Investing like a seasoned professional isn’t just about picking the right stocks or timing the market perfectly—it’s about understanding the intricate dance of market cycles and harnessing that knowledge to make informed investment decisions. Howard Marks, a renowned investor and co-founder of Oaktree Capital Management, is widely recognized for his expertise in identifying and navigating market cycles. In this comprehensive guide, we’ll delve into Howard Marks’ investment strategies, explore his approach to understanding market cycles, and uncover the principles that have made him a master in the field.

source: The Swedish Investor on YouTube

Howard Marks: A Maestro of Market Cycles

Howard Marks has carved out a distinguished reputation in the investment world as a master of market cycles. His deep understanding of economic trends, investor psychology, and asset valuation has enabled him to consistently outperform the market across various cycles. As the co-founder of Oaktree Capital Management, Marks has led the firm to prominence in distressed debt and value investing, areas where his insights into market cycles have been particularly impactful.

The Significance of Market Cycles in Investing

Market cycles—the recurring periods of expansion and contraction in the economy and financial markets—play a crucial role in shaping investment strategies. Recognizing and understanding these cycles allows investors to anticipate market movements, adjust their portfolios accordingly, and mitigate risks associated with market downturns. Howard Marks’ ability to identify where the market stands within its cycle is a testament to his strategic acumen and disciplined approach to investing.

source: Goldman Sachs on YouTube

Let’s explore Howard Marks’ approach to investing by understanding and mastering market cycles. Whether you’re an aspiring investor seeking to refine your strategies or a seasoned professional looking to enhance your understanding of market dynamics, studying Marks’ methodologies can provide valuable insights. We’ll break down his core principles, examine his risk management techniques, and offer practical steps to help you apply his strategies to your own investment practices.

The Concept of Market Cycles

What are Market Cycles?

