Investing wisely isn’t just about picking the right stocks or timing the market perfectly—it’s about adopting a disciplined approach, understanding fundamental principles, and making informed decisions based on intrinsic value. Benjamin Graham, often hailed as the father of value investing, has left an indelible mark on the world of finance with his timeless investment philosophies. In this comprehensive guide, we’ll delve into Benjamin Graham’s investment principles as outlined in his seminal work, The Intelligent Investor, and explore how you can apply his strategies to build a robust and resilient investment portfolio.

source: The Swedish Investor on YouTube

Benjamin Graham: The Father of Value Investing

Benjamin Graham is a towering figure in the investment world, renowned for his profound impact on value investing—a strategy focused on identifying undervalued securities and minimizing risk. As a mentor to legendary investors like Warren Buffett, Graham’s teachings have shaped the investment philosophies of countless professionals and amateurs alike. His emphasis on thorough analysis, intrinsic value, and margin of safety remains as relevant today as it was decades ago.

We’ll explore Benjamin Graham’s investment principles as outlined in The Intelligent Investor. Whether you’re a novice investor seeking foundational knowledge or a seasoned trader looking to refine your strategies, understanding Graham’s methodologies can provide valuable insights. We’ll break down his core principles, examine his approach to intrinsic value and risk management, and offer practical steps to help you emulate his disciplined and value-oriented investing style.

source: The Swedish Investor on YouTube

Graham’s Focus on Value, Safety, and Disciplined Investing

At the heart of Graham’s philosophy lies the pursuit of value and safety. He advocates for investing in securities that are priced below their intrinsic value, providing a margin of safety against potential losses. This approach encourages patience, thorough research, and emotional discipline—qualities that are essential for long-term investment success.

The Concept of Intrinsic Value

Intrinsic Value Explained

Intrinsic value is the true, inherent worth of a company or asset, based on fundamental analysis without reference to its market value. Graham emphasized that investors should calculate the intrinsic value of a stock to determine whether it is undervalued or overvalued.

How Graham Calculated Intrinsic Value:

Graham used various methods to estimate intrinsic value, including discounted cash flow (DCF) analysis, asset-based valuation, and earnings multiples. He advocated for a conservative approach, ensuring that intrinsic value calculations accounted for potential uncertainties and risks.

Example:

If a company’s intrinsic value is calculated at $100 per share but the market price is $70, Graham would consider it undervalued and a potential investment opportunity.

Tip: Regularly assess the intrinsic value of your investments using fundamental analysis to identify undervalued opportunities and avoid overpaying for stocks.

Margin of Safety

Margin of Safety Defined:

The margin of safety is the difference between a stock’s intrinsic value and its market price. Graham believed that purchasing securities with a significant margin of safety reduces the risk of loss and provides a buffer against market volatility.

Importance of the Margin of Safety:

A sufficient margin of safety ensures that even if the intrinsic value is overestimated, the investment remains protected. This principle is crucial for capital preservation and minimizing downside risk.

Application:

When evaluating a stock, aim to purchase it at a price significantly below your calculated intrinsic value. For instance, if a stock’s intrinsic value is $100, consider buying it at $70 or lower to ensure a margin of safety.

Tip: Incorporate a margin of safety in all investment decisions to protect against unforeseen market downturns and errors in valuation.

Application: Estimating Intrinsic Value and Applying Margin of Safety

To estimate intrinsic value, investors can employ several approaches:

- Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them back to their present value using a discount rate, typically the cost of capital.

- Asset-Based Valuation: Calculates intrinsic value based on the company’s net asset value (total assets minus total liabilities).

- Earnings Multiples: Uses metrics like the P/E ratio to estimate value relative to earnings.

Once intrinsic value is determined, the margin of safety is applied by purchasing the stock at a significant discount. This strategy not only safeguards the investment but also enhances the potential for returns.

Example:

Imagine a company with an estimated intrinsic value of $120 per share. Graham would advise buying the stock at $80-$90 per share, providing a substantial margin of safety and protecting the investor from potential miscalculations or unforeseen market downturns.

Tip: Utilize multiple methods to estimate intrinsic value, ensuring a well-rounded and accurate assessment before making investment decisions.

