Ever wondered if there’s a method to the madness of market movements? Enter Elliott Wave Theory, a fascinating approach to market analysis developed by Ralph Nelson Elliott in the 1930s. This theory posits that financial markets move in repetitive cycles, driven by collective investor psychology, or sentiment. Elliott discovered that these market movements could be categorized into waves, which repeat in predictable patterns.

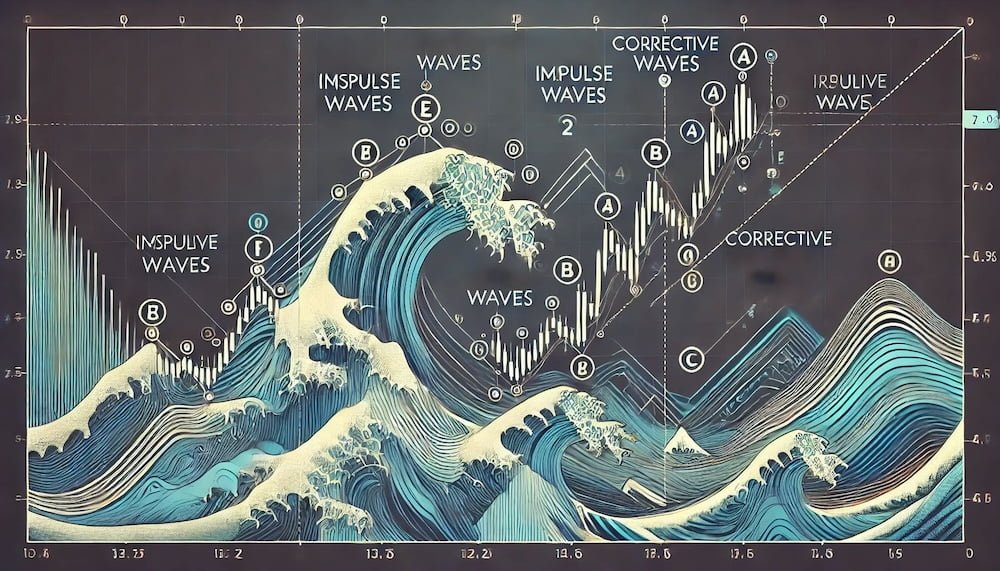

At its core, Elliott Wave Theory suggests that prices move in five-wave patterns in the direction of the main trend, followed by a three-wave corrective pattern against the trend. These wave patterns are fractal in nature, meaning they can be observed on both large and small timeframes. For traders, understanding these wave patterns can provide insights into future price movements and help in identifying potential trading opportunities.

source: Tom Crown on YouTube

Overview of Elliot Wave Theory

So, why are we delving into Elliott Wave Theory? The goal of this article is to demystify this complex yet powerful tool and show you how to effectively apply it to your trading strategies. Whether you’re a seasoned trader looking to refine your techniques or a newcomer eager to learn, this guide aims to provide you with practical, actionable insights.

We’ll break down the principles of Elliott Wave Theory, explain the structure of waves, and guide you on how to identify and label these waves in real-time market conditions. By the end of this article, you’ll have a solid grasp of Elliott Wave Theory and be equipped to incorporate it into your trading toolkit. Ready to dive in? Let’s get started!

Understanding Elliott Wave Theory

Definition

Elliott Wave Theory is like the Rosetta Stone of market analysis. Developed by Ralph Nelson Elliott in the 1930s, this theory posits that financial markets move in predictable, repetitive cycles. Elliott observed that these cycles were the result of collective investor psychology, oscillating between optimism and pessimism. By categorizing these movements into waves, he discovered that markets have a natural rhythm that can be mapped and anticipated.

Wave Patterns

At the heart of Elliott Wave Theory are its distinct wave patterns. Understanding these patterns is key to decoding market behavior.

