Investing like a legend isn’t about luck—it’s about strategy, insight, and a deep understanding of global markets. Jim Rogers, the co-founder of the legendary Quantum Fund, embodies these qualities. In this comprehensive guide, we’ll explore Rogers’ investment philosophies and strategies, offering you actionable insights to elevate your own investment game.

source: Real Vision on YouTube

Jim Rogers: A Titan in Global Investing

Jim Rogers is a household name among investors and financial enthusiasts. From his early academic pursuits at Yale and Oxford to co-founding the Quantum Fund with George Soros, Rogers has consistently demonstrated an uncanny ability to navigate and capitalize on global investment opportunities. His impact on the investment world is profound, influencing both institutional and individual investors alike.

The Quantum Fund: A Beacon of Investment Excellence

Founded in 1973, the Quantum Fund quickly rose to prominence under the leadership of Rogers and Soros. It became renowned for its innovative global macro strategies, which focus on large-scale economic and political trends to drive investment decisions. The Quantum Fund’s success laid the groundwork for modern hedge fund strategies and cemented Rogers’ reputation as a formidable investor.

source: Vida Potencial on YouTube

We’ll attempt to dissect Jim Rogers’ investment strategies and philosophies. Whether you’re a seasoned investor or just starting out, understanding Rogers’ approach can provide valuable lessons for navigating the complexities of global investing. We’ll delve into his background, the legacy of the Quantum Fund, his core investment principles, and practical steps to emulate his success.

Who is Jim Rogers?

A Glimpse into Jim Rogers’ Early Life

Born in 1942, James Warren Rogers developed an early interest in economics and markets. His academic journey began at Yale University, where he earned a degree in history. Seeking to expand his intellectual horizons, Rogers pursued further studies at Oxford University, focusing on Philosophy, Politics, and Economics (PPE). This diverse educational background equipped him with a unique analytical framework that would later inform his investment strategies.

From Academia to the Quantum Fund

After completing his studies, Rogers ventured into the financial sector. His partnership with George Soros led to the creation of the Quantum Fund in 1973. This collaboration was pivotal, blending Soros’ expertise in reflexivity theory with Rogers’ deep understanding of commodities and emerging markets. Together, they transformed the Quantum Fund into a powerhouse, achieving unprecedented returns and setting new standards in hedge fund management.

Key Achievements and Contributions

Jim Rogers is not just an investor; he’s an author, a thought leader, and a global commentator. His books, including “Investment Biker” and “Adventure Capitalist,” offer a blend of investment wisdom and personal anecdotes from his global travels. Rogers’ ability to foresee market trends, coupled with his fearless investment style, has earned him respect and admiration across the financial world. His influence extends to mentoring upcoming investors and contributing to economic discourse through his insightful commentary.

Notable Achievements:

- Co-Founding the Quantum Fund: Achieving stellar returns and setting industry benchmarks.

- Authoring Influential Books: Sharing his investment philosophies and global experiences.

- Global Exploration: Combining travel with investment insights to understand diverse markets.

- Public Speaking and Media Presence: Regularly sharing his views on economic trends and investment strategies.

Personal Philosophy and Lifestyle

Beyond his professional accomplishments, Jim Rogers is known for his adventurous spirit. He has traveled extensively, often blending his investment activities with exploration, which he documents in his books. This global perspective not only enriches his personal life but also informs his investment strategies, allowing him to gain firsthand insights into various economies and cultures.

Key Traits:

- Curiosity: A relentless desire to learn and explore new territories.

- Discipline: Maintaining a structured approach to investing despite market volatility.

- Resilience: Overcoming setbacks and adapting to changing market conditions.

- Vision: Anticipating future trends and positioning investments accordingly.

The Quantum Fund: A Legacy of Success

The Birth of a Financial Powerhouse

The Quantum Fund was established with a vision to leverage global macroeconomic trends for substantial returns. In an era where market dynamics were rapidly evolving, the fund’s focus on large-scale economic indicators positioned it uniquely to capitalize on emerging opportunities. This strategic positioning was instrumental in the fund’s early successes.

Foundation Goals:

- Global Diversification: Investing across various countries and sectors to mitigate risks.

- Innovative Strategies: Implementing cutting-edge investment techniques to stay ahead of market trends.

- High Returns: Aiming for superior returns through strategic positioning and informed decision-making.

Collaborative Strategies with George Soros

Working alongside George Soros, Jim Rogers honed the Quantum Fund’s investment strategies. Soros’ reflexivity theory, which emphasizes the feedback loop between market participants’ perceptions and the fundamentals of the economy, complemented Rogers’ expertise in commodities and emerging markets. This synergy allowed the Quantum Fund to navigate complex market landscapes effectively, identifying and exploiting inefficiencies that others might overlook.

