Financial leverage—sounds fancy, right? But it’s a pretty straightforward concept with massive implications in the business world. Essentially, financial leverage involves using borrowed funds (debt) to amplify returns on investment. Companies use leverage to boost their purchasing power, hoping to generate more profits than they could with equity alone. Think of it like using a lever to lift a heavy object; with the right leverage, you can achieve much more than you could with just your bare hands.

In corporate finance, financial leverage is a double-edged sword. On one hand, it can significantly increase a company’s return on equity (ROE). On the other hand, it also increases financial risk. If the company’s investments don’t pan out, the debt obligations remain, potentially leading to financial distress or even bankruptcy. This delicate balance makes understanding and managing financial leverage crucial for any business.

source: The Finance Storyteller

Degree of Financial Leverage

So, why are we diving into the Degree of Financial Leverage (DFL)? Because it’s a key metric that helps companies and investors gauge the impact of leverage on earnings. This article aims to demystify DFL, showing you how to interpret it and understand its implications. Whether you’re a business owner, a financial analyst, or an investor, grasping DFL can offer valuable insights into a company’s financial health and strategic positioning.

We’ll break down what DFL is, how to calculate it, and, most importantly, how to interpret it. By the end of this article, you’ll be equipped to analyze the financial leverage of any company with confidence. Ready to unlock the secrets of financial leverage? Let’s get started!

Understanding Financial Leverage

Definition

Financial leverage is like adding rocket fuel to your business engine. It involves using borrowed money (debt) to amplify the potential return on investment. Companies use financial leverage to boost their capital for growth, acquisitions, or other major expenses. By borrowing funds, they can invest more than what’s available from their equity alone, aiming for greater profits. However, this also means taking on additional risk. Essentially, financial leverage is a high-stakes game where the rewards can be significant, but so can the downsides.

Components

Let’s break down the components of financial leverage:

- Debt: This is the borrowed money that the company must repay over time. It can come from loans, bonds, or other forms of credit. The amount of debt a company takes on determines its leverage ratio.

- Equity: This represents the owner’s stake in the company. It’s the money invested by shareholders and retained earnings. While equity doesn’t have to be repaid, issuing more shares can dilute ownership.

- Interest Expenses: This is the cost of borrowing. It includes the interest payments made on the debt. High interest expenses can eat into profits, but they’re also tax-deductible, which brings us to our next point.

Benefits and Risks

Using financial leverage comes with its own set of pros and cons.

Benefits:

- Tax Advantages: Interest payments on debt are tax-deductible, which can reduce the overall tax burden. This makes debt a cheaper source of financing compared to equity.

- Increased Return on Equity: When a company uses debt effectively, it can enhance its return on equity (ROE). This means higher earnings for shareholders without having to invest more equity.

- Growth Opportunities: Leverage provides additional funds for expansion, acquisitions, and other growth opportunities that might be out of reach otherwise.

Risks:

- Higher Interest Costs: The more debt a company takes on, the higher its interest expenses. These costs must be paid regardless of the company’s performance, which can strain finances.

- Potential for Financial Distress: High levels of debt increase the risk of financial distress, especially if the company’s earnings are not sufficient to cover interest payments. This can lead to default or bankruptcy.

- Volatility: Financial leverage can make earnings more volatile. While it can amplify profits in good times, it can also magnify losses during downturns.

What is the Degree of Financial Leverage (DFL)?

Definition of DFL

The Degree of Financial Leverage (DFL) is a financial metric that quantifies how sensitive a company’s earnings per share (EPS) are to changes in its operating income (EBIT). Think of it as a magnifying glass for financial performance. When a company leverages its capital structure by taking on debt, DFL helps measure how this leverage impacts the company’s earnings. Essentially, it tells us how much EPS will fluctuate for a given change in EBIT. If DFL is high, a small change in operating income can lead to a large change in EPS, signaling higher financial risk.

Formula

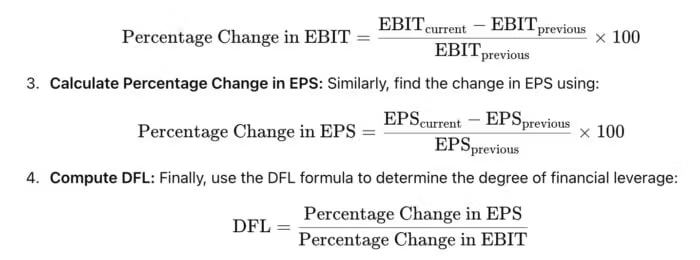

Calculating DFL is straightforward once you have the necessary data. Here’s the formula:

Let’s break it down:

- Percentage Change in EPS: This is the change in earnings per share expressed as a percentage.

