The Kelly Criterion stands as a quintessential strategy in the realms of investment and gambling, revered for its methodical approach to balancing risk and reward. At its core, this criterion is a mathematical formula designed to ascertain the optimal size of a series of bets. In essence, it dictates how much one should ideally wager when given a distinct edge in a probabilistic scenario. This strategy pivots on maximizing the logarithm of wealth, thereby ensuring the highest long-term growth of one’s portfolio, a concept that resonates deeply with savvy investors seeking sustainable growth.

Brief History and Origin of the Kelly Criterion

The genesis of the Kelly Criterion traces back to the prolific work of John L. Kelly Jr., a scientist at Bell Labs, in 1956. His paper, “A New Interpretation of Information Rate,” though initially intended to address issues in long-distance telephone signal noise, serendipitously found profound application in the world of finance and betting. Kelly’s formula, originally conceptualized to maximize the rate of information transmission, was soon recognized for its potential in optimizing bet sizes and investment strategies. This fortuitous discovery marked a paradigm shift, introducing a new dimension to the strategies employed in the financial and gambling spheres.

Importance of the Kelly Criterion in Investment Decision-Making

The significance of the Kelly Criterion in investment decision-making cannot be overstated. In a domain where the interplay of risk and return dictates the tempo, the Kelly Criterion offers a harmonious balance, enabling investors to methodically increase their capital while adeptly managing the inherent risks. By advocating for proportional betting based on one’s edge and the odds, the criterion serves as a bulwark against the twin pitfalls of excessive caution and reckless overexposure. In an investment landscape often clouded by emotional biases and speculative gambles, the Kelly Criterion emerges as a beacon of rationality, guiding investors towards decisions that are grounded in probabilistic logic and sound financial principles.

This doctrine not only underscores the importance of understanding and accurately gauging one’s edge but also emphasizes the role of diversification and risk assessment in portfolio management. The adoption of the Kelly Criterion in investment strategies heralds a shift towards a more disciplined, data-driven approach, eschewing the whims of intuition in favor of empirical evidence and mathematical rigor. It resonates particularly with those who espouse a systematic, analytical approach to investment, offering a structured methodology to navigate the tumultuous seas of the financial markets.

source: Financial Wisdom on YouTube

Explanation of the Kelly Criterion

Furthermore, the Kelly Criterion’s relevance extends beyond the individual investor, influencing broader market dynamics and asset allocation strategies. As more investors incorporate this principle into their decision-making matrix, we witness a subtle yet profound impact on market efficiency and the distribution of capital across various asset classes. In this regard, the Kelly Criterion is not just a tool for individual wealth maximization; it is a cornerstone principle that shapes the very fabric of financial markets, fostering a more informed, rational, and sustainable investment culture.

In summary, the Kelly Criterion is much more than a mathematical formula; it is a paradigm that encapsulates a holistic view of investment and risk management. Its adoption marks a commitment to strategic growth, prudent risk-taking, and an unwavering dedication to the principles of rational investment. For the discerning investor, mastering the Kelly Criterion is not just an academic exercise; it is an essential step towards achieving long-term financial success and stability.

