There are instances where I’m really excited about a new fund but I find myself on a lonely island.

This is the case when it comes to HCMT ETF.

It’s better known as Direxion HCM Tactical Enhanced US ETF.

I haven’t heard anybody else talking about it.

Crickets.

However, I’m fascinated by the tactical strategy it potentially offers investors.

200% equities or 100% cash based on trend.

It’s all in or it’s all out.

There is no middle ground.

When I apply the filter I use to evaluate funds for inclusion/exclusion into my portfolio it passes with flying colours.

Here is my framework:

- Capital Efficiency

- Maximum Diversification

- Optimization

This fund is without a doubt capital efficient stretching its canvas to 200% in offensive mode.

In terms of diversification, its dual approach of turning on the equity afterburners or retreating entirely to cash means that it is strategically diversified.

It’s not a single strategy unlike other 2X to 3X equity funds and it attempts to solve their biggest problem.

Managing downside risk.

And lastly, it’s without a doubt an optimization strategy.

Often when I’ve discussed optimization strategies I’ve referred to factor tilts (value, momentum, min vol, etc) but in this case we’re talking about HCMT ETF’s tactical nature.

It instantly creates a portfolio where you’ve now got an offensive mode and a defensive mode.

Let me explain.

We’ll use a dull MCW 60/40 portfolio as our example here.

As a base we’re starting off with 60% SPY and 40% AGG.

Let’s say we replace 20% of SPY and add 20% of HCMT ETF.

Our portfolio now goes from a static 60/40 to the following:

40% SPY

20% HCMT

40% AGG

Offensive Mode:

80% Equities

40% Bonds

Defensive Mode:

40% Equities

40% Bonds

20% Cash

We boost the offensive nature of the portfolio by an entire category (from balanced <60%> to growth <80%>) and we simultaneously shrink it as well (from balanced <60%> to conservative <40%>) depending on whether the portfolio is in offensive or defensive mode.

That’s fascinating!

In my opinion, we’re clearly aiming for better offensive production here.

But what if we used this fund to keep our equity position the same but then utilized this extra space in the portfolio to add some diversifying hedging strategies.

We’ll use the same backbone as our starting ground with a 60/40 of 60% SPY and 40% AGG.

This time we’ll replace 20% SPY with 10% HCMT and 5% CAOS and 5% BTAL.

Our portfolio now looks like this:

40% SPY

10% HCMT

40% AGG

5% CAOS

5% BTAL

Offensive Mode:

60% Equities

40% Bonds

5% OTM Put

5% Market Neutral Anti-Beta

Defensive Mode:

40% Equities

40% Bonds

10% Cash

5% OTM Put

5% Market Neutral Anti-Beta

This is a clearcut instance where we’ve used the capital efficiency of HCMT in an attempt to bolster our portfolio defense.

In my opinion, this showcases the versatility of the product to reach for the stars (boosting offense) or to create more space in the portfolio to clamp down (boosting defense).

Thus, it can be used to improve the firepower of your portfolio or to create more of a fortress. Irregardless of whichever way you tilt, you’re creating a tactical portfolio with an offensive and defensive mode by including it in your portfolio.

