fosters real-time price discovery.

- Dark Pools: Minimal or zero pre-trade transparency. Participants only learn about a trade after it occurs, keeping order flow under wraps. While post-trade data is eventually reported, the immediate detail of who’s bidding and at what size remains undisclosed.

Why It Matters:

- In lit environments, retail and smaller traders gain confidence that they know the “fair” market price. Price formation is robust, anchored by visible orders.

- In dark pools, stealth is beneficial for large blocks, but the broader market might not reflect those hidden orders, potentially creating partial illusions about how much demand or supply actually exists.

2. Market Impact

- Lit Exchanges: Large orders can shift prices if they appear in the public order book. High-frequency traders or savvy market participants may detect big buyer or seller presence and adjust accordingly.

- Dark Pools: By concealing large orders, dark pools reduce the risk of predatory front-running or significant price slippage. Big trades might be matched at or near the mid-price of the National Best Bid and Offer (NBBO), lessening the impact on the visible market.

Why It Matters:

- For institutions dealing with million-share transactions, putting everything on the lit exchange invites potential exploitation or undesired price swings.

- Retail participants trading smaller lots may prefer the lit environment’s clarity but occasionally benefit from dark pools if their brokers use them for better fill prices.

3. Participants

- Lit Exchanges: Open to all investor categories: retail, institutional, algorithmic, or high-frequency. Everyone sees the same quote data (though latency differences exist, giving high-frequency traders microsecond advantages).

- Dark Pools: Often oriented toward institutional players. Minimum order sizes can be high; some dark pools restrict or discourage smaller trades. Retail investors typically gain indirect access only when their brokers route orders there for potential midpoint price improvements.

Why It Matters:

- This difference fosters an impression that dark pools serve the “big fish,” giving them an advantage, while average investors remain on lit exchanges.

- However, some brokers do route retail orders to dark pools to glean price improvements, but it’s less transparent to the end user.

4. Price Discovery

- Lit Exchanges: Prime contributors to price discovery. Public quoting and continuous trading let market participants glean where consensus stands.

- Dark Pools: Limited influence on immediate price signals, given that large trades happen discreetly. Some argue that dark pools “free ride” off the lit market’s quote data.

Why It Matters:

- Without the references offered by lit exchanges, dark pools wouldn’t know how to fairly match trades.

- Critics worry that if too much volume migrates to dark venues, the lit market’s capacity for precise price discovery could erode, harming all participants.

5. Regulatory Oversight

- Lit Exchanges: Subject to strict listing standards, real-time monitoring, and rules around best execution. They typically operate under recognized exchange regulations, requiring transparent operations.

- Dark Pools: They must comply with regulatory frameworks (like the SEC’s Regulation ATS in the U.S.) but face fewer mandates on pre-trade transparency. They typically operate as Alternative Trading Systems (ATS), with partial oversight from regulators but less stringent public reporting of real-time quotes.

Why It Matters:

- The “lighter” regulation or less visible structure of dark pools occasionally draws criticism for opaqueness or possible conflicts of interest.

- On the other hand, many large financial institutions prefer these subdued environments for legitimate reasons—mainly to shield their big trades from predatory behaviors.

Each approach has trade-offs.

Taken together, these differences underscore the core tension: dark pools offer discretion at the cost of real-time clarity, while lit exchanges champion transparency but occasionally hamper efficient execution of large orders. So who, then, benefits most from each?

Who Benefits Most from Each?

Market participants come in all shapes and sizes, from an individual retiree investing in blue-chip stocks to a multinational hedge fund moving billions in a single day. Accordingly, the choice between executing on a lit exchange or a dark pool can differ drastically based on order size, trading objectives, and tolerance for potential front-running or partial fills. Let’s highlight how various market players might weigh the pros and cons.

Different strokes for different folks.

Dark Pools

1. Institutional Investors Managing Large Trades

- Hedge Funds: Often operate sophisticated strategies that require quiet accumulation or liquidation of positions to avoid copycatting or adverse price moves.