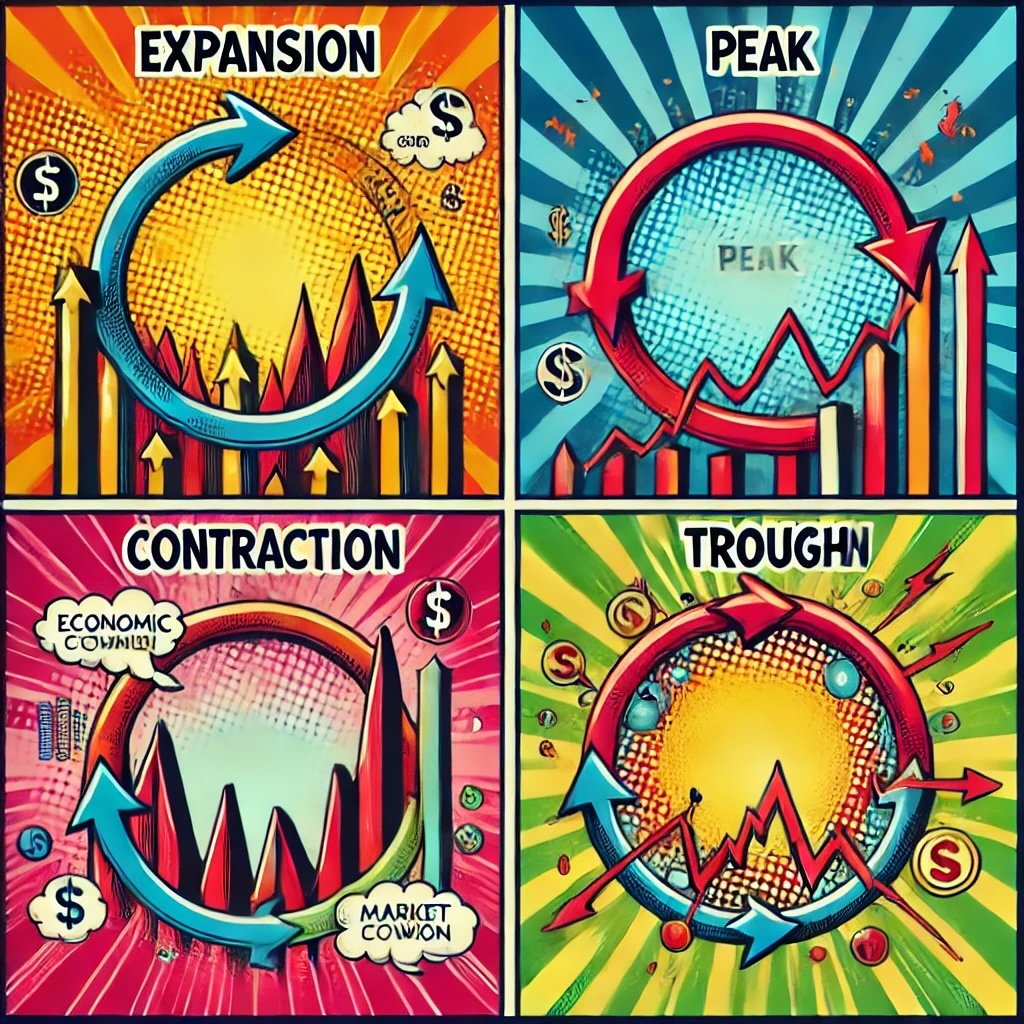

Market cycles refer to the natural ebb and flow of the economy and financial markets, characterized by periods of expansion, peak, contraction, and trough. Understanding these phases is fundamental to developing effective investment strategies.

- Expansion: During this phase, economic indicators such as GDP growth, employment rates, and consumer spending rise. Markets generally perform well, and investor confidence is high.

- Peak: This marks the culmination of the expansion phase. Economic indicators reach their highest levels, but growth begins to slow down. Markets are often overvalued, and signs of impending downturns start to emerge.

- Contraction: Economic growth reverses, leading to reduced consumer spending, higher unemployment rates, and declining asset prices. Markets experience downturns as investor sentiment becomes bearish.

- Trough: The lowest point of the cycle, where economic indicators stabilize before beginning the next expansion phase. Markets start to recover, setting the stage for a new cycle.

Importance in Investing

Understanding market cycles allows investors to time their investments more effectively. By recognizing the current phase of the cycle, investors can make strategic decisions to maximize returns during expansions and protect their portfolios during contractions.

Marks’ View on Market Cycles

Howard Marks views market cycles as inevitable and intrinsic to the functioning of the economy and financial markets. He emphasizes that while cycles are predictable in their recurrence, their exact timing and magnitude are difficult to forecast. Marks advocates for recognizing the phase of the cycle to inform investment decisions, helping investors avoid the pitfalls of market euphoria during peaks and the despair of market bottoms.

Identifying Market Cycles

Economic Indicators

Howard Marks utilizes a variety of economic indicators to identify where the market is within its cycle. These indicators provide insights into the health of the economy and the likely direction of markets.

- GDP Growth: Gross Domestic Product (GDP) is a primary indicator of economic health. Consistent GDP growth signals an expansion phase, while declining GDP indicates contraction.

- Interest Rates: Central bank policies on interest rates can influence economic activity. Lower interest rates typically stimulate growth, while higher rates can slow down the economy.

- Employment Data: Employment rates reflect the labor market’s strength. High employment indicates economic expansion, whereas rising unemployment suggests a contraction.

- Inflation Rates: Moderate inflation is a sign of a growing economy, but high inflation can signal overheating, leading to a peak.

Sentiment Analysis

Investor sentiment plays a significant role in market cycles. Howard Marks closely monitors indicators of investor sentiment, such as consumer confidence indexes and market surveys, to gauge the overall mood of the market.

- Bullish vs. Bearish Sentiment: Predominantly bullish sentiment can indicate that the market is nearing a peak, while bearish sentiment may suggest an approaching trough.

- Market Surveys: Tools like the AAII Investor Sentiment Survey provide insights into the proportion of investors who are optimistic or pessimistic about market performance.

Example: Historical Market Cycles

To illustrate, let’s look at how Marks identified key cycles in the past and adjusted his strategy accordingly.

The Dot-Com Bubble:

During the late 1990s, Marks observed an upward trend in technology stocks, driven by investor enthusiasm. Recognizing signs of overvaluation, such as excessively high P/E ratios and speculative trading, he adjusted his portfolio to reduce exposure to tech stocks, thereby mitigating potential losses when the bubble burst.

The 2008 Financial Crisis:

Marks identified the signs of economic contraction through declining GDP, rising unemployment, and tightening credit conditions. By shifting his investments towards more defensive assets and distressed debt, he positioned his portfolio to benefit from the recovery phase post-crisis.

Tip: Combine multiple indicators—economic, sentiment, and technical—to get a comprehensive view of where the market stands within its cycle. This holistic approach enhances the accuracy of cycle identification and informs more strategic investment decisions.

