Are you tired of the same old traditional investments that everyone else is making? Do you want to add some excitement and diversity to your investment portfolio? Look no further than timberland!

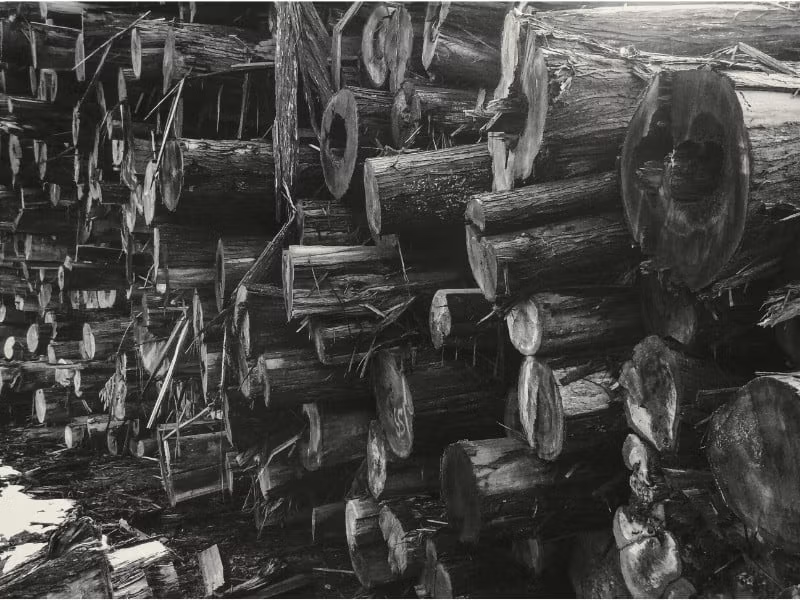

Timberland, as the name suggests, is land primarily used for growing trees for commercial purposes. It may not sound like the sexiest investment option out there, but it has a lot of unique benefits that make it worth considering.

First and foremost, investing in timberland can offer potential for long-term growth and income. Trees take time to grow, so investing in timberland requires patience, but the payoff can be significant. Plus, timberland investments have a low correlation with other asset classes, meaning they can provide a valuable diversification tool for your portfolio.

But that’s not all! Timberland investments can also have potential environmental benefits. By investing in land used for sustainable forestry practices, you’re supporting a renewable resource and contributing to the fight against climate change. And let’s not forget about potential tax benefits, as timberland investments can offer unique tax advantages.

Of course, there are risks and challenges to consider as well. Investing in timberland requires significant upfront costs, and it may take a while before you see any returns. Plus, natural disasters and climate change can pose risks to your investment. And managing timberland isn’t for the faint of heart, as it requires expertise and careful attention to ensure the trees are growing healthily and sustainably.

But if you’re up for the challenge, investing in timberland can be a rewarding and exciting option. In this article, we’ll explore the ins and outs of investing in timberland, from the factors to consider when selecting an investment, to the potential tax implications, to a historical case study on timberland’s performance compared to other asset classes. By the end of this article, you’ll have a better understanding of whether timberland is the right investment option for you. So grab your hard hat and let’s get started!

Benefits Of Investing In Timberland

Investing in timberland can offer a range of benefits to investors seeking to diversify their portfolio. Here are some of the key benefits of investing in timberland:

- Potential for Long-Term Growth and Income: Trees take time to grow, but they can provide a significant source of income once they reach maturity. As the trees grow, they increase in value, and when harvested, can provide a source of revenue for the landowner. Timberland investments have the potential to provide long-term growth and income, making them a valuable addition to any investment portfolio.

- Low Correlation with Other Asset Classes: One of the benefits of investing in timberland is that it has a low correlation with other asset classes. This means that timberland investments may not move in the same direction as other investments in your portfolio, reducing overall portfolio risk. This low correlation can also make timberland investments a valuable diversification tool.

- Potential Environmental Benefits: Investing in timberland can have potential environmental benefits. By investing in land used for sustainable forestry practices, investors are supporting a renewable resource and contributing to the fight against climate change. Additionally, trees absorb carbon dioxide from the atmosphere, making timberland investments a potentially eco-friendly investment option.