- Mutual Funds and Pension Funds: Responsible for big block trades that can spook markets if publicly visible. Dark pools allow them to feed in shares gradually, curbing intense volatility.

- Benefits: Minimizing market impact is the top priority; reducing the “leakage” of trading intentions can save millions. Dark pools also typically offer mid-spread executions, trimming transaction costs.

- Drawbacks: Because they rely on hidden liquidity, there’s a risk of partial or no fills if counterparties aren’t available in the dark pool. Also, questionable transparency can open them to regulatory scrutiny if conflicts arise.

2. Market Makers or Broker-Dealers

- Block-Facilitating Brokers: By operating or accessing a dark pool, brokers can match large client orders internally before sending residual amounts to lit exchanges, capturing potential spread and controlling the flow.

- Benefits: The broker can offer improved fill prices, keep client trades discreet, and perhaps earn fees from running the pool itself.

- Drawbacks: Potential conflicts of interest if the broker steers orders to its own dark pool at the expense of better execution on lit exchanges. Regulators watch for self-serving routing practices.

For big money, discreetness pays.

Lit Exchanges

1. Retail Investors and Smaller Traders

- Definition: Individuals trading hundreds or thousands of shares rather than millions. Often using discount broker apps or more traditional online platforms.

- Benefits: Access to immediate, transparent quotes fosters confidence that you’re paying or receiving a fair price. Depth-of-market data helps in planning entries or exits.

- Drawbacks: High-frequency traders might exploit visible retail orders, potentially front-running them or nibbling out small inefficiencies. Yet the effect on small orders is often negligible.

2. Active Traders and Algorithmic Participants

- Day Traders: Rely on real-time quote visibility to gauge momentum, scalp spreads, and pivot quickly when the tape changes.

- Algo Traders: Many algorithmic strategies revolve around deciphering changes in supply-demand as reflected in the lit order book.

- Benefits: The constant flow of data from the lit exchange is their lifeblood, enabling them to adjust strategies at split-second intervals.

- Drawbacks: In highly crowded equities, competition can be stiff, and big institutional players might vanish to dark pools, limiting the lit exchange’s liquidity for large blocks.

Small trades love big transparency.

Hybrid or Blended Approaches

- Institutional Investors Doing Partial Orders in Each Venue: Large funds might route a portion of an order to lit markets, potentially capturing favorable liquidity, while simultaneously floating the rest in dark pools. This approach can strike a balance: glean some price discovery from lit venues while limiting market impact via hidden trades.

- Retail-Focused Brokerages: Some platforms may route retail flow to dark or “internalized” pools for potential price improvement, returning only leftover volume to lit markets. Retail traders might not always realize this is happening in the background.

Caveats and Evolution

As technology evolves, the boundaries between dark and lit can blur. Some lit exchanges have introduced “hidden orders” or “iceberg orders” that conceal part of the order size until it’s partially filled, while certain dark pools disclose more data than before. Meanwhile, regulatory bodies debate the correct ratio of dark to lit volume to maintain healthy price discovery. Should dark pools surpass certain thresholds, critics warn, the integrity of the market’s “visible” pricing might degrade.

In short, dark pools primarily cater to big whales seeking stealth and minimal market impact, while lit exchanges remain the cornerstone for overall transparency, robust price formation, and universal access.

Dark Pool vs. Lit Exchange: Transparency Trade-Offs — 12-Question FAQ for Traders & Investors

What’s the core difference between a dark pool and a lit exchange?

A lit exchange publicly displays pre-trade information—quotes, depth, and recent prints—so everyone can see best bid/ask and much of the order book. A dark pool is a private venue where orders are hidden until execution; only the trade is reported afterward. In short: lit = visibility for price discovery, dark = discretion for execution.

Why do dark pools exist if transparency is so valuable?

