The name Warren Buffett is virtually synonymous with the very definition of investing success. Born in the city of Omaha, Nebraska, in 1930, Buffett has steadily crafted an enviable career that spans over six decades, with his name often etched next to the phrase ‘the greatest investor of all time.’ His sage wisdom and uncanny ability to decipher the financial markets’ ebbs and flows have earned him the moniker ‘The Oracle of Omaha.’ While many regard Buffett’s investment prowess as a kind of sorcery, it is, in reality, the product of hard work, innate curiosity, and an unparalleled dedication to understanding the complexities of business and economy.

Sneak Peek into the Crucible: Buffett’s Mentors and Their Indelible Influence

Yet, every hero has an origin story, and Warren Buffett is no exception. As the story unfolds, we find that the making of the Oracle didn’t happen in isolation. Rather, it was a carefully guided process, an insightful journey punctuated by the teachings and influences of three remarkable men who served as his mentors. This triad of wise men—Benjamin Graham, Philip Fisher, and Charlie Munger—played indispensable roles in shaping Buffett’s investment philosophy.

Their combined knowledge and experience acted as a crucible in which Buffett’s unique investment approach was forged. In the pages that follow, we will delve into the depths of these influential relationships, and examine how they left an indelible mark on Warren Buffett, the investor, and the man. So, fasten your seatbelts and prepare for a journey back in time, to the early days of a young, eager Warren Buffett—ready to take on the world, one investment at a time.

Early Life and Introduction to Investing

The Roots: Family Background and a Spark of Business Acumen

In the heartland of the United States, Omaha, Nebraska, Warren Edward Buffett was born into a modest family on August 30, 1930. His father, Howard Buffett, was a stockbroker and a four-term U.S Congressman, providing young Warren with his first glimpse into the world of finance. Perhaps it was the dinner-table conversations or the aura of the stock exchange that seeped into his very being, but Buffett developed an uncanny interest in business and investing at a tender age. His childhood, contrary to the popular perception of youth, was not spent in frivolous play, but rather in nurturing this burgeoning interest, as if he was destined to master the art of investing.

The Genesis of an Investor: Early Forays into the World of Business

Buffett’s first experiences with investing were nothing short of precocious. At the tender age of 6, he bought six-packs of Coca Cola to resell for a small profit, hinting at his future connection with the soda giant. By 11, he was ready to dip his toes into the stock market, purchasing shares of Cities Service Preferred for $38 apiece. This investment did not initially go as planned and was a first-hand experience in the trials and tribulations of the market, which left an indelible mark on his young mind.

Formative Lessons: The Building Blocks of a Legendary Career

These early years were a hotbed of learning for Buffett. His first stock purchase taught him the value of patience in investing. After the price of his Cities Service Preferred shares fell dramatically post-purchase, instead of panicking, he held on until the shares rebounded, eventually selling for a small profit. However, the stock price continued to climb significantly after he sold, teaching him another critical lesson: the importance of understanding a company’s worth and holding onto its stocks for the long-term. Furthermore, his childhood ventures instilled in him a robust work ethic and a strong understanding of profits and losses, which later became the pillars of his investment philosophy. Thus, in the school of life, Warren was learning some of his most profound lessons, ones that would guide his investment decisions in the decades to follow.

Influence of Benjamin Graham

source: The Financial Review on YouTube

An Encounter with The Dean: Discovering Benjamin Graham

It was while studying at the University of Nebraska that Buffett’s path intersected with the man who would become his earliest and arguably most influential mentor—Benjamin Graham. Buffett stumbled upon Graham’s seminal work, “The Intelligent Investor,” and it was a revelation. He described it as the book that ‘changed his life,’ so profoundly was he impacted by Graham’s unique approach to investing. Enthralled by Graham’s investment philosophy and eager to learn directly from the master himself, Buffett applied to Columbia Business School, where Graham taught.

The Graham Doctrine: Investment Principles of the Dean of Wall Street

Benjamin Graham, known as ‘The Dean of Wall Street,’ espoused an approach to investing rooted in thorough analysis, rational decision-making, and an unwavering focus on intrinsic value. His philosophy advocated for investing in companies trading for less than their intrinsic worth—the essence of ‘value investing.’ Graham also championed the concept of ‘margin of safety,’ that is, buying with a significant discount to intrinsic value, thus offering some protection against errors in judgement or unforeseen events.

The Protege’s Adaptation: Buffett’s Incorporation of Graham’s Principles

Buffett was an eager and devoted student. He embraced Graham’s teachings, internalizing the principles of value investing and margin of safety. The core tenets of Graham’s philosophy became the foundational stones upon which Buffett built his investing approach. Buffett’s focus on understanding a company’s fundamentals, analyzing its financial health, and calculating its intrinsic value before making an investment decision mirrored Graham’s teachings.

