Cryptocurrencies have transformed the financial landscape by offering new ways to transfer value, maintain ownership of digital assets, and participate in decentralized networks. Alongside well-known methods like trading or holding (HODLing), there’s another approach that has gained tremendous popularity: staking. Staking allows crypto holders to earn passive income on their tokens while simultaneously contributing to network security. This marriage of monetary incentive and blockchain consensus has piqued the interest of both small-scale retail investors and large institutional players.

Staking is all about rewards and security.

In a world where bank interest rates often linger near historically low levels, the ability to earn annual percentage yields (APYs) by simply locking up crypto tokens can be highly appealing. On the surface, the concept seems almost too good to be true—earn more of the same asset you already hold, without actively trading or monitoring the market’s every twist and turn. Yet, like every opportunity in the crypto space, staking comes with its own blend of risks, complexities, and nuances.

Shift From PoW to PoS

A fundamental reason for staking’s popularity is the shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus mechanisms in many blockchain ecosystems. PoW relies on computational power (i.e., mining), requiring significant energy consumption and specialized hardware. PoS, on the other hand, incentivizes validators to stake coins (or tokens) to validate transactions and secure the network, awarding them with new tokens as a form of interest. This system can be more energy-efficient and inclusive for those who don’t want to invest in expensive mining rigs. However, the move to PoS also introduces new considerations, such as slashing, lockup periods, and the potential for centralization if large entities amass disproportionate stakes.

PoW is about mining, PoS is about staking.

In this blog post, we’ll delve into how crypto staking works, the types of returns you might expect, and the dangers you need to be aware of before committing your tokens to a staking program. We’ll also provide practical guidance on how to begin staking—choosing the right coins, finding trustworthy staking platforms, and maximizing your rewards through compounding strategies. By the end, you should have a clearer understanding of both the rewards and risks, aiding your decision-making process and helping you determine whether staking aligns with your crypto investment philosophy.

Why Staking Matters

- Passive Income Potential: In an era of low savings account yields, staking’s APYs often appear lucrative, ranging from modest single digits to double digits in certain ecosystems.

- Network Security: By locking tokens in a staking contract, you play a role in transaction validation and governance decisions, directly supporting the project’s infrastructure.

- Decentralization vs. Centralization Tension: Staking can reduce the environmental impact linked with mining and can encourage broader network participation, but large holders might dominate governance if they stake huge amounts.

- Evolution of Blockchain: Ethereum’s shift to PoS is a milestone, driving more attention to staking across the broader crypto space. Other networks like Cardano, Polkadot, and Solana also rely heavily on staking for consensus, highlighting its growing importance.

Yet, it’s crucial to recognize the complexities underlying these positives. Crypto prices can be notoriously volatile, and if your staked coin’s value plunges, high APYs may not offset potential capital losses. Some networks impose lockup durations, meaning you can’t access your tokens or “unstake” them immediately—this can be problematic if you suddenly need liquidity or if the market changes drastically in your absence. Additionally, the concept of “slashing” penalizes validators who behave maliciously or fail to maintain required uptime, and these penalties can filter down to delegated stakers.

Rewards aren’t free lunch.

Staking can indeed be fruitful, but it demands a solid grasp of the underlying protocol, the credibility of validators (if you delegate), and the economic environment surrounding the token. In what follows, we’ll dissect how staking truly works—beyond the marketing hype—and map out both the potential windfalls and pitfalls. Whether you’re a curious newcomer or a seasoned investor, this guide aims to equip you with the knowledge to stake confidently and carefully in the ever-evolving cryptosphere.