Large orders can “signal” intentions on a lit book, inviting adverse price moves and front-running. Dark pools let institutions match blocks with less market impact, often at or near the midpoint of the public NBBO. They’re a tool to reduce slippage and information leakage, not a replacement for the lit market.

Who typically benefits most from each venue?

Institutions trading size often benefit from dark pools because stealth lowers impact costs. Retail and active traders tend to benefit from lit exchanges where transparent quotes, depth, and prints support better decision-making and tighter control over execution.

How do dark pools affect price discovery?

Because their orders are not displayed pre-trade, dark pools contribute less to immediate price discovery and instead reference the lit market’s prices to match trades. If too much volume shifts dark, the quality of the lit price signal can suffer—hence ongoing regulatory attention to maintain balance.

Are dark pools legal and regulated?

Yes. In the U.S., most operate as Alternative Trading Systems (ATS) under Regulation ATS and within the broader Reg NMS framework. Other jurisdictions (e.g., MiFID II in the EU/UK) impose their own pre-/post-trade transparency rules and limits on dark trading. The oversight focus is best execution, fair access, and conflict management.

What are the main execution trade-offs I should expect?

Lit markets offer transparency and stronger price discovery but can expose large orders to signaling and impact. Dark venues reduce visibility and potential slippage for size but may yield partial fills and provide less context about available liquidity. Many desks blend both to optimize outcomes.

How do midpoint and pegged orders fit into the picture?

Dark pools frequently match at the NBBO midpoint or via pegs to public quotes, allowing price improvement versus the displayed spread. On lit venues, pegged orders and hidden/iceberg functionality can also mitigate signaling while still anchoring to transparent quotes.

What risks or controversies surround dark pools?

Key concerns include conflicts of interest in broker-owned venues, uneven access for smaller participants, reduced contribution to public price discovery, and potential information leakage if a pool’s protections are weak. Due-diligence on venue rules, counterparty mix, and surveillance is essential.

Do retail investors ever interact with dark pools?

Often indirectly. Brokers may route retail orders to wholesalers or ATSs seeking price improvement. Retail traders usually don’t see this routing in real time, so reviewing your broker’s disclosures on routing logic and execution quality can help you understand outcomes.

How do I evaluate execution quality across venues?

Focus on realized slippage versus benchmark (e.g., arrival price, VWAP, TWAP), percentage of price-improved fills, fill rates, adverse selection/reversion after fills, and venue toxicity metrics. Over time, compare strategy results for similar conditions to refine routing preferences.

When should a trader prefer lit vs. dark in practice?

If you need price discovery, tight control, and immediate feedback—especially for smaller orders—lit is typically best. If you’re working a large block and impact is the primary risk, using dark liquidity (alone or in parallel with measured lit participation) can improve average execution.

What’s the likely future for dark vs. lit trading?

Expect continued coexistence and hybridization: lit venues adding hidden/iceberg tools and auctions; dark venues refining protections and transparency around matching rules. Regulation will keep nudging the system toward a balance that preserves public price discovery while allowing efficient block execution.

Conclusion

The modern financial market landscape is a far cry from bygone eras where trading floors echoed with shouted orders and frantic hand signals. Electronic systems dominate now, splitting liquidity between two fundamental categories of venues: lit exchanges and dark pools. This distinction speaks to the heart of how market participants balance the tension between visibility, which promotes fair and efficient price discovery, and anonymity, which protects large orders from adversarial front-running or excessive slippage.

It’s a constant balancing act.

Recap of Key Insights

- Lit Exchanges:

- Emphasize open order books and real-time quoting.

- Offer superior transparency, enabling the entire market to see best bids, best offers, and depths at different price levels.

- Encourage robust price discovery due to the public display of orders.

- However, large trades can move the market or signal strategic intentions, raising transaction costs for big players.

- Dark Pools:

- Conceal orders until after execution, allowing institutions to transact large blocks quietly.

- Shield big trades from immediate view, potentially reducing market impact and providing more favorable fills for institutional clients.

