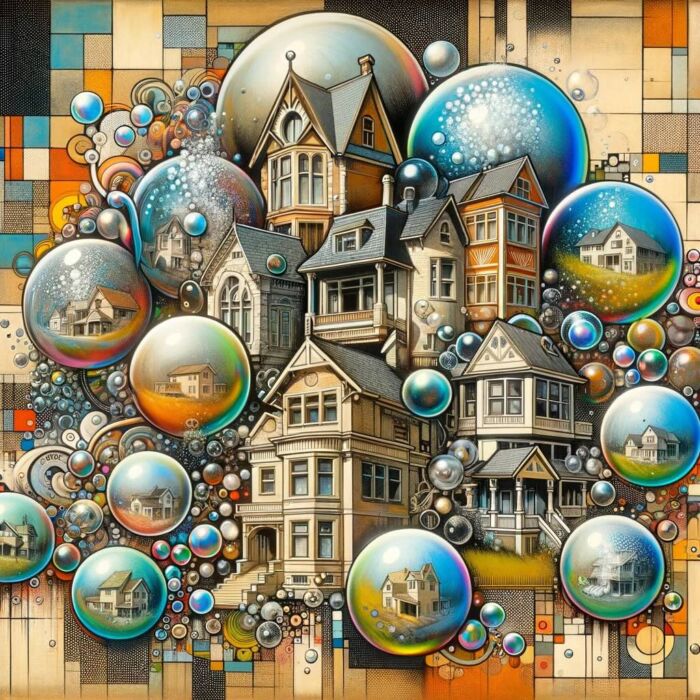

A housing bubble, at its simplest, refers to a sharp and unsustainable increase in the price of property in a particular region, driven not by underlying economic fundamentals but by exuberant market behavior and speculative demand. These bubbles are characterized by rapid surges in property prices to levels that are far above their inherent or “real” value. But what exactly causes these bubbles, and why should we concern ourselves with them?

Definition of a Housing Bubble:

Imagine a balloon. When air is pumped into it steadily and at a controlled pace, the balloon expands uniformly. But if we keep pumping too fast, there comes a point when the balloon becomes overstretched and can’t take in any more air. It’s vulnerable to even the tiniest prick. A housing bubble is the economic equivalent of this over-inflated balloon.

Housing bubbles are typically identified by a prolonged period during which property prices increase at a much faster rate than inflation or wage growth. Such rapid price increases often detach from the actual worth or intrinsic value of the properties. Instead, they’re based on the expectation that future prices will continue to rise, enticing more people to buy homes as investments, not just as places to live. This kind of speculative buying drives prices even higher, thus reinforcing the belief in the infallibility of the real estate market.

However, like the balloon, there’s a limit. Once the market reaches a saturation point where there are fewer new buyers, or when external factors change (like interest rates increasing or economic downturns), the bubble ‘bursts’. Prices start dropping, sometimes as rapidly as they rose, leading to a cascade of economic and social ramifications.

The Impact of Housing Bubbles on the Global Economy:

The real estate sector is one of the pillars of the global economy, affecting construction businesses, banks, investment firms, and even the average consumer. When a housing bubble bursts, the ramifications are widespread and profound:

- Banking and Financial Institutions: Many banks offer mortgage loans to home buyers. When property prices are skyrocketing, both lenders and borrowers can become reckless. Banks may hand out loans without stringent checks, and consumers might take on debts they can’t really afford, assuming that the value of their new home will cover the costs. When the bubble bursts, property values plummet, often leaving homeowners with a debt much larger than the worth of their homes, leading to defaults. This can weaken, or in worst cases, collapse banking institutions.

- Homeowners and Consumers: A burst bubble can leave homeowners in ‘negative equity’, meaning they owe more on their mortgage than what their home is now worth. This can lead to increased foreclosures, where people lose their homes. It also has a psychological effect on consumers; diminished home values can make people feel less wealthy and thus less likely to spend, leading to reduced consumption.

- Wider Economy: The fall in property prices reduces the value of assets held by individuals and institutions. This can result in a reduced ability or willingness to lend money, causing a credit crunch. Reduced consumer spending and investment can lead to recessions, job losses, and overall economic stagnation.

- Global Implications: In our interconnected global economy, a housing crisis in one major country can have cascading effects on others. This was evident during the 2007-2008 global financial crisis which, while originating in the U.S. housing market, sent shockwaves around the world.

Understanding housing bubbles isn’t just an academic exercise; it’s crucial to making informed decisions as homeowners, investors, and policymakers. Knowing the past can help us navigate the future, ensuring stable, sustainable growth in property markets worldwide.

2. The Anatomy of a Housing Bubble

- The stages of a housing bubble: inception, growth, peak, crash, and recovery

- Factors that contribute to housing bubbles: low-interest rates, speculative buying, lax lending practices, and more

- (write with great length and detail)

The Anatomy of a Housing Bubble

Every housing bubble, although unique in its circumstances and nuances, tends to follow a predictable trajectory that can be broadly categorized into various stages. This evolution is dictated by a combination of psychological, economic, and political factors. When analyzed, this anatomy can help us identify and potentially even curb the formation of bubbles in the future.

Stages of a Housing Bubble:

1. Inception:

Every bubble starts with a seemingly innocuous foundation, often rooted in genuine economic opportunity or growth. It could be due to favorable economic conditions, new employment opportunities in a region, technological advances, or governmental policies promoting homeownership. At this stage, there’s an uptick in demand, and housing prices begin to rise, but at a modest and justifiable rate.

2. Growth:

The initial price increase draws attention. The media starts covering the ‘boom’ in the real estate sector. Stories of people making considerable gains in short periods of time become commonplace. As more and more people hear of these success stories, there’s a rush to invest in property, hoping to secure a piece of the pie. The belief that property prices will only rise further becomes widespread.