The Importance of Patience and Timing

Waiting for the Right Opportunity

Howard Marks emphasizes the critical role of patience in investing. Rather than chasing short-term gains or reacting impulsively to market movements, Marks advocates for waiting until the market presents a clear, favorable opportunity aligned with the current phase of the cycle.

Strategic Patience: Patience allows investors to wait for proper valuations and avoid overpaying for assets during peak periods. It involves holding cash reserves to capitalize on buying opportunities during market downturns.

Example: During a market downturn, instead of hastily buying into falling stocks, Marks advises waiting until there is confirmation that the asset is undervalued and poised for a recovery, ensuring that investments are made with conviction and lower risk.

Avoiding FOMO (Fear of Missing Out)

The fear of missing out (FOMO) is a common pitfall that leads investors to make hasty decisions based on market hype rather than sound analysis. Howard Marks warns against succumbing to FOMO, especially during market peaks when prices are driven by speculative enthusiasm.

Consequences of FOMO:

- Overvaluation: Buying assets at inflated prices can result in poor returns when the market corrects.

- Increased Risk: Entering positions based on sentiment rather than fundamentals increases exposure to potential losses.

Example: In a booming market, many investors may rush to buy stocks expecting continued gains. Marks advises maintaining discipline and sticking to a systematic approach, even when the market seems excessively optimistic.

Example: Staying Disciplined During Market Booms

Howard Marks’ approach during market booms involves adhering to his investment criteria and avoiding the temptation to overextend into overvalued assets. By focusing on fundamentals and maintaining a disciplined investment strategy, he ensures that his portfolio remains resilient and positioned for sustainable growth.

Tip: Cultivate patience by setting clear investment criteria and sticking to them, regardless of short-term market fluctuations. Avoid making impulsive decisions driven by market hype, and wait for opportunities that align with your long-term investment strategy.

Risk Management Across Cycles

Adapting to the Cycle

Effective risk management is paramount for long-term investment success, especially in the context of market cycles. Howard Marks emphasizes the importance of adjusting risk exposure based on the current phase of the market cycle.

Risk Adjustment Strategies:

- Higher Risk During Expansions: As the market expands, taking on more risk can lead to higher returns. Marks suggests increasing exposure to growth-oriented assets while maintaining a balanced portfolio.

- Lower Risk During Contractions: In times of economic contraction, reducing risk exposure helps preserve capital. Shifting to defensive assets, such as bonds or cash equivalents, can safeguard the portfolio against downturns.

Capital Preservation

Marks places a strong emphasis on capital preservation, especially during the late stages of a market cycle. Protecting the investment capital ensures that investors can remain in the game and capitalize on future opportunities.

Techniques for Capital Preservation:

- Diversification: Spreading investments across various asset classes and sectors to reduce exposure to any single investment.

- Stop-Loss Orders: Implementing stop-loss orders to automatically sell assets if they fall below a certain price, limiting potential losses.

- Hedging: Using options or other derivative instruments to hedge against market downturns, thereby reducing overall portfolio risk.

Example: Risk Management During the 2008 Financial Crisis

During the 2008 financial crisis, Marks implemented stringent risk management techniques by shifting his portfolio towards distressed debt and high-quality bonds. This strategic shift protected his portfolio from the worst of the market downturn and positioned it for recovery as the markets rebounded.

Tip: Regularly reassess and adjust your risk exposure based on the current market cycle. Implementing dynamic risk management strategies ensures that your portfolio remains aligned with your investment goals and risk tolerance throughout different phases of the market cycle.

Contrarian Thinking in Market Cycles

Going Against the Crowd

Howard Marks is a staunch advocate of contrarian investing, especially during market extremes. Contrarian thinking involves making investment decisions that go against prevailing market sentiment, capitalizing on mispricings that arise when the majority of investors are either overly optimistic or pessimistic.

Benefits of Contrarian Investing:

- Identifying Mispricings: By going against the crowd, investors can identify assets that are undervalued or overvalued, creating opportunities for higher returns.

- Avoiding Herd Mentality: Contrarian investing helps in avoiding the pitfalls of herd mentality, where investors blindly follow the majority without conducting proper analysis.

Buying Low, Selling High

One of the fundamental principles of contrarian investing is buying low and selling high. Howard Marks emphasizes the importance of acquiring assets when they are undervalued and selling them when they reach fair value or become overvalued.

Strategies to Buy Low:

- Value Investing: Focusing on assets that are trading below their intrinsic value based on fundamental analysis.

- Distressed Assets: Investing in assets that are underperforming due to temporary setbacks but have strong underlying fundamentals.