- Percentage Change in EBIT: This is the change in earnings before interest and taxes, also expressed as a percentage.

To put it simply, DFL shows the proportional change in EPS resulting from a given proportional change in EBIT. For example, if a company’s DFL is 2, a 10% increase in EBIT would result in a 20% increase in EPS.

Now, let’s look at a practical example. Suppose a company’s EBIT increases by 15%, and as a result, its EPS increases by 30%. Using the DFL formula, we can calculate:

This means that for every 1% change in EBIT, EPS changes by 2%, illustrating the company’s financial leverage effect.

Calculating DFL

Step-by-Step Guide

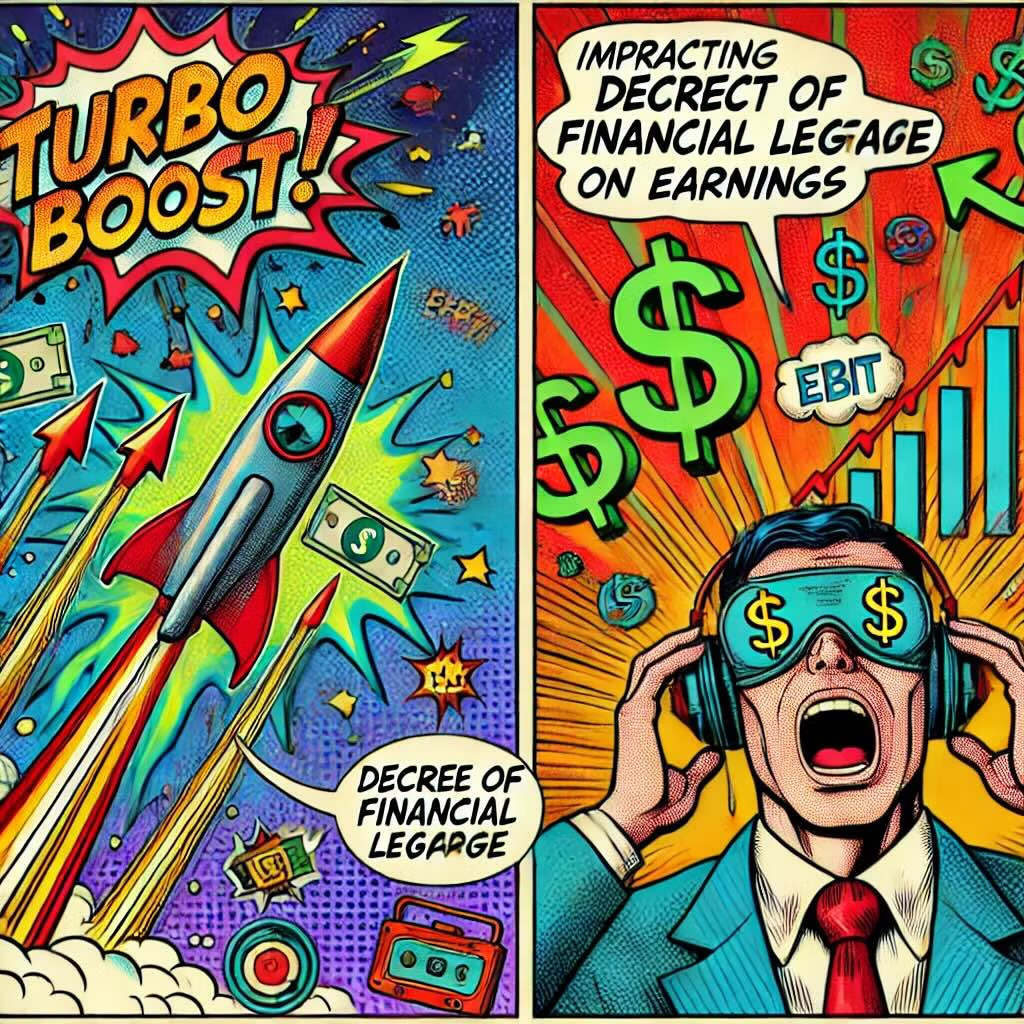

Calculating the Degree of Financial Leverage (DFL) involves a few straightforward steps. Let’s break it down:

- Gather Financial Data: You’ll need the company’s Earnings Before Interest and Taxes (EBIT) and Earnings Per Share (EPS) from its financial statements. Ideally, collect data from two consecutive periods for comparison.