Understanding the Kelly Criterion

The Mathematical Formula

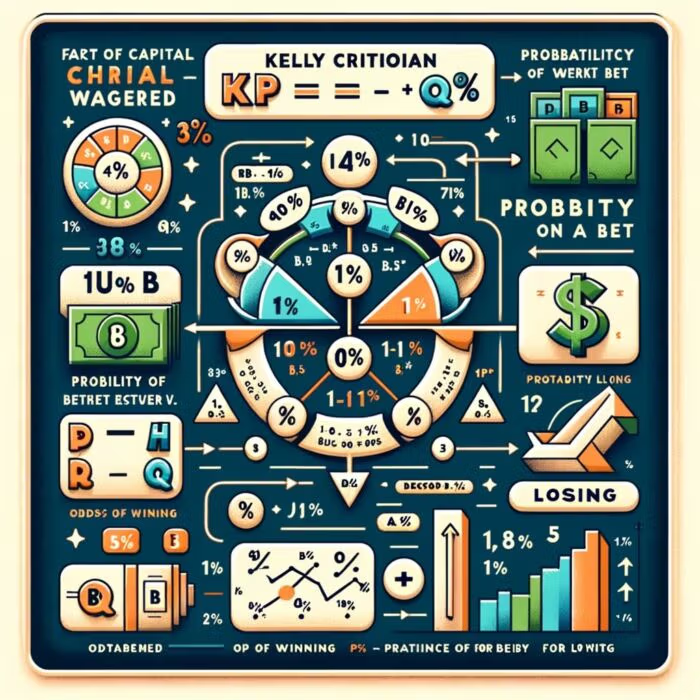

- Explanation of the Formula The Kelly Criterion, at its most fundamental level, is encapsulated in a deceptively simple formula: , where represents the fraction of the capital to be wagered, is the odds received on the bet, is the probability of winning, and is the probability of losing (which is 1 – P). This formula, though succinct, is a powerhouse of strategic planning. It calculates the optimal bet size to maximize the logarithm of wealth, which in turn ensures the highest possible long-term growth of an investment portfolio.

- Variables Involved and Their Meanings

- K% (Fraction of the Capital to be Wagered): This is the output of the Kelly Criterion formula, indicating the proportion of the total available capital that should be allocated to a particular investment or bet.

- B (Odds Received on the Bet): This variable represents the potential return on the bet for every unit of currency risked.

- P (Probability of Winning): This is the investor’s estimated probability of a successful outcome or win.

- Q (Probability of Losing): This is the complementary probability of the investment failing or the bet being lost.

Theoretical Basis

- Probability Theory and Expected Value: The Kelly Criterion is deeply rooted in probability theory and the concept of expected value. Expected value is a fundamental tenet of probability, representing the average outcome of a random event when considering all possible outcomes and their respective probabilities. The Kelly formula utilizes this concept to balance the expected return against the risk of an investment, striving for an optimal compromise between caution and aggression. This calculation ensures that the investment size is proportional to the perceived advantage, thereby aligning the stake with the investor’s confidence level and risk appetite.

- How the Kelly Criterion Maximizes Long-Term Wealth Growth: The overarching goal of the Kelly Criterion is to maximize the exponential growth rate of an investor’s capital over the long term. This is achieved by carefully calibrating the investment size in each venture, based on the probability of success and the potential returns. By doing so, it avoids the pitfalls of both over-betting, which could lead to rapid depletion of capital in the face of adverse outcomes, and under-betting, which underutilizes the potential of the capital. This judicious balancing act ensures that the investor’s capital grows at the fastest possible rate over a series of bets or investments, while minimizing the risk of catastrophic losses. It is this strategic approach to growth and risk management that cements the Kelly Criterion as a pivotal tool for investors seeking sustainable, long-term wealth accumulation.

In essence, the Kelly Criterion transcends the mere mechanics of investment to embody a philosophical approach to wealth management. It advocates for a disciplined, quantitatively informed strategy, leveraging the principles of probability and expected value to navigate the complex landscape of financial investment. Understanding and applying the Kelly Criterion is tantamount to embracing a holistic, mathematically sound methodology that seeks to optimize the interplay between risk and return, guiding the investor towards the zenith of financial prudence and acumen.

Applications of the Kelly Criterion in Investing

Stock Market Investing

- How to Apply the Kelly Criterion to Stock Selection: The application of the Kelly Criterion to stock market investing involves a meticulous analysis of potential investments based on their probabilistic returns. An investor must first ascertain the expected outcome of a stock, considering its historical performance, market trends, and fundamental analysis. This process involves estimating the probability of various returns and calculating the optimal portion of the portfolio to allocate to each stock based on these probabilities. The precision of these calculations is paramount, as it determines the efficiency and effectiveness of the Kelly Criterion in optimizing the portfolio’s growth.

