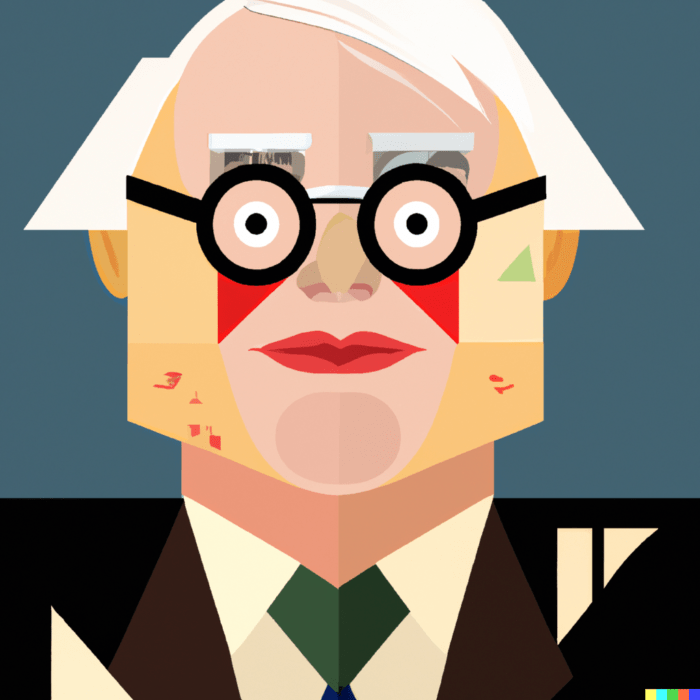

Ah, Warren Buffett. There’s a name that resounds in the world of finance with the echoing boom of a gong. The CEO and chairman of Berkshire Hathaway, often lovingly referred to as the “Oracle of Omaha,” he is widely considered one of the most successful investors of all time. His net worth, often hovering in the stratosphere of billions, might suggest that he possesses a secret alchemical formula to transform the leaden dross of the market into gleaming gold.

But the truth of Buffett’s philosophy is far more accessible and down-to-earth. At its core, it revolves around a few simple, timeless principles: investing in businesses he understands, favoring long-term value over short-term gains, meticulous analysis of a company’s fundamentals, and an unwavering commitment to the power of compound interest. While these principles might not sound as tantalizing as a quick-rich scheme, they have weathered the storms of volatile markets and held steadfast in the winds of financial change.

Introduction to the Concept of Compound Interest

So, let’s address the enigmatic elephant in the room: compound interest. Often hailed as the “eighth wonder of the world,” its magic lies in its simplicity and its extraordinary ability to grow wealth over time.

Imagine planting a small money tree in your backyard. You water it, tend to it, and over time, it begins to bear fruit in the form of interest. Now, instead of plucking and enjoying these fruits immediately, you leave them on the tree. These fruits themselves start to grow new fruits. Over time, your tree becomes larger and larger, bearing more and more fruit. This, in essence, is the concept of compound interest.

In more technical terms, compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. It differs from simple interest, where interest is calculated only on the initial amount (principal) that was deposited or borrowed.

Now, why should a small business owner care about a concept that sounds like it was plucked straight from a finance textbook? Well, as we will see in the following sections, when wielded correctly, compound interest can become a powerful tool in the arsenal of any business, big or small. Warren Buffett himself once said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.

So buckle up, dear reader, as we delve into the world of compound interest, guided by the wisdom of Warren Buffett and tailored for the ambitious small business owner. This journey promises to be as enlightening as it is profitable.

Understanding Compound Interest

Let’s wade a little deeper into the waters of compound interest. It’s often called the magic of investing, but really, it’s just mathematics working its charm. Compound interest is basically interest on interest. It’s the financial equivalent of a snowball rolling down a hill, growing bigger and faster as it goes.