- Contribute less to price discovery, and their relative secrecy can raise concerns about fairness, partial exclusivity, and potential internal conflicts of interest at broker-dealer-owned pools.

- Often remain the realm of big money managers, who value stealth and minimal slippage over the full transparency offered by lit markets.

Opposite ends of a spectrum.

Strengths and Weaknesses

- Lit Exchanges:

- Strengths: Transparent, regulated, inclusive to all investor sizes, strong price discovery anchor.

- Weaknesses: Large orders are vulnerable to front-running or heightened market impact, and high-frequency players can exploit order book data.

- Dark Pools:

- Strengths: Protect confidentiality for block trades, reduce harmful price movements, can offer midpoint or better fills for sizable orders.

- Weaknesses: Less visible, potential for conflicts of interest, less beneficial for smaller trades seeking rapid fill in a broad marketplace.

Where We Stand Today

In many global markets, dark pool volumes constitute a significant slice of total equity trading. For some actively traded stocks, 30–40% of volume might route through various dark venues. Regulators watch closely, wary that if dark activity grows too dominant, the price discovery process on lit exchanges might degrade. At the same time, investors pushing for best execution—particularly large buy-side entities—insist that dark pools remain crucial for transacting big orders without tipping off the entire market. This interplay of public interest in transparency and private need for anonymity spawns ongoing debate about the appropriate regulatory thresholds.

Additionally, technology has blurred lines: lit exchanges experiment with hidden or iceberg orders, while certain dark pools share partial quote data or use pegged references to the lit NBBO. Competition among venues intensifies as each tries to attract order flow. This synergy challenges the old notion that dark is purely “bad” and lit is purely “good”; the market is more complex, forging new solutions that combine the best of both worlds.

It’s a dynamic, shifting environment.

Implications for Investors

- Retail Traders: For small orders, lit exchanges often suffice. Good price transparency fosters confidence in the market, though your broker might route some orders to a dark pool anyway for better fill quality or internal crossing. It’s prudent to understand your broker’s routing policies.

- Institutional Players: Dark pools remain indispensable for block trades. Minimizing slippage can mean millions in savings, overshadowing any intangible cost of less direct contribution to public price discovery. Many institutional desks adopt hybrid strategies, splitting large orders between lit and dark environments.

- Regulatory Angle: Policymakers must weigh how big a role dark pools can occupy before diminishing the lit market’s function as a central aggregator of supply and demand. Balancing the corporate community’s legitimate desire for anonymity with the public’s desire for fairness and robust price signals remains an ongoing puzzle.

All sides strive for equilibrium.

Future Outlook

As technology evolves, we may see:

- More Nuanced Dark Pool Configurations: Innovative order types, partial disclosures, or dynamic matching rules that adapt to market conditions.

- Enhanced Retail Integration: If dark pools show they can consistently provide price improvement, regulators might encourage or codify certain best practices ensuring retail orders benefit while also preserving transparency.

- Potentially Stricter Oversight: If scandals or conflicts of interest arise, watch for new rules or enhanced audits of how brokers route orders, ensuring that best execution truly is the prime directive.

Ultimately, both lit exchanges and dark pools serve legitimate, complementary roles in the modern market. Lit exchanges anchor price discovery, giving a vital snapshot of supply-demand. Dark pools facilitate large trades with reduced noise, enabling big market players to operate without spiking or crashing prices. Striking an optimal balance between the two—transparent order books for fairness and hidden liquidity for block trading—constitutes an ongoing challenge for all involved: regulators, traders, and the markets themselves.

Transparency meets anonymity—coexisting in modern finance.

We hope this provides you with a nuanced understanding of dark pools vs. lit exchanges. Whether you’re a retail trader focusing on small-scale intraday moves or a fund manager overseeing massive block trades, knowing where your order lands and how that choice affects market dynamics can only enhance your investing acumen. At the core of these venues stands a single question: how much secrecy is too much, and how much transparency is just enough? The markets, as ever, are forging that delicate compromise in real time.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.