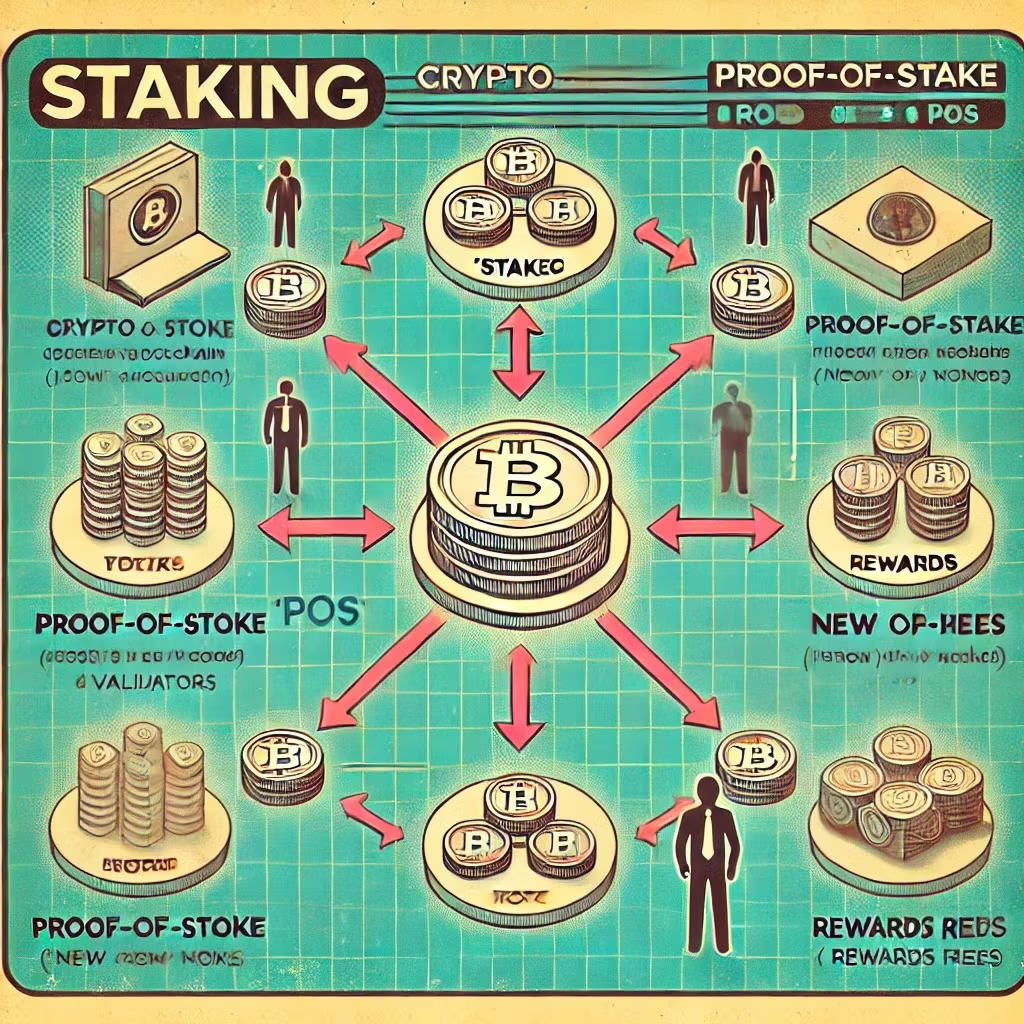

What Is Crypto Staking and How Does It Work?

Crypto staking is a process by which you commit (or “stake”) your digital tokens to support the security and operations of a Proof-of-Stake (PoS) blockchain network. In return, you receive staking rewards—a distribution of newly minted coins or transaction fees. If this sounds akin to earning interest at a bank, there are parallels: you lock up your funds for a specified period, assisting the institution (in this case, the blockchain) in its operations, and in exchange, receive compensation.

It’s the PoS alternative to mining.

The Proof-of-Stake (PoS) Mechanism

In Proof-of-Work (PoW) networks (like Bitcoin), miners compete using computational power to solve cryptographic puzzles, verifying transactions and adding blocks to the chain. This competition demands significant energy and hardware costs. Conversely, PoS relies on validators who stake tokens to become eligible for block production. The network randomly selects or prioritizes validators to propose or validate new blocks, with the probability often proportional to the size of their stake.

- Comparing PoW and PoS:

- Energy Efficiency: PoS typically consumes less energy since it doesn’t require specialized mining rigs running 24/7.

- Capital vs. Computing: PoS invests in tokens as collateral, whereas PoW invests in hardware and electricity bills.

- Inclusivity: It’s easier for an average user to stake coins than to set up a mining farm, though capital requirements can still be significant for some networks.

- Incentives: PoS networks reward validators for honest behavior. If a validator tries to cheat, they risk losing part of their stake via slashing—a penalty that can range from a small fraction of tokens to the entirety of the stake, depending on the severity of misconduct.

Staking Mechanics

Staking can take several forms, depending on how deeply involved you wish to be:

- Delegating Tokens:

- Common approach for users not wanting to run a dedicated validator node.

- You delegate your coins to a validator (or a set of validators) who handles the technical aspects of block proposal.

- Delegators typically pay a commission fee to the validator, and the rest of the reward is shared proportionally among delegators.

