Few names stand out as prominently as Ray Dalio, the founder of Bridgewater Associates in the world of finance. Established in 1975, Bridgewater has grown from a small startup operating out of Dalio’s two-bedroom apartment into one of the world’s largest and most successful hedge funds, managing over $160 billion in assets. Dalio’s innovative approach to investing, characterized by his unique principles and deep understanding of economic cycles, has not only yielded impressive returns but has also influenced countless investors and financial institutions globally.

source: Investopedia on YouTube

Ray Dalio is renowned for his principles-based philosophy, which extends beyond investing into management and personal development. His emphasis on radical transparency, systematic decision-making, and a comprehensive understanding of the “Economic Machine” sets him apart from traditional investors. Dalio’s principles are meticulously documented in his best-selling book, Principles: Life & Work, where he shares the strategies that have underpinned his success.

This article aims to delve deep into Dalio’s investment principles and explore how you can apply them to your own investing journey. We’ll cover key concepts such as radical transparency, the All Weather Portfolio, understanding economic cycles, and the importance of learning from failures. By integrating Dalio’s strategies, you can enhance your investment approach, manage risks more effectively, and potentially achieve more consistent returns.

Whether you’re a seasoned investor looking to refine your strategies or a novice eager to build a solid foundation, understanding Dalio’s principles can provide valuable insights. His methods emphasize the importance of being systematic, data-driven, and open-minded, all of which are crucial in navigating today’s complex financial markets.

The Principles of Radical Transparency

What is Radical Transparency?

At the core of Ray Dalio’s management and investment philosophy is the concept of radical transparency. This principle advocates for an environment where open and honest communication is not just encouraged but is integral to the organization’s culture. Dalio believes that by fostering radical transparency, organizations can unlock the full potential of their employees, drive innovation, and make better decisions.

In practice, radical transparency involves:

- Open Communication Channels: All employees are encouraged to voice their opinions, ideas, and concerns without fear of retribution.

- Meritocracy of Ideas: Decisions are made based on the merit of ideas rather than the hierarchy or position of the individual proposing them.

- Recorded Meetings: Meetings are often recorded and made accessible to all employees, ensuring that information is shared openly.

- Transparent Feedback: Performance reviews and feedback are shared openly, allowing individuals to understand their strengths and areas for improvement.

- Error Log: Mistakes are documented and analyzed openly to learn from them and prevent future occurrences.

Dalio asserts that this level of transparency leads to a more robust and effective organization. By exposing weaknesses and addressing them head-on, teams can innovate and adapt more quickly.

Application in Investing

In the context of investing, radical transparency means applying the same principles of open communication and honesty to the investment decision-making process. At Bridgewater, investment ideas are rigorously debated, and assumptions are challenged in an open forum. This ensures that decisions are made after thorough consideration of all perspectives.

For individual investors, embracing radical transparency can involve:

- Self-Reflection: Honestly assessing your investment decisions, acknowledging both successes and failures.

- Seeking Diverse Perspectives: Engaging with financial advisors, mentors, or investment communities to gain different viewpoints.

- Documenting Investment Rationale: Keeping a detailed investment journal that outlines the reasons behind each decision.

- Openly Addressing Mistakes: Analyzing and learning from investment errors without self-criticism.

- Establishing Clear Principles: Defining personal investment principles that guide decision-making.

By adopting radical transparency, investors can reduce cognitive biases, make more informed decisions, and improve their overall investment performance.

Benefits: The Importance of Honest Feedback and Transparency

Implementing radical transparency offers several significant benefits:

- Enhanced Decision-Making: Open dialogue and the free exchange of ideas lead to more thorough analysis and better investment choices.

- Identification of Blind Spots: By encouraging feedback and critique, potential oversights or errors in judgment can be identified and addressed.

- Improved Accountability: Transparency fosters a culture of responsibility, where individuals are accountable for their actions and decisions.

- Continuous Learning and Improvement: Honest feedback allows for ongoing personal and professional development.

- Stronger Relationships: Trust is built through openness, strengthening relationships with colleagues, clients, and stakeholders.

In investing, these benefits translate to a more disciplined approach, better risk management, and the potential for higher returns.

The All Weather Portfolio

Introduction

One of Ray Dalio’s most significant contributions to the investment world is the creation of the All Weather Portfolio. This portfolio is designed to perform well across all economic environments, hence the name “All Weather.” The primary goal is to achieve consistent, stable returns regardless of market conditions by balancing risk rather than focusing solely on returns.