3. Peak:

At this zenith, the frenzy reaches its height. Prices are soaring at a pace far removed from fundamental economic indicators. The market is driven primarily by speculation, with many buying properties not for their utility but purely in the hope of selling them at a higher price. Warning signs emerge—prices are so high that renting becomes a more economically viable option for many rather than buying. But the general belief remains that the market is different this time and that the old rules of economics no longer apply.

4. Crash:

The turning point. It could be triggered by various factors—a hike in interest rates, an economic recession, or simply the saturation of the market. Suddenly, the number of properties for sale exceeds the demand. Prices stagnate and then start to plummet rapidly. Many who bought properties with borrowed money hoping to sell them at a profit find themselves in a precarious position, often leading to distress sales or foreclosures, further pushing the prices down.

5. Recovery:

After the tumultuous crash, the market starts to stabilize. Prices reach a level aligned more closely with fundamental economic indicators. Confidence slowly returns, but it’s a cautious optimism. Regulatory bodies and governments might step in with measures to stabilize the market and prevent future bubbles. The recovery phase can be prolonged, often taking years or even decades, especially if the bubble burst led to a wider economic recession.

Factors Contributing to Housing Bubbles:

1. Low-Interest Rates:

Central banks might adopt low-interest-rate policies to stimulate economic growth. While beneficial in many ways, these low rates can make borrowing cheaper, leading to a surge in mortgage loans. With more people able to borrow money, demand for homes increases, pushing prices up.

2. Speculative Buying:

As discussed, when the narrative that property prices are bound to rise becomes pervasive, many people buy homes not for habitation but as an investment, intending to sell them at a profit. This speculative buying can inflate prices unrealistically.

3. Lax Lending Practices:

Financial institutions, in the race to capitalize on the booming market, might loosen their lending criteria, offering loans to those who are not in a position to repay them. This increase in borrowing can fuel demand and, by extension, prices.

4. Over-optimism and Herd Mentality:

Often, the belief that ‘this time is different’ prevails. People think that the old economic cycles of boom and bust don’t apply, leading to irrational exuberance. This over-optimism, coupled with a herd mentality where people follow what others are doing rather than analyzing the fundamentals, can drive the bubble.

5. Government Policies:

Sometimes, well-intentioned policies can inadvertently fuel bubbles. Tax incentives for homeowners, schemes to promote property ownership among first-time buyers, or even deregulation of the financial sector can all lead to increased demand and speculation in the housing market.

6. Global Investment Flows:

In an increasingly globalized world, real estate in certain ‘hotspot’ cities or regions can attract international investors. While this can be beneficial for the local economy, it can also drive up property prices and create bubbles if not managed prudently.

Understanding the anatomy of a housing bubble is vital. By recognizing the signs and stages, policymakers, investors, and the general public can better navigate the complexities of the real estate market, aiming for sustainable growth rather than volatile booms and busts.

source: toldinstone on YouTube

Historical Overview

The phenomenon of economic bubbles, including those in the housing sector, is not merely a product of modern economies. Throughout history, from ancient civilizations to the eve of the modern era, speculative fervor and economic volatility have left their mark, albeit in different forms and scales. Here’s a dive into the past to understand how housing markets and speculation evolved over time.

The Ancient World to Pre-Modern Times:

1. Ancient Rome:

While not a housing bubble in the contemporary sense, ancient Rome did witness periods of significant land speculation. Lucius Sergius Catilina, a Roman senator in the 1st century BC, is known to have indulged in land speculation by buying estates at depressed prices during times of crisis and later selling them when the situation improved.

2. Tulip Mania in the Dutch Golden Age:

Although not related to housing, the Tulip Mania of the 1630s is one of history’s most famous speculative bubbles. The prices of tulip bulbs in the Dutch Republic soared to extraordinary levels, only to collapse abruptly in 1637. While not a direct parallel, it’s a clear historical example of speculative behavior that can be likened to modern housing bubbles.

3. Spain’s Building & Population Boom:

In the 16th and 17th centuries, Spain experienced a building boom. With the influx of wealth from its colonies, particularly from the Americas, the country saw rapid urbanization. This led to increased demand for properties and a surge in construction activities. Though not a bubble in the strictest sense, the rapid rise and eventual stabilization offer insights into how sudden influxes of wealth can impact housing and construction markets.

The Emergence of Modern Housing Markets and Early Signs of Speculation:

1. The Industrial Revolution & Urbanization:

The late 18th and 19th centuries witnessed the Industrial Revolution, particularly in England and subsequently across Europe and America. This era marked a significant migration of the workforce from rural to urban areas, leading to the first real strains on housing in burgeoning cities like London, Manchester, and Birmingham. The rapid urbanization meant a spike in demand for housing, leading to the genesis of the modern housing market dynamics.

2. Paris and Haussmann’s Renovation:

In the mid-19th century, Paris underwent a massive urban renewal project under Baron Haussmann. The city’s narrow streets and medieval structures gave way to the grand boulevards and uniform architecture Paris is known for today. This project was not just about aesthetics or easing urban congestion—it also had profound economic implications. As old buildings were razed and new ones constructed, property values in these renovated areas soared. This led to both speculation and criticism, with some accusing Haussmann of favoring the bourgeoisie and uprooting the working class.

3. The Late 19th Century Land Boom in the US:

The latter half of the 19th century saw several land booms in the United States, particularly in Florida and the Midwest. As railway networks expanded, previously inaccessible or undeveloped land became attractive. Speculators bought vast tracts, anticipating future growth. Cities like Chicago witnessed rapid expansion, with property prices rising steadily. However, not all speculative ventures were successful, and there were periods of sharp corrections, providing early lessons in the risks of speculative investing.