Key Collaborative Strategies:

- Reflexivity Theory: Understanding how market perceptions influence economic fundamentals.

- Commodity Focus: Leveraging Rogers’ knowledge in commodities to identify undervalued assets.

- Emerging Markets: Capitalizing on growth opportunities in developing economies.

Performance Highlights

During Rogers’ tenure, the Quantum Fund delivered remarkable returns. One of the most notable performance highlights was the fund’s pivotal role in the devaluation of the British Pound in 1992, an event often referred to as “Black Wednesday.” This strategic move not only safeguarded the fund’s assets but also generated substantial profits, cementing the Quantum Fund’s reputation as a formidable player in the hedge fund industry.

Key Performance Milestones:

- 1973-1980s: Rapid growth and diversification into various asset classes.

- Black Wednesday (1992): Strategic shorting of the British Pound yielded enormous profits.

- Consistent Outperformance: The fund consistently outperformed market benchmarks, attracting significant capital and investor trust.

Legacy of the Quantum Fund

The Quantum Fund’s success under Rogers and Soros set a precedent in the hedge fund industry. It demonstrated the effectiveness of global macro investing and influenced countless investment strategies worldwide. The fund’s ability to adapt to changing economic conditions and capitalize on macro trends became a blueprint for modern hedge funds.

Impact on the Investment World:

- Benchmark for Hedge Funds: Setting high standards for performance and strategy implementation.

- Influence on Investment Strategies: Pioneering the use of global macro strategies that are now widely adopted.

- Attracting Talent: Drawing top-tier investment professionals seeking to emulate its success.

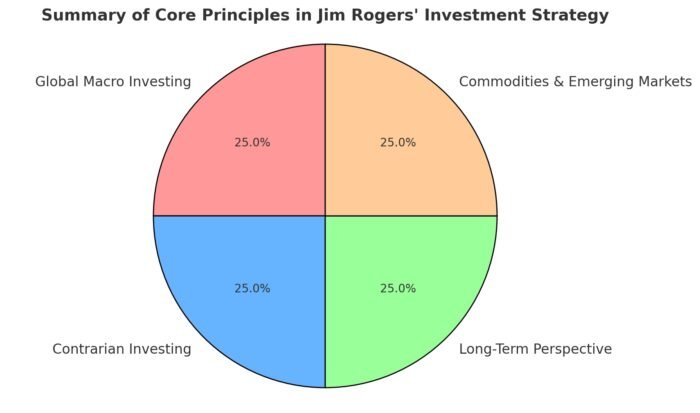

Core Principles of Jim Rogers’ Investment Strategy

Jim Rogers’ investment philosophy is a harmonious blend of strategic foresight, disciplined execution, and a profound understanding of global markets. His strategies are rooted in Global Macro Investing, Contrarian Investing, a Long-Term Perspective, and a keen focus on Commodities and Emerging Markets.

Global Macro Investing

At the core of Rogers’ investment philosophy is Global Macro Investing. This strategy involves analyzing and capitalizing on macroeconomic trends across various countries and regions. By understanding factors such as interest rates, political stability, and economic growth, Rogers identifies investment opportunities that transcend local market dynamics.

Key Components:

- Economic Indicators: Rogers closely monitors GDP growth rates, inflation, and unemployment figures to gauge the health of economies.

- Political Events: Elections, policy changes, and geopolitical tensions are scrutinized for their potential impact on markets.

- Currency Movements: Exchange rate fluctuations are analyzed to identify opportunities in forex markets.

Example: In the early 2000s, Rogers anticipated a surge in global demand for commodities driven by emerging markets like China and India. By investing heavily in oil and metals, he capitalized on the upward trend, leading to significant returns as commodity prices soared.

Contrarian Investing

Rogers is a staunch advocate of Contrarian Investing—a strategy that involves going against prevailing market sentiments. When the majority of investors are selling, a contrarian investor like Rogers sees an opportunity to buy undervalued assets, and vice versa.

Key Strategies:

- Buying in Bear Markets: Investing in markets or sectors that are out of favor, anticipating a reversal when conditions improve.

- Selling in Bull Markets: Divesting from overvalued assets to lock in gains before potential corrections.

Example: During the Asian Financial Crisis in the late 1990s, while many investors fled emerging markets, Rogers identified undervalued assets poised for recovery. His contrarian stance allowed him to benefit significantly as these markets rebounded.

Long-Term Perspective

Patience is a virtue that Rogers embodies through his Long-Term Perspective. Rather than seeking quick profits, he focuses on investments that have the potential to grow over extended periods.

