Have you ever embarked on a treasure hunt? If yes, you’d agree that it can be as exhilarating as it is challenging, full of cryptic clues and surprising twists. In many ways, the world of investing is like a continuous treasure hunt, where the investors are explorers searching for hidden gems or undervalued stocks that can yield them handsome rewards. In this adventurous journey, our compass is often an array of financial ratios and measures. One of the most powerful among them, and the focus of our discussion today, is the Price/Earnings-to-Growth (PEG) Ratio.

Definition of Price/Earnings-to-Growth (PEG) Ratio

The PEG Ratio, in the simplest of terms, is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected growth in the future. It’s a bit like reading the stock market’s pulse, giving you an insight into whether a stock is overvalued or undervalued compared to its predicted earnings growth. This ratio has earned its stripes in the finance industry due to its ability to account for future growth, a significant factor that many traditional valuation metrics tend to overlook.

Many a seasoned investor has turned to this metric in their quest for finding valuable investment opportunities. They would argue, and perhaps rightly so, that this ratio brings to the fore the underlying value of a stock, turning the spotlight on the stock’s future prospects rather than its past performance. The PEG Ratio is thus seen by many as a robust bridge between the realms of value and growth investing, offering a nuanced view of a company’s worth.

Its Importance in Value Investing

In this article, we are setting sail to explore the uncharted territories of the PEG Ratio, to unravel its mysteries and gauge its true power in the world of value investing. We will delve into its origin and history, unravel its formula, and discuss its traditional uses. Furthermore, we will attempt to understand the essence of value investing and how the PEG Ratio fits into this puzzle.

But no exploration is complete without acknowledging potential pitfalls. Therefore, we will also shed light on the limitations and criticisms that this ratio faces, and how one can navigate these challenges to effectively utilize this tool. As our journey progresses, we will venture beyond the PEG Ratio to discuss other critical factors in value investing. Additionally, we will embark on a detour to analyze real-world cases where the PEG Ratio has been successfully used, and gain insights from the experiences of prominent value investors.

Is the PEG Ratio truly the holy grail of value investing? Or is it just another tool in an investor’s toolbox? Join us as we unravel these mysteries and more.

Background of PEG Ratio

Origin and History of the PEG Ratio

The tale of the PEG Ratio begins with the advent of its more familiar sibling, the Price-to-Earnings (P/E) Ratio, a simple yet effective tool to compare a company’s current share price to its earnings per share. Yet, as time went by, investors yearned for a more nuanced approach, something that could factor in the future prospects of a company rather than just its current or past performance. They wanted a compass that pointed towards growth, not just value. Enter the PEG Ratio.

The PEG Ratio owes its conception to Peter Lynch, a celebrated Wall Street investor and the author of best-selling books like “One Up On Wall Street” and “Beating The Street”. Lynch, during his tenure at Fidelity Investments in the 1980s, significantly outperformed the S&P 500, attributing much of his success to the PEG Ratio. He believed that by factoring in a company’s growth rate into its valuation, one could uncover stocks that were undervalued, given their future growth prospects. Since then, the PEG Ratio has become a critical part of the investor’s analytical arsenal, allowing them to fish out those hidden gems that Lynch once found.

Explanation of PEG Ratio Formula

Unveiling the magic behind the PEG Ratio involves decoding its formula. The PEG Ratio is calculated by taking the Price-to-Earnings (P/E) Ratio of a stock and dividing it by the expected earnings growth rate of the company. Let’s break it down:

PEG Ratio = (Price/Earnings Ratio) / Annual EPS Growth

This formula represents an exquisite blend of a company’s current valuation (P/E ratio) and its future prospects (expected earnings growth), which is what makes the PEG Ratio such an invaluable tool for investors. It allows one to compare companies with different growth rates on a level playing field. In essence, it adjusts the P/E ratio to account for expected growth, allowing investors to make apples-to-apples comparisons.

Traditional Uses and Interpretation of the PEG Ratio

The PEG Ratio, like a wise old sage, is here to guide us in the tricky terrain of stock valuation. Traditionally, a PEG Ratio of 1 is considered fair value. A company with a PEG Ratio of less than 1 is considered undervalued given its growth prospects, suggesting it could be a good investment. Conversely, a PEG Ratio above 1 might indicate an overvalued stock, which could signal a potential selling opportunity.

