When one thinks of legendary investors who have stood the test of time, Warren Buffett invariably tops the list. Dubbed the “Oracle of Omaha,” Buffett has amassed a fortune that places him among the wealthiest individuals globally. Yet, what truly sets him apart is not just the accumulation of wealth but the consistent, principled approach he has employed over decades to achieve it. Born in 1930 in Omaha, Nebraska, Buffett displayed an early aptitude for business and investing, purchasing his first stock at the tender age of 11 and filing his first tax return at 13.

source: Forbes on YouTube

Buffett’s investment philosophy is rooted in value investing, a strategy that emphasizes buying securities that appear underpriced by some form of fundamental analysis. Unlike many market participants who are swayed by short-term trends or speculative fervor, Buffett focuses on the intrinsic value of businesses, seeking opportunities where the market has undervalued a company’s true worth. His approach is underpinned by patience, discipline, and a long-term perspective, allowing the power of compound growth to work its magic over time.

The purpose of this article is to delve deep into Buffett’s investment strategies and explore how they can be applied by individual investors. We will unpack his core principles, examine case studies of his most significant investments, and provide practical steps for incorporating his methods into your own investment journey. By understanding and adopting Buffett’s time-tested strategies, you can enhance your ability to make informed investment decisions and potentially achieve superior returns.

So, whether you’re a seasoned investor looking to refine your approach or a newcomer eager to learn from the best, this comprehensive guide aims to illuminate the path toward investing like Warren Buffett.

The Principles of Value Investing

At the heart of Warren Buffett’s success lies a straightforward yet profoundly effective approach: value investing. This investment philosophy, popularized by Benjamin Graham and David Dodd in their seminal work “Security Analysis,” centers on the idea that every stock has an intrinsic value that may differ from its current market price. The value investor seeks to capitalize on these discrepancies by purchasing stocks when they are undervalued and holding them until the market recognizes their true worth.

Intrinsic Value

Intrinsic value refers to the actual worth of a company based on its fundamental characteristics, including its assets, earnings, and growth prospects. It is an estimate of the present value of all future cash flows the company is expected to generate, discounted back to their present value using an appropriate discount rate. Determining intrinsic value is a critical component of Buffett’s investment process.

How Buffett Determines Intrinsic Value:

- Discounted Cash Flow (DCF) Analysis: Buffett often employs DCF analysis to estimate the present value of a company’s expected future cash flows. This involves projecting the company’s cash flows over a certain period and then discounting them back to their present value using a discount rate that reflects the investment’s risk.

- Earnings Stability: He looks for companies with consistent and predictable earnings, which makes forecasting future cash flows more reliable.

- Return on Capital Employed: Buffett assesses how efficiently a company uses its capital to generate profits, preferring those that produce higher returns on invested capital.

- Qualitative Factors: Beyond the numbers, he considers the company’s competitive position, management quality, and potential for future growth.

Key Considerations:

- Avoiding Overly Complex Calculations: Buffett prefers businesses whose intrinsic value can be estimated with reasonable accuracy, avoiding those that require speculative assumptions.

- Margin of Error: Recognizes that estimating intrinsic value is not an exact science; thus, he builds in a margin of safety.

Margin of Safety

The margin of safety is a fundamental concept in value investing, serving as a buffer against uncertainties and errors in valuation. It represents the difference between a stock’s intrinsic value and its current market price. By investing in companies whose stocks are trading significantly below their intrinsic value, investors can reduce the risk of loss and increase the potential for gain.

Importance of Margin of Safety:

- Risk Mitigation: Provides a cushion against unforeseen adverse developments or miscalculations in the intrinsic value assessment.

- Enhanced Returns: Increases the likelihood of significant capital appreciation as the market corrects its mispricing over time.

- Psychological Comfort: Allows investors to remain patient and confident during market volatility, knowing they have purchased at a favorable price.

Example:

If Buffett determines that a company’s intrinsic value is $100 per share but the stock is trading at $70, the $30 difference represents the margin of safety. This gap makes the investment more attractive and less risky.

Long-Term Perspective

Buffett is renowned for his long-term investment horizon, often holding stocks for decades. He believes that wealth is built by allowing investments to compound over time, rather than by frequent trading based on short-term market movements.

Benefits of a Long-Term Approach:

- Compound Growth: Reinvested earnings and dividends can grow exponentially over time, significantly enhancing returns.

- Reduced Costs: Fewer transactions mean lower brokerage fees and capital gains taxes, which can erode investment returns.

- Avoiding Market Timing Risks: Reduces the temptation to time the market, a strategy that is notoriously difficult and often counterproductive.

- Emotional Discipline: A long-term focus helps investors stay the course during periods of market turbulence, avoiding impulsive decisions driven by fear or greed.

Buffett’s Philosophy:

He famously stated, “Our favorite holding period is forever,” emphasizing his commitment to owning businesses with enduring value.

Application:

By investing in high-quality companies with durable competitive advantages and holding them over the long term, investors can benefit from both capital appreciation and the power of compounding.

How Buffett Selects Stocks

Warren Buffett’s stock selection process is meticulous and grounded in fundamental analysis. He seeks companies that not only appear undervalued but also possess qualities that suggest sustained future success.

