When I first came up with the idea for the “How I Invest” series I wanted to shine the spotlight upon skilled contrarian professional and amateur investors who are doing things a bit differently.

Although my next guest is not a quant legend in the sense that someone like Meb Faber or Larry Swedroe would be to the investing community at large, he is a “personal legend” to me in the sense that he’s written the most influential book of all-time (by a country mile in my opinion) about early retirement and lifestyle optimization:

Early Retirement Extreme

Indeed, that’s a bold statement but I’d challenge anyone who has an interest in the subject of achieving financial independence to read this book and then tell me otherwise.

It’s the type of book that should be purchased and read annually the same way you’d benefit from rereading Nassim Taleb’s Incerto series or The Almanack of Naval Ravikant where timeless wisdom related to different topics would speak to you in a profound manner each and every time.

To say Jacob Lund Fisker is one of the OGs of the FIRE movement would be a gross understatement.

His blog Early Retirement Extreme and book by the same name provide a comprehensive approach to achieving a financially independent lifestyle.

Both cover topics such as economic degrees of freedom, Renaissance ideals and lifestyle along with strategies, tactics and guiding principles to achieve financial freedom.

That’s in direct contrast with typical surface level observations such as “drink less frappuccinos” and “invest in the S&P 500 and chill” from random FIRE blogger XYZ .

Getting back on track to the subject of investing, I thought I’d share a couple of astute observations from Jacob that appear in his book before we kick off the interview:

“At the highest level there are people who create new rules, that is, they find some aspect of the market and the economy that allows them to predict more correctly what the future price of an asset will be. Since they don’t have to share their edge (fishing spot) with anyone, they can keep all the profits. Such research requires a bright mind and a lot of work, but the rewards are high (and of course proportional to the assets). Typically, new investment techniques start at this level and then diffuse down to the lower stages as more and more people pick them up and reduce the former edge (in investment parlance called alpha) to volatility (in investment parlance called beta). Various theories are in various stages of diffusion, with some still having an edge and others appearing to have no edge at all.”

“Many associate effort with taking action, but not taking action is also a form of action. In fact, often not taking action is just what is required. The easiest way to get in the right frame of mind is to stop thinking like a farmer and start thinking like a hunter. A farmer (and a modern salary-, working-, and businessman) gets rewarded by activity. The more he does, the greater his reward. Conversely, a hunter isn’t going to catch anything if he thrashes around in the woods, frantically looking for prey. A strategy where he first identifies the best place to hunt (skill) and then waits patiently for the opportunity to present itself, will be more successful.”

This is the longest introduction I’ve ever written for any guest because his book produced “a paradigm shift” in the way I think about my lifestyle, savings, burn-rate, investments, finances, hobbies and life goals.

Thus, on a personal level, I’m beyond thrilled he’s taking part in the series and without further ado let’s turn things over to Jacob Lund Fisker.

How I Invest with Jacob Lund Fisker of Early Retirement Extreme

Hey guys! Here is the part where I mention I’m a travel content creator! This “How I Invest” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Meet Jacob Lund Fisker: Retired Astrophysicist by Age 33

I am one of the OGs of the FIRE movement having run the ERE website since 2007.

The ERE framework was the result of spending much of my twenties figuring out the most resource efficient way to living a creative and interesting life within a sustainable and equitable ecological footprint.

This comes to spending about $7,000/person/year.

I got serious about investing after realizing that putting in the effort to saving and accumulating for a few years made it possible to invest and trade money for money rather than going along with the earn-buy time for money scheme.

As someone who used “work for a living” this was a paradigm-shifting game changer even if it seems trivially obvious today now that FIRE has gone mainstream.

Thus began a lifelong learning process of trying to become a better caretaker of my financial capital.

I retired from my career in astrophysics in 2009 (age 33) after deciding that devising sustainable alternatives to the prevailing paradigm of consumption-maximization was more important to the world than publishing a few more decimal points about neutron stars.

source: radical personal finance on youtube

My Investment Career Began Before The Age Of The Influencer

Who were your greatest influences as an investor when you first started to get passionate about the subject?

How have your views evolved over the years to where you currently stand?

If you had to recommend a handful of resources (books, podcasts, white-papers, etc) to bring others up to speed with your investing worldview what would you recommend?

My investment career began in 2005 before the “age of the influencer”, so I can’t really point to anyone in particular.