However, one must keep in mind that the PEG Ratio, despite its charm, is not a crystal ball predicting a company’s future. It is a tool, a guide that, when used wisely and in conjunction with other measures, can help investors make informed decisions. It’s a torch that illuminates a part of the path ahead, but doesn’t reveal the entire journey.

Understanding Value Investing

Definition and Concept of Value Investing

At the heart of the labyrinth that is the financial world, lies a strategy so timeless, it’s akin to discovering an ancient artifact of immense worth. This strategy, christened as Value Investing, is not merely an investing technique, but an art and a philosophy.

Value Investing is akin to being an archaeologist of the financial world. It is the practice of identifying and buying securities that appear underpriced by some form of fundamental analysis. The belief at the core of this strategy is that the market overreacts to good and bad news, resulting in stock price movements that do not correspond with the company’s long-term fundamentals. The result? An opportunity to profit when the price is deflated.

In essence, value investing is about buying stocks at a discount, holding onto them and later selling them for a handsome profit when the rest of the market realizes what they are really worth. It’s about finding diamonds in the rough, and patiently waiting for their true brilliance to emerge.

The Principles and Philosophy behind Value Investing

The roots of value investing can be traced back to the hallowed halls of Columbia Business School, where two professors, Benjamin Graham and David Dodd, laid the foundation of this strategy. This school of thought was later popularized by none other than Warren Buffett, a student of Graham’s who needs no introduction.

At its heart, value investing abides by a few key principles. First, it treats stocks not merely as ticker symbols, but as shares in a real business. Second, it emphasizes the importance of the “margin of safety”, or buying stocks at a price significantly below their intrinsic value to create a safety net for investors. Finally, it underscores the power of patience and long-term thinking, moving away from the noise and frenzy of daily stock price movements.

Key Metrics used in Value Investing

Navigating the bustling bazaar of value investing requires a toolkit of measures and metrics. Among these tools, the Price-to-Earnings (P/E) ratio has been a favorite of value investors, serving as a quick and dirty way to gauge a company’s valuation relative to its earnings. Another frequently used metric is the Book Value, or the net asset value of a company, which provides insight into a company’s financial health.

Other important metrics include the Debt-to-Equity Ratio, which helps investors assess a company’s financial leverage, and the Dividend Yield, a measure of a company’s annual dividend relative to its price, often used by those seeking income-producing investments.

But the star of our show today, the PEG Ratio, stands in a league of its own. It goes a step beyond traditional value investing metrics, marrying the principles of value and growth investing to provide a more holistic view of a company’s worth.

As we embark further into our journey, remember that value investing isn’t about seeking instant gratification. It’s akin to sculpting a masterpiece – chiseling away with patience and precision until the market recognizes and appreciates the true value of your work. It’s an endeavor for the steadfast, those who can peer through the fog of market sentiment to find the beacon of intrinsic value.

source: WallStreetMojo on YouTube

PEG Ratio as a Key Component in Value Investing

How PEG Ratio Adds Value to Investing Analysis

In the world of investing, one size doesn’t fit all. In the same vein, one financial ratio cannot wholly capture the intricacies of a company’s performance. Here, the PEG Ratio makes its grand entrance. The PEG Ratio introduces the element of ‘time’ to the narrative, by adding future earnings growth into the mix. This allows for a more forward-looking analysis and helps investors make more informed decisions.

Think of the PEG Ratio as the magnifying glass in an investor’s toolkit, enabling them to uncover layers of information that a standard P/E ratio might miss. By accounting for growth, it brings forth the company’s future potential, acting as a telescope that offers a glimpse into the horizon.

Advantages of Using PEG Ratio in Value Investing

The first advantage of the PEG Ratio is its simplicity. The formula, despite its robustness, is simple to comprehend and easy to calculate. This makes it accessible to both amateur and professional investors alike.

Second, it adds a dimension of growth to the value investing narrative, which can be critical in spotting undervalued stocks with high growth potential. By incorporating the growth aspect, it offers investors a more comprehensive view of a company’s worth.

Third, the PEG Ratio allows investors to compare companies across industries and sectors, including those with different growth rates. This flexibility makes it an invaluable tool in an investor’s arsenal.