Quality of the Business

Buffett invests in businesses with solid fundamentals and favorable long-term prospects. He focuses on companies that have demonstrated consistent performance and are likely to continue doing so.

Criteria for Identifying Strong Businesses:

- Consistent Earnings Growth: Companies that have shown steady increases in earnings over time are more likely to continue performing well.

- High Return on Equity (ROE): A high ROE indicates that a company is effectively using shareholders’ equity to generate profits. Buffett looks for companies with an ROE that exceeds the industry average.

- Strong Free Cash Flow: Ample free cash flow allows a company to invest in growth opportunities, pay dividends, and reduce debt.

- Low Debt Levels: Companies with manageable debt are less vulnerable to economic downturns and interest rate fluctuations.

- Competitive Advantage: The presence of a sustainable competitive edge, or economic moat, that protects the company’s market position.

- Simplicity and Understandability: Buffett prefers businesses with straightforward operations that he can easily comprehend.

Example:

See’s Candies: Buffett acquired See’s Candies in 1972. The company had a simple business model, strong brand recognition, and consistently generated high returns on invested capital with minimal need for reinvestment. This investment exemplifies Buffett’s preference for high-quality businesses with enduring appeal.

Management Quality

Buffett places immense importance on the integrity and competence of a company’s management team. He believes that even a great business can be a poor investment if it’s run by dishonest or inept managers.

What Buffett Looks for in Management:

- Integrity: Ethical behavior and honesty are non-negotiable. Buffett wants to trust that management will act in the best interests of shareholders.

- Talent and Competence: A proven track record of effective leadership and sound decision-making.

- Shareholder Alignment: Managers who think like owners, often demonstrated by significant personal investment in the company.

- Transparent Communication: Openness and honesty in reporting financial results and addressing challenges.

- Capital Allocation Skills: The ability to wisely invest the company’s capital to generate growth and returns.

Red Flags:

- Excessive Executive Compensation: May indicate self-serving behavior rather than a focus on shareholder value.

- Frequent Changes in Strategy: Could suggest a lack of clear direction or desperation.

- Aggressive Accounting Practices: Raises concerns about the reliability of financial statements.

Economic Moats

An economic moat refers to a company’s sustainable competitive advantage that protects it from competitors and enables it to maintain strong profitability over time. Buffett likens it to a moat surrounding a castle, keeping invaders at bay.

Types of Economic Moats:

- Cost Advantage: Companies that can produce goods or services at a lower cost than competitors, allowing for higher margins or more competitive pricing.

- High Switching Costs: Products or services that are costly or inconvenient for customers to switch away from, creating customer stickiness.

- Network Effect: The value of a product or service increases as more people use it, making it difficult for newcomers to compete.

- Intangible Assets: Strong brand identity, patents, trademarks, or regulatory licenses that provide a competitive edge.

- Efficient Scale: Operating in a niche market where the incumbents effectively deter new entrants due to high initial costs or limited demand.

How Buffett Identifies and Evaluates Economic Moats:

- Durability: The moat should be sustainable and not easily eroded by technological changes or market shifts.

- Measurability: The competitive advantage should be evident in financial metrics, such as high profit margins and return on capital.

- Barriers to Entry: The presence of significant obstacles that prevent competitors from entering the market or matching the company’s offerings.

- Customer Loyalty: Strong brand loyalty that keeps customers returning and discourages them from switching to competitors.

Examples:

- Coca-Cola: Its global brand recognition and extensive distribution network create a formidable moat, making it challenging for competitors to displace its market position.

- American Express: The company’s strong brand and network of merchants and cardholders create high switching costs and a network effect.

Significance:

Investing in companies with robust economic moats increases the likelihood of sustained profitability and long-term investment success.

Understanding Financial Statements

A thorough understanding of financial statements is essential for any investor aiming to emulate Buffett’s approach. These documents provide critical insights into a company’s financial health, operational efficiency, and future prospects.

Overview of the Key Financial Statements

- Income Statement (Profit and Loss Statement):

- Purpose: Reflects the company’s revenues, expenses, and profits over a specific period, usually a quarter or a year.

- Key Components:

- Revenue (Sales): Total income generated from goods sold or services provided.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs not directly tied to production, such as administrative and marketing expenses.

- Operating Income: Gross profit minus operating expenses.

- Net Income: The bottom line profit after all expenses, taxes, and interest.

- Balance Sheet:

- Purpose: Provides a snapshot of the company’s financial position at a specific point in time, detailing what it owns and owes.

- Key Components:

- Assets: Resources owned by the company, including current assets (cash, inventory) and non-current assets (property, equipment).

- Liabilities: Obligations the company owes to others, such as loans, accounts payable, and long-term debt.

- Shareholders’ Equity: The residual interest in the assets after deducting liabilities, representing the net worth of the company.

- Equation: Assets = Liabilities + Shareholders’ Equity

- Cash Flow Statement:

- Purpose: Shows how changes in the balance sheet and income affect cash and cash equivalents, breaking down cash flows into operating, investing, and financing activities.

- Key Components:

- Cash Flow from Operating Activities: Cash generated from core business operations.

- Cash Flow from Investing Activities: Cash used for investment in assets like equipment or securities, and proceeds from the sale of such assets.

