I’ll just go ahead and say it.

Managed Futures is my favourite asset allocation strategy.

Nothing, in my opinion, diversifies a portfolio more and provides a better partner in crime alongside equities than managed futures.

And shockingly there are few options for investors to consider in the ETF marketplace.

Enter the room CTA ETF.

It’s better known as Simplify Managed Futures ETF.

It’s made quite the splash since its debut!

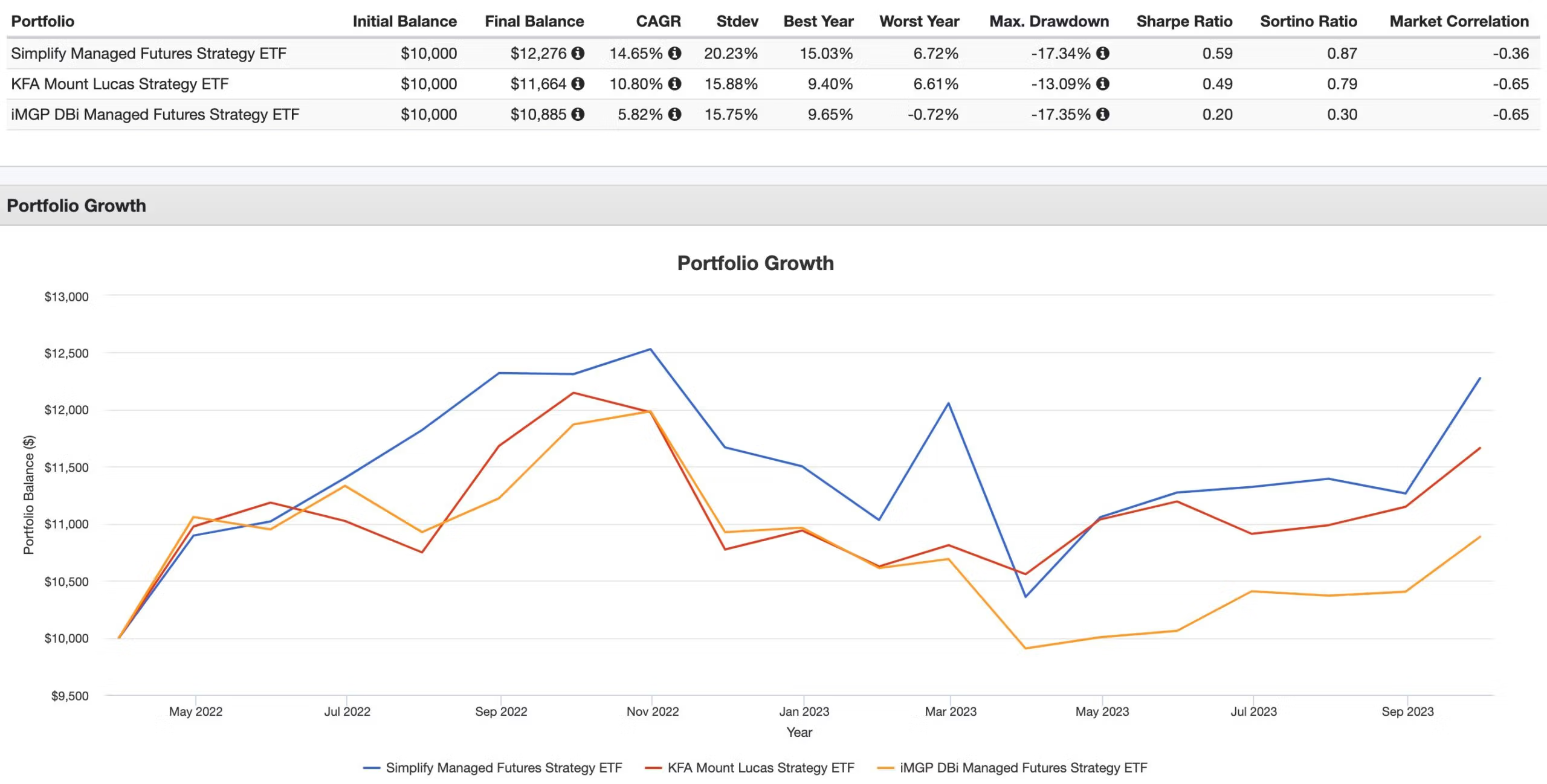

Not only has it outperformed its benchmark but it has also outpaced its peers.

That’s mighty impressive!

And today we’re joined by Larry Kim of Simplify to find out more about the fund.

Without further ado, let’s turn things over to Larry!

Meet Larry Kim of Simplify

Larry works with financial advisors and institutional investors on understanding the Simplify product lineup, with a special emphasis on creating written and video content. Previously, he was a senior consultant at Fidelity Institutional, where he advised large banks and insurance companies on how to set up and optimize their managed account programs. He also held roles in mutual fund product management and development as well as financial planning.