Defensive vs. Enterprising Investor

Benjamin Graham categorized investors into two distinct types: the defensive (or passive) investor and the enterprising (or active) investor. Understanding which category you fall into helps tailor your investment strategy accordingly.

Defensive Investor

Characteristics of a Defensive Investor:

- Safety and Stability: Prioritizes capital preservation over high returns.

- Passive Approach: Prefers a hands-off investment strategy with minimal active management.

- Simplified Portfolio: Focuses on a limited number of investments, often in well-established, blue-chip companies and high-grade bonds.

- Minimal Research: Relies on simple analysis and trusted investment frameworks rather than extensive research.

Strategies:

- Invest in Diversified Mutual Funds or Index Funds: These provide broad market exposure and reduce the need for individual stock selection.

- Focus on Dividend-Paying Stocks: These provide regular income and tend to be less volatile.

- Maintain a Balanced Portfolio: A mix of stocks and bonds to balance risk and reward.

Example:

A defensive investor might allocate 60% of their portfolio to high-quality bonds and 40% to dividend-paying, blue-chip stocks, ensuring a balance between safety and modest growth.

Enterprising Investor

Traits of an Enterprising Investor:

- Willingness to Take on More Risk: Seeks higher returns through more aggressive investment strategies.

- Active Management: Involves regular portfolio adjustments and active stock selection.

- Extensive Research: Invests significant time and resources into analyzing potential investments.

- Higher Diversification: May hold a larger number of stocks to spread risk and capitalize on various opportunities.

Strategies:

- Value Investing: Focuses on purchasing undervalued stocks with strong fundamentals.

- Special Situations Investing: Seeks out unique investment opportunities like mergers, spin-offs, or distressed assets.

- Growth Investing: Targets companies with strong growth potential, even if they appear overvalued on traditional metrics.

Example:

An enterprising investor might actively research and invest in small-cap companies with solid fundamentals but undervalued stock prices, aiming to capitalize on their growth as the market recognizes their true value.

Choosing Your Path

Determining whether you are a defensive or enterprising investor depends on your risk tolerance, investment goals, and the amount of time and effort you are willing to dedicate to managing your portfolio.

Steps to Determine Your Investor Profile:

- Assess Your Risk Tolerance: Understand how much risk you are comfortable taking and how you react to market volatility.

- Define Your Investment Goals: Clarify whether you are seeking capital preservation, steady income, or significant growth.

- Evaluate Your Time Commitment: Determine how much time you can devote to researching and managing your investments.

- Align Your Strategy: Choose an investment approach that aligns with your risk tolerance, goals, and time commitment.

Tip: Regularly revisit your investor profile to ensure your investment strategy remains aligned with your evolving financial goals and risk tolerance.

The Importance of Diversification

Diversification Basics

Diversification is a fundamental principle in Benjamin Graham’s investment philosophy. It involves spreading investments across different asset classes, sectors, and geographies to reduce risk and enhance portfolio stability.

Why Graham Emphasized Diversification:

- Risk Reduction: By diversifying, investors minimize the impact of poor performance in any single investment on their overall portfolio.

- Enhanced Returns: Diversification allows investors to capitalize on opportunities across various sectors and markets, potentially boosting overall returns.

- Volatility Management: A diversified portfolio tends to be less volatile, providing a smoother investment experience and reducing the emotional stress associated with market fluctuations.

Building a Diversified Portfolio

Steps to Create a Diversified Portfolio:

- Spread Across Asset Classes:

- Stocks: Invest in different types of stocks, including large-cap, mid-cap, and small-cap companies across various industries.

- Bonds: Allocate a portion to government and corporate bonds to provide stability and income.

- Alternative Investments: Consider including real estate, commodities, or mutual funds for additional diversification.

- Diversify Within Asset Classes:

- Sectors: Ensure your stock investments cover multiple sectors such as technology, healthcare, finance, and consumer goods.

- Geographies: Invest in both domestic and international markets to spread risk across different economies and political environments.

- Include Defensive and Cyclical Stocks:

- Defensive Stocks: These are less sensitive to economic cycles, providing stability during downturns.

- Cyclical Stocks: These tend to perform well during economic expansions, offering growth opportunities.

- Rebalance Regularly:

- Periodically review and adjust your portfolio to maintain your desired asset allocation, ensuring it remains diversified and aligned with your investment goals.

