Multi-strategy plus multi-asset class alternative ETFs are rarer than a solar eclipse.

Traditionally, investors seeking exposure to these types of funds have had to go the route of high fee hedge funds and/or interval funds that required hurdles that only accredited investors could clear.

Fortunately, we’re now starting to see some of these types of strategies emerge, in a more accessible manner, in the ETF marketplace.

Enter the room QIS ETF.

It’s better known as Simplify Multi-QIS Alternative ETF.

Its unique 10-20 QIS (quantitative investment strategies) approach seeks to provide an all-in-one alternative sleeve solution that slots neatly alongside your classic equity/bond asset allocation.

Without further ado, let’s find out more about this unique new fund!

Reviewing The Strategy Behind QIS ETF (Simplify Multi-QIS Alternative ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of QIS ETF?

For those who aren’t necessarily familiar with a “multi-strategy plus multi-asset class” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

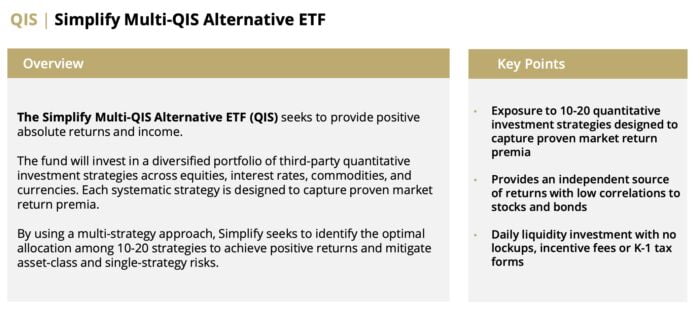

QIS refers to “quantitative investing strategies”. Simplify Multi-QIS Alternative ETF (QIS) is an actively managed ETF that invests in a diversified portfolio of 10-20 QIS strategies run by leading investment banks.

Quantitative investment strategies use techniques and investment philosophies that may be very similar to traditional active managers. The key difference is that the essence of the strategies is encapsulated into quantitative algorithms that are systematically traded. This maintains the strategy discipline and makes it more repeatable.

Here’s an example of one of the strategies that might be found within QIS: Historically, the popular high yield ETF HYG has consistently exhibited higher implied volatility than realized volatility. Selling a put and a call with the same expiration date can reliably capture this differential in volatility by generating income. This type of strategy is an example of taking advantage of volatility within the credit asset class.

Unique Features Of Simplify Multi-QIS Alternative Fund QIS ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

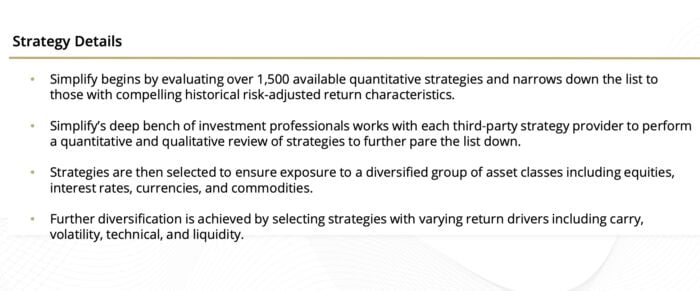

The fund begins with an analysis of approximately 2,000 strategies run by leading investment banks. The top 100 strategies are initially selected based on risk adjusted returns. From there, 10-20 strategies are selected to ensure diversification across asset classes and return drivers. The objective is to have positive absolute return with low correlations to stocks and bonds.

The fund will invest in strategies in each of the following asset classes: equities, commodities, interest rates, currencies and credit. Within these asset classes, the fund invests in strategies with different return drivers, including: carry, volatility, technicals and liquidity. QIS will target an investment in at least one strategy per asset class and one strategy per return driver. Each strategy is rules-based and actively managed. The discretionary component of the fund is Simplify management’s initial selection of the strategies, as well as ongoing monitoring and potential strategy replacements.

Some of the strategies within the fund will include leverage. However, many of the leveraged strategies also contain tail risk hedges. When combined with the fund’s extensive diversification, the goal remains to have a product with absolute returns with volatility in the 8-10% range. The expense ratio is 1.00%.

What Sets QIS ETF Apart From Other Diversified Alternative Funds?

How does your fund set itself apart from other “diversified alternative asset allocation funds” being offered in what is already a crowded marketplace? What makes it unique?

There are very few products in the multi-QIS space. One primary difference is the multi-strategist approach rather than constructing a portfolio from a single manager. The other key differential is the emphasis on diversification across not only asset classes, but return drivers.

source: Simplify Asset Management on YouTube

What Else Was Considered For QIS ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

One of the key discussion points during our research process was how much leverage/volatility the fund should target. A volatility target that’s too low would result in attractive correlation benefits, but with uninspiring returns. An equity-like volatility target could produce eyebrow-raising returns, but many allocators prefer lower volatility in their alternative sleeve. Ultimately, the 8-10 vol target was chosen as a sweet spot that could substantially improve a portfolio’s risk adjusted return while maintaining a reasonable level of volatility.

When Will QIS ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favorable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

Since the fund is broadly diversified across different asset classes and return drivers, there is no market condition or scenario where the fund would be expected to perform at its best or worst at an absolute level. On a relative performance level versus equities, the fund should exhibit its best performance during periods of equity drawdowns.

