Investing like Van K. Tharp means embracing a blend of psychological mastery, strategic risk management, and systematic trading methodologies. Renowned as a trading coach and author, Van Tharp has significantly influenced countless traders worldwide through his insightful teachings and innovative strategies. Whether you’re a budding trader or a seasoned investor, adopting Tharp’s principles can transform your approach to trading, leading to enhanced performance and sustained success. In this comprehensive guide, we’ll delve into Van K. Tharp’s trading philosophy, explore his core strategies, and provide actionable insights to help you emulate his success in the trading world.

source: The Swedish Investor on YouTube

Van K. Tharp: A Pioneer in Trading Psychology and Strategy Development

Van K. Tharp stands as a monumental figure in the realm of trading psychology and strategy development. With a career spanning several decades, Tharp has dedicated himself to understanding the intricate relationship between a trader’s mindset and their trading outcomes. His contributions have not only shaped the way traders approach the markets but also emphasized the paramount importance of psychological discipline in achieving trading success.

Understanding His Work as a Trading Coach and Author

As a trading coach, Van Tharp has mentored thousands of traders, guiding them through the complexities of the financial markets with a focus on psychological resilience and strategic planning. His books, such as Trade Your Way to Financial Freedom and Super Trader, have become essential reads for anyone serious about mastering the art of trading. Through seminars, workshops, and personal coaching, Tharp has empowered traders to develop personalized trading systems that align with their unique psychological profiles.

Let’s explore Van K. Tharp’s unique approach to trading and his profound impact on traders worldwide. By dissecting his trading philosophy and strategies, readers can gain valuable insights into building a disciplined, resilient, and profitable trading framework. From understanding the importance of psychology in trading to implementing effective risk management techniques, we’ll cover the multifaceted aspects that make Tharp a revered figure in the trading community.

Who is Van K. Tharp?

Background and Early Life of Van K. Tharp

Van K. Tharp was born in the mid-20th century, growing up with a keen interest in understanding human behavior and the complexities of decision-making. His academic journey led him to pursue a degree in psychology, a field that would later become the cornerstone of his trading philosophy. Tharp’s fascination with the human mind and its impact on trading decisions laid the foundation for his future endeavors in the financial markets.

Transition from Psychology to Trading and Coaching

Tharp’s transition from psychology to trading was driven by a desire to apply his understanding of human behavior to the dynamic world of financial markets. Recognizing that emotions and mental states play a critical role in trading success, he sought to bridge the gap between psychological theory and practical trading strategies. This unique blend of psychology and trading acumen positioned Tharp as a trailblazer in the industry, leading him to establish himself as a renowned trading coach and author.

Key Achievements: Books and the Founding of the Van Tharp Institute

- Author of Influential Books: Tharp has authored several best-selling books that delve into the psychology of trading and system development. His works, such as Trade Your Way to Financial Freedom and Super Trader, provide comprehensive guides on building personalized trading systems and overcoming psychological barriers in trading.

- Founder of the Van Tharp Institute: In 1989, Tharp founded the Van Tharp Institute, dedicated to educating traders and investors about the psychological and strategic aspects of trading. The institute offers a range of courses, workshops, and coaching programs aimed at helping individuals develop effective trading systems tailored to their unique psychological profiles.

- Pioneering Trading Strategies: Tharp is credited with pioneering several trading strategies that emphasize the importance of psychological resilience and disciplined risk management. His methodologies have been adopted by traders worldwide, contributing to improved trading performance and reduced emotional interference.

- Mentorship and Influence: Through his coaching and educational initiatives, Tharp has mentored thousands of traders, influencing the next generation of trading professionals. His emphasis on self-awareness, discipline, and strategic planning has transformed the way traders approach the markets.

The Importance of Psychology in Trading

Van Tharp’s Emphasis on Psychological Aspects of Trading

Van K. Tharp firmly believes that psychology is the key differentiator between successful and unsuccessful traders. While technical analysis and market knowledge are essential, the ability to manage emotions, maintain discipline, and cultivate a resilient mindset is what truly sets top traders apart. Tharp’s approach centers on understanding and mastering the psychological components that influence trading decisions and outcomes.

The Role of Mindset, Beliefs, and Emotions in Trading Success

Mindset: The Foundation of Trading Performance

A trader’s mindset encompasses their attitude, beliefs, and mental approach to trading. Tharp emphasizes the importance of cultivating a positive and growth-oriented mindset. Believing in one’s ability to learn, adapt, and succeed is crucial for navigating the challenges and uncertainties inherent in trading.

Beliefs: Shaping Trading Strategies and Decisions

Beliefs about the markets, risk, and personal capabilities significantly impact trading strategies and decisions. Tharp encourages traders to identify and challenge limiting beliefs that may hinder their performance. By aligning trading strategies with empowering beliefs, traders can enhance their confidence and effectiveness.

Emotions: Managing the Highs and Lows of Trading

Emotions like fear, greed, and overconfidence can cloud judgment and lead to impulsive decisions. Tharp advocates for emotional regulation techniques to maintain composure and objectivity. By recognizing and managing emotional triggers, traders can make more rational and informed decisions.

Self-Awareness and Psychological Discipline: Impacting Trading Outcomes

Self-Awareness: Understanding Personal Strengths and Weaknesses

Self-awareness involves recognizing one’s strengths, weaknesses, and emotional responses to trading situations. Tharp underscores the importance of self-assessment and introspection in identifying areas for improvement and developing tailored trading strategies.