Example:

A well-diversified portfolio might include 40% large-cap stocks, 20% mid-cap stocks, 10% small-cap stocks, 20% bonds, and 10% alternative investments. This mix provides exposure to various growth opportunities while mitigating risk through bond investments and alternative assets.

Example: How Graham’s Diversification Strategies Protected Investors During Market Downturns

During market downturns, diversified portfolios tend to fare better as losses in one asset class can be offset by gains or stability in others. For instance, during the 2008 financial crisis, a diversified portfolio with a mix of stocks, bonds, and real estate would likely have experienced less severe losses compared to a portfolio concentrated solely in stocks.

Case Study:

Imagine an investor with a diversified portfolio consisting of 50% large-cap stocks, 30% bonds, and 20% real estate. During a market downturn, while the stock portion may decline by 20%, the bond portion might remain stable or even gain, and real estate could experience smaller losses or steady income. This diversification cushions the overall portfolio against significant losses, preserving capital and providing opportunities for recovery when the market stabilizes.

Tip: Ensure your portfolio includes a mix of asset classes and sectors to protect against market volatility and reduce the risk of significant losses during downturns.

The Role of Fundamental Analysis

Fundamental Analysis Overview

Fundamental analysis is a cornerstone of Benjamin Graham’s investment philosophy. It involves evaluating a company’s financial health, performance, and intrinsic value based on economic and financial factors. Graham used fundamental analysis to identify undervalued stocks with strong potential for long-term growth.

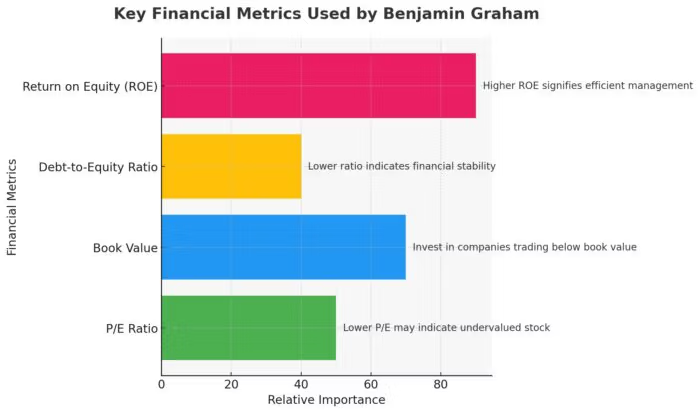

Key Financial Metrics Used by Graham:

- Price-to-Earnings (P/E) Ratio: Measures a company’s current share price relative to its earnings per share. A lower P/E ratio may indicate an undervalued stock.

- Book Value: Represents the net asset value of a company, calculated by subtracting liabilities from assets. Investing in companies trading below their book value is a core tenet of value investing.

- Debt-to-Equity Ratio: Assesses a company’s financial leverage by comparing its total liabilities to shareholder equity. A lower ratio indicates a more financially stable company.

- Return on Equity (ROE): Indicates how effectively a company uses shareholders‘ equity to generate profits. Higher ROE signifies efficient management and strong financial performance.

Analyzing Financial Statements

Income Statements:

The income statement provides a summary of a company’s revenues, expenses, and profits over a specific period. Key components include:

- Revenue: Total income generated from sales or services.

- Net Income: Profit after all expenses, taxes, and costs have been deducted from revenue.

- Earnings Per Share (EPS): Net income divided by the number of outstanding shares, indicating profitability on a per-share basis.

Balance Sheets:

The balance sheet offers a snapshot of a company’s financial position at a specific point in time. It includes:

- Assets: Resources owned by the company, such as cash, inventory, and property.

- Liabilities: Obligations the company owes to creditors, including loans and accounts payable.

- Shareholder Equity: The residual interest in the assets of the company after deducting liabilities.

Cash Flow Statements:

The cash flow statement tracks the flow of cash in and out of the company. It is divided into three sections:

- Operating Activities: Cash generated from core business operations.

- Investing Activities: Cash used for or generated from investments in assets.

- Financing Activities: Cash received from or paid to investors and creditors, including dividends and debt repayments.