- Case Studies or Examples: Consider the example of an investor analyzing a tech stock. After thorough research, the investor estimates a 60% chance of the stock yielding a significant return due to innovative product launches and market dominance. Utilizing the Kelly formula, the investor can calculate the optimal amount to invest in this stock, balancing the high potential return against the inherent risk. This methodical approach not only maximizes the potential growth but also minimizes the risk of overexposure to a single asset.

source: Mutual Information on YouTube

Portfolio Management

- Balancing a Portfolio Using the Kelly Criterion: In portfolio management, the Kelly Criterion is instrumental in determining the optimal asset allocation to maximize growth while maintaining a balanced risk profile. This involves applying the Kelly formula to each potential investment within the portfolio, considering the correlations between assets to manage risk effectively. The criterion’s emphasis on proportional betting ensures that the portfolio is diversified in a manner that aligns with the investor’s risk tolerance and investment objectives.

- Risk Management and Diversification: The Kelly Criterion inherently promotes risk management through its focus on proportional investment. By allocating funds in accordance with the calculated optimal bet size for each investment, the criterion ensures that no single investment unduly influences the overall portfolio’s risk profile. This disciplined approach to diversification not only mitigates the risk of significant losses but also enhances the potential for stable, long-term growth.

Other Investment Vehicles

- Applying the Kelly Criterion to Bonds, Real Estate, and Other Assets: The versatility of the Kelly Criterion extends beyond the stock market to other investment vehicles like bonds, real estate, and alternative assets. For instance, in bond investing, the criterion can be used to assess the optimal allocation towards different types of bonds, considering their yield, maturity, and credit risk. Similarly, in real estate, the Kelly Criterion aids in evaluating the proportion of capital to invest in various properties, factoring in their potential rental yields and appreciation. This comprehensive approach ensures a well-rounded, strategically optimized portfolio that leverages the strengths of diverse asset classes.

The Kelly Criterion’s application across different investment domains underscores its utility as a powerful tool for strategic asset allocation. It offers a structured, quantitative approach to investment decision-making, enabling investors to harness the full potential of their capital while adeptly managing risk. By embedding the principles of the Kelly Criterion into their investment strategies, investors can navigate the complexities of the financial markets with confidence, poised to capitalize on opportunities while safeguarding their capital against volatility and uncertainty.

Benefits of Using the Kelly Criterion

Optimal Growth

- How the Kelly Criterion Maximizes Capital Growth: Central to the allure of the Kelly Criterion is its capacity to maximize capital growth in a manner that is both efficient and strategically sound. This mathematical strategy excels in optimizing bet sizes or investment allocations to enhance the expected logarithmic growth of an investor’s portfolio. By tailoring the investment size to the specific risk-reward profile of each opportunity, it ensures that capital is allocated in a way that maximizes growth potential while avoiding undue risk. The criterion, by its very design, facilitates a harmonious balance between aggressive growth pursuits and prudent capital preservation, enabling investors to capitalize on opportunities for substantial returns without jeopardizing the integrity of their entire portfolio.

source: Trading Tact on YouTube

Risk Management

- Controlling Risk Through Proportional Investment A paramount advantage of the Kelly Criterion lies in its intrinsic risk management capabilities. It advocates for an investment strategy where the size of each investment is proportional to the expected return and the probability of achieving that return. This proportional investment approach serves as a safeguard against the pitfalls of over-leveraging and excessive risk-taking. By restricting investment sizes based on the calculated optimal proportion, the Kelly Criterion inherently limits potential losses, thus protecting the investor from disastrous financial outcomes. This methodology not only mitigates the impact of individual investment failures but also ensures the overall stability and health of the investment portfolio.