Larry has an MBA from the Leonard N. Stern School of Business at New York University and a bachelor’s degree from Oberlin College.

Reviewing The Strategy Behind CTA ETF (Simplify Managed Futures ETF)

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of CTA ETF?

For those who aren’t necessarily familiar with a “‘managed futures” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Managed Futures is a category of investment strategies that generally involve going long (or short) a basket of asset classes such as equities, interest rates, commodities and or currencies. Futures contracts are used as the underlying instruments. Trend following (or momentum) is the most commonly used investing strategy, with funds going long assets that are trending upwards and shorting assets that are trending downwards.

The investing case for managed futures is portfolio diversification. Most traditional portfolios invest in stocks and bonds. The idea is that bonds offer diversification from stocks and should provide a buffer against stock market volatility and drawdowns. However, as we saw in 2022, stocks and bonds are sometimes positively correlated. Managed futures have historically had little to no correlation with either stocks or bonds. They would have added significant value during periods of serious stock market drawdowns.

Unique Features Of Simplify Managed Futures Fund CTA ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Is it active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

Simplify Managed Futures Strategy ETF (CTA) offers exposure to interest rates and commodity futures. Specifically, it can take positions in 15 different futures contracts across US and Canadian interest rates, precious metals, industrial metals, energy or agriculture.

It’s managed systematically, using an algorithmic model developed by our research partner Altis Partners, a leading commodity trend advisor with more than 20 years in the space.

Positions are dynamically adjusted according to a daily trading signal. The signal can trigger a long or short position in an asset.

Like all strategies that invest in futures contracts, there is a degree of leverage involved, but it is limited to the fund’s regulatory requirements.

Signals generated by the algorithm are traded systematically. They are executed by Simplify’s portfolio managers regardless of their personal opinions on any particular asset.

Fund expenses are 0.75%. Lastly, it’s structured as a 1940 Act fund, so investors receive a 1099 tax form instead of a K-1.

What Sets CTA ETF Apart From Other Alternative Funds?

How does your fund set itself apart from other “managed futures” funds being offered in the ETF marketplace? What makes it unique?

The Simplify Managed Futures Strategy ETF (CTA) has several unique features.

First, it only takes positions in interest rate and commodity futures – excluding equities and currencies. According to our research, trend following strategies exhibit higher risk adjusted returns when applied to interest rate and commodity futures than they do with equities and currencies.

Furthermore, by excluding equities, correlations are kept as low as possible, adding to its diversification value.

Next, unlike most managed futures strategies that exclusively rely on trend following, Simplify adds a “fundamental reversion” factor to reduce risk. A very strong trend signal would indicate going long/short an asset in a big way. This can expose the fund to significant risk in the case of a sharp reversal, which is all too common with commodities futures. If a sharp trend moves an asset price well beyond what its indicated fair value price (using fundamental indicators) should be, the fundamental reversion indicator will take some of the risk off a trade.

Lastly, most managed futures funds rebalance weekly. That is, they use their signals to adjust their positions once per week. Simplify is one of the few – if not the only – managed futures ETF that incorporates daily rebalancing, which may enable it to enter/exit positions at a more advantageous point.

source: Simplify Asset Management on YouTube

What Else Was Considered For CTA ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

When deciding on the potential universe of futures contracts to take positions in, we were faced with hundreds of possible choices. Ultimately, we decided to limit the investment universe to a carefully curated set of 15 contracts. The contracts were selected with the goals of having an adequate representation across interest rates and commodities while also making it as easy as possible for market makers to trade, which adds to the fund’s liquidity.

When Will CTA ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

Like all trend following strategies, CTA will perform the best when there are significant market trends in place, either up trends or downtrends. It will tend to struggle the most in a trendless, choppy market environment.

Why Should Investors Consider Simplify Managed Futures Fund CTA ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

In 2022, the 60/40 portfolio had its worst year in over 50 years, as both stocks and bonds exhibited double digit negative returns.

Managed futures, on the other hand, exhibited one of its best years as an asset class.

A portfolio containing only stocks and bonds is like a two-legged stool – not particularly stable. Adding managed futures to a portfolio adds a third leg to the stool, making it much more stable.

There are three reasons managed futures are such an effective diversifier:

- They add an additional asset class – particularly commodities – that most investors are not exposed to.

- They add the ability to go both long and short, which adds diversification to portfolios which are traditionally long-only.

- They add a different return driver – trend following – which is typically not present in most portfolios.

How Does CTA ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

When you add managed futures to a portfolio of stocks and bonds, a 50% allocation to manage futures has maximized returns, while a 40% allocation has maximized risk adjusted returns. If an investor’s goal was to optimize a portfolio, a 40-50% allocation is reasonable.