- Potential for Tax Benefits: Timberland investments can offer potential tax benefits, making them an attractive option for some investors. In the United States, for example, investors in timberland may be eligible for certain tax deductions and preferential tax treatment. It is important to consult with a tax advisor to determine if these tax benefits apply to your specific situation.

Investing in timberland can offer a range of benefits to investors seeking to diversify their portfolio. From potential long-term growth and income to low correlation with other asset classes and potential environmental and tax benefits, timberland can be a valuable addition to any investment portfolio.

source: Get Rich Education on YouTube

Risks And Challenges Of Investing In Timberland

Investing in timberland can be like planting a seed and watching it grow into a money tree. But just like any investment, it’s not all sunshine and rainbows. There are risks and challenges that investors should be aware of before diving in.

One of the biggest hurdles of investing in timberland is the high upfront costs. You’ll need to have some serious cash on hand to acquire land, plant and manage trees, and wait patiently for years until they mature before you can even think about harvesting them. It’s like waiting for a slow cooker meal, but instead of six hours, you’re waiting for six years, or even longer.

Another challenge of timberland investing is the long-term outlook required. You can’t expect quick returns with timberland investments. You’ll need to be patient and willing to wait until the trees mature and reach their prime harvesting stage. It’s like investing in a savings account, but instead of a few years, you’re waiting for a few decades.

Natural disasters and climate change are also risks associated with timberland investments. Wildfires, floods, and storms can cause significant damage to trees, disrupt harvesting schedules, and hurt profits. Climate change can also affect tree growth and health, requiring investors to be mindful of potential impacts and adapt their management strategies accordingly.

Finally, managing timberland can be a challenging task that requires expertise and careful attention. It’s like being a tree whisperer, but instead of talking to the trees, you’re monitoring them for pests and diseases, managing their growth and harvesting, and ensuring that they are healthy and thriving.

Moreover, investing in timberland is not for the faint of heart. It requires patience, deep pockets, and a willingness to take on risks and challenges. But for those who are up for the challenge, investing in timberland can offer a unique combination of financial and environmental benefits, and can be a rewarding long-term investment strategy.

How To Invest In Timberland

So you’ve decided to take the plunge and invest in timberland, but how exactly do you go about it? There are a few different routes you can take, each with their own pros and cons.

The first option is direct ownership of timberland. This means you purchase the land outright and manage it yourself, or hire a professional management team to handle it for you. This approach gives you full control over the property and allows you to implement your own strategies and management practices. However, it also requires a significant amount of capital upfront, and can be time-consuming and complex to manage.

Another option is investing in timberland funds or Real Estate Investment Trusts (REITs) that specialize in timberland. These funds allow you to invest in a portfolio of timberland properties managed by professionals, without having to manage the properties yourself. This approach can provide a more diversified portfolio, lower entry costs, and potentially higher liquidity. However, it also means you give up some control over the management of the properties, and may be subject to fees and expenses associated with the fund.

When considering a timberland investment, there are several factors to keep in mind. Location is key, as some regions are better suited for timber growth and have stronger markets for wood products. You’ll also want to consider the quality of the timber on the property, as well as the expertise and experience of the management team. The sustainability of the timber harvesting practices is also an important consideration for investors who prioritize environmental responsibility.

Finally, it’s important to be aware of the tax implications of investing in timberland. Depending on how the investment is structured, investors may be able to take advantage of tax benefits such as deductions for management expenses, depletion allowances, and reduced capital gains tax rates. However, it’s important to consult with a tax professional to fully understand the tax implications of a timberland investment.

Consequently, there are several options for investing in timberland, each with its own benefits and challenges. When considering a timberland investment, it’s important to carefully evaluate factors such as location, timber quality, and management expertise, and to be aware of the tax implications of the investment.

source: Whitetail Properties on YouTube

Potential Performance Of Timberland Investments

To understand the potential returns and performance of timberland investments, it’s helpful to compare them to other asset classes. Over the past few decades, timberland investments have generally provided reasonable long-term returns.

However, it’s important to note that timberland returns can vary based on a variety of factors such as location, timber quality, and management practices. In addition, timberland investments require a long-term investment horizon, typically spanning several decades. This means that investors should be prepared to hold the investment for a significant period of time in order to realize its full potential returns.

