When I survey the landscape of capital efficient ETFs I’m hard-pressed to find a fund provider that has made a bigger impact in recent months than the Return Stacking crew.

In 2023, they launched three unique products which all adhere to a formula of $1 invested gives you exposure to 100% A plus 100% B.

RSBT ETF = 100% Bonds + 100% Managed Futures (Trend)

RSST ETF = 100% US Equities + 100% Managed (Trend)

RSSB ETF = 100% Global Equities + 100% Bonds (US Treasury Futures)

For a while it appeared that their Global Stocks and Bonds ETF was going to be a 90/60 fund, but I was thrilled on a personal level (and I think it was also a great decision on their part) that it distinguished itself from another capital efficient trio of 90/60 equity plus bonds products from WisdomTree.

NTSX ETF = 90% US Equities / 60% Bonds

NTSI ETF = 90% Int-Dev Equities / 60% Bonds

NTSE ETF = 90% Emerging Equities / 60% Bonds

So what is different and unique about RSSB ETF?

- Global Equities

- More Capital Efficient

- Better Bang For Your Capital Efficient Buck

It’s crucial to zoom in specifically on point number 3.

If maximum capital efficiency is your primary goal to create space in your portfolio for other asset classes and strategies (it sure is for me) you’d need to commit 67% of your resources with NTS(X,I,E) to accomplish the mandate of a 60/40 portfolio.

In other words, 67% of NTS(X,I,E) = 60/40 portfolio exposure.

You’ve got 33% resources leftover for something else.

Don’t get me wrong, that’s not too shabby at all!

However, look at what we can potentially do with 67% of our resources allocated to the following:

40% RSSB – 100% Equities / 100% Bonds

20% RSST – 100% Equities / 100% Managed Futures (Trend)

7% GDE – 90% Equities / 90% Gold Futures

We’re considerably more capital efficient with this trio:

66.3% Equities

40% Bonds

20% Managed Futures (Trend)

6.3 % Gold

Not only do we have a 60/40 (plus 6.3% additional equities) but we’ve also started to carve out space for an alternative sleeve with both managed futures and gold.

With that 67% space we’ve built ourselves a balanced portfolio (60/40) and we’ve efficiently added two uncorrelated alternatives to the mix.

You’ve gotta like that!

In many regards it reminds me of the movie scene where Captain Richard Phillips is taken hostage by Somali Pirates:

RSSB to NTS(X,I,E): “Look at me. Look at me. I’m the Captain now!”

source: Movieclips on YouTube

Indeed, if you’re seeking maximum capital efficiency as an investor there is a new captain aboard the equities plus bonds vessel.

Its name is Return Stacked Global Stocks & Bonds ETF.

AKA RSSB ETF.

Review of RSSB ETF : Reviewing Return Stacked Global Stocks & Bonds ETF

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

RSSB ETF Overview, Holdings and Info

The investment case for “Return Stacked Global Stocks and Bonds” has been laid out succinctly by the folks over at Return Stacked ETFs: (source: fund landing page)

Investment Case

“Capital Efficiency and Diversification. Replacing core stock and bond exposure with RSSB frees up capital to invest in diversifying asset classes and strategies.

Reduce Cash Drag. Utilize the embedded capital efficiency in RSSB to hold cash without necessarily losing core stock and bond exposure.

Avoiding 100% Equities for Growth Clients. Reduce equity concentration for growth clients by introducing a second, potentially diversifying source of returns.

