Ever found yourself scratching your head over the unpredictable swings of the stock market? One day, stocks are soaring, and everyone seems to be making money hand over fist. The next, markets are plummeting, and panic ensues. Welcome to the cyclical world of bull and bear markets—terms that capture the essence of market movements and investor sentiment. Understanding these cycles isn’t just for financial gurus on Wall Street; it’s essential for anyone who wants to navigate the financial landscape with confidence and savvy.

Defining Bull and Bear Markets

So, what exactly do we mean when we talk about bull and bear markets? These are metaphors that represent market trends and the prevailing investor attitudes during those times.

source: One Minute Economics on YouTube

A bull market is a period characterized by rising stock prices and general optimism among investors. Think of a bull thrusting its horns upward—that’s the market charging ahead. During a bull market, economic indicators like employment rates, gross domestic product (GDP), and corporate earnings are usually strong. Investors are confident, consumer spending is up, and there’s a general belief that the good times will continue.

On the flip side, a bear market is when stock prices are falling, and pessimism prevails. Picture a bear swiping its paws downward—that’s the market declining. In a bear market, economic conditions often worsen. Unemployment may rise, corporate profits may decline, and consumer confidence dwindles. Investors become risk-averse, selling off assets to avoid further losses, which can exacerbate the downward trend.

These terms aren’t limited to the stock market alone. They can apply to any financial market, including bonds, real estate, commodities, and currencies. Understanding whether we’re in a bull or bear market helps investors make informed decisions about buying, selling, or holding assets.

Why Understanding These Cycles Matters

You might be thinking, “Why should I care about these market cycles?” Well, recognizing and understanding bull and bear markets can significantly impact your investment strategy and financial well-being.

Firstly, risk management becomes more effective when you’re aware of the market phase. In a bull market, investors might be more inclined to take calculated risks to maximize gains. Conversely, in a bear market, the focus often shifts to capital preservation and defensive strategies.

Secondly, investment strategies differ between bull and bear markets. During a bull market, growth stocks and more aggressive investments might outperform. In a bear market, value stocks, bonds, or even holding cash might be more prudent choices.

Thirdly, understanding market cycles helps in emotional control. Markets are influenced by human psychology—fear and greed can drive irrational decisions. Being aware of the cycle can help you avoid panic selling during downturns or overenthusiastic buying during peaks.

Lastly, these cycles present opportunities. Bear markets, while challenging, can offer the chance to buy quality assets at discounted prices. Bull markets can be a time to reap the rewards of earlier investments.

Introduction to Bull and Bear Markets

This article aims to take you on a historical journey through some of the most significant bull and bear markets from the early 20th century to the present day. We’ll delve into the factors that triggered these cycles, the economic and social impacts, and the invaluable lessons learned along the way.

By understanding these historical patterns, you’ll gain insights that can help you make more informed investment decisions today. Whether you’re a seasoned investor, a student of economics, or someone just curious about financial markets, this comprehensive overview will equip you with knowledge to navigate the ever-changing financial landscape.

So, let’s embark on this exploration of market history, uncover the key lessons, and see how they apply to today’s investing world.

Early Bull and Bear Markets in the 20th Century

The early 20th century was a period of rapid industrialization, technological innovation, and significant social change. These factors contributed to dramatic shifts in financial markets, setting the stage for some of the most profound bull and bear markets in history. Two periods stand out in this era: the exuberant Roaring Twenties followed by the devastating Great Depression, and the transformative years surrounding World War II.

