Peter Lynch is widely regarded as one of the most successful and influential growth investors of all time. As the manager of the Fidelity Magellan Fund from 1977 to 1990, Lynch delivered staggering returns, growing the fund’s assets from $18 million to $14 billion. His ability to pick stocks and uncover hidden gems in the market made him a legendary figure in the world of investing. What made Lynch’s approach stand out was its simplicity and accessibility—his strategies weren’t reserved for Wall Street insiders. Instead, he encouraged everyday investors to tap into their own experiences and insights.

source: FREENVESTING on YouTube

During his tenure, Lynch averaged a return of 29.2% annually, a performance that far outpaced the overall market. This remarkable achievement earned him the reputation of being one of the greatest investors of his generation. Lynch’s methods were built on sound principles and, most importantly, could be applied by anyone with a bit of research and discipline.

Overview of Peter Lynch’s Success

We’ll explore the investment strategies that made Peter Lynch so successful and provide actionable tips for readers who want to apply his methods in their own portfolios. Lynch’s approach to investing was built on a foundation of common sense, thorough research, and the idea that anyone can find great investment opportunities by simply paying attention to the world around them. By focusing on growth stocks—companies with the potential to increase their profits significantly—Lynch consistently found investments that offered tremendous upside.

Whether you’re new to investing or have years of experience, understanding Lynch’s growth investing strategies can help you make better decisions in the stock market. From his famous mantra, “Invest in what you know,” to his emphasis on finding tenbaggers (stocks that grow tenfold), Lynch’s approach is both practical and rewarding.

Key Principles of Peter Lynch’s Approach

One of the key principles that Lynch popularized is the idea of “invest in what you know.” Rather than relying solely on complex financial models or expert advice, Lynch believed that everyday observations could lead to some of the best investment opportunities. For example, if you notice a product or service that’s gaining popularity or a company that’s consistently delivering quality, that might be worth looking into as a potential investment. Lynch found many of his best stock picks by simply paying attention to the businesses and brands he encountered in his daily life.

Another important aspect of Lynch’s strategy is his focus on growth stocks—companies that have the potential to grow their earnings at an above-average rate. Unlike value investors, who look for stocks that are underpriced relative to their intrinsic value, growth investors like Lynch focus on finding companies that are poised for significant expansion. He wasn’t afraid to invest in companies that others might overlook, often discovering undervalued growth opportunities before the broader market caught on.

- “Invest in What You Know”: Lynch encouraged investors to look for opportunities in companies they interact with in their everyday lives.

- Focus on Growth Stocks: Lynch targeted companies with the potential for rapid earnings growth, often before the market realized their potential.

- Long-Term Vision: Rather than making short-term trades, Lynch advocated for holding onto quality stocks for the long haul, allowing time for their growth potential to fully materialize.

Tip for Best Practices: Start by looking at the companies you already know and use. Pay attention to the brands and services you encounter daily. Do they seem to be growing in popularity? Are they innovating? That’s where you might find your next investment opportunity.

The “Invest in What You Know” Principle

Lynch’s Philosophy: Invest in What You Understand

One of Peter Lynch’s most famous investing principles is the idea of “invest in what you know.” Lynch believed that individual investors had a unique advantage over professionals in spotting investment opportunities simply by paying attention to their everyday lives. His approach was built on the notion that if you use a product, like a service, or notice a business gaining traction, you already have valuable insights into that company. You don’t need to be a financial expert to recognize a good investment opportunity—you just need to observe what’s happening around you.

This philosophy democratized investing, showing that anyone, regardless of financial expertise, could participate in the stock market. Lynch felt that people often overlooked companies right under their noses—products they use, stores they shop at, or services they depend on daily. Familiarity with a brand, product, or service can be the starting point for deeper research and potentially discovering a great investment.

Identifying Potential Investments Through Personal Experiences

Lynch’s strategy of investing in companies you’re already familiar with is refreshingly simple but powerful. To implement it, start by paying attention to the products and services you use or notice others using more frequently. Are you seeing more of a particular brand at your local stores? Do you find yourself gravitating toward a certain type of app or technology? These daily observations can serve as an initial screening tool for potential investments.

Consumer trends are also a valuable source of insight. For instance, if you notice a shift in the types of food people are buying (such as plant-based alternatives) or the way they are spending their money (like the rise of subscription services), it might signal a shift in market preferences. Spotting these changes early could lead you to companies poised for growth.