4. The Roaring Twenties and the Great Depression:

The 1920s, especially in the US, was a period of economic prosperity, and this was reflected in the real estate market. Many urban areas, especially in places like Florida, saw a massive real estate boom. However, by the end of the decade, over-speculation, coupled with external economic factors, led to a sharp crash. This real estate crash, along with the stock market crash of 1929, heralded the onset of the Great Depression.

In retrospect, these historical episodes underscore that the fundamental drivers of housing bubbles—be it speculation, rapid economic growth, or sudden influxes of capital—have always been embedded in human economic behavior. The modern housing market, with its intricate financial instruments and global reach, has only amplified these dynamics. But at its core, the interplay of supply, demand, and speculation remains as relevant today as it was in ancient Rome or Renaissance Europe.

Notable Housing Bubbles by Region

North America

North America has seen its fair share of housing bubbles, each influenced by its unique set of economic, political, and societal factors. The aftershocks of some of these bubbles have had worldwide consequences, reshaping financial regulations and economic policies on a global scale.

source: CrashCourse on YouTube

1. The US Housing Bubble of the 2000s and the Great Recession:

Arguably the most infamous housing bubble in recent history, the U.S. housing bubble of the early to mid-2000s culminated in the global financial crisis of 2007-2008. Here’s a breakdown of its progression:

Inception & Growth: Post the dot-com bubble burst in the early 2000s, the U.S. Federal Reserve adopted a low-interest-rate policy to stimulate the economy. Coupled with an abundance of liquidity in global financial markets, this led to a surge in home loans. The market was further buoyed by financial innovations, particularly mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), which bundled home loans and sold them as financial products.

Peak: By mid-2006, house prices had skyrocketed, with some regions seeing a double or even triple increase in property values in just a few years. Lending standards were relaxed, and many homebuyers were approved for subprime mortgages—loans granted to individuals with poor credit histories.

Crash: The bubble began to burst in 2006 when housing prices started to fall, leading to a wave of foreclosures. As mortgage defaults rose, the value of MBS and CDOs plummeted, causing massive losses for financial institutions globally. By 2008, it spiraled into a full-blown financial crisis, with investment banks like Lehman Brothers declaring bankruptcy.

Recovery: The U.S. government responded with a series of measures, including the controversial bank bailouts, to stabilize the financial system. The aftermath led to the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, aiming to reduce risks in the U.S. financial system.

source: Prime Properties TO on YouTube

2. Canada’s Property Booms and Moderations:

Canada’s housing market has seen its own cycles of booms and moderations, though it has often been regarded as more resilient than its southern neighbor.

Booms: Major cities like Toronto and Vancouver have seen considerable price hikes in the 21st century, fueled by low-interest rates, population growth, and foreign investments. The growth of the condominium market in these cities is a testament to the demand for housing in urban centers.

Moderation & Challenges: Concerns about overheated markets led to regulatory interventions. Measures like the foreign buyers’ tax and stricter mortgage rules were implemented to cool down the market. However, as of the last update in 2021, debates continue about the effectiveness of these interventions and the future trajectory of Canada’s housing market.

source: Al Jazeera English on YouTube

3. Mexico’s Real Estate Growth and Challenges:

The real estate market in Mexico has its unique dynamics, influenced by factors like urbanization, tourism, and foreign investments.

Growth: Tourist destinations like Cancun and the Riviera Maya, as well as urban centers like Mexico City, have seen substantial real estate development. The country’s proximity to the U.S. has also made places like Baja California popular among American retirees and expatriates, driving up property values.

Challenges: Despite growth in certain areas, Mexico faces challenges like income inequality, which affects housing affordability for many of its citizens. Informal housing—homes built without proper permits or not meeting regulatory standards—is a persistent issue, reflecting the broader socio-economic challenges.

North America’s housing markets, while interconnected in the age of globalization, have their unique characteristics and challenges. Understanding these regional nuances is vital for both investors and policymakers as they navigate the complexities of the real estate sector.

Europe

Europe, with its diverse set of economies and housing markets, has witnessed significant housing bubbles and related financial crises. These events not only affected national economies but also had repercussions on the European Union as a whole, especially within the Eurozone.

source: Economics AltSimplified on YouTube

1. The Spanish Housing Bubble of the 2000s:

Spain’s housing bubble of the 2000s was one of the most pronounced property booms and busts in modern European history.

Inception & Growth: Spain’s entry into the Eurozone in 1999 made borrowing cheaper due to low interest rates set by the European Central Bank. This was compounded by a surge in foreign investments and a construction boom. From 1996 to 2007, property prices in Spain tripled. The construction sector became a significant driver of the economy, accounting for up to 12% of Spain’s GDP by 2007.

Peak: By the mid-2000s, Spain was constructing more houses than Germany, France, and the UK combined. Coastal areas and even previously less-developed regions saw a proliferation of housing projects.

Crash: The global financial crisis of 2008 was the turning point. With a contraction in global credit markets, Spain’s over-leveraged banks faced crises. Property prices plummeted, and many newly built properties remained vacant. By 2009, the unemployment rate soared, with many from the construction sector out of work.

Recovery: The Spanish government introduced austerity measures to stabilize the economy, leading to protests and significant socio-political challenges. By the mid-2010s, Spain’s economy began to show signs of recovery, but the scars of the bubble are still visible in the form of “ghost towns” – unfinished housing projects scattered around the country.

source: euronews on YouTube

2. Ireland’s Property Boom and Crash:

Ireland’s property boom and subsequent crash in the late 2000s is often compared to Spain’s, though there were unique Irish factors at play.