Strategies to Sell High:

- Overvalued Assets: Selling assets that have become overvalued relative to their intrinsic value to lock in gains.

- Reducing Exposure During Bubbles: Taking profits from sectors or markets that are experiencing speculative bubbles to protect against potential downturns.

Example: Capitalizing on Pessimism in the Market

During periods of widespread pessimism, such as during economic recessions, Marks takes a contrarian approach by buying quality assets at depressed prices. As market sentiment improves and prices recover, he sells these assets at higher valuations, capitalizing on the initial mispricing.

Tip: Incorporate contrarian principles by seeking opportunities where market sentiment is extreme. Focus on fundamentals and avoid getting swayed by the prevailing mood of the market, whether it be fear or greed.

The Role of Psychology in Market Cycles

Understanding Market Psychology

Investor psychology plays a critical role in driving market cycles. Emotions such as fear, greed, optimism, and pessimism influence investment decisions, often leading to irrational market behavior and asset mispricings. Howard Marks emphasizes the importance of understanding these psychological dynamics to navigate market cycles effectively.

Key Psychological Factors:

- Fear and Greed: These emotions can cause investors to overreact to market news, leading to excessive selling during downturns or overbuying during upswings.

- Herd Behavior: The tendency of investors to follow the majority, often ignoring fundamental analysis, can result in bubbles and crashes.

- Overconfidence: Success in trading can lead to overconfidence, causing investors to take on excessive risks.

Controlling Emotions

Emotional control is crucial for successful investing. Marks provides several strategies to maintain discipline and avoid emotional decision-making during volatile markets.

Strategies for Emotional Control:

- Sticking to a Trading Plan: Having a well-defined trading plan with clear rules for entry, exit, and risk management helps maintain focus and prevent impulsive decisions.

- Mindfulness and Stress Management: Practices such as meditation, deep breathing, and regular exercise help in managing stress and maintaining mental clarity, enabling focus during trading sessions.

- Regular Performance Reviews: Analyzing trading performance regularly helps in identifying emotional biases and adjusting strategies accordingly.

- Setting Realistic Expectations: Maintaining realistic expectations about market performance helps in avoiding disappointment and frustration during adverse market conditions.

Example: Staying Calm During Market Downturns

During a market downturn, instead of panicking and selling assets indiscriminately, Marks remains calm and adheres to his risk management protocols. This disciplined approach prevents unnecessary losses and positions his portfolio for recovery when the market stabilizes.

Tip: Develop and adhere to a structured trading plan to minimize the influence of emotions on your trading decisions. Regularly practice stress management techniques to maintain emotional control, especially during volatile market conditions.

Practical Steps to Invest Like Howard Marks

Market Cycle Analysis

To invest like Howard Marks, it’s essential to analyze current market conditions and identify the phase of the cycle. Here’s how you can approach market cycle analysis:

- Assess Economic Indicators:

- GDP Growth: Look for signs of economic expansion or contraction.

- Interest Rates: Monitor central bank policies and interest rate movements.

- Employment Data: Analyze employment rates and trends.

- Inflation Rates: Track inflation to understand purchasing power and cost pressures.

- Evaluate Investor Sentiment:

- Surveys and Indices: Use tools like the AAII Investor Sentiment Survey or the CNN Fear & Greed Index.

- Market News and Trends: Pay attention to headlines and prevalent market narratives.

- Identify Market Trends:

- Technical Analysis: Use chart patterns, moving averages, and momentum indicators to spot trends.

- Sector Performance: Analyze which sectors are performing well or underperforming.

- Historical Context:

- Compare Current Conditions to Past Cycles: Understanding historical precedents can provide insights into potential market movements.

Portfolio Adjustment

Once you’ve identified the phase of the market cycle, adjust your portfolio accordingly to optimize returns and manage risk.

Tips for Adjusting Your Portfolio:

- During Expansion:

- Increase Exposure to Growth-Oriented Assets: Stocks with high growth potential can offer substantial returns.

- Maintain Some Defensive Assets: Keep a portion of your portfolio in bonds or other stable investments to balance risk.

- During Peak:

- Reduce Exposure to Overvalued Assets: Take profits from assets that have appreciated significantly.

- Increase Defensive Holdings: Shift more of your portfolio into bonds or cash equivalents to protect against potential downturns.

- During Contraction:

- Focus on Capital Preservation: Prioritize investments that offer stability and income.

- Seek Value Opportunities: Look for undervalued stocks that are trading below their intrinsic value.