- Operating a Validator Node:

- Requires more technical knowledge and often a higher minimum stake.

- You directly participate in consensus, are responsible for uptime, and might earn higher rewards.

- Risk includes slashing if your node misbehaves (double signing blocks, extended downtime, etc.).

- Platform-Based Staking:

- Many exchanges (like Binance, Coinbase, Kraken) and wallets offer simplified staking options—just deposit your coins, and they handle the validator processes.

- Pros: user-friendly, minimal setup.

- Cons: can be custodial and sometimes less transparent about fees or actual on-chain operations.

Different paths, same goal: earn rewards.

Popular Staking Coins

A handful of PoS or similar networks have attracted large staking communities:

- Ethereum (ETH): Switched from PoW to PoS in a highly publicized merge. Now, you can stake ETH directly or via liquid staking providers like Lido.

- Cardano (ADA): Employs a PoS protocol called Ouroboros. Users delegate ADA to stake pools and earn yields.

- Polkadot (DOT): Allows both validator operation and nomination. Nominators choose trustworthy validators to stake with.

- Solana (SOL): Known for high throughput. SOL holders can stake or delegate to a validator node for rewards.

- Cosmos (ATOM): Another ecosystem with an active staking model, using a mechanism called Tendermint.

Staking’s variety means you can choose networks whose visions align with your interests or that offer risk-return profiles you’re comfortable with. For instance, older networks with established track records and large market caps might feel “safer” than smaller projects promising higher yields.

Why People Stake

- Passive Income: Potential to earn returns on otherwise idle coins.

- Belief in the Project: Staking tokens signals a commitment to the network. Many stakers are long-term holders who want to see the ecosystem flourish.

- Governance Influence: Some PoS tokens confer voting rights over protocol proposals. Staking can amplify your influence.

Staking can be an elegant alignment of incentives, marrying user benefit (earning yields) with protocol benefit (enhanced security and decentralization). But as with any investment, it’s not risk-free. That’s why we’ll explore the potential returns you might garner—and the pitfalls that can beset unwary stakers.

Potential Returns from Staking

Staking often appears to be an attractive alternative to simply holding crypto in a wallet because you can grow your position without trading. Instead, the network pays you for locking up your tokens and contributing to consensus. However, the actual financial gains you experience hinge on multiple variables: the network’s inflation model, overall demand for the token, the performance of your chosen validator, and broader market trends. Let’s unpack how these factors converge to determine your potential staking returns.

Rewards can differ widely.

Earning Rewards

- Annual Percentage Yields (APYs):

- Staking returns are often quoted in APYs or APRs (annual percentage rates). They can range from ~2% for more conservative coins to over 20% for riskier or newer networks.

- Ethereum (post-merge) might yield anywhere between 4–7% annually, while smaller projects like certain DeFi protocols could promise upwards of 30%, albeit with higher uncertainty.

- Factors Influencing Reward Rates:

- Inflation Rate: Some blockchains mint new tokens to reward validators, effectively diluting the supply. This inflation can offset or complement real yield.

- Block Rewards: The base reward for producing a block can shift as the protocol evolves.

- Validator Commission: If you’re delegating, your validator might take a certain percentage as a fee.

- Network Participation: The more tokens staked across the network, the lower the individual reward rate tends to be (since rewards are distributed among more participants).

Compounding Returns

Staking typically pays out rewards periodically—sometimes daily, weekly, or per block, depending on the chain. You can choose to reinvest these rewards, effectively compounding your holdings over time. This compounding effect can be powerful:

- Simple Example: Suppose you stake 1,000 tokens at 10% APY. After one year, you might have 1,100 tokens (not accounting for any validator fees). If you restake, your second year’s earnings are on 1,100 tokens, so you’d gain around 110 tokens if the rate remains constant. Over a few years, this can amplify your initial position significantly.

Reinvest to turbocharge growth.

However, compounding in crypto is not purely arithmetic. Token price movements can overshadow gains or losses from staking. If your staked coin doubles in price, your yield’s dollar value surges. Conversely, if the coin’s price tanks, your staking gains might not compensate for the market value decline. Therefore, you should weigh both yield and the token’s long-term potential before committing to stake.

Impact of Token Price

The fluctuation of the token’s market price plays a pivotal role in determining the real returns you achieve, beyond the nominal staking rewards. While you might earn, say, 8% APY in tokens, if the asset’s price drops by 50% over the year, you’d be at a net loss from a USD perspective. On the flip side, if the token rises 300% during a bull run, your newly generated staking rewards can magnify total gains.

