Financial Independence, Retire Early (FIRE) is a life-empowering concept that has gained notable traction in recent years. This movement, deeply rooted in meticulous financial planning and strategic decision making, represents a paradigm shift in traditional retirement planning.

Definition of FIRE

The ethos of FIRE is all about reducing one’s reliance on full-time employment by fostering self-sufficient financial mechanisms that can provide a sustainable income for life, even without the typical 9-to-5 job.

Under the FIRE model, participants strive to amass a nest egg that’s typically calculated to be 25 times their yearly expenses. This ‘FIRE number,’ as it is colloquially referred to, represents the milestone when one can confidently step away from their routine employment, secure in the knowledge that their expenses are covered by their savings and investments.

Brief history of the FIRE movement

The seeds of the FIRE movement were planted in 1992, with the publication of “Your Money or Your Life” by Vicki Robin and Joe Dominguez. The book laid the groundwork for what would later become the financial independence and retiring early movement, urging readers to reconsider their consumer-driven lifestyles and shift their focus to financial independence and a richer, non-materialistic life experience.

In the digital age, the movement found a wider audience, with bloggers such as Mr. Money Mustache and Early Retirement Extreme acting as evangelists of this financial gospel. These platforms demonstrated, through real-life examples and practical advice, that early retirement was no longer a utopian dream limited to the ultra-wealthy. Instead, it was an achievable goal, attainable through conscious spending, disciplined saving, and smart investing.

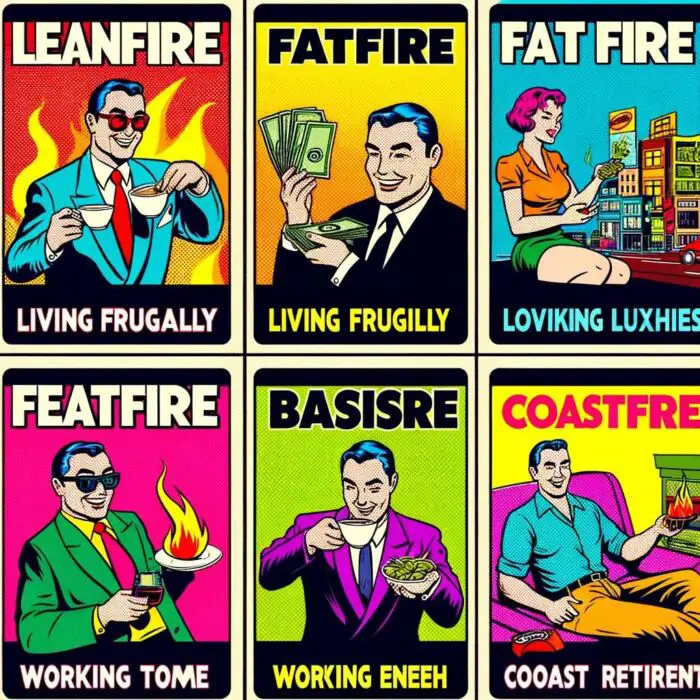

Over time, as more people subscribed to this philosophy, the financial independence and retiring early movement branched out into distinct paths like LeanFIRE, focused on extreme frugality, and FatFIRE, which allowed for a higher standard of living. There’s also BaristaFIRE, where part-time work supplements investment returns, allowing for a more relaxed approach to early retirement. Each of these branches represents different interpretations of the same core principle: prioritizing financial independence to achieve a higher degree of personal freedom.

Importance of FIRE

In a financial landscape where mounting debt, economic uncertainty, and lack of adequate savings have become all too common, the FIRE movement offers a beacon of hope and an empowering alternative. It delivers a roadmap for individuals to reclaim control of their financial futures and redefine the conventions of success.

The appeal of financial independence and retiring early lies not just in the prospect of an early retirement, but in the promise of financial freedom that it brings. This freedom allows for a life lived on one’s terms—whether that means traveling the world, spending more quality time with family, diving into a passion project, or contributing meaningfully to a cause you care deeply about.

FIRE is not necessarily a call to exit the workforce prematurely. Instead, it promotes financial independence that enables better choices, flexibility, and control over one’s life. Along this journey, individuals cultivate critical skills such as meticulous budgeting, discerning investing, and mindful consumption. These are life skills that provide immense value, irrespective of whether one decides to retire early or not.