Psychological Discipline: Adhering to Trading Plans and Strategies

Discipline is paramount in executing trading plans consistently. Tharp emphasizes the need for traders to adhere strictly to their predefined strategies, resisting the temptation to deviate based on emotional impulses or market noise. Psychological discipline ensures that traders remain focused on their long-term goals, enhancing their overall performance.

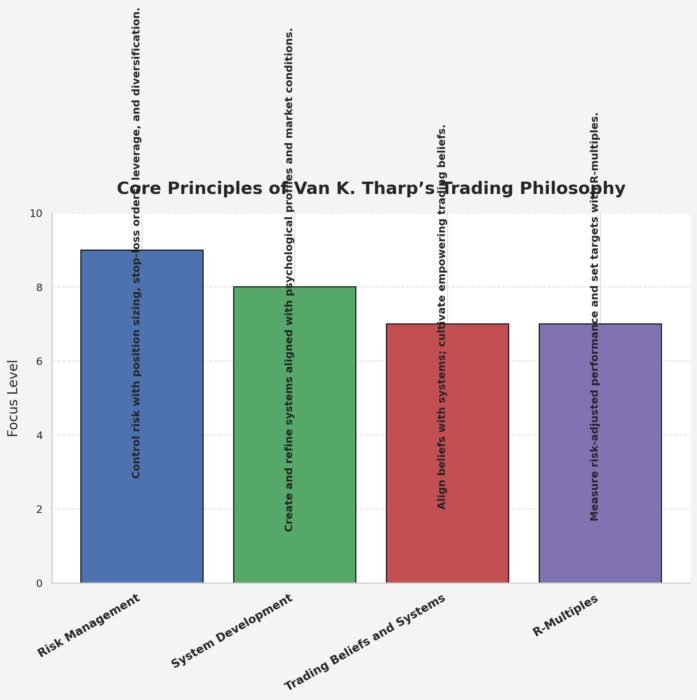

Core Principles of Van K. Tharp’s Trading Philosophy

Bruce Kovner’s trading success is anchored in several core principles that guide his decision-making and execution. These principles ensure that his trading remains disciplined, strategic, and resilient to market fluctuations.

1. Risk Management: Controlling Risk in Volatile Forex Markets

Risk management is the cornerstone of Tharp’s trading philosophy. In the volatile forex market, controlling risk is paramount to preserving capital and ensuring long-term success.

Key Aspects of Tharp’s Risk Management:

- Position Sizing: Determining the appropriate amount to invest in each trade based on the level of risk. Tharp often limits his exposure to a small percentage of his total portfolio per trade.

- Stop-Loss Orders: Setting predefined exit points to limit potential losses. By using stop-loss orders, Tharp ensures that a single trade does not result in significant capital erosion.

- Leverage Management: While leverage can amplify returns, it also increases risk. Tharp employs conservative leverage levels to mitigate potential losses.

- Diversification: Spreading investments across various asset classes and regions to reduce exposure to any single source of risk.

2. System Development: Steps to Develop a Robust and Effective Trading System

Developing a robust trading system is essential for achieving consistent trading success. Tharp outlines a systematic approach to creating and refining trading systems that align with individual psychological profiles and market conditions.

Steps to Develop a Trading System:

- Define Trading Objectives: Clearly outline what you aim to achieve with your trading system, including target returns and risk tolerance.

- Identify Trading Opportunities: Use technical and fundamental analysis to identify potential trading opportunities that align with your objectives.

- Establish Trading Rules: Define specific criteria for entering and exiting trades based on market signals and indicators.

- Backtest the System: Apply your trading rules to historical data to evaluate the system’s performance and identify any weaknesses.

- Optimize and Refine: Adjust your trading rules and parameters based on backtesting results to enhance the system’s effectiveness.

- Implement and Monitor: Deploy the trading system in a live or simulated environment, continuously monitoring its performance and making necessary adjustments.

3. Trading Beliefs and Systems: Understanding the Connection Between Trading Beliefs and the Performance of Trading Systems

Tharp emphasizes that a trader’s beliefs about trading play a critical role in the performance of their trading systems. Positive and empowering beliefs can enhance system performance, while limiting beliefs can undermine it.

Key Insights:

- Align Beliefs with Systems: Ensure that your trading beliefs support your trading systems. For instance, if you believe in risk management, your trading system should incorporate robust risk controls.

- Identify Limiting Beliefs: Recognize and challenge any beliefs that may negatively impact your trading performance, such as fear of loss or overconfidence.

- Cultivate Empowering Beliefs: Develop beliefs that reinforce disciplined trading, strategic planning, and resilience in the face of market challenges.

4. R-Multiples: Using R-Multiples to Evaluate and Improve Trading Performance

R-multiples are a powerful tool introduced by Tharp to measure the risk-adjusted performance of trades. An R-multiple represents how many times the initial risk (R) a trade has gained or lost.

How to Use R-Multiples:

- Calculate R: Determine the difference between the entry price and the stop-loss price for each trade.

- Measure Profit or Loss: Express the profit or loss of a trade in multiples of R. For example, a trade that gained twice the risk (2R) or lost the initial risk (1R).

- Analyze Performance: Assess the distribution of R-multiples to evaluate the effectiveness of your trading system and identify areas for improvement.

- Set Performance Goals: Use R-multiples to establish realistic performance targets and refine your trading strategies accordingly.