- Bull Market Upside: Staking can feel doubly rewarding if the token’s price appreciates significantly. Your yield in tokens grows, and each token is worth more in fiat terms.

- Bear Market Downside: A 10% yield doesn’t help much if the coin’s price plummets 70%. The nominal number of tokens increases, but their fiat value might still fall overall.

Volatility and Reward Stability

Some networks, especially newer or smaller ones, might see more extreme price swings or frequent changes to staking reward models. DeFi protocols offering “yield farming” can promise triple-digit APYs, but these can crash abruptly if liquidity shifts or the protocol’s token collapses. Meanwhile, more established PoS networks like Cardano or Polkadot might have steadier, though lower, yields.

High reward, high risk.

Token Governance Incentives

In certain ecosystems, staking doesn’t just yield tokens—it may also grant governance tokens or let you accrue rights in other affiliated protocols. This can expand the scope of your return beyond basic APYs, though it introduces additional complexity and potential price volatility for these extra tokens. Examples include:

- DeFi Aggregators: They might distribute governance tokens to stakers as a bonus, which can be sold or used for voting power.

- Nested Rewards: Some cross-chain staking arrangements offer layered rewards from multiple networks or bridging solutions.

When evaluating your potential returns, keep in mind both the straightforward APY metrics and the intangible benefits or costs—such as intangible governance influence or the intangible cost of locking your tokens, which could be used elsewhere for arbitrage or short-term trades. As appealing as these potential returns may be, they’re not guaranteed.

Risks Associated with Staking

Staking can seem like a low-effort path to passive income, but it is not without hazards. In some cases, the potential pitfalls are as significant as the rewards. Whether it’s the danger of locking up funds in a volatile market, the possibility of slashing penalties, or the challenges of illiquidity, each staker must weigh these risks before deciding to commit their tokens. Below, we unpack the major concerns you should keep top of mind.

No free lunch in crypto.

Price Volatility

Crypto is notorious for wild price swings. An APY of 8% might seem generous—until your staked token plunges 40% in a few weeks, or even in a single day. This volatility can overshadow any staking rewards, effectively erasing gains and pushing your net position into the red.

- Bear Markets: If the broader crypto market enters a prolonged downturn, your staked coins might steadily lose value.

- Staking-Focused Projects: Some altcoins brand themselves with ultra-high APYs to lure participants, but often these tokens face extreme volatility as supply inflates and hype fades.

Because staking generally assumes a longer-term perspective, a short-lived price drop may not matter if you believe the asset will rebound. However, if the asset does not recover, the nominal yield won’t offset your capital losses.

Lockup Periods and Liquidity

Many PoS networks impose lockup, bonding, or unbonding periods:

- Lockup (Bonding): The time during which you must keep your tokens staked. Some protocols might not allow you to unstake until a certain epoch or block is reached.

- Unbonding/Unstaking: Even after you initiate withdrawal, it can take days or weeks (e.g., 21 days in some networks) before tokens become liquid again.

During these intervals, you can’t sell or transfer your staked tokens, which can be problematic if you need cash urgently or if the market shifts dramatically. In a swift bull run for another crypto, your staked funds might remain inaccessible, preventing you from reallocating to more promising opportunities.

Immobility can be costly.

Slashing Risks

PoS networks use slashing to penalize validators (and possibly their delegators) for malicious acts (e.g., double-signing) or extended downtime. If your chosen validator node commits infractions, a portion of your stake can be confiscated. The severity varies:

- Minor Offenses: Slight downtime might incur minimal penalties, like losing a fraction of your rewards.

- Major Offenses: Malicious activity can lead to a significant portion of staked tokens being destroyed.

Delegators share in these consequences, so picking a trustworthy validator with a solid uptime record is critical. And even the best validator might occasionally face technical issues, introducing an element of unpredictability.

Centralization Concerns

In PoS, large holders can wield disproportionate power, controlling validator nodes or dominating delegations. This consolidation can undermine the decentralized ethos of crypto, giving influential validators the capacity to sway governance decisions or manipulate the network. Additionally, if too many tokens are staked through a small number of exchanges or services, single points of failure emerge. A hack, regulatory action, or internal meltdown at one major staking provider could disrupt the entire network’s security and hamper your ability to claim rewards or unstake tokens.

Beware of validator monopolies.