Lynch’s idea was to combine personal experiences with deeper research. Once a company catches your eye based on your observations, it’s important to dig into its fundamentals: Are its earnings growing? Is it well-managed? Does it have a competitive advantage? The key is to start with what you know, and then conduct due diligence to confirm whether it’s a sound investment.

- Personal Experiences: Start with the brands, products, or services you use regularly.

- Consumer Trends: Notice broader trends that indicate shifts in how people spend money.

- Research Further: Use your observations as a starting point, then dig into the company’s fundamentals.

Tip for Best Practices: Keep a mental or physical list of products and services you use frequently. Regularly revisit this list to see which companies are growing or innovating, and then research them as potential investments.

Example: How Lynch’s Observations Led to Investment Success

A perfect example of Peter Lynch’s “invest in what you know” philosophy in action is his investment in Dunkin’ Donuts. Lynch was already a fan of the brand and often visited their stores. Noticing long lines and strong customer loyalty at Dunkin’ Donuts, he realized that the company had a winning formula. It was simple but effective: people loved their coffee and donuts, and the business model was scalable. This observation led Lynch to dig deeper into the company’s financials, where he found that it had solid earnings growth, a loyal customer base, and room to expand.

Convinced that Dunkin’ Donuts was poised for long-term success, Lynch made a significant investment in the company, which paid off handsomely. The stock soared as Dunkin’ Donuts expanded, illustrating the power of investing in businesses that you interact with and understand.

Another classic Lynch example is his investment in Hanes. The company was known for its affordable and high-quality pantyhose, and Lynch noticed Hanes products consistently selling out in department stores. After further research, he saw that Hanes had a solid brand, good management, and significant potential for growth in the apparel industry. His investment in Hanes turned out to be another major success.

- Dunkin’ Donuts: Lynch’s personal experience as a customer led to an investment that capitalized on strong brand loyalty and business expansion.

- Hanes: Observing strong product demand in stores, Lynch recognized a growth opportunity and made a successful investment.

- Everyday Insights: Lynch’s success shows how simple observations from daily life can lead to highly profitable investments.

Tip for Best Practices: Before jumping into any investment, ask yourself: Do I understand this business? Is this something I use or notice often? If the answer is yes, it might be worth looking into further.

Identifying “Tenbaggers”

What is a “Tenbagger”?

One of Peter Lynch’s most famous concepts is the idea of the “tenbagger.” In simple terms, a tenbagger is a stock that increases tenfold in value, providing investors with a 1,000% return on their initial investment. Lynch coined the term while managing the Fidelity Magellan Fund, where he identified numerous stocks that turned into tenbaggers, significantly boosting his fund’s overall performance. For Lynch, finding tenbaggers was one of the most exciting parts of investing—these stocks had the potential to completely transform a portfolio’s returns.

Lynch didn’t believe that tenbaggers were the exclusive domain of Wall Street insiders. He argued that everyday investors could find these rare gems if they paid attention, conducted thorough research, and understood what made a stock capable of multiplying its value. The idea behind tenbaggers was rooted in long-term growth and the potential for companies to keep expanding their business models, increasing revenues, and enhancing profitability over time.

Characteristics of Potential Tenbaggers

Finding a tenbagger isn’t easy, but certain characteristics can help identify stocks with the potential to become one. Lynch focused on several key factors when searching for these extraordinary growth opportunities.

- Strong Earnings Growth: One of the primary indicators of a potential tenbagger is a company with consistent earnings growth. Lynch looked for businesses that could grow their earnings by a significant margin year after year. This kind of growth often signals that a company is expanding its market share, launching successful products, or improving operational efficiency. Investors should pay close attention to companies that can demonstrate this consistent upward trajectory in their financials.

- Scalable Business Model: Another crucial characteristic is a scalable business model. Companies that can replicate their success across different regions, products, or markets have a better chance of growing exponentially. A scalable model allows a business to add new customers, open new locations, or develop new products without drastically increasing costs, making it easier to achieve higher profits as the company expands.

- Market Positioning and Competitive Advantage: Companies that dominate a particular niche or have a strong competitive advantage are more likely to become tenbaggers. Whether it’s through brand recognition, a unique product, or proprietary technology, companies that differentiate themselves from competitors and establish a solid position in their market have the potential to grow much larger over time. Lynch was always on the lookout for companies that had a clear advantage in their industry, as this would help sustain their growth in the long run.