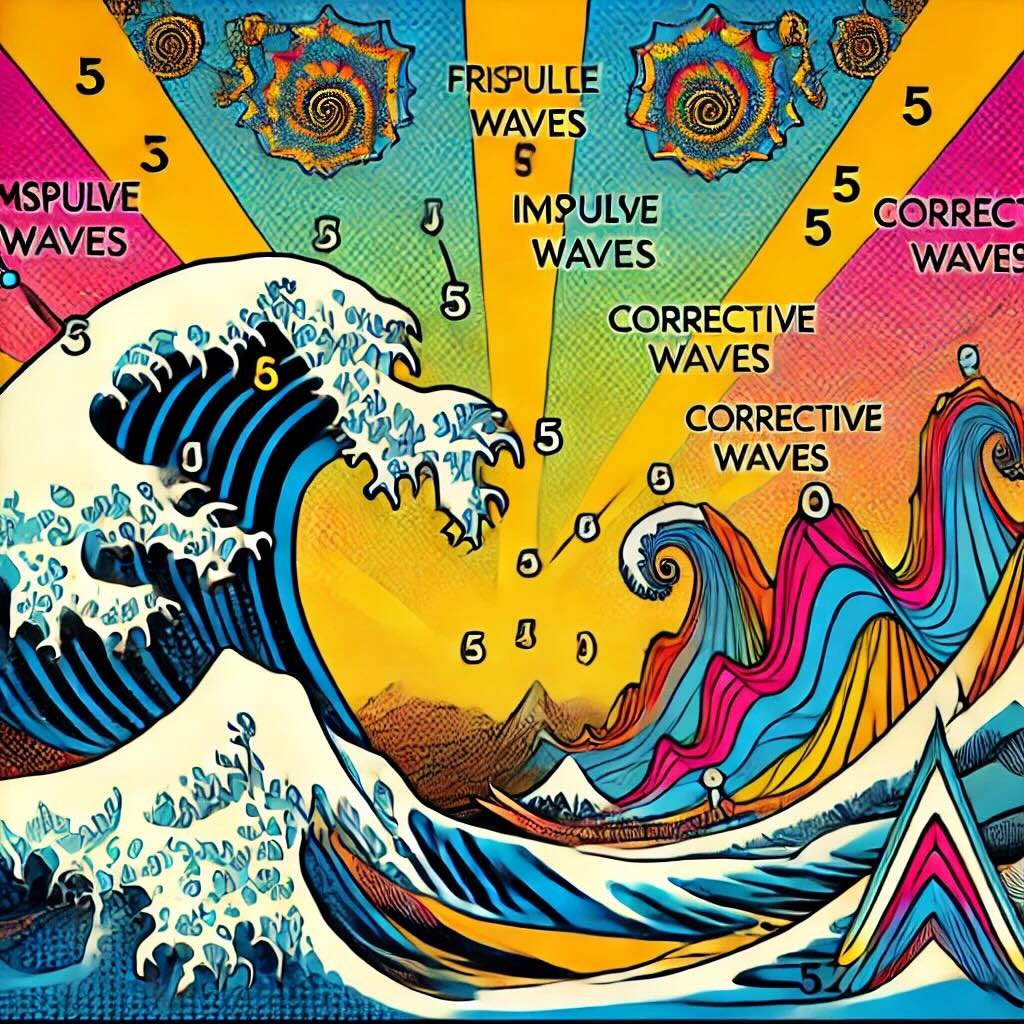

Impulse Waves: These are the driving force behind a trend. Impulse waves consist of five smaller waves moving in the direction of the larger trend. They are characterized by strong, decisive movements and are usually labeled 1, 2, 3, 4, and 5. Within an impulse wave, waves 1, 3, and 5 are the primary movers, while waves 2 and 4 are corrective, offering brief pauses before the trend resumes.

- Wave 1: The initial move in the trend’s direction, often met with skepticism.

- Wave 2: A pullback or correction, but not enough to erase the gains of Wave 1.

- Wave 3: Typically the strongest and longest wave, driven by widespread market recognition of the trend.

- Wave 4: Another corrective wave, which is often complex and can be sideways.

- Wave 5: The final push in the trend’s direction, driven by the last burst of optimism.

Corrective Waves: After the impulse waves, the market undergoes a correction. Corrective waves are typically made up of three smaller waves, labeled A, B, and C. These waves move against the direction of the primary trend and are generally less powerful than impulse waves.

- Wave A: The initial move against the trend, often seen as a minor pullback.

- Wave B: A brief rally in the direction of the original trend, which often traps traders.

- Wave C: The final move in the correction, typically mirroring the length and strength of Wave A.

Wave Degrees

Elliott Wave Theory is fractal in nature, meaning these wave patterns can be observed on various timeframes, from minute charts to monthly charts. This concept is referred to as wave degrees.

Grand Supercycle: This is the largest wave degree, spanning several centuries. It’s more of a historical perspective, showing the long-term trends in financial markets.

Supercycle: Lasting several decades, supercycles capture major economic eras, such as the post-World War II boom.

Cycle: These waves span a few years to a few decades and often correspond to major economic expansions and contractions.

Primary: Primary waves last a few months to a few years, capturing significant bull and bear markets within the broader cycle.

Intermediate: These waves last weeks to months and are the building blocks of primary waves.

Minor, Minute, and Minuette: These are the smaller degrees, lasting from days to hours, and are useful for short-term trading and detailed market analysis.

Key Principles of Elliott Wave Theory

Imagine looking at a coastline from a thousand feet up. It’s jagged, full of twists and turns. Now, zoom in to a few feet above the ground—those same patterns appear, just on a smaller scale. This is the essence of fractals, and it’s exactly how Elliott Waves operate in financial markets.

Elliott Wave Theory posits that market movements are fractal in nature. This means that the patterns you see on a daily chart are similar to those on a weekly, monthly, or even minute-by-minute chart. These repeating patterns help traders anticipate future price movements across different timeframes. Whether you’re a day trader or a long-term investor, understanding these fractals can provide insights into both the immediate and broader market trends.

Wave Characteristics

Grasping the characteristics of Elliott Waves is crucial for applying this theory effectively. Let’s break down the two main types of waves:

Impulse Waves: The movers and shakers of the market. Impulse waves consist of five waves moving in the direction of the primary trend. Here’s a closer look:

- Wave 1: Often hard to spot initially, as it comes after a trend reversal. This wave is typically met with skepticism.

- Wave 2: A pullback that doesn’t retrace all of Wave 1. This wave corrects some of the gains but generally stays above the starting point of Wave 1.

- Wave 3: The powerhouse. Wave 3 is usually the longest and strongest, driven by widespread market realization of the trend.

- Wave 4: A corrective phase, often complex and sideways, setting up the final leg of the trend.

- Wave 5: The final thrust in the trend direction, often driven by exuberance before a significant correction.

Corrective Waves: After the impulse comes the correction. These waves work against the prevailing trend and typically unfold in three waves:

- Wave A: The first move against the trend, marking the start of the correction.

- Wave B: A partial retracement of Wave A, often misleading traders into thinking the trend will resume.