To break it down further, let’s imagine you invest $1,000 at an interest rate of 5% per year. After one year, you’ll earn $50 in interest (5% of $1,000). If you leave that interest in your account, the next year you’ll earn interest not just on your original $1,000, but also on the $50 interest you earned. So, your interest for the second year would be $52.50 (5% of $1,050). That extra $2.50 might not seem like much, but remember our snowball rolling down the hill? Give it time and that snowball becomes a veritable avalanche.

How Compound Interest Works in Investing

So, how does compound interest figure in investing? Let’s head over to the stock market for a moment. The wonder of compound interest works in full force here, especially when you reinvest your dividends, which is a core strategy in Buffett’s playbook.

Here’s how it works: Let’s say you invest in a company that pays dividends. Instead of pocketing those dividends, you use them to buy more shares in the company. Now, you have more shares that can earn dividends, which can buy even more shares, which will earn even more dividends, and so on.

Over time, this can have a dramatic effect on the growth of your investment. It’s like our earlier money tree analogy, but instead of just letting the fruits grow more fruits, you’re continually planting more trees with each fruit, exponentially increasing the fruit-bearing capacity of your orchard over time.

Now, a word of caution: compound interest is a double-edged sword. It can work against you just as powerfully if you have high-interest debt. Much like how it can make your investments balloon, it can also make your debt snowball. So, it’s important to wield this tool wisely and judiciously.

So, there you have it – the magic and might of compound interest. As our guide Buffett puts it, “Do not save what is left after spending, but spend what is left after saving.” The heart of this philosophy lies in understanding and utilizing the potential of compound interest.

source: The Long-Term Investor on YouTube

Warren Buffett and Compound Interest

Warren Buffett, the maestro of the investing orchestra, has been conducting the symphony of compound interest to play to his advantage for decades. To put it simply, he has mastered the art of letting his money do the hard work for him.

From the get-go, Buffett has been a proponent of buy-and-hold investing, a strategy that relies heavily on the magic of compounding. His philosophy? Find solid, reliable companies, invest in them, and then…wait. While others may scramble to follow market trends, buying and selling with each rise and dip, Buffett prefers to sit back and let compound interest work its magic.

His strategy involves reinvesting dividends and earnings back into his holdings, thereby increasing the amount of capital that is compounding. This approach allows the returns to snowball over time, translating to exponential growth.

Examples of Buffett’s Investments That Show the Power of Compound Interest

For a masterclass in compound interest, one need look no further than Buffett’s investment in The Coca-Cola Company. Back in 1988, Buffett bought $1 billion worth of Coca-Cola shares, amounting to about 6.2% of the company. As of today, that investment has balloined to over $20 billion, not considering the dividends he has received and reinvested over the years.

But the returns aren’t the only marvel. Buffett hasn’t bought any additional Coca-Cola shares since 1988, meaning the growth is almost entirely due to the power of compounding. By reinvesting the dividends, he continually increased his number of shares, which led to larger dividends, which led to more reinvested shares, and so on. It’s like a financial perpetual motion machine.

Another compelling example is Buffett’s investment in American Express. Purchased in the early 1990s, Buffett’s initial 10% stake in the company has grown to about 20%, largely due to the dividends he’s received and reinvested. Again, it’s the music of compound interest playing to his tune.

These examples underline a fundamental truth of Buffett’s philosophy: Time is the friend of the wonderful business. Given enough time, compound interest can grow a seemingly modest investment into a veritable mountain of wealth. It’s a tune that’s been playing for decades, and as Buffett would attest, it’s music to the ears of patient investors.

Applying Compound Interest to Small Business Investing

If you’re a small business owner, you might be thinking, “This compound interest stuff sounds great for big-time investors like Buffett, but what does it have to do with me?” Fair question, dear reader, but the beauty of compound interest is that it doesn’t discriminate. Whether you’re a billion-dollar investor or a small business owner, the mathematical magic works just the same.

Why Compound Interest Matters for Small Businesses

Here’s why compound interest is critical for small businesses: it can significantly impact your business savings and investments. It can aid in accumulating a hefty retirement fund, allow for future expansions, or create a safety net for less prosperous times. The key here, just like with Buffett’s investments, is time. The longer you allow the interest to compound, the more your money will grow.

