Equity optimization strategies are a primary focus on this investing blog.

However, I’ve mostly spent time unpacking familiar ones such as factor focused quality, value, momentum, minimum volatility and shareholder yield.

Today we’re in for a real treat as we have an opportunity to learn about a unique approach.

Intangible Value.

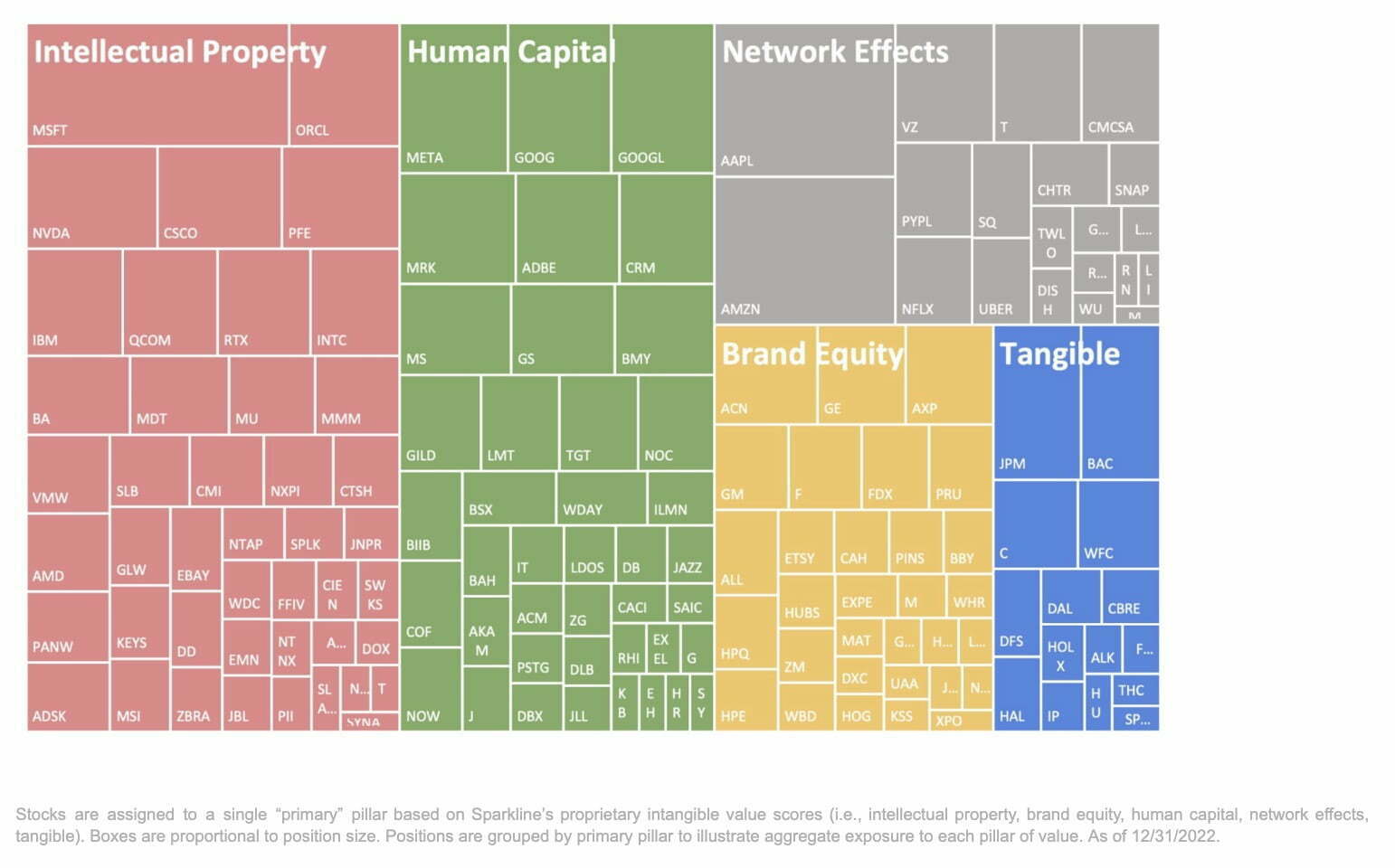

It specifically zeroes in on intangible assets including intellectual property, brand equity, human capital, and network effects.