Regulatory Risks

As of now, the global regulatory landscape for staking remains fragmented and evolving:

- Tax Implications: Some jurisdictions consider staking rewards as income, subject to taxation upon receipt. Others might treat them as capital gains. Keep track of local rules to avoid compliance issues.

- Legal Classification: In certain countries, staking might be interpreted as a security-like offering. This can prompt additional regulations or restrictions, potentially impacting the viability of staking services.

- Exchanges Under Scrutiny: Centralized exchanges offering staking might face stricter regulatory oversight. This could lead to abrupt changes—like ceasing certain staking pools for compliance reasons.

Technical Dependencies

Even if you delegate to a reputable validator, you still rely on their infrastructure. If their servers go offline or face DDoS attacks, your staking rewards might diminish, or you might even suffer slashing for extended downtime. Non-custodial staking solutions typically require a stable internet connection (for your own node) or trusting an on-chain contract, which itself can contain bugs if not audited thoroughly.

Mitigating the Risks

You can adopt several strategies to minimize these risks:

- Diversify Validators: Spread your staked tokens across multiple validators to mitigate slashing or downtime from a single node’s failure.

- Choose Liquid Staking: Some protocols enable “liquid staking tokens” that you can trade even while your underlying stake remains locked.

- Monitor Market Trends: If you sense an upcoming bear cycle, you might reduce your staked portion or select projects with stable fundamentals.

- Research: Prior to staking, study the validator’s track record, the protocol’s slashing conditions, and any binding periods.

Vigilance pays.

While staking might appear to be a “set it and forget it” approach, the reality demands ongoing vigilance, especially in a technology-driven sector prone to changes.