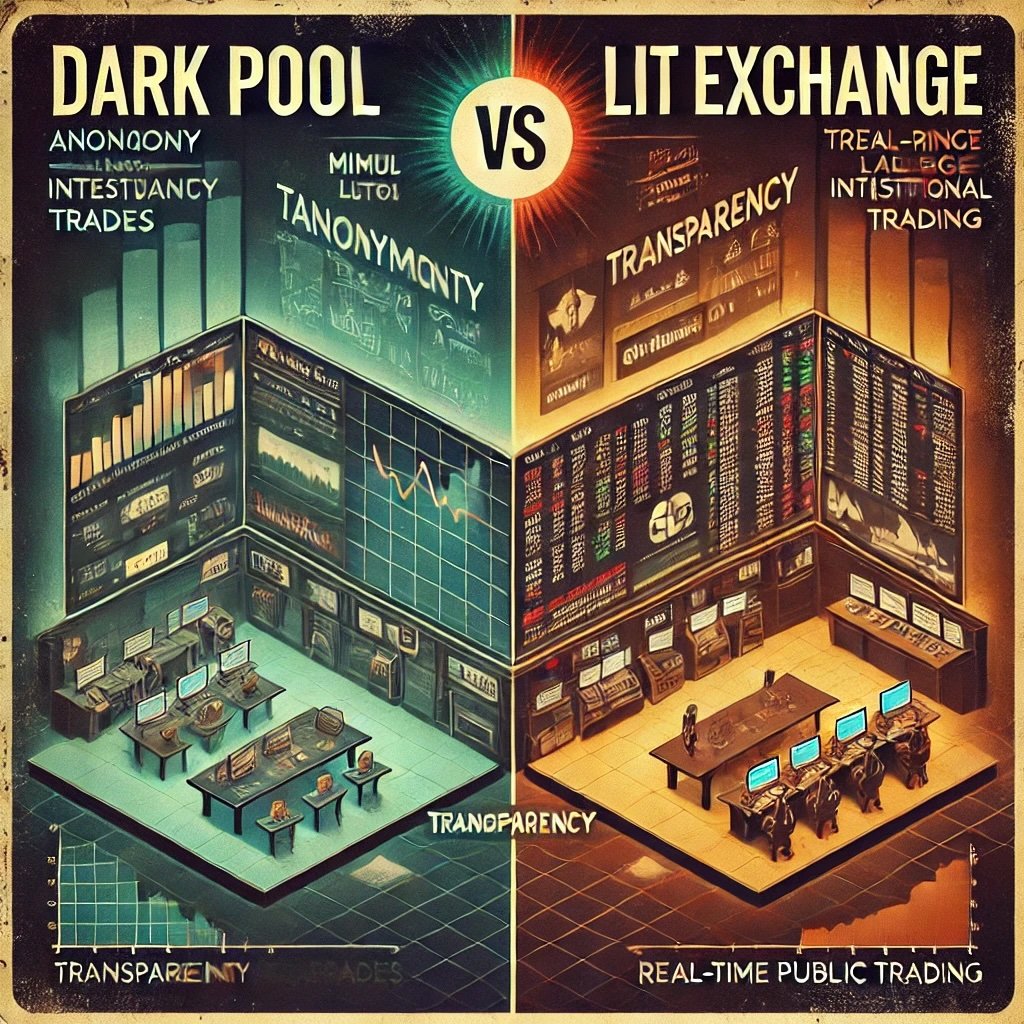

Comparisons with Other Valuation Methods

While PEG Ratio has its merits, it’s essential to compare it with other popular valuation methods to appreciate its uniqueness. Take the P/E Ratio, for example, a go-to metric for many value investors. The P/E Ratio gives us a snapshot of a company’s current valuation relative to its earnings. However, it doesn’t factor in future growth, making it a rear-view mirror, as opposed to the forward-looking PEG Ratio.

Another common valuation metric is the Price-to-Book (P/B) ratio, which compares a company’s market capitalization with its book value (net assets – liabilities). While this ratio can highlight a company’s financial health, it doesn’t capture growth prospects, unlike the PEG Ratio.

Case Study Showing the Application of PEG Ratio in Value Investing

To bring the magic of PEG Ratio to life, let’s consider a real-world scenario. Suppose we have two tech companies, Tech Titan A and Buzzy Startup B. Both have a P/E ratio of 20, but A’s earnings are expected to grow at 10% per year, while B’s earnings are set to grow at 20% per year.