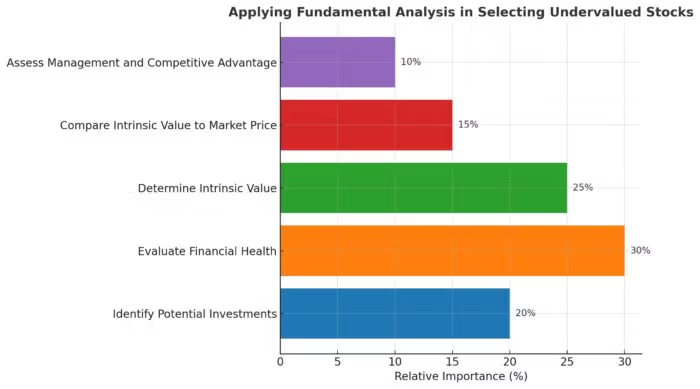

Application: How to Apply Fundamental Analysis in Selecting Undervalued Stocks

To apply fundamental analysis, investors can follow these steps:

- Identify Potential Investments:

- Screen for companies with strong financial metrics, such as low P/E ratios, high ROE, and low debt-to-equity ratios.

- Evaluate Financial Health:

- Analyze the income statement, balance sheet, and cash flow statement to assess the company’s profitability, financial stability, and cash-generating ability.

- Determine Intrinsic Value:

- Use valuation methods like DCF analysis or asset-based valuation to estimate the intrinsic value of the stock.

- Compare Intrinsic Value to Market Price:

- Identify stocks trading below their intrinsic value, offering a margin of safety.

- Assess Management and Competitive Advantage:

- Evaluate the quality of the company’s management team and its competitive position within the industry.

Example:

Suppose you identify a company with a P/E ratio of 10, a book value per share of $50, and an ROE of 15%. After conducting a DCF analysis, you estimate the intrinsic value of the stock at $80 per share. If the current market price is $60 per share, the stock is undervalued by $20, providing a margin of safety and a potential investment opportunity.

Tip: Regularly conduct fundamental analysis on potential investments to ensure they meet your criteria for value, safety, and long-term growth potential.

Mr. Market: Understanding Market Fluctuations

Mr. Market Concept

Benjamin Graham introduced the concept of “Mr. Market” as a metaphor to explain the irrational behavior of the stock market. Mr. Market is an imaginary business partner who offers to buy or sell his share of the business at different prices every day. Sometimes, Mr. Market is overly optimistic, setting high prices, while other times he is overly pessimistic, setting low prices.

Significance in Investment Decisions:

The Mr. Market analogy highlights the importance of not letting market fluctuations dictate your investment decisions. Instead, investors should focus on the intrinsic value of their investments and take advantage of Mr. Market’s irrational behavior by buying low and selling high.

Emotional Control

Emotional control is crucial for successful investing. Graham emphasized that investors should not be swayed by Mr. Market’s mood swings but should maintain a rational and objective approach to investing.

The Importance of Not Letting Market Fluctuations Influence Your Long-Term Strategy:

- Avoid Overreacting to Market News: Reacting emotionally to short-term market news can lead to poor investment decisions.

- Stick to Your Investment Plan: Maintain discipline by adhering to your predefined investment criteria, regardless of market conditions.

- Long-Term Focus: Focus on the long-term performance and intrinsic value of your investments rather than short-term market movements.

Example:

During a market downturn, Mr. Market may offer to sell stocks at significantly reduced prices. A disciplined investor like Graham would recognize the intrinsic value of these stocks and take advantage of the low prices rather than succumbing to panic and selling at a loss.

Tip: Develop a clear investment plan and stick to it, regardless of short-term market fluctuations, to ensure that your decisions are based on rational analysis rather than emotional reactions.

Example: Using Mr. Market’s Irrational Behavior to Your Advantage

Imagine you own shares in a company with an intrinsic value of $100 per share. On a particular day, Mr. Market offers to buy your shares for $80, citing negative news and market sentiment. If you recognize that the intrinsic value remains higher, you can choose to hold or buy more shares at the lower price, leveraging Mr. Market’s irrational behavior for long-term gain.

Tip: Use Mr. Market’s irrationality to your advantage by buying undervalued stocks during market pessimism and selling overvalued stocks during market exuberance.

