Today, I’m thrilled to welcome Ryan Krueger to the “Strategy Behind the Fund” series to review his MBOX ETF strategy.

It’s better known as the Freedom Day Dividend ETF.

As a quick teaser, it’s an actively managed high-quality dividend equity optimization strategy.

Without further ado, let’s turn things over to Ryan!

Reviewing The Strategy Behind MBOX ETF (Freedom Day Dividend ETF)

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Ryan Krueger

I began my career at Smith Barney in 1996 in the private client division, building separately managed accounts. We kept it very simple, there was a tax-free bond account, and an actively managed stock portfolio. I loved my time there, and learned so much. Smith Barney later became Citigroup, where I became a Senior Portfolio Manager. I felt lucky for the chance to work really hard at an amazing organization serving clients around the world.

However, my best compounding lessons were carefully studying all of the complicated Wall Street products that clients really didn’t need. I had no idea at the beginning of my career, that simplicity would prove to be the Holy Grail for investors, who I wanted to treat as partners not customers. I didn’t agree with the direction that large bank/brokerage firms were taking, which later led to their credit crisis. So, I voted with my feet and escaped in 2006 to launch our own investment management and planning firm, completely independent of all confusion and conflicts.

We still use that same original investment playbook, which has now been battle-tested by every market cycle. We’ve built a truly unique firm all around it, to customize “Freedom Day” plans alongside personal and ongoing advice, around every turn down the road. Every family we are blessed to work for knows where 100% of my own money is, right next to theirs. Our skin is in the game in every way and they are treated as family.

What’s The Strategy Of MBOX ETF?

Q1) For those who aren’t necessarily familiar with a “quality rising dividend” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

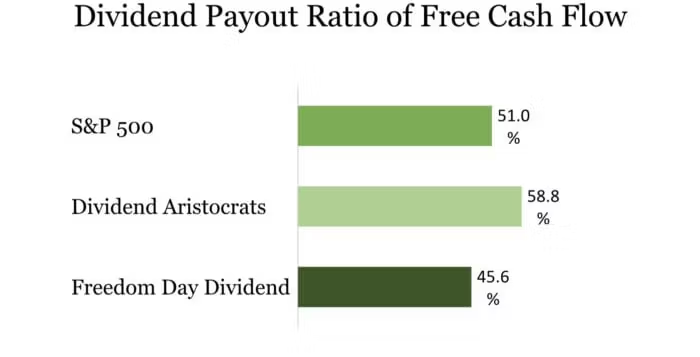

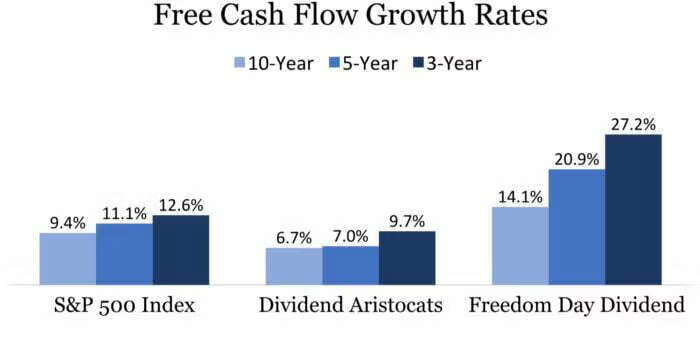

A high-quality dividend means a consistent payment from free cash flow, supported by a great balance sheet. For us that also means it must come from a business whose operating strength is accelerating even faster than the dividend pay raises it shares with stakeholders.

Our research over 25 years leads us to believe rising dividends are the best opinion-free clue of improvement – in a business, and for a stakeholder.