Implementation Tactics:

- Holding Periods: Investments are held for several years, allowing them to mature and realize their full potential.

- Fundamental Analysis: Emphasis is placed on the underlying value and long-term prospects of assets rather than short-term market fluctuations.

Example: Rogers’ sustained investment in agricultural commodities like soybeans and corn has paid off as global population growth and dietary changes have driven demand, leading to consistent price appreciation over the years.

Focus on Commodities and Emerging Markets

Rogers has a particular affinity for Commodities and Emerging Markets. He believes these sectors offer significant growth opportunities driven by global demand and economic development.

Investment Areas:

- Commodities: Investments in agriculture, energy, and metals have historically provided robust returns, especially during periods of economic expansion.

- Emerging Markets: Countries with rapid industrialization and growing middle classes present lucrative investment opportunities as their economies expand.

Example: Rogers’ investment in Brazilian agriculture and mining sectors capitalized on the country’s economic boom and natural resource abundance, resulting in substantial gains as these industries flourished.

Summary of Core Principles

- Global Macro Investing: Leveraging macroeconomic trends across the globe.

- Contrarian Investing: Taking positions opposite to prevailing market sentiments.

- Long-Term Perspective: Focusing on sustained growth over immediate profits.

- Commodities and Emerging Markets: Targeting sectors with high growth potential.

Additional Principles

- Risk Management: Implementing robust risk management techniques to protect against market volatility.

- Continuous Learning: Staying informed about global economic developments and refining strategies accordingly.

- Adaptability: Being flexible and willing to adjust investment approaches in response to changing market conditions.

Famous Investments and Market Calls

Jim Rogers is renowned for his bold market predictions and strategic investments that often defy conventional wisdom. His ability to foresee market trends and act decisively has led to several high-profile successes.

Turning Heads with Bold Predictions

One of Rogers’ most famous calls was his prediction of the collapse of the Japanese stock market in the early 1990s. At a time when Japan was considered an economic powerhouse, Rogers foresaw the impending stagnation and adjusted the Quantum Fund’s positions accordingly, resulting in substantial profits.

Case Study: The Japanese Market Collapse

- Context: Japan’s asset price bubble burst in the early 1990s, leading to a prolonged economic stagnation.

- Rogers’ Strategy: Shorting Japanese stocks and the Yen before the collapse.

- Outcome: The Quantum Fund reaped significant profits as the market corrected sharply.

Global Macro Success Stories

Rogers’ Global Macro approach has led to several high-profile successes:

Investment in Commodities (2000s)

Anticipating the surge in global demand, particularly from emerging markets, Rogers invested heavily in commodities like oil and metals. This move paid off handsomely as commodity prices soared in the ensuing years.

Details:

- Oil: Capitalizing on geopolitical tensions and increasing global demand.

- Metals: Investing in precious metals like gold and industrial metals like copper, benefiting from economic expansions.

Betting Against the British Pound (1992)

As mentioned earlier, the strategic short position on the British Pound during Black Wednesday was a masterstroke that significantly boosted the fund’s performance.

Details:

- Market Conditions: The UK was under pressure to maintain the Pound’s value within the European Exchange Rate Mechanism.

- Rogers’ Move: Shorting the Pound ahead of its devaluation.

- Outcome: Massive profits as the Pound plummeted following the government’s failed attempt to defend it.

Lessons from Rogers’ Investments

Each of Rogers’ investments offers valuable lessons for investors:

- Anticipate Trends: Understanding and predicting long-term economic and political shifts can lead to lucrative investment opportunities.

- Stay Disciplined: Adhering to a well-thought-out investment strategy, even in volatile markets, is crucial for long-term success.

- Be Patient: Allowing investments the time to grow and mature can lead to substantial gains, as seen in Rogers’ long-term holdings in commodities and emerging markets.

Additional Insights:

- Research and Analysis: Thoroughly researching and understanding market dynamics is essential before making significant investment moves.

- Risk Management: Balancing bold investment moves with effective risk management strategies can protect against potential downsides.

- Adaptability: Being willing to adjust strategies in response to changing market conditions is key to sustained success.

Famous Market Calls and Their Impact

Rising Sun: Investing in Chinese Markets

In the late 1990s and early 2000s, Rogers identified China’s rapid economic growth as a prime investment opportunity. By investing early in Chinese stocks and infrastructure projects, he capitalized on the country’s industrial boom and expanding middle class.

Impact:

- High Returns: Early investments in Chinese equities yielded substantial returns as the market grew.

- Diversification: Added significant diversification to the Quantum Fund’s portfolio, reducing reliance on Western markets.

- Influence: Inspired other investors to explore opportunities in emerging markets, particularly in Asia.