*Diversification does not assure a profit.*”

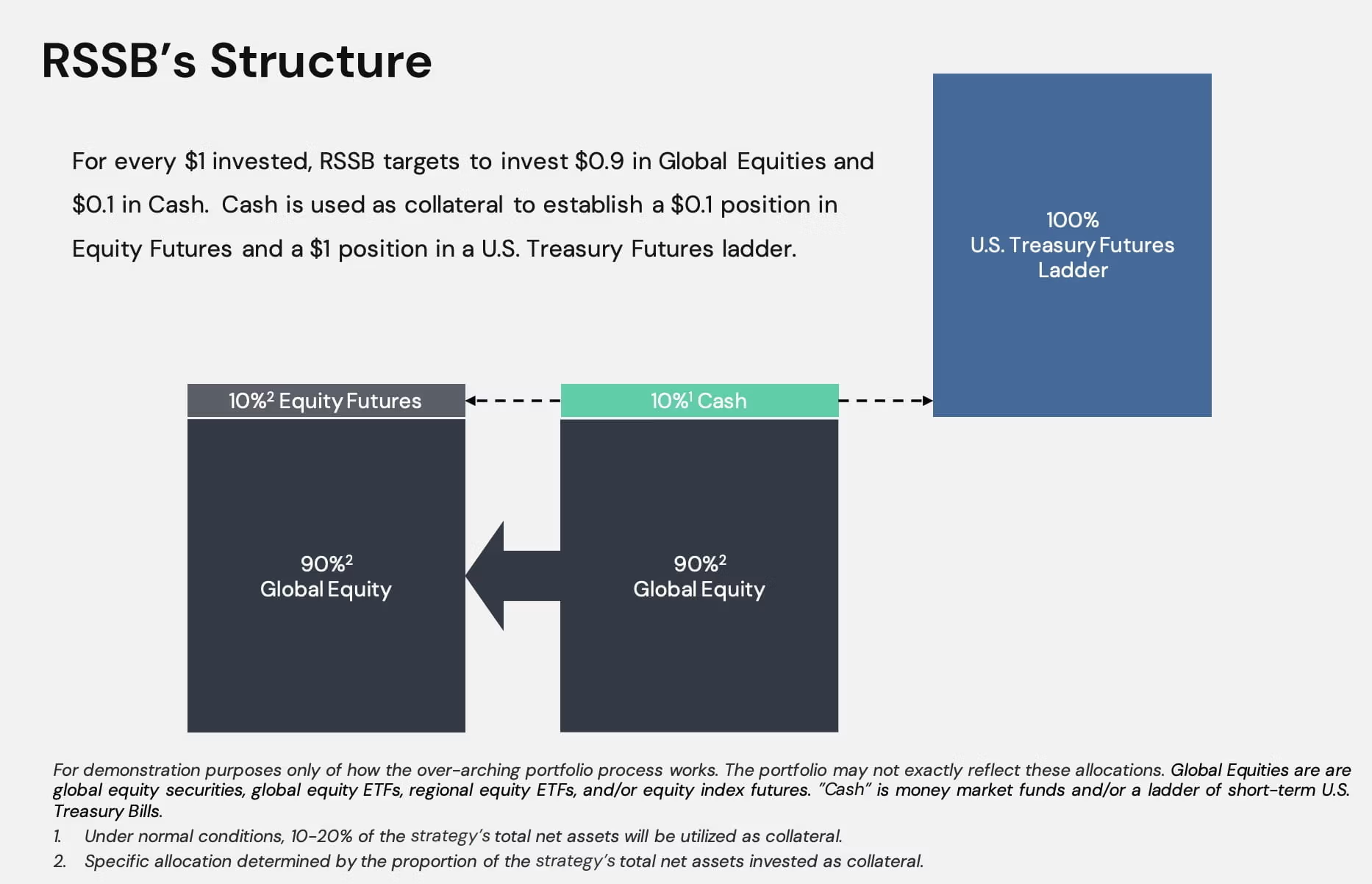

Fund Overview

“The Fund seeks long-term capital appreciation by investing in two complimentary investment strategies: a Global Equity strategy and a U.S. Treasury Futures strategy. For every $1 invested, the Fund attempts to provide $1 of exposure to its Global Equity strategy and $1 of exposure to its U.S. Treasury Futures strategy.

The Global Equity strategy seeks to capture the total return of global equities on a market capitalization-weighted basis, investing in global equities, global equity ETFs, regional equity ETFs, or equity index futures.