Ways Small Business Owners Can Use Compound Interest to Their Advantage

“Okay,” you say, “I’m sold on the idea. But how do I harness this power for my small business?” Well, it’s your lucky day because there are myriad ways for you to invite the magic of compound interest into your business.

- Business Savings Account: This is your classic route. Open a high-yield business savings account, consistently deposit a portion of your profits, and let the interest compound. Just remember: the secret ingredient is time.

- Retirement Funds: A SEP IRA or a Solo 401(k) can be great vehicles for a small business owner to grow their wealth through compounding while also getting some tax benefits. Just as with a personal retirement account, the sooner you start, the more time compound interest has to work its magic.

- Reinvest in Your Business: Much like how Buffett reinvests his dividends, you can reinvest your business profits. This could mean purchasing more inventory, expanding your operations, or investing in new technology. Each of these reinvestments can potentially lead to higher returns, which you can reinvest again, creating your very own compounding cycle.

- Invest in Stocks or Bonds: If you have some extra cash lying around, investing in stocks, bonds, or mutual funds can be a good way to earn compound interest. This strategy isn’t without its risks, but as Buffett says, “Risk comes from not knowing what you’re doing.” So, educate yourself or hire a financial advisor to make informed decisions.

In essence, by understanding and harnessing the power of compound interest, you can adopt a Buffett-esque approach to your small business finances. So, why not take a leaf out of Buffett’s book and become the Oracle of your own financial destiny? After all, small businesses and compound interest have one critical thing in common – with patience and time, they both have the potential to grow beyond imagination.

source: Investopedia on YouTube

Case Study: Compound Interest in Action

Let’s now stroll down to a real-world avenue where theory meets practice. This story is about a small bakery named “Dough Re Mi,” tucked away in a bustling corner of New York City.

When ‘Dough Re Mi’ first opened its doors, it was a cozy bakery, owned and run by a husband and wife duo, Rosa and Pete. With the aroma of fresh bread wafting in the air and the sight of decadent pastries displayed on the counters, the bakery was a hit among the locals. But Rosa and Pete had bigger dreams. They wanted to open another branch across town.

To make this dream a reality, they began by setting aside a small portion of their profits into a high-yield business savings account every month. The interest on this account compounded annually, and each year, the couple added the accrued interest back into the account.

As the years rolled by, something magical happened. The money in their savings account began to grow faster, and faster still. This was the wonder of compound interest at work. The interest they earned in the first year earned its own interest in the second year, and the interest from the second year, along with the initial amount and the first year’s interest, earned even more interest in the third year.

In about ten years, Rosa and Pete’s savings had ballooned enough to fund their second location. They opened ‘Dough Re Mi 2’ across town, and to their delight, it was as successful as the first. The profits from both locations were now being saved and compounded, paving the way for a third location a few years later.

This tale of Rosa and Pete illustrates the power of compound interest beautifully. With discipline, patience, and the magic of compounding, they were able to expand their humble bakery into a mini empire. Their success is a testament to the saying, “The biggest money trees grow from the seeds of patience and compound interest.”

So, there you have it: a small business waltzing with compound interest. ‘Dough Re Mi’ started with a simple melody of regular savings and let compound interest compose the symphony of their success. And in this harmonious dance, a dreamy bakery made its leap towards becoming a city-wide sensation, one compounded note at a time.

Tips for Small Business Owners

Now, let’s delve into the tips and tricks of how you, as a small business owner, can amplify the effects of compound interest. Think of these strategies as your navigation compass in your journey towards achieving a compound interest windfall.

- Start Early and Save Consistently: As Rosa and Pete’s story illustrated, the power of compound interest magnifies over time. The sooner you start saving or investing, the more time your money has to grow. Make it a habit to squirrel away a portion of your earnings regularly. Remember, it’s not just about the destination; the journey of consistent saving is equally crucial.