The All Weather Portfolio was born out of Dalio’s understanding that traditional portfolios were often too heavily weighted towards certain asset classes, leaving them vulnerable during economic downturns. By diversifying across various asset classes that respond differently to changes in economic growth and inflation, the All Weather Portfolio aims to minimize losses and capitalize on gains in any economic climate.

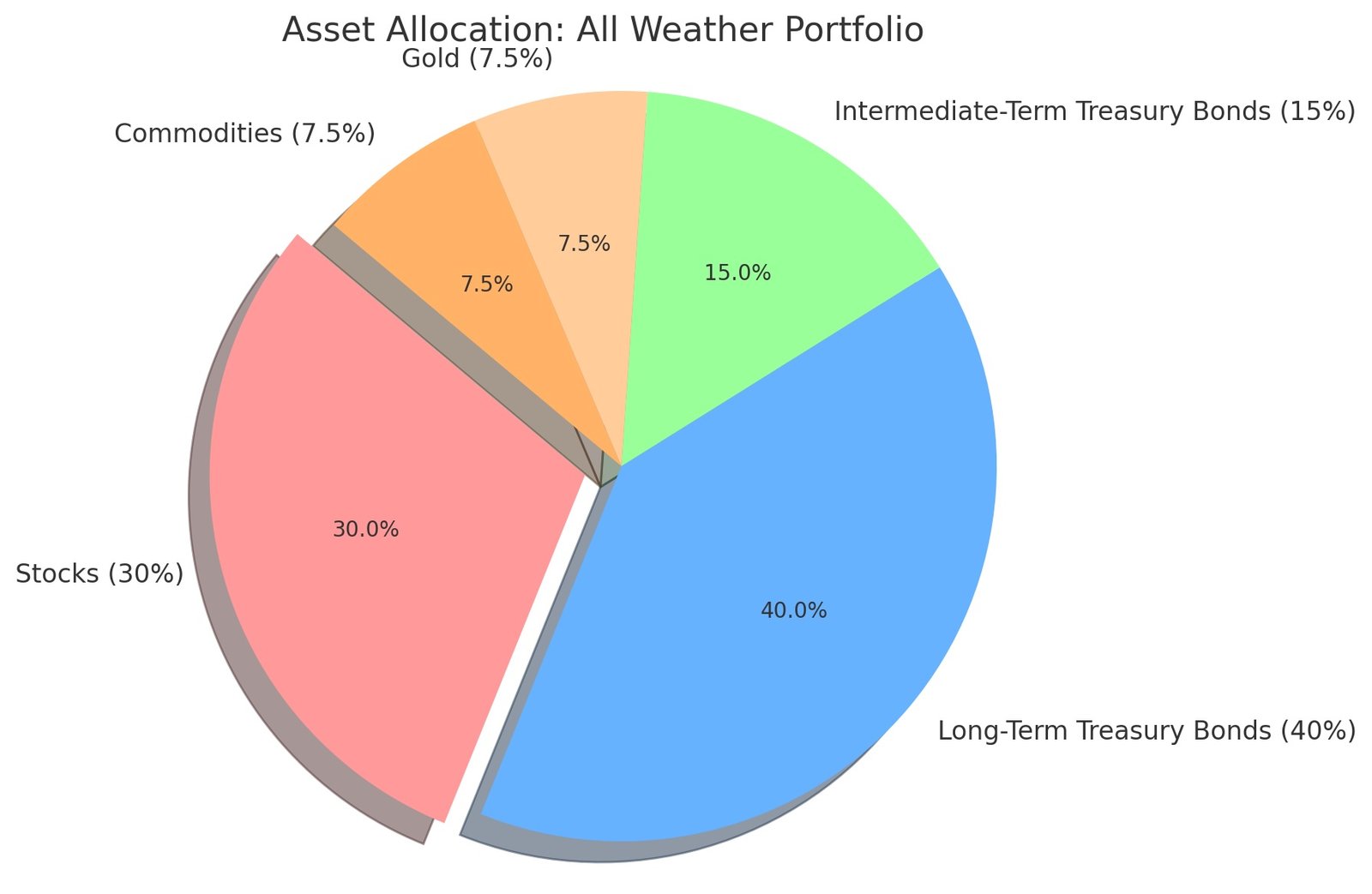

Asset Allocation

The All Weather Portfolio’s asset allocation is strategically designed to balance exposure across four economic scenarios:

- Rising Growth

- Declining Growth

- Rising Inflation

- Declining Inflation

To achieve this balance, the portfolio typically includes:

- 30% Stocks: Equities tend to perform well during periods of rising growth and stable inflation.