Since I had put in the effort to live well without much spending, I had a savings rate of 75-80% despite my median salary as an academic junior/bench physicist.

After 5 years of living sustainably my pile of unspent savings was big enough to make me financially independent insofar it was invested wisely.

However, growing up in Denmark, I knew nothing about investing.

Investing in anything other than bricks was not a thing at the time over there.

I mainly read academic textbooks, which I vastly prefer to autobiographical “Here’s what I did and so you can too”-stories.

My early influence was, therefore, mathematically oriented.

Black Scholes, Modern Portfolio Theory, efficient frontiers, correlations, financial analysis, and the likes.

As a physicist, I was more interested in diving deep into theory than practice.

It was immediately clear how economics and finance had a strong case of “physics envy”.

They often made very simplifying assumptions about human behavior in order to make their relatively simple math tractable to pen and paper analysis.

For example, risk is often defined as volatility or price variance under an L2-norm which makes it easier for researchers to gather data and derive some algebra.

However, humans are generally not 16 times unhappier losing $4 compared to losing $1.

Neither are they just as happy making a dollar as losing a dollar!?!

To a practitioner or an actual human being this is common sense, but it took a while for economists to turn that into its own subfield (behavioral economics).

My scientist’s focus was on what was potentially wrong with the model frameworks, whereas someone with an engineering-mindset would have focused on the conditions where the models worked well and proceeded to optimize them.

After spending a few years dabbling in options and value stocks and seeing the equivalent of the Emperor’s New Clothes play out during the run up to the Global Financial Crisis, it eventually became obvious that markets are not always behaving according to econ/finance theory.

There was clearly something more to the complexity of the market than rational expectations theory.

Kinda like how there’s more to playing poker than calculating the odds of a given hand.

Indeed, if markets were truly efficient, nobody would ever trade, because buyers and sellers would instantly agree on a new fair price every time new information was presented, thus creating a stalemate. (Please ponder this until it sinks in!)

However, this is not what happens.

Instead new information often causes disagreement about what something is worth.

The market is not guided by total information: There’s layer on top of information, call it knowledge, that decides what to do about that information, and different investors have different kinds of knowledge.

There may even be yet another layer on top of the knowledge layer, call it wisdom.

Trading is the process to resolve the disagreement over knowledge as investors put their money where their mouth is.

As such I became more interested in why investors disagree despite everybody having efficient access to the same information.

The answer must be that different investors somehow see the same information differently and consequently value it differently.

They have different paradigms.

Potayto, Potahto!

I know that you know that I know that … and so forth.

Different depths of playing.

The market is much more a kind of Keynesian beauty contest than we’d like to admit.

Later working as a quant on “Wall Street” for a few years (bucket list, checkmark) finalized the point that successful investing is not so much about being right but about being slightly less wronger than wrong.

The market can famously stay irrational longer than you can remain solvent.

However, staying out is not an alternative because cash is also a market position.

From this it follows that you may have to deal with sustained periods of irrationality in order to make or even keep your money in the face of inflation.

Instead of seeing investing as a rational objective pursuit, it is an intersubjective construct.

This is not really different from other human action.

So I began to focus more on the practical psychology of investing.

Not simply my own biases, but those of other investors and how people form their worldview.

Bias lends itself to one-variable statistical analysis and this is why behavioral economics is a thing.

But biases don’t exist independently.

The act of forming a biased framework is much more complex.

This also makes it more interesting.

The aggregate process of resolving this disagreement within the individual limits of hierarchical complexity creates the market dynamics.

I see the market as a mass experiment is applied human psychological development.

A handful of books is never going to get anyone up to speed, but if you want a taste of how I approach the markets, these three are the closest I can think of.

Caveat: They may not mean the same to you as they do to me.

They are definitely not a good place to start for beginning investors:

Mastering The Market Cycle: Getting the Odds on Your Side

Investing: The Last Liberal Art (Columbia Business School Publishing)

More Than You Know: Finding Financial Wisdom in Unconventional Places

For those who want to pursue a similar path to mine, I suggest the following approach:

Intuition needs to be rooted in numbers and psychology, so three steps along with a martial arts analogy in parenthesis:

- Mathematical foundation: Study a basic academic finance curriculum to get a solid foundation. Something corresponding to first year of business school or CFA Level 1. See here for a list: http://earlyretirementextreme.com/startup-curriculum-for-finance-economics-investing.html This corresponds to about 8000 pages of reading which can be completed in about a year or so. Most never finish it.