- Calculate Percentage Change in EBIT: Determine how much EBIT has changed between the two periods. Use the formula:

Example Calculation

Let’s walk through a practical example to illustrate the calculation process. Suppose you have the following financial data for a company:

- Previous Period EBIT: $100,000

- Current Period EBIT: $120,000

- Previous Period EPS: $2.00

- Current Period EPS: $2.40

In this example, the DFL is 1, meaning that the EPS is equally sensitive to changes in EBIT. For every 1% change in EBIT, there is a corresponding 1% change in EPS.

Interpreting DFL

High DFL

A high Degree of Financial Leverage (DFL) can be both a blessing and a curse. When a company has a high DFL, it indicates that its earnings per share (EPS) are highly sensitive to changes in operating income (EBIT). In simpler terms, a small increase in EBIT can lead to a significant boost in EPS, which sounds fantastic, right?

But hold on, there’s a flip side. A high DFL also means that a small decrease in EBIT can drastically reduce EPS. This volatility makes the company riskier from an investment perspective. High leverage magnifies profits during good times but also amplifies losses during downturns. Companies with a high DFL are essentially riding a financial rollercoaster. For investors, it’s crucial to weigh this risk against the potential for high returns.

Low DFL

On the other end of the spectrum, a low DFL suggests that the company’s EPS is less sensitive to changes in EBIT. This stability can be reassuring for investors, indicating that the company isn’t relying heavily on debt to finance its operations.

A low DFL means that the company has a more conservative approach to leverage, resulting in less volatility in its earnings. While this might imply lower potential returns during boom periods, it also means reduced risk during downturns. Companies with a low DFL are often viewed as financially stable and less risky, making them attractive to conservative investors seeking steady, reliable returns.

Industry Comparisons

When interpreting DFL, it’s essential to consider industry norms. Different industries have varying capital structures and leverage practices. For instance, utility companies often have high leverage due to their stable, predictable cash flows, whereas tech startups might operate with lower leverage due to higher volatility and growth prospects.

Why Compare Within the Same Industry? Comparing a tech company’s DFL with that of a utility company isn’t meaningful because their business models and risk profiles are vastly different. Instead, compare the DFL of companies within the same industry to get a clearer picture of how they manage financial leverage relative to their peers. This context helps investors make more informed decisions by understanding whether a company’s DFL is typical for its industry or if it indicates a more aggressive or conservative approach to leverage.

Implications of DFL

Impact on Earnings

The Degree of Financial Leverage (DFL) significantly impacts how changes in operating income (EBIT) translate into changes in earnings per share (EPS). For companies with high DFL, even a slight increase in EBIT can result in a substantial rise in EPS. It’s like having a turbo boost for your earnings.

For example, if a company with a DFL of 3 experiences a 10% increase in EBIT, its EPS could soar by 30%. However, the same leverage effect works in reverse. A 10% decline in EBIT would slash EPS by 30%, demonstrating the double-edged nature of financial leverage. On the other hand, companies with low DFL exhibit more stable earnings. A 10% change in EBIT might only result in a 10% change in EPS, indicating less volatility and more predictability in earnings.

Risk Assessment

DFL is a valuable tool for assessing a company’s financial risk, especially in volatile markets. High DFL indicates that a company is more leveraged, meaning it has more debt relative to its equity. This increased leverage amplifies both potential gains and losses.

In turbulent economic times, companies with high DFL face greater risks. If the market turns and EBIT declines, their EPS can drop sharply, leading to potential financial distress. Investors and analysts use DFL to gauge how susceptible a company is to market fluctuations. A higher DFL suggests higher risk, requiring more robust risk management strategies. Conversely, a lower DFL indicates that a company is more conservatively financed, with lower risk of financial instability in volatile markets.

Strategic Decisions

Understanding DFL helps companies make strategic decisions about their capital structure to optimize risk and return. Here are some insights on how companies might adjust their strategies:

- Balancing Act: Companies must find the right balance between debt and equity to optimize their DFL. Too much debt increases risk, while too little might limit growth opportunities.

- Capital Structure Adjustments: If a company’s DFL is too high, it might consider reducing debt levels by refinancing with equity or using retained earnings to pay down existing debt. This approach lowers financial risk and stabilizes earnings.

- Growth Strategies: Companies with a lower DFL might decide to take on more debt to finance expansion projects, aiming to boost returns without significantly increasing risk. By carefully managing their leverage, they can support growth while maintaining financial stability.