Inception & Growth: Beginning in the late 1990s and peaking around 2007, Ireland saw substantial property price increases. The Celtic Tiger, as Ireland’s economy was called during its years of rapid growth, was buoyed by low-interest rates, aggressive lending practices, and an influx of foreign capital.

Peak: Property development became one of the dominant sectors, with both residential and commercial properties seeing steep price rises. Dublin, in particular, became one of the most expensive cities in the world in terms of property prices.

Crash: The 2008 financial crisis revealed the vulnerabilities in the Irish economy. Property prices collapsed, with some properties losing up to 50% of their value. This led to a banking crisis, with several major Irish banks at risk of insolvency.

Recovery: The Irish government sought a bailout from the European Union and the International Monetary Fund in 2010. A series of austerity measures were implemented, and by the mid-2010s, the Irish economy began to recover. However, the crisis had profound socio-political implications, shaping debates and policies in Ireland for years to come.

source: PensionCraft on YouTube

3. The UK’s History of Property Booms:

The UK, especially London, has a storied history of property booms and busts.

Several Booms: The UK experienced property booms in the late 1970s, late 1980s, and most recently, from the early 2000s onwards. Factors like the financialization of the London economy, foreign investments (especially in the luxury property segment), and housing shortages have often driven prices up.

Busts: The UK housing market crash in the early 1990s saw a sharp drop in property values, leading to negative equity for many homeowners. Similarly, the 2008 financial crisis caused a brief but significant dip in UK property prices.

Current Trends: As of the last update in 2021, the UK’s property market, especially in London, remains one of the most expensive globally. There are concerns about affordability, the role of foreign investments in inflating property prices, and the potential implications of Brexit on the housing market.

While Europe’s housing markets are tied together through shared economic structures like the Eurozone, local factors—be it the allure of sun-soaked Spanish coasts or the global financial hub of London—play pivotal roles in shaping each country’s property boom and bust cycles.

Asia and Oceania

Asia and Oceania have seen some of the most dynamic growth patterns in the world over the past few decades. This growth has been accompanied by significant changes in housing markets, with some nations experiencing tremendous booms and inevitable corrections.

source: Money & Macro on YouTube

1. Japan’s Bubble Economy of the Late 1980s:

Japan’s bubble economy, which culminated at the close of the 1980s, remains one of the most illustrative examples of a housing and asset bubble in global economic history.

Inception & Growth: Starting from the mid-1980s, low-interest rates, overconfident economic policies, and a surge in corporate and consumer confidence led to excessive credit growth and asset price inflation. Real estate, along with stocks, witnessed astronomical price surges. Prime real estate in Tokyo’s Ginza district, at one point, was famously said to be worth more than the entire state of California.

Peak: By the late 1980s, the Nikkei stock index had reached an all-time high, and property prices in major cities like Tokyo were at unprecedented levels. Corporations and individuals alike believed in the invincibility of the Japanese economic model.

Crash: The bubble began deflating in the early 1990s. The Bank of Japan raised interest rates to curb excessive lending, leading to a contraction in credit availability. Real estate prices plummeted, and the stock market crashed.

Aftermath: Japan entered what’s often termed the “Lost Decade,” a period of economic stagnation that, in many respects, extended into the 2000s. The impacts of the bubble economy were profound, leading to prolonged deflation, banking crises, and policy challenges that Japan grapples with even today.

source: South China Morning Post on YouTube

2. China’s Rapid Urbanization and Property Market Concerns:

China’s meteoric rise as an economic powerhouse has brought with it significant urbanization and changes in its housing market.

Urbanization Boom: From the late 1990s onward, China witnessed one of the most rapid urban migrations in history. Cities expanded, and new ones sprang up, driven by government policies and the lure of better economic opportunities.

Property Market Dynamics: The Chinese government used infrastructure and real estate development as tools to drive economic growth. This led to a surge in property prices in cities like Beijing, Shanghai, and Shenzhen. By the 2010s, concerns of a property bubble began to surface, with reports of “ghost cities” – vast urban areas constructed but largely unoccupied.

Concerns & Interventions: Fears of a housing bubble have prompted the Chinese government to intermittently introduce measures to cool the property market, including restrictions on multiple home purchases, higher down payment requirements, and limits on property sales.

source: ABC News (Australia) on YouTube

3. Australia’s Property Price Surges:

Australia, especially its major cities like Sydney and Melbourne, has been no stranger to property booms.

Growth Factors: Multiple elements have contributed to Australia’s property price surge. These include a limited supply of housing in prime urban areas, population growth, foreign investment (particularly from Asia), and attractive tax incentives related to property investment.

Recent Trends: The early 21st century saw consistent growth in Australian property prices. By the 2010s, there were increasing concerns about housing affordability, especially for younger Australians.

Government Interventions: The Australian government has, at times, introduced measures to curb rapid price growth, such as limiting foreign property investments and introducing macroprudential regulations to limit risky lending practices.

External Factors: Events like the global financial crisis of 2008 did impact the Australian property market, but the effects were comparatively muted, with the market rebounding relatively quickly, driven in part by Australia’s strong ties to the booming Asian economies.

Asia and Oceania present a rich tapestry of housing market dynamics. From Japan’s cautionary tale of unchecked exuberance to China’s unparalleled urbanization and Australia’s struggles with affordability, the regions offer invaluable lessons on the complexities of housing bubbles in varied economic contexts.

South America

South America, characterized by its rich cultural history and diverse economies, has also seen its fair share of property market fluctuations. The continent’s economies, often influenced by factors like commodity prices, political instabilities, and foreign debts, have witnessed real estate markets that reflect these complexities.

source: TeleSUR English on YouTube

1. Brazil’s Real Estate Cycles:

Brazil, as the largest economy in South America, has experienced significant fluctuations in its real estate market, often mirroring broader economic and political trends in the country.

