Investing isn’t just a game of chance or a matter of gut feeling—it’s a strategic endeavor rooted in data and analysis. Enter Jim O’Shaughnessy, a pioneer in the realm of quantitative investing. Through his groundbreaking work, particularly his seminal book What Works on Wall Street, O’Shaughnessy has revolutionized how investors approach the markets. This comprehensive guide delves deep into his investment principles and demonstrates how you can apply them to build a resilient, data-driven portfolio.

source: Talks at Google on YouTube

Who is Jim O’Shaughnessy?

Jim O’Shaughnessy is a luminary in the world of quantitative investing. As the founder of O’Shaughnessy Asset Management and the author of the influential book What Works on Wall Street, he has significantly shaped modern investment strategies. O’Shaughnessy’s approach leverages historical data and statistical analysis to uncover investment patterns that consistently outperform the market. His work emphasizes a systematic, data-driven methodology that removes emotional bias from investment decisions, making his strategies both reliable and replicable.

We’ll unpack the investment principles outlined in What Works on Wall Street and demonstrate how you can implement them in your own investment strategy. Whether you’re a seasoned investor seeking to refine your approach or a novice looking to build a solid foundation, understanding O’Shaughnessy’s data-driven methods can significantly enhance your decision-making process and improve your portfolio’s performance.

source: The Investor’s Podcast Network on YouTube

Introduction to Data-Driven Investing

At the heart of O’Shaughnessy’s approach lies a data-driven methodology. By meticulously analyzing decades of market data, O’Shaughnessy identifies factors that have historically led to superior investment returns. This objective approach not only minimizes emotional bias but also focuses on strategies that have stood the test of time. In a world where markets are often influenced by sentiment and speculation, a quantitative, evidence-based approach provides a clear edge.

The Importance of Data-Driven Investing

Why Data Matters

In the unpredictable world of investing, relying solely on intuition can be perilous. Jim O’Shaughnessy emphasizes the importance of using historical data to inform investment decisions. By examining extensive market performance data, investors can identify patterns and trends that might not be immediately apparent. Here’s why data is so crucial:

- Objective Analysis: Data provides an unbiased foundation for making investment choices, free from the distortions of personal emotions or market noise.

- Identifying Trends: Historical data helps in spotting recurring market behaviors, enabling investors to anticipate future movements based on past performance.

- Performance Measurement: Quantitative metrics allow for precise evaluation of investment strategies, helping investors understand what works and what doesn’t.

Tip: Regularly incorporate data analysis into your investment process to stay informed and make evidence-based decisions.

Quantitative Analysis: Removing Emotional Bias

One of the biggest pitfalls in investing is allowing emotions to dictate decisions. Fear during a market downturn or greed during a boom can lead to poor choices. Quantitative analysis helps mitigate these emotional influences by providing clear, data-backed criteria for buying and selling.

- Consistent Criteria: Decisions are based on predefined metrics rather than fleeting emotions, ensuring a disciplined approach.

- Discipline: A data-driven approach encourages sticking to a strategy, even when emotions run high, fostering long-term success.

- Performance Tracking: Regular analysis of data ensures that strategies remain effective over time, allowing for adjustments based on empirical evidence.

Tip: Establish a set of quantitative criteria for your investment decisions to maintain consistency and reduce the impact of emotions.

Example: Challenging Conventional Wisdom

O’Shaughnessy’s research often challenges traditional investing beliefs. For instance, conventional wisdom might suggest that investing in large-cap stocks is safer, but his data reveals that small-cap stocks have historically outperformed their larger counterparts. This kind of insight underscores the value of a data-driven approach.

- Small-Cap Advantage: Historically, small-cap stocks offer higher returns, albeit with higher volatility. Their growth potential and market inefficiencies present opportunities for informed investors.

- Value vs. Growth: Data may reveal periods where value stocks outperform growth stocks, contrary to popular belief. Understanding these dynamics allows investors to pivot their strategies based on empirical evidence.

- Momentum Trading: Stocks that have performed well recently may continue to do so in the short term. Identifying and capitalizing on these trends can lead to substantial gains.