Long-Term Strategy

- The Kelly Criterion as a Tool for Sustainable Investing The Kelly Criterion is not merely a tactical tool for immediate gains; it is a strategic framework for sustainable, long-term investing. Its emphasis on optimizing the logarithmic growth of wealth makes it particularly suitable for investors who are focused on long-term capital accumulation. By aligning investment sizes with the probability and magnitude of potential returns, the Kelly Criterion fosters a disciplined approach to investing that prioritizes steady, sustainable growth over short-term fluctuations. This approach is instrumental in building wealth over time, as it compounds the advantages of prudent investment choices while minimizing the impact of losses. For the astute investor, the Kelly Criterion is a beacon guiding towards a future of financial stability and prosperity, anchored in the principles of calculated risk-taking and strategic capital allocation.

Limitations and Considerations

Estimation Risks

- The Challenge of Accurate Probability and Outcome Estimation: While the Kelly Criterion provides a robust framework for investment decision-making, its efficacy is contingent on the accuracy of the inputs – particularly the probability of an event’s success and the potential outcomes. The crux of this challenge lies in the inherent uncertainty and complexity of financial markets. Estimating probabilities and outcomes with precision is a daunting task, often compounded by the dynamic nature of markets and the myriad of factors influencing asset performance. Misjudgments in these estimations can lead to suboptimal allocation decisions, thereby diluting the effectiveness of the Kelly Criterion. This necessitates a rigorous, well-informed approach to probability and outcome estimation, underpinned by comprehensive market analysis and an astute understanding of economic indicators.

Market Volatility

- Adapting the Kelly Criterion to Changing Market Conditions: The Kelly Criterion, while robust, is not immune to the challenges posed by market volatility. In highly volatile markets, the assumptions underpinning the criterion’s calculations can quickly become outdated, rendering its recommendations less effective. This volatility demands agility and adaptability in applying the Kelly Criterion. Investors must be vigilant, continuously updating their probability assessments and outcome expectations to reflect current market realities. This dynamic adaptation is crucial for maintaining the relevance and efficacy of the Kelly Criterion in guiding investment decisions amidst the ever-shifting landscape of the financial markets.

Practicality and Implementation

- Real-world Constraints and Simplifications: Implementing the Kelly Criterion in real-world scenarios presents its own set of challenges. The mathematical rigour and complexity of the formula can be daunting, especially for individual investors without extensive quantitative training. Moreover, the criterion assumes an idealized scenario where markets are efficient, and all relevant information is accessible and accurately quantifiable – conditions that are seldom fully met in real-world markets. As a result, many investors resort to simplified versions of the Kelly formula or hybrid strategies that combine its principles with other investment approaches. These adaptations, while practical, may compromise the theoretical purity of the criterion, necessitating a careful balance between mathematical idealism and pragmatic investment practices.

Advanced Topics in Kelly Criterion

Leveraging and Margin Trading

- How Leverage Affects Kelly Criterion Calculations The interplay between the Kelly Criterion and leverage, particularly in margin trading, introduces a layer of complexity to investment strategies. Leverage amplifies both the potential returns and risks of an investment, thereby influencing the calculus of the Kelly Criterion. When an investor employs leverage, the potential outcomes of an investment are magnified, which in turn affects the probability-weighted return used in the Kelly calculation. This necessitates a recalibration of the formula to accommodate the increased volatility and risk associated with leveraged positions.The effective application of the Kelly Criterion in leveraged scenarios requires a nuanced understanding of the leveraged investment’s risk-return profile. The heightened risk must be meticulously accounted for to avoid overexposure. The criterion’s emphasis on proportional betting takes on added significance here; it becomes imperative to carefully modulate the size of leveraged positions to align with the increased risk. The challenge lies in striking a balance that leverages the potential for amplified returns while safeguarding against the escalated risk of substantial losses.