The U.S. Treasury Futures strategy seeks to provide exposure to the U.S. Treasury bond market by investing in U.S. Treasury futures contracts with maturities ranging from 2 to 30 years.”

RSSB ETF: Fund Selection Process

To better understand the process of how the fund operates, let’s turn our attention towards the summary prospectus where I’ve highlighted the key points at the very bottom. (source: summary prospectus)

Principal Investment Strategies:

Principal Investment Strategies

“The Fund is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing primarily in large-capitalization global equity securities, global equity ETFs (or a combination of other ETFs that together provide global equity market exposure), and futures contracts that provide the Fund with exposure to the performance of the U.S. Treasury bond market.

In addition, the Fund will hold U.S. Treasury bills and other high-quality securities as collateral for the futures contracts as well as to generate income. The Fund uses leverage to “stack” the total return of holdings in the Fund’s global equity strategy together with the potential returns of the Fund’s U.S. treasury futures contract strategy.

Essentially, for each dollar invested in the Fund, it provides about 90 cents of exposure to the Fund’s global equity investments and about 60 cents of exposure to investments in the Fund’s U.S. Treasury futures strategy. So, the return of the Fund’s U.S. Treasury futures strategy is stacked on top of the returns of the Fund’s global equity strategy. 12 Under normal circumstances, the Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, in (a) global equity securities and ETFs that, in the aggregate, provide exposure to the global equity markets, and (b) U.S. Treasury future contracts that provide the Fund with indirect exposure to the performance of the U.S. treasury bond market.

The Fund’s “80%” policy is nonfundamental and can be changed without shareholder approval. However, Fund shareholders would be given at least 60 days’ notice prior to any such change.”

Global Equity Exposure:

“The Fund may invest in the equity securities of companies located throughout the world (e.g., in the United States, other developed markets (e.g., Europe), and emerging markets). Under normal conditions, the Fund will invest at least 40% of its assets (unless market conditions are not deemed favorable, in which case the Fund would invest at least 30% of its assets) in companies in multiple countries outside of the Unites States (i.e., non-U.S. companies).

In determining whether a company is a U.S. or non-U.S. company, the Fund’s sub-adviser, Newfound Research, LLC (the “Sub-Adviser”) primarily considers the location of the principal trading market for the company’s common stock, and may also consider other metrics, such the location of the company’s corporate or operational headquarters or principal place of business.

The Sub-Adviser will seek to construct the Fund’s global equity portfolio to reflect the overall global equity markets on a market capitalization weighted basis. To do so, the Fund will invest in global equity ETFs, which are ETFs that invest primarily in the equity securities of companies located throughout the world, or other broad-based ETFs that provide exposure to the global equity market. For example, rather than hold a global equity ETF, the Fund may hold multiple ETFs that, together, provide similar exposure (e.g., a combination of U.S. equity ETFs, international equity ETFs, and emerging markets ETFs).

The Fund’s investment in global equity ETFs (or a combination of ETFs providing global equity market exposure) will generally comprise between 80% and 90% of the Fund’s portfolio. In addition, the Fund may invest in foreign equity securities directly.”

U.S. Treasury Futures Exposure:

“To provide the Fund with exposure to performance of the U.S. Treasury bond market, the Fund will invest in U.S. Treasury future contracts, which are contracts for the purchase and sale of U.S. government notes or bonds for future delivery. The Fund will invest in futures contracts on U.S. Treasuries with maturities ranging from 2 to 30 years, with a target duration of 2 to 8 years.

Under normal circumstances, the Fund’s aggregate U.S. Treasury futures contracts position will represent a “notional exposure” (i.e., the total underlying amount of exposure created by a derivatives trade) of approximately 60% of the Fund’s net assets. Note: Notional value is the total underlying amount of a derivatives trade. Leverage allows an investor (like the Fund) to use a small amount of money to theoretically control a much larger amount. So, notional value reflects the total value of a trade, not the cost (or market value) of taking the trade. Futures contracts have a limited lifespan before they expire (e.g., quarterly).