Example: In his book, O’Shaughnessy presents numerous case studies where small-cap, value, and momentum strategies outperformed the broader market. These findings challenge the one-size-fits-all approach and highlight the importance of tailored, data-backed strategies.

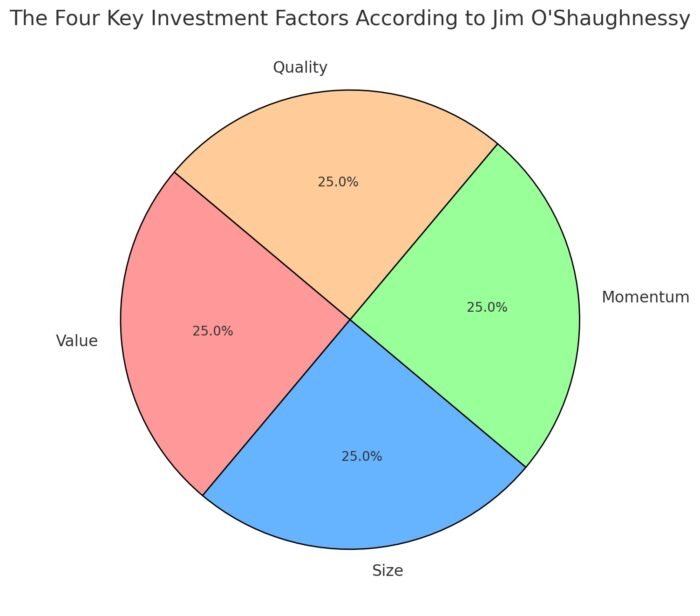

The Four Key Investment Factors

Jim O’Shaughnessy’s investment philosophy revolves around four primary factors that have consistently delivered superior returns. Understanding and leveraging these factors can significantly enhance your investment strategy.

1. Value: Finding Undervalued Stocks

Value investing involves identifying stocks that are undervalued relative to their intrinsic worth. O’Shaughnessy uses metrics like Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios to pinpoint these opportunities.

- Price-to-Earnings (P/E) Ratio: A lower P/E ratio indicates that a stock may be undervalued. By comparing a company’s current share price to its per-share earnings, investors can assess its valuation relative to earnings.

- Price-to-Book (P/B) Ratio: A lower P/B ratio suggests the stock is trading below its book value. This metric compares a company’s market value to its book value, providing insight into whether the stock is undervalued.

- Dividend Yield: High dividend yields can signal undervaluation and provide steady income. Companies with robust dividend payouts often have strong fundamentals, making them attractive to value investors.

Tip: Regularly screen for stocks with low P/E and P/B ratios to uncover potential value investments that may be overlooked by the broader market.

2. Size: Embracing Small-Cap Stocks

The size factor focuses on the market capitalization of companies. O’Shaughnessy found that small-cap stocks often outperform large-cap stocks over the long term.

- Growth Potential: Smaller companies have more room to grow compared to their larger counterparts. This growth potential can translate into higher returns as these companies expand and capture market share.

- Market Efficiency: Small-cap markets are less efficient, providing more opportunities for informed investors to capitalize on mispriced stocks.

- Higher Risk, Higher Reward: While more volatile, small-cap stocks can offer substantial returns. Their growth trajectories can lead to significant appreciation, rewarding investors who can withstand the associated risks.

Tip: Allocate a portion of your portfolio to small-cap stocks to capture higher growth potential, but balance it with other factors to manage risk effectively.

3. Momentum: Riding the Wave of Strong Performers

Momentum investing capitalizes on the tendency of stocks that have performed well recently to continue doing so in the near future.

- Trend Following: Identify and invest in stocks that are in an upward trend. Momentum traders believe that these stocks will keep rising as investor sentiment remains positive.

- Short-Term Gains: Momentum strategies can yield quick returns, complementing long-term investments by capturing gains from trending stocks.

- Market Sentiment: Momentum reflects the collective sentiment of the market, often driven by news and events. Positive sentiment can drive stock prices higher, creating opportunities for momentum investors.

Tip: Use moving averages or other technical indicators to identify stocks with strong momentum, ensuring that you invest in those with the most significant upward trends.

4. Quality: Investing in Financially Strong Companies

The quality factor emphasizes investing in companies with strong financials, including high profitability and robust balance sheets.