- 40% Long-Term Treasury Bonds: These provide protection during periods of declining growth and deflation.

- 15% Intermediate-Term Treasury Bonds: Offer additional stability and income.

- 7.5% Gold: Acts as a hedge against inflation and currency devaluation.

- 7.5% Commodities: Benefit from rising inflation and increased demand.

This allocation is not about equally dividing capital but about ensuring that each asset class contributes equally to the portfolio’s risk profile.

Risk Parity: Balancing the Portfolio Across Different Asset Classes

Central to the All Weather Portfolio is the concept of risk parity. Risk parity focuses on allocating assets based on their risk contribution rather than their expected returns or capital allocation. The idea is to balance the portfolio so that each asset class has an equal impact on the overall risk.

Here’s how it works:

- Measuring Risk: Determine the volatility (standard deviation) of each asset class to assess its risk level.

- Adjusting Allocations: Allocate more capital to lower-risk assets (like bonds) and less to higher-risk assets (like stocks) to balance their risk contributions.

- Diversification: Ensure that the portfolio is not overly dependent on any single economic condition.

By balancing risk, the portfolio aims to achieve more stable returns over time and reduce the likelihood of significant losses during market downturns.

Application: How Investors Can Create a Balanced Portfolio

Individual investors can apply the principles of the All Weather Portfolio by following these steps:

- Assess Risk Tolerance: Understand your personal risk appetite and investment goals.

- Select Appropriate Asset Classes:

- Stocks: Use broad-market index funds or ETFs to gain exposure to equities.

- Bonds: Include both long-term and intermediate-term government bonds.

- Commodities and Gold: Use commodity ETFs and gold ETFs or funds.

- Implement Risk Parity: Adjust allocations based on the risk profile of each asset class.

- Diversify Geographically: Consider including international stocks and bonds for additional diversification.

- Rebalance Regularly: Periodically review and adjust your portfolio to maintain the desired risk balance.

- Consider Tax Implications: Be mindful of the tax consequences of buying and selling assets.

By constructing a portfolio that aligns with the All Weather principles, investors can potentially achieve more consistent returns and better withstand market volatility.

Economic Principles and the “Economic Machine”

Understanding the Economic Machine

Ray Dalio’s concept of the “Economic Machine” is a simplified framework that explains how the economy functions. Dalio believes that the economy is like a machine, consisting of simple parts and transactions that repeat over time, leading to economic cycles.

The Economic Machine is built on three primary components:

- Productivity Growth: This is the most critical and consistent driver of economic growth, fueled by technological advancements and improvements in efficiency.

- Short-Term Debt Cycles (Business Cycles):

- Typically last 5-8 years.

- Driven by fluctuations in credit availability and demand.

- When credit is easily accessible, spending increases, leading to economic expansion.

- When credit tightens, spending decreases, leading to economic contraction.

- Long-Term Debt Cycles:

- Span 75-100 years.

- Involve the accumulation and eventual deleveraging of debt.

- As debt levels become unsustainable, the economy undergoes a deleveraging process, which can lead to recessions or depressions.

Key elements of the Economic Machine include:

- Transactions: The fundamental units of the economy, involving exchanges of goods, services, or financial assets for money or credit.

- Credit and Debt: Play a crucial role in economic cycles by affecting spending and investment.

- Interest Rates: Used by central banks to regulate the economy by influencing borrowing costs.

- Inflation and Deflation: Changes in the price levels of goods and services that impact purchasing power.

Implications for Investing

Understanding the Economic Machine helps investors anticipate how different assets may perform under various economic conditions. By analyzing economic indicators and recognizing where the economy is within its cycles, investors can make more informed decisions.

Key implications include:

- Interest Rate Movements:

- Rising Interest Rates: Can negatively impact bond prices and high-growth stocks.

- Falling Interest Rates: Generally benefit bonds and can stimulate economic growth.

- Inflation Trends:

- High Inflation: May erode purchasing power, benefiting commodities and real assets.

- Low Inflation/Deflation: Can increase the value of money, benefiting cash holdings and fixed-income investments.

- Economic Growth:

- Expansion: Equities and risk assets typically perform well.