- Wave C: The final leg of the correction, usually as long as Wave A, completing the counter-trend movement.

Rules and Guidelines

Elliott Wave Theory isn’t just about recognizing patterns—it’s also about following specific rules and guidelines to identify and label these waves accurately.

Impulse Wave Rules:

- Wave 2 Cannot Retrace More Than 100% of Wave 1: If Wave 2 retraces all of Wave 1, it’s not an impulse wave.

- Wave 3 Cannot Be the Shortest Wave: Among Waves 1, 3, and 5, Wave 3 must be longer than at least one of the others.

- Wave 4 Cannot Enter the Price Territory of Wave 1: Wave 4 must stay above the peak of Wave 1 in an uptrend and below the trough of Wave 1 in a downtrend.

Corrective Wave Guidelines:

- Alternation: If Wave 2 is a sharp correction, expect Wave 4 to be a flat correction, and vice versa.

- Equality: In a typical correction, Wave A and Wave C tend to be equal in length.

- Channeling: Draw trendlines connecting the highs of Waves 1 and 3, and a parallel line through the low of Wave 2 (in an uptrend). Wave 5 often terminates near this upper trendline.

Additional Guidelines:

- Fibonacci Relationships: Elliott Waves often follow Fibonacci ratios. Wave 2 typically retraces 50% to 61.8% of Wave 1, while Wave 4 often retraces 38.2% of Wave 3. Wave 3 and Wave 5 are often related by the golden ratio (1.618).

Identifying Elliott Waves

Recognizing Patterns

Spotting Elliott Waves on price charts is like finding hidden gems in a treasure map. It takes practice, a keen eye, and a bit of patience. Here’s a step-by-step guide to help you recognize and label these patterns:

- Identify the Trend: Start by determining the overall trend of the market. Are you in a bull market or a bear market? This will set the stage for identifying the impulse and corrective waves.

- Look for Five-Wave Impulse Patterns: In the direction of the main trend, search for a five-wave pattern. Remember, Waves 1, 3, and 5 move with the trend, while Waves 2 and 4 are corrective.

- Wave 1: The initial move in the trend’s direction. This wave can be tricky to identify as it often appears after a trend reversal.

- Wave 2: A pullback that doesn’t completely retrace Wave 1. Wave 2 should be a smaller correction within the larger trend.

- Wave 3: Typically the strongest and longest wave. Wave 3 confirms the trend and is usually where the majority of the movement occurs.

- Wave 4: Another corrective wave, often more complex and sideways, setting up the final push of the trend.

- Wave 5: The final thrust in the trend direction, often accompanied by strong market sentiment before a significant correction begins.

- Identify Three-Wave Corrective Patterns: After the five-wave impulse, look for a three-wave corrective pattern moving against the trend.

- Wave A: The first move against the trend, marking the start of the correction.

- Wave B: A partial retracement of Wave A, often creating a false sense of trend continuation.

- Wave C: The final leg of the correction, usually mirroring Wave A in length and strength.

- Label the Waves: Use the standard Elliott Wave notation to label the waves on your chart. Impulse waves are labeled 1, 2, 3, 4, 5, while corrective waves are labeled A, B, C.

Using Fibonacci Ratios

Fibonacci ratios are like the secret sauce of Elliott Wave Theory. They help confirm wave patterns and provide targets for future price movements. Here’s how to use them:

- Fibonacci Retracements: These are used to measure the pullbacks in corrective waves.

- Wave 2 Retracement: Typically retraces 50% to 61.8% of Wave 1.

- Wave 4 Retracement: Often retraces 38.2% of Wave 3. Draw the retracement levels from the start of Wave 1 to the end of Wave 5 to identify potential support and resistance levels.

- Fibonacci Extensions: These are used to project the length of impulse waves.

- Wave 3 Projection: Often extends to 161.8% of Wave 1.

- Wave 5 Projection: Can be equal to Wave 1 or extend to 61.8% or 100% of the distance from the start of Wave 1 to the end of Wave 3.