- Return on Equity (ROE): Measures a company’s ability to generate profits from shareholders’ equity. High ROE indicates efficient management and profitable operations.

- Debt-to-Equity Ratio: Lower ratios indicate less financial risk. Companies with lower debt levels are better positioned to withstand economic downturns and have more flexibility for growth.

- Earnings Stability: Consistent earnings growth signals a reliable and stable company. Firms with stable earnings are less likely to experience significant volatility, making them attractive to quality-focused investors.

Tip: Focus on companies with high ROE and low debt-to-equity ratios to ensure financial strength and resilience, enhancing the overall stability of your portfolio.

Combining Factors for Optimal Performance

Multi-Factor Investing: The Best of All Worlds

While each of the four factors—value, size, momentum, and quality—can independently enhance portfolio performance, combining them can lead to even greater results. Multi-factor investing leverages the strengths of each factor to create a more resilient and high-performing portfolio.

- Diversification of Strategies: Combining multiple factors reduces reliance on any single strategy, balancing out potential underperformance in one area with strengths in another.

- Enhanced Returns: The synergistic effect of multiple factors can lead to superior performance. By capturing the benefits of value, size, momentum, and quality, multi-factor portfolios can achieve higher returns than portfolios focused on a single factor.

- Risk Mitigation: Diverse factors help balance risks associated with individual strategies. For instance, while small-cap stocks may offer high returns, they also come with higher volatility. Combining them with quality stocks can mitigate some of this risk.

Tip: Develop a multi-factor strategy by selecting and weighting multiple factors based on their historical performance and relevance to your investment goals.

Backtesting Results: Proven Success

O’Shaughnessy’s multi-factor models have been extensively backtested, showing consistent outperformance compared to the broader market. Historical data demonstrates that portfolios built using a combination of value, size, momentum, and quality factors tend to achieve higher returns with manageable risk.

- Historical Outperformance: Multi-factor strategies have historically beaten major indices like the S&P 500. This outperformance is attributable to the systematic capture of premium returns from each factor.

- Consistent Performance: These strategies perform well across various market conditions, from bull markets to recessions. Their diversified nature allows them to adapt and thrive regardless of economic cycles.

- Risk-Adjusted Returns: Multi-factor portfolios often exhibit better risk-adjusted returns, balancing high performance with controlled risk. This balance ensures that investors are rewarded for taking on calculated risks.

Example: In his book, O’Shaughnessy presents case studies where multi-factor strategies consistently outperformed traditional, single-factor approaches. These results validate the effectiveness of combining multiple factors to enhance overall portfolio performance.

Example: Case Study of a Multi-Factor Strategy

Case Study: Let’s consider an investor who implements a multi-factor strategy by selecting stocks based on low P/E ratios (value), small market capitalization (size), strong recent price performance (momentum), and high ROE (quality). Over a 10-year period, this portfolio not only outperformed the S&P 500 but also demonstrated lower volatility and better risk-adjusted returns.

Key Outcomes:

- Superior Returns: The multi-factor portfolio achieved an average annual return of 12%, compared to 9% for the S&P 500.

- Lower Volatility: With a standard deviation of 15%, the multi-factor portfolio was less volatile than the S&P 500, which had a standard deviation of 18%.

- Better Risk-Adjusted Metrics: The Sharpe ratio of the multi-factor portfolio was 0.8, compared to 0.6 for the S&P 500, indicating better compensation for the risk taken.

This example underscores the power of combining multiple factors to achieve optimal investment performance, highlighting how a systematic, data-driven approach can lead to substantial long-term gains.

Tip: Regularly review and adjust your factor-based criteria to ensure continued alignment with market conditions and investment goals, maintaining the effectiveness of your multi-factor strategy.

The Power of Consistency and Discipline

Sticking to the Strategy

One of the most critical aspects of successful investing is consistency and discipline. O’Shaughnessy emphasizes the importance of adhering to your chosen investment strategy, even during periods of underperformance.

- Long-Term Commitment: Investing based on data-driven principles requires patience and a long-term perspective. The benefits of factor investing often materialize over extended periods, rewarding those who remain committed.