The Tharp Thinks Framework

Overview of the “Tharp Thinks” Framework

The Tharp Thinks framework is a comprehensive approach developed by Van K. Tharp to enhance a trader’s mindset and strategic planning. It encompasses various mental and strategic elements that contribute to successful trading.

Key Components of the Tharp Thinks Framework:

- Self-Assessment: Understanding your personal strengths, weaknesses, and psychological tendencies.

- Goal Setting: Establishing clear and achievable trading goals that align with your overall financial objectives.

- Strategic Planning: Developing a structured plan that outlines your trading strategies, risk management protocols, and performance metrics.

- Continuous Learning: Emphasizing the importance of ongoing education and adaptability in the ever-evolving financial markets.

- Performance Evaluation: Regularly reviewing and analyzing your trading performance to identify areas for improvement and optimize strategies.

Applying the Tharp Thinks Framework to Improve Trading Mindset

Steps to Apply the Tharp Thinks Framework:

- Conduct a Self-Assessment:

- Identify Strengths and Weaknesses: Reflect on your trading habits, emotional responses, and decision-making processes.

- Understand Your Psychological Profile: Recognize how your mindset influences your trading behavior and outcomes.

- Set Clear Trading Goals:

- Define Specific Objectives: Determine what you aim to achieve, such as target returns, risk tolerance, and time horizons.

- Align Goals with Personal Values: Ensure that your trading goals are in harmony with your overall financial and personal aspirations.

- Develop a Strategic Trading Plan:

- Outline Trading Strategies: Detail the technical and fundamental strategies you will use to identify and execute trades.

- Incorporate Risk Management Protocols: Establish rules for position sizing, stop-loss orders, and diversification to protect your capital.

- Commit to Continuous Learning:

- Stay Informed: Keep up with market news, economic indicators, and advancements in trading techniques.

- Seek Educational Resources: Utilize books, courses, and seminars to deepen your understanding of trading psychology and strategy development.

- Regularly Evaluate Performance:

- Analyze Trading Results: Use tools like R-multiples to assess the effectiveness of your trading system.

- Identify Areas for Improvement: Recognize patterns in your trading performance and adjust your strategies accordingly.

Examples of How the Framework Has Helped Traders Achieve Consistent Success

- Enhanced Self-Awareness: Traders who have adopted the Tharp Thinks framework report increased self-awareness, allowing them to identify and overcome psychological barriers that hindered their trading performance.

- Structured Goal Setting: By setting clear and achievable goals, traders have been able to maintain focus and direction, leading to more consistent trading outcomes.

- Improved Risk Management: Implementing robust risk management protocols has enabled traders to protect their capital and sustain long-term profitability, even during volatile market conditions.

- Continuous Strategy Refinement: The emphasis on continuous learning and performance evaluation has helped traders adapt to changing market dynamics, ensuring their trading systems remain effective and relevant.

Developing a Trading System with Van Tharp’s Methodology

Step-by-Step Guide to Developing a Trading System Inspired by Tharp

Creating a robust trading system requires a structured approach that incorporates both strategic planning and disciplined execution. Here’s a step-by-step guide inspired by Van Tharp’s methodologies:

1. Define Your Trading Goals

- Identify Objectives: Determine what you aim to achieve with your trading system. This could include specific return targets, risk tolerance levels, and investment horizons.

- Set Time Horizons: Establish both short-term and long-term goals to guide your trading activities and ensure alignment with your overall financial objectives.

2. Conduct Comprehensive Market Analysis

- Data Collection: Gather historical price data, economic indicators, and other relevant information from reliable sources.

- Trend Identification: Use statistical tools and technical analysis to identify trends and patterns in the data, focusing on sustained movements that can be capitalized upon.

3. Develop Trading Rules and Algorithms

- Rule Creation: Define specific criteria for entering and exiting trades based on your analysis. This includes identifying key technical indicators and signals that indicate potential trading opportunities.

- Algorithm Development: Translate your trading rules into algorithms that can execute trades automatically. This ensures consistency and removes emotional bias from the trading process.

4. Backtest Your Strategy

- Historical Testing: Apply your trading strategy to historical data to evaluate its performance. This helps in assessing the viability and profitability of the strategy before deploying it in live markets.

- Performance Metrics: Analyze key metrics such as profitability, drawdowns, win-loss ratios, and risk-adjusted returns to gauge the effectiveness of your strategy.

5. Optimize and Refine Your Strategy

- Parameter Tuning: Adjust the parameters of your trading rules and algorithms based on backtesting results to enhance performance.

- Validation: Test the optimized strategy on out-of-sample data to ensure its robustness and adaptability to different market conditions.

6. Implement Risk Management Techniques

- Position Sizing: Determine the appropriate size for each trade based on your risk tolerance and the volatility of the asset being traded.

- Stop-Loss Orders: Set predefined exit points to limit potential losses, ensuring that no single trade can significantly impact your overall portfolio.

- Diversification: Spread investments across various asset classes and regions to mitigate risk and enhance portfolio resilience.

7. Execute and Monitor Your Strategy

- Automated Execution: Utilize trading platforms that support automated trading to implement your strategy efficiently and consistently.

- Continuous Monitoring: Regularly review the performance of your trading system, tracking key metrics and making adjustments as necessary to maintain optimal performance.

Importance of Backtesting and Adapting the System to Individual Needs

Backtesting is a critical step in developing a trading system, allowing you to evaluate how your strategy would have performed under historical market conditions. It provides valuable insights into the strengths and weaknesses of your system, enabling you to make informed adjustments before deploying it in live markets.