Common Pitfalls

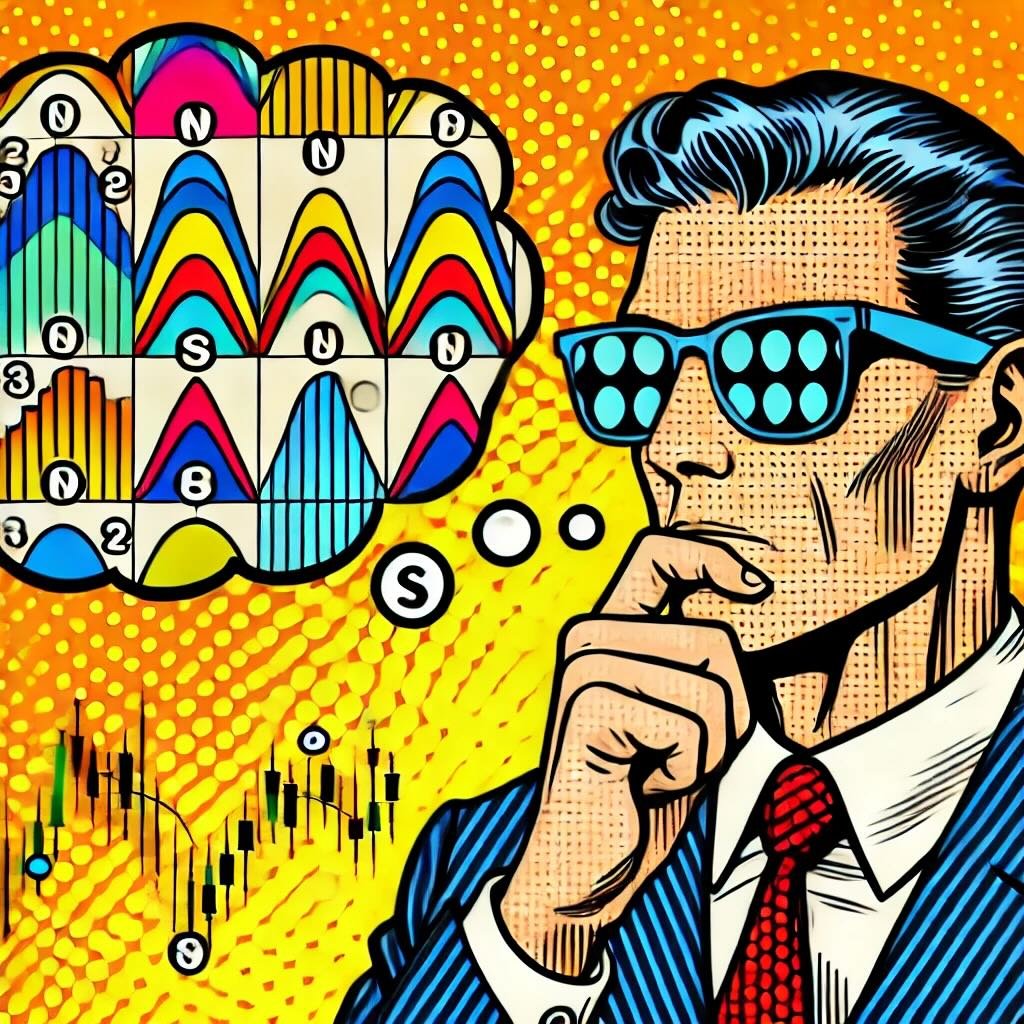

Even seasoned traders can stumble when identifying Elliott Waves. Here are some common mistakes and how to avoid them:

- Forcing the Pattern: One of the biggest mistakes is trying to fit the market into an Elliott Wave pattern when it’s not there. If the waves don’t align with the rules and guidelines, don’t force it. It’s better to wait for a clear pattern to emerge.

- Ignoring Market Context: Always consider the broader market context. Elliott Waves don’t operate in a vacuum. Economic news, market sentiment, and other technical indicators can influence wave patterns.

- Mislabeling Waves: Another common error is mislabeling corrective waves as impulse waves or vice versa. Use the key rules and guidelines to ensure your labels are accurate. For example, remember that Wave 3 can never be the shortest wave, and Wave 4 should not overlap with the price territory of Wave 1.

- Neglecting Time Frames: Elliott Waves are fractal, meaning they appear on multiple timeframes. Make sure to analyze different timeframes to confirm your wave count. A pattern on a daily chart might look different when viewed on a weekly chart.