Why Should Investors Consider Simplify Multi-QIS Alternative Fund QIS ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

A low cost portfolio of equities and bonds is a good start, but we’ve seen how this two-legged stool can sometimes be unstable. This is especially true during inflationary periods like 2022 where stock and bond returns were highly correlated. Adding an alternative sleeve to a portfolio that has little correlation to both stocks and bonds adds a third leg that can improve a portfolio’s diversification when needed the most.

How Does QIS ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

QIS is a portfolio diversifier. It can be a part of a diversified alternatives sleeve or – due to its diversification – it could serve as an investor’s single alternative investment. A 10-20% allocation to the fund would add a significant amount of diversification benefits without introducing excessive tracking error.

The Cons of QIS ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Clients are definitely interested in learning more about the underlying strategies and managers employed, and we are working on ways to improve communication and transparency around this topic.

The Pros of QIS ETF

On the other hand, what have others praised about your fund?

It’s still early, but we have received interest in the fund, particularly from sophisticated investors who understand the benefits of a multi-QIS approach.

Learn More About QIS ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

It’s important to note that strategies similar to what are in QIS have historically only been available in the hedge fund space. As such, they were not accessible to most financial advisors and individual investors. QIS, on the other hand, is an ETF which means daily liquidity, no additional paperwork, no performance fees or redemption gates, and no K-1 tax forms.

As for Simplify, we’re really excited about our growing alternatives lineup, as well as the products in our high-yielding income suite.

QIS ETF — 12 Essential FAQs on the Simplify Multi-QIS Alternative ETF Strategy

What is QIS ETF and why is it significant?

QIS (Simplify Multi-QIS Alternative ETF) is a multi-strategy, multi-asset class alternative ETF that provides investors access to 10–20 quantitative investment strategies (QIS) historically available only through high-fee hedge funds or interval funds. It offers an accessible, liquid, and diversified alternative sleeve for traditional portfolios.

What does “Multi-QIS” mean in this context?

“QIS” stands for Quantitative Investment Strategies—systematic, rules-based approaches often designed and run by major investment banks. QIS ETF invests in a diversified selection of these strategies spanning equities, rates, credit, commodities, and currencies, using different return drivers like carry, volatility, technical signals, and liquidity.

What is the core investment strategy of QIS ETF?

The ETF screens around 2,000 strategies, selects the top 100 based on risk-adjusted returns, and then builds a portfolio of 10–20 diversified strategies across five asset classes and four return drivers. It aims for positive absolute returns with low correlation to traditional stocks and bonds.

How is the portfolio managed in terms of active vs. rules-based strategies?

Each underlying QIS is rules-based and systematic, while Simplify’s role is actively selecting, monitoring, and potentially replacing strategies over time. This hybrid approach combines the discipline of systematic trading with active oversight for portfolio construction.

Does QIS ETF use leverage?

Some of the underlying QIS employ leverage, but many also include tail risk hedges. The fund is designed to target 8–10% volatility, seeking to balance return potential with prudent risk management. Leverage is a tool within strategies, not applied indiscriminately at the fund level.

What sets QIS ETF apart from other alternative ETFs?

Unlike single-manager or single-strategy alternatives, QIS ETF uses a multi-strategist model, sourcing diversified QIS from leading investment banks. It diversifies across both asset classes and return drivers, providing a broader, hedge-fund-style exposure in a transparent ETF structure with daily liquidity.

What considerations shaped its volatility and leverage target?

During development, Simplify debated how aggressive the fund’s volatility target should be. They ultimately chose 8–10%—a “sweet spot” offering meaningful diversification and improved risk-adjusted returns without taking on equity-like volatility, making it a more palatable fit for an alternative sleeve.

When might QIS ETF perform best?

Given its diversified structure, QIS ETF isn’t designed to shine in any single market condition. However, relative to equities, it may perform best during equity drawdowns, inflationary regimes, or environments where stocks and bonds are highly correlated, offering diversification when it matters most.

When might it perform worst?

The ETF may lag during strong bull markets in traditional equities when diversified alternatives underperform relative to concentrated beta. Since its goal is absolute return and diversification, not beating equity indexes, underperformance versus a roaring stock market is expected at times.

How can QIS ETF be used in a portfolio?

QIS ETF functions best as a diversified alternative sleeve. It can complement a 60/40 portfolio or even serve as a single alternative allocation for advisors and individuals who don’t want to pick multiple alt strategies. A 10–20% allocation can provide meaningful diversification without excessive tracking error.

What are the main pros and cons investors have highlighted?

Pros:

Hedge-fund-like exposure in ETF form

Daily liquidity, no K-1s, no performance fees

Broad diversification across assets and strategies

Cons:

Complexity—investors want more transparency on underlying strategies

Early stage—needs continued education for broader understanding

Why is this fund considered groundbreaking?

Historically, multi-QIS strategies were gated, illiquid, expensive, and reserved for institutions. QIS ETF brings that same institutional alternative exposure to everyday portfolios through a liquid, low-cost ETF structure, democratizing access to strategies once confined to hedge funds.

Connect With Simplify ETFs

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: QIS ETF

Nomadic Samuel Final Thoughts

I want to personally thank the team over at Simplify for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.