In its essence, the FIRE movement is not just a retirement strategy; it’s a life philosophy. It nudges us to question the status quo, rethink our relationship with money, and reprioritize our life goals. Whether you’re striving to quit your job at 40 or simply yearn for a financially secure future, the tenets of the financial independence and retiring early movement can be instrumental in guiding you towards a life that aligns with your values and aspirations.

Understanding the FIRE Movement

Principles behind FIRE

At its core, the FIRE movement operates on three fundamental principles: income maximization, expense minimization, and aggressive investing. The first, income maximization, focuses on amplifying your earning potential. This may involve climbing the corporate ladder, developing high-income skills, starting a business, or establishing passive income streams.

The second principle, expense minimization, revolves around living frugally and cutting unnecessary costs. This doesn’t mean living a life of deprivation, but rather making thoughtful choices about spending, striving for efficiency, and prioritizing needs over wants.

Lastly, aggressive investing refers to deploying your surplus income (income after expenses) into investment vehicles that generate substantial returns over time. Common strategies include investing in low-cost index funds, real estate, bonds, and other income-generating assets.

Key terminologies

Several key terminologies are central to the financial independence and retiring early discourse:

- FIRE Number: This is the amount of money you need to have saved or invested before you can retire. The standard rule is that your FIRE number should be at least 25 times your annual living expenses.

- LeanFIRE: This term refers to achieving FIRE on a minimalist lifestyle. Adherents of LeanFIRE are known for their extreme frugality and ability to live comfortably on a smaller budget. The FIRE number for LeanFIRE adherents is typically lower than the conventional FIRE number.

- FatFIRE: The antithesis of LeanFIRE, FatFIRE refers to achieving FIRE while maintaining a more traditional, even luxurious, lifestyle. Individuals pursuing FatFIRE aim to retire with a larger nest egg, allowing for higher annual spending.

- BaristaFIRE: This concept involves working part-time or in a low-stress job after achieving FIRE, to cover living expenses without tapping into retirement savings. The term was coined from the idea of working a low-stress job, such as a barista at a coffee shop, after retirement.

Types of FIRE and their differences

The FIRE movement is not a one-size-fits-all approach. Instead, it encompasses various sub-movements that tailor the principles of FIRE to different lifestyles and goals.

LeanFIRE, as mentioned earlier, emphasizes severe frugality and efficient living. LeanFIRE enthusiasts often live well below their means to save a higher percentage of their income and retire as early as possible.

FatFIRE is for those who desire a more affluent lifestyle in retirement. FatFIRE enthusiasts aim to accumulate a larger portfolio, often double or triple the standard FIRE number. This enables them to enjoy luxuries such as travel, fine dining, and high-end experiences in retirement.

BaristaFIRE is for those who wish to leave their high-stress jobs but continue to work in some capacity, either for the enjoyment of work itself or to cover day-to-day expenses.

There are also other variations, such as CoastFIRE, where individuals save enough early in life that they no longer need to contribute to their retirement fund and can coast along until they retire.

Benefits of pursuing FIRE

Pursuing financial independence and retiring early can bring manifold benefits, beyond the obvious allure of early retirement:

- Financial Security: Achieving FIRE means you have a nest egg large enough to sustain you for the rest of your life, offering a sense of security that most people only dream of.

- Freedom and Flexibility: With financial independence comes the freedom to leave a job you don’t love, take risks on new opportunities, spend more time with family, or travel the world. Your choices are no longer dictated by financial constraints.

- Personal Growth: The journey to FIRE can be a path of profound personal growth. It often involves learning new financial skills, building discipline, and defining what truly matters in life.

- Improved Quality of Life: By encouraging mindful spending and a focus on what’s truly important, the pursuit of FIRE can lead to a more fulfilling and less materialistic life.

- Peace of Mind: Financial stress can take a toll on mental health. The financial stability that FIRE brings can greatly enhance peace of mind and overall well-being.