- Cash Flow from Financing Activities: Cash flow from issuing debt or equity, paying dividends, and repurchasing shares.

How Buffett Uses Financial Ratios

1. Return on Equity (ROE):

- Formula: ROE = Net Income / Shareholders’ Equity

- Purpose: Measures how effectively management is using shareholders’ capital to generate profits.

- Buffett’s Benchmark: Looks for companies with a consistent ROE of at least 15%.

2. Debt-to-Equity Ratio:

- Formula: Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

- Purpose: Assesses a company’s financial leverage and risk.

- Buffett’s Preference: Favors companies with low debt-to-equity ratios, typically below 0.5.

3. Profit Margin:

- Formula: Profit Margin = Net Income / Revenue

- Purpose: Indicates how much profit a company makes for every dollar of revenue.

- Buffett’s View: Prefers companies with higher profit margins, as they often have better cost control and pricing power.

4. Current Ratio:

- Formula: Current Ratio = Current Assets / Current Liabilities

- Purpose: Measures a company’s ability to pay short-term obligations.

- Application: While important, Buffett does not overemphasize this ratio if the company has strong cash flows.

5. Earnings Per Share (EPS) Growth:

- Formula: EPS = (Net Income – Preferred Dividends) / Average Outstanding Shares

- Purpose: Shows the company’s profitability on a per-share basis over time.

- Buffett’s Focus: Looks for consistent EPS growth, indicating a company’s ability to increase profitability.

Buffett’s Approach to Analyzing Earnings Stability and Growth Prospects

Consistency Over Volatility:

- Predictable Earnings: Buffett values companies with stable and predictable earnings, making future performance easier to forecast.

- Historical Performance: Analyzes at least five to ten years of financial data to identify trends and assess the company’s resilience during economic downturns.

Quality of Earnings:

- Avoiding One-Time Gains: Adjusts for non-recurring items that may inflate earnings temporarily.

- Accounting Practices: Scrutinizes accounting methods to ensure transparency and avoid companies that use aggressive or questionable practices.

Growth Prospects:

- Sustainable Growth: Evaluates whether earnings growth is likely to continue based on the company’s market position and industry trends.

- Reinvestment Needs: Prefers companies that can grow without requiring excessive capital expenditures, which can strain cash flows.

Cash Flow Analysis:

- Free Cash Flow Generation: Emphasizes the importance of free cash flow, which represents the cash a company can generate after accounting for capital expenditures.

- Use of Cash: Assesses how management allocates free cash flow—whether it’s reinvested wisely, used to pay down debt, distributed as dividends, or wasted on poor acquisitions.

Example:

Buffett’s Investment in Burlington Northern Santa Fe (BNSF):

- Stable Industry: Railroads have predictable demand and are critical to the economy.

- Consistent Earnings: BNSF demonstrated steady earnings and strong cash flows.

- Capital Efficiency: While railroads require significant capital investment, BNSF effectively managed its capital expenditures and generated substantial free cash flow.

Key Takeaway:

A comprehensive analysis of financial statements and ratios enables investors to assess a company’s financial health, operational efficiency, and potential for long-term success.

Buffett’s Investment in Companies

To illustrate how Warren Buffett applies his investment principles in practice, let’s examine three of his most significant investments: Coca-Cola, American Express, and Apple.

Case Study 1: Coca-Cola

Background:

- Investment Initiation: Buffett began purchasing Coca-Cola shares in 1988, following the stock market crash of 1987.

- Initial Investment: Approximately $1 billion, making it one of Berkshire Hathaway’s largest holdings at the time.

Why Buffett Invested:

- Strong Brand Recognition: Coca-Cola is one of the most recognized and valuable brands globally, with a product that enjoys widespread consumer acceptance.

- Economic Moat: The company’s brand loyalty, extensive distribution network, and significant marketing muscle create formidable barriers to entry for competitors.

- Consistent Earnings and Cash Flow: Coca-Cola has a long history of stable earnings growth and generates substantial free cash flow.

- Global Reach: Operating in over 200 countries, Coca-Cola benefits from diversified revenue streams and exposure to emerging markets.

- Management Quality: At the time, Roberto Goizueta was the CEO, and Buffett admired his leadership and strategic vision.

Buffett’s Analysis:

- Intrinsic Value vs. Market Price: Determined that the market was undervaluing Coca-Cola’s future earnings potential, providing a significant margin of safety.

- Long-Term Growth Prospects: Recognized the potential for international expansion and increased per capita consumption.

- Dividend Growth: Expected steady dividend increases, enhancing the investment’s total return.

Outcome:

- Capital Appreciation: The investment has multiplied in value many times over.

- Dividend Income: Coca-Cola has consistently increased its dividend, providing Berkshire Hathaway with substantial income.

- Long-Term Holding: Buffett continues to hold Coca-Cola shares, demonstrating his commitment to a long-term investment horizon.

Case Study 2: American Express

Background:

- Investment Initiation: Early 1960s, during the Salad Oil Scandal of 1963.

- Catalyst: A significant drop in American Express’s stock price due to a fraud scandal involving one of its clients.

