Shining the spotlight upon newly minted and unique ETF strategies is what Picture Perfect Portfolios is all about.

You’ll find vanilla elsewhere.

Here we’re about delving a bit deeper to unpack the strategy behind interesting new funds.

With that in mind, we’re thrilled to welcome back Wes Gray to discuss the BOXX ETF.

It’s better known as Alpha Architect 1-3 Month Box ETF.

Without further ado, let’s turn things over to Wes to find out more!

Reviewing The Strategy Behind BOXX ETF (Alpha Architect 1-3 Month Box ETF)

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

Meet Wes Gray of Alpha Architect

After serving as a Captain in the United States Marine Corps, Dr. Gray earned an MBA and a PhD in finance from the University of Chicago where he studied under Nobel Prize Winner Eugene Fama. Next, Wes took an academic job in his wife’s hometown of Philadelphia and worked as a finance professor at Drexel University.

Dr. Gray’s interest in bridging the research gap between academia and industry led him to found Alpha Architect, an asset management firm dedicated to an impact mission of empowering investors through education. He is a contributor to multiple industry publications and regularly speaks to professional investor groups across the country.

Wes has published multiple academic papers and four books, including Embedded (Naval Institute Press, 2009), Quantitative Value (Wiley, 2012), DIY Financial Advisor (Wiley, 2015), and Quantitative Momentum (Wiley, 2016). Dr. Gray currently resides in Palmas Del Mar Puerto Rico with his wife and three children.

What’s The Strategy Of BOXX ETF?

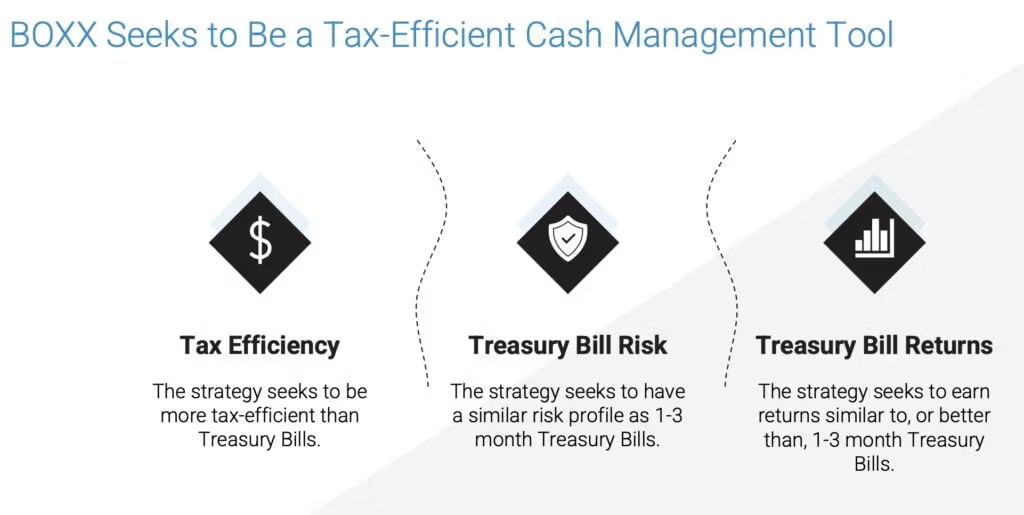

For those who aren’t necessarily familiar with a “tax efficient cash management tool” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Cash management tools are generally referring to assets that have very low duration and very low risk and very low returns. We are talking about cash, CDs, money markets, treasury bills, and so forth. And in this instance, we are also including the more esoteric “box spread” in this category.

The tax-efficiency aspect is something we always think about as tax-sensitive investors, however, we can only operate within the law, like everyone else. That said, the ETF structure has some unique features that, we believe, allows us to be relatively tax-efficient in the delivery of the risk/return tied to box spread transactions.

Unique Features Of Alpha Architect 1-3 Month Box Fund BOXX ETF

Let’s go over all the unique features your fund offers so investors can better understand it.

What key exposure does it offer?

Is it static or dynamic in nature?

Is it active or passive?

Is it leveraged or not?

Is it a rules-based strategy or does it involve some discretionary inputs?

How about its fee structure?