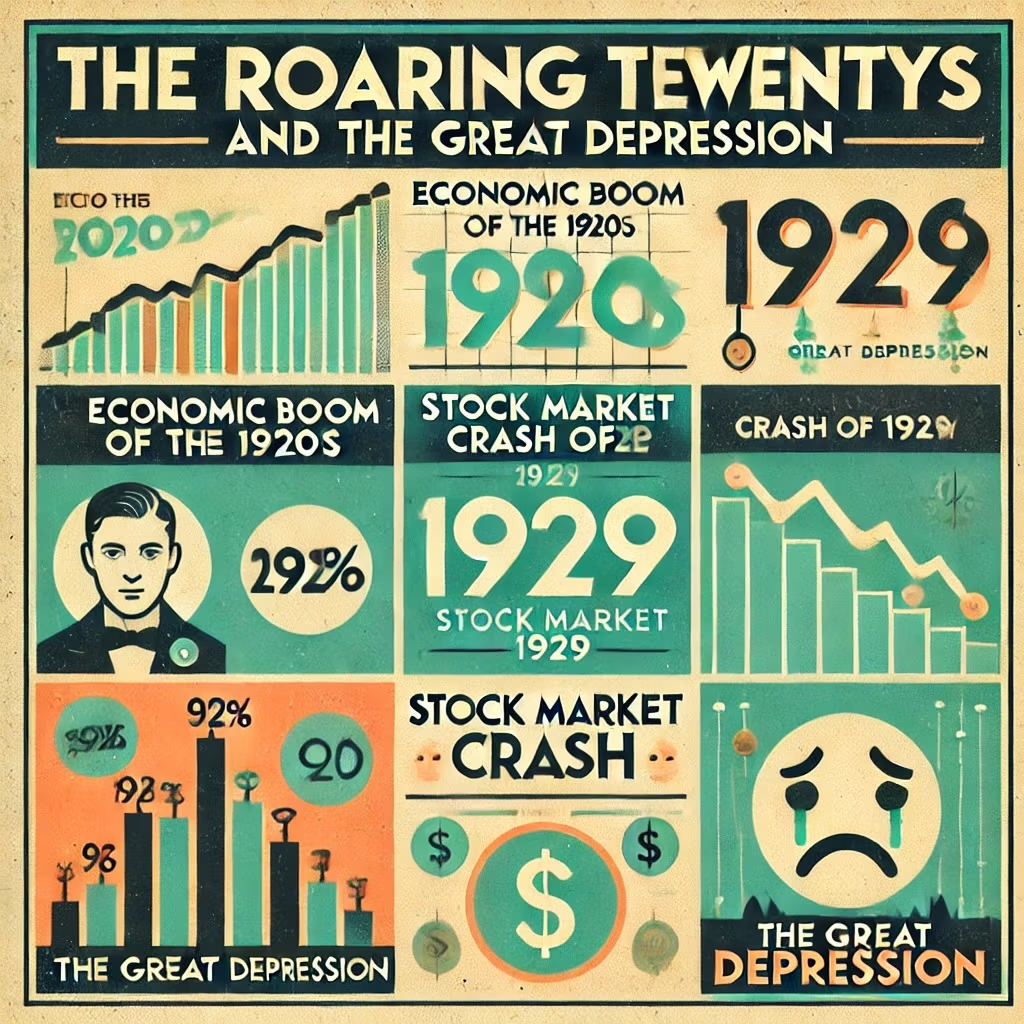

The Roaring Twenties and the Great Depression

The Booming 1920s Bull Market

The 1920s in the United States, often referred to as the Roaring Twenties, were a time of great economic prosperity and cultural dynamism. The nation emerged from World War I relatively unscathed and entered a period of rapid industrial growth.

Several factors fueled this bull market:

- Technological Advancements: Innovations such as the automobile, radio, and motion pictures transformed daily life and created new industries. Henry Ford’s assembly line revolutionized manufacturing, making cars affordable for the average American.

- Consumerism Rise: Easy credit and installment buying allowed more people to purchase goods they previously couldn’t afford. This surge in consumer spending boosted corporate profits and stock prices.

- Stock Market Accessibility: The stock market became more accessible to the general public. People from all walks of life began investing, often with little understanding of the risks involved.

- Speculative Investing: The idea of getting rich quickly through stock investments became widespread. Buying on margin—borrowing money to purchase stocks—became a common practice, amplifying both gains and potential losses.

The Dow Jones Industrial Average reflected this exuberance, climbing from 63 points in August 1921 to a peak of 381 points in September 1929. Optimism was rampant, and the prevailing belief was that the market would continue its upward trajectory indefinitely.

The 1929 Stock Market Crash

However, beneath the surface, the economy was fraught with underlying issues:

- Overproduction: Industries were producing more goods than could be consumed, leading to surpluses and falling prices.