(This corresponds to doing pushups, situps, and learning the punches and kicks of the system. Like getting a black belt, learning the repertoire of techniques is the foundation and the beginning of the journey as a martial artist. Of course, ultimately there are no techniques—practicisn techniques is just a method of learning. Until you can provide the proverbial explaination of what a P/E multiplier is to your proverbial mother in 3 different ways, do not pass go, do not collect $200.) - Psychological understanding: Pick up random old guru books from libraries and thrift stores and read them with the benefit of 20/20 hindsight. What did the authors get right? What did they get wrong? What did they miss? Reading history is also useful, but I recommend going directly for the sources (old newspapers) to see what it looked like as it happened. I don’t think history books are all that useful because they don’t give the same sense of time as lived experience.

(This corresponds to studying other fighters. What made them great? Why did some ultimately fail? How has fighting evolved. For fun, compare early MMA styles as they evolved to the present? What would defeat the present style?) - Building intuition: Read widely. Or listen to podcast conversations if you have to. Also practice widely. Whether that’s from hobbies or actual jobs in different fields, carrying knowledge over from one field to another often creates new perspectives on things. This is the same ERE-style “renaissance”-approach I use in the rest of my life.

(This corresponds to getting your feet wet and also to breaking out of the system of your formal training by getting new ideas. There’s a reason it’s called “martial arts” and not “martial science”. The point of learning the foundations of your field is to break out of them properly.)

I’ll see you on the other side.

Investing Is A Process Of Taking Care Of Your Little Space Of The World

Aside from investing influences, what real life events have molded your overall views as an investor?

Was it something to do with the way you grew up?

Taking on too much risk (or not enough) early on in your journey/career as an investor?

Or just any other life event or personality trait/characteristic that you feel has uniquely shaped the way you currently view yourself as an investor.

Education.

Travel.

Work Experience.

Volunteering.

A major life event.

What has helped shape the type of investor you’ve become today?

Good question!

I think one’s investing-style is ideally a reflection of who one is as a person. (Caution: Extraverts in particular may confuse who they really are with who they’ve become in order to fit in with friends and family or career)

If these two are teleologically aligned, tension decreases and one will sleep well at night (SWAN).

And SWAN is very important for personal well-being. (Drinking less coffee also helps!)

I covered that a bit above when I talked about the “renaissance”-ideal.

I believe that homo sapines sapiens is the universally adaptive/generalist species.

Humanity has so much^H^H^H^H .. some potential.

However, industrialization followed by the echo-chambers of the information age has turned us into specialized idiot savants.

Cogs in the career machine.

Capable of formally optimizing our assigned part of a job-given problem; ignorant of the wider context; barely able to fix a sink or cook a meal without an app and a subscription box.

This also goes for investing.

Investors tend to form echo chambers that act like different species in the market place.

The market place in turn forms an ecology of investor types who squabble online in order to establish primacy.

I think my ERE goal of becoming more of a generalist when it comes to consumption (see my second talk on The Stoa) has also made me a generalist on the production side when it comes to investing.

I see investing much like taking care of a garden space.

Think permaculture.

Adding some securities to my garden portfolio and subtracting others depending on what thrives and what dies as the investment climate changes.

Not so much about arguing whether growing beans is better than growing beets.

Not so much about growing the market garden bigger.

Investing is a process of taking care of your little space of the world, your capital.

You’re responsible.

You’re part of the system.

What’s useful about this perspective is how it leaves room for understanding context and how the context is changing.

Insofar one is blind to context—like how the fish don’t see the water they swim in—such advice is easily confused for a load of in-actionable blahblah.

This attitude tends to frustrate most people, especially those looking for a quick and easy solution.

source: the stoa on youtube

Finance Is Part Of Adulting: Punt At Your Peril

Imagine you could have a three hour conversation with your younger self.

What would you tell the younger version of yourself in order to become a better investor?

Something that you know now that you wish you knew back then.

Start earlier!

Finance is part of the adulting curriculum of the 21st century.

You can’t escape it.

Punt at your peril.

Whether you want to be or not, you are always an investor of something. You savings, your health, your relationships.