Applying Elliott Wave Theory in Trading

Entry and Exit Points

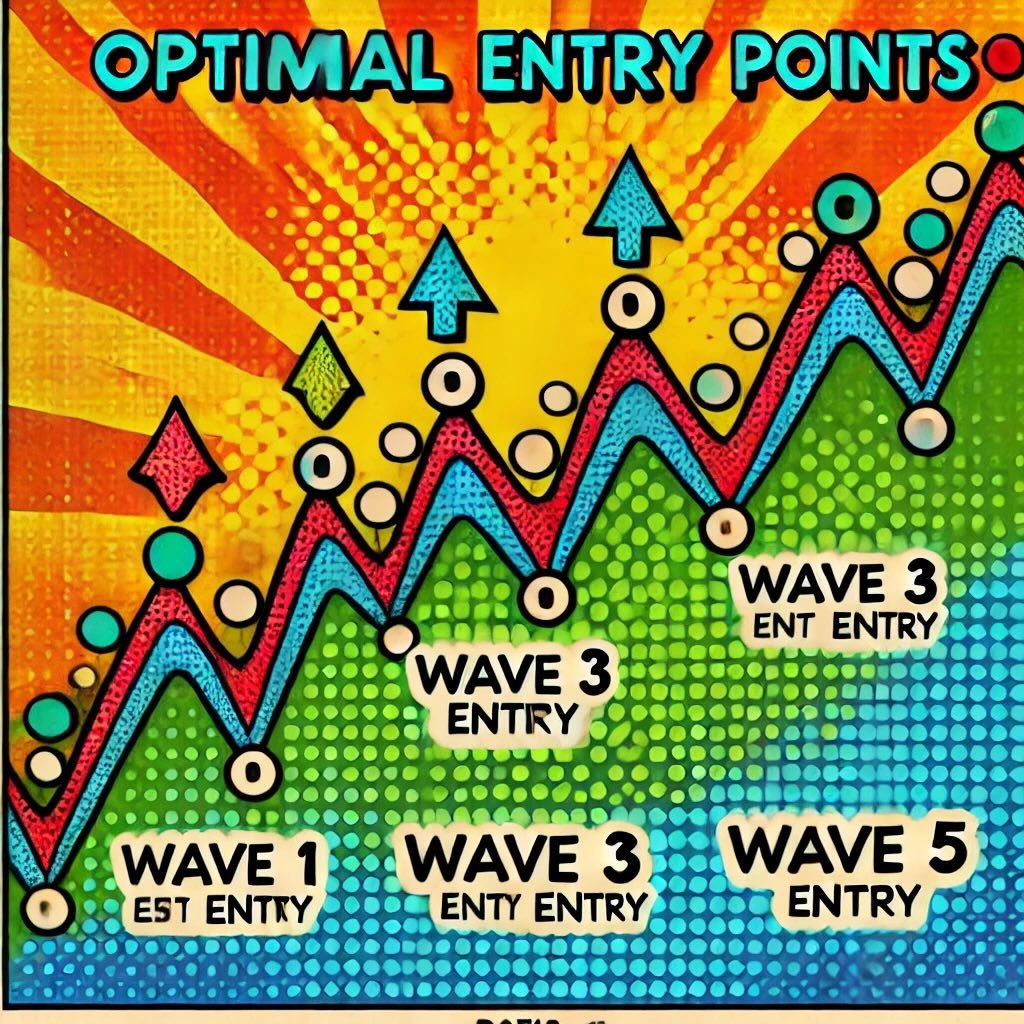

Knowing when to enter and exit trades can be the difference between profit and loss. Elliott Wave Theory can guide you to those sweet spots.

Optimal Entry Points: Look to enter trades at the beginning of impulse waves. For a bullish trend, this means getting in at the start of Wave 1, Wave 3, or Wave 5. These are the points where the market is likely to move strongly in your favor.

- Wave 1 Entry: This can be tricky to spot, as it often looks like a regular market fluctuation. But if you catch it, you’re in early.

- Wave 3 Entry: Typically the most powerful wave, Wave 3 is a prime entry point. Confirmation often comes when Wave 3 surpasses the peak of Wave 1.

- Wave 5 Entry: This wave can be a bit risky, as it’s the final push before a correction. However, it can still offer profitable opportunities if you time it right.

Optimal Exit Points: Exiting at the end of impulse waves ensures you lock in profits before the market turns.

- End of Wave 5: This is the most straightforward exit point, where the trend is likely to reverse. Look for signs of exhaustion in the trend and prepare to exit.

- During Corrective Waves: If you’re riding a long trend, consider taking profits at the end of Wave 3 and re-entering at the end of Wave 4.

Setting Stop-Losses

Managing risk is crucial, and stop-loss orders are your safety net. Using Elliott Wave Theory, you can place stop-losses strategically to minimize potential losses.

Based on Wave Structures: Stop-loss placements should align with the wave patterns you’ve identified.

- Wave 1 and 2: If entering at the start of Wave 1 or 2, place your stop-loss just below the start of Wave 1. This limits risk if the wave count is incorrect.

- Wave 3: For trades during Wave 3, place your stop-loss below the peak of Wave 1. This protects your position in case of unexpected pullbacks.

- Wave 4 and 5: When entering at Wave 4 or 5, set your stop-loss below the start of Wave 4. This helps manage risk if the wave structure fails.

Adjusting Stops: As the trade progresses and waves form, adjust your stop-losses to lock in gains and protect against reversals.

- Trailing Stops: Use trailing stops to move your stop-loss order along with the price. This technique locks in profits while giving the trade room to grow.

Using Complementary Indicators

Combining Elliott Wave Theory with other technical indicators can enhance your trading accuracy. Here are some powerful pairings:

RSI (Relative Strength Index): RSI measures the speed and change of price movements, helping to identify overbought or oversold conditions.

- Wave 3 and RSI: Look for RSI confirming the strength of Wave 3. An RSI above 70 during Wave 3 suggests strong bullish momentum.

- Corrective Waves and RSI: During corrective waves, an RSI below 30 can indicate oversold conditions, signaling a potential entry point for the next impulse wave.

MACD (Moving Average Convergence Divergence): MACD shows the relationship between two moving averages of a stock’s price, indicating momentum and trend direction.

- Wave Confirmation: Use MACD to confirm wave structures. For example, a bullish MACD crossover (MACD line crossing above the signal line) during the formation of Wave 1 or 3 can provide added confidence in the wave count.

- Divergence: Look for MACD divergences to spot potential wave reversals. If prices are making higher highs, but MACD is making lower highs, it might indicate the end of an impulse wave.

Fibonacci Levels: Fibonacci retracements and extensions are naturally aligned with Elliott Wave Theory, providing precise levels for potential reversals or continuations.

- Wave 2 and 4 Retracements: Use Fibonacci retracement levels (38.2%, 50%, 61.8%) to gauge the depth of corrective waves. This helps in setting entry points for subsequent impulse waves.

- Wave 3 and 5 Extensions: Fibonacci extensions (161.8%, 200%) can predict the potential end of Wave 3 and 5, aiding in setting profit targets.

Case Studies and Examples

Historical Examples

Understanding Elliott Wave Theory becomes much easier when we look at it in action. Let’s dive into some historical market movements to see how Elliott Waves played out and what they taught us.

The Dot-Com Bubble (1995-2000)

The dot-com bubble is a classic example of Elliott Wave Theory in action. During this period, tech stocks experienced a massive boom, followed by a dramatic bust.

Impulse Waves:

- Wave 1 (1995-1996): The initial surge in tech stocks as the internet became commercially viable. Investors began to pour money into tech companies, fueling early growth.

- Wave 2 (1996-1997): A mild correction, where skeptical investors pulled back, but the overall optimism remained.

- Wave 3 (1997-1999): The most powerful wave. Tech stocks soared as the internet revolution gained traction, attracting widespread attention and investment.

- Wave 4 (1999): A brief pullback, often interpreted as profit-taking by early investors.