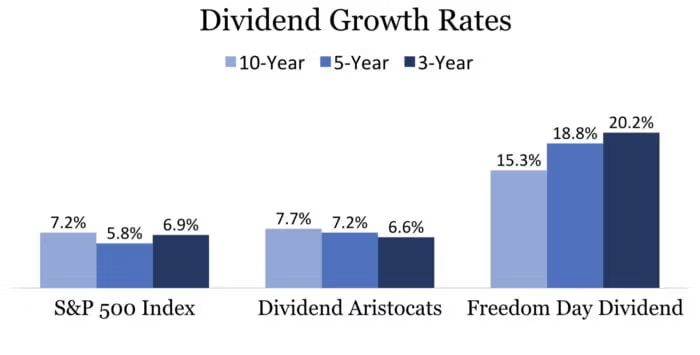

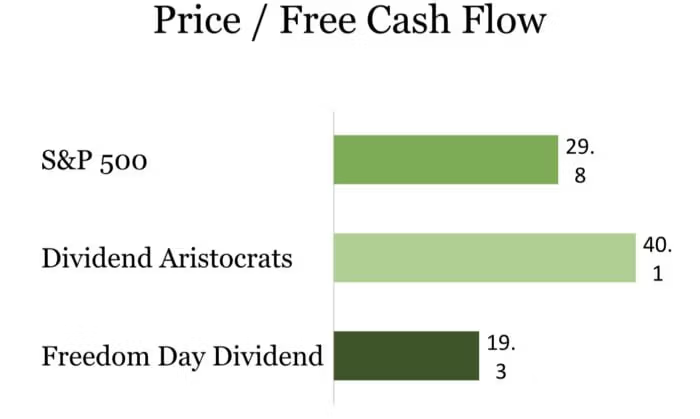

Currently, here is our more specific way to answer your question with objective math.

Unique Features Of Freedom Day Dividend Fund MBOX ETF

Q2) Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

It is an actively managed fund of dividend growth stocks. Since all market pricing is dynamic, the odds for investor success can dramatically change even for the exact same businesses. At the same time, prices may not move for a business with remarkable improvement. Alternatively, the market price may not reflect a business that is eroding, or worse. To me, active management is not a choice, it is a requirement. For all these reasons, I actually think sell disciplines are the single best reasons for active management, even before considering any of the upside that can be found.

We built a quantitative scoring system that measures every stock, ranking them across dozens of variables. The key to our selection process is then re-measuring the direction of those inputs. A stock with “good fundamentals” may be priced accurately as such. I want to find improvement instead. A lower growth rate that is accelerating is more interesting than a high growth rate that is slowing. We carefully examine each.

A key to active management is humility. No position is sacred, they must compete against a bullpen of exceptional opportunities ready to take their roster spot.

Roster construction is critically important. This should never be about buying a list of stocks or funds, or about what an investor or a portfolio manager likes. I have zero predictions about what should happen next. I have a profound respect for what IS happening, and math makes that quite clear, leaving no room for opinions including our own. We are completely diversified and balanced across sectors, size, and style – yet in a concentrated portfolio of no more than 50 stocks, the optimal roster size we determined after years of due diligence.

source: Excess Returns on YouTube

What Sets MBOX ETF Apart From Other Equity Funds?

Q3) How does your fund set itself apart from other “equity funds” being offered in what is already a crowded marketplace?

What makes it unique?

Almost every fund category is already too crowded. Many categories shouldn’t even exist. When I started as a portfolio manager in the late 90s, funds were supposed to help make the Stock Market smaller for people. Now there are more funds than stocks, and they’re popping out like Gremlins. So, the last thing in the world I wanted to do was create another product.

No investor needs another growth or income fund. I would not have entered this arena, to launch a fund against global fund distribution giants – that makes David vs. Goliath look like an even match up – if there was not a big problem to solve. I am willing to bet my career on the biggest question investors will have over the next 30 years is not more growth or income it will be how to achieve growth OF income.

source: Excess Returns on YouTube

What Else Was Considered For MBOX ETF?

Q4) What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

A lot! Thousands of stocks, every single day, to be precise. Our selection process does all the careful consideration for us, and then again tomorrow. We stick to the math, which leaves no room for opinions including our own. An emotionless quantitative approach closes the door for any hard decisions to distract us. What I have seen hurt even the most brilliant money managers is how hard it is to let go of years of research on a particular company. Or even worse, if a position you know very well goes down in price, most money managers will continue to average-down their cost basis, convinced they are right.

I love relying on a repeatable selection system that discovers not what I think should happen, but what IS happening. Then we stick to strict sell disciplines when we are wrong, opening the door for objectively superior fundamentals to replace losings positions.

When Will MBOX ETF Perform At Its Best/Worst?

Q5) Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

There have been plenty of short periods of time where crowds of investors will prefer to chase price appreciation from popular themes that emerge. Understandably, new innovation will be exciting to the point it’s often profitless innovation that will attract capital sending share prices soaring, and boring dividend stocks will underperform.