- Avoiding Deviations: Resist the urge to deviate from your strategy in response to short-term market fluctuations. Emotional reactions can lead to impulsive decisions that undermine your long-term goals.

- Systematic Approach: Consistently apply your investment criteria to maintain a disciplined approach. This systematic methodology ensures that your decisions are grounded in data rather than emotion.

Tip: Set clear investment rules and stick to them, regardless of market noise or emotional impulses, to maintain consistency in your investment strategy.

Avoiding Emotional Decisions

Emotions like fear and greed can cloud judgment and lead to impulsive investment decisions. By relying on a data-driven approach, you can minimize emotional biases and make more rational investment choices.

- Objective Decision-Making: Data provides a clear framework for making investment decisions, reducing the influence of emotions. This objectivity helps in maintaining a steady investment course.

- Reducing Bias: Quantitative strategies help eliminate common psychological pitfalls, such as overconfidence or loss aversion, ensuring that decisions are based on facts rather than feelings.

- Maintaining Focus: A disciplined approach keeps you focused on long-term goals rather than short-term market movements, promoting stability and consistency in your portfolio.

Tip: Develop a routine to review your investment portfolio regularly, ensuring that you stay aligned with your long-term strategy without being swayed by short-term market volatility.

Example: Discipline Leading to Long-Term Success

During the 2008 financial crisis, many investors panicked and sold their holdings at significant losses. However, investors who adhered to a disciplined, data-driven strategy—focusing on quality and value factors—were able to weather the storm and benefit from the subsequent market recovery. This example highlights how consistency and discipline can lead to long-term investment success, even in the face of severe market downturns.

Outcome:

- Preserved Capital: Disciplined investors avoided the steep losses incurred by those who sold in panic.

- Capitalized on Recovery: As the market rebounded, these investors were positioned to take advantage of the recovery, realizing substantial gains.

- Long-Term Growth: Over the long term, maintaining a disciplined approach resulted in a robust and growing investment portfolio.

Tip: Keep a long-term perspective and remind yourself of your investment goals during turbulent times to maintain discipline and avoid impulsive decisions.

Practical Steps to Implement O’Shaughnessy’s Strategies

Selecting Factors: Aligning with Your Investment Goals

Choosing the right factors is the first step in implementing O’Shaughnessy’s strategies. Your selection should align with your investment objectives, risk tolerance, and time horizon.

- Identify Relevant Factors: Focus on value, size, momentum, and quality factors that resonate with your investment goals. These factors are the cornerstone of O’Shaughnessy’s approach and have been proven to deliver superior returns.

- Customize Factor Weights: Assign different weights to each factor based on their perceived importance and your risk appetite. For instance, you might prioritize value and quality if you seek stability, or momentum and size for higher growth potential.

- Balance Factor Exposure: Ensure a balanced exposure to avoid over-reliance on any single factor, which can increase risk. A well-balanced approach leverages the strengths of multiple factors to enhance overall portfolio performance.

Tip: Use factor screening tools to identify stocks that meet your chosen criteria, ensuring that your portfolio remains aligned with your investment philosophy.

Building a Quantitative Portfolio

Constructing a portfolio using a factor-based approach involves several key steps:

- Data Collection: Gather historical data on various stocks, focusing on the factors you’ve selected. Reliable data sources include financial databases like Bloomberg, Reuters, or specialized investment platforms.

- Screening: Use quantitative screens to identify stocks that exhibit strong value, small size, momentum, and quality characteristics. This process filters out stocks that don’t meet your predefined criteria.

- Ranking: Rank the screened stocks based on their factor scores to prioritize the most promising candidates. Higher-ranked stocks are more likely to deliver superior performance.

- Selection: Choose the top-ranked stocks to include in your portfolio, ensuring diversification across different sectors and industries. Avoid concentration in a single sector to manage risk effectively.

- Allocation: Allocate capital based on factor strength and risk considerations, balancing growth potential with stability. Consider position sizing strategies to optimize your investments.

Tip: Utilize automated tools and software to streamline the data collection and screening process, saving time and enhancing accuracy.

Tools and Resources: Enhancing Your Quantitative Approach

Leveraging the right tools can significantly enhance your ability to implement O’Shaughnessy’s strategies effectively.