The Crisis:

- Scandal Details: Allied Crude Vegetable Oil Company used fraudulent warehouse receipts to secure loans from banks and American Express, leading to substantial losses when the fraud was uncovered.

- Market Reaction: Investors panicked, and American Express’s stock price plummeted as concerns about its solvency and reputation mounted.

Why Buffett Invested:

- Core Business Strength: Despite the scandal, Buffett believed that American Express’s core charge card business remained fundamentally strong.

- Brand Trust: Recognized that consumers continued to trust and use American Express services.

- Market Overreaction: Saw the sharp decline in stock price as an irrational market response, creating an opportunity to buy a great company at a discounted price.

Buffett’s Analysis:

- Intrinsic Value vs. Market Price: Determined that the company’s intrinsic value far exceeded its depressed market price.

- Economic Moat: Identified American Express’s strong brand and customer loyalty as a durable competitive advantage.

- Management Response: Had confidence in the management’s ability to address the crisis and restore confidence.

Outcome:

- Recovery and Growth: American Express overcame the scandal, and its stock price recovered and continued to grow over the ensuing decades.

- Significant Returns: Buffett’s investment yielded substantial long-term returns, illustrating the benefits of contrarian investing and patience.

- Ongoing Investment: American Express remains one of Berkshire Hathaway’s core holdings.

Case Study 3: Apple

Background:

- Investment Initiation: Buffett began purchasing Apple shares in 2016, a departure from his historical avoidance of technology stocks.

- Initial Skepticism: Historically, Buffett avoided tech companies due to their rapid pace of change and uncertainty.

Why Buffett Invested:

- Reframing Apple: Viewed Apple not just as a technology company but as a consumer products company with a strong, loyal customer base.

- Economic Moat: Recognized the strength of Apple’s ecosystem, which creates high switching costs and customer stickiness.

- Brand Loyalty: Acknowledged that Apple’s brand commanded significant consumer trust and preference.

- Financial Strength: Noted Apple’s consistent earnings growth, high profit margins, and substantial free cash flow.

- Shareholder-Friendly Policies: Appreciated Apple’s commitment to returning capital to shareholders through dividends and share repurchases.

Buffett’s Analysis:

- Intrinsic Value vs. Market Price: Believed that Apple’s stock was undervalued relative to its intrinsic value, providing a margin of safety.

- Management Quality: Expressed confidence in CEO Tim Cook’s leadership and strategic vision.

- Future Growth Potential: Saw opportunities in Apple’s expansion into services and emerging technologies.

Outcome:

- Significant Appreciation: Apple’s stock price has increased substantially since Buffett’s initial investment, making it one of Berkshire Hathaway’s largest holdings.

- Dividends and Buybacks: Berkshire Hathaway has benefited from Apple’s dividend payments and share repurchase programs.

- Portfolio Evolution: Buffett’s investment in Apple demonstrates his willingness to adapt his approach when presented with compelling opportunities.

Key Takeaways from the Case Studies:

- Consistency in Principles: Despite different industries and circumstances, Buffett applied the same fundamental principles in each investment.

- Focus on Intrinsic Value: In each case, Buffett identified a significant gap between the company’s intrinsic value and its market price.

- Emphasis on Quality: Prioritized companies with strong brands, durable competitive advantages, and competent management.

- Long-Term Commitment: Maintained his investments over extended periods to realize the full potential of his investment thesis.

The Power of Compounding

The concept of compounding is central to Buffett’s investment philosophy. By allowing earnings to grow over time and reinvesting dividends and profits, wealth can increase exponentially.

Explanation of How Buffett Uses Compounding to Grow Wealth Over Time

- Reinvesting Earnings: Buffett reinvests the profits from his investments back into additional shares or new investments, creating a snowball effect.

- Dividend Reinvestment: Dividends received from holdings are often reinvested to purchase more shares, enhancing the compounding effect.

- Long-Term Holdings: By holding investments for extended periods, the compounding of returns significantly amplifies wealth accumulation.

Mathematical Illustration:

- Compound Interest Formula: A = P(1 + r/n)^(nt)

- A: The future value of the investment.

- P: The principal investment amount.

- r: The annual interest rate (in decimal).

- n: The number of times that interest is compounded per year.

- t: The number of years the money is invested.

Example:

- Initial Investment: $1 million at an annual return of 15%.

- After 10 Years: A = $1,000,000 * (1 + 0.15)^10 ≈ $4,045,558

- After 20 Years: A = $1,000,000 * (1 + 0.15)^20 ≈ $16,366,539

- After 30 Years: A = $1,000,000 * (1 + 0.15)^30 ≈ $66,211,540

Impact:

- Exponential Growth: The longer the investment period, the more pronounced the compounding effect becomes.

- Time as an Ally: Starting investments early allows more time for compounding to work its magic.

Importance of Reinvesting Dividends and Allowing Investments to Grow Exponentially

- Dividend Reinvestment Plans (DRIPs): Automatically reinvesting dividends can significantly increase the total return over time.

- Cost Averaging: Regular reinvestment can reduce the average cost per share over time, mitigating the impact of market volatility.

- Income Generation: Reinvested dividends generate additional dividends, creating a virtuous cycle of income growth.

Example:

- Stock Yielding 3% Dividend: An initial investment of $10,000 with a 3% annual dividend reinvested can grow substantially over 20-30 years.