The Fund will frequently “roll-over” futures contracts – replace an expiring contract with a contract that expires further in the future. As a result, the Fund’s portfolio will be subject to a high portfolio turnover rate.”

________________________________________________________________________________________________

“This supplement provides technical clarifications to the principal investment strategy description of the Return Stacked® Global Stocks & Bonds ETF (the “Fund”).

In particular, the description is being revised to clarify the Fund’s ability to invest in individual equity securities and equity index futures contracts, and to reflect the Fund’s target exposure to the Fund’s global equity investments and the Fund’s U.S. Treasury futures strategy.

The last two sentences of the first paragraph under “Principal Investment Strategies” in the “Fund Summary” section are amended and restated to read as follows: Essentially, one dollar invested in the Fund provides approximately one dollar of exposure to the Fund’s global equity investments and approximately one dollar of exposure to the Fund’s U.S. Treasury futures strategy.

So, the return of the U.S. Treasury futures strategy (minus the cost of financing) is essentially stacked on top of the returns of the global equity strategy. The second paragraph under the sub-heading “Global Equity Exposure” is deleted and replaced with the following:

The Sub-Adviser will seek to construct the Fund’s global equity portfolio to reflect the overall global equity markets on a market capitalization weighted basis.

To do so, the Fund will invest in global equity ETFs (which are ETFs that invest primarily in the equity securities of companies located throughout the world), other broad-based ETFs that provide exposure to the global equity market, individual equity securities, and equity index futures contracts.

For example, rather than hold a global equity ETF, the Fund may:

● Hold multiple ETFs that, together, provide similar exposure (e.g., a combination of U.S. equity ETFs, international equity ETFs, and emerging markets ETFs);

● Hold individual securities that, together, provide similar exposure (e.g., through a basket of securities representing the underlying holdings of a global equity ETF);

● Hold equity index futures contracts that, together, provide similar exposure; or

● Employ a combination of the above holdings, so the aggregated investment provides similar exposure.

The Fund’s investment in global equity ETFs (or a combination of ETFs, individual securities providing global equity market exposure) will generally comprise between 75% and 80% of the Fund’s portfolio.

The remaining exposure to global equities will generally be achieved through equity index futures. The equity index futures may be linked to leading indices from developed, emerging, and global markets.

The last sentence of the first paragraph under the sub-heading “U.S. Treasury Futures Exposure” is amended and restated to read as follows: Under normal circumstances, the Fund’s aggregate U.S. Treasury futures contracts position will represent a “notional exposure” (i.e., the total underlying amount of exposure created by a derivatives trade) of approximately 100% of the Fund’s net assets.

The paragraph under the sub-heading “Collateral – U.S. Treasury Futures” is amended and restated to read as follows:

The Fund expects to invest approximately 0% to 25% of its net assets in U.S. Treasury bills, money market funds, cash, and cash equivalents (e.g., high quality commercial paper and similar instruments that are rated investment grade or, if unrated, of comparable quality, as the Adviser or Sub-Adviser determines), that provide liquidity, serve as margin or collateralize the Fund’s investments in futures contracts.”

Return Stacked Globals Stocks and Bonds Key Points

- Active Management Strategy: The Fund operates as an actively-managed exchange-traded fund (ETF) focusing on achieving its investment objective through strategic investments.

- Primary Investment Focus: It primarily invests in large-capitalization global equity securities, global equity ETFs, or combinations of ETFs that offer global equity market exposure, and futures contracts related to the U.S. Treasury bond market.

- Use of Leverage: The Fund employs leverage to enhance the total return of its holdings, combining the returns from its global equity strategy with the potential returns from its U.S. Treasury futures strategy. Specifically, for each dollar invested, approximately 90 cents are exposed to global equities and 60 cents to U.S. Treasury futures. *(Now 100 cents global equities and 100 cents US. Treasury Futures)*

- Investment Allocation Policy: At least 80% of the Fund’s net assets, plus any borrowings for investment purposes, are allocated towards global equity securities, ETFs providing global equity market exposure, and U.S. Treasury future contracts.