- Reinvest Your Earnings: If your business generates profits or if your investments yield dividends, consider reinvesting those gains. This strategy can create a cycle of earning and reinvesting that can lead to exponential growth over time. Think of it as your business’s self-sustaining ecosystem.

- Leverage High-Interest Savings Accounts or Investment Vehicles: Seek out financial instruments that offer a higher interest rate and compound frequently. This could be a high-yield business savings account or investment vehicles like stocks, bonds, or mutual funds.

Common Pitfalls to Avoid

Despite its charms, the world of compound interest is not without its pitfalls. Here are some potential slip-ups you should steer clear of:

- Impatience: Compound interest is a slow cook recipe. If you’re expecting instant results, you’ll be disappointed. Resist the urge to dip into your savings or investments prematurely. Remember, compound interest needs time to work its magic.

- Neglecting Debt: Just as compound interest can work in your favor, it can also work against you in the form of compound debt. High-interest debts, like credit card debt, can spiral out of control if left unchecked. Always strive to manage and reduce your debts effectively.

- Inconsistent Investments: In the world of compounding, consistency is key. Irregular or infrequent investments can significantly reduce the power of compounding. So, commit to a regular investment plan and stick to it.

In a nutshell, navigating the world of compound interest is akin to steering a ship. It requires a keen understanding of the winds (interest rates), a well-charted course (consistent investments), and, most importantly, the patience to sail through the calm and the storm. Stick to these guidelines, and you might just find yourself in the prosperous land that Buffett calls home.

source: One Minute Economics on YouTube

Learning from Warren Buffett: The Power of Compound Interest — 12-Question FAQ

What does Warren Buffett mean by “the power of compounding”?

That small, steady returns compounded over long periods create outsized results. Compounding multiplies gains on prior gains, so time in the market is more critical than timing the market.

How is compound interest different from simple interest?

Simple interest is earned only on principal. Compound interest is earned on principal plus previously earned interest/returns, creating an exponential growth curve over time.

Why does Buffett favor holding periods measured in decades?

Long holding periods reduce taxes and frictions, let fundamentals play out, and maximize the exponential tail of compounding. Quality + time is the core edge.

How do dividends accelerate compounding?

Reinvested dividends buy more shares, which then generate more dividends, creating a self-reinforcing loop of share count and income growth.

What annual return do I need to see compounding’s “wow” effect?

Even modest rates work. At 7%, money doubles ~every 10 years (Rule of 72). The magic is consistency and duration, not heroic yearly returns.

How can small business owners harness compounding?

Automate recurring transfers to high-yield accounts or retirement plans (SEP IRA/Solo 401(k)), reinvest a slice of profits into growth initiatives, and keep the flywheel turning via regular contributions.

What kills compounding?

High fees, taxes from frequent trading, behavioral mistakes (panic selling), and high-interest debt. Protect the base; compounding needs a stable foundation.

Should I prioritize paying off debt or investing to compound?

If debt rates are high (e.g., credit cards), kill that first. If debt is low-rate and fixed, a split strategy (pay down + invest) can preserve compounding momentum.

How do I build a compounding plan I’ll actually stick to?

Use an Investment Policy Statement: set contribution amounts/dates, target mix, rebalancing bands, and rules for withdrawals. Automate contributions to remove willpower from the loop.

What’s the role of costs and taxes in a compounding strategy?

Every 0.25%–0.50% in costs dents long-run outcomes. Favor low-cost funds and tax-efficient vehicles; minimize turnover; locate assets strategically (taxable vs. tax-advantaged).

How do I measure if my compounding is on track?

Track: contribution pace, time-weighted return, after-fee/after-tax return, drawdown behavior, and progress to goal. Review quarterly; make small, rule-based adjustments.

What’s the one Buffett-style habit to adopt today?

Start (or raise) an automatic, recurring contribution and pledge not to interrupt it. Compounding’s superpower is unlocked by time + consistency.