- Cost of Capital Considerations: Companies also need to consider the cost of capital. Debt is typically cheaper than equity due to tax deductibility of interest payments. However, high levels of debt increase financial risk, which can raise the company’s overall cost of capital. Striking a balance is key.

Practical Applications

Investor Perspective

For investors, the Degree of Financial Leverage (DFL) is like a financial magnifying glass, revealing the true impact of leverage on a company’s earnings. When evaluating potential investments, DFL can help investors assess both the financial risk and potential return.

Evaluating Risk and Return: A high DFL indicates that a company is using a significant amount of debt to finance its operations. This can be a double-edged sword. On one hand, if the company’s EBIT increases, the EPS will increase disproportionately, leading to potentially higher returns. On the other hand, if EBIT decreases, EPS will take a hit, indicating higher financial risk. For risk-averse investors, a lower DFL might be more appealing as it suggests more stable earnings and less vulnerability to economic downturns.

Comparative Analysis: Investors can also use DFL to compare companies within the same industry. A company with a DFL significantly higher than its peers might be taking on more risk, which could either lead to higher returns or greater financial distress. By comparing DFLs, investors can make more informed decisions about which companies align with their risk tolerance and investment goals.

Management Perspective

From a management perspective, understanding DFL is crucial for making informed decisions about financing and operational strategies. It provides insights into how changes in operating income will affect earnings, guiding strategic planning and risk management.

Financing Decisions: Companies can use DFL to determine the optimal mix of debt and equity in their capital structure. If the DFL is high, management might consider reducing debt to lower financial risk and stabilize earnings. Conversely, if the DFL is low and the company is in a stable market, taking on additional debt might be a strategic move to finance growth and expansion without significantly increasing risk.

Operational Strategies: Management can also use DFL to evaluate the impact of operational changes. For instance, if a company is considering a major investment that will increase EBIT, understanding the DFL will help predict how this investment will affect EPS. This insight allows management to weigh the potential benefits against the risks, ensuring that the decision aligns with the company’s overall financial strategy.

Risk Management: High DFL requires robust risk management practices. Companies need to ensure they have sufficient cash flow to cover interest payments during downturns. This might involve maintaining a cash reserve, diversifying revenue streams, or hedging against interest rate fluctuations. By actively managing financial risk, companies can mitigate the negative effects of high leverage.

Common Mistakes and Pitfalls

Misinterpretation of DFL

Misinterpreting the Degree of Financial Leverage (DFL) is a common pitfall that can lead to misguided decisions. One of the biggest mistakes is viewing DFL in isolation without understanding its broader implications. For example, seeing a high DFL might tempt an investor to think only of potential high returns without considering the accompanying risks. It’s crucial to remember that a high DFL means greater volatility in earnings. While this can lead to significant gains, it can also result in substantial losses if the company’s EBIT declines.

Another common error is assuming that a high DFL is inherently bad. In reality, the impact of a high DFL depends on the company’s financial stability and market conditions. A company with a high DFL but strong, stable cash flows might manage its debt effectively, while another with volatile earnings might struggle. The key is to consider DFL alongside other financial metrics and the company’s overall financial health.

Ignoring Industry Context

Another frequent mistake is ignoring the industry context when analyzing DFL. Different industries have different norms for leverage. For instance, utilities and telecommunications companies often have higher DFLs because they have stable, predictable cash flows. In contrast, tech startups might operate with lower leverage due to their higher volatility and growth-focused strategies.

Why Industry Context Matters: Comparing DFL across different industries without accounting for these differences can lead to misleading conclusions. A high DFL in a utility company might be standard and manageable, whereas the same DFL in a volatile tech company could signal excessive risk.

How to Avoid This Pitfall: Always compare a company’s DFL with industry averages and its direct competitors. This context helps you understand whether the company’s leverage strategy is aggressive, conservative, or in line with industry norms. Use industry reports, financial databases, and benchmarking studies to gather relevant data for comparison.

12-Question FAQ: How to Interpret the Degree of Financial Leverage (DFL)

1) What is the Degree of Financial Leverage (DFL)?

DFL measures how sensitive a company’s earnings per share (EPS) are to changes in operating income (EBIT)—i.e., how debt magnifies earnings volatility.

2) Why does DFL matter?

Because higher DFL means bigger swings in EPS for a given change in EBIT: great in good times, dangerous in downturns. It’s a fast read on financing risk.

3) How do you calculate DFL?