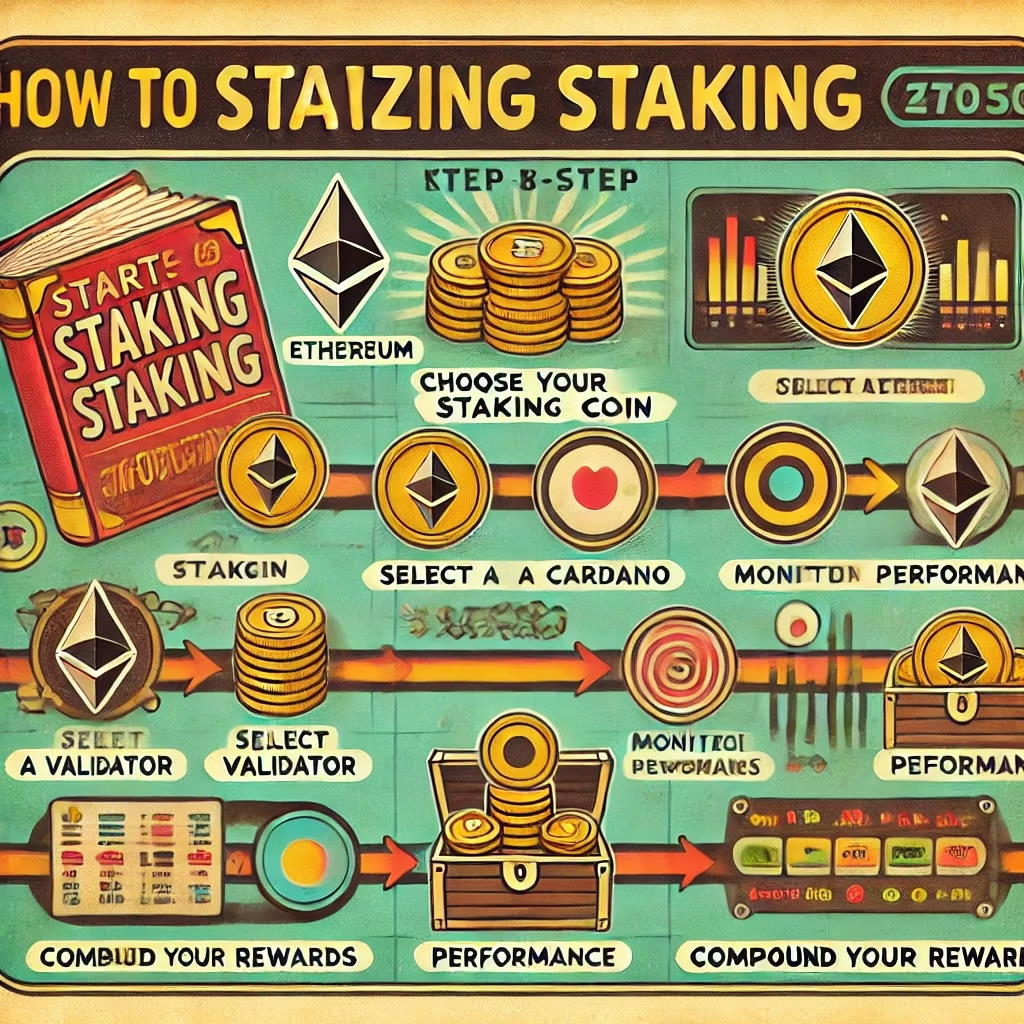

How to Start Staking and Maximize Rewards

For crypto enthusiasts eager to transform idle tokens into yield-bearing assets, staking represents a compelling path. However, diving in without planning can lead to subpar returns or unexpected pitfalls. Below, we detail a structured approach to start staking successfully, from selecting the right coin to actively compounding rewards for optimal growth.

Preparation breeds confidence.

Choose the Right Coin

The first—and arguably most crucial—step is deciding which cryptocurrency to stake. Not all tokens are equally suitable, and many do not support staking at all if they rely on Proof-of-Work or other consensus mechanisms.

- Research Fundamentals

- Evaluate the project’s roadmap, community, developer activity, and real-world use cases. A sustainable, long-term project typically makes a safer staking choice than a hype-driven altcoin with uncertain prospects.

- Consider the token’s inflation rate. Some networks print new coins to pay staking rewards, diluting existing holders. If the inflation is too high, token value might suffer unless demand also grows.

- Check Potential Yields

- Compare advertised APYs across different PoS networks.

- Higher yields often correspond with higher risk or more significant token inflation. Make sure you understand why the yield is high.

- Assess Volatility

- The more volatile the coin, the greater the possibility of capital losses, overshadowing any staking yield. For novices, selecting a more established coin with moderate volatility might be wise.

Select a Staking Platform

You have multiple avenues for staking, each with its advantages and trade-offs:

- Centralized Exchanges

- Examples: Binance, Coinbase, Kraken.

- These typically offer “one-click staking” where you just deposit your tokens, and the platform handles everything else. Some even offer “locked” or “flexible” staking terms.

- Pros: Simple to use, minimal technical overhead.

- Cons: You might forfeit custody of your tokens, rely on the exchange’s security, and pay higher fees or lower reward rates.

- Self-Custodial Wallets

- Examples: Ledger Live, Trust Wallet, Exodus.

- Some wallets have integrated staking features, letting you delegate tokens without an intermediary.

- Pros: You retain control of your private keys.

- Cons: May require more active management, possibly less user-friendly than an exchange.

- Direct On-Chain Staking

- Operating a validator node or delegating to multiple validators on the native blockchain.

- Pros: Maximum transparency, potential for higher yields if you run your own node well.

- Cons: Technical complexity, risk of slashing if misconfigured, or downtime penalties.

Matching platform to skillset is key.

Evaluate Validators

If you’re delegating, the choice of validator can profoundly affect your returns and risk exposure. Key factors:

- Performance: A validator with high uptime (close to 100%) secures consistent block production and thus higher rewards.

- Fees/Commission: Many validators charge between 0–10% of rewards. Higher commission doesn’t always mean worse choice if the validator consistently delivers top-notch reliability and advanced security.

- Reputation: Look at community forums, staking dashboards, or explorer metrics to see if a validator has been slashed before. Also pay attention to how they approach governance proposals.

- Decentralization: Delegating to smaller or mid-sized validators helps avoid concentration risk where a few large validators dominate the network.

Some blockchains, like Polkadot or Cosmos, have official explorers and community-led resources to help stakers compare validator stats (uptime, commission, total stake, etc.), facilitating an informed delegation process.

Minimize Risks

Caution fosters confidence.

- Liquid Staking Solutions

- Services like Lido (for Ethereum) or other “liquid staking” protocols let you stake your tokens while receiving a derivative token that represents your claim on the staked position. You can then trade or use that derivative token in DeFi, retaining a semblance of liquidity.

- This approach mitigates lockup concerns, although it carries smart contract risk from the liquid staking protocol itself.

- Monitor Market Conditions

- If you suspect a major market downturn, you might reduce or pause staking, especially for altcoins with fragile fundamentals.

- Keep tabs on mainnet upgrades and governance proposals that could alter reward rates or slashing penalties.

- Stay Informed

- Follow the project’s official blog, Discord, or Telegram channels for updates on any changes to staking parameters or potential forks.