Conclusion: Understanding and Utilizing Compound Interest

We’ve come a long way on our journey through the land of compound interest. We’ve explored its concepts, visited the high towers of Warren Buffett’s investment successes, strolled through the bustling streets of small businesses like ‘Dough Re Mi’, and even navigated our way around potential pitfalls.

Understanding compound interest is not just about knowing a formula or recognizing a financial term. It’s about appreciating the rhythm of time and money, and how they dance together in this grand financial ballet. It’s about realizing that each dollar you save or invest isn’t just a piece of currency, but a seed that can grow into a towering tree, given the right conditions and enough time.

Final Thoughts and Encouragement for Small Business Owners

To all the small business owners reading this: You hold in your hands the power to harness this financial force. Like Warren Buffett, you too can use compound interest to amplify your wealth and take your business to new heights.

Remember, the realm of compound interest rewards the patient, the consistent, and the wise. It’s not about getting rich quick; it’s about growing wealth steadily. It’s not about watching the clock, but about mastering the calendar.

Yes, there will be storms, and yes, the seas might get rough. But remember Rosa and Pete, who stayed the course, kept their compass steady, and reached their desired shore. They are proof that compound interest is not just the privilege of billionaire investors, but a powerful tool accessible to anyone, including you, the small business owners.

In the end, success, like compound interest, compounds over time. And as you consistently sow the seeds of investment, saving, and reinvestment, you’re bound to reap the bountiful harvest of compound interest. So, here’s to your journey, your growth, and your compounding success!

As you close this chapter, may you carry the spirit of Warren Buffett’s wisdom, “Do not save what is left after spending, but spend what is left after saving.” For in these words lies the enchanting melody of compound interest, the symphony that could score the soundtrack to your financial success.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

The Eighth Wonder of the World is compound interest.

This post really highlights the importance of compound interest in building wealth over time. Warren Buffett’s approach is truly inspiring, and it’s a great reminder to start investing early. Thanks for sharing these valuable insights!

This post really highlights the incredible impact of compound interest! It’s amazing to think how small, consistent investments can grow over time, just like Buffett advocates. I’m definitely inspired to start prioritizing my savings and making my money work for me. Thanks for the insightful read!

This post beautifully captures the essence of compound interest and its impact on wealth building, just as Buffett emphasizes. It’s incredible to think about how patience and consistent investing can yield such exponential growth over time. I’m definitely inspired to take my savings habits a step further!

This post really highlights the importance of compound interest in building wealth! Warren Buffett’s perspective on patience and long-term investing is a great reminder that financial success isn’t just about making quick gains. I’ll definitely be applying these principles in my own investment strategy moving forward!

This was a fantastic read! I love how you broke down the concept of compound interest and highlighted Buffett’s approach. It’s amazing to see how small, consistent investments can lead to significant growth over time. Definitely inspired to start prioritizing my savings!

This post really highlights the incredible power of compound interest! It’s fascinating how even small investments can lead to significant wealth over time if you stay disciplined. Warren Buffett’s perspective makes it clear that patience is key in investing. Thanks for sharing these insights!

This post perfectly captures the essence of compound interest and how it has played a pivotal role in Warren Buffett’s success. It’s inspiring to see how starting early and staying consistent can lead to significant financial growth over time. Thanks for breaking it down so clearly!

Great insights on compound interest! Warren Buffett’s approach really highlights the long-term benefits of investing wisely. It’s amazing how starting early and being patient can lead to significant growth over time. Thanks for sharing this valuable perspective!

This post truly highlights the magic of compound interest! Warren Buffett’s approach makes it clear that patience and consistency can lead to extraordinary growth over time. I’m definitely going to start applying these principles to my own investments. Thanks for sharing such valuable insights!

This post really highlights the wisdom of Warren Buffett! The example of compound interest is eye-opening—it’s amazing how small, consistent investments can lead to significant wealth over time. It’s a great reminder to start early and stay committed!