With this in mind, I’m thrilled to welcome Kai Wu of Sparkline Capital to discuss Sparkline Intangible Value ETF (Ticker ITAN) as part of the “Strategy Behind The Fund” series.

Without further ado, let’s turn things over to Kai!

Meet Kai Wu of Sparkline Capital

My interest in financial markets began with my college economics thesis.

Against the backdrop of the 2008 Global Financial Crisis, I put together a study of hundreds of historical crises, showing how imbalances in asset prices and credit led to elevated crisis risk.

From there, I joined Grantham, Mayo, Van Otterloo (GMO), one of the pioneers of quantitative value investing and famous for its work on financial bubbles.

At GMO, I was fortunate to have the opportunity to travel the world, working with teams across asset classes in Sydney, London, San Francisco and Boston.

In 2014, I left GMO and found myself engaged in crypto trading.

These were the early days when arbitrages were plentiful but not scalable.

I ultimately decided to join a former GMO coworker, and we co-founded a quantitative hedge fund specializing in futures and options.

The firm was successful, growing to a few hundred million dollars in AUM.

In 2018, I left to found my own firm, Sparkline Capital.

Sparkline sets out to answer a trillion dollar question that has vexed me since I started my career: “What explains the last decade’s underperformance of value investment strategies?”

After many years working on this problem, we believe we finally have a solution in our “intangible value” strategy.

Reviewing The Strategy Behind ITAN ETF (Sparkline Intangible Value ETF) with its creator Kai Wu

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of ITAN ETF?

For those who aren’t necessarily familiar with an “intangible value” style of investing, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Let’s start with the definition of value investing.

Value investors seek to buy low and sell high against some measure of fair value.

The style originated in the 1930s with Ben Graham, when the economy was primarily industrial, comprised of utilities, railroads and textile mills.

Of course, the economy has transformed over the past century.

Value today is increasingly driven not by physical capital, but intangible assets, such as intellectual property, brand equity, human capital, and network effects.

Today, most companies in the S&P 500 are intangible-intensive, such as Apple, Google, or Coca-Cola. And intangible investment is only increasing as a share of GDP, so it is unlikely that this trend will abate anytime soon.

The problem is that most investors rely on obsolete accounting data, which has failed to evolve with the rise of the intangible economy.

Accounting statements make only inconsistent and limited disclosure as to intangible assets.

Thus, it is no surprise that traditional value strategies based on metrics such as price / book that omit intangibles have struggled.

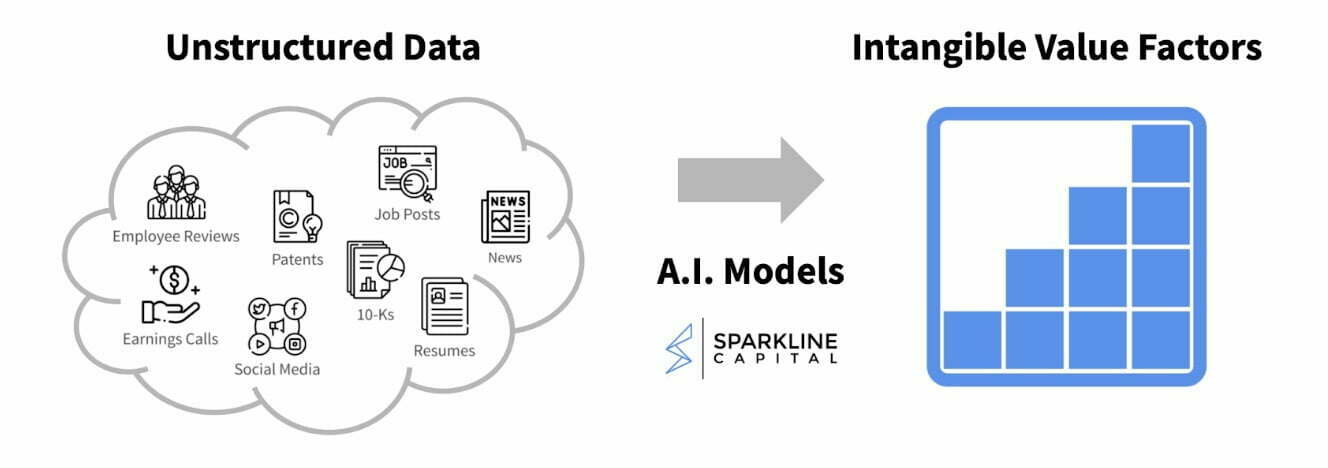

Fortunately, the rise of the digital economy has also led to an explosion of new alternative data sources.