Finance is one of the governing intersubjective human constructs that determine what we do and where we go. (Compare to legislation+its enforcement which is another technology for governing human behavior at a mass scale).

Investing requires developing a future-oriented perspective.

You can invest in your career, your family, your environment, the world.. at any level from the egocentric to the world-centric.

Being an investor means you take an active role in where the world is going. Investing ties current decisions to future consequences.

In a democracy, you get one vote per adult heart. In the markets, you vote your spending and your savings—your savings being what you have produced minus what you have consumed as far as the market is concerned.

Whether you spend or invest, you play a real albeit minor role in where this world is going.

For good and bad, having savings means you have a responsibility to place it well.

You’re voting with your money.

This makes you responsible.

This is serious stuff!

Woe To Anyone Who Simplistically Copies Someone Else’s Portfolio

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Let’s pop the hood of your portfolio.

What kind of goodies do we have inside to showcase?

Spill the beans.

How much do you got of this?

Why did you decide to add a bit of that?

If you’d like to go over every line-item you can or if would be easier to break your portfolio into categories or quadrants that’s another route worth considering.

When do you anticipate this portfolio performing at its best?

Ugh!

No offense, but let’s not.

I once made the mistake of revealing my portfolio in a random blog comment.

Many years later, someone dug it up and sent me a complete analysis of how it had performed over the years.

I wrote them back to inform them that I had sold off many of the positions several years ago.

Their well-intended analysis had made incorrect (buy&hold) presumptions about my strategy.

I don’t believe it’s possible to separate an investor from their investments.

They come as a pair. Knowing WHAT someone is holding is not the complete picture.

You also need to know WHY, HOW, and WHEN they’re holding it and that is very personal.

Woe to anyone who simplistically copies someone else’s portfolio without understanding why it is the way it is.

Everyone needs to match their holdings to their own being.

My personal portfolio depends my personal sphere of competence and interests, my net-worth and tax-situation, and my desire to sleep well at night.

It’s a complete package.

These all change over the years so managing a portfolio is matter of continual adaption to personal as well as global circumstances.

However, if you really want to know, my approach can be categorized as “top-down discretionary macro”.

My tools are mainly equity and bonds, some 30-40 positions total, because that’s what I know.

I do NOT analyze stocks (I have no edge there).

I consider the prevailing intersubjective narratives and their likelihood of changing within my objective (taxes, networth, …) and interobjective (interest rates, valuations,…) constraints.

I position my portfolio accordingly.

The way this works in practice is that I have a hypothesis about “something I know but they don’t but think they do” about the macroeconomic environment.

For example, “interest rates are not going up” (in contrast to the commonly held belief that they are).

WARNING: This is just an example, not a prediction.

This in turn would suggest that certain companies are incorrectly valued.

For example, bad balance sheets are undervalued.

I then set up a stock screen for those companies and simply pick whatever analysts consider best in breed.

You can call that “irrational expectations theory” if you want. I think that covers it pretty well.

I Have Known No Wise People Who Didn’t Read All The Time

What kind of investing skills (trading, asset allocation, investor psychology, etc) are necessary to become good at the style of investing you’re pursuing?

Is there a certain type of knowledge, experience and/or personality trait that gives one an advantage running this type of portfolio?

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero. You’d be amazed at how much Warren reads–and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.”—Charlie Munger

Uhm, yes … me too.

I couldn’t follow my strategy without reading a wide range of sources.

Don’t ask which ones.

That’s missing the point entirely.

The key is always looking for new ways of seeing the world—also about how others see the world—and integrating them to add new perspectives.

Building a lattice work.

Also, see Stoa 2.

Ken Wilber termed this vision logic, which is basically a broadly informed intuition from multiple perspectives as opposed to a singular perspective based on gut-feeling or rationality.

In modern parlance, the market is a hyperobject.

This is but a fancy way of saying that the same thing looks different depending on which angle is it viewed from.

For example, a cylinder looks a circle from the top or a square from the side.

Upon encountering a difference in perspective, the natural impulse for someone who has been trained in formalized expertise is to debate and disagree with other perspectives according to their training.

People talk their book.

Instead of endlessly arguing why the cylinder is a square and not a circle or vice versa, I accept that some people see a square while others see a cylinder.

I position my portfolio according to who is most likely to change their mind.