- During Trough:

- Prepare for Recovery: Begin positioning your portfolio to take advantage of the upcoming expansion.

- Increase Equity Exposure Gradually: As signs of recovery emerge, slowly increase your investment in growth-oriented assets.

Continuous Learning

Staying informed and adapting to changing market conditions is crucial for emulating Howard Marks’ investment success. Here are ways to ensure continuous learning:

- Read Marks’ Memos: Howard Marks regularly publishes memos that provide deep insights into market dynamics and investment strategies.

- Engage with Investment Communities: Participate in forums, attend seminars, and network with other investors to exchange ideas and stay updated.

- Study Economic Trends: Keep abreast of global economic developments, policy changes, and emerging market trends.

- Utilize Educational Resources: Invest in books, courses, and other materials that enhance your understanding of market cycles and investment principles.

Example: Applying Continuous Learning

Suppose a new economic policy is introduced that significantly impacts interest rates. By staying informed through Marks’ memos and other reliable sources, you can anticipate how this policy might affect different asset classes and adjust your portfolio accordingly, ensuring that your investments remain aligned with market conditions.

Tip: Commit to lifelong learning by continuously seeking knowledge and staying informed about market developments. This proactive approach ensures that your investment strategies remain relevant and effective in varying market conditions.

Howard Marks FAQ: Mastering Market Cycles (12 Expert Q&As)

Who is Howard Marks and what defines his investment style?

Howard Marks is the co-founder of Oaktree Capital Management, famed for his memos on cycles, risk, and “second-level thinking.” He specializes in credit and distressed investing, emphasizing probabilistic analysis, risk control, and positioning to the market’s cycle rather than precise forecasts.

What does “second-level thinking” mean in practice?

First-level thinking stops at headlines; second-level asks, “What’s priced in? What’s the variant view? What’s the distribution of outcomes?” Practically, it means comparing consensus expectations to price, seeking situations where the odds and payoff skew in your favor.

How does Marks define and use market cycles?

Cycles are recurring waves in economies, markets, credit, and psychology. You can’t time them precisely, but you can judge where we are approximately (early, mid, late) and adjust aggressiveness, quality, and liquidity accordingly.

Which indicators help locate the cycle?

He blends fundamentals and psychology: credit spreads and lending standards, covenant quality, default rates, IPO/SPAC heat, valuations vs. history, leverage, sentiment surveys, and flows into risk assets. Tight spreads + loose covenants + euphoria = late cycle; wide spreads + fear = early recovery.

How should positioning change across the cycle?

Early cycle: lean more aggressive—selective credit/equity risk, cyclicals, and distressed opportunities. Mid: balance quality with selective cyclical risk. Late: upgrade quality, shorten credit duration, add defenses/liquidity, demand wider risk premia.

What is Marks’ stance on forecasting vs. preparation?

He avoids precise forecasts. The edge is in preparation and calibration: build portfolios that can withstand a range of scenarios, keep dry powder, and insist on adequate prospective returns before taking risk.

How does psychology drive mistakes near cycle extremes?

At peaks, greed and FOMO compress risk premia; investors extrapolate good times and overpay. At troughs, fear and forced selling create bargains. Recognize these emotional climates and act counter to them.

Why are credit conditions central in his framework?

Credit both reflects and amplifies the cycle. Easy credit pushes assets beyond fair value; tight credit creates scarcity and future excess returns. Watching spreads, covenants, and lender behavior often gives earlier signals than equities.

How does Marks think about risk management?

Risk is the probability of bad outcomes after price. Control it via quality bias late cycle, diversification, liquidity buffers, position sizing, and insisting on adequate yield/spread or margin of safety before committing capital.

What’s a practical playbook for late-cycle discipline?

Raise the bar for new buys, avoid weak balance sheets, shorten duration, trim crowded winners, add ballast (cash/defensives), and document red lines (valuation, leverage, covenant quality) you won’t cross.

How can individual investors apply Marks’ ideas?

Create a cycle checklist, watch credit spreads and sentiment, pre-define stance (aggressive/neutral/defensive) bands, size positions to downside risk, and journal decisions to avoid emotional drift.

What are the most common errors Marks would flag?

Confusing brains with a bull market, reaching for yield, ignoring liquidity needs, relying on point forecasts, and staying aggressive as risk premia shrink instead of pulling back.