- Income Inequality: Wealth was concentrated among a small percentage of the population, limiting overall purchasing power.

- Agricultural Struggles: Farmers faced low crop prices and high debts, weakening a significant sector of the economy.

On October 24, 1929, known as Black Thursday, the stock market began to show signs of instability. Panic selling started, and despite efforts by major banks to stabilize the market, the downward spiral continued. The crash culminated on Black Tuesday (October 29, 1929), when the market collapsed entirely.

The consequences were severe:

- Massive Wealth Loss: Investors lost billions of dollars, wiping out fortunes overnight.

- Bank Failures: Banks that had invested in the stock market or loaned money for stock purchases faced insolvency, leading to widespread bank runs.

- Unemployment Surge: Businesses cut back or shut down entirely, causing unemployment rates to skyrocket to 25% by 1933.

- Global Impact: The crisis wasn’t confined to the U.S.; it spread globally, contributing to a worldwide economic downturn known as the Great Depression.

Lessons Learned: Managing Speculative Risk and the Impact of Market Bubbles

The 1929 crash offers several critical lessons:

- Beware of Over-Leverage: Buying stocks on margin can amplify gains but also magnifies losses. When the market turned, many investors couldn’t cover their margin calls, leading to forced selling and further declines.

- Recognize Market Bubbles: Unsustainable price increases not backed by fundamental economic growth are warning signs. The euphoria of the Roaring Twenties led to inflated stock valuations detached from actual company performance.

- Diversify Investments: Concentrating investments in a single asset class or sector increases risk. A diversified portfolio can mitigate losses during market downturns.

- Regulatory Oversight Is Essential: The lack of financial regulation contributed to unethical practices and market manipulation. This realization led to significant regulatory reforms, including the establishment of the Securities and Exchange Commission (SEC) in 1934.

- Economic Fundamentals Matter: Strong economic indicators are vital for sustained market growth. Ignoring signs of economic weakness can lead to catastrophic outcomes.

Understanding these lessons helps modern investors avoid similar pitfalls and underscores the importance of prudent investment strategies.

World War II and the Post-War Boom

Effects of WWII on Markets

The outbreak of World War II in 1939 had profound effects on the global economy and financial markets. Initially, uncertainty and fear led to market volatility:

- Economic Disruption: Many countries faced resource shortages, disrupted trade, and increased government spending on the military.

- Stock Market Fluctuations: Markets reacted negatively to the uncertainty of war, with investors wary of the potential for prolonged conflict.

However, as the war progressed, the U.S. economy began to transform:

- Industrial Mobilization: The U.S. became the “Arsenal of Democracy,” ramping up production to supply not only its own military but also its allies.

- Full Employment: Unemployment virtually disappeared as men and women were employed in factories and the armed forces.

- Technological Advancements: Innovations in technology and manufacturing processes accelerated, laying the groundwork for post-war growth.

The Post-War Economic Boom

Following the end of WWII in 1945, the United States entered a period of exceptional economic growth, known as the Post-War Boom or the Golden Age of Capitalism.

Key factors contributing to this bull market included:

- Pent-Up Consumer Demand: Years of wartime rationing and savings led to a surge in consumer spending on homes, cars, and household goods.

- The GI Bill: The Servicemen’s Readjustment Act of 1944 provided veterans with benefits, including low-cost mortgages and tuition assistance, fueling housing and education sectors.

- Suburbanization: The growth of suburbs stimulated construction and related industries, creating jobs and boosting the economy.

- Technological Innovation: Wartime technologies found civilian applications, spurring advances in electronics, aviation, and manufacturing.

- Global Economic Leadership: The U.S. emerged from the war with its infrastructure intact and became a global economic leader, benefiting from international trade and investment.

The stock market reflected this prosperity. The Dow Jones Industrial Average, which had been around 150 points at the end of the war, climbed steadily, reaching over 600 points by the late 1950s.

Lessons Learned: How Major World Events Can Trigger Both Downturns and Prolonged Market Recoveries

The experiences of WWII and the subsequent economic boom highlight important insights:

- Global Events Have Profound Impacts: Wars, political shifts, and international agreements can dramatically affect economies and markets. Investors must consider geopolitical factors in their strategies.