- Nonfundamental 80% Policy: This policy is nonfundamental and can be changed without shareholder approval, albeit with a 60-day notice to shareholders before any changes.

- Global Equity Investment Approach:

- The Fund invests globally, including in the U.S., other developed markets, and emerging markets.

- At least 40% of its assets are invested in non-U.S. companies under normal conditions, which can be reduced to 30% if market conditions are deemed unfavorable.

- Investments may include direct equity securities, global equity ETFs, or a mix of ETFs that collectively mimic global equity exposure.

- U.S. Treasury Futures Strategy:

- Investments in U.S. Treasury future contracts aim to provide exposure to the U.S. Treasury bond market, with a focus on futures with maturities ranging from 2 to 30 years and a target duration of 2 to 8 years.

- The notional exposure of U.S. Treasury futures contracts is about 60% of the Fund’s net assets, reflecting leverage use.

- High Portfolio Turnover: Due to frequent rollovers of futures contracts, the Fund is likely to experience a high portfolio turnover rate.

- Collateral and Income Generation: The Fund holds U.S. Treasury bills and high-quality securities as collateral for futures contracts and to generate income.

- Technical Clarifications and Adjustments:

- The Fund has clarified its strategy to include investments in individual equity securities and equity index futures contracts, adjusting its exposure targets for global equity investments and U.S. Treasury futures strategy.

- It now provides approximately equal exposure to both its global equity investments and U.S. Treasury futures strategy, aiming for a 1:1 dollar exposure ratio.

- The global equity portfolio is designed to mirror the global equity markets on a market capitalization weighted basis, involving a mix of global equity ETFs, individual securities, and equity index futures.

- Portfolio Composition Changes:

- The investment in global equity ETFs or a combination providing global equity market exposure will comprise between 75% and 80% of the Fund’s portfolio.

- The remaining exposure to global equities will be achieved through equity index futures linked to major indices across developed, emerging, and global markets.

- U.S. Treasury Futures Exposure Adjustment: The notional exposure of U.S. Treasury futures contracts has been adjusted to approximately 100% of the Fund’s net assets.

- Collateral for U.S. Treasury Futures: The Fund plans to invest between 0% and 25% of its net assets in U.S. Treasury bills, money market funds, cash, and cash equivalents for liquidity, serving as margin, or collateralizing its futures contracts investments.

RSSB ETF Info

Ticker: RSSB

Canvas Size: 200% Total = (100% Global Stocks + 100% Bonds)

Net Expense Ratio: 0.41

AUM: 70.54

Inception: 12/04/2023

RSSB ETF Strategy Pros and Cons

Let’s move on to examine the potential pros and cons of RSSB ETF.

RSSB Pros: Distinct Advantages

- Features a unique combination of 100% US Equities and 100% Treasury Futures, offering investors a distinctive capital-efficient tool.

- The first of its kind capital-efficient 100% global equities + 100% Treasury Futures ETF with 100/100 exposure of both asset classes

- Flexibility to pair this with other capital efficient building blocks (e.g., managed futures, gold, m/n, style premia, otm put, etc).

- Option to pair with other capital efficient funds to create a 60/40 portfolio + alternatives

- Compatibility with various other capital-efficient ETFs and Mutual Funds to craft a personalized return stacking design.

- More capital efficient exposure to stocks and bonds 100/100 compared to 90/60 NTS(X,I,E) WisdomTree suite

- No home country bias with this product as it is Global Equities as opposed to US only

- Creates room in your portfolio for alternative diversified diversifiers like global systematic macro, gold, market-neutral strategies, long-short equity, style premia, catastrophe bonds, arbitrage, bitcoin, etc.