Boom Periods: In the 2000s, Brazil’s economy saw robust growth, fueled by high commodity prices, increasing domestic consumption, and foreign investments. This economic upswing also led to a surge in property prices, particularly in major cities like São Paulo and Rio de Janeiro. The lead-up to international events like the 2014 FIFA World Cup and 2016 Olympics further accelerated infrastructure and real estate development.

Factors Driving Demand: Brazil’s expanding middle class, urbanization trends, and credit availability were primary drivers of the real estate boom. Additionally, programs like “Minha Casa, Minha Vida” (My House, My Life) aimed at providing affordable housing options, further boosted construction activities.

Cooling Down & Challenges: The latter half of the 2010s saw Brazil grappling with economic and political challenges, including recessions and political scandals. These factors impacted the real estate sector, leading to reduced demand, stagnant or declining property prices, and increased inventories of unsold properties.

source: Al Jazeera English on YouTube

2. Argentina’s Property Market Dynamics:

Argentina’s property market has historically been influenced by its intricate economic situation, characterized by cycles of booms, busts, inflation, and currency controls.

The Dollar’s Influence: In Argentina, property transactions have often been denominated in U.S. dollars due to historical inflation and distrust in the local currency (Argentine peso). This has made the property market sensitive to fluctuations in the peso-dollar exchange rate and government currency controls.

Booms and Declines: The early 2000s, post the Argentine economic crisis, saw a boost in the property market, driven by increased foreign investments and relatively stable economic conditions. Buenos Aires, in particular, saw significant property development.

Challenges and Interventions: The latter half of the 2010s brought challenges. Economic instabilities, high inflation rates, and changing currency controls impacted the real estate sector. The government intermittently implemented measures, such as restrictions on the purchase of U.S. dollars, which indirectly affected the property market by limiting the ability of locals to engage in dollar-denominated property transactions.

The Resilience of the Market: Despite challenges, Argentina’s property market has shown resilience. Historically, real estate has been viewed by Argentinians as a safe-haven asset, especially during times of high inflation or economic uncertainty. This cultural predisposition has meant that, even in tough times, there’s a propensity for individuals to invest in tangible assets like property.

South America’s real estate markets offer a lens into the broader socio-economic and political landscapes of these nations. Brazil and Argentina, as leading economies in the region, exemplify the intertwining of national fortunes with real estate dynamics. From Brazil’s rapid urban growth and subsequent economic challenges to Argentina’s dance with inflation and currency controls, the property narratives of these countries are both cautionary and enlightening.

Africa

Africa, often dubbed the ‘last frontier’ of global economic growth, has a real estate narrative that is as diverse and complex as its 54 nations. With its vast array of cultures, economies, and histories, the continent presents unique property market dynamics influenced by factors ranging from urbanization and infrastructure development to political stability and foreign investments.

source: africanews on YouTube

1. South Africa’s Housing Market Ups and Downs:

As one of Africa’s most developed economies, South Africa offers insights into the challenges and opportunities of a transitioning property market in the continent.

Post-Apartheid Dynamics: The end of apartheid in the early 1990s heralded a new era for South Africa’s real estate sector. One of the primary challenges was addressing historical housing inequalities. The government embarked on massive low-income housing projects to accommodate historically disadvantaged communities.

Booms and Busts: The early 2000s saw a notable boom in South Africa’s property market, driven by economic growth, low-interest rates, and increased access to credit. By the late 2000s and into the 2010s, various factors such as electricity supply issues, political uncertainties, and later, water shortages, began to dampen the enthusiasm in the housing market.

Affordability and Inequality: Despite the growth, housing affordability remains a significant concern, especially in major cities like Cape Town and Johannesburg. Gated communities and luxury apartments juxtapose informal settlements, highlighting the nation’s socio-economic disparities.

2. The Urbanization Challenge and Property Markets in Key African Nations:

Urbanization is a defining trend in many African countries, leading to both challenges and opportunities in the property market.

Rapid Urban Growth: Cities like Lagos (Nigeria), Nairobi (Kenya), and Addis Ababa (Ethiopia) are experiencing some of the world’s highest urbanization rates. This rapid influx into cities has led to skyrocketing demand for both residential and commercial real estate.

Infrastructure and Housing Deficit: The rapid pace of urban growth often outstrips the ability of governments to provide essential infrastructure and housing. This has led to the proliferation of informal settlements or slums in many major cities.

Foreign Investment and Development: Recognizing the potential, foreign investors, especially from China, have heavily invested in real estate across the continent. From massive malls in Kenya to sprawling mixed-use developments in Nigeria, these investments are shaping the urban landscapes of many African nations.

Emerging Middle Class: An emerging middle class in countries like Ghana, Nigeria, and Kenya seeks modern housing and amenities, driving demand for new residential developments, gated communities, and luxury apartments.

Economic Reliance on Commodities: The property markets in nations reliant on commodities, such as oil in Nigeria or minerals in Zambia, often mirror the boom and bust cycles of these commodities. Economic downturns resulting from plummeting commodity prices can lead to stagnation or decline in property values.

Africa’s real estate narratives are both promising and challenging. The potential presented by rapid urbanization and a growing middle class is immense, but issues of infrastructure deficits, socio-economic inequalities, and political instabilities can pose significant hurdles. As with many aspects of the African story, the property market is one of contrasts and dynamism, reflective of a continent in flux.

The Socio-Economic Impact of Housing Bubbles

The ripple effects of housing bubbles permeate through individual lives, communities, and national economies. Their aftermath can be felt for years, if not decades, after the initial burst. This section delves into the profound socio-economic impacts that housing bubbles can manifest.