In essence, the FIRE movement is about crafting a life you don’t need to retire from. It’s about taking control of your financial future and, by extension, gaining greater control over your life’s path.

source: Road to FIRE on YouTube

Steps to Achieving FIRE

Assessing Your Current Financial Situation

The first step towards embarking on your FIRE journey is a comprehensive and honest assessment of your current financial situation. This involves evaluating your income sources, expenses, savings, debts, and overall net worth. Understanding where you stand financially is crucial as it forms the foundation on which your financial independence and retiring early plan will be built. Use tools like budgeting apps, net worth calculators, and expense trackers to help paint a clear picture of your finances.

Setting Clear Financial Goals

Once you have a grasp of your current situation, it’s time to define your financial goals. Are you aiming for LeanFIRE, FatFIRE, or perhaps BaristaFIRE? How many years from now do you envision reaching your FIRE number? What lifestyle changes are you willing to make to achieve this? Having clear, specific, and realistic goals is essential in keeping you motivated and focused on your journey.

Developing a High Savings Rate

A key principle of FIRE is saving a significant portion of your income. While the average American might save 15-20% of their income, those pursuing financial independence and retiring early aim to save 50% or more. This aggressive savings rate is what allows FIRE adherents to accumulate wealth quickly. The goal here is to find a balance between a savings rate that accelerates your journey to FIRE but still allows for a lifestyle that you can sustain and enjoy.

Investing Wisely

Saving alone won’t get you to FIRE – your money needs to work for you. This is where investing comes in. The financial independence and retiring early community typically favors investments with a long-term view, such as low-cost index funds and rental real estate. The key is to develop a diversified investment portfolio that aligns with your risk tolerance and financial goals. If investing seems daunting, there are numerous resources available to help you learn, or you might consider seeking advice from a financial advisor.

Creating and Maintaining a Budget

Budgeting is crucial in managing your expenses and ensuring that you’re saving enough to meet your FIRE goals. A well-structured budget provides a roadmap for your money and helps keep your spending in check. It should account for all your income and every single expense, including housing, food, healthcare, leisure, and even the occasional splurge. Remember, your budget isn’t meant to restrict you, but to empower you by giving you control over your finances.

Embracing Frugality

Frugality is a cornerstone of the financial independence and retiring early movement. It’s not about pinching pennies or depriving yourself, but rather making mindful decisions about your spending. This could mean choosing a smaller house, biking instead of owning a car, or cooking at home instead of dining out. The goal is to cut waste, not joy, from your budget.

Earning Additional Income

While cutting expenses is essential, there’s a limit to how much you can save. On the other hand, your potential to earn more is limitless. Consider ways you could generate additional income, such as a side hustle, freelance work, or investing in income-generating assets. The extra income can significantly speed up your journey to FIRE.

Calculating Your FIRE Number

Your FIRE number is the amount of money you need to have invested to live off the returns indefinitely. A popular method to calculate this is the 4% rule, which suggests that you can safely withdraw 4% of your portfolio each year without running out of money. Using this rule, your FIRE number would be 25 times your annual expenses.

Tracking Progress and Adjusting Plans Accordingly

The journey to FIRE isn’t a straight path, and you’ll need to make adjustments along the way. Regularly track your progress towards your FIRE number, evaluate your budget, review your investments, and adjust your plan as needed. Life changes, like a new job, marriage, kids, or even a global pandemic, can all impact your financial independence and retiring early journey. Being flexible and adaptable will help ensure your plan stays resilient in the face of life’s unpredictability.

In the end, remember that the journey to FIRE is not a race. It’s a personal journey of financial growth and self-discovery that leads to a life of freedom and fulfillment. The key is to start where you are, use what you have, and do what you can – and before you know it, you’ll be fanning the flames of your own FIRE journey.

source: FIRE We Go! – Financial Independence Retire Early on YouTube

Strategies for FIRE

Real Estate Investing

Investing in real estate is a popular strategy among the FIRE community. The appeal lies in the potential for both steady cash flow from rental income and long-term appreciation. Real estate can be a particularly powerful tool in achieving FIRE, thanks to its various income streams and tax benefits. From traditional rental properties and house hacking to real estate investment trusts (REITs), the real estate market offers myriad ways to create wealth. However, remember that while real estate can be lucrative, it’s not without risks and requires due diligence.