The Good, The Bad and The Ugly With 2X Single Strategy Funds

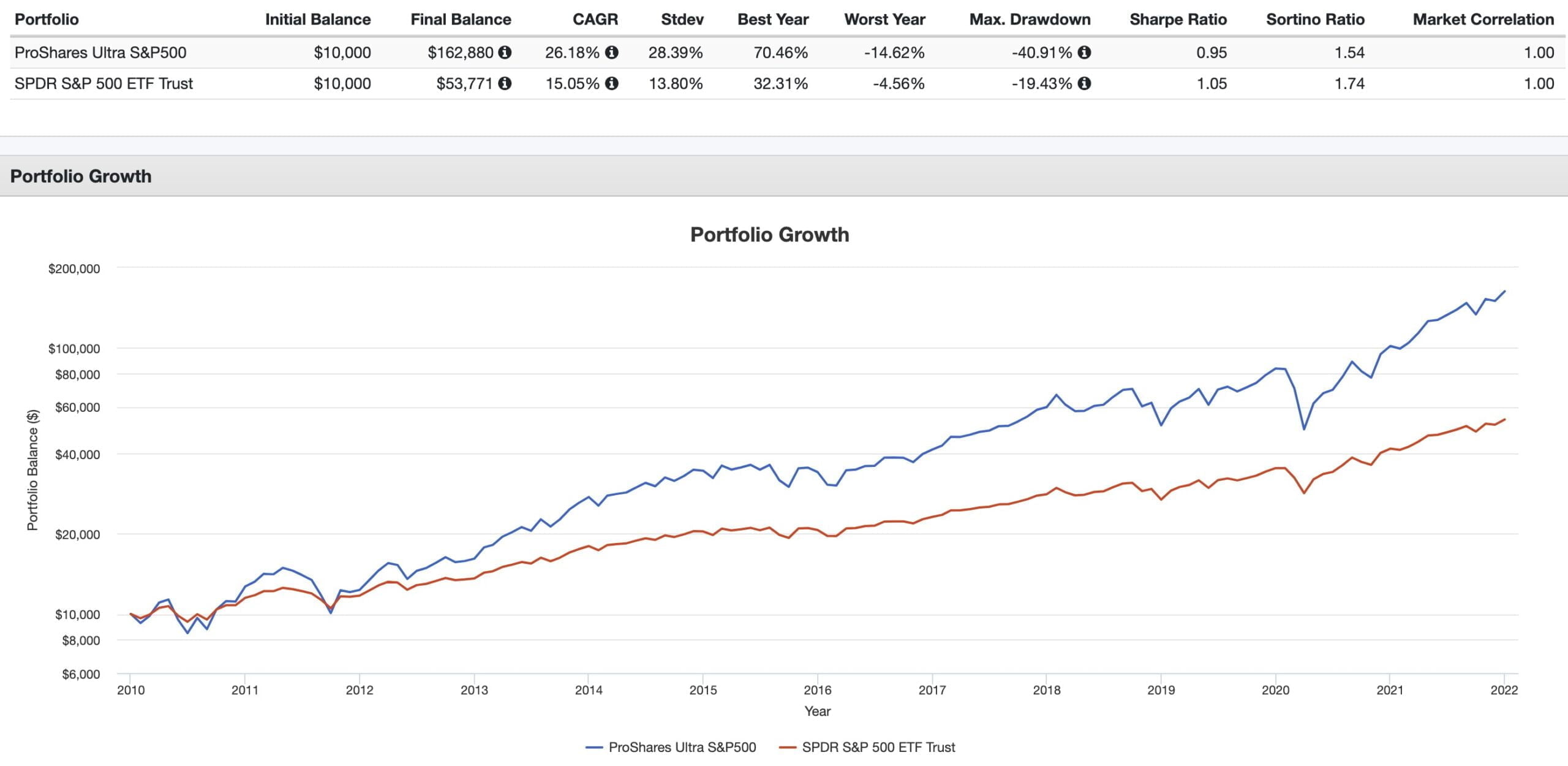

2X funds are a lot of fun when markets are trending upwards for an extended period of time.

Just look at how well SSO performs from 2010 until 2021.