Agricultural Boom: Betting on Global Food Demand

Rogers foresaw the increasing global demand for agricultural products driven by population growth and changing dietary preferences. By investing in farmland and agricultural commodities, he positioned the fund to benefit from this trend.

Impact:

- Sustainable Returns: Investments in agriculture provided stable and growing returns amidst fluctuating commodity prices.

- Economic Insight: Demonstrated the importance of understanding global demographic trends in investment decision-making.

- Legacy: Reinforced the value of investing in tangible assets that meet fundamental human needs.

Risk Management Techniques

Effective risk management is paramount in Jim Rogers’ investment strategy. By implementing robust risk management techniques, Rogers ensures that potential losses are minimized while maintaining the potential for significant gains.

Diversification: The Cornerstone of Risk Management

Rogers emphasizes Diversification as a fundamental risk management strategy. By spreading investments across various asset classes and geographies, he mitigates the risks associated with market volatility and economic downturns in specific regions.

Key Diversification Strategies:

- Asset Classes: Investments are diversified across equities, bonds, commodities, and real estate to balance risk and reward.

- Geographical Spread: Exposure to both developed and emerging markets reduces the impact of localized economic issues.

- Sector Diversification: Investing in different sectors such as technology, healthcare, energy, and consumer goods to spread sector-specific risks.

Example: During periods of economic uncertainty in one region, investments in stable markets like the United States or diversified assets like gold can offset potential losses.

Balancing Risk and Reward

In volatile markets, balancing risk and reward is paramount. Rogers employs several strategies to ensure that potential losses are minimized while maintaining the potential for significant gains.

Strategies Employed:

- Hedging: Utilizing financial instruments such as options and futures to protect against adverse price movements.

- Asset Allocation: Strategically distributing investments based on risk tolerance, investment horizon, and market conditions.

- Position Sizing: Determining the appropriate size of each investment position to prevent excessive exposure to any single asset.

Example: When investing in emerging markets, Rogers might allocate a smaller percentage of the portfolio to high-risk assets while balancing it with more stable investments to maintain overall portfolio stability.

Adapting to Market Conditions

Flexibility is a key component of Rogers’ risk management approach. He continuously monitors global markets, adjusting his investment positions to align with changing economic conditions and emerging opportunities.

Implementation Tactics:

- Regular Reviews: Periodic assessment of the investment portfolio to ensure alignment with current market dynamics.

- Proactive Adjustments: Making timely changes to investment holdings in response to new information or shifts in market trends.

- Scenario Analysis: Evaluating different market scenarios to anticipate potential risks and prepare appropriate responses.

Example: During the 2008 financial crisis, Rogers adjusted the Quantum Fund’s positions by reducing exposure to highly volatile assets and increasing holdings in safer investments like government bonds and gold.

Additional Risk Management Best Practices

- Stop-Loss Orders: Implementing stop-loss orders to automatically sell assets when they reach a certain price, limiting potential losses.

- Risk-Reward Ratio: Assessing the potential return of an investment relative to its risk to ensure favorable risk-reward profiles.

- Continuous Learning: Staying informed about new risk management techniques and integrating them into the investment strategy.

- Stress Testing: Simulating various market conditions to understand potential impacts on the portfolio and develop contingency plans.

Example: Before entering a new investment, Rogers might conduct a stress test to evaluate how different economic scenarios could affect the asset’s performance, allowing him to make informed decisions about its suitability for the portfolio.

Risk Management in Practice: A Case Study

Case Study: Diversification During Commodity Price Fluctuations

- Context: Commodity prices can be highly volatile, influenced by geopolitical events, natural disasters, and changes in global demand.

- Rogers’ Approach: Diversifying investments across multiple commodities (e.g., oil, gold, agricultural products) and incorporating hedging strategies to protect against significant price drops.

- Outcome: While some commodities may experience sharp declines, others may perform well, balancing the overall portfolio and reducing the impact of individual asset volatility.

The Role of Psychology in Investing

Jim Rogers acknowledges that Psychology plays a significant role in investing. Market sentiments, driven by fear and greed, often lead to irrational price movements. By understanding these psychological factors, investors can gain an edge in making informed decisions.

Understanding Market Psychology

Market psychology refers to the collective emotions and behaviors of investors that influence market movements. Rogers emphasizes the importance of recognizing these psychological factors to anticipate market trends.

Key Psychological Concepts:

- Herd Mentality: The tendency of investors to follow the majority, often leading to market bubbles or crashes.

- Fear and Greed: Emotional drivers that can cause overreactions in the market, leading to irrational investment decisions.

- Overconfidence: The belief in one’s ability to predict market movements accurately, potentially leading to excessive risk-taking.