Key Benefits of Backtesting:

- Performance Evaluation: Assess the profitability and risk of your trading strategy, identifying areas for improvement.

- Strategy Validation: Confirm that your trading rules are effective and can generate consistent returns across different market conditions.

- Risk Assessment: Understand the potential drawdowns and volatility associated with your strategy, ensuring that it aligns with your risk tolerance.

Tips for Refining and Optimizing the System Over Time

- Regular Reviews: Periodically assess your trading system’s performance, analyzing key metrics and identifying areas for enhancement.

- Adapt to Market Changes: Be willing to modify your trading rules and strategies in response to evolving market dynamics and new information.

- Incorporate Feedback: Seek feedback from other traders, mentors, or trading communities to gain diverse perspectives and improve your system.

- Stay Informed: Continuously educate yourself about new trading techniques, technologies, and market trends to keep your trading system relevant and effective.

Sample Trading System Inspired by Tharp

Strategy Overview

- Market: S&P 500 Index (or any preferred asset class)

- Time Frame: Daily charts

- Indicators: Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands

- Entry Rules:

- Long Position: Enter when the MACD line crosses above the signal line, RSI is above 50, and the price touches the lower Bollinger Band.

- Short Position: Enter when the MACD line crosses below the signal line, RSI is below 50, and the price touches the upper Bollinger Band.

- Exit Rules:

- Long Position Exit: Exit when the MACD line crosses below the signal line or RSI drops below 50.

- Short Position Exit: Exit when the MACD line crosses above the signal line or RSI rises above 50.

- Risk Management:

- Position Sizing: Allocate 2% of the portfolio to each trade.

- Stop-Loss: Set a stop-loss at 1% below the entry price for long positions and 1% above for short positions.

- Take-Profit: Set a take-profit target at 2% above the entry price for long positions and 2% below for short positions.

Implementation Steps

- Define Trading Rules: Clearly outline the conditions for entering and exiting trades based on MACD, RSI, and Bollinger Bands.

- Develop Algorithm: Program the rules into a trading platform that supports automated trading, ensuring consistent and objective execution.

- Backtest: Apply the strategy to historical S&P 500 data to evaluate its performance, focusing on key metrics like profitability and drawdowns.

- Optimize: Adjust the indicator settings or risk management rules to enhance profitability and reduce drawdowns, ensuring the strategy remains robust.

- Forward Test: Implement the strategy in a simulated trading environment to observe real-time performance without risking capital.

- Execute: Deploy the strategy in a live trading account with proper risk management measures in place, adhering strictly to the predefined rules.

- Monitor and Refine: Continuously track the strategy’s performance, making adjustments as necessary to maintain optimal performance and adapt to changing market conditions.

Risk Management Techniques

Detailed Look at Tharp’s Approach to Managing Risk

Risk management is not just a component of Van Tharp’s trading philosophy; it’s the foundation upon which his entire trading strategy is built. Tharp believes that preserving capital is paramount, as it provides the necessary cushion to withstand inevitable market downturns and unexpected losses. His approach to risk management is meticulous and multifaceted, ensuring that traders can protect their investments while still capitalizing on profitable opportunities.

1. Position Sizing: Allocating the Right Amount

Position sizing is a critical element in Tharp’s risk management toolkit. It involves determining the appropriate amount to invest in each trade based on the level of risk and the volatility of the asset being traded.

Key Strategies for Position Sizing:

- Fixed Percentage Allocation: Allocate a fixed percentage of your portfolio to each trade, ensuring that no single trade can significantly impact your overall capital.

- Volatility-Based Sizing: Adjust the size of each position based on the asset’s volatility. More volatile assets receive smaller positions to mitigate risk, while less volatile assets can have larger allocations.

- Risk-Reward Assessment: Evaluate the potential risk and reward of each trade to determine the optimal position size, aiming for trades where the potential reward justifies the risk.

2. Stop-Loss Orders: Limiting Potential Losses

Stop-loss orders are predefined exit points set to limit potential losses on a trade. Tharp integrates stop-loss orders into his trading system to ensure disciplined exits and protect capital.

Implementing Stop-Loss Orders:

- Technical Levels: Place stop-loss orders at key technical levels, such as support or resistance points, identified through technical analysis. This ensures that stops are placed at logical points rather than arbitrary levels.

- Fixed vs. Trailing Stops: Use fixed stop-losses for simplicity and trailing stops to lock in profits as the trade moves in a favorable direction. Trailing stops adjust dynamically with price movements, providing flexibility while maintaining protection.

- Automated Execution: Employ automated systems to execute stop-loss orders when predefined conditions are met. This eliminates the potential for emotional interference, ensuring timely and objective exits.

3. Use of Leverage: Balancing Risk and Reward

Leverage can amplify both profits and losses, making its effective management crucial in Tharp’s trading strategy.

Strategies for Managing Leverage:

- Conservative Leverage Levels: Use leverage levels that align with your risk tolerance and trading strategy, avoiding excessive exposure that can lead to significant losses.

- Monitoring Leverage: Continuously monitor leveraged positions to ensure they remain within acceptable risk parameters. Adjust leverage as needed based on market conditions and portfolio performance.

- Risk-Adjusted Returns: Evaluate the potential returns against the associated risks to determine appropriate leverage levels for each trade. Aim for a balance that maximizes returns without disproportionately increasing risk.

4. Diversification: Spreading Risk Across Markets

Diversification involves spreading investments across various asset classes and regions to reduce exposure to any single source of risk. Tharp’s diversified approach enhances the resilience of his portfolio, ensuring that losses in one area are offset by gains in another.