Datasets such as patents, social media and job postings can provide insight into the various intangible pillars.

However, this data is unstructured, meaning it is not amenable to basic statistical analysis.

Thus, we have spent years building expertise in artificial intelligence tools, which allow us to process this natural language data.

To summarize, the “intangible value” style of investing is just value investing but where intrinsic value also includes intangible assets.

In our view, the principles of value investing are timeless, we just need the metrics to evolve.

Unique Features Of Sparkline Intangible Value ETF ITAN

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

The Fund invests in large- and mid-cap U.S. equities.

Our models generate valuation scores for each of the 1,000 largest stocks in the U.S..

The portfolio is then composed of the 150 most attractive companies from this set.

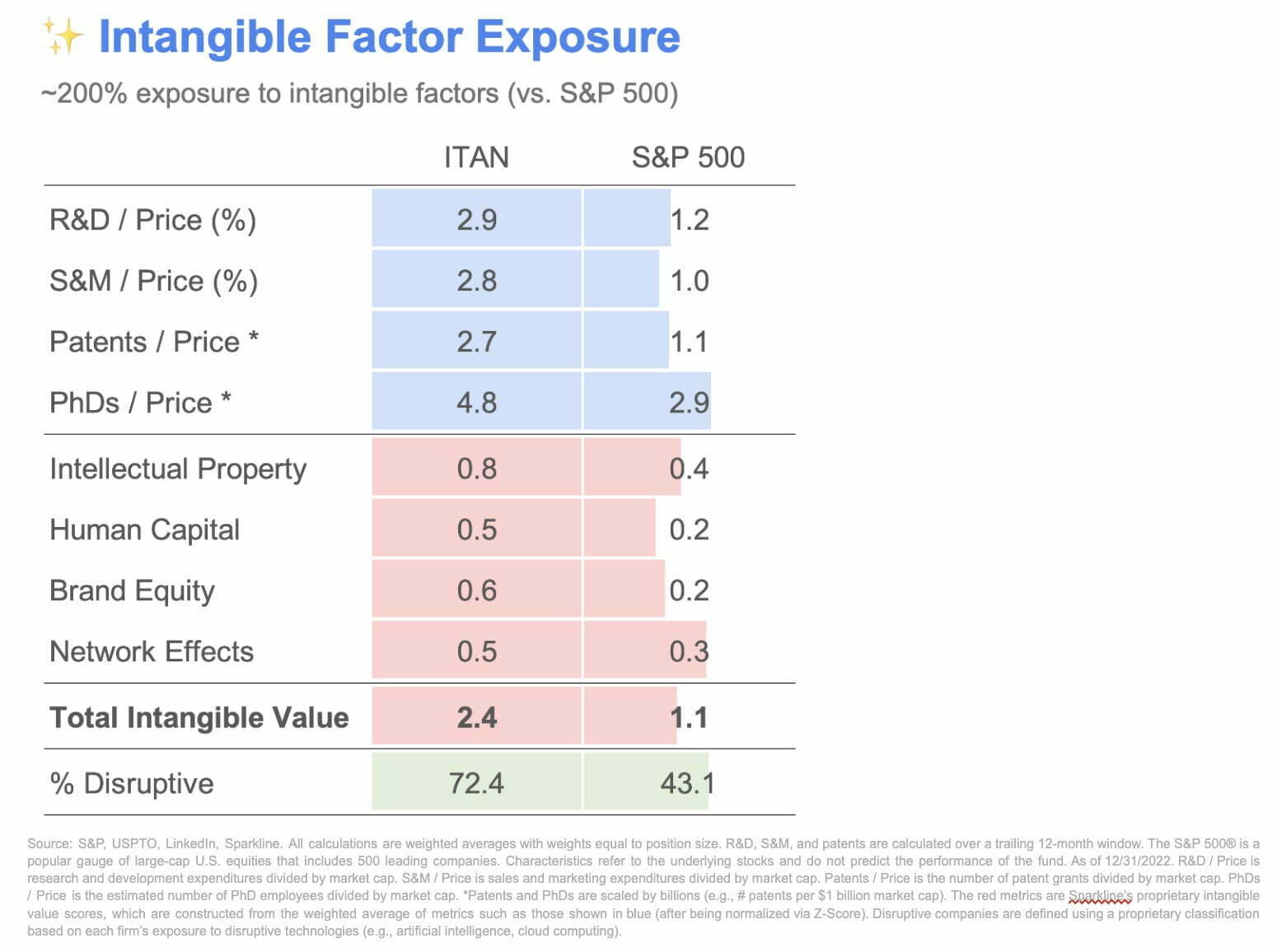

By design, the portfolio offers enhanced exposure to intangible value characteristics.

For example, the number of patents per dollar invested is around 2.5x that of the S&P 500.

We obtain similar advantages for PhDs, R&D, marketing expenditures, and other intangible metrics.

In other words, it invests in companies with stronger IP, brands, human capital and network effects per share.

The strategy is always ~100% invested in stocks, but the relative weightings are rebalanced on a roughly monthly basis in response to changes in prices and fundamentals (e.g., new patent grants, new hires, viral marketing).

While it is fully model driven, it is technically an active strategy (opposed to indexed).

This gives us the ability to upgrade the strategy as new research and datasets become available.

source: Excess Returns on YouTube

What Sets ITAN ETF Apart From Other Equity Funds?

How does your fund set itself apart from other “optimized equity” funds being offered in what is already a crowded marketplace?

What makes it unique?

We are the only ETF purely dedicated to intangible value.

While there are other funds focused on specific pillars, such as company culture, disruptive innovation, or brand, no other fund exists that puts all these ideas together in a consistent way.

Furthermore, our strategy builds in a valuation framework.

Thus, unlike many single-pillar thematic funds (e.g., disruptive innovation), we only own companies if we believe they are reasonably priced.