Stock Market Investing

Another cornerstone of the FIRE strategy is investing in the stock market, specifically in low-cost index funds. Index funds, which are designed to match the performance of a specific market index, offer diversification, low fees, and generally reliable returns over the long term. The idea is to consistently invest, regardless of market highs and lows, in a strategy often referred to as dollar-cost averaging. Over time, the compounding returns from these investments can significantly contribute to reaching your FIRE number.

Retirement Accounts Optimization

Optimizing retirement accounts is another important aspect of a solid FIRE strategy. Utilizing tax-advantaged accounts like 401(k)s, IRAs, and HSAs can result in significant tax savings and allow for more money to grow through compounding. It’s important to understand the contribution limits, withdrawal rules, and potential penalties associated with each type of account. Some financial independence and retiring early followers even employ strategies like the Roth IRA conversion ladder to access these funds before the traditional retirement age without penalties.

Tax Optimization

Tax optimization is a powerful, yet often overlooked, tool in the pursuit of FIRE. This involves utilizing various strategies to minimize your tax burden legally, thereby maximizing your savings and investments. Strategies may include tax-efficient investing, taking advantage of tax credits and deductions, and strategic withdrawal plans in retirement. Given the complexities of the tax code, consulting with a tax professional can be beneficial.

Passive Income Generation

Generating passive income, or income that requires little to no effort to maintain, is another popular strategy for achieving FIRE. This could include dividends from investments, royalties from a book or invention, income from a rental property, or earnings from a side business. The goal is to create reliable income streams that can help cover your living expenses and reduce the amount you need to draw from your nest egg.

Geographic Arbitrage

Geographic arbitrage involves leveraging the cost of living differences between various locations to your advantage. This might mean living in a low-cost country while earning a salary (or retirement income) based on a higher-cost country’s rates. It could also involve relocating to a less expensive region within your own country. This strategy can significantly reduce living expenses and accelerate your path to FIRE.

Side Hustles and Gigs

In today’s gig economy, there are endless opportunities to earn extra income outside of your primary job. This could involve freelancing, consulting, teaching or tutoring, selling handmade products, driving for a rideshare service, or any number of other gigs. The income from these side hustles can be used to boost your savings rate and invest more towards your FIRE goals. Plus, they might even offer a chance to explore a passion or hobby and could potentially turn into a full-time endeavor in your post-FIRE life.

Remember, these strategies aren’t exclusive and can be mixed and matched according to your personal preferences, risk tolerance, and financial goals. The journey to FIRE is a personal one, and the best strategy is the one that aligns with your values and fits into your life.

source: Our Money Quest on YouTube

Dealing with Challenges in FIRE

Market Downturns

Market downturns can be especially challenging for those on the FIRE path since the strategy heavily relies on investment returns. It’s important to understand that market volatility is a natural part of investing, and downturns can offer opportunities to buy investments at lower prices. Developing a resilient portfolio and maintaining a long-term perspective can help weather these periods. Regular rebalancing of your portfolio and maintaining a sufficient emergency fund are also crucial in buffering the impact of market downturns on your FIRE journey.

Healthcare Costs

Healthcare costs are a significant concern, especially for those in the U.S., as early retirement may mean losing employer-sponsored health coverage long before qualifying for Medicare. Strategies to tackle this include budgeting for healthcare costs in your FIRE number, considering health sharing plans, using a Health Savings Account (HSA), or even exploring medical tourism for major procedures. It’s also essential to maintain a healthy lifestyle to minimize potential healthcare issues.

Inflation

Inflation, the rate at which the general level of prices for goods and services is rising, can erode the purchasing power of your savings over time. One strategy to mitigate the impact of inflation is to invest in assets that tend to increase in value over time, such as stocks and real estate. Additionally, the “4% rule” commonly used in FIRE calculations already accounts for inflation to some degree.

Lifestyle Changes

The frugality required to achieve FIRE can necessitate substantial lifestyle changes, which may include downsizing your home, reducing leisure activities, or cutting out non-essential spending. These changes can be challenging, particularly if they feel like sacrifices. The key is to focus on value-based spending—allocating money in a way that aligns with your values and brings you joy—and to find low-cost activities and habits that enhance your life.