Diversification Strategies:

- Asset Class Diversification: Invest in a mix of equities, bonds, commodities, and currencies to balance risk and return. Each asset class responds differently to market conditions, providing a hedge against adverse movements in any single market.

- Geographical Diversification: Allocate investments across different regions to mitigate the impact of localized economic downturns. This ensures that geopolitical events or regional economic issues do not disproportionately affect your portfolio.

- Sector Diversification: Spread investments across various sectors to avoid concentration risk and capitalize on opportunities in different industries. Sector diversification provides additional layers of protection and growth potential.

5. Balancing Risk and Reward: Ensuring Sustainable Profitability

Balancing risk and reward is essential for optimizing portfolio performance. Tharp’s approach ensures that each trade offers a favorable risk-reward ratio, enhancing the potential for sustained profitability.

Strategies for Balancing Risk and Reward:

- Risk-Reward Ratio: Target trades where the potential reward significantly outweighs the risk, such as aiming for a 2:1 or 3:1 ratio. This ensures that even with a lower win rate, overall profitability remains high.

- Thorough Analysis: Conduct comprehensive research and analysis to assess the viability and potential returns of each investment. This involves both technical and fundamental analysis to ensure that trades are based on solid data and insights.

- Continuous Monitoring: Regularly review and adjust the portfolio to maintain an optimal balance between risk and reward, responding to changing market conditions and emerging opportunities.

Implementing Tharp’s Risk Management Techniques

To effectively implement Tharp’s risk management techniques, traders should:

- Define Risk Parameters: Clearly outline the maximum acceptable loss per trade and overall portfolio risk. This involves setting specific thresholds that align with your risk tolerance and trading objectives.

- Utilize Technology: Leverage trading platforms and software to automate risk management measures, ensuring consistent application and reducing the potential for human error.

- Regularly Review Strategies: Continuously assess and refine risk management strategies to adapt to evolving market dynamics, incorporating new insights and data to enhance effectiveness.

The Role of Self-Awareness and Discipline in Trading

How Tharp Emphasizes the Need for Self-Awareness in Trading Decisions

Self-awareness is a cornerstone of Van K. Tharp’s trading philosophy. Understanding one’s own psychological makeup, strengths, and weaknesses is essential for making informed and objective trading decisions. Tharp believes that traders who are self-aware are better equipped to manage emotions, adhere to their trading plans, and adapt to changing market conditions.

Key Aspects of Self-Awareness in Trading:

- Recognizing Emotional Triggers: Identify the situations or market conditions that evoke strong emotional responses, such as fear during market downturns or overconfidence after a series of winning trades.

- Understanding Personal Biases: Acknowledge and address cognitive biases, such as confirmation bias or recency bias, that can distort trading decisions and lead to suboptimal outcomes.

- Evaluating Trading Habits: Assess your trading habits and behaviors to identify patterns that contribute to success or hinder performance. This includes evaluating discipline, consistency, and adaptability.

Techniques for Maintaining Discipline and Avoiding Emotional Trading

Discipline is paramount in executing a successful trading strategy. Tharp provides several techniques to help traders maintain discipline and avoid making impulsive, emotion-driven decisions.

1. Establish a Trading Routine

Creating a consistent trading routine reinforces disciplined behavior and minimizes the potential for impulsive decisions. A well-structured routine includes:

- Pre-Market Preparation: Review economic calendars, market news, and technical indicators before the trading day begins.

- Set Specific Trading Hours: Allocate dedicated time slots for trading activities to maintain focus and prevent overtrading.

- Post-Market Review: Analyze the day’s trades, document outcomes, and identify areas for improvement.

2. Adhere to a Trading Plan

A comprehensive trading plan serves as a roadmap, guiding your trading decisions and strategies. Key elements of a trading plan include:

- Defined Trading Rules: Clearly outline criteria for entering and exiting trades based on technical and fundamental analysis.

- Risk Management Protocols: Incorporate strategies for position sizing, stop-loss orders, and diversification to protect capital.

- Performance Metrics: Establish key performance indicators (KPIs) to track and evaluate trading performance objectively.

3. Utilize Automated Trading Systems

Automated trading systems execute trades based on predefined criteria, eliminating the potential for emotional interference. By relying on algorithms to make trading decisions, traders can maintain consistency and objectivity in their trading strategies.

4. Practice Mindfulness and Emotional Regulation

Mindfulness techniques, such as meditation and deep breathing exercises, can enhance emotional control and reduce stress. By maintaining a calm and focused mindset, traders can make more rational and informed decisions, even during periods of market volatility.

The Impact of Psychological Resilience on Long-Term Trading Success

Psychological resilience—the ability to recover quickly from setbacks and maintain focus during challenging times—is crucial for long-term trading success. Tharp emphasizes that resilient traders are better equipped to handle losses, stay committed to their trading plans, and adapt to changing market conditions.

Key Benefits of Psychological Resilience:

- Enhanced Decision-Making: Resilient traders can make objective decisions without being clouded by emotions, leading to more consistent trading performance.

- Sustained Motivation: Psychological resilience helps traders maintain motivation and persistence, even after experiencing losses or setbacks.

- Adaptability: Resilient traders are more adaptable, allowing them to refine their strategies and approaches in response to evolving market dynamics.