Using the PEG Ratio, we find that A’s PEG Ratio is 2 (20/10), while B’s PEG Ratio is 1 (20/20). Despite having the same P/E ratio, the PEG Ratio reveals that Buzzy Startup B is a more attractive investment due to its higher growth rate.

Through this simple case, we can appreciate how the PEG Ratio can add another dimension to our investment analysis, helping us uncover opportunities that may otherwise be hidden. As the adage goes, “all that glitters is not gold,” and the PEG Ratio is just the tool to separate the fool’s gold from the real deal in the complex world of investing.

source: The Motley Fool on YouTube

Limitations and Criticisms of the PEG Ratio

Limitations of PEG Ratio as a Standalone Tool

Every tool, no matter how shiny and promising, comes with its own set of limitations. The PEG Ratio is no exception to this rule. While it provides a valuable perspective on a company’s future prospects, it should not be used as a standalone tool.

For starters, the PEG Ratio relies on estimates of future earnings growth, which is more an art than a science. Future predictions, despite the best intentions and calculations, remain susceptible to a variety of unforeseen factors, from shifts in market trends to global economic fluctuations.

Moreover, the PEG Ratio does not consider other essential facets of a business, such as its balance sheet strength, quality of management, or competitive position in the industry. These factors, though not easily quantifiable, can significantly impact a company’s long-term success.

Analysis of Common Criticisms

Among the common criticisms of the PEG Ratio is the argument that it tends to favor high-growth companies. This is because the denominator in the PEG Ratio is the growth rate, meaning companies with higher growth rates can appear less expensive relative to their earnings.

Furthermore, the PEG Ratio can give misleading results for companies that do not have positive earnings or those with cyclical earnings. For instance, if a company’s earnings are negative or zero, the PEG Ratio becomes meaningless. Similarly, for companies with cyclical earnings, their growth rate can fluctuate significantly, leading to erratic PEG Ratios.

Mitigating the Shortcomings of PEG Ratio

Despite its limitations, the PEG Ratio can still be a valuable tool when used wisely. The first step in mitigifying its shortcomings is to use the PEG Ratio in conjunction with other valuation measures. While the PEG Ratio gives you a perspective on a company’s growth, combining it with ratios like the P/E Ratio, P/B Ratio, Debt-to-Equity Ratio, etc., can provide a more holistic picture of a company’s worth.

Secondly, it’s crucial to consider the quality of the earnings growth. A company might have high earnings growth due to a one-time event or aggressive accounting practices, neither of which is sustainable. Therefore, understanding the source and quality of the growth is as essential as the growth rate itself.

Finally, remember the role of judgment in investing. Financial ratios are tools to guide your decisions, not dictate them. Therefore, complement these tools with your own research, understanding of the industry, and intuition.

In the end, the PEG Ratio, like any investing tool, is as effective as the hands that wield it. Used judiciously and in harmony with other tools, it can help illuminate your path in the often cloudy skies of value investing.

source: New Money on YouTube

Beyond the PEG Ratio: Other Essential Factors in Value Investing

The Role of Other Factors in Value Investing

Let’s step back from the financial statements for a moment, and peer into the less quantifiable, yet equally impactful aspects of a company. As Warren Buffet once quipped, “I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.” These words, drenched in Buffett’s typical wit, underscore the importance of factors beyond financial ratios.

At the helm of these factors is the quality of management. A competent and ethical management team is the secret sauce behind any successful company. Management’s strategic decisions, their approach to capital allocation, and their philosophy towards shareholders can significantly affect the long-term growth and stability of the firm.

Next up is the company’s position within its industry. Companies that have a strong market position, a unique value proposition, or a sustainable competitive advantage often have better resilience against economic fluctuations. This, in turn, translates into a higher probability of stable and consistent returns.

The financial health of a company, including its debt levels, liquidity, and financial flexibility, is another crucial consideration. High debt levels can increase the risk of bankruptcy, especially during economic downturns, while a strong cash position provides a company with the flexibility to invest in growth opportunities or weather financial storms.

The Importance of a Holistic Approach in Value Investing

The world of investing is not black and white. It’s a kaleidoscope of factors, each subtly influencing the others, collectively shaping a company’s trajectory. And this is precisely why a holistic approach is pivotal in value investing.

Relying solely on the PEG Ratio, or any single ratio for that matter, is like trying to understand a symphony by listening to just one instrument. It’s only when all the instruments play in harmony that the true brilliance of the composition comes to life.