- Contraction: Defensive assets like government bonds and gold may offer protection.

By aligning investment strategies with the economic cycle, investors can position their portfolios to capitalize on potential opportunities and mitigate risks.

Case Study: Dalio’s Application During a Specific Economic Cycle

The 2008 Financial Crisis

Leading up to the 2008 financial crisis, Ray Dalio observed signs of an impending economic downturn based on his Economic Machine model. Key observations included:

- Excessive Debt Levels: Particularly in the housing market, with high levels of subprime mortgages.

- Credit Bubble: Easy credit conditions led to over-leveraging by consumers and financial institutions.

- Asset Bubbles: Housing prices were inflated beyond sustainable levels.

Dalio’s Response:

- Reducing Exposure to Risk Assets: Bridgewater decreased positions in equities and high-yield bonds.

- Increasing Positions in Safe-Haven Assets: Allocated more to government bonds and cash equivalents.

- Implementing Hedging Strategies: Used derivatives to hedge against market declines.

- Shorting Vulnerable Assets: Took short positions in financial stocks and other overvalued sectors.

Outcome:

- Positive Returns: While many investors suffered significant losses, Bridgewater’s Pure Alpha fund reportedly achieved double-digit gains.

- Validation of Principles: The success reinforced the effectiveness of Dalio’s Economic Machine framework and risk management strategies.

This case demonstrates how understanding economic cycles can enable investors to anticipate market shifts and adjust their portfolios accordingly.

Bridgewater’s Pure Alpha Strategy

What is Pure Alpha?

Pure Alpha is Bridgewater Associates’ flagship hedge fund strategy. Unlike traditional investment approaches that aim to outperform a benchmark index, Pure Alpha seeks to generate high risk-adjusted returns that are uncorrelated with the broader markets.

Key characteristics of the Pure Alpha strategy include:

- Global Macro Focus: Invests across various asset classes globally, including equities, fixed income, currencies, and commodities.

- Active Management: Utilizes proprietary research and models to identify mispricings and investment opportunities.

- Diversification: Spreads risk across multiple markets and asset classes to reduce exposure to any single factor.

- Absolute Return Objective: Aims for positive returns regardless of market direction.

Research-Driven Investing

At the heart of Pure Alpha is a rigorous, research-driven investment process. Bridgewater’s approach involves:

- Macro-Economic Analysis: Examining global economic trends, monetary policies, and geopolitical events.

- Data-Intensive Research: Collecting and analyzing vast amounts of data to inform investment decisions.

- Proprietary Models: Developing complex models to forecast economic indicators and asset prices.

- Systematic Processes: Implementing investment strategies based on systematic rules and algorithms.

This deep research enables Bridgewater to identify unique investment opportunities and make informed decisions that are less influenced by market noise or short-term trends.

Diversification and Risk Management

Effective risk management is critical to the Pure Alpha strategy. Bridgewater employs several techniques:

- Dynamic Allocation: Adjusts exposure to different asset classes based on changing economic conditions and forecasts.

- Risk Budgeting: Allocates risk capital to strategies with the highest expected returns relative to risk.

- Stress Testing: Simulates how the portfolio might perform under various adverse scenarios.

- Correlation Analysis: Monitors the relationships between assets to prevent unintended concentration of risk.

- Leverage and Hedging: Uses leverage prudently and implements hedging strategies to manage downside risks.

By meticulously managing risk and diversifying across uncorrelated assets, the Pure Alpha strategy aims to achieve consistent performance in various market environments.

Principles of Systematic Investing

Systematic Approach

Ray Dalio advocates for a systematic approach to investing, which involves making decisions based on predefined rules and models rather than relying on intuition or gut feelings. This approach emphasizes:

- Consistency: Applying the same principles and processes across all investment decisions.

- Objectivity: Reducing emotional biases and subjective judgments.

- Transparency: Clearly defining investment criteria and decision-making processes.

- Repeatability: Creating processes that can be replicated over time and across different markets.

Systematic investing relies heavily on data analysis and quantitative methods to identify opportunities and manage risks.

Algorithmic Trading: Incorporating Algorithms and Quantitative Models

Bridgewater incorporates algorithms and quantitative models extensively in its investment process:

- Data Processing: Uses advanced technology to process and analyze large datasets efficiently.

- Model Development: Creates proprietary models to forecast economic indicators and asset price movements.

- Automated Execution: Implements trades automatically based on model outputs, reducing execution risk.