Combining Kelly Criterion with Other Investment Strategies

- Hybrid Strategies for Diversified Approaches Integrating the Kelly Criterion with other investment strategies can create a more robust, diversified approach to portfolio management. Hybrid strategies that blend the Kelly Criterion with other methodologies can leverage the strengths of each while mitigating their individual limitations. For instance, combining the criterion with modern portfolio theory (MPT) can enhance the risk-adjusted return of a portfolio. MPT’s focus on diversification and asset correlation complements the Kelly Criterion’s optimization of bet size, leading to a more holistic investment strategy.Another approach involves integrating the Kelly Criterion with fundamental analysis. This involves using fundamental analysis to select securities and the Kelly Criterion to determine the optimal allocation to these securities. This synthesis harnesses the Kelly Criterion’s mathematical rigor and the depth of insights provided by fundamental analysis, creating a strategy that is both analytically sound and deeply informed by market realities.Similarly, incorporating elements of behavioral finance into the Kelly strategy can address the psychological aspects of investing, which are often overlooked in purely quantitative models. This integration acknowledges the impact of investor psychology on market dynamics and decision-making, leading to a more comprehensive investment approach.

Case Studies and Real-World Examples

Success Stories

- Examples of Investors Who Successfully Used the Kelly Criterion: The annals of investing are replete with luminaries who have harnessed the power of the Kelly Criterion to achieve remarkable success. One such paragon is Edward O. Thorp, a mathematics professor and hedge fund manager, renowned for his application of the Kelly Criterion in both blackjack and the stock market. Thorp’s methodical use of the criterion in blackjack led to groundbreaking success, which he later translated to the financial markets. By applying the Kelly formula to his investment decisions, Thorp managed to achieve an enviable track record, significantly outperforming the market over decades.Another success story is that of Bill Gross, known as the ‘Bond King’, who utilized a version of the Kelly Criterion in his bond trading strategy. Gross’s adept use of the criterion to gauge the optimal size of bond positions contributed to his long-term success and the growth of PIMCO, one of the world’s largest bond investment firms.These narratives underscore the practical effectiveness of the Kelly Criterion when applied with precision, discipline, and deep market understanding. These investors exemplify the criterion’s potential in translating mathematical insights into substantial financial success.

Lessons from Failures

- Common Pitfalls and How to Avoid Them: While the Kelly Criterion has been instrumental in numerous success stories, it is not without its pitfalls. A common misstep is the overestimation of probabilities, leading to overly aggressive betting or investing. This overconfidence can result in significant losses, especially when compounded by market volatility. Investors can mitigate this risk by adopting a more conservative approach, often referred to as ‘Fractional Kelly’, which involves betting only a fraction of the amount suggested by the Kelly formula.Another pitfall is the underestimation of the criterion’s complexity and the nuances of its application in diverse market conditions. Misapplication of the formula, due to a lack of understanding of its mathematical and probabilistic foundations, can lead to suboptimal decisions. Continuous education and a thorough grasp of the Kelly Criterion’s principles are crucial in avoiding this pitfall.Additionally, reliance solely on the Kelly Criterion without considering other market factors and investment strategies can be myopic. The financial markets are influenced by a myriad of factors, including economic indicators, market sentiment, and geopolitical events, which the Kelly Criterion does not directly account for. Successful investors often use the Kelly Criterion as one tool among many in their decision-making arsenal, combining it with other analytical methods and market insights.

Tools and Resources

Software and Calculators

- Tools to Simplify Kelly Criterion Calculations In the digital age, a plethora of sophisticated tools and calculators are available to simplify the application of the Kelly Criterion. These technological aids range from basic online calculators to advanced software solutions, designed to automate and refine the complex calculations involved in the Kelly formula.Online Kelly Criterion calculators are a popular starting point for many investors. These user-friendly tools require basic inputs such as the probability of winning, the odds, and the bankroll, and they promptly return the optimal bet size. These calculators are ideal for beginners or for quick calculations but lack the depth required for more advanced applications.For investors seeking more comprehensive solutions, specialized investment software incorporating the Kelly Criterion offers a more robust approach. These software packages often include features for in-depth analysis, such as historical data integration, probability estimation assistance, and scenario analysis. They enable investors to conduct detailed, nuanced analyses of various investment opportunities, tailoring the Kelly calculations to specific market conditions and individual investment profiles.Moreover, mobile applications dedicated to the Kelly Criterion have emerged, offering the convenience of on-the-go calculations. These apps are particularly useful for active traders and bettors who require quick decision-making support in dynamic environments.