How to Start Trading Like Van K. Tharp

Practical Steps for Implementing Tharp’s Strategies in Your Own Trading

Emulating Van K. Tharp’s trading approach involves a blend of strategic planning, disciplined execution, and continuous learning. Here are practical steps to help you incorporate Tharp’s methodologies into your own trading practice:

1. Educate Yourself in Trading Psychology and Strategy Development

- Foundational Knowledge: Begin by gaining a solid understanding of trading psychology principles and strategic planning. Tharp’s books, such as Trade Your Way to Financial Freedom, provide invaluable insights into these areas.

- Advanced Studies: Pursue advanced courses or certifications in trading strategies, market analysis, and risk management to enhance your expertise and stay competitive.

2. Develop a Comprehensive Trading Plan

- Define Objectives: Clearly outline your trading goals, including desired returns, risk tolerance, and investment horizon. This clarity will guide your trading decisions and strategy formulation.

- Strategy Formulation: Develop trading strategies based on technical analysis, risk management, and market timing principles. Ensure that your strategies are aligned with your trading goals and risk appetite.

- Risk Management Protocols: Establish rules for position sizing, stop-loss orders, and portfolio diversification to protect your capital and minimize potential losses.

3. Start with a Simulated Trading Environment

- Paper Trading: Begin by executing your trading strategies in a simulated environment to gain experience without risking real capital. This practice helps in refining strategies and building confidence.

- Backtesting: Apply your strategies to historical data to evaluate their performance and identify areas for improvement. Backtesting provides insights into how your strategies would have performed under different market conditions.

4. Gradually Scale Up Your Trading Activities

- Small Positions: Start with small positions to test your strategies in live market conditions without exposing yourself to significant risk. This approach allows for real-time learning and adjustment.

- Incremental Scaling: Gradually increase your position sizes as you gain confidence and experience in your trading strategies. Scaling up should be aligned with your trading plan and risk management protocols.

5. Implement Automated Trading Systems

- Algorithm Development: Translate your trading rules into algorithms that can execute trades automatically based on predefined criteria. Automated systems ensure consistent and objective trade execution.

- Platform Selection: Choose reliable trading platforms that support automated trading and offer robust analytical tools. Platforms like MetaTrader, Thinkorswim, and Interactive Brokers’ Trader Workstation are popular choices.

6. Monitor and Refine Your Trading Systems

- Performance Tracking: Continuously monitor the performance of your trading systems using key metrics such as profitability, drawdown, and risk-adjusted returns. Regular tracking helps in assessing the effectiveness of your strategies.

- System Refinement: Regularly update and optimize your trading systems based on performance data and changing market conditions. Refinement ensures that your strategies remain effective and adaptable.

- Stay Adaptable: Be willing to pivot your strategies in response to new information or shifts in global economic trends, ensuring that your trading systems remain relevant and effective.

Resources for Learning More About Tharp’s Trading Philosophy and Techniques

To deepen your understanding of Van K. Tharp’s trading philosophy and enhance your trading skills, consider the following resources:

Books

- Trade Your Way to Financial Freedom by Van K. Tharp: A comprehensive guide to developing personalized trading systems that align with your psychological profile and trading objectives.

- Super Trader: Make Consistent Profits in Good and Bad Markets by Van K. Tharp: Explores advanced trading concepts and strategies, emphasizing the importance of psychology and risk management.

- The Definitive Guide to Position Sizing by Van K. Tharp: Focuses on the critical aspect of position sizing, providing strategies to optimize risk and maximize profitability.

- Trade Your Way to the Top by Van K. Tharp: Offers insights into refining trading strategies and improving trading performance through disciplined execution and psychological resilience.

Online Courses and Workshops

- Van Tharp Institute Courses: The Van Tharp Institute offers a range of courses and workshops that delve into trading psychology, system development, and risk management. These programs are designed to provide practical tools and strategies for traders of all levels.

- Coursera’s Financial Markets by Yale University: Offers comprehensive insights into financial markets and trading strategies, complementing Tharp’s methodologies.

- Udemy’s Trading Psychology and Risk Management: Provides detailed strategies and techniques for managing emotions and risk in trading, aligning with Tharp’s principles.

Websites and Journals

- Van Tharp Institute: The official website of the Van Tharp Institute offers a wealth of resources, including articles, webinars, and course information to support your trading education.

- Investopedia: Features a vast array of articles and tutorials on trading psychology, risk management, and strategy development, providing additional perspectives and insights.

- The Journal of Portfolio Management: Offers in-depth research and analysis on trading strategies and portfolio management, catering to advanced traders and financial professionals.

Tools and Platforms to Support the Development of a Tharp-Inspired Trading System

Leveraging the right tools and platforms is essential for developing, testing, and executing Tharp-inspired trading strategies. Here are some recommended options:

Trading Platforms

- MetaTrader 4/5: Known for its advanced charting capabilities, automated trading features, and user-friendly interface, MetaTrader is a popular choice among traders looking to implement automated strategies.

- Thinkorswim by TD Ameritrade: Offers comprehensive trading tools, real-time data, and support for automated trading strategies, catering to both novice and experienced traders.

- Interactive Brokers’ Trader Workstation (TWS): Renowned for its extensive range of tradable assets, low commission rates, and robust trading tools, making it suitable for high-volume traders.

Analytical Tools

- TradingView: Provides powerful charting tools, a vibrant community of traders, and the ability to backtest trading strategies. Its intuitive interface makes it accessible for traders of all levels.

- Bloomberg Terminal: Delivers in-depth financial data, analytics, and trading tools for professional traders, offering comprehensive market insights and real-time information.