Example: During periods of market euphoria, such as the dot-com bubble, herd mentality can drive asset prices to unsustainable levels. Recognizing this, Rogers may choose to reduce exposure to overvalued sectors to protect against potential downturns.

Maintaining Discipline and Emotional Control

One of Rogers’ key principles is maintaining Discipline and Emotional Control. In turbulent markets, it’s easy to succumb to fear or greed, leading to impulsive decisions that can harm the investment portfolio.

Strategies for Emotional Control:

- Sticking to the Strategy: Adhering to a well-defined investment plan regardless of short-term market fluctuations.

- Avoiding Emotional Decisions: Making rational decisions based on analysis rather than reacting to market hysteria.

- Mindfulness and Stress Management: Practicing mindfulness and stress-reduction techniques to maintain mental clarity and focus.

Example: During the 2008 financial crisis, while many investors panicked and sold off assets, Rogers remained calm and adhered to his investment strategy, allowing him to capitalize on the subsequent market recovery.

Patience and Conviction

Success in investing often requires Patience and Conviction. Rogers believes in holding investments long enough to see their true value, even when immediate returns are not apparent. This steadfastness can lead to substantial long-term gains.

Implementation Tactics:

- Long-Term Focus: Prioritizing long-term growth over short-term profits.

- Confidence in Analysis: Trusting in thorough research and analysis to guide investment decisions, even when facing skepticism from the market.

- Resisting Short-Term Temptations: Avoiding the urge to make frequent trades based on short-term market movements.

Example: Rogers’ long-term investment in agricultural commodities during the early 2000s required patience, as it took several years for global demand to significantly increase, ultimately leading to substantial profits.

Overcoming Psychological Biases

Investors must recognize and mitigate common psychological biases that can impair investment judgment.

Common Biases and Mitigation Strategies:

- Confirmation Bias: Seeking information that confirms existing beliefs. Mitigation: Actively seeking contradictory information to challenge assumptions.

- Anchoring: Relying too heavily on the first piece of information encountered. Mitigation: Evaluating all available data before making decisions.

- Loss Aversion: Preferring to avoid losses over acquiring gains. Mitigation: Focusing on the long-term potential of investments rather than short-term fluctuations.

Example: An investor may hold onto a losing stock due to loss aversion, hoping it will rebound. By recognizing this bias, Rogers would assess the fundamental value of the asset and decide whether to hold or sell based on objective analysis rather than emotional attachment.

Building Emotional Resilience

Developing emotional resilience is crucial for maintaining discipline and executing investment strategies effectively.

Strategies to Build Resilience:

- Continuous Education: Understanding market dynamics and investment principles to build confidence.

- Diversification: Reducing portfolio volatility through diversification, thereby lowering emotional stress.

- Support Systems: Engaging with mentors, financial advisors, and peer networks to gain perspective and support.

Example: By maintaining a diversified portfolio, an investor can reduce the emotional impact of a single asset’s poor performance, allowing them to stay focused on long-term goals rather than short-term losses.

Building a Global Investment Strategy

Inspired by Jim Rogers’ approach, here’s a step-by-step guide to crafting your own global investment strategy. By understanding and implementing these steps, you can emulate Rogers’ success in navigating the complexities of global markets.

Step-by-Step Guide to Developing a Global Investment Strategy

- Research and Analysis

- Conduct Comprehensive Research: Start by conducting thorough research on global economic trends, political developments, and market dynamics.

- Utilize Quantitative and Qualitative Insights: Combine numerical data with qualitative assessments to form a holistic view of potential investments.

- Identify Opportunities

- Look for Growth Potential: Focus on sectors and regions with strong growth prospects, such as emerging markets or booming industries like technology and renewable energy.

- Assess Competitive Landscape: Evaluate the competitive environment to identify undervalued assets and companies with sustainable advantages.

- Diversify Investments

- Spread Across Asset Classes: Diversify your portfolio by investing in different asset classes, including stocks, bonds, commodities, and real estate.

- Geographical Diversification: Invest in both developed and emerging markets to mitigate regional risks.

- Monitor and Adjust

- Continuous Monitoring: Keep a close eye on your investments and the broader market environment.

- Be Prepared to Adjust: Modify your portfolio in response to changing economic conditions and emerging opportunities.

- Stay Informed

- Keep Up with Global News: Stay abreast of global news, economic reports, and market analyses that could impact your investments.

- Leverage Multiple Information Sources: Utilize a variety of information sources, including financial news outlets, research reports, and expert opinions.

Identifying and Analyzing Potential Investment Opportunities

Rogers’ approach involves a meticulous process to identify undervalued assets and growth opportunities:

- Economic Indicators: Analyze GDP growth rates, inflation, and employment data to assess economic health.