Books and Educational Material

- Recommended Reading for Further Understanding To gain a deeper understanding of the Kelly Criterion and its applications, there is a wealth of literature ranging from introductory texts to advanced treatises.“Beat the Dealer” by Edward O. Thorp is a seminal work that, while focused on blackjack, provides a lucid introduction to the Kelly Criterion and its practical applications. Thorp’s follow-up book, “Beat the Market,” extends these principles to the stock market, offering valuable insights for investors.“Fortune’s Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street” by William Poundstone is another highly recommended read. This book delves into the history and applications of the Kelly Criterion, weaving in fascinating stories and practical examples.For those seeking a more technical and mathematical perspective, “Information Theory and the Kelly Criterion” by Leonard C. MacLean, Edward O. Thorp, and William T. Ziemba offers an in-depth exploration of the theoretical underpinnings of the Kelly Criterion. This work is more suited to readers with a solid foundation in mathematics and probability theory.Additionally, a range of academic papers and journal articles on the Kelly Criterion are available for those interested in empirical studies and advanced concepts. These papers often explore specific applications of the criterion in various investment contexts, providing a window into the latest research and developments in the field.

The tools and resources available for understanding and applying the Kelly Criterion are diverse and abundant. From simple online calculators to comprehensive software solutions, and from introductory books to in-depth academic papers, there are options to suit all levels of interest and expertise. By leveraging these tools and resources, investors can gain a thorough grasp of the Kelly Criterion, equipping themselves with the knowledge and skills needed to apply this powerful strategy effectively in their investment endeavors.

Kelly Criterion Investing FAQ: Master the Formula, Strategies & Practical Applications

What is the Kelly Criterion in simple terms?

The Kelly Criterion is a mathematical formula that determines the optimal fraction of your capital to invest or bet in situations where you have a measurable edge. It aims to maximize the long-term growth of your wealth by balancing risk and reward in a systematic way.

Who created the Kelly Criterion and why?

John L. Kelly Jr., a Bell Labs scientist, introduced the formula in 1956 in a paper originally focused on telecommunications. His work on maximizing information transmission was later adapted to gambling and investing to optimize bet sizing.

How is the Kelly Criterion formula calculated?

The formula is K = (BP − Q) ÷ B, where K is the fraction of capital to bet, B is the odds, P is the probability of winning, and Q is the probability of losing (1−P). This fraction indicates the ideal investment size for maximum logarithmic growth.

What makes the Kelly Criterion appealing to investors?

Unlike fixed allocation or gut-based investing, Kelly offers a mathematically grounded method to grow capital efficiently over time. It minimizes ruin risk while avoiding the underutilization of capital, making it attractive for disciplined, long-term investors.

Can the Kelly Criterion be used for stock investing?

Yes. Investors can estimate probabilities and potential payoffs for different stocks, then use the Kelly formula to decide portfolio weights. This approach helps balance high-conviction positions with overall portfolio risk.

Is the Kelly Criterion only for aggressive investors?

No. While the formula often suggests bold allocations, many investors use Fractional Kelly (e.g., half-Kelly) to temper volatility and reduce the risk of overestimating probabilities. This makes the strategy suitable for both cautious and aggressive investors.

What are the main risks of using the Kelly Criterion?

The biggest risk is misestimating probabilities. If your edge is overstated, Kelly’s aggressive sizing can lead to large losses. Market volatility and changing conditions also require constant reassessment to keep allocations appropriate.