This requires holding two or more opposing perspectives in the mind at the same time, understanding other people’s blindspots, knowing how to position one’s portfolio accordingly.

Then having the patience to wait for the inevitable shift in price when investors finally shift their perspective.

source: the stoa on youtube

I Retired Early At 33: My Portfolio Has To Last Me At Least 60 Years

What would be a toned down version of your portfolio?

Something that’s a bit watered down.

Conversely, what would be a more aggressive version of your portfolio, if someone were willing to take on more risk for a potentially greater reward?

I retired early at 33 so my portfolio has to last me at least 60 years—okay, it’s down to 45 by now :-P.

As such I can’t accept the risk = reward paradigm.

In my situation, risk is the potential for irrecoverable losses and the reward is maintaining financial independence from an recurring cash stream.

Neither of these are related to market volatility.

The question, therefore, is how to keep this cash stream going for more than half a century.

What makes this difficult is how much the next “sure thing” changes and how quickly it can be abandoned again.

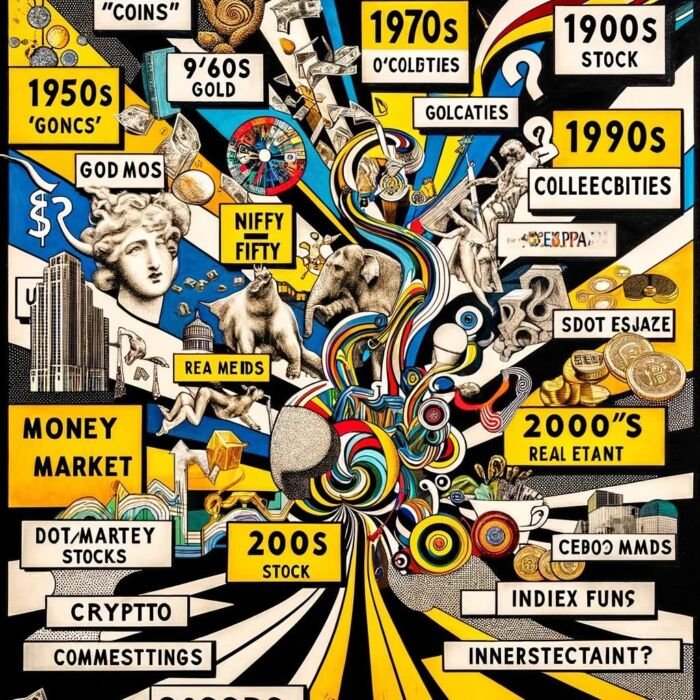

Here’s a brief list of popular “sure things” that “can’t fail” and “always go up” because < insert rationalization >:

1950s “onics” stocks (any stock ending in onics)

1960s Go-Go stocks followed by Nifty Fifty blue chip stocks

1970s Gold and collectibles

1980s Money market and commodities

1990s Dotcom stocks

2000s Real estate

2010s Index funds

2020s Crypto? NFTs? Homesteads? Or maybe not?

Many investors justify their paradigm with selective backtesting.

It’s almost always possible to p-hack a new strategy and/or data-dredge up a country or a handful of decades where any strategy worked really well.

Some investors endlessly check themselves for this trap.

Charismatic investors not so much.

Remember the “2/3 of average”-problem! (You did click and read all the links above, right?) Never take the “2/3 of average”-line of reasoning to its logical conclusion because the market doesn’t.

Yet, don’t extrapolate your paradigm into the far future either.

Investors are often unaware of their own paradigm.

It is very difficult to change what one does not see.

In particular, many investors don’t even see their paradigm as a paradigm.

It’s like water to fish.

Thanks paradigm!

Popular paradigms dominate the market for 5-15 years, yet remain defended by core believers even 30-50 years later.

Once popularity declines, the paradigm faces headwinds as more and more exit the trade, yet zealots always remain.

All this to say there’s no such thing as aggressive or toned down.

These attitudes are but other paradigms and strategies.

All part of the same market.

As An Investor Your Greatest Strength Also Determines Your Greatest Weakness

What do you feel is your greatest strength as an investor?

What is something that sets you apart from others?

Conversely, what is your greatest weakness?

Are you currently trying to address this weakness, prevent it from easily manifesting or simply doubling down on what it is that you’re great at?

The biggest strength also determines the biggest weakness.