- Political Stability: Evaluate the political environment to gauge the risk of policy changes or instability.

- Industry Trends: Identify industries poised for growth based on technological advancements or shifting consumer preferences.

- Local Insights: Understand cultural and regulatory factors that can influence market performance in specific regions.

Tools and Techniques:

- Fundamental Analysis: Assess the intrinsic value of an investment by examining related economic, financial, and other qualitative and quantitative factors.

- Technical Analysis: Use statistical trends gathered from trading activity, such as price movement and volume, to identify potential investment opportunities.

- Sentiment Analysis: Gauge investor sentiment through surveys, news sentiment, and market indicators to predict potential market movements.

Tips for Refining and Adapting the Strategy Over Time

- Stay Flexible: Be ready to pivot your strategy as new information and trends emerge. Flexibility allows you to capitalize on unexpected opportunities and mitigate emerging risks.

- Learn Continuously: Invest in your education to stay ahead of market developments. Attend seminars, read extensively, and engage with financial experts to enhance your knowledge.

- Seek Expertise: Collaborate with analysts and industry experts to gain diverse perspectives. Leveraging specialized knowledge can provide deeper insights into complex markets.

Additional Tips:

- Regular Portfolio Reviews: Conduct periodic reviews of your portfolio to assess performance and make necessary adjustments.

- Set Clear Goals: Define your investment objectives and align your strategy to achieve them.

- Maintain Discipline: Stick to your investment plan and avoid making impulsive decisions based on short-term market movements.

Implementing the Strategy: A Practical Example

Example: Investing in Renewable Energy Markets

- Research and Analysis

- Global Trends: Identify the increasing global focus on renewable energy sources to combat climate change.

- Economic Indicators: Assess the growth rates of renewable energy sectors in various countries.

- Identify Opportunities

- Growth Regions: Focus on countries like Germany, China, and the United States, where renewable energy investments are booming.

- Innovative Companies: Identify companies leading in solar, wind, and battery technologies.

- Diversify Investments

- Asset Classes: Invest in renewable energy stocks, green bonds, and commodities like lithium for batteries.

- Geographical Spread: Allocate investments across different regions to mitigate regional regulatory risks.

- Monitor and Adjust

- Track Developments: Stay updated on policy changes, technological advancements, and market demand shifts.

- Rebalance Portfolio: Adjust holdings based on performance and emerging opportunities within the renewable sector.

- Stay Informed

- Industry Reports: Regularly review reports from energy research firms.

- Expert Opinions: Attend industry conferences and webinars to gain insights from thought leaders.

Outcome: By following this strategy, an investor can effectively capitalize on the growing renewable energy sector, achieving both financial returns and contributing to sustainable development.

Challenges of Global Macro Investing

While global macro investing offers significant opportunities, it also comes with its own set of challenges. Understanding these challenges and implementing strategies to overcome them is crucial for success.

Potential Pitfalls in Global Macro Investing

- Market Volatility: Sudden economic or political changes can lead to unpredictable market movements, impacting investment returns.

- Complexity: Understanding and analyzing global markets requires extensive knowledge and resources, making it a complex endeavor.

- Currency Risks: Fluctuations in currency exchange rates can affect the value of international investments, introducing additional risk.

- Geopolitical Risks: Political instability, regulatory changes, and international conflicts can have significant impacts on global markets.

- Liquidity Issues: Some emerging markets and niche sectors may have lower liquidity, making it challenging to enter or exit positions without affecting prices.

Overcoming Common Challenges in International Markets

To navigate these challenges effectively, investors should adopt the following strategies:

- Diversify: Spread investments across various markets and asset classes to minimize the impact of any single market downturn.

- Stay Informed: Maintain a continuous flow of information about global events and trends to anticipate and react to changes promptly.

- Use Hedging Strategies: Implement financial instruments like options and futures to protect against adverse currency movements and market volatility.

- Engage Local Expertise: Collaborate with local experts and analysts to gain deeper insights into regional markets and regulatory environments.

- Maintain Liquidity: Ensure a portion of the portfolio remains liquid to capitalize on emerging opportunities and manage unforeseen risks.

Example: An investor diversified their portfolio across North America, Europe, Asia, and emerging markets, reducing the impact of economic downturns in any single region. Additionally, by using currency hedging, they protected against significant exchange rate fluctuations that could erode investment returns.

The Importance of Staying Informed and Adaptable

In the ever-evolving global landscape, staying informed and adaptable is crucial. Investors must continuously update their knowledge and be willing to adjust their strategies to align with new developments and emerging opportunities.

Key Practices:

- Regular Learning: Commit to ongoing education about global markets, economic theories, and investment strategies.