A holistic approach in value investing means taking into account a multitude of factors. From the financial ratios we’ve discussed to the management quality, industry position, competitive advantages, market trends, and even the macroeconomic environment.

The beauty of this approach is in its balance. It merges the hard, quantifiable data from financial statements with the soft, qualitative aspects of a business, painting a comprehensive picture of a company’s potential value.

Remember, value investing is akin to being a treasure hunter, patiently sifting through the sands of data and information, keeping an eye out for those hidden gems. And when you find them, it’s not just about recognizing their current value, but about envisioning their potential, their capacity to sparkle even brighter in the future.

So, arm yourself with your financial ratios, delve deep into the nuances of the company and its industry, and let your wisdom guide your decisions. After all, in the dynamic and ever-evolving world of investing, a keen eye, an open mind, and a balanced approach are your true allies.

Case Studies: Successful Application of PEG Ratio in Value Investing

Real-World Examples Where PEG Ratio Has Been Effectively Used

Let’s step out of the realm of theory and dive into the pragmatic world of real investment scenarios. Two case studies stand out when we talk about the successful application of the PEG Ratio: The investments made by the legendary Peter Lynch in Dunkin’ Donuts and Taco Bell.

Peter Lynch, the wizard of Wall Street, was renowned for his knack of identifying “tenbaggers,” stocks that multiplied tenfold in value. One of his key tools in this value-quest was the PEG Ratio.

In the case of Dunkin’ Donuts and Taco Bell, both companies had robust growth rates and relatively low P/E ratios when Lynch invested in them. Using the PEG Ratio, he identified that these companies were undervalued compared to their growth potential, leading him to make sizeable investments.

Analysis of Strategies and Results of These Cases

The strategy Peter Lynch employed was straightforward yet effective. He looked for companies that were out of favor in the market, with low P/E ratios but high growth rates, leading to low PEG Ratios.

The result? His investments in both Dunkin’ Donuts and Taco Bell proved to be grand slams, earning him and the Fidelity Magellan Fund’s investors spectacular returns. The PEG Ratio was instrumental in these successes, highlighting the potential these companies had despite the market’s short-term pessimism.

Lessons Learned and Insights from These Case Studies

There’s much wisdom to glean from these cases, especially for value investors.

Firstly, these cases underscore the power of the PEG Ratio in identifying undervalued growth stocks. When used effectively, this simple ratio can uncover opportunities that may be missed by a cursory glance at the P/E ratio.

Secondly, the cases reiterate the importance of patience in value investing. The market can often be short-sighted, overly focused on the here and now. As a value investor, your edge lies in your ability to see beyond the present, to envision the potential a company has to grow and prosper.

Finally, the case studies underline the significance of independent thought. Peter Lynch did not let market sentiment cloud his judgment. Instead, he stuck to his analysis, trusted his tools, including the PEG Ratio, and made his moves confidently.

Future of PEG Ratio in Value Investing: Trends and Innovations

Examination of Recent Trends Affecting the Use of PEG Ratio

As we venture into the future, it’s clear that the world of investing is not what it used to be. New trends are emerging, altering the way we understand and evaluate investments.

One significant trend is the increasing prominence of high-growth, high-P/E companies, particularly in the technology sector. These companies often have P/E ratios that might make a traditional value investor squirm. But the PEG Ratio, with its adjustment for growth, can help reveal the potential value beneath the intimidating P/E numbers.

Another trend is the evolving nature of earnings themselves. With an increasing emphasis on intangible assets like brand value, user base, or data, earnings figures are becoming more complex. This complexity can have implications for the PEG Ratio, pushing investors to refine and adapt their application of this metric.

Impact of Technology and AI on PEG Ratio Usage

With the advent of technology and AI, the investing landscape is undergoing a seismic shift. Advanced data analytics and machine learning algorithms are enabling more sophisticated, real-time financial analysis.

In the context of the PEG Ratio, AI can help improve the accuracy of the growth component. By analyzing vast datasets, machine learning models can predict earnings growth with greater precision, enhancing the reliability of the PEG Ratio.

Moreover, technology allows for a more dynamic use of the PEG Ratio. Instead of a static one-time calculation, investors can use real-time data feeds to continuously update and monitor the PEG Ratios of their portfolio companies, providing them with a more timely and accurate valuation tool.