- Government Policy Can Stimulate Growth: Fiscal policies, such as government spending on infrastructure and social programs, can drive economic recovery and expansion.

- Investment in Innovation Pays Off: Technological advancements not only enhance productivity but also create new industries and investment opportunities.

- Consumer Confidence Drives Markets: A confident public willing to spend and invest fuels economic growth and market gains.

- Long-Term Perspective Is Beneficial: Investors who remained in the market during the war years and invested in the post-war economy reaped significant rewards.

These lessons emphasize the importance of staying informed about global developments and recognizing the potential for recovery and growth even after significant disruptions.

Major Bull and Bear Markets from the 1970s to the 1990s

The period from the 1970s to the 1990s was marked by significant economic shifts, including oil crises, inflation, technological advancements, and changing monetary policies. These factors contributed to notable bull and bear markets, each providing valuable lessons for investors.

1970s Stagflation and the Oil Crisis Bear Market

The Economic Climate of the 1970s

The 1970s presented a challenging economic environment characterized by stagflation, a term that combines stagnation and inflation. This period defied traditional economic theories, which suggested that inflation and unemployment had an inverse relationship.

Key features of the 1970s economy included:

- High Inflation: The cost of goods and services rose rapidly, eroding purchasing power.

- Rising Unemployment: Economic growth slowed, leading to job losses.

- Energy Dependency: The global economy was heavily reliant on oil, much of which was imported from politically unstable regions.

The 1973 Oil Crisis

The situation intensified with the onset of the oil crisis:

- OPEC Embargo: In 1973, the Organization of Arab Petroleum Exporting Countries (OAPEC) imposed an oil embargo against nations supporting Israel during the Yom Kippur War.

- Oil Price Surge: Oil prices quadrupled, from about $3 per barrel to over $12 per barrel.

- Economic Impact: The sudden spike in energy costs led to higher production expenses, reduced consumer spending, and increased inflation, exacerbating stagflation.

The stock market reacted negatively, with the Dow Jones Industrial Average declining by approximately 45% between 1973 and 1974.

Lessons Learned: The Impact of Inflation and Energy Dependency on the Economy and Markets

The 1970s bear market highlighted several critical lessons:

- Inflation’s Adverse Effects: High inflation can erode investment returns and purchasing power. Traditional investments may not keep pace with rising prices, prompting a need for inflation-protected assets.

- Energy Dependency Risks: Reliance on foreign oil exposed economies to geopolitical risks. Diversifying energy sources and investing in alternative energy became essential strategies.

- Policy Challenges: Combating stagflation required unconventional monetary policies. Raising interest rates to control inflation risked further slowing economic growth.

- Importance of Diversification: Investors learned to diversify not just across asset classes but also to consider geographic and sector diversification to mitigate risks associated with specific industries or regions.

- Long-Term Perspective: Despite short-term challenges, markets eventually recovered. Investors who maintained a long-term view were better positioned to benefit from the eventual upturn.

Understanding these dynamics helps modern investors appreciate the complex interplay between economic factors and market performance.

The 1980s Bull Market and the 1987 Crash

The Bull Market of the 1980s

The early 1980s marked the beginning of a significant bull market, driven by several key factors:

- Monetary Policy Shifts: Federal Reserve Chairman Paul Volcker implemented tight monetary policies, raising interest rates to combat inflation. This approach eventually succeeded, stabilizing prices.

- Economic Expansion: With inflation under control, the economy began to grow. Tax cuts and deregulation under the Reagan administration stimulated business investment.

- Technological Innovation: The rise of personal computers and advancements in technology fueled productivity and created new industries.

- Investor Confidence: Lower inflation and interest rates made equities more attractive, leading to increased investment in the stock market.

The Dow Jones Industrial Average reflected this optimism, climbing from around 800 points in 1982 to over 2,700 points by August 1987.

The 1987 Stock Market Crash

On October 19, 1987, known as Black Monday, the stock market experienced a sudden and severe crash:

- Historic Decline: The Dow Jones Industrial Average plummeted 22.6% in a single day—the largest one-day percentage drop in history.

- Global Impact: The crash wasn’t confined to the U.S.; markets around the world saw significant declines, highlighting the interconnectedness of global finance.