- Stock Screeners: Tools like Finviz, Bloomberg, or Morningstar allow you to filter stocks based on specific factor criteria, making it easier to identify potential investments.

- Backtesting Software: Platforms like QuantConnect or Portfolio Visualizer enable you to test your investment strategies against historical data, ensuring their viability before committing capital.

- Financial Databases: Access comprehensive financial data through sources like Bloomberg Terminal, Reuters, or Yahoo Finance to support your analysis and decision-making process.

- Investment Platforms: Use brokerage platforms that offer advanced research tools and analytics to facilitate factor-based investing, providing insights into market trends and stock performance.

Tip: Continuously explore and integrate new tools that can improve your data analysis and investment decision-making processes, staying ahead of the curve in quantitative investing.

Risk Management and Portfolio Construction

Diversification: Spreading Your Risk

Diversification is a fundamental principle of risk management. By spreading your investments across different factors, sectors, and geographies, you can reduce the impact of any single investment’s poor performance on your overall portfolio.

- Factor Diversification: Incorporate multiple factors to balance different risk exposures and enhance portfolio resilience. Combining value, size, momentum, and quality factors ensures that your portfolio isn’t overly reliant on any single strategy.

- Sector Diversification: Invest across various sectors to avoid concentration risk in any particular industry. For example, allocate funds to technology, healthcare, finance, consumer goods, and energy sectors to capture growth across the economy.

- Geographic Diversification: Include international stocks to mitigate country-specific risks and tap into global growth opportunities. Geographic diversification can protect your portfolio from regional economic downturns and benefit from growth in emerging markets.

Tip: Regularly review your portfolio to ensure that it remains diversified and aligned with your risk management goals, adjusting allocations as needed to maintain balance.

Position Sizing: Balancing Exposure and Risk

Determining the appropriate size for each position is crucial in managing risk. Position sizing should be based on factor exposure, risk tolerance, and investment objectives.

- Equal Weighting: Assign equal weights to each stock to maintain balance and prevent overexposure to any single investment. This approach simplifies portfolio management and ensures that no single stock dominates your portfolio.

- Risk-Based Weighting: Allocate more capital to lower-risk stocks and less to higher-risk ones, aligning with your risk tolerance. For instance, you might invest more in high-quality stocks and less in small-cap, high-volatility stocks.

- Factor Weighting: Adjust position sizes based on the strength of each factor, giving more weight to stronger factors to maximize returns. If value factors are currently outperforming, you might allocate more to value stocks while maintaining exposure to other factors.

Tip: Use position sizing calculators or portfolio management software to determine optimal weights for each investment, ensuring a balanced and risk-adjusted portfolio.

Rebalancing: Keeping Your Portfolio Aligned

Regular rebalancing is essential to maintain your desired asset allocation and factor exposures. As market conditions change, your portfolio may drift away from its target allocation, increasing risk or reducing returns.

- Scheduled Rebalancing: Set regular intervals (e.g., quarterly, annually) to review and adjust your portfolio. This systematic approach ensures that your investments remain aligned with your strategy without relying on market timing.

- Threshold-Based Rebalancing: Rebalance when your portfolio deviates significantly from your target allocation by a predefined threshold (e.g., 5%). This method ensures that adjustments are made only when necessary, reducing transaction costs and maintaining strategic focus.

- Dynamic Rebalancing: Adjust your portfolio in response to significant market events or changes in factor performance. While maintaining a disciplined approach, flexibility allows you to capitalize on new opportunities or mitigate emerging risks.

Tip: Automate the rebalancing process using robo-advisors or portfolio management tools to ensure consistency and discipline, minimizing the impact of human error or emotional decision-making.

Adapting to Market Conditions

Understanding Market Cycles

Different factors perform differently across various market cycles. Understanding these dynamics is crucial for maintaining a resilient investment strategy.

- Bull Markets: Factors like momentum and quality tend to perform well as investor confidence and earnings growth drive stock prices higher. Momentum stocks, in particular, can capitalize on the upward trend, delivering substantial returns.

- Bear Markets: Value and size factors may provide better performance as investors seek undervalued stocks with strong fundamentals. Small-cap stocks, often overlooked during downturns, can offer attractive entry points for value-oriented investors.