The Graham Era: Lessons from the Master’s Footsteps

Buffett’s time as Graham’s student, and later as an employee at Graham-Newman Corp., was a masterclass in practical investing. Graham’s stringent criteria for stock selection, his disciplined approach, and his stoic indifference to market fluctuations left a lasting impact on Buffett. This experience reinforced the importance of rationality, patience, and independent thinking in investing—lessons that Buffett carried with him throughout his career. Yet, as much as he revered Graham, Buffett recognized the limitations of Graham’s quantitative-focused strategy. He began to contemplate the importance of a company’s quality and its long-term prospects, setting the stage for the next chapter in his investment philosophy.

Influence of Philip Fisher

Serendipity Strikes: Buffett’s Introduction to Philip Fisher

After absorbing the principles of Benjamin Graham, Buffett’s investment journey led him to another luminary—Philip Fisher. Renowned for his focus on investing in high-quality growth companies, Fisher was a stark contrast to Graham. Buffett was introduced to Fisher’s work through his book, “Common Stocks and Uncommon Profits.” The book struck a chord with Buffett and initiated a philosophical shift in his investment approach.

source: The Financial Review on YouTube

The Fisher Doctrine: Investing in Innovation and Quality

Philip Fisher’s investment philosophy can be encapsulated in one phrase: “buy and hold.” Unlike Graham’s deep-value approach, Fisher placed a greater emphasis on the quality of a business and its potential for future growth. He preferred investing in innovative companies with robust management, exceptional products or services, and a clear competitive advantage. Fisher was an advocate of thorough research or ‘scuttlebutt,’ involving an in-depth study of a company’s operations, products, and management before investing.

Buffett’s Evolution: Marrying Value with Quality

Inspired by Fisher, Buffett began to incorporate qualitative factors into his investment strategy. He didn’t abandon Graham’s principles of value investing; instead, he melded them with Fisher’s focus on company quality and growth prospects. This synergy led to Buffett’s unique investment approach: buying undervalued companies not merely based on price-to-earnings ratios, but also with solid business models, competitive advantages, and potential for long-term growth.

The Fisher Influence: Long-Term Thinking and Business Quality

Philip Fisher’s impact on Buffett’s philosophy was significant. It added a new dimension to Buffett’s investment strategy—long-term thinking. Fisher’s doctrine taught him that, given a choice, it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price. This lesson greatly influenced Buffett’s future investments, notably his acquisitions of companies like See’s Candies and Coca-Cola. These were not ‘cheap’ stocks per se, but they were wonderful businesses with substantial growth potential, thereby reflecting the successful integration of Fisher’s principles into Buffett’s philosophy.

source: CNBC Television on YouTube

Influence of Charlie Munger

When Like Minds Meet: The Blossoming Partnership of Buffett and Munger

Buffett’s introduction to Charlie Munger, a fellow Omaha native, was serendipitous. They were introduced by a mutual acquaintance in 1959 and found in each other a shared enthusiasm for investing and a similar sense of humor. Their friendship quickly blossomed into a partnership that has since become legendary. Both men recognized in each other not only a brilliant investment mind but also a kindred spirit that led to the formation of one of the most fruitful partnerships in the world of finance.

Munger’s Mantra: The ‘Sit on Your Ass’ Investment Approach

Charlie Munger, ever the contrarian, promoted a unique investment philosophy that he humorously dubbed ‘sit on your ass investing.’ This wasn’t a call to laziness, but rather an argument for long-term investing in outstanding companies. Munger believed that the best returns come from owning a few high-quality businesses and holding them for the long haul, a concept that resonated deeply with Buffett’s evolving investment approach.

A Symphony of Minds: The Berkshire Hathaway Investment Approach

The synergy of Buffett and Munger’s philosophies led to the unique investment approach that characterizes Berkshire Hathaway. Munger’s influence nudged Buffett further away from the pure ‘value’ philosophy of Graham towards a blend of value and ‘quality’ investing. Together, they looked for ‘compounding machines’—businesses that could reinvest earnings at high rates of return. The dual forces of value investing and long-term growth became the hallmark of their strategy, leading to unparalleled success at Berkshire Hathaway.