Psychological Impacts

The transition from full-time work to FIRE can have unexpected psychological impacts. Losing the structure, social connections, and sense of purpose that work provides can lead to feelings of aimlessness or isolation. It’s important to plan not just for the financial aspect of financial independence and retiring early, but also for the emotional and psychological side. This could mean developing hobbies, pursuing passion projects, volunteering, or even continuing some form of part-time or flexible work.

Maintaining Social Connections

Retiring early can impact your social life, as work is a primary source of social interaction for many people. Plus, being the only one in your social circle who isn’t working a traditional job can sometimes lead to feelings of isolation or disconnection. Proactively maintaining and developing social connections is vital. This might look like joining local clubs or communities, volunteering, taking part in social hobbies, or even starting a part-time job or side gig purely for the social aspect.

Navigating the path to FIRE can be challenging and isn’t always a straight line. But with careful planning, flexibility, and resilience, these obstacles can not only be overcome, but can also provide opportunities for growth and new experiences. It’s important to remember that financial independence and retiring early is not about achieving a perfect plan, but about progressing towards financial independence and creating a life that aligns with your values and aspirations.

Case Studies and Success Stories

Individual Experiences of Achieving FIRE

To truly understand the potential of the FIRE movement, let’s take a look at some real-world experiences.

Meet Jane, a software engineer from San Francisco. Despite earning a six-figure salary, she felt trapped in the 9-5 grind and longed for freedom to travel and pursue her passion for photography. Jane embarked on her financial independence and retiring early journey at 28 and managed to retire by 38. Her strategy involved aggressive saving (over 60% of her income), investing heavily in index funds, and developing a side income from selling her photographs. Now, Jane enjoys a nomadic lifestyle, traveling the world with her camera, financed by the returns from her investment portfolio.

Diverse Experiences Across Age, Gender, Family Status, Geography

The beauty of the FIRE movement is its inclusivity; it’s not just for high earners or single people with no kids.

Consider the Smiths, a family of four from Minnesota. Both teachers, the Smiths may not have high salaries, but they’ve embraced frugality to save 50% of their income. They grow their own vegetables, cycle wherever possible, and enjoy low-cost local activities with their kids. They invest in low-cost index funds and plan to retire in their early 50s, demonstrating that FIRE is achievable even on a moderate income and with a family.

Then, there’s Ana from Spain. Ana didn’t discover FIRE until she was in her 40s but proved it’s never too late to start. She capitalized on geographic arbitrage, moving from bustling Madrid to a smaller, cheaper city. This allowed her to drastically cut her living expenses, enabling her to save more of her income, which she invested in a mix of stocks and bonds. Ana plans to achieve financial independence and retiring early by 55, showing that the FIRE movement is indeed a global phenomenon, and it’s accessible at any age.

Lessons Learned from These Experiences

These stories illustrate the diversity of the FIRE movement and the many paths to achieving financial independence. The common threads amongst them, though, are clear financial goals, a high savings rate, thoughtful investing, and a willingness to make lifestyle changes.

However, they also highlight that the FIRE journey can be unique to each person. Jane’s approach was quite aggressive, reflecting her high income and risk tolerance. The Smiths’ journey emphasizes the importance of frugality and family participation. Ana’s story reminds us that it’s never too late to start and demonstrates the power of geographic arbitrage.

These varied experiences show that there is no one-size-fits-all approach to FIRE. It’s about finding the strategies that best fit your lifestyle, financial situation, and goals, proving that financial independence and early retirement are attainable realities for many, not just a privileged few.

source: BiggerPockets Money on YouTube

Post-FIRE Life

Adjusting to a New Lifestyle

Life after achieving FIRE is an adventure into uncharted territory. The shift from work-focused life to a life of financial freedom can be exciting yet daunting. The newfound time and freedom can be overwhelming initially. It’s important to gradually explore interests, hobbies, and activities that you didn’t have time for during your working years. This could range from traveling, volunteering, or taking up a new hobby, to even starting a passion project or a small business. The key is to find a balance in your daily routine that suits you, promoting both productivity and relaxation.

Managing Your Finances in Retirement

In the post-FIRE phase, you transition from the accumulation stage to the withdrawal stage, which requires a different financial strategy. Managing your nest egg responsibly to ensure it lasts is crucial. This involves establishing a sustainable withdrawal rate, rebalancing your portfolio periodically, and keeping an eye on your expenses. Having a contingency plan for market downturns, unexpected expenses, or changes in your lifestyle is also important.