Causes of the Crash

Several factors contributed to the crash:

- Program Trading: Computerized trading strategies, such as portfolio insurance, led to automatic sell orders when the market began to decline, exacerbating the downturn.

- Overvaluation: Stock prices had risen rapidly, leading to concerns that they were overvalued relative to corporate earnings.

- Interest Rate Increases: Rising interest rates made bonds more attractive than stocks, prompting some investors to shift assets.

- Trade Deficit and Currency Concerns: The U.S. trade deficit and concerns about the dollar’s value created economic uncertainty.

- Investor Psychology: Fear and panic selling contributed to the severity of the crash.

Lessons Learned: The Influence of High-Interest Rates, Global Market Interconnections, and Investor Panic on Market Volatility

The 1987 crash offered several important insights:

- Technology’s Double-Edged Sword: While technological advancements improved trading efficiency, they also introduced new risks. Program trading amplified market movements, leading to calls for regulatory oversight.

- Globalization of Markets: Financial markets had become increasingly interconnected. Events in one market could rapidly affect others, emphasizing the need for a global perspective in investing.

- Importance of Liquidity: Market liquidity is crucial for stability. A sudden lack of buyers can lead to sharp price declines.

- Role of Investor Psychology: Emotions like fear can drive irrational market behavior. Understanding behavioral finance helps in navigating volatile markets.

- Regulatory Measures: The crash led to the implementation of “circuit breakers” and other mechanisms to halt trading temporarily during significant declines, aiming to prevent panic selling.

These lessons underscore the need for robust risk management strategies and the importance of staying informed about global economic developments.

The Tech Boom and the Dot-Com Bust

The late 1990s and early 2000s witnessed a technological revolution with the rise of the internet, leading to one of the most dramatic bull markets and subsequent crashes in history. This period provides valuable insights into the dynamics of innovation-driven markets.

Rise of the 1990s Tech Bull Market

The Technological Revolution

The 1990s saw the commercialization of the internet and rapid advancements in technology:

- Internet Accessibility: The World Wide Web became publicly available, and internet usage exploded.

- E-Commerce Emergence: Companies like Amazon (founded in 1994) and eBay (1995) introduced new ways of doing business, revolutionizing retail and auctions.

- Venture Capital Investment: Significant funding flowed into tech startups, fueling innovation and expansion.

- IPO Boom: Numerous tech companies went public, often experiencing substantial first-day gains.

Market Enthusiasm and Speculation

The stock market surged, particularly the Nasdaq Composite, which is heavily weighted with technology stocks:

- Skyrocketing Valuations: Companies with little or no earnings achieved market capitalizations in the billions.

- Media Hype: Success stories dominated headlines, and the media often portrayed the internet as a gold rush.

- Investor Euphoria: Fear of missing out (FOMO) led many investors to pour money into tech stocks without fully understanding the companies’ business models or financials.

- “New Economy” Thinking: There was a widespread belief that traditional valuation metrics no longer applied, and that the internet would transform the economy in unprecedented ways.

Dot-Com Bubble Burst in the Early 2000s

The Collapse

By the year 2000, signs of instability began to appear:

- Profitability Concerns: Many tech companies were burning through cash without turning a profit.

- Market Saturation: The sheer number of startups led to intense competition and unsustainable business practices.

- Investor Skepticism: As companies failed to meet expectations, confidence eroded.

- Interest Rate Increases: The Federal Reserve raised interest rates to combat inflation, reducing liquidity and making borrowing more expensive.

The Economic Recession That Followed

The bubble burst dramatically:

- Market Decline: The Nasdaq Composite peaked at over 5,000 in March 2000 and fell to around 1,100 by October 2002—a decline of nearly 80%.

- Company Failures: High-profile bankruptcies included Pets.com and Webvan, emblematic of the excesses of the era.

- Job Losses: The tech sector shed jobs, and the economic downturn spread to other industries.

- Investor Losses: Trillions of dollars in market value were wiped out, affecting individual investors, pension funds, and institutional portfolios.

Lessons Learned: The Dangers of Overvaluation and Herd Mentality in Investing

The dot-com bust offers several key lessons:

- Fundamentals Matter: A company’s valuation should be based on solid financial metrics, such as earnings, revenue growth, and sustainable business models.