- Total Return Enhancement: Reinvested dividends can contribute significantly to total returns, especially over long periods.

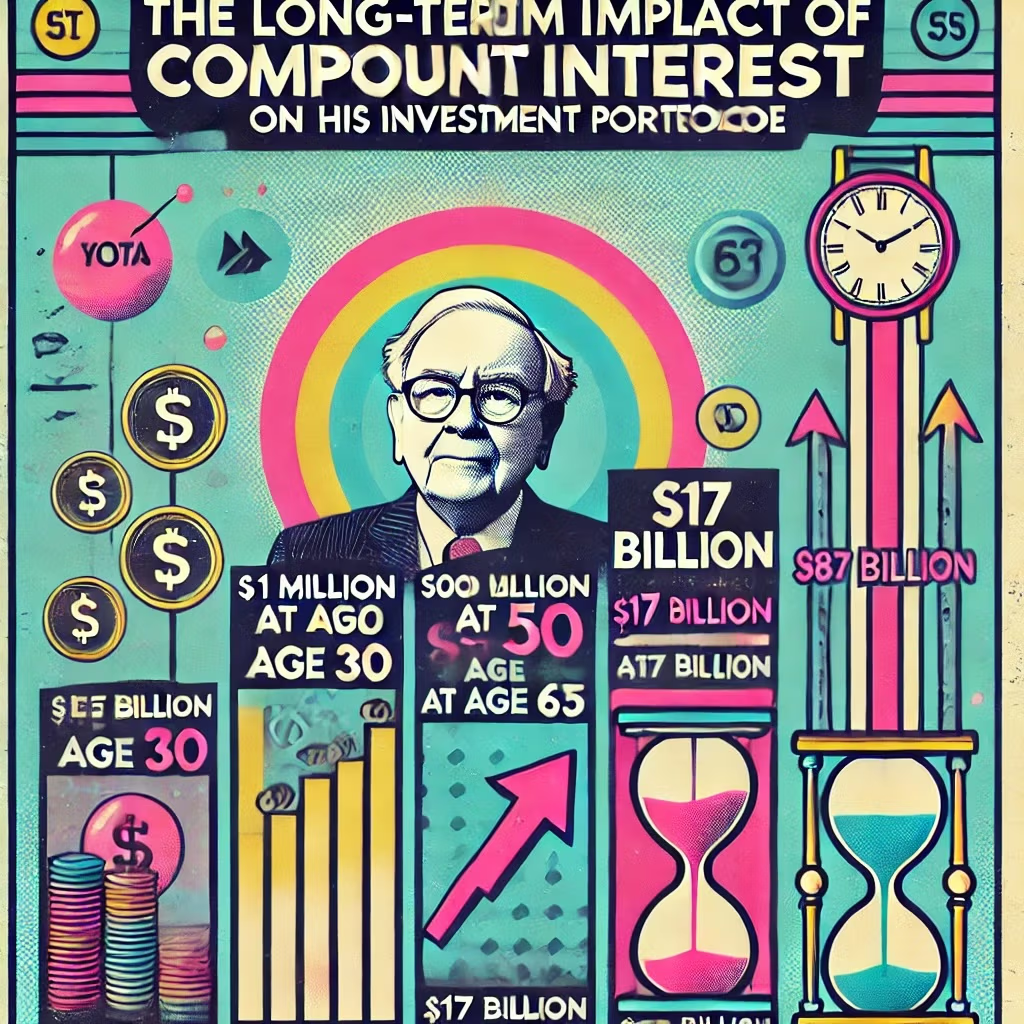

The Long-Term Impact of Compound Interest on Buffett’s Investment Portfolio

- Buffett’s Wealth Accumulation:

- At age 30: Net worth of approximately $1 million.

- At age 50: Net worth of about $300 million.

- At age 65: Net worth of around $17 billion.

- In his 90s: Net worth exceeding $80 billion.

- Observation:

- A significant portion of Buffett’s wealth was accumulated after the age of 60, illustrating the power of compounding over time.

Key Takeaway:

Patience and time are essential components of compounding. The earlier you start investing and the longer you allow your investments to grow, the more significant the impact of compounding on your wealth.

Staying Within Your Circle of Competence

Buffett emphasizes the importance of investing in areas where you have expertise and understanding, referring to this as your “circle of competence.” Operating within this circle allows investors to make more informed decisions and reduces the likelihood of costly mistakes.

The Importance of Investing in Industries and Businesses You Understand Well

- Risk Reduction: Familiarity with an industry or business model helps in identifying potential risks and opportunities.

- Better Decision-Making: Understanding the nuances of a business enables more accurate assessments of its value and prospects.

- Confidence in Investments: Knowledge breeds confidence, allowing investors to remain steadfast during market fluctuations.

Buffett’s Approach:

- Avoiding Complexity: Prefers businesses that are simple and understandable, avoiding those that are overly complex or speculative.

- Consistent with Skills: Invests in industries where he feels he has a competitive advantage in understanding.

How Buffett Defines and Operates Within His “Circle of Competence”

- Self-Awareness: Recognizes the boundaries of his knowledge and avoids venturing into areas where he lacks expertise.