1. Effects on Homeowners:

Wealth Effects: At the height of a housing bubble, many homeowners perceive an increase in their net worth due to the inflated value of their properties. This perceived wealth can lead to increased consumer spending as homeowners feel richer and may take out equity loans against the increased value of their homes. However, when the bubble bursts, this wealth evaporates, often leaving homeowners with properties that are worth less than what they owe on their mortgages.

Foreclosure Crises: As property values drop post-bubble, many homeowners find themselves “underwater” on their mortgages, leading to increased rates of default. The U.S. housing bubble of the 2000s is a prime example, where massive numbers of foreclosures led to personal financial catastrophes, displaced families, and communities riddled with vacant homes.

Mental and Physical Health: The stress of losing one’s home or facing insurmountable debt can have significant health implications. Studies have shown increased rates of depression, anxiety, and even physical ailments among those hardest hit by housing market crashes.

2. Impacts on the Broader Economy:

Banking Crises: When homeowners default on their mortgages en masse, it can lead to significant financial strain on lending institutions. Banks may face liquidity crises, and in some severe cases, insolvency. The domino effect can lead to widespread banking crises, requiring massive government interventions, as was the case in the U.S. in 2008.

Unemployment: The real estate sector, during a boom, often becomes a significant source of employment. From construction workers to real estate agents to financiers, many jobs become intrinsically linked to the health of the property market. When a bubble bursts, job losses in these sectors can be swift and devastating. The ripple effect can spread to other sectors as well, leading to broader economic recessions.

Reduced Consumer Spending: As property values plummet and individual wealth shrinks, consumer confidence often takes a hit. Households may cut back on spending, leading to reduced revenues for businesses, further layoffs, and a vicious cycle of economic contraction.

3. Long-term Consequences:

Stagnation: Some economies, after facing a housing bubble burst, enter prolonged periods of stagnation. Japan after the late 1980s bubble is a telling example, where the economy faced years of deflation and tepid growth, termed the “Lost Decade” – which, in reality, extended even longer.

Changes in Financial Regulations: In the aftermath of housing market crashes, there’s often a call for tighter financial regulations to prevent future bubbles. This can lead to stricter lending practices, increased oversight of financial institutions, and reforms aimed at improving transparency and accountability. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in the U.S. after the 2008 crisis, is a notable example of such regulatory changes.

Shifts in Societal Attitudes: After experiencing the trauma of a housing bubble burst, societal attitudes towards homeownership, debt, and investment can shift. There may be increased skepticism towards the idea of homes as infallible investments, and a cultural shift towards more conservative financial practices.

In wrapping up, the socio-economic ramifications of housing bubbles are profound. Beyond the headline-grabbing statistics of falling property prices and financial meltdowns lie the deeply personal stories of individuals and families whose lives are upended. The lessons from these bubbles are cautionary tales for policymakers, financial institutions, and individuals alike, underscoring the importance of sustainable and responsible economic practices.

Lessons Learned and Strategies for the Future

The fallout from housing bubbles provides a wealth of knowledge, highlighting both the pitfalls to avoid and the strategies to embrace for a more stable economic future. By understanding these lessons, societies can hope to prevent similar financial disasters and pave the way for a more resilient housing market.

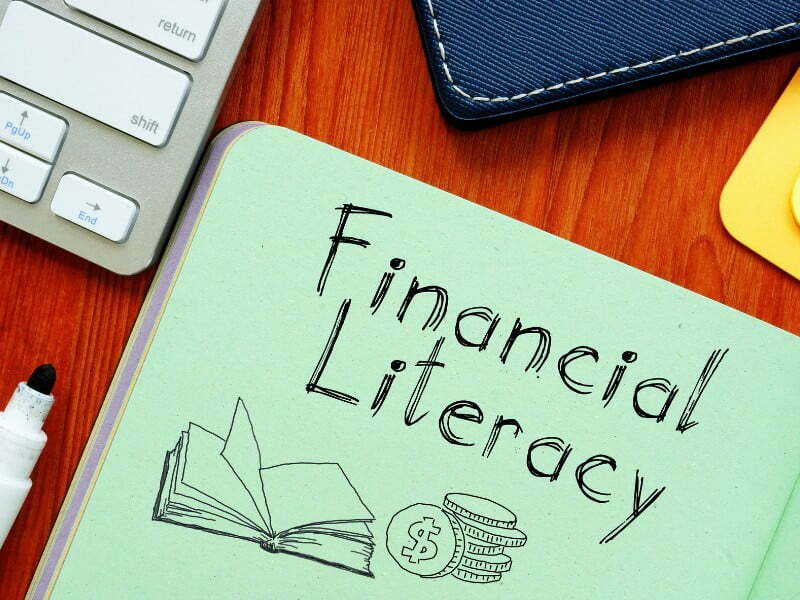

1. The Importance of Financial Literacy and Responsible Lending:

Empowered Decision-Making: One of the most significant takeaways from past housing bubbles is the need for robust financial literacy. When individuals understand the nuances of mortgages, interest rates, and the implications of their financial decisions, they are better equipped to make choices that are in their long-term interest. By promoting financial education at the grassroots level – in schools, community centers, and through media campaigns – societies can nurture a more informed populace that can navigate the complexities of the housing market.

Lending Practices: Financial institutions play a pivotal role in the health of the housing market. Responsible lending practices, which emphasize thorough background checks, proper documentation, and fair interest rates, are critical. By eschewing short-term gains for long-term stability, banks can ensure that they are not setting up borrowers – and by extension, the broader economy – for failure.

Regulatory Oversight: Governments and regulatory bodies must be vigilant in their oversight of lending institutions. By setting clear guidelines, conducting periodic reviews, and penalizing predatory lending practices, they can maintain the integrity of the housing finance ecosystem.