- Due Diligence Is Crucial: Investors need to thoroughly research companies before investing, rather than relying on hype or speculative trends.

- Beware of Herd Mentality: Following the crowd can lead to inflated asset prices and increased risk of significant losses when the bubble bursts.

- Risk Management: Diversification across sectors and asset classes can mitigate the impact of a downturn in any one area.

- Long-Term Perspective: While the bust was painful, it also cleared the way for stronger companies to emerge. Investors with a long-term view and a focus on quality companies were better positioned for future gains.

Understanding these dynamics helps investors recognize the signs of speculative bubbles and emphasizes the importance of disciplined investing.

The 2008 Global Financial Crisis and Recovery

The 2008 financial crisis was one of the most severe economic downturns since the Great Depression. Rooted in the housing market and complex financial instruments, its impact was global and profound, offering critical lessons on risk management and financial regulation.

The Housing Bubble and the 2008 Bear Market

Analysis of the Subprime Mortgage Crisis

Several factors contributed to the housing bubble:

- Low-Interest Rates: Following the dot-com bust and the 9/11 attacks, the Federal Reserve lowered interest rates to stimulate the economy, making mortgages more affordable.

- Loose Lending Standards: Financial institutions issued mortgages to borrowers with poor credit histories (subprime mortgages), often without verifying income or assets.

- Securitization of Mortgages: Banks bundled mortgages into mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), selling them to investors worldwide.

- Derivatives and Leverage: Complex financial products like credit default swaps (CDS) were used to insure against defaults, increasing leverage in the system.

The Financial Meltdown

The bubble burst when:

- Housing Prices Declined: Starting in 2006, housing prices began to fall, undermining the assumption that they would always rise.

- Mortgage Defaults Increased: As adjustable-rate mortgages reset to higher rates, many borrowers defaulted.

- Collapse of Financial Institutions: Major firms like Lehman Brothers filed for bankruptcy, and others like Bear Stearns were acquired under distress.

- Credit Freeze: Banks became reluctant to lend, leading to a liquidity crisis.

The stock market reacted with a severe downturn, with the S&P 500 losing over 50% of its value from its peak in October 2007 to its trough in March 2009.

Lessons Learned: The Role of Leverage, Credit Risk, and the Importance of Financial Regulation

The crisis highlighted several crucial lessons:

- Excessive Leverage Is Dangerous: High levels of borrowing can amplify losses, leading to insolvency when asset prices fall.

- Understanding Credit Risk: Ignoring the creditworthiness of borrowers and counterparties can lead to widespread defaults and systemic risk.

- Complex Financial Instruments Require Oversight: Lack of transparency and understanding of complex products like CDOs and CDS contributed to the crisis.

- Regulatory Gaps Need Addressing: Inadequate regulation and oversight allowed risky practices to flourish.

- Global Interconnectedness: The crisis spread internationally due to the interconnectedness of financial markets, affecting economies worldwide.

Post-Crisis Bull Market of the 2010s

Overview of the Long Bull Market Recovery

In response to the crisis, governments and central banks implemented unprecedented measures:

- Monetary Policy Actions:

- Quantitative Easing (QE): Central banks purchased government bonds and other securities to inject liquidity into the economy.

- Near-Zero Interest Rates: Lowered borrowing costs to encourage lending and investment.

- Fiscal Stimulus: Governments enacted spending programs to support economic activity and job creation.

- Regulatory Reforms: Legislation like the Dodd-Frank Act aimed to improve financial stability and consumer protection.

The economy gradually recovered:

- Stock Market Gains: The S&P 500 and other indices reached new highs, marking one of the longest bull markets in history.

- Unemployment Decline: Job creation improved, and unemployment rates fell.

- Corporate Profits Rebounded: Companies adapted, reducing costs and innovating.

Lessons Learned: The Influence of Monetary Policy on Market Recovery and Growth

Key takeaways include:

- Central Bank Influence Is Significant: Monetary policies can have a profound impact on markets and economies, supporting recovery during crises.

- Long-Term Investing Rewards Patience: Investors who stayed invested during the downturn benefited from substantial gains during the recovery.