Value vs. Speculation

Difference Between Investing and Speculating

Benjamin Graham made a clear distinction between investing and speculating. Investing involves purchasing securities with a thorough analysis of their intrinsic value and a focus on long-term growth, while speculating involves making bets on market movements without sufficient analysis, often driven by emotions and short-term gains.

Graham’s Emphasis on the Distinction Between Sound Investing and Risky Speculation:

- Investing: Based on fundamental analysis, focusing on intrinsic value and long-term growth.

- Speculating: Driven by market trends, emotions, and short-term price movements without adequate analysis.

Avoiding Speculation

Graham advised investors to avoid speculation by adhering to disciplined investment principles and focusing on the intrinsic value of their investments.

Tips for Staying Focused on Value and Avoiding the Pitfalls of Speculation:

- Conduct Thorough Research: Base investment decisions on fundamental analysis rather than market rumors or hype.

- Set Clear Investment Criteria: Establish and follow criteria for selecting investments, ensuring they meet your value and safety standards.

- Maintain Discipline: Stick to your investment plan and avoid making impulsive decisions based on short-term market movements.

Example:

During the dot-com boom, many investors speculated on technology stocks without considering their intrinsic value, leading to inflated prices and subsequent crashes. Graham’s disciplined approach of focusing on intrinsic value and margin of safety would have protected investors from the fallout of such speculative bubbles.

Tip: Prioritize investments that are undervalued based on fundamental analysis, and avoid chasing trends or making decisions based on market sentiment to minimize the risks associated with speculation.

Example: How Graham’s Disciplined Approach to Value Investing Protected Against Speculative Bubbles

During the late 1990s, the technology sector experienced a massive speculative bubble. Many investors poured money into tech stocks based on hype and fear of missing out, driving prices to unsustainable levels. Benjamin Graham’s approach, focusing on intrinsic value and margin of safety, would have led investors to scrutinize the fundamental metrics of these tech companies, identifying overvalued stocks and avoiding significant losses when the bubble burst.

Tip: Always base your investment decisions on solid fundamental analysis and intrinsic value assessments, rather than succumbing to market hype or speculative fervor.

The Importance of Long-Term Thinking

Long-Term Perspective

Benjamin Graham advocated for a long-term investment perspective, encouraging investors to focus on the enduring value and performance of their investments rather than being distracted by short-term market fluctuations.

How Graham Encouraged Investors to Think Long-Term:

- Focus on Fundamentals: Emphasize the long-term prospects and intrinsic value of investments over short-term market trends.

- Avoid Frequent Trading: Limit the number of trades to reduce transaction costs and avoid making impulsive decisions based on short-term market movements.

- Patience in Holding Investments: Allow investments time to grow and compound, capitalizing on the long-term growth potential of undervalued stocks.

Patience and Discipline

Patience is a crucial virtue in Graham’s investment philosophy. Waiting for the right investment opportunities and maintaining discipline during market volatility are essential for long-term success.

The Role of Patience in Waiting for the Right Opportunities and Maintaining Discipline in Volatile Markets:

- Wait for Value Opportunities: Exercise patience by waiting for stocks to become undervalued before investing, ensuring a margin of safety.

- Maintain Discipline During Volatility: Stay committed to your investment plan, avoiding panic selling or irrational buying during market volatility.

- Reinvest Earnings: Reinvest dividends and capital gains to take advantage of compounding growth over time.

Example: How Graham’s Long-Term Approach Led to Consistent Investment Success

Consider an investor who follows Graham’s principles, identifying undervalued stocks with strong fundamentals. By holding these investments over the long term, the investor benefits from the growth and market corrections that recognize the true value of the companies, resulting in consistent returns and capital appreciation.

Tip: Cultivate patience and a long-term perspective in your investment strategy, allowing time for your investments to realize their intrinsic value and grow steadily over time.

Practical Steps to Invest Like Benjamin Graham

Getting Started

Adopting Benjamin Graham’s investment principles involves a disciplined approach to value investing, thorough research, and robust risk management. Here’s how you can begin applying Graham’s principles to your own investments.

1. Develop a Comprehensive Research Process

- In-Depth Fundamental Analysis: Conduct thorough research on the companies you intend to invest in. Analyze their financial statements, understanding key metrics like earnings, revenue growth, debt levels, and cash flow.