2. The Role of Diversified Investment Portfolios:

Beyond Real Estate: While real estate is a valuable asset class, the dangers of over-relying on it became painfully clear during housing bubbles. For individual investors, diversifying investments across various asset classes – stocks, bonds, commodities, and more – can mitigate risks and provide a cushion during downturns in any particular sector.

Financial Advisors and Education: Engaging with financial advisors can help individuals and institutions chart out balanced investment strategies. Continuous education about the benefits and risks of different investment avenues can further guide decisions.

3. Urban Planning and Sustainable Housing Development:

Holistic Urban Planning: The rapid urbanization witnessed in many parts of the world needs to be met with thoughtful and sustainable urban planning. Cities must be designed with an emphasis on infrastructure, green spaces, public transport, and community facilities. A well-planned city can accommodate growth without leading to speculative property bubbles.

Affordable Housing Initiatives: Governments and private developers must prioritize affordable housing. By ensuring that a broad spectrum of the populace has access to reasonably priced homes, societies can mitigate some of the demand pressures that contribute to inflated property prices.

Embracing Technology: The use of modern construction technologies can reduce costs, improve building efficiency, and speed up housing development. Prefabricated units, 3D printed homes, and green building practices can revolutionize how housing is approached in the future.

Community Engagement: Engaging with communities during urban planning and development processes ensures that the needs and aspirations of residents are factored into decision-making. This participatory approach can lead to more harmonious and sustainable urban growth.

The scars left by housing bubbles serve as stark reminders of the perils of unchecked speculation, lack of financial knowledge, and systemic vulnerabilities. However, by internalizing these lessons and adopting forward-thinking strategies, societies can hope to foster a housing market that is both robust and equitable. The future of housing lies in the synergy of informed individuals, responsible institutions, and visionary urban planning – a confluence that promises stability and growth.

Current Trends and Future Predictions

The global landscape of housing is in the throes of a transformative phase. Influenced by technological advancements, socio-cultural shifts, and most recently, the repercussions of the COVID-19 pandemic, housing markets worldwide are experiencing unprecedented changes. Delving into these trends provides a glimpse into the possible trajectories that housing may take in the coming decade.

1. The Post-COVID Era: The Rise of Remote Work and its Impact on Urban Property Markets:

Decentralization of Workspaces: The COVID-19 pandemic forced businesses worldwide to adapt to remote working models. As many organizations found that their operations remained efficient (or even improved) with remote work, it’s likely that this model will persist for many, even post-pandemic. This shift is decentralizing the need for employees to live near their places of work.

Migration to Suburbs and Smaller Cities: As a direct result of the remote work trend, there’s been a notable migration from densely populated urban centers to suburbs and smaller cities. People are valuing space, affordability, and quality of life over proximity to a physical office. This is leading to a softening of demand in traditionally expensive urban property markets while boosting interest in previously overlooked regions.

Reimagining Urban Spaces: With reduced pressure on housing in urban centers, cities have an opportunity to reimagine and repurpose spaces. Commercial buildings can be converted to residential units, green spaces, or community centers, thereby changing the urban fabric for the better.

2. The Growing Importance of Green and Sustainable Housing:

Environmental Imperatives: The threats posed by climate change have brought environmental considerations to the forefront. This is evident in the housing market as both consumers and developers prioritize eco-friendly housing solutions.

Green Building Practices: Techniques like passive solar design, rainwater harvesting, green roofs, and the use of sustainable construction materials are becoming standard in new constructions. Energy-efficient appliances, smart home systems, and waste management solutions are also gaining prominence.

Regulatory Incentives: Governments around the world are providing incentives for green housing initiatives. This includes tax breaks, grants, and premium FSI (Floor Space Index) for sustainable constructions.

3. Predictions for the Next Decade:

The Rise of Digital Real Estate Transactions: As technology continues to advance, expect more real estate transactions to move online. Virtual property tours, AI-driven property recommendations, and blockchain-based property registries could become the norm.

Flexible Housing Models: The lines between residential, commercial, and recreational spaces may blur. Homes could be designed to be more versatile, allowing residents to seamlessly switch between work, leisure, and rest.

Community-Centric Developments: As people increasingly value a sense of community, housing developments that offer communal spaces, shared amenities, and community-building initiatives might see a surge in demand.

Shift in Investment Priorities: Given the fluctuations and unpredictabilities in housing markets, investors might lean more towards real estate investment trusts (REITs) or other diversified real estate investment models rather than direct property ownership.

Urban Regeneration: Instead of constantly expanding city boundaries, there might be a trend towards regenerating and rejuvenating existing urban spaces, making them more livable, sustainable, and community-friendly.

In synthesizing the above, it becomes evident that the future of housing is not just about brick and mortar; it’s intertwined with technological, environmental, and socio-cultural evolutions. The lessons from the past, the challenges of the present, and the aspirations for the future will together shape a new era of housing – one that promises to be more inclusive, sustainable, and attuned to the needs of its inhabitants.

The Complete History of Housing Bubbles Around the World: 12-Question FAQ

1) What is a housing bubble?

A housing bubble is a period of sharp, unsustainable property price increases fueled by speculation, easy credit, and exuberant market behavior rather than fundamentals like wage growth or genuine demand. Like an overinflated balloon, these markets expand rapidly until external factors trigger a sudden collapse.

2) Why do housing bubbles matter for the global economy?

Because real estate is deeply interconnected with banking, investment, and consumer spending, housing bubbles can destabilize entire economies. When bubbles burst, banks face defaults, homeowners lose equity, spending contracts, and recessions can follow, as seen in 2008.

3) What are the typical stages of a housing bubble?