- Backtesting: Tests models against historical data to validate their effectiveness.

Algorithmic trading allows Bridgewater to execute complex strategies with precision and speed, capitalizing on opportunities that may not be apparent through traditional analysis.

Scalability: Benefits of a Systematic Approach

The systematic approach offers several advantages:

- Scalability: Strategies can be applied across different markets and asset classes without significant modifications.

- Efficiency: Automation reduces the time and resources required for decision-making and trade execution.

- Risk Control: Systematic processes enforce risk parameters consistently, minimizing human error.

- Adaptability: Models can be updated with new data, allowing strategies to evolve with changing market conditions.

- Performance Consistency: Reduces the impact of emotional decision-making, leading to more stable performance.

For individual investors, adopting systematic investing can enhance discipline, reduce biases, and improve long-term results.

The Role of Meditation and Mindfulness

Dalio’s Personal Practices: Meditation to Manage Stress and Maintain Clarity

Ray Dalio credits much of his success to his practice of Transcendental Meditation (TM). He began meditating in 1969 and has maintained the practice throughout his career.

Benefits of Dalio’s meditation practice include:

- Stress Reduction: Helps manage the high-pressure environment of financial markets.

- Enhanced Focus: Improves concentration and the ability to process complex information.

- Emotional Balance: Aids in regulating emotions, leading to more rational decision-making.

- Creativity and Insight: Facilitates deeper thinking and the generation of innovative ideas.

Dalio often refers to meditation as “the single most important reason” for his success, highlighting its impact on his personal and professional life.

Impact on Leadership: Influence on Organizational Culture

Dalio’s commitment to mindfulness has influenced Bridgewater’s organizational culture:

- Open-Mindedness: Encourages employees to approach challenges with an open mind.

- Resilience: Fosters a culture where setbacks are viewed as opportunities for growth.

- Empathy and Understanding: Promotes stronger relationships and collaboration among team members.

- Focus on Principles: Reinforces the importance of aligning actions with core values and principles.

By integrating mindfulness into the workplace, Bridgewater aims to create an environment that supports high performance and personal development.

Practical Application: Incorporating Mindfulness Practices

Investors and traders can benefit from incorporating mindfulness practices into their routines:

- Establish a Meditation Routine: Regular meditation can improve mental clarity and reduce stress.

- Practice Mindful Breathing: Use deep breathing techniques to stay calm during market volatility.

- Emotional Awareness: Recognize and acknowledge emotions without letting them drive decisions.

- Mindful Observation: Pay close attention to market movements and news without immediate reactions.

- Reflective Journaling: Document thoughts and feelings related to investment decisions to gain insights.

By cultivating mindfulness, investors can enhance their ability to make rational decisions, manage stress, and maintain focus.

Learning from Failures

Dalio’s Approach to Failure: Opportunities to Learn and Improve

Ray Dalio views failures as critical learning opportunities. He believes that embracing mistakes and analyzing them systematically leads to personal and professional growth.

Key aspects of his approach include:

- Acknowledging Mistakes: Accepting failures openly without assigning blame.

- Diagnosing Root Causes: Investigating the underlying reasons for mistakes.

- Documenting Lessons Learned: Recording insights to prevent repeat occurrences.

- Developing Principles: Formulating guiding principles based on experiences.

- Applying Changes: Implementing adjustments to strategies and processes.

Dalio’s perspective transforms failures into valuable assets that contribute to continuous improvement.

Principles of Reflective Learning: Analyzing Mistakes and Adapting Strategies

Reflective learning involves:

- Self-Examination: Honestly assessing one’s actions and decisions.

- Seeking Feedback: Gathering input from others to gain different perspectives.

- Identifying Patterns: Recognizing recurring issues or behaviors.

- Formulating Solutions: Developing strategies to address identified problems.

- Implementing Changes: Applying new approaches and monitoring results.

By embracing reflective learning, investors can refine their strategies and enhance their performance over time.

Example: A Major Failure and Its Impact

Dalio’s Near Bankruptcy in the Early 1980s

In the early 1980s, Dalio incorrectly predicted that the U.S. economy was heading into a depression following the debt crisis in Latin America. He positioned Bridgewater accordingly, expecting significant market declines.

Consequences:

- Financial Losses: The markets did not crash as anticipated, leading to substantial losses for Bridgewater.

- Personal Impact: Dalio had to lay off all employees and borrow money to stay afloat.