Key Takeaways from Howard Marks’ Approach to Mastering Market Cycles

Howard Marks’ approach to mastering market cycles offers a comprehensive framework for understanding and navigating the complexities of the financial markets. By emphasizing the importance of recognizing market phases, implementing disciplined risk management, and maintaining a contrarian mindset, Marks provides a robust strategy for achieving consistent investment success.

Key Takeaways:

- Understanding Market Cycles: Recognizing the different phases of market cycles—expansion, peak, contraction, and trough—is fundamental to making informed investment decisions.

- Comprehensive Analysis: Utilizing a combination of economic indicators, sentiment analysis, and technical analysis enhances the accuracy of market cycle identification.

- Patience and Timing: Emphasizing the importance of patience in waiting for the right investment opportunities and avoiding impulsive decisions driven by market hype.

- Risk Management: Implementing robust risk management strategies, including position sizing, stop-loss orders, and diversification, is crucial for protecting capital and sustaining long-term performance.

- Contrarian Thinking: Adopting a contrarian approach during market extremes can lead to significant investment opportunities by capitalizing on market mispricings.

- Psychological Resilience: Maintaining emotional discipline and controlling psychological biases ensures that investment decisions remain objective and aligned with long-term goals.

- Continuous Improvement: Adapting and refining trading strategies based on ongoing performance reviews and market developments enhances the effectiveness and resilience of the investment approach.

Understanding and Applying Market Cycle Analysis

In today’s dynamic and interconnected financial markets, the ability to understand and apply market cycle analysis is more important than ever. Market cycles are driven by a combination of economic factors, investor sentiment, and geopolitical events, making them complex and multifaceted. However, by adopting Howard Marks’ approach, investors can gain a deeper insight into these cycles, allowing for more strategic and informed investment decisions.

Relevance in Modern Markets:

- Technological Integration: The rise of algorithmic trading and big data analytics has enhanced the ability to analyze market cycles with greater precision and speed.

- Globalization: Understanding global market trends and their interconnections is essential for navigating the complexities of today’s globalized economy.

- Market Volatility: Robust trend-following and risk management strategies can effectively navigate volatile markets, capturing profitable trends while minimizing losses.

- Behavioral Insights: Incorporating behavioral finance principles helps in understanding the psychological drivers of market cycles, enabling more accurate predictions and strategic positioning.

Example:

During the COVID-19 pandemic, Howard Marks’ principles of market cycle analysis enabled him to recognize the early signs of economic contraction and shift his investment strategy accordingly. By reallocating assets toward more defensive sectors and cash equivalents, he protected his portfolio from significant losses and positioned it for recovery as markets stabilized and began to recover.

Apply Marks’ Strategies: Investing Practices

Emulating Howard Marks’ approach to mastering market cycles requires dedication, discipline, and a commitment to continuous learning. However, the benefits of understanding market cycles and applying strategic investment principles can be substantial, offering a path to consistent and sustainable investment success. Here are some actionable steps to get you started:

- Adopt a Market-Cycle Mindset: Embrace the principles of market cycle analysis by focusing on identifying and understanding the current phase of the cycle. Use economic indicators, sentiment analysis, and technical tools to enhance your cycle identification process.

- Implement a Systematic Investment Plan: Develop a comprehensive investment plan that outlines your criteria for entering and exiting investments, risk management rules, and performance benchmarks. Stick to this plan to maintain discipline and consistency in your investing.

- Prioritize Risk Management: Use position sizing, stop-loss orders, and diversification to manage risk effectively. Protect your capital by ensuring that no single investment can significantly impact your portfolio.

- Leverage Technology and Analytical Tools: Invest in advanced trading platforms and analytical tools to enhance your investment analysis and execution capabilities. Utilize quantitative models and data analytics to inform your trading decisions.

- Seek Mentorship and Education: Learn from experienced investors and seek mentorship opportunities to gain valuable insights and refine your investment strategies. Attend seminars, workshops, and engage with the investment community to expand your knowledge.

- Commit to Continuous Improvement: Regularly review and assess your investment performance, and be prepared to adapt and refine your strategies based on market developments and performance feedback.

- Maintain Mental Resilience: Cultivate a strong mental attitude by practicing stress management techniques and maintaining emotional control. Understand that losses are part of investing and use them as learning opportunities to enhance your strategies.

Final Encouragement:

Investing like Howard Marks isn’t about replicating his every move but about embracing the underlying principles that have driven his success. It’s about understanding market dynamics, maintaining discipline, and being willing to take calculated risks. By incorporating Marks’ strategies and adapting them to your unique circumstances, you can navigate the complex world of investing with greater confidence and insight.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.