- Management Quality: Great companies need great leadership. Lynch emphasized the importance of strong, forward-thinking management teams that could steer a company toward sustained growth. Companies led by visionary leaders who understand the market, adapt to changes, and innovate tend to perform better over the long term.

Tip for Best Practices: Look for companies with a combination of consistent earnings growth, scalable business models, and a strong market position. These characteristics often signal the potential for long-term, exponential growth.

Case Studies: Examples of Tenbaggers

Peter Lynch’s ability to identify tenbaggers set him apart from other investors. Two well-known examples of companies he identified as having tenbagger potential are Apple and Nike.

Apple

When Lynch first spotted Apple, it was far from the tech giant we know today. Back in the early days, Apple was still growing and facing intense competition from other tech companies. However, Lynch recognized Apple’s innovative product lineup and the brand’s ability to create loyal customers. As Apple continued to innovate and release industry-changing products like the iPod, iPhone, and MacBook, its stock price skyrocketed. Over time, Apple became one of the most valuable companies in the world, providing early investors with astronomical returns.

Nike

Another classic tenbagger identified by Lynch was Nike. At the time Lynch invested, Nike was a rising star in the athletic footwear and apparel industry, but it hadn’t yet reached its global dominance. Lynch saw the company’s potential to capitalize on the growing trend of fitness and sports culture. Nike’s brand recognition and marketing strategies, including partnerships with high-profile athletes, helped it gain market share rapidly. The company continued to expand into new product lines and markets, becoming a global icon in sportswear. Investors who followed Lynch’s lead in investing in Nike enjoyed massive returns as the stock price grew more than tenfold.

- Apple: Lynch saw Apple’s innovative potential early on, and the company’s consistent product innovation led to a tenfold increase in its stock value.

- Nike: Lynch recognized Nike’s ability to capitalize on growing fitness trends, turning it into a global powerhouse and a tenbagger for patient investors.

- Visionary Companies: Both examples show how identifying companies with strong management, innovation, and a scalable business model can lead to tenfold returns.

Tip for Best Practices: Keep an eye out for companies that are industry leaders in innovation and have a brand that resonates with consumers. These companies often have the potential to become the next tenbagger.

Research, Due Diligence, and Understanding the Story

Lynch’s Emphasis on Thorough Research

One of the fundamental pillars of Peter Lynch’s investing success was his commitment to thorough research and due diligence before making any investment decisions. Lynch believed that it wasn’t enough to just look at a company’s stock price or financials; he emphasized the importance of truly understanding a company’s “story.” For Lynch, every company had a narrative, and successful investing was about finding companies with compelling stories that aligned with their potential for growth. By delving deep into a company’s operations, management, and competitive landscape, Lynch was able to make highly informed investment choices.

Understanding a company’s story means going beyond the numbers. It’s about grasping what makes the company tick—how it generates revenue, where its growth opportunities lie, and whether its competitive advantages can be sustained. Lynch encouraged investors to approach stock picking like detectives, piecing together information that would help them form a clear picture of the business’s long-term potential. He believed that if you understood the story well enough, you could make more confident and successful investment decisions.

Key Research Factors: What to Look For

When conducting research, Lynch focused on a few key factors to determine whether a company had the potential to deliver long-term growth. These factors included:

- Earnings Growth: A company with steady and significant earnings growth is often a good sign of a healthy and expanding business. Lynch looked for companies that could grow their earnings consistently over time, as this typically led to increasing stock prices. However, it’s not just about the raw growth numbers—Lynch wanted to understand the drivers behind that growth and whether they were sustainable.

- Competitive Advantage: Lynch always sought out companies with a competitive moat—something that gave them an edge over their rivals. This could be anything from a strong brand, innovative technology, or a unique product offering. A company with a solid competitive advantage is more likely to continue expanding and fend off competition, making it a more secure investment.

- Market Position: A company’s position within its industry is another critical research factor. Is it a market leader or a rising star in its sector? Understanding where a company fits in its industry helps to gauge its growth potential and whether it can capture more market share over time.

- Management Quality: Lynch put a high premium on management teams that were both capable and honest. A great company can be dragged down by poor leadership, so it was essential for Lynch to invest in companies with management teams that had a clear vision and the ability to execute. He believed that management’s track record and decision-making skills could make or break a company’s long-term success.

Tip for Best Practices: When researching a company, focus on these key factors—earnings growth, competitive advantage, market position, and management quality. They provide a holistic view of the company’s potential.