Finding New Purposes and Passions

With financial worries put to rest, the post-FIRE phase provides an excellent opportunity to discover and pursue new passions and purposes. This could be anything from learning a new language, diving into a new field of study, or devoting time to a cause you care about. It’s a time to redefine your identity outside of a traditional career and to create a fulfilling and meaningful life based on your passions and values.

Dealing with Potential Return-to-Work Situations

While the goal of FIRE is to eliminate the need for traditional employment, there might be situations where returning to work becomes an option or a necessity. This could be driven by financial reasons, such as unexpected expenses, or personal reasons, like missing the social interactions and structure of a workplace. It’s beneficial to stay open to these possibilities and to keep your skills and network updated.

Life and Financial Planning Beyond FIRE

Achieving FIRE is not the end of the journey. It’s the beginning of a new chapter where ongoing life and financial planning become essential. This includes areas like estate planning, considering long-term care options, maintaining health insurance, and planning for potential life changes. Engaging with the FIRE community, staying informed about financial trends, and perhaps working with a financial advisor can be useful in navigating life beyond financial independence and retiring early.

Ultimately, the post-FIRE life is a period of exploration, freedom, and self-discovery. It’s a time to live life on your own terms, free from financial constraints. The lifestyle changes, management of finances, pursuit of passions, and planning for the future are all part of this exciting phase. Despite the challenges and adjustments it may bring, the post-FIRE life is a testament to the power of financial independence and the potential it has to shape our lives.

source: Damien Talks Money on YouTube

Criticisms and Counterarguments of FIRE

Perceived Downsides of the FIRE Lifestyle

Like any movement, financial independence and retiring early is not immune to criticism. Some perceive it as a lifestyle of extreme frugality, denying oneself the joys of present-day life in order to save for an uncertain future. Others argue that it promotes an unrealistic and unachievable goal, given that not everyone has the high incomes often associated with successful FIRE stories. There’s also the concern of unexpected events such as health issues, market downturns, or family emergencies, which can derail even the best laid FIRE plans.

Common Misconceptions about FIRE

Several misconceptions exist about FIRE. Some people believe it’s only for the wealthy or for those without children. Others see it as a path that mandates extreme frugality, requiring people to live like paupers. Another misconception is the idea that FIRE followers are idle in their early retirement, lacking purpose or productivity. These misconceptions can overshadow the flexibility, diversity, and potential benefits that the FIRE movement can offer.

Addressing and Countering these Criticisms

Firstly, while achieving FIRE does require discipline and often a high savings rate, it doesn’t necessarily mean living in deprivation. Many people practicing financial independence and retiring early espouse value-based spending, where you allocate your money towards what truly brings you joy and cut ruthlessly in areas that do not. Frugality in the FIRE movement is about prioritizing and making intentional choices, not about denying oneself pleasure.

Secondly, while high earners may have an advantage in pursuing FIRE, the principles of saving, investing, and living below one’s means are beneficial for anyone, at any income level. FIRE is more about the journey towards financial independence and less about the actual early retirement. It promotes financial literacy, resilience, and freedom from the paycheck-to-paycheck cycle.

Thirdly, unexpected life events can certainly pose a risk, but part of the FIRE planning involves preparing for such situations. This includes maintaining an emergency fund, having adequate insurance, and being flexible with withdrawal rates and plans.

As for the misconceptions, FIRE is indeed attainable by a wide range of people, not just the wealthy or child-free. Every FIRE journey is unique, and each person tailors their path according to their income, responsibilities, and goals. Also, post-FIRE life is not about idleness. Many financial independence and retiring early enthusiasts engage in purposeful activities, take on passion projects, or even start businesses in their early retirement, leading fulfilling and productive lives.

In conclusion, the FIRE movement, like any lifestyle choice, has its critics and challenges. However, when understood properly and tailored to one’s personal circumstances, it can serve as a powerful tool towards achieving financial independence and crafting a life of choice and freedom.

FIRE: Complete Guide to Financial Independence & Retiring Early — 12-Question FAQ

1) What exactly is FIRE?

FIRE means building enough invested assets that work becomes optional. Your portfolio (plus any passive income) covers your annual spending so you can choose if, when, and how to work.