- If your validator signals upcoming downtime, consider switching to avoid slashing events.

Track and Compound Rewards

Once you’ve chosen your coin, platform, and validators, you’ll start accruing rewards. At this point, you can:

- Track Performance: Use explorers or aggregator sites that display real-time data about your staked amount, accrued rewards, and net APY.

- Reinvest Rewards: If you want compounding growth, periodically restake your newly earned tokens. Some platforms offer an “auto-compound” feature that does this for you.

- Diversify Over Time: You might branch out into staking multiple coins across different ecosystems, spreading risk and possibly capturing better yields in emerging networks.

Example Staking Journey

Imagine you decide to stake 1000 ADA on Cardano. You research and pick a reputable stake pool with a 3% commission. Over a year, the network’s base APY is around 5%. Your actual yield might end up near 4.85% after subtracting the pool’s cut. If you diligently redelegate your rewards back into the pool each time they’re distributed, your balance grows faster than with simple interest. Meanwhile, you watch ADA’s price, hoping its fundamental progress and mainstream adoption leads to capital appreciation. If the price rises significantly, your original 1000 ADA plus your newly compounded rewards might yield impressive gains in fiat terms.

Little steps, big potential.

By following these steps—choosing your coin carefully, picking a good platform, evaluating validators, managing risks, and compounding rewards—you can maximize your chances of success. Although no approach guarantees profit in the turbulent crypto markets, staking can be a powerful mechanism for believers in PoS networks who want to earn while they hold.

Harvesting Crypto Staking Rewards: Returns, Risks, Liquid Staking, Taxes, and Pro Tips

What is crypto staking in simple terms?

Staking means locking eligible Proof-of-Stake (PoS) tokens to help validate transactions and secure a network. In exchange, you earn rewards (newly minted tokens and/or a share of fees). You can do this by delegating to a validator, using a staking service, or—if you’re technical—running your own validator.

How are staking rewards calculated (APR vs. APY)?

APR is the headline annual rate without compounding. APY includes compounding—restaking rewards as you earn them—so it’s higher if payouts are frequent. Your realized return also depends on validator commission, network participation (how much is staked overall), inflation, and your compounding cadence.

What’s a realistic yield range?

On major PoS networks, nominal yields often land in the low-to-mid single digits, while smaller or newer chains may advertise double-digit rates with higher risk. Remember: the token’s price movement can dominate outcomes. An 8% APY won’t help if price falls 60%; likewise, a bull run can greatly amplify returns.

What is liquid staking and why do people use it?

Liquid staking lets you stake and receive a tradable “receipt” token (e.g., stETH-like derivatives) that represents your staked position. You keep earning staking rewards while retaining some liquidity to trade, lend, or use in DeFi. Trade-offs include smart-contract risk, depeg/liquidity risk, and added protocol fees.

What are the biggest risks of staking?

Key risks include: price volatility; lockups and unbonding delays; slashing (for validator misbehavior or downtime, which can impact delegates); smart-contract vulnerabilities (in liquid/custodial setups); centralization (power pooling in a few validators/providers); and changing regulations or exchange policies.

How long are lockups and unbonding periods?

It varies by chain—from no explicit lock to days or weeks of unbonding after you click “unstake.” During unbonding you usually stop earning rewards and can’t move tokens. Always check your chain’s current bonding/unbonding rules before committing funds.

How do I choose a good validator or pool?

Look for high uptime, clean slashing history, transparent operations, reasonable commission, and community reputation. Avoid over-concentrated “whales”—supporting mid-sized, reliable validators can improve network decentralization while still earning competitive rewards.

Should I stake on an exchange or self-custody?

Exchanges offer one-click convenience but introduce custodial and policy risks (account freezes, region changes). Self-custody (hardware/software wallets) gives you control but requires more setup and responsibility. Many users start with an exchange, then graduate to self-custody as confidence grows.

How does compounding actually help?

If rewards are paid frequently and you restake them, your base grows and so do future rewards. Over time, APY (with compounding) outpaces APR (no compounding). Some services auto-compound for you; otherwise, schedule manual restakes at sensible intervals to balance effort and gas/fee costs.

What fees should I expect?

Common costs include validator commission (often 0–10% of rewards), network/gas fees for staking, claiming, and restaking, and—if applicable—service fees from staking providers or exchanges. Fees reduce your headline yield; compare net (after-fee) returns.

How are staking rewards taxed?