- Wave 5 (1999-2000): The final euphoric push, characterized by speculative mania. Investors were convinced the tech boom would never end.

Corrective Waves:

- Wave A (2000): The initial crash, as reality set in and overvalued stocks began to tumble.

- Wave B (2000-2001): A short-lived rebound, giving false hope that the worst was over.

- Wave C (2001-2002): The continuation of the bear market, with tech stocks hitting new lows.

Analyzing this period through the lens of Elliott Wave Theory shows how understanding wave patterns can provide insights into market psychology and potential turning points.

Live Market Analysis

Let’s take a look at how Elliott Wave Theory can be applied to current market scenarios. By analyzing real-time data, we can see how these principles help in making informed trading decisions.

Example: S&P 500 (2023-2024)

Suppose we’re looking at the S&P 500 in mid-2024. Here’s how you might apply Elliott Wave Theory to identify potential trades.

Current Market Scenario:

- Wave 1 (Early 2023): The S&P 500 begins a new bull market after a significant correction, driven by strong corporate earnings and economic recovery post-pandemic.

- Wave 2 (Mid-2023): A correction occurs as investors take profits and inflation fears rise. However, the pullback is shallow, indicating underlying strength.

- Wave 3 (Late 2023 to Early 2024): A powerful upward movement as confidence in the market returns, bolstered by positive economic data and corporate performance.

Identifying Entry and Exit Points:

- Entry Point: As Wave 2 ends, signs of support and bullish reversal patterns (confirmed by RSI and MACD) suggest an optimal entry point.

- Exit Point: During the late stages of Wave 3, when RSI starts showing overbought conditions, and MACD indicates weakening momentum, you might consider taking profits.

Setting Stop-Losses:

- Wave 2 Entry: Place a stop-loss below the low of Wave 2 to protect against further downside.

- Wave 3 Exit: Use a trailing stop to lock in profits as Wave 3 progresses, adjusting based on the wave structure and market volatility.

Combining with Other Indicators:

- Fibonacci Levels: Apply Fibonacci retracement from the start of Wave 1 to the end of Wave 3 to anticipate potential support levels for Wave 4.

- RSI and MACD: Use these indicators to confirm wave counts and identify potential reversals or continuations.

By applying Elliott Wave Theory in real-time, traders can develop a structured approach to market analysis, enhancing their ability to make informed decisions and manage risk effectively.

Tools and Software for Elliott Wave Analysis

Charting Platforms

When it comes to Elliott Wave analysis, having the right charting platform is crucial. Here are a few top-notch platforms that make wave identification and analysis a breeze:

TradingView: Known for its user-friendly interface and powerful charting tools, TradingView is a favorite among traders. It supports a wide range of technical indicators, including Elliott Wave tools. With TradingView, you can easily label waves, draw Fibonacci retracements, and analyze patterns across different timeframes. Plus, its social trading features let you share insights and learn from other traders.

MetaTrader (MT4 and MT5): MetaTrader is a robust platform widely used by forex and CFD traders. It offers comprehensive charting tools and supports custom indicators for Elliott Wave analysis. You can download and install Elliott Wave indicators or create your own using MetaTrader’s programming language, MQL. MetaTrader also excels in automated trading, making it a versatile choice for Elliott Wave enthusiasts.

ThinkorSwim by TD Ameritrade: This platform is a powerhouse for technical analysis. ThinkorSwim provides a variety of tools for Elliott Wave analysis, including built-in wave indicators and drawing tools. It’s highly customizable and offers advanced features like backtesting and paper trading, which are perfect for practicing your Elliott Wave strategies.

Elliott Wave Indicators

Specific indicators and tools can simplify the process of Elliott Wave analysis. Here are some essential ones:

Elliott Wave Oscillator (EWO): This oscillator helps identify the strength and direction of waves. It measures the difference between a 5-period and a 35-period moving average, providing insights into wave patterns and potential reversals.

ZigZag Indicator: The ZigZag indicator is useful for filtering out market noise and highlighting significant price movements. It helps in visualizing the main waves by connecting the highs and lows, making it easier to spot Elliott Wave patterns.

Fibonacci Retracement and Extension Tools: These tools are indispensable for Elliott Wave analysis. They help you identify potential support and resistance levels based on Fibonacci ratios, which are crucial for wave counts and projecting future price movements.

Automated Software

For those who prefer a more automated approach, several software solutions can help identify and analyze Elliott Waves:

MotiveWave: MotiveWave is a professional-grade trading and charting platform specifically designed for Elliott Wave analysis. It offers advanced features like automated wave counts, pattern recognition, and detailed wave labeling. MotiveWave also includes a wide range of technical analysis tools, making it a comprehensive solution for traders.

Elwave: Elwave is a dedicated Elliott Wave software that automates the process of wave identification. It provides real-time wave counts, trading signals, and detailed analysis reports. Elwave’s algorithm adapts to market conditions, ensuring accurate wave counts and improving your trading decisions.

NeoWave: NeoWave software combines traditional Elliott Wave Theory with Glenn Neely’s advanced wave analysis techniques. It offers automated wave counts, pattern identification, and detailed market analysis. NeoWave’s approach focuses on improving the accuracy and reliability of wave counts, making it a valuable tool for serious traders.

