Simplify ETFs have quickly built up a reputation for offering investors some of the most fascinating alternative ETF puzzle pieces.

The fund we’ll be examining today certainly fits the bill.

Better known as Simplify Volatility Premium ETF.

We’re fortunate enough to have Simplify’s very own Shailesh Gupta (Head of Trading and the product designer of SVOL) join us as part of the “Strategy Behind The Fund” series to help unpack this unique ETF from various vantage points.

Without further ado, let’s turn things over to Shailesh!

Reviewing The Strategy Behind SVOL ETF (Simplify Volatility Premium ETF) with Shailesh Gupta

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of SVOL ETF?

For those who aren’t necessarily familiar with an “optimized exposure for monetizing the premium in the VIX futures market” alternative style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

VIX is an index – not an asset that one can buy.

Investors take on VIX exposure through futures to hedge equity beta.

Long VIX exposure, which one can think of as buying insurance against market volatility, loses money over long time horizons.

Hence, short VIX exposure should make money as the equity risk premium is getting transferred into the VIX market.

Monetizing this risk premium in a risk managed way is what we do in SVOL.

We short ~25% VIX futures and buy OTM call options on VIX to hedge the tail risk of a sharp VIX spike.

In normal markets short futures harvest significant premium, while in markets with extreme volatility, like the COVID crash of 2020, deep, OTM VIX options come into play.

source: Simplify Asset Management on YouTube

Unique Features Of Simplify Volatility Premium SVOL ETF

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The portfolio is mostly static with VIX futures exposure around 25%.

We avoid daily rebalancing and let the exposure drift a bit with market moves to mitigate the drag typically associated with funds with short exposure.

It is an active ETF but the philosophy is to run a passive portfolio that can monetize the volatility risk premium in a risk mitigated way.

It is an under levered, mostly rules-based strategy which is designed to have a lower beta and volatility than US large cap equities and deliver equity income across different market conditions.

The discretion is marginal for the sake of risk mitigation and efficient roll/rebalancing of futures and options.

What Sets SVOL ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other “alternative funds” being offered in what is already a crowded marketplace?

What makes it unique?

SVOL is unique in that it taps into an underutilized part of the risk landscape while also embedding tail risk hedging.

It is not only an alternate to traditional and crowded equity income strategies but can also be treated as an alternate beta to equities.

It also acts as a diversifier in a broader basket of alternate investments and potentially a primary return generator.

source: Simplify Asset Management on YouTube

What Else Was Considered For SVOL ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We considered a strategy with dynamic exposure up to 50% but decided against it to maintain a risk-managed profile while mitigating sequence of return risks that can emerge when using high leverage in short VIX.

When Will SVOL ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

The strategy performs best when markets are sideways or trending upwards and worst when there are a series of risk events that result in above average VIX readings and higher volatility (vol of vol) related to VIX.

The strategy is designed to be robust for markets with extreme volatility like in March 2020, as that is when out of the money VIX options come into play.

source: Passive Income Investing on YouTube

Why Should Investors Consider Simplify Volatility Premium SVOL ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

I would argue that short VIX is a beta exposure like US large cap equities and in fact Morningstar categories SVOL as such.

It happens to be a part of the market where demand to be long VIX exposure is much greater than short VIX exposure, which results in an elevated risk premium.

When harvested in a risk managed way, this exposure can result in a portfolio with lower than market risk and the potential for higher than market return.

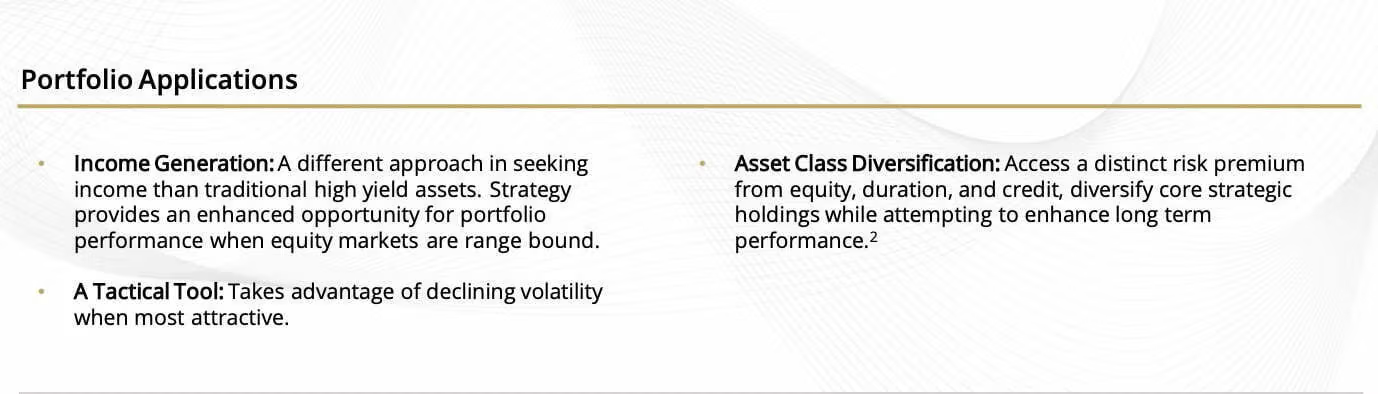

How Does SVOL ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

It depends on the needs of an individual investor.