Looking ahead, the outlook for timberland investments remains positive. With increasing demand for wood products and a growing focus on sustainable forestry practices, the timberland market is poised for continued growth. Additionally, timberland investments may offer potential environmental benefits, as well-managed timberland can sequester carbon and contribute to overall forest health.

Overall, while timberland investments come with their own set of risks and challenges, they have the potential to provide long-term growth and income, diversify a portfolio, and offer potential tax benefits. As with any investment, it’s important to conduct thorough research and due diligence before making a decision.

source: Gokce Capital on YouTube

Timberland as an Alternative Investment: 12-Question FAQ

1) What is timberland as an investment?

Land managed to grow and harvest trees for commercial products (lumber, plywood, pulp/paper, biomass). Returns come from biological growth, timber price changes, and land value.

2) Why add timberland to a portfolio?

It has historically shown low correlation to stocks and bonds, offers potential inflation sensitivity (wood and land are real assets), and can provide long-duration, income-plus-growth characteristics.

3) How do timberland investments make money?

Three main engines:

Biological growth (trees increase in volume/grade over time)

Timber pricing (market cycles for sawtimber, pulpwood, poles)

Land/option value (recreation, conservation easements, HBU—higher and better use)

4) What are the main risks?

Weather and natural disasters (wildfire, wind, ice), pests/disease, market cyclicality (housing/pulp demand), illiquidity, regulatory/environmental constraints, and execution risk in silviculture and harvest timing.

5) What are the typical ways to invest?

Direct ownership of acres (DIY or with a professional forester/manager)

Private timberland funds (closed-end/PE style)

Public timber REITs and timber-focused equities/ETFs (more liquid, market beta)

6) What should I look for in due diligence?

Region/species mix (e.g., US South pine vs. PNW fir vs. Nordic spruce), age-class distribution, site quality/productivity, access/logistics/mills, management plan, ESG certifications (FSC/SFI), and historical harvest/price data.

7) What time horizon fits timberland?

Long-term. Rotation cycles often span 20–35+ years. Even with REITs/funds, underwriting assumptions are multiyear; plan for patient capital and periodic (not quarterly) performance realizations.

8) How liquid is timberland?

Direct holdings are illiquid and transact slowly. Private funds have multi-year lockups. REITs are exchange-traded and liquid but add public-market volatility and broader equity factor exposure.

9) Are there income streams besides log sales?

Yes: hunting leases, recreation, conservation easements, aggregate/mineral rights (situational), biomass/renewables, and emerging carbon projects (afforestation/IFM credits) where viable.

10) What about taxes?

Potential benefits can include capital-gains treatment on timber, depletion allowances, expense deductions, and estate planning advantages—all jurisdiction-specific. Consult a qualified tax professional.

11) How “green” is timberland investing?

Sustainably managed forests are renewable, can sequester carbon, and supply wood that substitutes for more carbon-intensive materials. Verify credible certification (FSC/SFI/PEFC) and transparent harvest/replant practices.

12) Who is timberland right for—and how much?

Investors seeking diversification and inflation-sensitive real assets, comfortable with illiquidity and long horizons. Sizing is personal, but many allocate a single-digit to low-teens % within an alternatives or real-assets sleeve.

Timberland Final Thoughts

In conclusion, investing in timberland can offer a range of benefits, including potential long-term growth and income, low correlation with other asset classes, potential environmental benefits, and potential tax advantages. However, it also comes with risks and challenges, such as high upfront costs, a long investment horizon, and risks associated with natural disasters and climate change.

Before making any investment decisions, it’s important to carefully consider these factors and consult with a financial advisor who can provide guidance on whether timberland investments align with your overall investment goals and risk tolerance. Additionally, it’s important to conduct thorough research and due diligence on any potential timberland investment opportunities to ensure they meet your specific investment criteria.

Ultimately, investing in timberland as part of a diversified portfolio can provide an opportunity to add an alternative asset class to your investment mix, potentially increasing returns and reducing overall portfolio risk. However, it’s important to approach this investment with caution and seek professional advice before making any commitments.

source: Mossy Oak on YouTube

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.