- NinjaTrader: Offers advanced charting, market analytics, and automated trading capabilities, supporting the development and execution of complex trading strategies.

Data Sources

- Quandl: Provides access to a vast array of financial, economic, and alternative datasets for quantitative analysis, supporting data-driven trading strategies.

- Yahoo Finance: A free resource for historical price data and financial news, essential for conducting comprehensive market analysis.

- Bloomberg: Offers comprehensive financial data and market analytics, catering to the needs of professional traders and financial institutions.

Algorithmic Trading Platforms

- QuantConnect: A cloud-based platform that supports algorithmic trading and provides access to historical market data, enabling the development and testing of automated strategies.

- Quantopian (now part of Robinhood): Offers tools and resources for developing and testing trading algorithms, facilitating the creation of automated trading systems.

- AlgoTrader: An institutional-grade algorithmic trading software for developing, automating, and executing quantitative trading strategies, ideal for advanced traders.

Building Analytical Skills for Tharp-Inspired Trading

Developing strong analytical skills is crucial for designing and implementing effective trading strategies inspired by Van K. Tharp. Focus on the following areas:

1. Trading Psychology

- Mindset Development: Cultivate a growth-oriented mindset that embraces learning, adaptability, and resilience. Understanding how your psychological state impacts trading decisions is essential for maintaining discipline and objectivity.

- Emotional Regulation: Learn techniques to manage emotions such as fear, greed, and overconfidence. Practices like mindfulness and meditation can enhance emotional control and reduce stress.

- Self-Awareness: Regularly assess your trading habits, strengths, and weaknesses. Self-awareness helps in identifying areas for improvement and developing strategies to overcome psychological barriers.

2. Risk Management

- Position Sizing: Master the art of position sizing to optimize risk and reward. Understanding how to allocate capital effectively is critical for preserving capital and achieving long-term profitability.

- Stop-Loss Strategies: Implement effective stop-loss strategies to limit potential losses on each trade. Placing stops at strategic levels based on technical analysis ensures that you exit trades before losses escalate.

- Diversification: Learn how to diversify your portfolio across different asset classes and markets to mitigate risk. Diversification reduces the impact of adverse movements in any single market on your overall portfolio.

3. Technical and Fundamental Analysis

- Technical Analysis: Gain proficiency in using technical indicators, chart patterns, and trend analysis to identify trading opportunities. Technical analysis provides insights into market sentiment and potential price movements.

- Fundamental Analysis: Understand how macroeconomic indicators, geopolitical events, and economic trends influence market dynamics. Fundamental analysis complements technical analysis by providing a broader context for trading decisions.

- Data Interpretation: Develop the ability to interpret complex data sets and extract actionable insights. This involves analyzing historical data, economic reports, and market trends to inform your trading strategies.

4. System Development and Optimization

- Algorithmic Trading: Learn programming languages like Python or R to develop and implement trading algorithms. Automated trading systems enhance efficiency and consistency in executing trading strategies.

- Backtesting: Master the process of backtesting trading systems to evaluate their performance against historical data. Backtesting helps in identifying the strengths and weaknesses of your strategies, allowing for informed refinements.

- Continuous Improvement: Embrace a mindset of continuous improvement by regularly reviewing and optimizing your trading systems. Adaptation ensures that your strategies remain effective in changing market conditions.

Van K. Tharp Trading FAQ: Psychology-First Systems, Position Sizing, R-Multiples, and SQN Explained

What makes Van K. Tharp’s approach different from most trading advice?

Tharp put psychology at the center of performance. Instead of hunting “perfect entries,” he taught traders to build a written system matched to their beliefs and risk tolerance, then execute it with discipline using robust risk control. In his framework, your mindset, position sizing, and post-trade review often matter more than any single indicator.

What is an R-multiple and why does Tharp use it?

An R-multiple expresses a trade’s profit or loss relative to the initial risk (R). If your entry is 100, stop is 95, your R is 5. A 10-point gain is +2R; a 5-point loss is −1R. Normalizing results in R lets you compare very different trades, summarize distributions, and calculate expectancy without getting confused by price levels or tick sizes.

How do I calculate expectancy the Van Tharp way?

Expectancy is the average R you can expect per trade:

Expectancy = (Win% × Avg Win in R) − (Loss% × Avg Loss in R).

A system with 40% wins, +2.5R average win, and −1R average loss has: 0.40×2.5 − 0.60×1.0 = +0.4R. Positive expectancy, repeated with discipline and appropriate position sizing, is the engine of long-run equity growth.

What is the System Quality Number (SQN)?

SQN summarizes system quality using the mean and variability of R-results over a sufficient sample. Higher SQN indicates a more dependable edge. Traders use SQN to compare systems, choose when to scale risk, and to avoid over-allocating to noisy edges. (Tharp encouraged measuring, not guessing, system quality.)

How does position sizing fit into Tharp’s philosophy?

Tharp viewed position sizing as the primary lever of results. Two traders with the same signals can end with very different equity curves depending on risk per trade, volatility sizing, and portfolio heat (total risk on). He favored small, consistent risk per idea (e.g., fractions of a percent to low single digits) that keep you in the game.

What is “risk of ruin” and how do Tharp-style traders reduce it?

Risk of ruin is the probability your account falls to a level where you can no longer trade your system. You reduce it by keeping risk per trade small, avoiding correlated bets that spike portfolio heat, and maintaining positive expectancy. Consistent sizing and stop discipline are essential safeguards.

