I’m of the firm opinion that many of the best ETFs are recently minted.

As an expanded canvas investor, I’m relentlessly seeking the most capital efficient funds to gain core exposure to stocks, bonds and alternatives.

The one combination that has been missing in the ETF marketplace is a return stacking stocks and managed futures fund.

Well, that’s no longer the case!

Because as of today RSST ETF is now available.

It’s better known as Return Stacked U.S. Stocks & Managed Futures ETF.

Thus, I’m thrilled to welcome back (its creator) Corey Hoffstein to go over all of its unique features.

Without further ado, let’s turn things over to Corey!

Corey Hoffstein: CIO of Newfound Research

Corey Hoffstein is co-founder and Chief Investment Officer of Newfound Research, a quantitative investment firm offering alternative investment strategies and capital efficient solutions.

At Newfound, Corey oversees quantitative research and overall corporate strategy.

A passionate researcher and educator, Corey is best known for his writing on liquidity cascades, his journal-published papers on rebalance timing luck, his most recent piece “15 Ideas, Frameworks, and Lessons from 15 Years” and being the host of the quantitative investment podcast Flirting with Models.

Corey holds a B.S. in Computer Science from Cornell University and a M.S. in Computational Finance from Carnegie Mellon University.

Reviewing The Strategy Behind RSST ETF (Return Stacked U.S. Stocks & Managed Futures ETF)

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of RSST ETF?

For those who aren’t necessarily familiar with a “‘return stacked’ capital efficient” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