Lessons from the Dynamic Duo: Key Takeaways from the Buffett-Munger Partnership

The Buffett-Munger partnership offers rich lessons in collaboration, complementary strengths, and shared values. Their shared philosophy, mutual respect, and unyielding integrity have become the foundation of their investment success. Buffett often credits Munger with broadening his perspective and making him a better investor. Their alliance underscores the power of partnership and the importance of continual learning, even at the peak of success.

source: WeLoveValue Investing on YouTube

Warren Buffett’s Unique Investment Philosophy

A Symphony of Wisdom: The Birth of Buffett’s Unique Investment Strategy

As we journey through Buffett’s formative years, we witness the birth of a unique investment philosophy. The teachings of his mentors—Graham’s insistence on intrinsic value and a margin of safety, Fisher’s focus on business quality and growth potential, and Munger’s emphasis on long-term investing—converged to form the cornerstone of Buffett’s approach. The Oracle of Omaha didn’t merely copy these masters; he creatively combined their wisdom, adding his own insights and experience to develop a strategy that was uniquely his own.

In the Limelight: The Proving Grounds of Buffett’s Investments

A look at Buffett’s biggest investments offers a masterclass in his investment philosophy. Consider his 1988 investment in Coca-Cola. While the company wasn’t undervalued in the strict Graham sense, Buffett saw immense brand strength and growth potential, aligning with Fisher’s qualitative focus. His decision to hold onto these shares for decades, reaping the benefits of compounding, echoes Munger’s ‘sit on your ass’ philosophy.

Similarly, his acquisition of See’s Candies illustrated a willingness to pay a fair price for an exceptional business with a strong competitive advantage. This willingness to deviate from strict value investing rules in favor of quality and potential for long-term growth marks a significant evolution in Buffett’s approach.

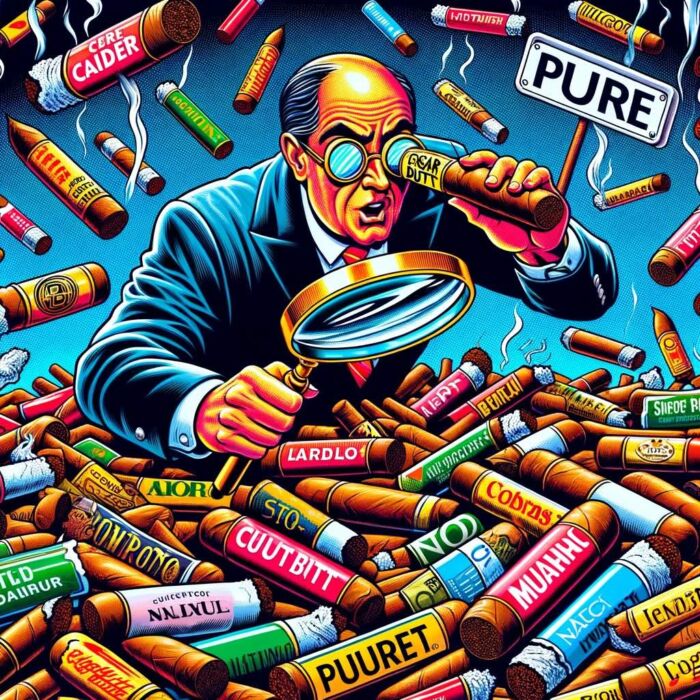

An Odyssey of Learning: The Evolution of Buffett’s Philosophy

Buffett’s philosophy has been anything but static. His transition from a pure ‘cigar butt’ investor, hunting for cheap, mediocre companies, to someone willing to pay a fair price for a fantastic company, attests to his ability to adapt and learn. While the core tenets—value, quality, and long-term investing—have remained consistent, the weight he places on each has changed. Today, Buffett is less likely to purchase a company solely because it’s cheap; instead, he values excellent businesses with enduring moats and shareholder-friendly management. This evolution underscores Buffett’s open-mindedness and willingness to learn—an attribute that every investor should aspire to imbibe.

source: Investor Archive on YouTube

Warren Buffet’s Legacy and Influence

An Enduring Influence: Buffett’s Philosophy and the Next Generation of Investors

Warren Buffett’s philosophy has not only garnered incredible wealth but also left a profound impact on the investing world. His approach has influenced countless investors—both individuals and professionals. His annual letters to Berkshire Hathaway shareholders have become canonical readings in investment circles, with each letter illuminating aspects of his philosophy. The underlying principles of value, business quality, and long-term thinking have found their way into countless investment strategies. His philosophy has truly democratized investing, making it accessible to everyone, from Wall Street to Main Street.

Paying it Forward: The Importance of Mentorship in Buffett’s Journey

Warren Buffett stands as a beacon of the power of mentorship. His journey, shaped by his mentors’ guidance, highlights the impact of learning from those who tread the path before us. Yet, the cycle does not stop with him. Buffett, aware of the role mentorship played in his life, has taken up the mantle to guide many others. He continues to share his wisdom through interviews, shareholder letters, and public appearances, nurturing the next generation of investors.