Example: Dunkin’ Donuts

A great example of Lynch’s research-driven approach is his investment in Dunkin’ Donuts. Lynch was already familiar with the brand, noticing its popularity and how consistently busy its stores were. However, he didn’t rely solely on this observation. Lynch conducted deep research into the company’s financials, growth strategy, and competitive position. He saw that Dunkin’ Donuts had strong earnings growth and a scalable business model that allowed it to expand rapidly while maintaining profitability.

Lynch also recognized Dunkin’s competitive advantage in the coffee and donut market. While there were plenty of local and national competitors, Dunkin’ Donuts had a strong brand identity and customer loyalty, which allowed it to hold a dominant market share. On top of that, the company’s franchise model enabled it to expand quickly without overextending itself financially. Lynch saw that Dunkin’ had the right ingredients for long-term growth and decided to invest.

That investment paid off handsomely as Dunkin’ Donuts continued to expand and deliver strong returns for its shareholders. Lynch’s ability to combine personal observation with deep research gave him the confidence to back the company for the long haul, demonstrating how understanding a company’s story can lead to significant investment success.

- Dunkin’ Donuts: Lynch’s research confirmed the company’s scalable model and strong market position.

- Franchise Model: Dunkin’ used franchising to grow efficiently, which Lynch identified as a key factor for its success.

- Competitive Advantage: Dunkin’ had strong brand recognition and customer loyalty, which gave it an edge over competitors.

Tip for Best Practices: Use Lynch’s approach of combining personal observations with thorough research. Look beyond the surface to understand what makes a company thrive and whether its growth potential is sustainable.

The Power of Patience and Avoiding the Herd Mentality

Lynch’s Belief in Long-Term Investing

Peter Lynch was a firm believer in the power of patience when it came to investing. In his view, the real gains in the stock market were made by holding onto stocks for the long haul, allowing their growth potential to fully play out. Lynch wasn’t interested in quick trades or trying to time the market. Instead, he focused on finding high-quality companies with strong growth prospects and then holding onto them long enough for their value to appreciate significantly. By staying invested through market fluctuations and downturns, Lynch avoided the costly mistake of selling too soon or reacting to short-term volatility.

One of Lynch’s favorite sayings was that “time is on your side when you own shares of superior companies.” He knew that even the best companies would experience periods of underperformance or temporary setbacks. However, as long as the fundamentals remained intact, these companies had the potential to recover and continue growing. By holding onto his positions, Lynch was able to capture the maximum growth that many short-term investors missed out on by selling too early.

- Long-Term Growth: Lynch’s approach emphasized holding stocks long enough for their true value to materialize.

- Riding Out Volatility: Patience allowed Lynch to avoid selling during market dips, which helped him benefit from long-term appreciation.

- Time Is an Asset: For superior companies, time is often the most valuable factor in achieving high returns.

Tip for Best Practices: When you find a high-quality stock, hold onto it for the long term, even if the market experiences short-term fluctuations. Selling too soon can cause you to miss out on substantial gains.

Avoiding the Herd Mentality

Another key aspect of Lynch’s success was his ability to avoid the herd mentality. Lynch believed that investors often made poor decisions when they followed the crowd, whether it was chasing the latest stock trend or panicking during a market downturn. He cautioned against getting swept up in the excitement of hot stocks or following what everyone else was doing. Instead, Lynch emphasized the importance of sticking to your own research and maintaining a disciplined approach to investing.

Lynch was known for ignoring hype and focusing on fundamentals. He sought out undervalued companies that weren’t necessarily in the spotlight but had strong earnings growth and good business models. While many investors were chasing the latest tech stocks or riding the wave of industry trends, Lynch quietly found opportunities in less glamorous sectors. This contrarian approach often paid off, as he was able to buy stocks at lower prices while others were overpaying for the popular names of the day.

- Independent Thinking: Lynch stressed the importance of making investment decisions based on your own research, not on market trends.

- Contrarian Investing: Lynch often found success by going against the crowd, focusing on stocks that were overlooked or undervalued.

- Avoiding Hype: Rather than chasing the latest hot stock, Lynch stuck to companies with strong fundamentals, even if they were out of favor with the market.

Tip for Best Practices: Don’t get caught up in the latest market trends or popular stocks. Stay disciplined and make decisions based on your own research and the fundamentals of the company.

Example: Ford and Regional Banks

A great example of Lynch’s patience and ability to avoid the herd mentality was his investment in Ford Motor Company. During a time when many investors were losing faith in the auto industry, Lynch saw potential in Ford’s ability to recover from its challenges. While others were selling off their shares due to short-term concerns, Lynch held onto his position, confident in the company’s long-term growth prospects. His patience paid off when Ford’s stock rebounded, delivering significant gains for Lynch and his investors.