- Competitive management fee for a fund offering 200% expanded canvas coverage

RSSB Cons: Potential Limitations

- For investors seeking very specific exposures to US, Int-Dev and EM equities and less leverage the NTS(X,I,E) suite might be a better fit

- Likely best suited for tax advantaged accounts due to potential gains/losses with futures contracts

RSSB ETF Model Portfolio Ideas

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

RRSB ETF is a powerful puzzle piece that allows investors to build the capital efficient portfolio of their dreams.

Let’s explore a few different options.

Return Stacking Maximum Diversification 3 Fund Portfolio

Model Portfolio:

40% RSSB

20% QLEIX

40% QDSIX

Exposures:

40% Global Equities

20% L/S Global Equities

40% Bonds (U.S. Treasuries)

40% Diversified Alternatives (6 distinct strategies including style premia, m/n equities, macro, managed futures, etc)

Expanded Canvas: 140%

That’s it.

You’re done.

With just three funds you’ve built an exceptionally well diversified portfolio.

Return Stacking Tactical Portfolio

If you’re keen to create a portfolio with an offensive and defensive mode let’s explore how you can do just that.

Model Portfolio:

40% RSSB

20% RSST

20% HCMT

10% CAOS

10% BTAL

Exposures:

Offensive Mode

100% Equities

40% Bonds (US Treasuries)

20% Managed Futures

10% OTM PUT

10% M/N Anti-Beta

Defensive Mode

60% Equities

40% Bonds (US Treasuries)

20% Managed Futures

20% Cash

10% OTM Put

10% M/N Anti-Beta

Expanded Canvas: 180% in offensive mode and 160% in defensive mode

Return Stacking 10+ Strategies Under One Hood Portfolio

For investors seeking a maximally diversified portfolio (10 strategies / 9 funds) with a desire to keep things within the ETF universe the following may be of interest:

Model Portfolio:

20% RSSB ETF

20% RSBT ETF

20% GDE ETF

20% QIS ETF

4% BTAL ETF

4% CAOS ETF

4% SVOL ETF

4% FBTC ETF

4% LBAY ETF

Exposures:

58% Equities

40% Bonds (US Treasuries)

20% Managed Futures Trend

18% Gold

10% QIS Multi-Strategy Alt

4% M/N Anti-Beta

4% OTM Put

4% Short Vol

4% Bitcoin

4% L/S Equity

Expanded Canvas: 166%

12-Question FAQ — Return Stacked Global Stocks & Bonds ETF (RSSB) Review

1) What is RSSB and why is it notable?

RSSB (Return Stacked Global Stocks & Bonds ETF) is a capital-efficient “stacked” ETF designed so that each $1 invested targets ~$1 of global equity exposure and ~$1 of U.S. Treasury futures exposure. That 100/100 design can free up space in a portfolio for additional diversifiers while preserving core stock/bond exposure.

2) How does RSSB compare to WisdomTree’s 90/60 trio (NTSX/NTSI/NTSE)?

WisdomTree’s funds target 90% equities + 60% bonds (U.S., international developed, or EM), whereas RSSB targets ~100% global equities + ~100% U.S. Treasury futures. Practically, RSSB can deliver more “bang for your buck” in capital efficiency and, being global in scope, avoids a home-country equity bias.

3) How does the capital efficiency translate into portfolio design?

Because RSSB stacks two return streams into the same dollar, you can recreate a 60/40 core with less capital and use the freed space for diversifiers. For example, allocating 40% RSSB + 20% RSST + 7% GDE inside a 67% sleeve can approximate ~66% equities, 40% bonds, 20% managed futures, and ~6% gold, delivering a balanced core plus alternatives within the same capital.

4) What is RSSB trying to do under the hood?

The fund actively combines:

A Global Equity strategy seeking market-cap-weighted global equity beta (via global/region ETFs, individual securities, or equity index futures), and

A U.S. Treasury Futures strategy (2–30-year maturities) to add a stacked bond return stream on top of equities.

5) How does the Global Equity sleeve work in practice?

Under normal conditions, the portfolio keeps broad global equity exposure with at least 30–40% in non-U.S. companies. The sub-adviser can mix global ETFs, regional ETFs, individual stocks, and equity index futures so the aggregate resembles cap-weighted global equities.