How do beliefs and identity affect system design?

Tharp argued your beliefs shape markets you trade, timeframes, and exits you’ll actually follow. If your system conflicts with your beliefs or lifestyle, you won’t execute it. He advised clarifying beliefs (about trend, mean reversion, risk, and self), then designing rules that align with those beliefs to improve adherence.

What does a Tharp-inspired trading plan include?

It documents objectives, markets, setups, entries, exits, position sizing rules, risk limits, and procedures for journaling and review. It also defines acceptable drawdown, maximum portfolio heat, and contingencies for market regime shifts. The plan is concise enough to execute and detailed enough to remove ambiguity.

How should I set and manage stops under this framework?

Stops define R, so set them where your trade thesis is invalidated (technical structure) rather than at round numbers. Use automation to enforce them, consider volatility-aware placement, and pair with take-profit or trailing logic that reflects your edge. Never widen stops out of discomfort—that breaks your statistics.

How do I journal trades the “Tharp way”?

Record pre-trade intent, R, emotions, rule compliance, and post-trade R-result. Tag mistakes (process errors) separately from normal losses (system outcomes). Review distributions of R, expectancy, mistake rate, and whether wins come from outliers. The goal is continuous system and self-improvement.

How do I scale risk without blowing up?

Earn the right to scale. Increase position size only after a statistically meaningful sample confirms positive expectancy and stable mistake rates. Cap portfolio heat, respect max drawdown limits, and scale down quickly if SQN or expectancy deteriorate or if correlations rise.

What are the most common mistakes new traders make per Tharp?

Oversizing, system-hopping, discretionary overrides of rules, moving stops, and ignoring journaling. Many traders chase entries instead of mastering exits and sizing. Tharp’s remedy: codify rules, trade small, measure results in R, and iterate with data—not emotion.

Key Takeaways from Van K. Tharp’s Trading Approach

Van K. Tharp’s trading philosophy offers a comprehensive framework for achieving consistent success in the financial markets. Here are the key takeaways from his approach:

- Strategic Risk Management: Emphasize controlling risk through position sizing, stop-loss orders, and diversification to protect capital and ensure long-term profitability.

- Trading Psychology: Recognize the profound impact of psychology on trading performance. Cultivate self-awareness, emotional regulation, and psychological discipline to enhance decision-making and maintain objectivity.

- Systematic Approach: Develop and adhere to a structured trading plan that outlines specific entry and exit criteria, risk management protocols, and performance metrics. A systematic approach ensures consistency and reduces the influence of emotions.

- R-Multiples: Utilize R-multiples to evaluate the risk-adjusted performance of trades, providing a clear and objective measure of trading success.

- Continuous Learning: Commit to ongoing education and strategy refinement to adapt to evolving market conditions and incorporate new insights into your trading system.

- Self-Awareness and Discipline: Maintain a disciplined trading routine and adhere strictly to your trading plan, avoiding impulsive decisions driven by emotions or market noise.

Relevance of Tharp’s Methods in Today’s Markets

In today’s dynamic and fast-paced financial markets, the principles and strategies advocated by Van K. Tharp remain highly relevant. The increasing complexity of markets, coupled with the psychological challenges faced by traders, underscores the importance of a disciplined and psychologically resilient trading approach. Tharp’s emphasis on risk management, trading psychology, and systematic planning provides a robust foundation for navigating the complexities of modern trading.

With the advent of advanced technologies and algorithmic trading, the ability to develop and execute automated trading systems has become increasingly important. Tharp’s methodologies, which emphasize the importance of aligning trading systems with individual psychological profiles, offer valuable insights into creating effective and adaptable trading strategies. As markets continue to evolve, the principles of strategic risk management, psychological discipline, and continuous learning will remain integral to achieving sustained trading success.

Explore and Apply These Trading Strategies

Embarking on a trading journey inspired by Van K. Tharp is both challenging and rewarding. It requires a commitment to disciplined execution, continuous learning, and self-improvement. However, the potential rewards—consistent profitability, enhanced decision-making, and psychological resilience—make it a compelling approach for dedicated traders.

As you explore and develop your own trading systems, keep the following in mind:

- Stay Disciplined: Adhere strictly to your trading rules and risk management protocols to maintain consistency and objectivity in your trading decisions.

- Be Patient: Trading often involves waiting for the right market conditions and opportunities. Patience ensures that you enter trades with high conviction, reducing the likelihood of impulsive decisions.

- Embrace Technology: Leverage advanced trading platforms and analytical tools to enhance your trading capabilities, streamline execution, and facilitate comprehensive market analysis.

- Continuously Refine: Regularly review and optimize your trading systems to ensure they remain effective and aligned with your trading goals. Adaptation is key to maintaining competitiveness in evolving markets.

- Learn from Mistakes: Analyze your trading performance to identify and rectify errors, fostering continuous improvement and strategic growth.

By embracing the principles and strategies of Van K. Tharp, you can navigate the complexities of financial markets with confidence and strategic insight. Tharp’s enduring legacy in trading psychology and strategy development offers a blueprint for disciplined, consistent, and potentially lucrative trading, empowering you to achieve your financial goals with resilience and precision.

Investing like Van K. Tharp isn’t just about following a set of rules; it’s about cultivating a mindset that prioritizes psychological mastery, strategic risk management, and continuous improvement. By embracing Tharp’s trading principles, you can navigate the financial markets with confidence and precision, unlocking the potential for sustained trading success. Happy trading!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.