A Tectonic Shift: Impact of Buffett’s Investment Philosophy on the Global Investment Landscape

The influence of Warren Buffett’s investment philosophy on the global investment landscape is undeniable. He has reframed the way many perceive investing. Rather than a speculative gamble, investing, in Buffett’s view, is about owning pieces of businesses. His approach has brought fundamental analysis and long-term thinking to the forefront, challenging the frenetic pace of Wall Street. Moreover, his emphasis on ethical management and corporate responsibility has started to reshape corporate governance norms. Warren Buffett’s philosophy, while rooted in the financial realm, transcends numbers—it’s a guide to rational decision-making, patience, and integrity.

12-Question FAQ: How Warren Buffett’s Mentors Shaped His Investment Philosophy

1) Who were Warren Buffett’s most influential mentors?

Benjamin Graham (value + margin of safety), Philip Fisher (quality + growth via scuttlebutt), and Charlie Munger (multidisciplinary mental models + “buy a wonderful business and sit”).

2) What did Buffett learn from Benjamin Graham?

A rigorous, numbers-first approach: buy below intrinsic value with a clear margin of safety, stay rational, and treat volatility as opportunity—not risk.

3) How did Philip Fisher change Buffett’s lens?

Fisher added the qualitative side: judge management quality, culture, innovation, and durable customer love—then hold for long runways of growth.

4) Where does Charlie Munger fit in?

Munger fused disciplines (psychology, economics, game theory) and pushed Buffett from “cheap cigar butts” to quality at a fair price, held patiently.

5) How did these mentors combine into Buffett’s unique style?

Buffett marries Graham’s valuation discipline with Fisher’s business-quality filter, then applies Munger’s mental-models toolkit to think broadly and hold long.

6) What is “margin of safety,” and why is it central?

It’s paying well below conservative intrinsic value to absorb errors, bad luck, or shocks—reducing the chance of permanent capital loss.

7) What is Fisher’s “scuttlebutt,” and how did Buffett use it?

Real-world research—talking to customers, suppliers, and competitors—to judge moat strength, culture, and durability beyond the spreadsheets.

8) How did Munger’s mental models alter Buffett’s decisions?

They sharpened behavior-aware investing (e.g., incentives, feedback loops, network effects), helping Buffett avoid biases and spot compounding machines.

9) Which classic Buffett investments show mentor influence?

See’s Candies (Fisher/Munger: brand power, pricing, long hold), Coca-Cola (Fisher: global franchise + moat; Graham: sensible price), and later Apple (quality ecosystem + cash returns).

10) How did Buffett evolve from “cigar butts” to “wonderful businesses”?

Experience + Munger’s push: mediocre but cheap stalls; great businesses compound. He shifted weight from price-only to quality-plus-price.

11) How can individual investors apply this blended philosophy?

Value first (Graham), quality filter (Fisher), broad thinking + patience (Munger): know your circle of competence, research deeply, demand a margin of safety, and hold.

12) Biggest pitfalls when copying Buffett without the mentors’ context?

Overpaying for “quality,” ignoring culture/incentives, straying outside your competence, and mistaking volatility for risk instead of impairment.

Conclusion: (Revisiting the Masters: A Recap of Buffett’s Influences)

As we step back and survey the panorama of Warren Buffett’s investment journey, the contours of influence become vividly clear. From Benjamin Graham’s rigorous principles of value investing, Philip Fisher’s emphasis on business quality and growth, to Charlie Munger’s call for long-term investing, each mentor left an indelible mark on Buffett’s approach. These mentors, through their teachings, laid the foundation for Buffett’s illustrious career and helped shape him into the Oracle of Omaha.

The Art of Learning: Reflecting on the Importance of Adaptation

Warren Buffett’s journey underscores the importance of learning from others and adapting their wisdom to our context. He was not just a student who blindly adopted his mentors’ philosophies. Instead, he ingested their principles, digested them, and synthesized a unique philosophy that catered to his strengths and understanding. This ability to learn, adapt, and evolve holds a lesson far beyond investing—it’s a timeless principle applicable to all facets of life.

An Evergreen Philosophy: Closing Thoughts on Buffett’s Relevance

In an era of algorithmic trading and high-frequency transactions, Buffett’s philosophy stands as an enduring testament to the power of fundamentals. It reminds us that, at its core, investing is about purchasing value, understanding businesses, and fostering patience. As we navigate the volatile tides of the market, Buffett’s wisdom serves as a beacon, guiding us towards rational decisions and long-term thinking. Buffett’s philosophy, steeped in simplicity and prudence, is as relevant today as it was when he first set foot in the investing world, and it’s likely to remain so in the decades to come. After all, wisdom, much like a good investment, only appreciates with time.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.