6) How does the U.S. Treasury Futures sleeve work?

RSSB uses exchange-traded U.S. Treasury futures across the curve (target 2–8 years duration overall) and rolls those contracts as they near expiry. It holds T-bills/cash for margin and collateral and may have higher turnover in the futures sleeve due to rolling.

7) Did the fund update its exposure targets?

Yes. A technical clarification aligned the design to ~$1 global equities + ~$1 U.S. Treasury futures per $1 invested (i.e., ~100/100), with the global sleeve expressed via a mix of ETFs, individual equities, and equity index futures, and the Treasury futures notional set around 100% of net assets.

8) What are the key reasons to consider RSSB?

Capital efficiency & diversification: Replace part of your core 60/40 with RSSB to free capital for uncorrelated sleeves (managed futures, gold, style premia, market-neutral, etc.). It may also reduce cash drag and temper equity concentration for growth-tilted allocations by adding a second, potentially diversifying return stream.

9) What are the main caveats?

If you want granular regional equity tilts with lower leverage, WisdomTree’s 90/60 suite might suit you better. Also, because RSSB uses futures, many investors prefer it in tax-advantaged accounts to simplify tax treatment of gains/losses from derivatives.

10) What are the fund facts?

Ticker: RSSB

Target Canvas: ~200% (≈100% global equities + ≈100% U.S. Treasuries)

Net Expense Ratio: 0.41%

AUM: ~70.5M

Inception: 12/04/2023

11) What are example model portfolios using RSSB?

Maximum Diversification (3-Fund): 40% RSSB, 20% QLEIX, 40% QDSIX → ~40% global equities, 40% bonds, 20% L/S equities, 40% multi-alts (expanded canvas ~140%).

Tactical (Offense/Defense): 40% RSSB, 20% RSST, 20% HCMT, 10% CAOS, 10% BTAL → Offense: 100% equities, 40% bonds, 20% trend, 10% OTM put, 10% anti-beta; Defense: 60% equities, 40% bonds, 20% trend, 20% cash, 10% OTM put, 10% anti-beta (canvas ~180%/160%).

10+ Strategies, All-ETF: 20% RSSB, 20% RSBT, 20% GDE, 20% QIS, 4% each of BTAL/CAOS/SVOL/FBTC/LBAY → ~58% equities, 40% bonds, 20% trend, 18% gold, 10% multi-strategy, 4% anti-beta, 4% OTM put, 4% short vol, 4% bitcoin, 4% L/S equity (canvas ~166%).

12) What’s the bottom line from this review?

For investors who prize capital efficiency and want room for uncorrelated alternatives—without abandoning a core stock/bond backbone—RSSB is a compelling “new captain of the ship.” The 100/100 design makes it a versatile building block for expanded-canvas portfolios.

Note: This review is for entertainment/education only and not investment advice. Do your own research and consider consulting a financial professional.

Nomadic Samuel Final Thoughts

If you haven’t guessed it already, I’m a big fan and investor in RSSB ETF!

It’s an important capital efficient puzzle piece in my expanded canvas portfolio.

Those 100/100 stacked combos are on point.

But at this point in the review I’m more interested in what you’ve got to say.

What do you think of RSSB ETF?

Are you a capital efficient investor?

Please let me know in the comments below.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Great review!

I would enjoy your thoughts on TFPN, FLSP, and maybe an expanded one on QIS. Thanks!

I’m interested in the return stacked funds but would like a better understanding of the math of how the leverage works. For instance, if over a long time frame the stocks earned 10% and bonds 5% I should not expect of CAGR of 15% given the cost of borrowing and fees. So what should I expect? Do you have any articles on this topic? Any help or articles you can guide me too would be greatly appreciated.

Have you considered buying treasury futures directly? This would allow for a DIY returned stacked portfolio where the 100% equity side can be whatever you want, not just global MCW. Would be really interested to read your thoughts.