- Continuous Learning: While he stays within his circle, Buffett is an avid reader and lifelong learner, gradually expanding his circle over time.

- Discipline: Resists the temptation to invest in trendy or popular sectors that are outside his circle, even if they appear lucrative.

Quote from Buffett:

“What counts for most people in investing is not how much they know, but rather how realistically they define what they don’t know.”

Tips for Identifying and Expanding Your Own Circle of Competence

1. Assess Your Knowledge and Experience:

- Professional Background: Leverage industries where you have work experience or specialized knowledge.

- Personal Interests: Consider sectors related to hobbies or areas you’re passionate about.

2. Education and Research:

- Read Extensively: Books, industry reports, and financial news can deepen your understanding.

- Formal Education: Courses and seminars can provide structured learning opportunities.

3. Start Small and Build Confidence:

- Practice with Modest Investments: Begin with smaller investments in familiar areas to gain experience.

- Paper Trading: Simulate investing without real money to test your understanding.

4. Seek Mentorship and Networking:

- Join Investment Clubs: Engage with peers who share similar interests.

- Attend Conferences and Seminars: Learn from experts and broaden your network.

5. Be Honest with Yourself:

- Acknowledge Limitations: Recognize areas where your knowledge is lacking and avoid overestimating your competence.

- Stay Updated: Industries evolve, so continuous learning is essential to maintain competence.

6. Gradually Expand Your Circle:

- Deliberate Learning: Focus on one new industry at a time, investing significant effort to understand it thoroughly.

- Apply Core Principles: Use the same analytical framework you apply within your existing circle.

Key Takeaway:

Investing within your circle of competence increases the likelihood of making informed decisions and achieving better investment outcomes.

The Role of Patience and Discipline

Patience and discipline are integral to Buffett’s investment philosophy. His success is as much about temperament as it is about analytical skills.

How Buffett’s Patience and Discipline Have Contributed to His Success

- Waiting for the Right Opportunities: Buffett is known for being selective, often sitting on cash until he finds investments that meet his criteria.

- Avoiding Impulsive Decisions: Does not succumb to market hype or fear, maintaining a steady course based on fundamental analysis.

- Letting Investments Mature: Allows sufficient time for his investment thesis to play out, even if it takes years.

Example:

Buffett’s Investment in Washington Post:

- Opportunity During Uncertainty: In the early 1970s, the Washington Post’s stock was undervalued due to market pessimism and legal challenges.

- Long-Term Holding: Buffett held the investment for decades, during which the company’s value grew substantially.

- Outcome: Demonstrated the benefits of patience and conviction in his investment thesis.

The Importance of Avoiding Impulsive Decisions and Market Noise

- Emotional Resilience: By focusing on long-term value rather than short-term market fluctuations, Buffett avoids making decisions based on fear or greed.

- Information Overload: Recognizes that excessive attention to daily market news can be distracting and counterproductive.

- Consistency in Strategy: Maintains adherence to his investment principles regardless of market conditions.

Quote from Buffett:

“The stock market is designed to transfer money from the active to the patient.”

Example: Buffett’s Ability to Wait for the Right Opportunities

During Market Downturns:

- 2008 Financial Crisis:

- While many investors were selling in panic, Buffett invested in companies like Goldman Sachs and General Electric under favorable terms.

- COVID-19 Pandemic:

- Initially refrained from making large investments, demonstrating patience and caution amid uncertainty.

Outcome:

- Favorable Deals: Secured investments with attractive returns due to his willingness to act when others were hesitant.

- Long-Term Gains: His investments during crises often resulted in substantial profits as markets recovered.

Key Takeaway:

Patience and discipline enable investors to avoid costly mistakes, capitalize on opportunities when they arise, and achieve superior long-term results.

Ethical and Social Responsibility in Investing

Warren Buffett places significant importance on ethical considerations and social responsibility in his investment decisions.

Buffett’s Views on Corporate Governance, Ethical Business Practices, and Social Responsibility

- Integrity as a Core Value: Believes that ethical behavior is essential for long-term business success.

- Corporate Governance: Advocates for strong oversight, transparency, and accountability within companies.

- Social Responsibility: Recognizes that companies have a responsibility to contribute positively to society.

Examples of Ethical Considerations:

- Avoiding Sin Stocks: Generally avoids investing in industries like tobacco and firearms due to ethical concerns.

- Employee Treatment: Values companies that treat their employees well, believing it leads to better performance and reputation.

How Buffett Considers a Company’s Reputation and Ethical Standards in His Investment Decisions

- Reputation Risk Assessment: Evaluates the potential impact of a company’s actions on its brand and public perception.

- Long-Term Viability: Believes that unethical practices can undermine a company’s sustainability and profitability.

- Alignment with Values: Prefers to invest in companies whose values align with his own principles.

Example: Berkshire Hathaway’s Approach to Investing in Socially Responsible Companies

- Investment in Renewable Energy:

- Berkshire Hathaway Energy: Invests heavily in wind and solar power, aligning with global trends toward sustainable energy.

- Philanthropic Initiatives:

- The Giving Pledge: Buffett has pledged to give away the majority of his wealth to charitable causes.