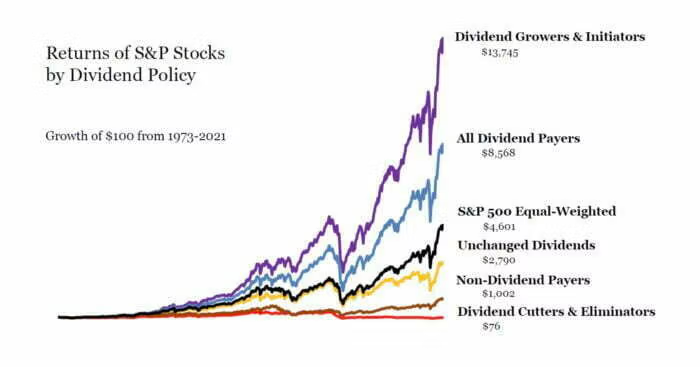

However, history has been pretty clear that boring is beautiful when those dividends are being raised consistently. I’ll objectively share a conservative answer to your question that includes zero active management quality criteria, or sell disciplines – both of which can add considerably to these results hiding in plain sight for any investors who no longer want to be distracted by short-term themes. Significant outperformance can find them instead.

Why Should Investors Consider Freedom Day Dividend Fund MBOX ETF?

Q6) If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

I’ve learned the Holy Grail is deeply informed simplicity that consistently works, not sophisticated, confusing and expensive models with different layers of fees. The cost of doing business is an incredibly important detail for any investor.

I can explain anything inside our wealthiest families accounts to my 5th grader. The only beta he’s ever heard of is in his fish bowl. Having spent the first half of my career on Wall Street inside the belly of the beast of expensive confusion, I would humbly share that they may be confusing by design, to justify their higher fees and illusion of wizards behind the curtain that investors need. Investors really only have two questions that matter – am I going to be okay, how much is enough?

source: 7investing on YouTube

How Does MBOX ETF Fit Into A Portfolio At Large?

Q7) Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

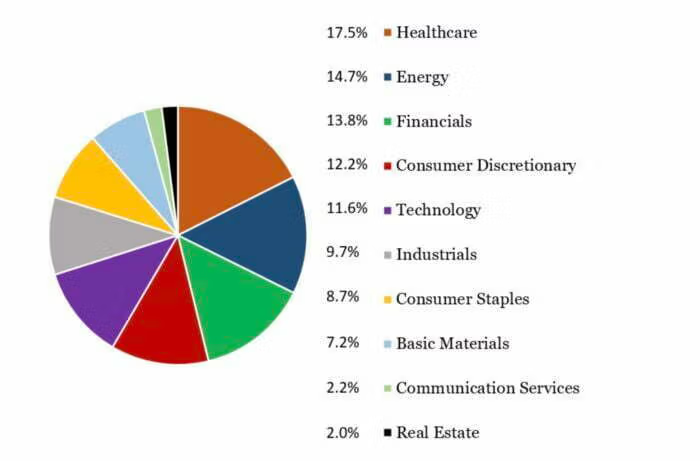

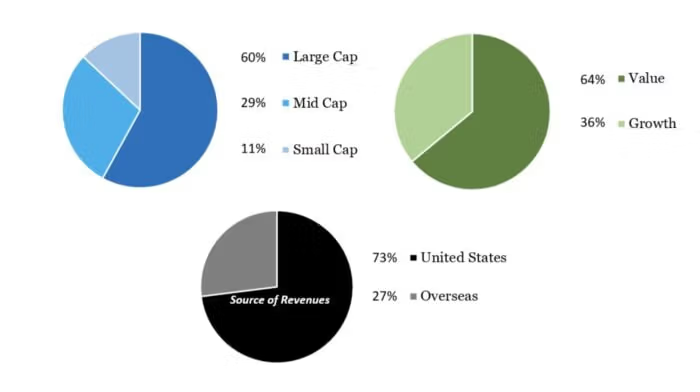

Great question that I think can be carefully answered in many different ways by advisors or by investors doing this on their own. By itself, our dividend growth strategy is extremely well balanced to potentially offer one simple stock account if somebody chose to knock out many birds with one stone. Here is our current balance across all sectors, sizes, and styles:

But the way to better answer your question, is exactly where all of my own money is invested. It’s not a recommendation, but it’s my favorite honest answer to the best question any investor should ask any advisor or portfolio manager. My friend Brian Portnoy captured this wonderfully in the book “How I Invest My Money” that I was delighted to write a chapter for.

Morningstar has the objective data that is more compelling than any prediction, showing a consistent source of outperformance clues can be found from portfolio manager with their own skin in the game – how much do they own of their own fund. Investors would be shocked to learn how rare that ownership is. For me, this account is the largest portion of my nest egg.