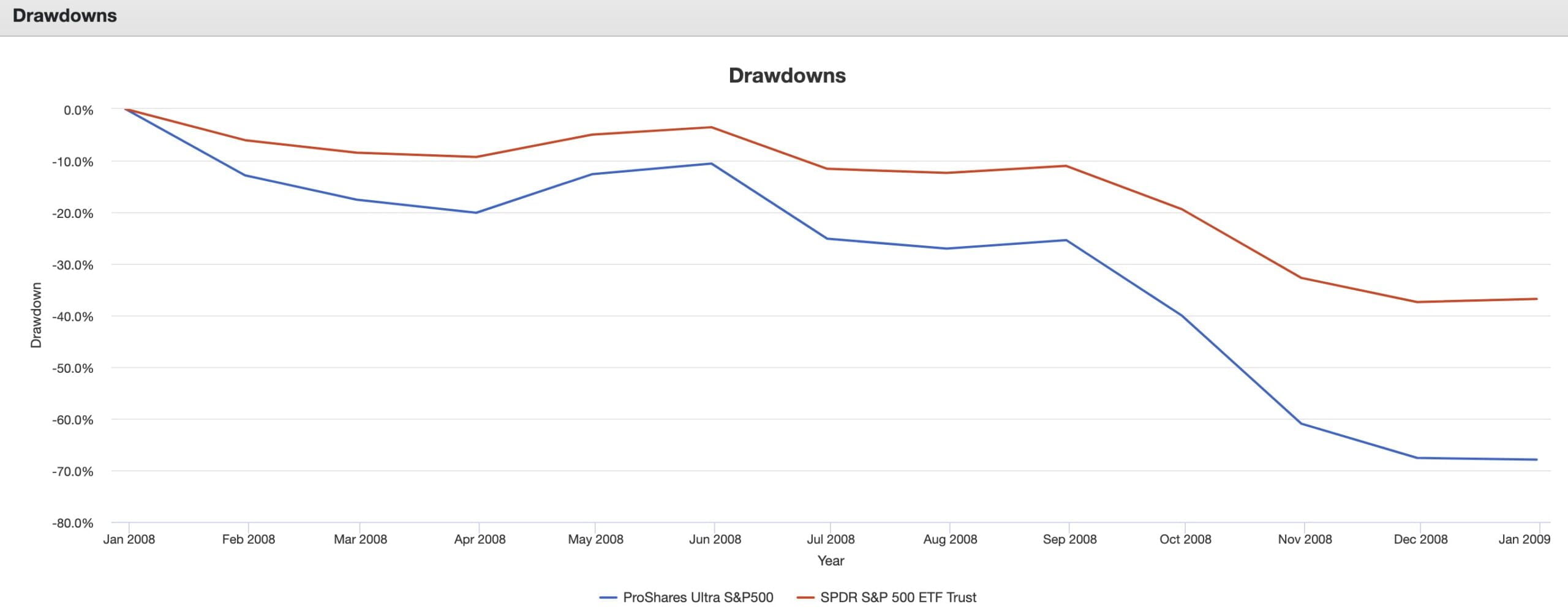

But then you’ve got those pesky years such as 2008 or 2022 when the fund (due to its 2X nature) gets absolutely massacred.

A lot of levered long-only asset allocators try to solve this problem by adding other long-only levered funds such as 2 or 3X long-term treasury.

That’s worked at times but then you have a year like 2022 where you’re just grasping at straws as you watch two asset classes that are historically uncorrelated get nuked together.

Being able to turn on the afterburners and retreat is a potential solution to this problem.

It’s however anything but a free lunch.

By hiding out in cash you’re also hiding out from participating in the upside recovery.

In other words, by attempting to avoid downside damage you also avoid participating in its initial recovery.

The fund, given its rules based systematic nature, retreats to 100% cash and only returns back to 200% equities when the coast is clear (when markets are in uptrend).

The best real-life example I can think of is, you’re attempting to drive away from a crazy person swinging a golf club at your vehicle.

You get dinged with a few spectacular whacks but you eventually get away and avoid crashing your car into the telephone pole.

This represents the pain felt while the fund is getting hit by a golf club before retreating to cash.

Since you didn’t need a full body repair, you’re in much better shape from a recovery standpoint.

But when things are sunny again, you’re not out driving your car right away.

You’ve got to wait a bit to get the green light.

This represents the fund still being in cash as recovery in the marketplaces is taking place.

There is clearly a tradeoff taking place.

Less damage whilst missing out on the initial stages of recovery.

Basically, the success (or failure) of the fund hinges upon its ability to be 200% configured when markets are thriving whilst trying to sidestep carnage on the downside by hanging out in cash.

It’s a timing strategy.

Those aren’t easy to pull off.

One scenario where it wouldn’t work out so well would be a series of choppy and continuous drawdowns which have the fund getting dinged, retreating to cash (missing out on most of the upside recovery) X repeat (getting dinged again and again and again) in this fashion.

Ouch.