- Corporate Culture:

- Decentralized Management: Empowers subsidiary managers to make decisions that are ethically sound and socially responsible.

- Avoiding Predatory Practices:

- Responsible Lending: Berkshire’s financial subsidiaries avoid predatory lending practices.

Key Takeaway:

Ethical considerations are not only morally sound but can also lead to better investment outcomes by fostering trust, loyalty, and long-term viability.

Lessons from Berkshire Hathaway’s Success

Berkshire Hathaway’s transformation under Buffett’s leadership offers valuable insights into effective investment and management strategies.

Overview of Berkshire Hathaway’s Growth Under Buffett’s Leadership

- From Textiles to Conglomerate: Initially a struggling textile company, Berkshire Hathaway evolved into a diversified conglomerate with interests in insurance, utilities, railroads, manufacturing, and more.

- Investment Portfolio: Holds significant stakes in publicly traded companies like Apple, Bank of America, Coca-Cola, and American Express.

- Consistent Returns: Delivered compounded annual gains that have significantly outpaced the S&P 500 over several decades.

Key Lessons from Buffett’s Management Style and Investment Approach at Berkshire Hathaway

1. Decentralized Management Structure:

- Autonomy: Subsidiary companies operate independently, with minimal interference from headquarters.

- Empowerment: Trusts managers to make decisions, fostering a sense of ownership and accountability.

2. Long-Term Focus:

- Patient Capital: Willingness to hold investments indefinitely if they continue to meet performance expectations.

- Strategic Acquisitions: Prefers to acquire entire companies rather than just stocks, allowing for greater control and influence.

3. Conservative Financial Practices:

- Strong Balance Sheet: Maintains substantial cash reserves, enabling flexibility and the ability to seize opportunities during market downturns.

- Minimal Debt: Avoids excessive leverage, reducing financial risk.

4. Ethical Business Practices:

- Integrity and Reputation: Prioritizes ethical conduct and builds a culture of trust.

- Social Responsibility: Engages in philanthropy and sustainable business practices.

The Importance of Diversification, but with Concentrated Bets on High-Conviction Ideas

- Diversification:

- Risk Management: Spreads investments across various industries to mitigate sector-specific risks.

- Concentrated Investments:

- High Conviction: Allocates significant capital to investments with strong confidence and thorough analysis.

- Balancing Act:

- Optimizing Returns: Balances the benefits of diversification with the potential for higher returns from concentrated positions.

Example:

While Berkshire Hathaway owns a diverse range of businesses, a significant portion of its portfolio value is concentrated in top holdings like Apple and Bank of America.

Key Takeaway:

A strategic combination of diversification and concentrated investments can optimize returns while effectively managing risk.

Practical Steps to Invest Like Warren Buffett

Emulating Buffett’s investment approach involves adopting his principles and applying them consistently.

Actionable Steps for Applying Buffett’s Investment Principles to Your Own Portfolio

1. Educate Yourself:

- Read Foundational Literature:

- “The Intelligent Investor” by Benjamin Graham

- Buffett’s annual letters to shareholders

- Understand Financial Statements:

- Learn to interpret income statements, balance sheets, and cash flow statements.

2. Define Your Investment Criteria:

- Set Clear Goals: Determine your financial objectives and risk tolerance.

- Establish a Margin of Safety: Invest only when a stock is trading significantly below its intrinsic value.

3. Conduct Thorough Research:

- Focus on Quality Businesses:

- Look for companies with consistent earnings, strong ROE, and low debt levels.

- Evaluate Management:

- Assess leadership integrity, competence, and shareholder alignment.

- Identify Economic Moats:

- Seek companies with sustainable competitive advantages.

4. Stay Within Your Circle of Competence:

- Invest in What You Understand: Focus on industries and businesses where you have expertise.

- Gradually Expand Your Knowledge: Continuously learn to broaden your circle over time.

5. Adopt a Long-Term Perspective:

- Hold for the Long Term: Plan to hold investments for several years to allow compounding to work.

- Reinvest Dividends: Enhance returns through dividend reinvestment.

6. Practice Patience and Discipline:

- Avoid Market Noise: Focus on fundamentals rather than short-term market fluctuations.

- Stick to Your Principles: Maintain adherence to your investment criteria.

7. Incorporate Ethical Considerations:

- Invest Responsibly: Consider the ethical implications and social impact of your investments.

Tips for Researching Stocks, Evaluating Businesses, and Maintaining a Long-Term Perspective

- Use Reliable Sources:

- Company filings, financial news outlets, and reputable research reports.

- Leverage Financial Tools:

- Utilize platforms like Yahoo Finance, Bloomberg, or Morningstar.

- Stay Informed:

- Keep abreast of industry trends, economic indicators, and market developments.

- Engage with Investment Communities:

- Join forums, attend seminars, and network with other investors.

- Regularly Review Your Portfolio:

- Periodically assess your holdings to ensure they align with your investment thesis.

Resources for Further Learning

Books:

- “The Essays of Warren Buffett” by Warren Buffett

- “Poor Charlie’s Almanack” by Charlie Munger

- “Common Stocks and Uncommon Profits” by Philip Fisher

Online Courses:

- Investment and financial analysis courses on platforms like Coursera, edX, or Khan Academy.