We are not wedded to any one pillar, but have the ability to rotate as valuations fluctuate.

As we recently saw with the rise and fall of disruptive innovation stocks, valuations matter!

Finally, while some other strategies utilize accounting data to estimate intangibles, our measures of intangible value incorporate unstructured data using natural language processing models.

There are few funds utilizing these cutting-edge techniques.

We believe this gives us a technical advantage over many of the others in the marketplace.

What Else Was Considered For ITAN ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We initially considered implementing the strategy industry-neutral.

This would ensure that we don’t deviate from the S&P 500 industry weightings.

However, we ultimately decided to let the industry-weights emerge bottoms-up based on fundamentals and valuations.

Ultimately, we concluded that the standard industry classifications are deeply flawed.

Most companies cannot be put in a single box.

For example, Amazon is both a retailer and (through AWS) an enterprise tech company.

Furthermore, tech is now a key part of the economy, so the definition of the IT sector is increasingly blurred.

We didn’t want to constrain our strategy based on an arbitrary, reductive classification scheme.

source: Flirting With Models on YouTube

When Will ITAN ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

One major challenge for investors today is that the market environment often shifts between “value and growth.”

For example, many investors rotated into energy and other value stocks last year, just to be whipsawed this month.

We believe factor timing is challenging and that valuation is the best way to navigate through these cycles.

Thus, part of our goal is for the portfolio to not have biases toward certain market conditions, at least over long periods of time.

Our hope is that investors can count on us for the long-term, without having to worry about what market condition we will do better or worse in. We are not a thematic fund suitable for trading.

That said, the Fund does currently have a relatively high exposure to technology companies and limited exposure to energy and materials stocks.

Thus, if energy prices surge again, the Fund will likely underperform.

And if rate hikes abate and tech stocks rip, we will outperform.