Lynch’s contrarian approach also extended to sectors that many investors overlooked. For example, he recognized the value in regional banks at a time when larger banks and other industries were getting most of the attention. Lynch saw that these smaller banks had strong local markets, stable earnings, and room for growth. By avoiding the crowd and investing in regional banks, he was able to capitalize on their growth when others had ignored them.

- Ford: Lynch’s patience with Ford allowed him to benefit from the company’s long-term recovery, despite short-term challenges.

- Regional Banks: While others focused on larger financial institutions, Lynch found success in smaller regional banks with strong local markets.

- Contrarian Success: These examples highlight Lynch’s ability to stick with his own analysis rather than following popular trends.

Tip for Best Practices: Be willing to look beyond the mainstream and focus on companies or sectors that are overlooked by the market. Some of the best opportunities can be found in areas that others are ignoring.

How to Invest Like Peter Lynch — 12-Question FAQ (Growth, GARP, Tenbaggers)

1) What’s Peter Lynch’s core philosophy in one line?

“Invest in what you know,” then do the homework: find understandable businesses with real growth run by capable managers—bought at reasonable prices—and hold while the story plays out.

2) How does “invest in what you know” actually give me an edge?

Your day-to-day life surfaces early signals—crowded stores, addictive apps, products friends rave about. Use these as leads, not buys: start a watchlist, then validate with fundamentals, unit economics, and competitive position.

3) What stock types did Lynch track and why does it matter?

He grouped picks into fast growers, stalwarts, slow growers, cyclicals, turnarounds, and asset plays. Knowing the type sets expectations (e.g., cyclicals look cheapest near peak earnings; stalwarts rarely 10x but defend capital).

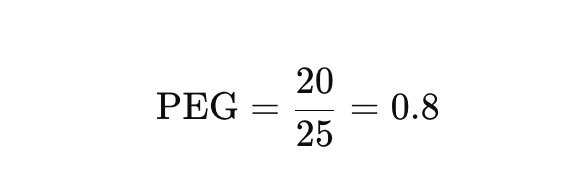

4) What is GARP and how do I use the PEG ratio?

Growth At a Reasonable Price balances growth and valuation. PEG = (P/E) ÷ (earnings growth rate). Around 1.0 ≈ fair; <1.0 can be attractive if growth is durable and accounting is clean.

5) What’s a “tenbagger” and how do I spot one early?

A 10x winner often starts as a small, simple, scalable business with: rapid same-store or user growth, long runway, rising margins, and low debt. You’ll see it in the real world first—then confirm with numbers.

6) What’s Lynch’s “two-minute story” test?

If you can’t explain how the company grows (drivers), why it wins (moat), and what could kill the thesis—in ~120 seconds—you don’t know it well enough to own it.

7) Which numbers did Lynch watch first?

Sales/earnings growth consistency, inventory vs. sales (retail/CPG), debt-to-equity (low is safer for growers), cash generation vs. accounting earnings, store/unit economics, and insider ownership/buybacks.

8) When is a beloved product still a bad stock?

When expectations are already priced in: sky-high P/S with decelerating growth, PEG ≫ 1, shrinking TAM, or competitive pressures compressing margins. Great company ≠ great stock at any price.

9) How many positions and how big should they be?

Concentrate more in your best-understood ideas; keep starter sizes for developing stories. Add on execution (beats, unit economics) rather than on mere price dips.

10) What are Lynch-style sell signals?

The story changes: slowing comparable growth, margin erosion, loss of moat, reckless M&A, rising leverage, accounting red flags, or the stock vaults far beyond fundamentals (PEG balloons). Trim or exit.

11) How do I research like Lynch without Wall Street access?

Read 10-Ks/10-Qs, calls, trade mags, app-store reviews, Glassdoor (culture), channel checks, store walks, and competitor pricing. Track a thesis dashboard: 3–5 KPIs that must trend right.

12) Biggest behavioral mistakes to avoid?

Chasing fads, averaging down broken stories, confusing volatility with risk, and selling winners too early. Patience with proven growers—and impatience with deteriorating ones—is the Lynch edge.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

rmation

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized reproduction, republication, or commercial use of this content without express written permission is strictly prohibited.

8. Governing Law, Arbitration & Severability BINDING ARBITRATION:

Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.