- Calculate Intrinsic Value: Determine the intrinsic value of a stock using methods such as discounted cash flow (DCF) analysis, asset-based valuation, or earnings multiples. Compare this value to the current market price to identify undervalued opportunities.

- Assess Margin of Safety: Ensure that the stock is trading at a significant discount to its intrinsic value, providing a margin of safety against potential valuation errors or unforeseen market downturns.

2. Implement Robust Risk Management Practices

- Position Sizing: Determine the appropriate size of each investment based on your overall portfolio size and risk tolerance. Avoid allocating too much capital to any single investment to mitigate risk.

- Use of Stop-Loss Orders: Set stop-loss orders to automatically sell a stock if it falls below a predetermined price, limiting potential losses and protecting your capital.

- Diversification: Spread your investments across different sectors, industries, and asset classes to reduce exposure to any single investment. Diversification enhances portfolio stability and reduces risk.

3. Adopt a Value-Oriented Portfolio Approach

- Focus on Undervalued Stocks: Prioritize investing in companies that are trading below their intrinsic value, offering a margin of safety and potential for long-term growth.

- Invest in High-Quality Companies: Select companies with strong fundamentals, including stable earnings, low debt levels, and solid management teams.

- Hold for the Long Term: Embrace a long-term investment horizon, allowing your investments to grow and compound over time. Avoid frequent trading and the temptation to chase short-term market movements.

4. Execute the Investment Plan with Discipline

- Follow Your Investment Criteria: Stick to your predefined criteria for selecting and evaluating investments. Avoid making impulsive decisions based on market noise or emotions.

- Regularly Monitor Investments: Continuously monitor the performance of your investments, reviewing financial statements, and staying informed about any significant developments that could impact the company’s value.

- Rebalance Your Portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation, ensuring it remains diversified and aligned with your investment goals.

5. Continuous Evaluation and Adaptation

- Performance Review: Conduct regular reviews of your investment performance to assess the effectiveness of your strategies and identify areas for improvement.

- Adapt to Market Conditions: Be prepared to adjust your strategies based on changing market dynamics, economic indicators, and emerging trends.

- Innovate and Refine: Incorporate new trading techniques and tools to enhance your strategy and stay ahead of market developments.

Tools and Resources

To effectively implement Benjamin Graham’s investment principles, utilizing the right tools and resources is essential.

Recommended Platforms:

- Financial News Websites:

- Morningstar: Offers comprehensive stock analysis, ratings, and portfolio management tools.

- Yahoo Finance: Provides access to financial statements, stock screeners, and market news.

- Investment Research Tools:

- Value Line: Provides detailed reports and analysis on thousands of companies.

- GuruFocus: Offers in-depth analysis and tracking of value investing principles.

Books:

- “The Intelligent Investor” by Benjamin Graham: The definitive guide to value investing, covering fundamental principles and strategies.

- “Security Analysis” by Benjamin Graham and David Dodd: An in-depth exploration of fundamental analysis and valuation techniques.

- “Common Stocks and Uncommon Profits” by Philip Fisher: Complementary reading that emphasizes growth investing alongside value investing.

Software:

- Stock Screeners:

- Finviz: A powerful stock screening tool that allows you to filter stocks based on various financial metrics.

- Zacks: Offers stock screeners with value investing criteria.

- Portfolio Management Tools:

- Personal Capital: Helps track and manage your investment portfolio.

- Quicken: Provides tools for managing and analyzing your investments.

Maintaining Discipline

Maintaining discipline is crucial for the successful application of Benjamin Graham’s investment principles. Here are some tips to stay committed to value investing, even in challenging market conditions:

- Set Clear Investment Goals: Define your financial objectives and align your investment strategy with these goals. This clarity helps maintain focus and discipline.

- Stick to Your Investment Plan: Avoid making impulsive decisions based on market emotions or short-term movements. Adhere strictly to your predefined investment criteria.

- Regularly Review and Reassess: Periodically assess your investment performance and strategy. Make adjustments as necessary to stay aligned with your goals and market conditions.

- Avoid Overtrading: Resist the temptation to frequently buy and sell stocks. Focus on quality investments and hold them for the long term.

- Stay Informed: Continuously educate yourself about value investing, market trends, and economic indicators. Knowledge reinforces discipline and informed decision-making.