Two common views:

Elasticity form (multi-period): DFL = %ΔEPS ÷ %ΔEBIT.

Point-in-time form (no preferreds): DFL ≈ EBIT ÷ (EBIT − Interest Expense).

(If preferred dividends exist, adjust the denominator to reflect the EPS burden.)

4) Can you show a quick example?

If EBIT rises 20% and EPS rises 20%, then DFL = 20% ÷ 20% = 1.0 (low leverage effect). If EBIT rises 10% and EPS rises 30%, DFL = 3.0 (high leverage effect).

5) What is considered a “high” DFL?

There’s no universal cutoff, but DFL > 2 typically signals meaningful financial leverage—EPS will swing at least twice as much as EBIT.

6) What indicates a “low” DFL?

DFL near 1 implies limited amplification: EPS changes roughly one-for-one with EBIT, reflecting a conservative capital structure.

7) How should DFL be interpreted across industries?

Always benchmark within the same industry. Capital-intensive, stable-cash-flow sectors (e.g., utilities) often carry higher, manageable DFL; volatile, growth sectors typically run lower DFL.

8) How does DFL relate to operating leverage and total leverage?

Operating Leverage (DOL): EBIT sensitivity to sales (fixed vs variable costs).

Financial Leverage (DFL): EPS sensitivity to EBIT (debt effects).

Total Leverage (DTL): DOL × DFL = EPS sensitivity to sales.

9) Do taxes and preferred dividends change DFL?

Interest is tax-deductible (a “tax shield”), but EPS is after-tax and after preferreds. For point-in-time approximations, many use EBIT ÷ (EBIT − Interest); with preferred dividends, adjust the denominator (or compute via % changes) to capture their EPS impact.

10) How can investors use DFL?

Risk filter: Prefer lower DFL for defensive picks; accept higher DFL for higher-beta ideas.

Stress tests: Model a ±10% EBIT shock and apply DFL to gauge likely EPS impact.

Peer checks: Compare DFL vs peers to spot aggressive financing.

11) How can management manage or adjust DFL?

Refinance or reduce debt, extend maturities, lower coupon costs, build cash, or raise equity/retained earnings. Conversely, adding prudent debt can raise DFL when stable cash flows justify it.

12) What are common pitfalls when using DFL?

Viewing DFL in isolation (ignoring liquidity, covenants, cash coverage).

Cross-industry comparisons without context.

Single-period snapshots taken during unusual quarters (seasonality or one-offs).

Best practice: pair DFL with interest coverage, free cash flow, covenants, and industry norms.

Educational content only—not investment advice. Validate with company filings and your own analysis.

Conclusion

We’ve journeyed through the intricacies of the Degree of Financial Leverage (DFL), unraveling its significance in financial analysis. Here’s a quick recap:

- Understanding Financial Leverage: We discussed what financial leverage is and why companies use it, highlighting the components of debt, equity, and interest expenses.

- What is DFL?: We defined DFL, showing how it measures the sensitivity of EPS to changes in EBIT, and walked through the calculation process.

- Interpreting DFL: We explored the implications of high and low DFL, emphasizing the importance of industry context.

- Implications of DFL: We looked at how DFL impacts earnings, aids in risk assessment, and influences strategic decisions.

- Practical Applications: We considered how investors and management can use DFL for better decision-making.

- Common Mistakes and Pitfalls: We highlighted the importance of proper interpretation and the need to consider industry-specific factors.

Encouragement to Analyze

Now that you’re equipped with a thorough understanding of DFL, it’s time to put that knowledge to work. Take a closer look at the companies you’re interested in. Analyze their financial statements, calculate their DFL, and interpret what it means for their financial health and risk profile. Compare these metrics within the industry to get a well-rounded view. This hands-on approach will deepen your understanding and help you make more informed investment or management decisions.

Final Thoughts

Grasping the Degree of Financial Leverage is a powerful tool in financial analysis and decision-making. It provides insights into how leverage affects a company’s earnings and risk, guiding both strategic planning and investment choices. By understanding DFL, you can better navigate the complexities of corporate finance, balancing the potential for higher returns with the inherent risks of increased leverage.

Remember, DFL is just one piece of the financial puzzle. Use it in conjunction with other metrics to gain a comprehensive view of a company’s financial health. Whether you’re an investor looking for the next big opportunity or a manager steering your company toward growth, understanding DFL can significantly enhance your financial acumen. Ready to dive deeper into financial analysis? Keep exploring, keep analyzing, and watch your financial insights grow. Happy analyzing!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.