Predictions and Possible Innovations in Value Investing with Respect to PEG Ratio

Looking ahead, the PEG Ratio is set to continue playing a crucial role in value investing, albeit in an evolved form.

We may witness an adaptation of the PEG Ratio to better accommodate the nuances of modern businesses. For instance, it could incorporate factors like environmental, social, and governance (ESG) practices, which are becoming increasingly important in assessing a company’s future growth and sustainability.

Moreover, the concept of the PEG Ratio might be extended beyond earnings. With the growing significance of non-financial metrics like user growth or engagement levels, especially in digital businesses, we might see the advent of new types of PEG Ratios. These ‘modern PEG Ratios’ could use growth rates of such non-financial metrics in place of, or alongside, earnings growth.

In a nutshell, while the core principles of value investing and the PEG Ratio remain timeless, their application is evolving, adapting to the changing tides of the business and investing world. As value investors, it’s our task to ride these tides, constantly learning, adapting, and innovating, guided by our north star – the quest for true value.

Expert Opinions: Interviews and Insights from Successful Value Investors

Renowned Value Investors about the Role of PEG Ratio

A deep dive into the world of investing wouldn’t be complete without hearing from those who’ve navigated its choppy waters with success. Let’s hear from some renowned value investors about the role of the PEG Ratio in their investing journey.

Take, for instance, Peter Lynch, the master of “buy what you know” investing. He swears by the PEG Ratio as a core tool for identifying undervalued growth stocks. In his own words, “The P/E ratio of any company that’s fairly priced will equal its growth rate.” This is the essence of the PEG Ratio.

Likewise, the renowned investor Mario Gabelli, fondly known as “Super Mario” in the investing world, often uses the PEG Ratio in his investment analysis. Gabelli has emphasized how the PEG Ratio can provide a more nuanced perspective, allowing him to discern growth opportunities that others might overlook.

Interviews Discussing Their Personal Approach and Experiences with PEG Ratio

In interviews, these investing gurus often share their personal approaches to using the PEG Ratio. Lynch, for instance, has spoken about how he uses the PEG Ratio as an initial filter, using it to shortlist companies that warrant a deeper investigation.

Gabelli, on the other hand, talks about the importance of contextualizing the PEG Ratio within the industry. He emphasizes that what may be a high or low PEG Ratio can vary significantly across different sectors.

These personal experiences, shared by the best in the business, offer valuable nuggets of wisdom for anyone seeking to master the PEG Ratio.

Expert Advice for Using PEG Ratio Effectively in Value Investing

The insights from these investing maestros boil down to a few key pieces of advice:

- Use the PEG Ratio as a starting point, not an endpoint. It should inform your investing decisions, not dictate them.

- Understand the context. A PEG Ratio that looks high in one industry might be average in another. Comparing PEG Ratios across companies in the same sector can offer a more accurate perspective.

- Look at the quality of growth. Ensure that the projected earnings growth is sustainable and based on sound business fundamentals.

- Remember, the PEG Ratio, like any other tool, is as good as the hands that wield it. It requires a sound understanding of its principles, an awareness of its limitations, and a thoughtful application in practice.

12 Frequently Asked Questions About the PEG Ratio and Value Investing

What is the PEG Ratio in simple terms?

The PEG Ratio measures a stock’s valuation by comparing its Price-to-Earnings (P/E) ratio to its expected earnings growth rate. It helps investors assess whether a stock is fairly valued, overvalued, or undervalued after factoring in future growth potential—something the P/E ratio alone does not account for.

Who created the PEG Ratio and why?

The PEG Ratio was popularized by Peter Lynch, the legendary manager of Fidelity Magellan Fund, in the 1980s. Lynch believed that factoring in growth rates allowed investors to identify undervalued growth stocks that traditional valuation metrics might miss, leading to his famous “tenbagger” investments.

How do you calculate the PEG Ratio?

The PEG Ratio is calculated using the formula:

PEG = (Price / Earnings) ÷ Annual EPS Growth Rate

For example, a stock with a P/E of 20 and a growth rate of 10% would have a PEG of 2. This formula adjusts a company’s valuation to account for its expected growth.

What is considered a “good” PEG Ratio?

Traditionally, a PEG Ratio of 1.0 is seen as fair value.

PEG < 1 suggests the stock may be undervalued relative to its growth.