They exist in pairs.

Addressing a weakness would also curb the corresponding strength.

The investor would change into a different investor.

Market participants play different roles according to their individual strengths and weaknesses.

Much like an eco-system, the greater the variety in strengths, the more resilient the system is.

The financial system should fundamentally reflect the economic system.

When it doesn’t malinvestments occur.

The biggest danger to the system is when investors collectively decide to focus on one kind of strength, especially when it’s not their own, and form a herd.

A shared paradigm is a kind of collective madness.

This kind of madness recurs at regular intervals.

Social media likely made it worse.

The biggest danger to the individual investor is focusing on a strength that is not naturally their own.

This is especially hazardous to beginning investors.

You’re not going to be the next Warren Buffett.

My greatest strength is the ability to see and hold multiple different perspectives at the same time.

This is not really something I’m born into but rather an outcome of spending 2015-2020 moderating political discussions on my forum.

It does gets tiresome.

Holding perspectives (or space) requires a suspension of a kind of disbelief in order to root out what a given investor-type grouping either doesn’t see (known-unknowns) or refuses to accept (unknown-knowns).

This is done by following a wide range of sources—put out sensors everywhere—and essentially taking a 4th person view on the market: I have little interest in arguing “best investments” but great interest in watching how different groups argue with and amongst each other.

My biggest weakness follows from that. I’d be unlikely to go all in on a single perspective.

I became aware of crypto in 2012ish.

However, I was also aware of eGold and Liberty dollars in 2005.

One went well, the others not so much.

There’s No Such Thing As A Free Lunch

What’s something that you believe as an investor that is not widely agreed upon by the investing community at large?

On the other hand, what is a commonly held investing belief that most in the industry would agree with that rubs you a bit differently?

I don’t presume that market efficiency is instantaneously settled.

I think it’s an on-going negotiated process that takes months or even years to unfold.

While information is widely and instantly available, its translation into knowledge takes effort.

It’s not frictionless!

Furthermore, while such knowledge is achievable second-hand through education and from other investors, the wisdom to act on it is mostly achieved first-hand and personally.

That there’s no such thing as a free lunch.

That this affects every instance of life.

To be clear, the simplified math assumes that transmission is instant at the ground level.

I think there are at least two additional levels of translation beyond that.

Perhaps more generally I don’t believe there isn’t a group of “they” as in “they will think of something” whether it comes to ensuring that the market always has the best price, or inventing new technology to compensate for bad resource management, or fixing climate change, malnutrition, lack of exercise, or unhealthy behavioral choices.

If modernist rationalism was the answer, “more education and books and apps” would have solved all these problems.

It clearly hasn’t.

If postmodernism was the answer, “forming communities and talking everything to death” would have solved all problems too.

That approach isn’t working overly well either.

What can I say?

Rather we’re all in this world together even if half of us have yet to realize or accept it.

Everybody is responsible for doing something on their own as well as doing something with others.

This includes investing.

I like to think of investing as “guiding the future”.

Voting by market.

You put your monies to direct the future evolution in a certain way.

Not just for humans, but other species and the planet as such.

Insofar you have enough savings, consider giving up a few basis points for the future of the planet.

There’s only one as far as we know.

You Go To War With The Army You Have

What’s a subject area in investing that you’re eager to learn more about?

And why?

If you knew more about that particular topic would it influence the way you’d construct your portfolio?

With 8 billion humans on the planet comprising 1/3 of the mammal biomass, managing our combined follies and foibles is literally the most important “elephant in a china shop”-bottleneck of the world during the 21st century.

Investing will continue to play a big role going forward because “debating” and “arms-length transactions with money” still defines our operating paradigm.

Our tool-set so to speak.

You go to war with the army you have, not the army you might want or wish you had.

This means navigating the 21st century using 19th and 20th century investment tools.

Trying to solve problems with money.

Yet generals usually to go to war using the toolset of their last war—diddle, diddle, straight up the middle—and everybody suffers accordingly.

I’m interested in how investors will be changing their minds living through the 21st century.

How investors will respond to the consequences of their commitments within the limits of their chosen constraints.

If we can’t rely on expertise or community, where do we go then?

source:paul wheaton on youtube

Anti-Jacob Lund Fisker Portfolio: FIRE & Forget

What would be the ultimate anti-Jacob Lund Fisker portfolio?