They follow a recognizable pattern:

Inception (early demand and optimism)

Growth (media hype, investment frenzy)

Peak (prices soar far above fundamentals)

Crash (trigger causes mass sell-offs and defaults)

Recovery (stabilization and policy reforms)

4) What key factors contribute to housing bubbles forming?

Typical contributors include low interest rates, speculative buying, lax lending practices, herd behavior, government incentives that stoke demand, and global capital inflows into “hot” real estate markets.

5) How far back in history do housing bubbles go?

Speculative land and property frenzies trace back to Ancient Rome, but more structured bubbles emerged during Tulip Mania in 17th-century Netherlands, Spain’s building boom in the 1500s–1600s, and the urban surges of the Industrial Revolution.

6) How did modern housing markets intensify these cycles?

Urbanization, industrialization, and the rise of mortgage finance systems in the 19th–20th centuries created fertile ground for repeated speculative cycles, from Paris’ Haussmann renovation to the U.S. land booms of the 1800s and the 1920s Florida real estate frenzy.

7) What are some notable housing bubbles in North America?

U.S. 2000s: Low rates, subprime lending, securitization → 2008 Global Financial Crisis

Canada 21st century: Booms in Toronto/Vancouver from low rates, foreign capital, and urban demand; moderated through policy measures

Mexico: Growth in resort and urban markets, tempered by inequality and informality.

8) How have European housing bubbles unfolded?

Spain (1996–2008): Eurozone cheap credit fueled massive overbuilding; crash led to ghost towns.

Ireland (1990s–2008): Celtic Tiger boom collapsed into banking crisis.

UK: Repeated booms in London’s globalized market; major busts in the 1990s and during 2008.

9) What about Asia and Oceania?

Japan (1980s): Legendary asset bubble burst led to the “Lost Decade.”

China (1990s–2010s): Rapid urbanization created ghost cities and price surges; government intervenes periodically.

Australia: Sydney and Melbourne faced affordability crises due to population growth and foreign investment.

10) How have housing bubbles affected South America and Africa?

Brazil: 2000s boom tied to commodities and global events, later cooled by recession.

Argentina: Dollarized property markets affected by inflation and currency controls.

Africa: Rapid urbanization and foreign investment drive demand, but infrastructure gaps and political instability shape cycles.

11) What socio-economic impacts follow housing bubbles?

They include foreclosure waves, banking crises, unemployment in construction and finance, reduced consumer spending, regulatory overhauls, and shifts in cultural attitudes toward homeownership and debt.

12) What lessons can we learn for the future?

Key strategies include financial literacy, responsible lending, diversified investments, sustainable urban planning, green building practices, and proactive policy-making to temper speculative excesses and stabilize markets.

Conclusion

The world of housing, with its complex tapestry of socio-economic, political, and cultural factors, has proven time and again its cyclical nature. From spectacular booms to heart-wrenching busts, housing markets have traced arcs that bear witness to human aspirations, follies, and resilience. Reflecting on this journey provides a profound understanding of not just real estate but the broader contours of human society.

1. The Cyclical Nature of Housing Markets:

Inevitable Ebbs and Flows: No market, regardless of its nature, remains static. Like all economic systems, housing markets are subject to the immutable laws of supply and demand, sentiment and speculation. History is replete with examples of soaring property prices followed by inevitable corrections. These cycles, while shaped by myriad factors – from interest rates to urbanization trends – underline the inherent volatility of housing markets.

Learning from Patterns: These cycles, although varied in their intensity and duration, offer patterns. Recognizing these patterns is invaluable. They provide investors, policymakers, and the general public insights into when a market might be overheating or when it’s poised for a rebound.

2. The Intertwined Relationship Between Global Economies and Housing Markets:

A Global Domino Effect: In an increasingly interconnected world, no housing market operates in isolation. A financial crisis in one part of the world can ripple across oceans, impacting property prices in distant lands. The U.S. subprime mortgage crisis of 2008, which snowballed into a global financial meltdown, is a testament to this deep-seated interconnectivity.

Beyond Borders: Similarly, global economic trends, like shifts in commodity prices, changes in global interest rates, or international investment flows, can sway housing markets in countries far removed from where these events originate. This global perspective is crucial for stakeholders, reminding them that vigilance must extend beyond local or national horizons.

3. The Need for Vigilance, Education, and Prudent Policy-making:

Eternal Vigilance: Given the stakes involved – both in terms of personal wealth and broader economic health – vigilance is paramount. Regulators, financial institutions, and individuals must perpetually be on the lookout for signs of irrational exuberance or undue pessimism.

The Power of Education: Financial literacy, especially concerning real estate, is a powerful tool. An informed populace is less likely to fall prey to speculative frenzies or make decisions based on incomplete or misleading information. Education arms individuals with the knowledge to navigate the complexities of the housing market with confidence and caution.

Policy-making for Stability: Governments and regulatory bodies bear the weighty responsibility of ensuring market stability. Through prudent policy-making – be it interest rate adjustments, lending criteria modifications, or housing development initiatives – they can mitigate the extremes of housing market cycles. Their role is not just reactive but also proactive: anticipating challenges and crafting strategies to address them before they escalate.

The realm of housing is more than a mere reflection of bricks, mortar, and monetary transactions. It is a mirror to societal values, aspirations, and collective psyche. The tales of housing bubbles, while cautionary, also offer hope. They underscore humanity’s ability to learn, adapt, and evolve. As the world stands on the cusp of new beginnings – shaped by technological advancements, environmental imperatives, and shifts in work and living dynamics – the lessons from the past serve as guiding beacons. With vigilance, education, and astute policy-making, the future of housing can be as much about stability and sustainability as it is about dreams and aspirations.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

i really enjoyed reading this article