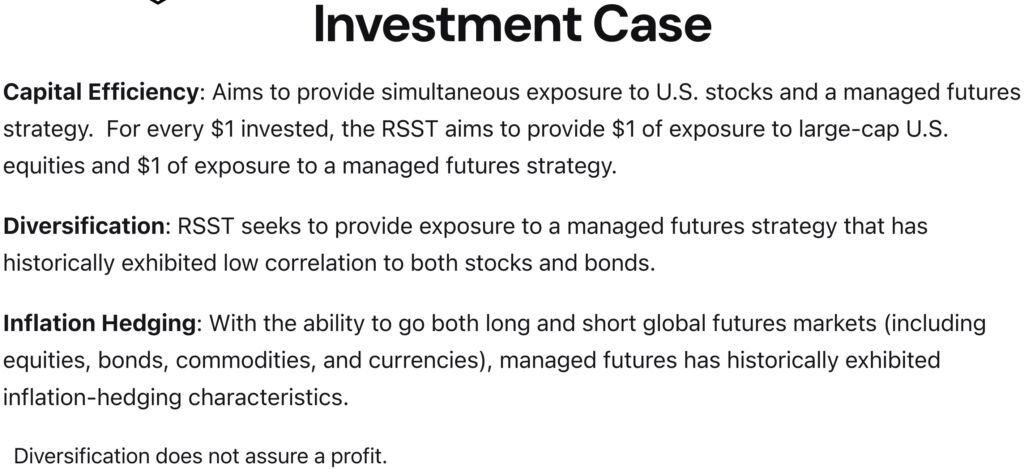

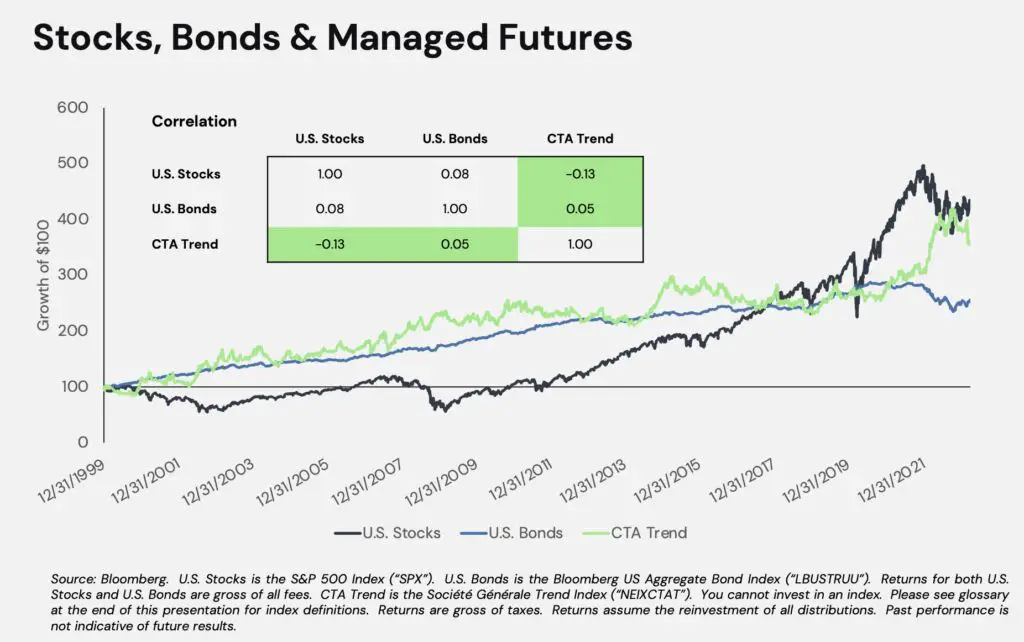

Most investors will acknowledge that more diversification is generally favorable to less. By combining uncorrelated assets, wealth can compound more consistently and investors can achieve their financial plans with more certainty.

The best non-correlated options tend to be alternative assets like gold and commodities as well as alternative strategies like managed futures, systematic global macro and other liquid alts. Unfortunately, most investors today allocate little to no money to these areas? Why?

In my experience, it is because adding alternatives also means subtracting exposure to core stocks and bonds. This can create significant tracking error and lead to substantial relative underperformance during decades like the 2010s when stocks and bonds thrived and many alternatives languished.

Return stacking aims to solve this problem by providing investors with a “yes and” solution rather than an “either/or” decision.

It does this by combining multiple exposures into a single fund. For example:

- In the Return Stacked Bonds & Managed Futures ETF (RSBT), for every $1 invested, we provide $1 of exposure to bonds and $1 of exposure to a managed futures strategy.

- In the Return Stacked U.S. Stocks & Managed Futures ETF (RSST), for every $1 invested we provide $1 of exposure to large-cap U.S. equities and $1 of exposure to a managed futures fund.

By swapping out a portion of core stock or bond exposure with the respective two-for-one pre-packaged ETF, we are able to reintroduce the core exposure AND stack managed futures on top of their original portfolio.

For more on return stacking, you can visit our “what is return stacking” primer.

Unique Features Of Return Stacked U.S. Stocks & Managed Futures Fund RSST ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

For every $1 invested, the Return Stacked U.S. Stocks & Managed Futures ETF (RSST) is designed to provide $1 of large-cap U.S. equity exposure and $1 of exposure to a managed futures strategy.

The relative exposure to U.S. equities and the managed futures strategy is static.

The large-cap U.S. equity exposure simply seeks to provide broad large-cap U.S. equity exposure (e.g. S&P 500); there is no active stock-picking component.

The managed futures strategy seeks to replicate the Société Générale Trend Index.

This fund is meant to complement our existing Return Stacked Bonds & Managed Futures ETF (RSBT), which is designed similarly but seeks to provide $1 of bonds and $1 of exposure to a managed futures strategy for every $1 invested.

source: ReSolve Asset Management on YouTube

What Sets RSST ETF Apart From Other Asset Allocation Funds?

How does your fund set itself apart from other “asset allocation” funds being offered in what is already a crowded marketplace? What makes it unique?

There are two primary differentiators to this fund.

- We believe return stacking is the key value proposition. There are hundreds of U.S. equity funds and dozens of managed futures funds. We’re not aware of any that give you $1 of exposure to U.S. equities and $1 of managed futures for every $1 invested.This enables a whole new dimension of portfolio construction for investors and allocators.

- The managed futures strategy seeks to replicate the Société Générale Trend Index. The managed futures category is notorious for performance dispersion among managers. Rather than introduce idiosyncratic process risk, our goal is to try to provide the “beta” of the category.