However, we view these sorts of macro shocks as mostly unpredictable (at least relative to what the market is already pricing in) over a short run.

And in the long run, they largely wash out in the cycle.

Furthermore, remember that the strategy is active and will rotate over time.

In our backtests, the strategy actually had basically the opposite positioning in the dot-com bubble.

This is because, at the time, tech valuations were extremely overextended against a relatively limited base of fundamental value (which has grown a lot over the past two decades).

source: CFA Institute on YouTube

Why Should Investors Consider Sparkline Intangible Value ITAN ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Low cost beta has an important place in a portfolio.

In equities, these tend to be market-cap weighted indexes following rigid quarterly rebalance rules.

Market cap weighting perversely tends to buy high and sell low, as it increases its weighting as stocks rise in price.

In the dot-com bubble, the S&P 500 increased its weight to the tech sector as the bubble inflated, leading to big losses in the bust.

We believe investors should instead have a value orientation, whereby they consider the price of each stock relative to its fundamentals.

As mentioned, our research shows that intangible assets tend to be frequently undervalued, providing ample opportunities for outperformance.

Replacing some (or all) of one’s index exposure with our Fund can help increase the portfolio’s overall exposure to firms with undervalued intangible assets, which we believe are well positioned to outperform the market.

source: Excess Returns on YouTube

How Does ITAN ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

Our clients use ITAN in a few different ways.

Some investors (such as myself) use it as a core allocation.

The strategy is well diversified (150 names), while providing a more sensible weighting scheme than market cap.

We have conviction that undervalued intangible assets will produce market-beating returns.

Other investors utilize the Fund as a satellite to their core portfolio.

They view ITAN as a way to tilt their portfolio toward stocks with more intangible value.

This gives them a lever to dial up their portfolio’s exposure to intangible value characteristics, but only up to their desired amount.

Importantly, we have found the intangible value factors to have low correlations to traditional style factors (e.g., P/B, momentum, size, quality).

Thus, for investors already using these other factors, mixing in ITAN could be helpful.

We have recently had several investors tell us they are funding ITAN from their “growth” allocation (e.g., QQQ, ARKK*).

Like many growth funds, ITAN owns innovative companies in industries such as software, semiconductors, and healthcare.

However, by paying great attention to valuation, it hopes to employ a more disciplined approach – disruption at a reasonable price, not at any price.

* Not a recommendation to buy or sell securities and positions are subject to change.

The Cons of ITAN ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

The biggest point of criticism is that the top 10 names in the fund look “boring,” as they tend to be companies like MSFT and GOOG*.

This is a function of our weighting scheme.

As mentioned, we select the top 150 from the 1000 largest U.S. stocks.

However, we also weight by both value score and size.

Thus, all else equal, we put more weight behind larger firms.

We considered equal-weighting the portfolio.

However, this would introduce a heavy bias toward the “small cap factor.”

For better or worse, most investors compare us against the S&P 500.

We did not want our relative performance to be driven so heavily by the performance of large vs. small stocks.

In addition, as a quantitative fund manager, we care about how aggregating many small advantages across a portfolio compounds into a big advantage.

While not every holding will be better in every way, the Fund has superior intangible value characteristics at the portfolio level.

In other words, it is less about any one company and more about how they fit together in a portfolio.

* Not a recommendation to buy or sell securities and positions are subject to change.

The Pros of ITAN ETF

On the other hand, what have others praised about your fund?

Our Fund appeals to sophisticated investors with an appreciation for data-driven research.

Over the past few years, we’ve published several papers on intangible investing.

For example, our last paper showed that firms that invest in influence (via lobbying or political donations) tend to outperform.

Other papers have used social media to identify strong brands, Glassdoor reviews for company culture, and Crunchbase to identify sectors of VC investment.

If applicable, our research insights go into the ITAN strategy.

Thus, to the extent investors find our insights around the intangible economy compelling, the Fund ends up being a good way for them to access this in an efficient and transparent vehicle.

source: Instituto Juan de Mariana on YouTube

Driven By Dedication Towards Independent and Innovative Investment Research

We’ll finish things off with an open-ended question.

Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy?