- Seek Professional Advice: Consult with financial advisors or investment professionals to gain additional perspectives and maintain accountability.

Tip: Establish a routine for reviewing your investments and stick to it, ensuring that your portfolio remains aligned with your investment strategy and goals.

Benjamin Graham FAQ: Invest Like The Intelligent Investor (12 Expert Q&As)

Who was Benjamin Graham and why does he matter to investors?

Benjamin Graham is widely considered the father of value investing. His books Security Analysis and The Intelligent Investor laid out a disciplined framework for buying securities below intrinsic value with a margin of safety. His teachings shaped legends like Warren Buffett and remain a durable antidote to speculation and market euphoria.

What does “intrinsic value” mean in Graham’s framework?

Intrinsic value is an estimate of a business’s true worth based on fundamentals (assets, earnings power, cash flows), not its market price. You can approximate it using discounted cash flow, asset-based valuation, or conservative earnings multiples—then compare that estimate to the current price to decide if value exists.

How big should the “margin of safety” be?

Graham didn’t prescribe a single number, but he argued it should be meaningful. Many practitioners target 20–40% below intrinsic value (or more in uncertain cases). The wider the range of possible outcomes or the shakier the inputs, the larger your margin of safety should be.

How do I decide if I’m a Defensive or Enterprising investor?

If you prefer simplicity, low maintenance, and capital preservation, you’re likely Defensive; if you enjoy deep research and can stomach volatility, you’re Enterprising. Choose the path that matches your risk tolerance, time commitment, and temperament—and stick with it through full cycles.

What asset mix did Graham recommend for Defensive investors?

Graham suggested a flexible stock/bond mix bounded by 25/75 to 75/25, with 50/50 as a sensible default. Shift toward the lower stock weight when markets are euphoric and valuations rich; tilt higher when quality equities are clearly undervalued—always within those bands.

What stock-selection filters fit Graham’s style?

Look for reasonable or low P/E, low price-to-book relative to peers, solid balance sheets (modest debt), consistent earnings, and a record of dividends. Prefer companies with tangible assets and understandable businesses. Insist on quantitative quality before you even consider price.

How do I apply fundamental analysis the Graham way?

Start with clean financials (income, balance sheet, cash flow). Test profitability (ROE, margins), solvency (debt-to-equity, interest coverage), and asset value (book value, working capital). Estimate intrinsic value conservatively using multiple methods, then only act if price < value by a healthy margin.

How often should I rebalance or reassess positions?

For Defensive investors, annual rebalancing (or when allocations breach target bands) is practical. Enterprising investors may reassess with earnings updates or thesis changes. Rebalancing enforces buy-low/sell-high behavior and keeps risk aligned with your plan.

What is “Mr. Market,” and how should I use the idea?

Mr. Market is Graham’s metaphor for the market’s mood swings—quoting you prices every day, sometimes silly-high, sometimes silly-low. Your job isn’t to mirror his emotions; it’s to exploit them. Sell to him when he’s euphoric; buy from him when he’s despondent—provided your valuation work supports it.

How do I avoid drifting into speculation?

Write clear buy/sell rules, require a margin of safety, and never trade news or hype. Anchor decisions to financial statements, competitive position, and conservative valuations. If you can’t value it, don’t buy it. If the thesis changes for the worse, exit methodically.

What are common mistakes Graham would warn against?

Over-precision in valuations, ignoring balance-sheet risk, chasing hot narratives, concentrating excessively in one idea, and failing to diversify. Another big one: abandoning your process when markets get noisy. Discipline—especially when it’s uncomfortable—is the edge.

Do you have a quick Graham-style checklist before buying?

Yes: (1) understandable business, (2) durable economics/competitive moat, (3) conservative leverage, (4) consistent earnings/dividends, (5) sensible valuation on multiple measures, (6) clear margin of safety, (7) position size aligned to risk, (8) predefined sell/reevaluation triggers.

Key Takeaways from Benjamin Graham’s Investment Philosophy

Benjamin Graham’s investment philosophy offers a robust framework for building a resilient and profitable investment portfolio. By focusing on intrinsic value, maintaining a margin of safety, distinguishing between defensive and enterprising investors, and emphasizing diversification and fundamental analysis, Graham provides timeless principles that continue to guide investors toward consistent success.