- Diversification and Asset Allocation Remain Key: Balancing investments across asset classes helps manage risk and capitalize on growth opportunities.

- Regulation Can Enhance Stability: Improved oversight and risk management practices contribute to a more resilient financial system.

Understanding these dynamics helps investors appreciate the importance of policy responses and the potential for recovery following economic crises.

The Pandemic Bear Market and Current Market Insights

The onset of the COVID-19 pandemic in 2020 introduced unprecedented challenges, leading to a swift market downturn followed by a rapid recovery. This period offers valuable insights into the impact of global crises and the effectiveness of policy responses.

The 2020 Pandemic-Induced Bear Market

The Market’s Sharp Decline Due to COVID-19

As the pandemic spread globally:

- Economic Shutdowns: Governments imposed lockdowns to contain the virus, halting economic activity across multiple sectors.

- Market Plunge: Major indices like the S&P 500 fell more than 30% within weeks, entering a bear market at record speed.

- Unemployment Surge: Millions lost their jobs, leading to the highest unemployment rates since the Great Depression.

The Quick Recovery That Followed

Despite the severe initial impact, markets rebounded swiftly:

- Massive Fiscal Stimulus: Governments enacted relief packages totaling trillions of dollars, providing support to individuals and businesses.

- Monetary Policy Support: Central banks reduced interest rates to near zero and implemented asset purchase programs.

- Technological Adaptation: Companies pivoted to remote work and e-commerce, leveraging technology to maintain operations.

- Vaccine Development: Rapid progress on vaccines improved economic outlooks.

By the end of 2020, the stock market had recovered its losses and reached new highs.

Lessons Learned: How Global Crises Impact Markets and the Role of Rapid Fiscal and Monetary Response

Key insights include:

- Swift Policy Action Is Effective: Rapid and significant fiscal and monetary interventions can stabilize markets and support economic recovery.

- Technology Enables Resilience: Digital infrastructure allows businesses to adapt quickly to changing circumstances.

- Sectoral Differences Matter: Industries like technology and healthcare thrived, while travel and hospitality suffered, emphasizing the importance of sector diversification.

- Investor Sentiment Is Influential: Confidence in policy responses and future prospects can drive market rebounds.

- Global Cooperation Is Beneficial: Collaborative efforts in vaccine development and economic support enhance overall effectiveness.

Current Market Dynamics and Key Takeaways

Recent Market Trends

As we continue to navigate the pandemic’s effects:

- Inflation Concerns: Supply chain disruptions and stimulus spending have raised questions about potential sustained inflation.

- Interest Rate Outlook: Central banks face decisions on adjusting monetary policies to balance growth and inflation risks.

- Technological Innovation: Advancements in areas like artificial intelligence, renewable energy, and biotechnology present new investment opportunities.

- Environmental, Social, and Governance (ESG) Investing: Increased focus on sustainable and ethical investing practices influences market dynamics.

Final Takeaways: Summarizing the Lessons Learned from Each Historical Cycle

- Risk Management Is Crucial: Diversification, regular portfolio reviews, and understanding personal risk tolerance help navigate market volatility.

- Stay Informed and Adaptable: Keeping abreast of economic indicators, policy developments, and global events informs investment decisions.

- Emotional Discipline Enhances Outcomes: Avoiding panic during downturns and euphoria during booms leads to more rational investment choices.

- Long-Term Perspective Pays Off: Markets have historically trended upward over the long term, rewarding patient investors.

- Embrace Innovation and Change: Investing in emerging technologies and adapting to new market realities can drive growth.

- Global Awareness Is Essential: Recognizing the interconnectedness of economies and markets helps in assessing risks and opportunities.

A Complete History of Bull & Bear Markets: 12-Question FAQ (Key Lessons, Playbooks, and Pitfalls)

1) What defines a bull vs. a bear market?

A bull market is a broad, sustained price advance (commonly +20% from a prior low) fueled by improving earnings, liquidity, and optimism. A bear market is a broad decline (commonly −20% from a prior high) driven by deteriorating fundamentals, tightening liquidity, and pessimism. Thresholds are conventions; the real story is breadth, duration, drawdown, and macro backdrop.