Rules vary by jurisdiction: rewards may be taxed as income when received, with capital gains/losses when you later sell. Track lot dates, fair market value at receipt, and any fees. Consider using crypto-aware tax software and consult a qualified professional for your location and situation.

Who is staking best suited for?

Long-term holders who believe in a project, can tolerate token volatility, and don’t need immediate liquidity. Technically inclined users might run validators for higher potential returns, while most investors delegate or use liquid staking to balance yield, risk, and convenience.

Conclusion

Staking emerges as a fundamental pillar of the Proof-of-Stake era, offering a blend of passive income, network participation, and—in many cases—governance influence. By locking tokens into a blockchain’s consensus mechanism, you actively strengthen the network’s security and validate transactions, all while earning a share of the newly minted coins or collected fees. But as with all investments in the crypto sphere, staking is not a surefire path to easy money. High returns often come hand in hand with significant risks such as price volatility, lockup requirements, and slashing penalties.

Caution and research go a long way.

Key Takeaways

- Staking Basics:

- PoS blockchains reward validators and delegators for locking tokens and securing the network.

- Staking removes the energy-heavy competition found in PoW, arguably offering a more inclusive and eco-friendly approach to consensus.

- Potential Returns:

- Annual yields can range from a modest 2–3% to well over 20% in certain protocols, with some DeFi ventures advertising triple-digit APYs.

- Compounding rewards can boost total returns, especially if the token’s market value also appreciates.

- Associated Risks:

- Price volatility can overshadow your yield gains if the token’s value collapses.

- Lockup periods limit liquidity, potentially causing missed opportunities or hindering timely exits.

- Slashing penalizes misbehaving or offline validators, meaning your staked funds might be partially confiscated.

- Centralization and regulatory issues loom large, requiring ongoing vigilance.

- Implementation Strategy:

- Choose coins with robust fundamentals, realistic APYs, and stable communities.

- Decide on whether to stake via exchanges, self-custodial wallets, or by running a node yourself.

- Evaluate validators carefully, looking at fees, performance, and reputation.

- Monitor your progress, reinvest rewards if desired, and remain alert to changing network conditions.

Who Should Stake?

- Long-Term Believers: If you firmly trust in a project’s vision and want to hold its tokens for months or years, staking can deliver returns on your idle holdings.

- Risk-Tolerant Investors: You must handle the emotional swings of crypto pricing and accept that a bear market can wipe out nominal staking gains.

- Technically Inclined Users: Running a validator node can yield higher returns but demands knowledge of node operations, security, and potential slashing risks.

- Those Comfortable with Lockups: If you can afford to set aside tokens for a while and are not reliant on immediate liquidity, you’ll be better suited to staking’s constraints.

Staking Versus Other Crypto Strategies

Staking is not an isolated phenomenon in the crypto ecosystem—many alternative strategies exist, each with distinct pros and cons:

- Trading: Requires active management and a high level of market analysis, with no guaranteed income if the market moves against your positions.

- Lending: Platforms like Aave or Compound let you earn interest by lending your tokens to borrowers, sometimes at rates similar to or above staking yields.

- Yield Farming: More complex DeFi protocols might offer liquidity mining incentives, but these can be ephemeral and highly risky, with impermanent loss and contract vulnerabilities.

- Mining (PoW): Still an option for networks like Bitcoin, but typically demands specialized hardware, significant energy costs, and more operational complexity.

Staking’s advantage often resides in its relative simplicity—once set up, you can passively collect rewards, although the wise staker will periodically evaluate whether the chosen validators and networks remain optimal.

There’s no single right approach for everyone.

A Final Word on Balancing Risk and Reward

Cryptocurrency is a rapidly transforming industry, frequently generating hype and speculation. Staking can mitigate some anxieties by letting you harness the intrinsic mechanisms of PoS blockchains for yield, but it doesn’t eliminate the overarching threat of price downturns or network-level issues. Hence, prudent risk management is paramount. Diversify across different validators, keep an eye on slashing rules, stay updated on regulatory guidelines, and maintain enough liquid capital outside your staked positions for emergency needs or new opportunities.

Knowledge is the best hedge.

If you decide that staking aligns with your goals—be it earning passive income, endorsing your favorite network, or positioning yourself for long-term appreciation—consider starting small. This is especially true if you’re new to PoS or the concept of locking tokens. With time, experience, and ongoing research, you can refine your staking strategy, compounding your gains and expanding your role in the vibrant world of blockchain. Good luck, and may your staking rewards flourish!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.