PEG = 1 indicates fair value.

PEG > 1 suggests possible overvaluation.

However, interpretation depends on the industry and broader market conditions.

Why is the PEG Ratio important in value investing?

The PEG Ratio bridges value and growth investing by considering future growth. It allows investors to compare companies on a level playing field, making it easier to find undervalued stocks with strong growth potential—a key focus for value investors seeking mispriced opportunities.

How does PEG Ratio compare to P/E Ratio and P/B Ratio?

Unlike P/E, which looks only at current earnings, the PEG Ratio adds a forward-looking element through expected growth. Compared to P/B, which focuses on asset values, PEG provides insight into future profitability. PEG is often more informative for growth-oriented companies, while P/B is useful for asset-heavy industries.

Can the PEG Ratio be used across industries?

Yes, one of its strengths is cross-sector comparability, since it adjusts for different growth rates. However, PEG benchmarks vary by industry—what’s considered “cheap” in tech might not apply to utilities. Always contextualize PEG values within the sector.

What are the main limitations of the PEG Ratio?

It depends on future growth estimates, which may be inaccurate.

It can produce misleading results for companies with low or negative earnings.

It may favor high-growth firms, potentially overlooking risks.

It ignores qualitative factors like management quality, competitive advantages, and financial health.

How can investors mitigate the PEG Ratio’s shortcomings?

Use the PEG Ratio in combination with other metrics like P/E, P/B, Debt-to-Equity, and cash flow measures. Evaluate the quality and sustainability of growth, and apply sound judgment—PEG should inform decisions, not dictate them.

How has the PEG Ratio been used successfully in real-world investing?

Peter Lynch famously used the PEG Ratio to identify Dunkin’ Donuts and Taco Bell as undervalued growth plays. Both had low PEG Ratios due to strong growth forecasts and moderate P/Es. His investments yielded outstanding returns, illustrating PEG’s potential when paired with rigorous analysis.

How is technology and AI affecting PEG Ratio analysis today?

Modern investors use AI and machine learning to refine growth estimates, improving PEG accuracy. Real-time data feeds now allow PEG Ratios to be updated dynamically, providing investors with more timely insights and better screening tools.

Is the PEG Ratio truly the “Holy Grail” of value investing?

No single metric is perfect. The PEG Ratio is a powerful tool, but not a panacea. It should be seen as a compass—useful for direction but not the entire map. The best value investors combine PEG with qualitative research, industry context, and patience to uncover true long-term value.

Conclusion: PEG Ratio Investing

And there you have it. We’ve journeyed through the realm of value investing, with the PEG Ratio as our trusted guide. We’ve traced its origins and deciphered its workings, delved into its role in value investing, and weighed its strengths and weaknesses. We’ve heard tales of its triumphs from the legends of investing, gleaned insights from their wisdom, and explored the horizons of its future potential.

Whether PEG Ratio is the “Holy Grail” of Value Investing

So, is the PEG Ratio the “Holy Grail” of value investing? Well, like most things in life, the answer isn’t a straightforward ‘yes’ or ‘no’.

The PEG Ratio is a potent tool, no doubt. It offers a sophisticated twist to the conventional P/E ratio, adding a growth dimension to the valuation equation. It helps unearth companies that, while appearing expensive on a P/E basis, might be undervalued when you factor in their growth potential.

But is it flawless? Far from it. It hinges on projected earnings growth, which is an estimate and subject to uncertainty. It’s a single figure that can’t capture the complex tapestry of a company’s prospects. And it might not always suit companies in sectors like utilities or real estate, where growth isn’t the primary value driver.

Role of PEG Ratio in a Value Investor’s Arsenal

In the grand scheme of value investing, the PEG Ratio is not a panacea, but rather a compass. It’s not an oracle, predicting with certainty, but a lens, offering a nuanced perspective. It’s not a standalone yardstick, but a part of the toolkit, complementing other measures like the P/E ratio, book value, and many more.

The key, then, lies in using the PEG Ratio judiciously – understanding its principles, recognizing its limitations, and employing it in concert with other tools and metrics. After all, value investing isn’t a treasure hunt, where one “Holy Grail” leads to the booty. It’s a quest, where wisdom, insight, and a well-stocked arsenal pave the way to value.

So, gear up, brave value seeker, and embrace the journey with the PEG Ratio as your trusted ally. The world of value investing awaits!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.