2) How long do bull and bear markets usually last?

History shows bulls often last years (median ~4–6 years) and bears are shorter but sharper (months to ~2 years). Duration is regime-dependent: policy, inflation, productivity, demographics, and credit cycles all modulate the clock.

3) What typically ends bull markets?

A trio does it: valuation excess (froth), policy tightening (higher real rates/liquidity withdrawal), and profit deterioration (margins compress, earnings roll). Exogenous shocks (oil, war, pandemics) can accelerate the turn when valuations/liquidity are stretched.

4) What typically ends bear markets?

Policy pivots (rate cuts/QE/fiscal), valuation reset (risk premia widen), and earnings troughs (inflection in revisions). Markets usually bottom before recession ends as forward expectations stabilize.

5) Which signals help identify late-cycle risk?

Rising real yields vs. slowing EPS revisions

Tight credit (wider spreads, weaker lending surveys)

Narrowing breadth (few leaders carry the index)

Elevated valuations vs. trend earnings

Yield-curve re-steepening from deeply inverted levels (often near late bear/early recovery—context matters)

6) Which assets/sectors tend to lead in bulls vs. bears?

Early bull/recovery: small caps, cyclicals (industrials, materials), high beta, EM, value factors.

Mid bull: quality growth, tech/productivity winners.

Late bull: defensives (staples, healthcare) often hold up as leadership narrows.

Bears: Treasuries (duration), min-vol/quality, sometimes commodities (if inflation shock). Factor leadership flips with the macro driver (growth scare vs. inflation shock).

7) What historical cycles teach about inflation shocks (1970s) vs. disinflation booms (1980s–90s)?

Inflation shocks: equities de-rate; real assets, energy, commodities, and TIPS (post-1997) help; nominal bonds struggle.

Disinflation booms: falling rates + productivity gains fuel multiple expansion; long duration assets (growth stocks, long Treasuries) excel.

8) What did the dot-com bust and GFC teach about leverage and narratives?

Narrative + leverage = fragility. When cash flows don’t validate stories, funding dries up. Overconcentration in a hot theme magnifies drawdowns. Diversification across cash-flow quality, sectors, and geographies is the antidote.

9) What is a practical portfolio playbook across the cycle?

Early cycle: add cyclicals/small caps, extend equity beta, own credit beta prudently.

Mid cycle: tilt to quality/compounders, keep balance across styles.

Late cycle: raise quality/defensives, shorten credit duration, add ballast (duration/TIPS depending on inflation).

Bear/recession: rebalance, harvest tax losses, ladder cash needs, avoid forced selling; prepare shopping list for the turn.

10) How should investors time entries—DCA or all-at-once?

On average, lump sum beats DCA because markets drift up over time; however, DCA improves behavioral adherence and reduces regret near turning points. Choose the method you’ll actually stick with.

11) What are the most common mistakes across cycles?

Performance-chasing, abandoning plan at bottoms, ignoring base rates, over-concentration, leverage without risk controls, and not rebalancing. Process beats prediction.

12) What risk controls help you survive bears and capitalize on bulls?

Policy for rebalancing (calendar or bands)

Diversifiers (duration, TIPS for inflation shocks, some real assets)

Liquidity runway (6–24 months spending in safe assets for retirees)

Position sizing & stop-loss rules (for active sleeves)

IPS discipline (documented plan to counter emotions)

Conclusion

The history of bull and bear markets reveals a consistent theme: markets are cyclical, influenced by a complex interplay of economic conditions, technological advancements, policy decisions, and human psychology. Each cycle offers valuable lessons that remain relevant for today’s investors.

By understanding these historical patterns, investors can:

- Make Informed Decisions: Knowledge of past market behaviors aids in anticipating potential future trends.

- Manage Risks Effectively: Applying lessons learned enhances risk management strategies.

- Seize Opportunities: Recognizing when markets are undervalued or overvalued can guide investment timing.

- Maintain Perspective: Appreciating the long-term nature of markets helps in weathering short-term volatility.

In a world of constant change, the wisdom gleaned from past bull and bear markets provides a foundation for navigating the financial landscape with confidence and foresight.

Happy investing, and may your financial journey be prosperous!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.