Lessons Learned:

- Humility: Realized the importance of acknowledging the possibility of being wrong.

- Diversification: Understood the need to hedge against various outcomes.

- Systematic Decision-Making: Began to document principles to guide future decisions.

- Openness to Feedback: Valued the input of others to challenge his assumptions.

Impact on Bridgewater:

- Cultural Transformation: The experience led to the development of Bridgewater’s culture of radical transparency and systematic processes.

- Enhanced Strategies: Improved risk management and investment methodologies.

This failure became a pivotal moment in Dalio’s career, shaping his philosophy and contributing to Bridgewater’s long-term success.

How to Implement Dalio’s Strategies in Your Own Investing

Building a Balanced Portfolio: Steps to Create an All Weather-Like Portfolio

To construct a portfolio inspired by the All Weather Portfolio:

- Define Investment Goals: Clarify your financial objectives and time horizon.

- Assess Risk Tolerance: Determine your comfort level with potential losses and volatility.

- Select Asset Classes:

- Equities: Include broad-market index funds or ETFs.

- Fixed Income: Incorporate both long-term and intermediate-term government bonds.

- Commodities and Gold: Use ETFs or mutual funds for exposure.

- Implement Risk Parity:

- Calculate the volatility of each asset class.

- Adjust allocations so that each contributes equally to overall portfolio risk.

- Diversify Globally: Consider international assets for additional diversification.

- Rebalance Periodically: Review and adjust your portfolio to maintain the desired risk balance.

- Monitor Economic Indicators: Stay informed about economic trends that may impact asset performance.

By following these steps, you can create a balanced portfolio designed to perform well in various economic conditions.

Applying Economic Principles: Using Dalio’s Economic Machine Model

To apply Dalio’s Economic Machine model:

- Educate Yourself:

- Learn about key economic indicators (GDP growth, inflation, interest rates).

- Understand the mechanics of short-term and long-term debt cycles.

- Analyze Current Economic Conditions:

- Assess where the economy is within its cycles.

- Identify potential risks and opportunities.

- Adjust Asset Allocation:

- Align your portfolio with expected economic trends.

- For example, increase exposure to equities during expansions or to bonds during contractions.

- Stay Informed:

- Follow economic news and reports.

- Be aware of policy changes and geopolitical events.

- Use Scenario Planning:

- Consider how different economic scenarios might impact your investments.

- Develop contingency plans.

By integrating economic analysis into your investment strategy, you can make more informed decisions and potentially enhance returns.

Adopting a Systematic Approach: Incorporating Data-Driven Strategies

To adopt a systematic, data-driven approach:

- Define Clear Investment Rules:

- Establish criteria for buying and selling assets.

- Include risk management parameters like position sizing and stop-loss levels.

- Use Quantitative Analysis:

- Utilize financial ratios, indicators, and models to evaluate investments.

- Consider using investment software or tools.

- Develop a Trading Plan:

- Outline your investment strategy, including entry and exit points.

- Ensure consistency in decision-making.

- Backtest Strategies:

- Test your approach using historical data to assess its effectiveness.

- Monitor and Adjust:

- Regularly review performance.

- Refine your models and rules based on outcomes.

By implementing a systematic approach, you can reduce emotional biases and improve the consistency of your investment decisions.

Ray Dalio Investing FAQ: All Weather, Risk Parity & the Economic Machine (Actionable Guide)

What makes Ray Dalio’s approach different?

Dalio systematizes decision-making: clear principles, data-driven models, and debate (radical transparency). He diversifies by economic environment (growth/inflation rising or falling) rather than by ticker symbols, and he manages risk first via risk-parity concepts before seeking return.

What is the All Weather Portfolio in plain English?

A set-and-forget, regime-balanced mix designed to hold up in most macro climates: stocks for growth, long/intermediate Treasuries for slowdowns/deflation, plus gold and broad commodities for inflation. The idea is smoother ride, fewer nasty surprises.

What’s “risk parity” and why does Dalio use it?

Instead of allocating dollars, you allocate risk contribution. Lower-vol assets (bonds) get more capital; higher-vol assets (equities/commodities) get less, so each sleeve pulls its fair share of total portfolio risk. Result: more balanced behavior across cycles.

What’s the difference between All Weather and Pure Alpha?

All Weather = strategic, diversified beta aimed at resilience across regimes. Pure Alpha = active global-macro bets (long/short across assets) seeking uncorrelated absolute returns using proprietary research/models. One is a permanent core; the other is a skill strategy.