Advantages and Limitations

Benefits

Using Elliott Wave Theory in trading offers several compelling benefits. Here’s why many traders swear by it:

Improved Market Timing: One of the standout advantages of Elliott Wave Theory is its potential to improve market timing. By understanding the wave patterns, traders can identify the start and end of trends, enabling them to enter and exit trades at optimal points. Whether it’s catching the beginning of a powerful Wave 3 or exiting before a corrective Wave C, precise market timing can enhance profitability.

Enhanced Pattern Recognition: Elliott Wave Theory provides a structured framework for recognizing market patterns. It helps traders see beyond the noise and understand the underlying market sentiment. Recognizing these patterns allows traders to anticipate future price movements and make more informed decisions. The fractal nature of Elliott Waves means these patterns can be applied to various timeframes, from minute charts to monthly charts.

Predictive Power: Elliott Waves can provide predictive insights into future price movements. By analyzing the wave structure, traders can forecast potential price targets and reversal points. This predictive power is invaluable for setting realistic profit targets and stop-loss levels, contributing to better risk management.

Combining with Other Indicators: Elliott Wave Theory works well with other technical indicators. Combining wave analysis with tools like RSI, MACD, and Fibonacci retracements can validate wave counts and provide additional confirmation for trades. This multi-faceted approach enhances trading accuracy and confidence.

Limitations

Despite its advantages, Elliott Wave Theory is not without its challenges and limitations. Here are some key points to consider:

Subjective Nature of Wave Labeling: One of the primary criticisms of Elliott Wave Theory is the subjective nature of wave labeling. Different traders might interpret the same price chart differently, leading to varied wave counts. This subjectivity can create confusion and inconsistency in analysis, especially for those new to the theory.

Complexity of Patterns: Elliott Wave patterns can be complex and difficult to identify, particularly in real-time trading. The theory involves numerous rules and guidelines that must be adhered to, which can be overwhelming for beginners. Additionally, markets don’t always move in perfect wave patterns, adding to the complexity.

Dependence on Market Conditions: Elliott Wave Theory works best in trending markets. In choppy or sideways markets, wave patterns can be harder to discern, leading to inaccurate analysis. Traders need to be adaptable and use other methods during such market conditions to avoid misinterpreting the waves.

Time-Consuming: Analyzing and labeling waves can be time-consuming. It requires a deep understanding of the theory, continuous learning, and regular practice. For traders with limited time, this can be a significant drawback. Automated software can help, but it’s not a complete substitute for manual analysis.

Risk of Overfitting: Relying too heavily on historical data and wave patterns can lead to overfitting, where the analysis fits past data perfectly but fails to predict future movements accurately. Traders need to be cautious and ensure that their wave counts are robust and adaptable to changing market conditions.

Tips for Success

Continuous Learning

In the ever-evolving world of trading, continuous learning is your secret weapon. Mastering Elliott Wave Theory isn’t a one-time event; it’s an ongoing journey. Dive into books, attend webinars, and participate in forums. There’s always something new to learn, whether it’s a fresh perspective on wave patterns or a novel way to combine Elliott Waves with other indicators.

Stay Updated: Markets change, and so do trading strategies. Stay updated with the latest developments in technical analysis and market behavior. Follow industry experts, subscribe to financial journals, and engage with trading communities.

Practice, Practice, Practice: Theory is just the beginning. Apply what you learn by practicing on historical charts and in demo accounts. The more you practice, the better you’ll get at spotting wave patterns and making real-time trading decisions. Remember, it’s the hands-on experience that hones your skills.

Learn from Mistakes: Every mistake is a lesson in disguise. Don’t be afraid to make errors—analyze them, understand what went wrong, and refine your approach. Each misstep is a stepping stone to mastery.

Adaptability

Flexibility is key in trading. Markets are dynamic, and rigid strategies often fall short. Elliott Wave Theory provides a framework, but it’s crucial to adapt your strategies based on current market conditions.

Assess Market Context: Before applying Elliott Wave Theory, assess the broader market context. Are you in a trending market or a range-bound one? Understanding the environment helps you apply the theory more effectively.

Be Open to Adjustments: Don’t get married to your wave count. Be willing to adjust your analysis as new data comes in. If the market isn’t behaving as expected, re-evaluate your wave labeling and consider alternative scenarios.

Use Complementary Tools: Enhance your wave analysis with other technical tools. Indicators like RSI, MACD, and Fibonacci retracements can provide additional confirmation and help you make more informed decisions. This holistic approach improves accuracy and adaptability.

Risk Management

Sound risk management is the cornerstone of successful trading. Even the best analysis can go awry, so protecting your capital should always be a priority.

Set Clear Stop-Loss Levels: Determine your stop-loss levels based on wave structures and stick to them. This discipline prevents small losses from turning into significant setbacks. For instance, if you’re entering at the start of Wave 3, place your stop-loss just below the low of Wave 2.

Position Sizing: Don’t risk too much on a single trade. Use position sizing to manage your exposure and ensure that a few losing trades don’t wipe out your account. A common rule is to risk no more than 1-2% of your trading capital on any single trade.

Regularly Review and Adjust: Continuously review your risk management strategies and adjust them based on performance and changing market conditions. This ongoing refinement helps you stay prepared for any market scenario.

Diversify Your Portfolio: Spread your investments across different assets and timeframes to mitigate risk. Diversification reduces the impact of adverse movements in any single market or position.

12-Question FAQ: How to Apply the Elliott Wave Theory Strategy in Trading

1) What is Elliott Wave Theory in one sentence?

A market framework proposing that prices move in repeating 5-wave impulses with the trend and 3-wave corrections against it, driven by crowd psychology.