However, many investors – particularly investment professionals – have other goals beyond portfolio optimization. They must also be cognizant of tracking error, as excessive tracking error to traditional benchmarks can introduce business risk. In other words, it’s safer to be with the crowd. For these investors, a 10-20% allocation would still add to returns and reduce volatility while maintaining an acceptable level of tracking error.

The Cons of CTA ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

One debate in the managed futures world is whether it’s better to invest in a single manager strategy or to invest in a “replication” strategy, which attempts to reverse-engineer and replicate the returns of the total managed futures marketplace.

While replication can have its place, it does have a few weaknesses. First, replication itself is not easy, with many different strategies that could potentially be applied. There’s no guarantee that any particular strategy can successfully represent the benchmark. Secondly, replication can be a very slow moving strategy, with replication funds taking positions weeks after underlying funds have moved. CTA, on the other hand, can process new signals on a daily basis.

The Pros of CTA ETF

On the other hand, what have others praised about your fund?

CTA, launched in March 2022, has gotten off to a great start, significantly outperforming its benchmark since launch.

source: Simplify Asset Management on YouTube

Learn More About CTA ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

As we discussed previously, managed futures perform best in trending markets. But another environment where they are expected to perform well is during inflationary markets. That’s because they usually are accompanied by significant trend opportunities in commodities (up or down).

At Simplify, we continue to focus on bringing institutional-quality alternative strategies to all investors in the convenient ETF format. In today’s environment of high equity valuations, potential for recession, and interest rate volatility, we believe it’s smart to focus on alternative sources of returns and income.

To learn more about Simplify or to speak with a Simplify representative, please go to simplify.us. You can also follow us on YouTube at https://www.youtube.com/@SimplifyAssetManagement

CTA ETF: The Strategy Behind Simplify Managed Futures Strategy ETF — 12-Question FAQ

1) What is CTA and what’s the goal?

CTA (Simplify Managed Futures Strategy ETF) seeks absolute, diversifying returns by going long/short liquid futures, aiming to zig when traditional stock/bond portfolios zag and improve total-portfolio risk/return.

2) What are “managed futures,” and how does CTA implement them?

Managed futures go long assets in uptrends and short assets in downtrends using futures across major asset classes. CTA applies a systematic trend approach to rates and commodities to capture persistent moves and provide low correlation to stocks/bonds.

3) What’s in the investable universe?

CTA can trade up to 15 liquid futures across U.S./Canadian interest rates and commodities (precious/industrial metals, energy, agriculture). The universe is curated for breadth + tradability to support liquidity and efficient execution.

4) How are positions chosen and sized?

Signals are generated by an algorithmic model (Altis Partners). Daily signals dictate long or short and size positions; the portfolio dynamically adjusts as trends emerge, persist, or reverse.

5) Is there leverage? What’s the fund structure and fee?

Futures embed modest, regulated leverage; portfolio risk is controlled by the model and fund guidelines. CTA is a ’40 Act ETF (investors receive a 1099, not a K-1) with a 0.75% expense ratio.

6) What makes CTA different from other managed futures ETFs?

Focus: Rates + commodities only (excludes equities/currencies) to maximize diversification vs. traditional portfolios.

Risk control: Adds a fundamental reversion overlay to dial back extreme trend exposure when prices detach from fair-value indicators.

Cadence: Daily rebalancing (many peers adjust weekly), potentially improving responsiveness to changing trends.

7) Why limit the contract set to 15?

A targeted set balances broad macro coverage with market-making ease, liquidity, and slippage control—key for an ETF wrapper—while avoiding dilution from thin or redundant markets.

8) When should CTA perform best—and struggle?

Best: Strong, persistent up or down trends in rates/commodities (e.g., inflation shocks, policy shifts, supply/demand dislocations).

Challenging: Choppy, range-bound regimes with frequent whipsaws that can erode trend profits.

9) Why consider managed futures alongside a 60/40?

2022 highlighted that stocks and bonds can fall together. Managed futures add:

Another asset set (notably commodities),

Shorting ability, and

A different return driver (trend)—all of which historically reduced drawdowns and smoothed portfolio paths.

10) How might investors use CTA in a portfolio?

Optimization frame: Studies often show ~40–50% managed-futures weight can maximize risk-adjusted profile in simple stock/bond mixes.

Practical frame (tracking error aware): ~10–20% can lower volatility and drawdowns with more benchmark familiarity.

11) What’s a common critique—and the response?

Critique: Why not use a replication ETF of the managed-futures “beta”?

Response: Replication can lag real strategies and miss turning points. CTA’s daily, rules-based implementation and overlay risk controls are designed for timelier adjustments and strategy purity.

12) What do supporters praise?

CTA’s rules-based design, focus on true diversifiers, daily responsiveness, 1099 tax simplicity, and early performance versus peers/benchmark since its 2022 launch have all drawn favorable attention.

Connect With Simplify ETFs

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: CTA ETF

Nomadic Samuel Final Thoughts

I want to personally thank Larry Kim at Simplify for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Blndx far superior…