How does the Kelly Criterion help with risk management?

Because it ties position size to edge, Kelly naturally caps investment size and discourages overexposure. This proportional investment strategy inherently protects against catastrophic losses while still seeking growth.

Can Kelly be applied to bonds, real estate, or other asset classes?

Yes. The formula is flexible. It can guide allocations to bonds (based on yield and credit risk), real estate (based on expected returns and rental income), or alternative assets, helping build a quantitatively balanced multi-asset portfolio.

How does leverage affect Kelly calculations?

Leverage magnifies both risk and reward, so Kelly allocations must be recalculated to account for the increased volatility. Applying Kelly with leverage requires precise risk assessment to avoid overexposure.

Can Kelly be combined with other strategies like Modern Portfolio Theory?

Absolutely. Many investors use Kelly for position sizing within a Modern Portfolio Theory framework, or combine it with fundamental analysis. Hybrid strategies can blend diversification benefits with Kelly’s growth optimization.

Are there tools or books to help apply the Kelly Criterion?

Yes. There are online calculators, mobile apps, and specialized investment software that automate calculations. Key books include Edward O. Thorp’s Beat the Dealer, William Poundstone’s Fortune’s Formula, and academic works by MacLean, Thorp & Ziemba.

Conclusion: Importance of the Kelly Criterion in Investing

The Kelly Criterion stands as a paragon of strategic investment, offering a rigorous, mathematically grounded approach to the allocation of capital in uncertain environments. Its core principle – to optimize bet size for maximum long-term growth – resonates deeply within the investment community, advocating for a disciplined balance between the pursuit of profit and the management of risk. Throughout this discourse, we have explored the multifaceted applications of the Kelly Criterion, from its traditional role in stock market investing and portfolio management to its adaptability in managing bonds, real estate, and other assets. The Criterion’s emphasis on probabilistic outcomes and precise bet sizing renders it a vital tool for investors seeking to navigate the complex dynamics of financial markets with acumen and foresight.

Practice and Implement the Strategy with Caution

As we conclude this exploration, it is imperative to underscore the importance of implementing the Kelly Criterion with caution and due diligence. The successful application of this strategy hinges on the accuracy of probability estimations and the astute interpretation of market conditions. Investors are encouraged to practice applying the Kelly Criterion in varying market scenarios, starting with conservative estimates and potentially using fractional Kelly strategies to mitigate risk. The journey to mastery is iterative and demands continuous learning, adaptation, and refinement. Aspiring practitioners should immerse themselves in both theoretical study and practical application, leveraging the myriad of tools and resources available to deepen their understanding and hone their skills.

Final Thoughts and Advice for Aspiring Investors

For the aspiring investor, the Kelly Criterion is more than a formula; it is a philosophy of investment that champions the principles of discipline, rationality, and strategic foresight. Embracing this Criterion requires a commitment to analytical rigor and a steadfast resolve to make investment decisions grounded in probabilistic logic rather than emotional impulse. It is a pathway to cultivating a more sophisticated, informed approach to investment, one that balances the quest for growth with the imperative of risk management.

The journey to effectively integrating the Kelly Criterion into one’s investment strategy is as challenging as it is rewarding. It demands a deep understanding of both the mathematical underpinnings of the formula and the ever-evolving landscape of the financial markets. As you embark on this journey, be prepared to encounter both triumphs and setbacks. Use these experiences as opportunities for growth, refining your strategy and expanding your knowledge with each decision.

In summary, the Kelly Criterion emerges not only as a powerful tool for investment strategy but also as a beacon guiding investors towards more thoughtful, disciplined, and successful financial decision-making. Its application, when approached with rigor and caution, can open new horizons in investment strategy, paving the way for sustainable long-term growth and financial stability. As you step forward into the complex world of investing, let the principles of the Kelly Criterion light your path, guiding you towards informed decisions, strategic growth, and enduring success.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.