Something you’d never own unless you were duct-taped to a chair as a hostage?

What about this portfolio is repulsive to you?

Conversely, if you were forced to Steel Man it, what would potentially be appealing about the portfolio to others?

What is so alluring about it?

Whenever space probes are portrayed in the media, reporters marvel about “hitting the bullseye from millions of kilometers away”.

This is not really how it works though.

Interplanetary launches are not fixed on super-precise course at the outset only to cruise for years or decades to hit their intended destination within a few meters.

What happens is that ongoing telemetry and regularly scheduled course corrections that guide the vehicle along the way.

The ultimate anti-Jacob portfolio would be committing an irrecoverable amount of savings to an unguided “fire & forget”-portfolio that is justified by binary absolutes like “always”, “never”, “nobody”, and so on.

Things change slowly.

Course corrections are necessary.

Steel-manning it, I think many true believers eventually do change their mind.

A firm belief protects the ego from doubts and whip-sawing in the short run.

It’s quicker and easier than spending thousands of hours on a solid argument.

Paying attention to the popular paradigm once or twice each decade (perhaps via a CFP) may be good enough.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” — Mark Twain

Early Retirement Extreme x Investing — 12-Question FAQ

1) Who is Jacob Lund Fisker and why does he matter to investors?

He’s the author of Early Retirement Extreme (ERE), a foundational FIRE text. He retired from astrophysics at 33 and promotes a systems/lifestyle approach to financial independence and investing.

2) What is the core philosophy of Early Retirement Extreme?

Live resource-efficiently (e.g., ~$7k/person/year), build broad competence (“renaissance” generalism), and optimize lifestyle systems so investing complements—rather than compensates for—consumption.

3) How does Jacob think about market efficiency?

He views markets as intersubjective—a negotiated process over months/years—where different paradigms interpret the same data differently; success comes from being “slightly less wrong” and patient.

4) What investing style does Jacob identify with?

Top-down discretionary macro using mainly equities and bonds (30–40 positions), positioned around macro narratives and constraints (taxes, rates, valuations), not bottom-up stock picking.

5) Why won’t he share exact portfolio tickers?

Because what he owns can’t be separated from why/how/when he owns it. Blindly copying ignores objectives, constraints, timing, and ongoing adaptation—“woe to copycats.”

6) What skills underpin his approach?

A latticework of math + psychology: formal finance basics, wide reading across disciplines, and the ability to hold multiple perspectives simultaneously (“vision logic”).

7) How does he define risk and reward in early retirement?

Risk = irrecoverable loss that threatens a decades-long cash stream; reward = sustaining independence. Volatility is not the point—durability of cash flows is.

8) What common investor trap does he warn about?

Over-commitment to a single paradigm/fad (dot-coms, one-factor dogma, “always/never” rules). Popular narratives tend to dominate 5–15 years, then fade; course corrections are essential.

9) What’s his view on “FIRE & forget” portfolios?

He’s against them. Like space probes, portfolios need telemetry and periodic course corrections; unguided, absolute “set-and-forget” approaches court irrecoverable mistakes.

10) How should a beginner build Jacob-style intuition?

Three steps: (1) Master basics (MPT, accounting, derivatives) to explain them simply; (2) Read old sources with hindsight to see where views failed/succeeded; (3) Read widely beyond finance.

11) What differentiates ERE from standard FIRE advice?

Depth over tips: systems design, economic degrees of freedom, skill acquisition, and ecological sustainability—versus “skip lattes, buy an S&P 500 index fund.”

12) Where can people follow Jacob and learn more?

Read the Early Retirement Extreme book and ERE blog archives; he’s occasionally on podcasts, active on the ERE forum, lightly on Twitter @extremejacob and Facebook (Early Retirement Extreme).

How To Connect With Jacob Lund Fisker

You can read more about ERE on my site.

Note, the blog itself is no longer updated with new content.

My twitter account, which I mostly ignore is @extremejacob and facebook ditto is Early Retirement Extreme.

I am mostly active on my forum and I occasionally appear on podcasts.

Nomadic Samuel Final Thoughts

I want to personally thank Jacob Lund Fisker for taking the time to participate in the “How I Invest” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to take part in the “How I Invest” interview series feel free to reach out to nomadicsamuel at gmail dot com.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.