This will introduce its own modeling risk, but we believe, over the long run, this approach will have less tracking error to the benchmark than any individual manager.

source: The Meb Faber Show on YouTube

What Else Was Considered For RSST ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

Since the managed futures strategy was being paired with equities, we discussed at length whether we wanted to run a managed futures strategy that was designed to exhibit more consistently negative correlation to equities, particularly during tail environments (e.g. no long equity exposure).

Ultimately, we decided that we wanted this ETF to mirror the design of RSBT, simplifying the choice for investors simply down to whether they want to pair with bonds or stocks.

When Will RSST ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

The fund is new and I cannot discuss backtests. That said, we like the “return stacked” nomenclature because we think it helps explain precisely how returns in the fund should materialize.

While U.S. equities and managed futures have exhibited a low degree of correlation historically, they have exhibited high degrees of correlation over short-term periods. These periods can lead to amplified returns: both positive and negative.

We’d expect the fund to do well during periods when U.S. equities are doing well and there are sufficient trends in equities, rates, commodities, and currencies futures markets for the managed futures strategy to profit from.

Conversely, we’d expect the fund to do poorly during periods when U.S. equities are doing poorly and there mean reversion in equities, rates, commodities, and currencies futures markets are causing the managed futures strategy to lose money.

On average, we’d expect the volatility of U.S. equities to match well with the volatility of the managed futures strategy, so neither should dominate the ETF’s risk profile over the long run.

Why Should Investors Consider Return Stacked US Stocks & Managed Futures RSST ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

Our aim with Return Stacked funds is to allow investors to keep their global beta exposure and complement it with diversifying alternatives.

Why should they replace that low-cost exposure with a more expensive fund?

- By retaining the core beta through stacking, the fee is explicitly to pay for the alternative. We no longer have to ask, “can the alternative outperform the core beta after fees,” but simply: “can the alternative outperform the fees?”

- We believe we can offer the alternatives at a lower cost than our peer group.

- We believe that introducing additional return streams through stacking has several potential benefits, including: (1) enhanced long-term returns; (2) the potential to improve diversification and reduce risk; and (3) the potential for a more sustainable allocation to alternatives.

source: Raise Your Average on YouTube

How Does RSST ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

The primary use case for RSST is quite simple: replacing large-cap U.S. equities with RSST allows investors to retain their large-cap U.S. equity exposure while introducing a managed futures strategy to their portfolio.

The size of the allocation ultimately determines the size of the overlay. I believe you’ve introduced this to your audience as “what is the canvas size” of the portfolio. For example, selling 5% of large-cap U.S. equity exposure to buy RSST would create a 5% managed futures overlay on the portfolio, a total canvas size of 105%; selling 20% to buy RSST would result in a 20% overlay, a total canvas size of 120%.

source: Return Stacked® Portfolio Solutions on YouTube

The Cons of RSST ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Many investors are simply averse to leverage. And, make no mistake, return stacking is an application of leverage.

The fear of leverage is understandable: if you look at just about every major financial catastrophe, you’ll find leverage lurking at the crime scene. But it is usually concentrated leverage.

What we’re specifically advocating for is utilizing leverage to better unlock the potential benefits of diversification. We believe that return stacking can not only help investors introduce alternatives in a way that can improve expected portfolio results, but also introduce alternatives in a manner that is behaviorally sustainable.

The Pros of RSST ETF

On the other hand, what have others praised about your fund?

We are excited at the number of people who see our funds the same way as we do: pre-stacked building blocks that enable a variety of different portfolios to be constructed.

Some may elect to create a small overlay on their very traditional stock-bond portfolio. Others have created examples where they re-think what an “all weather” portfolio might look like, creating levered, balanced allocations of stocks, bonds, commodities, and alternative strategies.

Our intention with launching Return Stacked ETFs (www.returnstackedetfs.com) is not to be prescriptive (though we do have opinions), but rather to provide the building blocks for informed investors to build the portfolios that are best for them. Having said that, we do offer clear assembly instructions via model portfolios for those advisors and institutions that want turnkey solutions and incorporates other pre-packaged funds and ETFs at Return Stacked Portfolio Solutions (www.returnstacked.com).