- Adaptability: Be prepared to modify your investment approach in response to shifting market conditions and new information.

- Proactive Decision-Making: Anticipate changes and act proactively rather than reactively to maintain a competitive edge.

- Technology Utilization: Leverage advanced analytical tools and platforms to monitor global markets in real-time and make informed decisions.

Example: As renewable energy became a significant trend, an adaptable investor shifted a portion of their portfolio from traditional energy sectors to renewable technologies, positioning themselves to benefit from the growing demand for sustainable energy solutions.

Additional Challenges and Mitigation Strategies

- Regulatory Compliance: Navigating different regulatory environments requires understanding and compliance with local laws.

- Mitigation: Stay updated on regulatory changes and consult with legal experts when necessary.

- Cultural Differences: Cultural nuances can impact business operations and market behavior.

- Mitigation: Develop cultural awareness and incorporate it into investment analysis.

- Information Overload: The vast amount of data available can be overwhelming.

- Mitigation: Focus on key indicators and utilize data analytics tools to filter relevant information.

- Time Zone Differences: Operating across multiple time zones can complicate market monitoring and decision-making.

- Mitigation: Utilize technology and establish a team that can provide around-the-clock coverage of key markets.

Case Study: Navigating Geopolitical Tensions

Context: During heightened geopolitical tensions between the U.S. and China, markets became volatile, with significant impacts on trade, technology, and global supply chains.

Rogers’ Approach:

- Analysis: Assessed the long-term implications of the tensions on various sectors, particularly technology and manufacturing.

- Diversification: Reduced exposure to sectors most affected by the tensions while increasing investments in resilient industries like healthcare and consumer staples.

- Hedging: Utilized options to protect against potential downturns in highly volatile sectors.

Outcome: By proactively adjusting his portfolio, Rogers mitigated potential losses and positioned the fund to benefit from sectors that thrived despite geopolitical challenges.

Jim Rogers FAQ: Co-Founder of the Quantum Fund (12 Expert Q&As)

Who is Jim Rogers and why is he influential?

Jim Rogers is a global macro investor and co-founder of the Quantum Fund. He popularized long-horizon, contrarian bets across countries, currencies, and commodities, and later created the Rogers International Commodity Index (RICI).

What defines Rogers’ investing philosophy?

A global, top-down view; deep fundamental research on countries and cycles; a contrarian bias; concentration in his best ideas; and very long holding periods—especially in real assets and emerging markets.

How does he use commodities in a portfolio?

Rogers treats commodities as core, inflation-sensitive exposures tied to real-world demand. He prefers simple theses (supply/demand, capex cycles) over complex timing, and he’s comfortable holding through multi-year booms and busts.

Why does he favor emerging markets?

That’s where growth, reform, and resource endowments can combine for multi-year reratings. He looks for improving governance, rising reserves, favorable demographics, and pro-investment policies—plus cheap entry prices.

What does “be contrarian” mean in Rogers’ practice?

Buy what’s hated but improving; sell what’s loved and over-owned. He waits for pessimism, improving fundamentals, and a visible catalyst—then sizes positions with conviction.

How long is “long term” for Rogers?

Often years, sometimes a decade. He’d rather be early with the right thesis than chase late-cycle momentum. Patience and the discipline to do nothing are part of the edge.

What signals does he watch at the country level?

Current-account trends, FX reserves, interest-rate and fiscal policy, rule-of-law/institutional change, infrastructure and capex cycles, terms of trade, and valuation versus history and peers.

How does he manage risk when concentrating?

He diversifies by driver (commodities vs. equities vs. currency), insists on clear theses and stop-rules for being wrong, maintains liquidity, and resists leverage that forces decisions at bad times.

How does travel/research shape his ideas?

Rogers stresses on-the-ground checks—talking to farmers, truckers, exporters, and local officials—to test narratives against reality. Primary evidence can reveal inflections before spreadsheets do.

What role do currencies play in his framework?

FX expresses country views cleanly. He favors strong external balances, rising real rates, and reform momentum; avoids pegs at unsustainable levels and countries burning reserves.

How can individual investors apply Rogers’ approach?

Build a simple macro dashboard, pick a few high-conviction secular themes (e.g., agriculture, electrification metals), use low-cost vehicles, size patiently, and review theses quarterly—not daily.

Biggest mistakes Rogers would warn against?

Chasing popular stories, ignoring cycles and policy shifts, overtrading, confusing luck with skill in bull phases, and quitting a sound thesis just before the turn.

Key Takeaways from Jim Rogers’ Investment Approach

Jim Rogers’ investment philosophy is a harmonious blend of strategic foresight, disciplined execution, and a profound understanding of global markets. His emphasis on global macro investing, contrarian strategies, and a long-term perspective offers invaluable lessons for investors aiming to navigate the complexities of the financial world.