As mentioned, we are driven by a dedication toward independent and innovative investment research.

If investors are interested in learning more about the strategy, I would highly recommend checking out some of the research papers on our website.

The Intangible Value paper is probably the most relevant, but there several other papers focused on more specific intangible pillars.

Feel free to dive into whatever topic piques your interest!

In terms of current projects, we are currently writing a paper on the big tech layoffs and tech human capital more broadly.

If you’re interested in getting our research as it comes out, you can join our email list here.

ITAN ETF: Review Of The Strategy Behind Sparkline Intangible Value ETF (with Kai Wu) — 12-Question FAQ

What is ITAN in one sentence?

Sparkline Intangible Value ETF (ticker: ITAN) is an actively managed, model-driven U.S. equity strategy that seeks undervalued companies rich in intangible assets—intellectual property, brand equity, human capital, and network effects.

What does “intangible value” mean here?

It’s classic value investing updated for today’s economy: instead of relying mainly on book value and other legacy accounting figures, ITAN estimates intrinsic value by explicitly incorporating hard-to-measure intangibles like patents, R&D, brand strength, employee talent, and network effects.

Why are traditional value metrics insufficient for intangibles?

Financial statements undercount or inconsistently disclose intangibles (e.g., R&D is expensed, brands/human capital rarely appear on balance sheets), so simple ratios like price-to-book can misclassify modern, asset-light businesses; ITAN augments accounting data with alternative, unstructured data.

How does ITAN measure intangibles in practice?

Sparkline applies natural language processing and related AI to large unstructured datasets—patent filings, job postings, social media, corporate disclosures, etc.—to score firms on IP, brand, human capital, and networks, then blends these with valuation to rank securities.

What’s the portfolio construction approach?

From roughly the 1,000 largest U.S. stocks, the models select ~150 with the most attractive “intangible value” profiles; positions are sized using a combination of value score and company size to balance conviction with scalability and turnover costs.

How dynamic is the strategy (rebalancing/updates)?

ITAN stays ~100% invested but refreshes weights on about a monthly cadence as prices, fundamentals, and intangible signals (e.g., new patents, hiring, brand momentum) evolve; the research stack is active, allowing ongoing model improvements.

Is ITAN sector- or industry-neutral?

No—Sparkline chose not to force index-like sector weights; instead, industry exposures emerge bottom-up from fundamentals and valuations to avoid arbitrary classification constraints in a tech-blurred economy.

When might ITAN do relatively well—or struggle?

Because it tilts toward firms with strong, underpriced intangibles, it can benefit when high-quality innovation is rewarded without extreme overvaluation; it can lag in sharp, factor-whipsaw regimes (e.g., sudden commodity spikes favoring energy/materials) or when richly priced “story stocks” lead and valuation discipline is out of favor.

How is ITAN different from “innovation” or single-pillar thematic funds?

ITAN integrates multiple intangible pillars within a valuation discipline—“disruption at a reasonable price”—rather than chasing one theme regardless of price; it’s a systematic value framework adapted to intangibles, not a momentum-driven theme bet.

What are the main pros supporters highlight?

A research-heavy, data-driven process; explicit measurement of intangibles most indexes miss; diversified 150-stock portfolio; historically low correlation of intangible factors to common style tilts (value via P/B, momentum, size, quality), making it a potentially complementary equity sleeve.

What constructive criticism has ITAN received?

Some investors find the top holdings “boring” (e.g., mega-cap platforms) due to sizing by both value score and size; Sparkline intentionally avoids equal-weighting to prevent unintended small-cap factor dominance and to match how many investors benchmark U.S. large/mid equities.

How could investors use ITAN in a portfolio?

As a core equity replacement for cap-weighted U.S. exposure, as a satellite tilt to add intangible value characteristics alongside existing factors, or as a growth replacement for investors seeking innovative companies but with valuation discipline.

Connect With Kai Wu of Sparkline Capital

Website: Sparkline Capital

Fund Page: Sparkline Intangible Value ETF ITAN

Twitter: @ckaiwu

LinkedIn: @ckaiwu

Nomadic Samuel Final Thoughts

I want to personally thank Kai for taking the time to participate in the “Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.