Learn More About RSST ETF and Return Stacking

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

As I mentioned in the last answer, we see our funds as pre-stacked building block solutions and so, as you might expect, we plan to continue to launch different combinations of stacks in the coming months and years.

For financial professionals, we also offer model portfolios. These are turnkey portfolio solutions that implement return stacking concepts and are available in a variety of risk profiles. Advisors can implement them directly, customize them, or simply use them as inspiration. We plan on expanding our model lineup over the next several years.

We’ve also been working on several tools to allow investors to learn by getting their hands dirty. To date we’ve published two tools: the Return Stacking Visualizer and a Return Stacking Withdrawal Visualizer. The former allows investors to easily explore and backtest different return stacking concepts. The latter allows investors to explore how return stacking combinations can impact portfolio longevity and withdrawals. Both are currently available to financial professionals after they register on our website. We hope to expand this toolkit going forward.

Finally, we recognize that this concept will be novel for many, so education is a strong focus for us. So, we plan on publishing more content on our blog as well as our YouTube channel.

RSST ETF — 12 Essential FAQs on the Return Stacked U.S. Stocks & Managed Futures Fund (with Corey Hoffstein)

What is RSST in one sentence?

RSST (Return Stacked U.S. Stocks & Managed Futures ETF) is a capital-efficient “two-for-one” fund designed to deliver $1 of large-cap U.S. equity exposure + $1 of managed futures exposure for every $1 invested.

How does “return stacking” actually work here?

RSST pairs a static large-cap U.S. equity sleeve (think broad market beta) with a managed futures sleeve that seeks to replicate the SG Trend Index, combining two lowly-correlated return streams in a single ETF so investors don’t have to cut core equity to add alternatives.

Is the equity portion actively stock-picking?

No. The equity sleeve is passive, broad large-cap exposure—the active edge comes from stacking it with a managed futures “beta” replication of trend following.

Why stack managed futures with U.S. stocks?

Because investors often under-allocate to alts to avoid tracking error versus benchmarks. Stacking lets you keep your core beta while adding a diversifier that historically has low correlation and can help in inflationary or crisis regimes.

How is RSST different from other asset-allocation or alt ETFs?

Two key ways: (1) it explicitly targets $1 stocks + $1 managed futures per $1 invested; (2) the MF sleeve seeks category beta (SG Trend replication) to reduce manager idiosyncrasy and dispersion.

When might RSST perform best?

When U.S. equities are up and global futures trends (across equities, rates, commodities, and FX) are well-defined, allowing both sleeves to contribute positively (“stacked” tailwinds).

When might RSST struggle?

When equities are down and managed futures face mean-reversion or choppy, trendless conditions—short-term correlations can converge, amplifying negative returns over brief windows.

Is RSST “leveraged”?

Return stacking uses derivatives to create notional exposure > 100% (the “expanded canvas”). This is a measured, diversified use of leverage intended to unlock diversification—distinct from concentrated leverage that often drives blow-ups.

How do I use RSST in a portfolio?

Replace part of a large-cap equity sleeve with RSST to overlay managed futures. Example: swapping 10% of large-cap for RSST adds ~10% MF overlay (portfolio “canvas” ~110%) while keeping the equity exposure.

What’s the role of RSST alongside RSBT?

RSBT stacks bonds + managed futures; RSST stacks stocks + managed futures. Together they offer two pre-stacked building blocks to introduce trend following without dropping traditional beta.

What are the main pros and cons to consider?

Pros: capital efficiency, easier behavioral buy-in (keep core beta), potential risk-diversification and inflation resilience.

Cons: leverage aversion for some allocators; short-term correlation spikes can magnify drawdowns; modeling risk in index replication.

How should investors think about fees and value?

The fee effectively pays for the alternative sleeve while retaining equity beta; the key question becomes, “Can the managed futures component outperform its fee over time?”—rather than “beat equities” outright.

Nomadic Samuel Final Thoughts

I want to personally thank Corey Hoffstein at Return Stacked ETFs for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.