Key Takeaways:

- Intrinsic Value: Understanding and calculating the true value of a stock is fundamental to identifying undervalued opportunities.

- Margin of Safety: Investing with a margin of safety protects against market volatility and errors in valuation.

- Defensive vs. Enterprising Investor: Recognizing your investor profile helps tailor your investment strategy to align with your risk tolerance and financial goals.

- Diversification: Spreading investments across different assets and sectors minimizes risk and enhances portfolio stability.

- Fundamental Analysis: Thorough analysis of financial statements and key metrics ensures informed investment decisions.

- Long-Term Perspective: Patience and a long-term investment horizon are crucial for capitalizing on the growth potential of undervalued stocks.

- Psychological Discipline: Maintaining emotional control and sticking to a disciplined investment plan prevents impulsive decisions driven by market emotions.

- Continuous Improvement: Adapting and refining your investment strategies based on ongoing performance reviews and market developments enhances your investment approach.

Relevance of Graham’s Principles in Today’s Investing Environment

In today’s fast-paced and often volatile financial markets, Benjamin Graham’s principles remain as relevant as ever. The focus on value investing, intrinsic value, and margin of safety provides a solid foundation for navigating market uncertainties and achieving long-term investment success. While market dynamics have evolved with technological advancements and globalization, the core principles of disciplined analysis, risk management, and value orientation continue to offer valuable guidance for modern investors.

Relevance in Modern Markets:

- Technological Advancements: The rise of algorithmic trading and big data analytics has enhanced the ability to conduct thorough fundamental analysis, aligning well with Graham’s emphasis on intrinsic value.

- Globalization: Understanding global market trends and diversifying investments across different regions and sectors helps in managing risks associated with localized economic downturns.

- Increased Volatility: Robust risk management techniques, such as position sizing and diversification, are crucial for protecting portfolios in highly volatile markets.

- Behavioral Insights: Incorporating behavioral finance principles complements Graham’s philosophy by addressing the psychological aspects of investing, ensuring more rational and disciplined decision-making.

Example:

During the COVID-19 pandemic, many investors turned to value investing principles to identify companies with strong fundamentals that were temporarily undervalued due to market disruptions. Graham’s emphasis on intrinsic value and margin of safety provided a reliable framework for making informed investment decisions amidst unprecedented market volatility.

Adopt a Value-Oriented, Disciplined Approach to Investing

Emulating Benjamin Graham’s investment strategies requires dedication, discipline, and a commitment to continuous learning. However, the rewards of adopting his methodologies can be substantial, offering a path to consistent and sustainable investment success. Here are some actionable steps to get you started:

- Adopt a Value-Oriented Mindset: Focus on identifying undervalued stocks by conducting thorough fundamental analysis. Prioritize investments that offer a margin of safety and have strong intrinsic value.

- Implement a Systematic Trading Plan: Develop a comprehensive investment plan that outlines your entry and exit criteria, risk management rules, and performance benchmarks. Stick to this plan to maintain discipline and consistency in your investing.

- Prioritize Risk Management: Use position sizing, stop-loss orders, and diversification to manage risk effectively. Protect your capital by ensuring that no single investment can significantly impact your portfolio.

- Leverage Technology and Analytical Tools: Invest in investment analysis tools and software to enhance your research and decision-making process. Utilize financial modeling software, stock screeners, and portfolio management platforms to gain deeper insights.

- Seek Mentorship and Education: Learn from experienced investors and seek mentorship opportunities to gain valuable insights and refine your investment strategies. Attend seminars, workshops, and engage with the investment community to expand your knowledge.

- Commit to Continuous Improvement: Regularly review and assess your investment performance, and be prepared to adapt and refine your strategies based on market developments and performance feedback.

- Maintain Emotional Discipline: Develop techniques to manage emotions and maintain discipline, such as setting clear investment goals, practicing mindfulness, and adhering to your trading plan.

Final Encouragement:

Investing like Benjamin Graham isn’t about replicating his every move but about embracing the underlying principles that have driven his success. It’s about understanding market dynamics, maintaining discipline, and being willing to take calculated risks. By incorporating Graham’s strategies and adapting them to your unique circumstances, you can navigate the complex world of investing with greater confidence and insight.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.