2) How are the waves structured?

An impulse is labeled 1-2-3-4-5 (with 1,3,5 in trend direction; 2,4 corrective). A correction is typically A-B-C against the prior impulse.

3) What are the three non-negotiable impulse rules?

Rule 1: Wave 2 never retraces 100% of Wave 1.

Rule 2: Wave 3 is never the shortest of waves 1,3,5.

Rule 3: In a standard impulse, Wave 4 does not overlap Wave 1 price territory.

4) Which guidelines help refine counts?

Alternation: If Wave 2 is sharp, Wave 4 tends to be sideways (and vice versa).

Equality: Waves A and C are often similar in length/time.

Channeling: Draw a channel through 1–3 highs with a parallel from 2; Wave 5 often terminates near the top.

5) How do Fibonacci levels integrate with waves?

Common anchors: Wave 2 retraces ~50–61.8% of Wave 1; Wave 4 ~23.6–38.2% of Wave 3. Wave 3 often extends 161.8% of Wave 1; Wave 5 can equal Wave 1 or project 61.8–100% of 1→3.

6) How do I start an Elliott count on a fresh chart?

Identify the dominant trend on a higher timeframe.

Mark the first clean 5-up/5-down structure.

Validate with the three rules above.

Layer to lower timeframes to align degrees (Primary → Intermediate → Minor).

7) Where are the preferred entries?

End of Wave 2 (buy dips/sell rallies near 50–61.8% retrace with invalidation at start of Wave 1).

Early Wave 3 break above/below Wave 1 extreme (highest momentum).

End of Wave 4 for the Wave 5 push (tighter targets, manage risk).

8) How do I set stops and targets with waves?

Stops: Just beyond the invalidating level (e.g., below start of Wave 1 for a long).

Targets: Use Fibonacci extensions (Wave 3 ≈ 161.8%*Wave1; Wave 5 ≈ Wave1 or 61.8–100% of 1→3). Trail with a channel or ATR.

9) Which indicators best complement Elliott analysis?

RSI for divergence at Wave 5 tops/bottoms.

MACD for momentum confirmation of Wave 3.

Fibonacci tools for retrace/extension confluence.

Volume or OBV to confirm impulsive thrusts.

10) What are the most common mistakes to avoid?

Forcing counts to fit bias, ignoring the three rules, overlapping Wave 4, counting corrections as impulses, and neglecting multi-timeframe alignment.

11) Which platforms and tools help with wave work?

TradingView, ThinkorSwim, MetaTrader for manual labeling + Fib tools.

Specialist software like MotiveWave, ELWAVE for assisted counts (still require human oversight).

12) How do I validate an Elliott-based strategy before live trading?

Backtest and forward-test a rule-set (entry at Wave-2 retrace + invalidation; risk 1–2%; targets via extensions), include costs/slippage, review win rate, R-multiple, max drawdown, and track adherence to rules.

Educational content only—not investment advice. Always test and size risk appropriately.

Conclusion

We’ve journeyed through the fascinating world of Elliott Wave Theory, uncovering its principles and practical applications. Here’s a quick recap of the main points we covered:

- Introduction to Elliott Wave Theory: We explored the origins of Elliott Wave Theory and its significance in trading, providing a foundation for understanding market movements.

- Understanding Elliott Waves: We delved into the structure of impulse and corrective waves, discussing their characteristics and how they fit into the larger market context.

- Key Principles: We highlighted the concept of fractals, the specific rules and guidelines for wave labeling, and the importance of Fibonacci ratios in confirming wave patterns.

- Identifying Waves: A step-by-step guide helped you recognize and label Elliott Wave patterns on price charts, using tools like the Elliott Wave Oscillator and Fibonacci retracements.

- Trading Strategies: Practical tips on determining optimal entry and exit points, setting stop-losses, and combining Elliott Wave Theory with other indicators like RSI and MACD.

- Case Studies and Examples: We examined historical and live market scenarios to illustrate the application of Elliott Wave Theory in real-world trading.

- Tools and Software: We recommended charting platforms and automated software to enhance your Elliott Wave analysis.

- Advantages and Limitations: A balanced view of the benefits and challenges of using Elliott Wave Theory, emphasizing the need for a well-rounded approach.

- Tips for Success: Continuous learning, adaptability, and sound risk management practices were highlighted as crucial for mastering Elliott Wave Theory.

Encouragement to Practice

Theory is one thing, but practice is where the real learning happens. Before diving into live trading, take the time to practice identifying and trading Elliott Waves in a demo account. This risk-free environment allows you to hone your skills, test your strategies, and build confidence. Pay close attention to your wave counts, backtest your methods, and don’t rush the process. The more you practice, the more intuitive your wave analysis will become.

Final Thoughts

Elliott Wave Theory has the potential to transform your trading strategy and deepen your understanding of market dynamics. While it comes with its challenges—like the subjective nature of wave labeling and the complexity of patterns—the benefits can be substantial. Improved market timing, enhanced pattern recognition, and predictive insights are just a few advantages of mastering this powerful tool.

By integrating Elliott Wave Theory with other technical indicators and maintaining a disciplined approach, you can navigate the markets with greater confidence and precision. Remember, trading is a continuous learning journey. Stay curious, be adaptable, and always manage your risk. With dedication and practice, Elliott Wave Theory can become a valuable asset in your trading arsenal. Ready to start your Elliott Wave journey? Dive in, keep learning, and watch as your trading skills soar. Happy trading!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Very good presentation and educational.