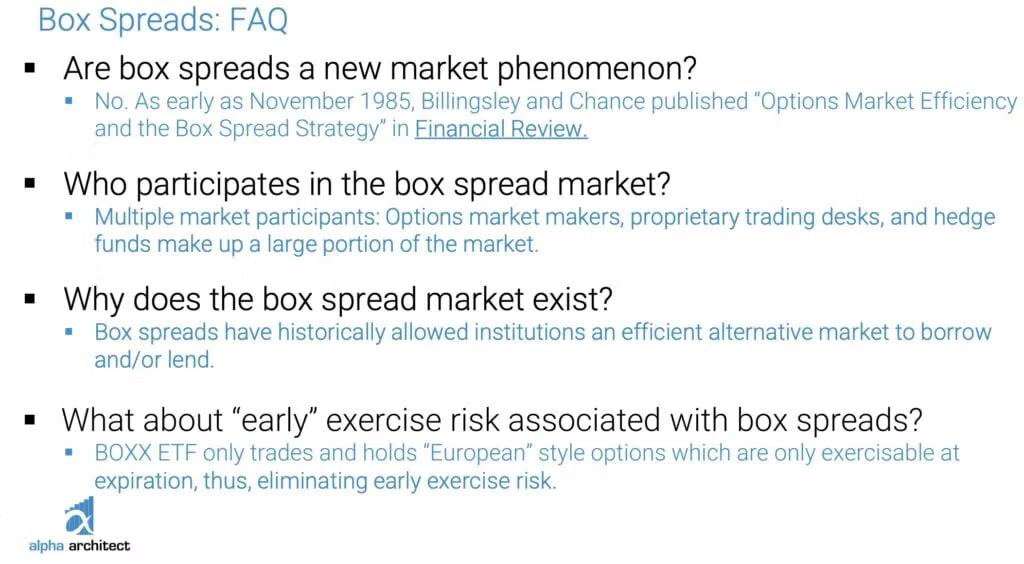

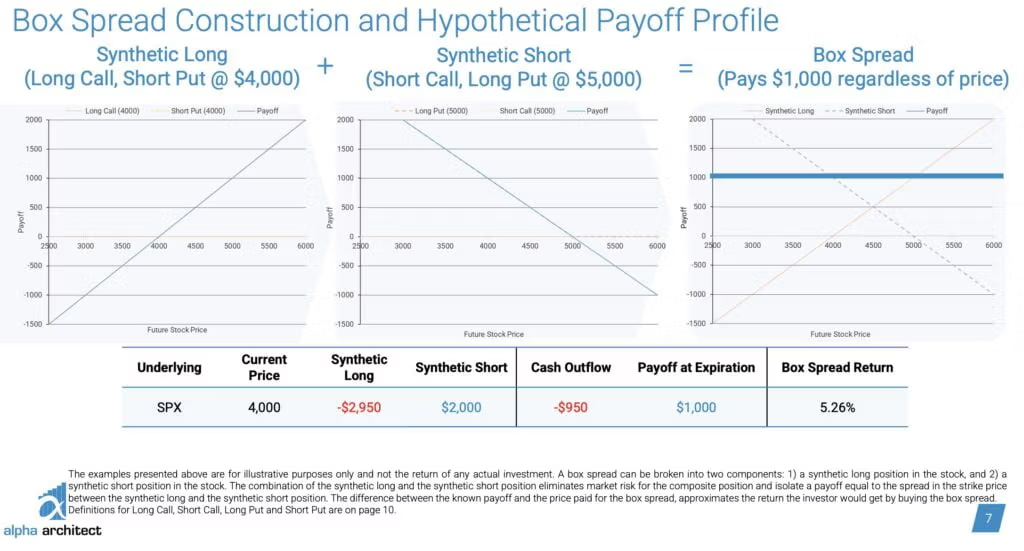

We focus on delivering the return on 1-3 month box spreads. A box spread is a 4 leg option strategy that is designed to synthesize the funding rates from option markets. In general, the risk on these trades is similar to treasury bills, and the returns are also similar. A detailed explanation of box spreads is available here https://alphaarchitect.com/2023/05/box-spreads-an-alternative-to-treasury-bills/

To our knowledge, box spread exposure has never been delivered via a 40-Act mutual fund or ETF. So this strategy is certainly innovative and unique, almost by definition. Our partners in this product, Arin Risk Advisors, have been trading and operating in option markets for 20+ years. They bring a unique trading and execution expertise that is incredibly difficult for other operators to replicate.

BOXX ETF from Wesley Gray on Vimeo.

What Sets BOXX ETF Apart From Other Short-Term Fixed Income Funds?

How does your fund set itself apart from other “short-term fixed income, money market or brokerage account products” being offered in what is already a crowded marketplace?

What makes it unique?

The key difference is in how the returns are sourced. Most limited credit risk fixed income boils down to treasury bills, which relies on the US government not defaulting and them paying their debts. Box spread returns are backed by OCC, which has its own credit risk policy, but their situation is different than the US government. One key example is that OCC is generally not subject to the politics of ‘debt ceilings’ that can cause risk in the treasury bill market.

The other difference is that box spreads have historically earned slightly higher returns than equivalent duration treasury bills. So there is an opportunity, over time, to earn higher returns on box spreads versus treasury bills. There is a recent paper on this topic via https://www.sciencedirect.com/science/article/abs/pii/S0304405X21002786

What Else Was Considered For BOXX ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board?

What made you decide not to include it?

We spent a lot of time developing this product – 5 yrs+ in fact. But the overall interest rate environment was terrible and short rates were often 50bps or less. This meant that nobody really cared about cash management. However, now that cash rates are 4-5%+, cash management became an important topic and we thought that BOXX would be a unique offering that was highly differentiated from all of the treasury bill products on the market.

When Will BOXX ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests.

What types of market conditions or other scenarios are most favourable for this particular strategy?

On the other hand, when can investors expect this strategy to potentially struggle?