That’s gonna hurt.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Review of HCMT ETF: Reviewing Direxion HCM Tactical Enhanced US ETF

Howard Capital Management

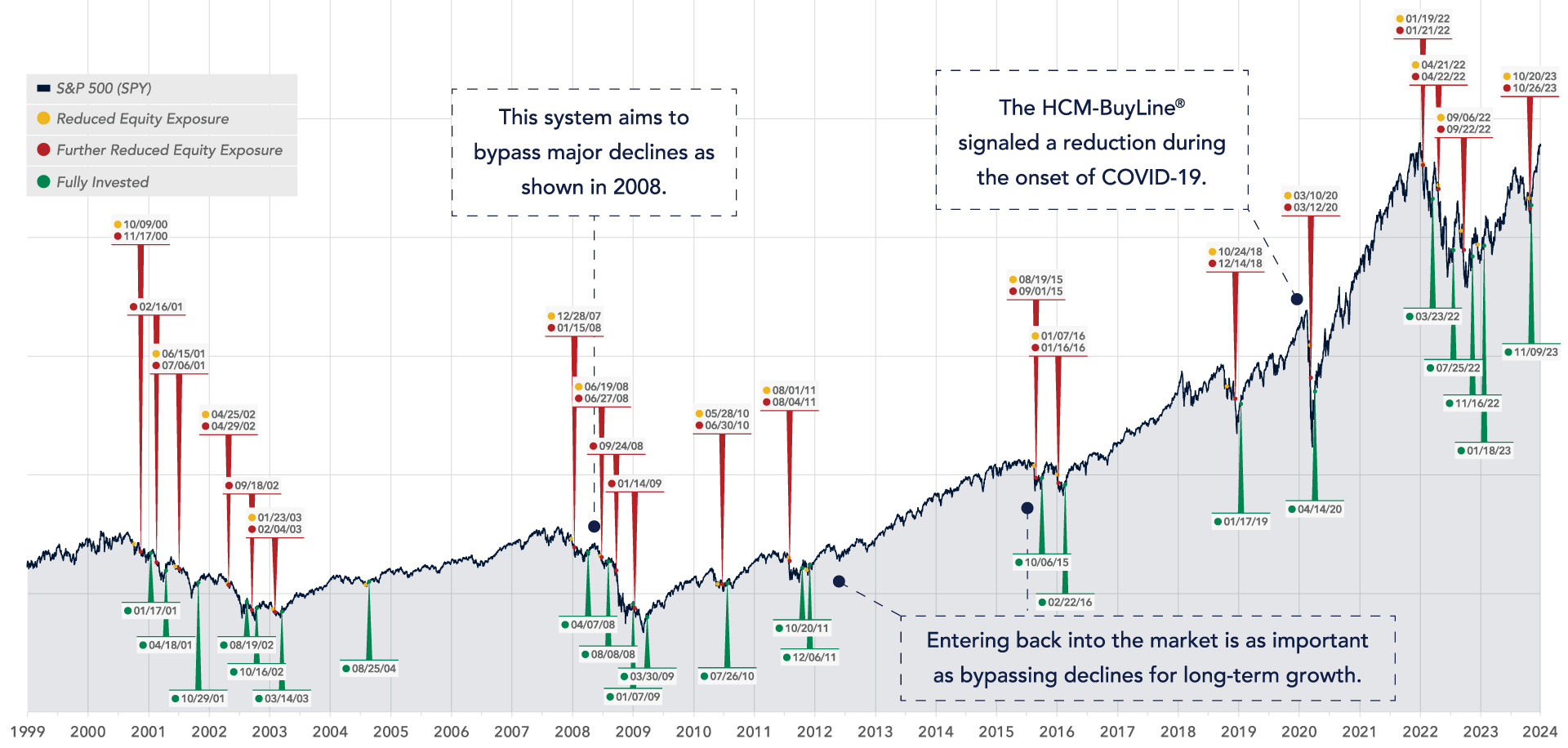

Howard Capital Management is the creator of this fund with the following slogan on its homepage:

“Returns Matter. Risk Management Matters.”

They’re a firm that specializes in tactical mandates with the goal of participating in the upside (as much as possible) of markets whilst limiting its downside participation (as much as possible) of markets.

They’ve developed a rules based HCM Buyline System which you can view on their website:

HCMT ETF Overview, Holdings and Info

The investment case for “Direxion HCM Tactical Enhanced US ETF” has been laid out succinctly by the folks over at Direxion: (source: fund landing page)