I also own tax-free municipal bonds. Between AAA-rated insured bond interest income + rising dividends, I will put those two simple accounts up against the most complicated allocations across dozens of funds and take my chances. And, I’ll be taking less risk, paying far less in fees, and be able to see it all transparently with complete liquidity. After those two accounts provide all the free cash flow any investor of any size might one day need to arrive at “Freedom Day” where inflows exceed outflows, then he or she can afford to speculate wildly with whatever is left over. Real estate, private equity, farmland, or any other alternative investment that may interest them. I believe in all of them in small portions. The advantage that simple balance of Safe and Sacred, before Speculative money offers – is never again will there be any scared money.

source: 7investing on YouTube

The Cons of MBOX ETF

Q8) What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

“Ryan, you have no marketing department or distribution network.”

And that’s correct. I’m focused on making sure the portfolio is working, for those who trust us to do for them as we do for ourselves.

The Pros of MBOX ETF

Q9) On the other hand, what have others praised about your fund?

Same answer.

Connect With Freedom Day Solutions

Q10) We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

You asked great questions, and I’m honored by the interest you have and grateful for the desire to share any part of our little story and playbook that I dearly love working on. The best way to follow along with what we’re doing is sign up for our Partners & Friends e-mail at freedomdaysolutions.com. Everything we do is an open-book project so we can continue to learn ourselves also, by surrounding ourselves with brilliant people who like sharing and living in this world of abundant opportunities for all of us. I have learned it really is a shockingly small and beautiful world IF we want it to be.

Thanks so much for taking part in the “The Strategy Behind The Fund” series!

How can others connect with you on social media and other platforms that you run?

@RyanKruegerROI on Twitter.

MBOX ETF — 12 Essential FAQs on the Freedom Day Dividend ETF (MBOX)

1) What is MBOX in one sentence?

MBOX (Freedom Day Dividend ETF) is an actively managed, high-quality dividend growth strategy that seeks growing income and attractive total return by owning companies whose free cash flow and fundamentals are accelerating faster than their dividend hikes.

2) What do you mean by “quality rising dividends”?

“Quality” means dividends funded by free cash flow and supported by strong balance sheets; “rising” means consistent, measurable increases—used here as an objective signal of business improvement, not just a yield screen.

3) How does the stock selection process work?

A quantitative scoring system ranks stocks on dozens of variables (cash-flow, payout discipline, balance-sheet strength, sentiment, etc.), then re-measures the direction of change (accelerating vs. decelerating). Improving fundamentals beat merely “good.”

4) Is MBOX active or passive? Rules-based or discretionary?

Active. It’s rules-driven for ranking and monitoring, with discretion applied to roster construction and sell discipline. No position is “sacred”—candidates must compete against a ready bullpen of higher-scoring ideas.

5) How concentrated and diversified is the portfolio?

MBOX typically holds no more than ~50 stocks (the team’s optimal roster size), yet is deliberately diversified across sectors, sizes, and styles to avoid over-exposure to any single theme.

6) What’s unique vs. other dividend/equity funds?

The focus is growth of income (rising, well-funded dividends) rather than chasing yield or broad “dividend” labels. The process emphasizes rate-of-change (acceleration) and strict sell rules—aiming to upgrade into improving businesses and exit deteriorating ones.

7) Is there leverage? Options?

No. This is a cash, long-only equity portfolio—no leverage and no options overlays described.

8) When might MBOX do best—and worst?

Favorable: Markets that reward cash-flow discipline and dividend growth, or broader regimes where quality/defensives re-rate.

Challenging: Risk-on manias that reward profitless innovation/popular themes over fundamentals; short bursts of speculative leadership can see dividend growers lag.

9) Why consider MBOX alongside a low-cost stock/bond core?

A simple, opinion-light framework that targets improving free cash flow + rising payouts can complement a beta core, potentially smoothing behavior, anchoring cash-flow growth, and reducing reliance on forecasts and fads.

10) How can MBOX fit in a portfolio?

It can serve as a core equity sleeve or single-ticker dividend growth anchor. Many pair it with high-quality bonds/munis to build a “Freedom Day” income plan—letting rising dividends + tax-efficient interest fund future cash-flow needs.

11) Biggest pros and cons called out by investors?

Pros: Simplicity, transparency, disciplined sell rules, and manager “skin in the game.”

Cons: Underwhelming during speculative surges; and the team notes no big marketing machine, preferring to focus on process over promotion.

12) Fees and where to find them?

MBOX is actively managed; for the current expense ratio and details, consult the fund prospectus / official site. (Always review fees before allocating.)

Nomadic Samuel Final Thoughts

I want to personally thank Ryan Krueger for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.