2) How do I calculate my “FIRE number”?

Start with annual spending and multiply by ~25–33×. Example: $40,000/yr → ~$1.0M–$1.32M. Use the higher multiple (30–33×) for extra safety, long horizons, or higher healthcare/tax costs.

3) Is the “4% rule” still reliable?

Treat 4% as a historical heuristic, not a promise. Many FIRE folks plan around 3–3.5% for longer retirements and add flexibility (spend a bit less after bad market years and a bit more after good ones).

4) How long will FIRE take at different savings rates?

Time to FI is driven by savings rate: ~20% save = decades; ~50% = ~15 years; ~65–70% = ~8–10 years (assumes sensible returns and constant spending). Boosting income and controlling housing/transport are the biggest levers.

5) What are the main FIRE “flavors”?

LeanFIRE: minimal, frugal lifestyle; smallest nest egg.

FatFIRE: higher annual spend; larger cushion/luxuries.

BaristaFIRE: part-time/low-stress work to cover some expenses.

CoastFIRE: save early, then let compounding finish with minimal new contributions.

6) What investing approach fits FIRE best?

A low-cost, diversified core (broad stock index funds) plus stabilizers (bonds/cash). Real estate, small businesses, or REITs can diversify cash flow—but require added skill and risk management.

7) How should I handle taxes and account types?

Aim for tax diversification: taxable, tax-deferred, and tax-free accounts. Map a withdrawal/ROTH-conversion plan years in advance, harvest gains/losses in taxable, and place assets tax-efficiently (bonds in tax-advantaged when possible).

8) What about healthcare and insurance?

Budget premiums, deductibles, and out-of-pocket maximums explicitly. Build a medical sinking fund, use HSAs (where available), and consider term life and disability insurance pre-FI. Explore geo- or employer-benefit options if part-time post-FI.

9) How do I reduce sequence-of-returns risk (bad markets early in retirement)?

Keep 1–3 years of expenses in cash/T-bills, use dynamic “guardrails” for withdrawals, rebalance, and trim discretionary spend after down years. Optional: small annuities later in life or part-time income.

10) Which income boosters help most on the path to FI?

Negotiating pay, job switching for higher comp, monetizing skills (consulting/contracting), scalable side hustles, and income-producing assets (rentals, royalties). Income growth + expense control = faster FI.

11) What are the biggest pros and cons of FIRE?

Pros: time freedom, financial resilience, value-aligned living, lower money stress.

Cons: high savings demands, market/healthcare uncertainty, social/identity shifts, and the need for ongoing tax/benefit planning.

12) What’s a practical first-steps checklist?

(1) Track every expense; (2) set a target spend and FIRE number; (3) raise savings rate steadily; (4) automate investing into low-cost funds; (5) build 3–6 months’ emergency cash; (6) draft a withdrawal/tax plan; (7) test-drive your target budget for 3–12 months.

source: On Cash Flow on YouTube

Conclusion: Potential benefits of FIRE

The concept of Financial Independence, Retire Early (FIRE) is a transformative paradigm shift, placing financial autonomy at the heart of one’s life aspirations. Beyond the lure of retiring early, it presents an opportunity to redefine one’s relationship with money, work, and life itself. The potential benefits of this movement are manifold. It offers the possibility of breaking free from financial anxiety, of achieving a state of financial resilience that can weather life’s unpredictables, and of liberating oneself from the traditional cycle of earning and spending. It grants the time and freedom to embark on ventures that truly align with personal passions, be it traveling the world, devoting time to volunteer work, nurturing a hobby, or starting a business.

Encouragement for Those Contemplating FIRE

If the FIRE movement has sparked your interest and you find yourself standing at the precipice of this bold journey, know that the path, while demanding, holds unparalleled potential. Yes, it calls for meticulous planning, self-discipline, and often the courage to challenge societal norms around work, consumption, and lifestyle. However, the promise of gaining control over your financial destiny, of securing peace of mind, and of unlocking the freedom to pursue a life defined by your own desires and not by financial obligations, makes the journey worthwhile. Remember, the beauty of financial independence and retiring early lies in its flexibility – it’s not a rigid doctrine, but a philosophy that you can mold to suit your own financial circumstances and life goals. Even if the destination of early retirement seems distant, the journey itself will equip you with valuable financial skills and habits that can significantly enhance your quality of life.