How can a DIY investor approximate All Weather with ETFs?

Use broad, liquid funds:

Equities: total U.S. + international (or a global stock ETF)

Bonds: long-term U.S. Treasuries + intermediate Treasuries

Inflation hedges: gold ETF + broad commodities ETF

Rebalance periodically and mind taxes/trading costs.

What’s a sample All Weather-style allocation?

A commonly cited template: 30% stocks, 40% long Treasuries, 15% intermediate Treasuries, 7.5% gold, 7.5% commodities. Treat it as a starting point, then adjust for your risk tolerance, taxes, and access to instruments.

Should I use leverage like some risk-parity funds?

Leverage can align expected returns of low-vol assets with equities—but it adds complexity, financing costs, and blow-up risk. If you’re not fully fluent with margin, futures, and stress testing, don’t use leverage; instead scale allocations to comfort.

How often should I rebalance?

Simple rule: calendar (e.g., semiannual/annual) or band rebalancing (e.g., when any sleeve drifts ±20% of its target weight). Bands reduce churn and taxes while keeping risk on-target.

Where does Dalio’s “Economic Machine” fit into investing?

It’s a lens: short-term debt cycles, long-term debt cycles, and productivity. Map where growth and inflation are trending; hold a mix that benefits in each quadrant so you don’t have to predict perfectly.

What are common mistakes when copying Dalio?

Chasing performance, skipping bonds, underweighting inflation hedges, rebalancing too rarely (or too often), and ignoring after-tax realities. Another big one: expecting equity-like booms in all markets—resilience ≠ maximum upside.

Who is All Weather best for—and who should avoid it?

Best for investors who want smoother, rules-based compounding and can tolerate times when a single roaring asset (e.g., U.S. stocks) leaves a balanced mix behind. Poor fit if your mandate is aggressive equity outperformance every year.

What’s a simple “start today” checklist?

Define goals/time horizon → pick low-cost, broad ETFs for each sleeve → set target weights (risk-aware) → choose a rebalance rule → automate contributions → journal decisions → review annually with a pre-mortem/post-mortem mindset.

Conclusion: Key Takeaways

Ray Dalio’s investment principles offer a comprehensive framework for navigating the complexities of the financial markets. By understanding and applying these principles, investors can enhance their strategies and potentially achieve more consistent results.

Key takeaways include:

- Embracing Radical Transparency:

- Fosters open communication and honest self-assessment.

- Leads to better decision-making and stronger relationships.

- Building a Balanced Portfolio:

- Implementing the All Weather Portfolio principles can help withstand various economic conditions.

- Risk parity ensures balanced exposure across asset classes.

- Understanding the Economic Machine:

- Provides insights into how economic cycles impact asset performance.

- Enables proactive adjustments to investment strategies.

- Adopting a Systematic Approach:

- Reduces emotional biases.

- Enhances consistency and scalability of investment decisions.

- Learning from Failures:

- Transforming mistakes into learning opportunities.

- Continuous improvement through reflective learning.

- Incorporating Mindfulness Practices:

- Improves focus and stress management.

- Enhances decision-making abilities.

Final Thoughts on Relevance in Today’s Investing Environment

In today’s rapidly changing and often volatile financial markets, Dalio’s principles are more relevant than ever. The emphasis on diversification, risk management, and systematic processes provides a solid foundation for navigating uncertainty. Additionally, the focus on personal development and learning from failures can lead to long-term success beyond just financial gains.

By integrating these principles into your investment approach, you can build a more resilient portfolio, make more informed decisions, and develop the adaptability needed to thrive in various market conditions.

Encouragement to Explore and Apply Dalio’s Strategies

As you continue your investment journey, consider exploring Ray Dalio’s strategies further:

- Read Dalio’s Books:

- Principles: Life & Work for insights into his management and investment philosophies.

- Principles for Navigating Big Debt Crises for understanding economic cycles.

- Apply the Principles:

- Start by implementing small changes in your investment approach.

- Reflect on the outcomes and adjust as necessary.

- Engage with Investment Communities:

- Join forums or groups where you can discuss ideas and gain feedback.

- Stay Committed to Learning:

- The financial markets are ever-evolving; continuous education is key.

Your investment journey is a marathon, not a sprint. By integrating Ray Dalio’s proven principles, you can enhance your ability to navigate the financial markets confidently and achieve your long-term financial objectives.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.