- Economic Expansion: Growth and quality factors shine during periods of economic growth, capturing the benefits of rising corporate profits and increased investor optimism.

- Economic Contraction: Value and size factors help protect the portfolio by focusing on financially stable and undervalued companies, which are better positioned to withstand economic downturns.

Tip: Analyze historical performance data to understand how different factors behave during various market conditions, enabling informed adjustments to your strategy.

Evolving Strategies: Staying Ahead of the Curve

Markets are dynamic, and successful investors must adapt their strategies to changing conditions while maintaining discipline.

- Regular Strategy Reviews: Periodically assess the effectiveness of your factor-based strategy and make adjustments as needed. This ensures that your approach remains relevant and continues to capture the desired premiums.

- Incorporate New Data: Stay updated with the latest research and incorporate new data points that can enhance your investment strategy. Emerging trends and evolving market dynamics can provide new opportunities for factor-based investing.

- Flexibility: Be willing to modify factor combinations or weights based on evolving market dynamics without abandoning your core principles. This balance of flexibility and discipline allows you to navigate changing environments effectively.

Example: Adapting Strategies in Response to Market Shifts

During the technology boom of the late 1990s, momentum and growth factors outperformed traditional value factors. Conversely, during the 2008 financial crisis, value and size factors provided better protection and recovery. Jim O’Shaughnessy adapted his strategies by adjusting factor weights and incorporating new factors to navigate these shifts successfully.

Outcome:

- Technological Boom: Increased exposure to momentum and growth factors capitalized on the rapid rise of technology stocks, driving substantial returns.

- Financial Crisis: Enhanced focus on value and size factors provided stability and protection during the downturn, facilitating a swift recovery once market conditions improved.

- Post-Crisis Growth: Balancing factors allowed the portfolio to benefit from the recovery while maintaining resilience against future downturns.

Tip: Maintain a flexible approach that allows for strategic adjustments while adhering to your overarching investment philosophy, ensuring that your portfolio remains robust across different market conditions.

How to Invest Like Jim O’Shaughnessy (What Works on Wall Street): Expert 12-Question FAQ

Who is Jim O’Shaughnessy and why do his ideas matter?

Jim O’Shaughnessy popularized evidence-based, rules-driven equity strategies using decades of market data. His framework shows that simple, consistent factor rules—applied with discipline—can beat ad-hoc, emotion-led stock picking over full cycles.

What are the core factors he emphasizes?

Four workhorses: Value (cheap vs. fundamentals), Size (tilt to smaller companies), Momentum (recent relative strength), and Quality (profitability/balance-sheet health). Each has a long-run premium and lowish correlation to the others, which is why they combine well.

How do I translate those factors into screenable metrics?

Keep it simple and consistent:

Value: P/E, EV/EBITDA, P/B, shareholder yield.

Size: Market cap bands (e.g., exclude micro-illiquid; favor small/mid).

Momentum: Total return over 6–12 months, skip the most recent month (to reduce reversals).

Quality: ROE/ROC, gross profitability, stable margins, low leverage.

What does a basic O’Shaughnessy-style process look like?

(1) Define universe (liquid U.S./global stocks).

(2) Apply factor screens/filters.

(3) Rank remaining names on a composite score (weighted blend of factors).

(4) Buy top-ranked basket (e.g., 25–75 names).

(5) Rebalance on a fixed schedule with sensible turnover rules.

Should I combine factors or run them separately?

Combine. A multi-factor composite smooths the ride because factors take turns underperforming. Blending value, momentum, quality, and size tends to deliver better risk-adjusted results than any single factor alone.

How often should I rebalance?

Quarterly or semi-annually is common. More frequent rebalances can chase noise and increase taxes/fees; too infrequent lets positions drift and deteriorate. Pick a cadence and stick to it.

What about risk management—what’s “in bounds” for this approach?

Diversify across sectors and position sizes (e.g., equal-weight or risk-aware caps), use sell rules (falling out of top ranks, momentum breaks), and avoid extreme leverage or illiquidity. A stop-light checklist (green/amber/red) helps keep rules mechanical.

Does this only work with small caps?