Podcasts and Blogs:

- The Motley Fool

- Invest Like the Best

- Seeking Alpha

Investor Letters and Speeches:

- Berkshire Hathaway Annual Letters

- Speeches and interviews by Buffett and Charlie Munger

Key Takeaway:

Investing like Warren Buffett requires a disciplined approach, continuous learning, and a commitment to fundamental principles.

How To Invest Like Warren Buffett: 12-Question FAQ (Value, Moats, Patience, and Discipline)

What is Warren Buffett’s core investment philosophy in one sentence?

Buy wonderful businesses at fair (or better) prices and hold them for a very long time, letting superior economics and compounding do the heavy lifting.

How does Buffett define “intrinsic value” and estimate it?

Intrinsic value is the discounted value of the cash a business can generate over its life. In practice: project conservative free cash flows, choose a sensible discount rate, add a terminal value grounded in durable economics, and demand a margin of safety to reflect uncertainty.

What makes a business “wonderful” to Buffett?

Enduring competitive advantages (moats), high returns on incremental capital, consistent free-cash-flow generation, predictable demand, pricing power, and candid, capable, shareholder-aligned management—all available at a price that builds in safety.

Which economic moats does Buffett prize most?

Brand & network effects (e.g., Coca-Cola, American Express)

Switching costs & ecosystems (e.g., Apple’s integrated hardware/software/services)

Cost/scale advantages (e.g., railroads, insurance platforms)

He favors moats that get wider with growth, not ones that erode under competitive attack.

What simple metrics echo Buffett’s quality bias?

ROIC/ROE consistently above peer cost of capital

Gross & operating margins stable or rising over cycles

Free cash flow positive through downturns

Debt conservative relative to cash generation (ability to self-fund growth)

Share count stable or shrinking (disciplined buybacks)

How big is the “margin of safety” in a Buffett-style purchase?

Enough that imprecision in the valuation won’t sink the thesis—often 20–30% below conservative intrinsic value estimates. The riskier or less predictable the business, the larger the cushion he wants.

Why does Buffett emphasize “circle of competence”?

Staying within what you truly understand reduces unforced errors. He prefers simple, comprehensible economics over complexity; you can expand your circle, but invest only where your knowledge is durable today.

How does Buffett think about timing the market?

He doesn’t. He times prices, not markets—waiting with cash for rare moments when great businesses are mispriced (panic, scandals unrelated to core economics, forced selling), then buying decisively.

What role do dividends and buybacks play in Buffett’s returns?

He loves owner earnings returned rationally:

Dividends provide cash that can be redeployed.

Buybacks create value when shares are repurchased below intrinsic value.

Capital return policies signal management’s capital-allocation skill and alignment.

How does insurance (“float”) power Berkshire’s model?

Low-cost, long-duration insurance float funds investments and acquisitions. If underwriting breaks even (or better), float is effectively negative-cost capital, amplifying compounding across the group.

What are the most common mistakes Buffett would warn investors about?

Overpaying for growth, chasing fads, ignoring leverage risk, underestimating competitive response, investing outside your competence, and letting emotions (fear/greed) override a sound process.

How can I build a Buffett-style process I’ll actually follow?

Write a one-page checklist: moat, management, financial quality, conservative valuation, margin of safety, risk list, and exit rules. Review 5–10 years of statements, read annual letters, and act rarely—but with size—when criteria are met.

Conclusion

Warren Buffett’s investment philosophy offers timeless wisdom for investors seeking to achieve long-term success. His principles of value investing, focusing on intrinsic value, margin of safety, and the power of compounding, provide a solid foundation for making informed investment decisions.

Summary of the Key Takeaways from Warren Buffett’s Investment Approach

- Value Investing Works: Purchasing undervalued companies with strong fundamentals can lead to substantial returns.

- Know What You Invest In: Operating within your circle of competence reduces risk and enhances decision-making.

- Patience Is a Virtue: A long-term perspective allows the benefits of compounding and reduces the influence of market volatility.

- Ethics Matter: Investing in companies with strong ethical standards contributes to sustainable success.

- Continuous Learning: Staying informed and adaptable is crucial in an ever-changing market environment.

- Discipline and Consistency: Adhering to fundamental principles leads to better investment outcomes.

Final Thoughts on the Relevance of Buffett’s Principles in Today’s Market

- Timeless Principles: Despite technological advancements and evolving markets, the core tenets of Buffett’s investment philosophy remain highly relevant.

- Simplicity Over Complexity: In a world of complex financial instruments and speculative trends, Buffett’s straightforward approach offers clarity and reliability.

- Resilience: His strategies have withstood various market cycles, economic crises, and technological shifts.

Encouragement for Readers to Adopt a Value-Oriented, Long-Term Approach to Investing

Adopting Buffett’s investment strategies doesn’t require extraordinary intelligence or insider information. It demands discipline, patience, and a willingness to think independently.

- Start Your Journey: Whether you’re a novice or experienced investor, adopting Buffett’s principles can enhance your investment strategy.

- Stay Committed: Success requires patience, discipline, and a willingness to think independently.

- Think Like an Owner: Invest in companies as if you were buying the entire business, fostering a deeper understanding and commitment.

Closing Thought:

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.