Parting Thoughts and Guidance for FIRE Aspirants

As you gear up to embark on your FIRE adventure, remember that this journey is a deeply personal one. No two FIRE paths are identical, and it’s crucial to adapt its principles to fit your specific lifestyle, values, and financial standing. The path demands a commitment to financial literacy, which will empower you to make informed decisions about your savings, expenditure, investments, and overall financial strategy. Be prepared for obstacles along the way and remain adaptable in your approach, ready to adjust your plans as your circumstances evolve. And, importantly, savor the journey.

The FIRE journey is not just a financial quest, but a pursuit of a life unshackled by monetary constraints. It’s about building a future where you possess the freedom and the time to engage in activities you love, on your own terms, without the incessant shadow of financial worry. This vision, this promise of financial independence and a life of deliberate choices, is a beacon worth striving for, no matter where you currently stand in your financial journey. Embrace it, and let the journey transform you.

source: The Money Plant on YouTube

Resources for Further Learning

A. Recommended Books, Blogs, and Podcasts about FIRE

- Books: The literature landscape for FIRE is both broad and insightful. Top of the list is “Your Money or Your Life” by Vicki Robin and Joe Dominguez. Often touted as the book that ignited the FIRE movement, it offers a profound examination of our relationship with money and delivers actionable steps towards achieving financial independence. Another seminal work is “The Simple Path to Wealth” by JL Collins, a book that turns the complex world of investing into a comprehensible guide, an essential skillset on the road to FIRE. Additionally, “Early Retirement Extreme” by Jacob Lund Fisker is a must-read. It challenges traditional notions of retirement planning and provides a holistic framework for financial independence, one that’s scalable and adaptable to a range of income levels.

- Blogs: In the realm of blogs, Mr. Money Mustache stands out as a pillar of the FIRE community. It marries humor with hard-hitting advice on frugality, investing, and lifestyle design. The blog is a testament to the power of the FIRE philosophy and a guide to implementing it in real life. Another key resource is the Early Retirement Extreme blog, an extension of Fisker’s book. It delves deeper into the philosophy of economic efficiency and resilience. Moreover, the Mad Fientist blog, known for its detailed research and tax optimization strategies, provides valuable insights on accelerating your journey to financial independence.

- Podcasts: Podcasts offer another avenue for learning and inspiration. “ChooseFI” is a popular choice, hosting in-depth discussions on a variety of FIRE-related topics, from investment strategies to lifestyle changes. The “Mad Fientist” podcast supplements the blog by bringing together thought leaders and successful practitioners of financial independence and retiring early, offering listeners a wealth of first-hand insights and actionable tips.

Tools and Calculators for FIRE Planning

Embracing the right tools can supercharge your journey towards FIRE. For instance, the “FIRE Calculator” found in the Financial Independence subreddit (r/financialindependence) is a dynamic tool that allows you to calculate your own FIRE timeline based on your financial details. Additionally, personal finance management platforms like Mint and You Need a Budget (YNAB) offer invaluable assistance in tracking your income, expenses, investments, and progress towards financial goals.

Communities and Groups for FIRE Enthusiasts

As you navigate your FIRE journey, you’ll find immense value in engaging with communities of like-minded individuals. Online forums such as the Financial Independence subreddit and the Early Retirement Extreme Forum provide robust platforms for sharing experiences, strategies, and encouragement. Furthermore, social media groups such as the Financial Independence/Early Retirement (FIRE) group on Facebook, offer an accessible community of fellow FIRE practitioners. Don’t underestimate the value of connecting locally, too. Websites like Meetup.com often list local FIRE groups that host regular meetups.

In conclusion, pursuing financial independence and retiring early doesn’t mean you’re in this alone. There are numerous resources and communities brimming with knowledge, advice, and support. These resources will not only equip you with the skills and strategies to achieve FIRE but also provide inspiration and camaraderie on your journey. Whether it’s reading a new perspective in a book or blog, listening to a fresh idea in a podcast, or connecting with fellow enthusiasts in a forum or meetup, each step brings you closer to the goal of financial independence and early retirement.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.