Core Takeaways:

- Global Macro Focus: Understanding and capitalizing on large-scale economic trends.

- Contrarian Mindset: Going against prevailing market sentiments to find undervalued opportunities.

- Long-Term Vision: Prioritizing sustained growth over short-term gains.

- Diversification and Risk Management: Spreading investments across various asset classes and geographies to mitigate risks.

- Psychological Discipline: Maintaining emotional control and patience to execute investment strategies effectively.

The Relevance of Global Macro Investing Today

In today’s interconnected and rapidly changing global economy, the principles of global macro investing are more relevant than ever. By identifying and capitalizing on broad economic trends, investors can uncover opportunities that may not be immediately apparent through traditional investment approaches. The ability to think globally and act strategically is a significant advantage in the modern investment landscape.

Current Relevance:

- Technological Advancements: Rapid technological changes create new investment opportunities and disrupt traditional industries.

- Globalization: Increased interconnectivity between markets makes understanding global trends essential.

- Economic Shifts: Emerging markets continue to grow, offering high potential returns despite inherent risks.

- Geopolitical Tensions: Political instability and international conflicts can create both risks and opportunities for savvy investors.

Example: The rise of artificial intelligence and renewable energy presents lucrative investment opportunities. By leveraging global macro strategies, investors can position their portfolios to benefit from these technological advancements while managing associated risks.

Encouragement to Explore and Experiment

Embracing Jim Rogers’ strategies requires courage, commitment, and a willingness to explore uncharted territories. However, by adopting his principles and continuously refining your approach, you can enhance your investment outcomes and build a robust portfolio poised for long-term success. Remember, investing is as much about understanding yourself and your risk tolerance as it is about market analysis. Take inspiration from Jim Rogers, but tailor your strategy to fit your unique financial goals and circumstances.

Final Thoughts:

- Be Bold Yet Calculated: Take decisive actions based on thorough research and analysis.

- Stay Curious: Continuously seek knowledge and explore new markets and sectors.

- Adapt and Evolve: Be willing to change your strategies in response to new information and market conditions.

- Maintain Integrity: Uphold ethical standards in all investment decisions to build trust and long-term success.

- Embrace Patience: Allow your investments the time to grow and realize their full potential.

Practical Steps to Emulate Jim Rogers’ Success

- Develop a Global Perspective

- Travel and explore different countries to gain firsthand insights into various markets.

- Engage with local experts and participate in international forums to broaden your understanding.

- Implement a Robust Research Process

- Combine quantitative data analysis with qualitative assessments to form a comprehensive view of potential investments.

- Utilize advanced analytical tools and stay updated with the latest market research.

- Adopt a Disciplined Investment Strategy

- Define clear investment goals and develop a strategic plan to achieve them.

- Stick to your investment principles, even when faced with market volatility or short-term setbacks.

- Focus on Continuous Learning

- Stay informed about global economic developments, technological advancements, and emerging market trends.

- Invest in your education through courses, seminars, and mentorship programs.

- Cultivate Emotional Resilience

- Practice mindfulness and stress management techniques to maintain emotional control.

- Build a support network of mentors and peers to gain perspective and encouragement.

- Leverage Technology and Data Analytics

- Use sophisticated data analytics tools to monitor market trends and identify investment opportunities.

- Stay ahead of the curve by adopting new technologies that enhance your investment analysis and decision-making processes.

- Engage in Ethical Investing

- Uphold high ethical standards in all investment decisions.

- Consider the social and environmental impact of your investments to contribute to sustainable development.

Final Encouragement: Embrace Global Insights and Strategic Foresight

Jim Rogers’ legacy in the investment world is a testament to the power of global insights and strategic foresight. As you embark on your investment journey, let his principles guide you towards informed decisions and sustained growth. Remember, the global market is vast and ever-changing—embrace its complexity, stay informed, and remain adaptable. With these strategies in your toolkit, you can navigate the financial landscape with the confidence and acumen of a seasoned investor like Jim Rogers.

Embrace the Following Mindset:

- Global Perspective: Think beyond local markets to identify international opportunities.

- Strategic Foresight: Anticipate future trends and position your investments accordingly.

- Continuous Improvement: Always seek to refine your strategies based on new knowledge and experiences.

- Resilience: Stay committed to your investment principles, even in the face of market volatility and uncertainty.

- Ethical Standards: Maintain integrity and ethical standards to build trust and ensure long-term success.

By adopting Jim Rogers’ investment strategies and maintaining a disciplined, informed, and adaptable approach, you can build a robust and successful investment portfolio that stands the test of time.

I

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.