I would refer you to the recently published paper on this topic, which is independent of our organization. https://www.sciencedirect.com/science/article/abs/pii/S0304405X21002786

The chart below outlines the SPX box spread rate against equivalent treasury bills/bonds over time. In general, the blue line is above the red line throughout history.

Why Should Investors Consider Alpha Architect 1-3 Month Box Fund BOXX ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

BOXX is not meant to make you rich. This is a cash and cash equivalent holding that is meant to deliver treasury bill type risk and treasury bill type returns. So investors would use this for strategic or tactical cash positions. And perhaps there are retirees and others who live on fixed income where there could be a place for something like BOXX.

How Does BOXX ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large.

Is it meant to be a total portfolio solution, core holding or satellite diversifier?

What are some best case usage scenarios ranging from high to low conviction allocations?

Same as above, this is a cash and cash equivalent vehicle. The one interesting, but complicated aspect of BOXX, is the taxation. But we recommend you consult your tax advisor and/or reach out to us with specific questions on how this works since it is beyond the scope of this discussion.

The Cons of BOXX ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

Primarily that the box spread concept is complex and nobody has ever heard of it. In short, outside of option market makers and proprietary trading professionals, “box spread” is essentially a foreign language.

The Pros of BOXX ETF

On the other hand, what have others praised about your fund?

The innovative qualities and the fact that we were savvy enough to figure out how to deliver box spread exposure via an ETF wrapper.

BOXX ETF — 12 Essential FAQs on the Alpha Architect 1–3 Month Box ETF (with Wes Gray)

What is BOXX ETF in a nutshell?

BOXX (Alpha Architect 1–3 Month Box ETF) is a tax-efficient cash management ETF that seeks to deliver T-bill-like risk and returns through short-term box spreads, an option-based strategy that synthesizes funding rates in the options market.

What is the core investment strategy behind BOXX?

The fund invests in 1–3 month box spreads, a four-legged options structure that replicates the payoff of a short-term loan. The goal is to harvest box spread yields—which historically track or slightly exceed Treasury bill yields—within a tax-efficient ETF wrapper.

How do box spreads work in this context?

A box spread involves simultaneously entering into a bull call spread and a bear put spread with the same strikes and expiration. The net effect is a fixed, bond-like payoff equal to the strike spread, creating synthetic short-term funding exposure with low credit and duration risk.

What makes this ETF tax efficient?

The ETF structure allows in-kind creations and redemptions, minimizing taxable distributions. Additionally, box spread income may avoid the ordinary income treatment typically associated with direct Treasury holdings, depending on individual circumstances (consult a tax advisor).

How is BOXX different from money market funds or T-bill ETFs?

Instead of lending to the U.S. Treasury, BOXX’s returns come from option market funding rates cleared through the OCC, which is not subject to debt-ceiling politics. Historically, box spreads have earned slightly higher yields than equivalent-duration T-bills.

Is the strategy active or passive? Leveraged or unleveraged?

BOXX is rules-based and unleveraged from a risk standpoint. It focuses on 1–3 month box spreads, rolling them systematically. The strategy is neither discretionary trading nor attempting to forecast markets.

When might BOXX perform best?

In normal or rising short-rate environments where box spreads trade efficiently and yields remain stable or above T-bill equivalents, BOXX can offer competitive or slightly enhanced yields relative to Treasury bills.

When might BOXX underperform or face challenges?

If box spread rates compress below T-bill yields due to structural changes in options markets, or if execution costs increase, the ETF could lag traditional cash equivalents. Unexpected OCC counterparty issues could also affect relative performance, though this is historically rare.

Who typically uses BOXX in a portfolio?

BOXX is designed as a cash or cash-equivalent sleeve for strategic or tactical allocations. It’s particularly relevant for tax-sensitive investors, retirees, or advisors managing fixed-income buckets who want T-bill-like characteristics in ETF form.

How does BOXX fit in with traditional fixed income or alternatives?

It doesn’t replace core bonds or equities—it fills the cash management role. Investors might use BOXX instead of a T-bill ETF, money market fund, or brokerage sweep to potentially gain incrementally higher after-tax yields.

What are the main pros and cons allocators have noted?

Pros: Innovative structure; potential yield pickup vs T-bills; ETF tax efficiency; no debt ceiling drama.

Cons: Complexity—box spreads are unfamiliar to most investors; education required; still relatively new and untested at scale in ETF format.

Is BOXX meant to “beat the market”?

No. BOXX isn’t designed for growth—it’s meant to store capital efficiently, like a smart T-bill alternative. Think of it as a cash sleeve with potential incremental return and ETF tax advantages, not a return-seeking risk asset.

Connect With Alpha Architect

Thanks so much for taking part in the “The Strategy Behind The Fund” series! How can others connect with you on social media and other platforms that you run?

Twitter: Twitter.com/alphaarchitect

Advisor Site: https://advisors.alphaarchitect.com/

ETF Site: https://etfsite.alphaarchitect.com/boxx/

Video: https://vimeo.com/816987988

Nomadic Samuel Final Thoughts

I want to personally thank Wes Gray for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.