SVOL can act as a diversifier and return generator for a typical alternative portfolio or it can be a core holding for an equity income investor.

It is probably not a total portfolio solution unless one has a specific view of the market, yet it does (in my opinion) offer one of the best reward per unit of risk in current market conditions.

The Cons of SVOL ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

The biggest criticism, and rightly so, is that it is a complicated strategy tapping in a market which is not very well understood.

It is complicated and difficult to access for most investors, which is why it has extra return per unit of risk.

Our job at Simplify is to offer simple investible solutions like driving a car where complicated stuff stays under the hood.

The Pros of SVOL ETF

On the other hand, what have others praised about your fund?

Lower than market beta and higher than market returns in SVOL since inception are well appreciated, which means that we have calibrated the risks well.

Income investors also like high and consistent dividends.

Getting a “fixed” income from an equity-like exposure is something that investors seem to value, as well.

Is Short VIX A Momentum Or Value Strategy?

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

I sometimes wonder is short VIX should be momentum strategy or a value strategy.

Presently, it seems to be both.

From a momentum point of view, it has been doing well and thus will likely continue to do well.

On the other hand, curve roll premium per unit of beta risk is also quite and hence it is also a value strategy.

Short VIX should be integral part of any diversified income solution.

SVOL is providing it in a generic way, and we are working on integrating this exposure in other income solutions.

SVOL (Simplify Volatility Premium ETF) — Strategy, Risks, Income & Portfolio Fit: 12-Question FAQ

What is SVOL in one sentence?

SVOL seeks to harvest the volatility risk premium by maintaining a generally ~25% short VIX futures exposure while owning out-of-the-money VIX call options as a built-in tail hedge.

How does SVOL actually generate returns?

Over time, long VIX exposure tends to lose due to carry/roll and hedging demand; SVOL takes the other side via a measured short VIX futures stance to capture that premium, while the OTM VIX calls aim to mitigate large losses during volatility spikes.

Is SVOL active, passive, or rules-based?

It’s an active ETF with a mostly rules-based, under-levered approach: target short exposure is around 25% (allowed to drift modestly to avoid rebalance drag), with discretion limited to risk controls and efficient futures/option rolls.

What exactly is the tail-risk hedge?

SVOL purchases deep OTM VIX calls intended to flare up when volatility surges (e.g., crash regimes). The goal is not to profit from every bump higher in VIX, but to cushion severe spikes that could otherwise overwhelm a short-vol position.

In what market conditions does SVOL tend to do best?

Typically in sideways-to-up equity markets with moderate/declining volatility, contangoed VIX curves, and muted “vol of vol.” The short futures harvest carry while the hedge remains inexpensive (but present).

When can SVOL struggle?

During clustered risk events where VIX stays elevated or choppy (rising vol of vol), or in sharp, repeated spikes where hedge timing/strike provides imperfect offsets. Also, if the curve flips to backwardation for long stretches, carry shrinks or turns negative.

How risky is a ~25% short VIX stance versus higher-beta short-vol funds?

SVOL’s posture is intentionally under-levered relative to products that push high short exposure. That tempers drawdowns and sequence risk, but it also limits upside versus more aggressive short-vol strategies in easy regimes.

What role can SVOL play in a portfolio?

It can serve as an equity-income alternative / diversifier or an “alternative beta” sleeve: a potential return generator with lower beta than broad equities, and a different risk driver than stocks/bonds—particularly useful in a multi-strategy alternatives basket.

How might an allocator size SVOL?

Sizing depends on goals and risk tolerance. Many treat it as a modest satellite (e.g., low- to mid-single-digit %s) within an alts/income sleeve, recognizing tail risk exists even with the hedge and that results may deviate from equity/bond behavior.

What should investors monitor over time?

Watch VIX term structure (contango/backwardation), vol of vol, spread/roll costs, option hedge notional/strikes, distribution sustainability, and any changes Simplify discloses to target exposure or risk controls.

How does SVOL handle income?

SVOL has historically targeted equity-like income characteristics by monetizing the premium and distributing cash flows; realize that distributions are not guaranteed, can vary, and reflect portfolio outcomes, costs, and market carry.

What are the key trade-offs in plain English?

You’re swapping some strategy complexity (futures + hedge) and crash-scenario uncertainty (hedge may not perfectly offset) for the chance to earn carry with a built-in tail option, packaged in an under-levered, risk-managed ETF.

Connect With Simplify ETFs and Shailesh!

Simplify Asset Management: Simplify ETFs

Fund Page: SVOL ETF

Twitter: @SimplifyAsstMgt / @VIX_Sage (Shailesh)

YouTube: Simplify Asset Management

source: Simplify Asset Management on YouTube

Nomadic Samuel Final Thoughts

I want to personally thank Shailesh for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

Also, special thanks to Eric McArdle (@EMcArdleInvest) for helping to coordinate things behind the scenes!

Simplify offers some of the most innovative alternative funds in the marketplace and it’s fantastic that we’ve now covered two other ETFs as part of the “Strategy Behind The Fund” series:

I’ve also personally reviewed some of my favourite Simplify funds:

- FIG Simplify Macro Strategy ETF

- TYA Simplify Intermediate Term Treasury Futures Strategy ETF

- CTA Simplify Managed Futures Strategy ETF

- SPD Simplify US Equity PLUS Downside Convexity ETF

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.