No, but size is a meaningful tailwind. Many practitioners use a blended universe (e.g., exclude mega-caps, include small/mid) while enforcing liquidity and spread constraints so the strategy remains tradable.

How do I keep emotions out of it?

Write an Investment Policy Statement for your model: universe, factors, weights, rebalancing, max turnover, risk limits. Automate as much as possible and review on schedule—not in response to headlines.

What pitfalls do beginners make with factor strategies?

Over-fitting backtests, using data not available at the time (“look-ahead bias”), ignoring transaction costs/taxes, changing rules after brief underperformance, and building models that can’t be traded due to liquidity.

Which tools make implementation easier?

A fundamentals screener, a portfolio/backtest tool, and a rebalancing worksheet. Even a spreadsheet can work if you’re consistent. For live execution, choose a broker with decent basket trading and tax-lot controls.

How do I adapt when market leadership changes?

Don’t abandon the core. Let your composite handle regime shifts, and revisit weights methodically (e.g., annual research review). If a factor is in a drawdown, that’s normal—judge by multi-year horizons, not months.

Key Takeaways from Jim O’Shaughnessy’s Investment Philosophy

Jim O’Shaughnessy’s investment principles, as detailed in What Works on Wall Street, offer a powerful framework for data-driven investing. The key takeaways include:

- Data-Driven Approach: Leveraging historical data and quantitative analysis to identify and implement effective investment strategies.

- Four Key Factors: Focusing on value, size, momentum, and quality factors to enhance portfolio performance.

- Multi-Factor Investing: Combining multiple factors to create a diversified and robust investment portfolio.

- Consistency and Discipline: Maintaining a disciplined approach and adhering to your strategy, even during periods of underperformance.

- Risk Management: Implementing diversification, proper position sizing, and regular rebalancing to manage risk effectively.

- Adaptability: Adjusting your strategies to align with changing market conditions while staying true to your core principles.

These principles collectively create a foundation for sustained financial success, allowing investors to navigate the complexities of the financial markets with confidence and strategic insight.

Thoughts on Data-Driven Investing

In the ever-evolving landscape of the financial markets, a data-driven, quantitative approach provides a significant edge. By systematically analyzing historical data and focusing on proven investment factors, investors can make more informed decisions, reduce emotional biases, and achieve superior long-term returns.

Why Embrace O’Shaughnessy’s Strategies?

- Proven Track Record: O’Shaughnessy’s strategies have consistently outperformed the market, demonstrating their effectiveness and reliability.

- Scientific Approach: The reliance on data and quantitative analysis ensures that investment decisions are grounded in evidence rather than speculation or emotion.

- Scalability: These strategies can be applied by both individual investors and institutional portfolios, making them versatile and accessible to a wide range of investors.

Tip: Embrace a scientific mindset in your investing approach, prioritizing data and analysis over speculation and emotion to enhance your investment outcomes.

Encouragement to Apply O’Shaughnessy’s Strategies

If you’re looking to enhance your investment practices, exploring and applying Jim O’Shaughnessy’s strategies can be a game-changer. Start by incorporating the four key factors into your investment process, leverage multi-factor models to build a diversified portfolio, and maintain the discipline to stick with your strategy through all market conditions.

Take Action Today:

- Educate Yourself: Read What Works on Wall Street to gain a deeper understanding of O’Shaughnessy’s methodologies. The book offers valuable insights and practical guidance on implementing quantitative investing strategies.

- Analyze Your Portfolio: Assess your current investments and identify areas where you can integrate value, size, momentum, and quality factors. Look for opportunities to diversify and optimize your portfolio based on these factors.

- Utilize Tools: Implement stock screeners, backtesting software, and portfolio management tools to support your data-driven approach. These tools can streamline your investment process and enhance accuracy.

- Stay Disciplined: Commit to a consistent investment strategy and avoid making impulsive decisions based on short-term market movements. Discipline is key to long-term success.

- Seek Professional Advice: Consider consulting with a financial advisor who specializes in quantitative investing to tailor these strategies to your unique financial goals. Professional guidance can help you navigate complex investment landscapes and optimize your portfolio effectively.

By embracing a data-driven, quantitative approach to investing, you can navigate the complexities of the financial markets with confidence and strategic insight, ultimately achieving your long-term investment objectives.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.