When it comes to evaluating stocks, the Price-to-Book Ratio (P/B) is one of those metrics that often flies under the radar, but it shouldn’t. What exactly is the P/B ratio? Simply put, it’s a financial metric that compares a company’s market value (the price investors are willing to pay for its stock) to its book value (the value of its assets minus liabilities). In essence, the P/B ratio gives you a snapshot of whether a stock is undervalued or overvalued relative to what the company is actually worth on paper.

source: Rynance on YouTube

So why do investors care about the P/B ratio? It’s particularly useful for assessing companies that have substantial tangible assets, like manufacturers, banks, or real estate firms. If the ratio is below 1, it might indicate that the stock is undervalued—possibly a bargain. On the other hand, a higher P/B ratio could suggest that investors are expecting high growth or that the stock is overvalued. For value investors, this ratio is a go-to tool for spotting potential opportunities in the market.

Overview of the Price-to-Book Ratio (P/B)

Our goal is to demystify the P/B ratio—to show you not just how to calculate it, but how to use it effectively when making investment decisions. We’ll walk through the calculation process step by step, discuss what the ratio tells you about a stock, and explore how it fits into a broader investment strategy. By the end, you’ll have a solid grasp of how this metric works and why it’s a valuable addition to your investment toolkit.

We’ll cover everything from understanding the components that go into the ratio to interpreting the results in real-world scenarios. Whether you’re a seasoned investor or just starting out, this article will give you the insights you need to leverage the P/B ratio in your own investment decisions.

Understanding the Price-to-Book Ratio

What is the P/B Ratio?

The Price-to-Book Ratio (P/B) is one of those essential tools that gives you a glimpse into a company’s valuation, but what exactly does it measure? At its core, the P/B ratio compares a company’s market value—what investors are currently willing to pay for its shares—to its book value, which is essentially the company’s net assets as recorded on its balance sheet. Think of it like this: the P/B ratio tells you how much you’re paying for every dollar of net assets the company owns.

Why is this ratio particularly useful? Because it’s grounded in tangible, hard numbers. For companies that are rich in assets—like banks, manufacturing firms, or real estate companies—the P/B ratio can be a reliable indicator of whether the stock is undervalued or overvalued. If the ratio is less than 1, it might suggest that the market is undervaluing the company’s assets, potentially signaling a buying opportunity. Conversely, a higher ratio could mean that investors are betting on the company’s growth prospects or, in some cases, that the stock is overpriced. For asset-heavy companies, the P/B ratio is like a magnifying glass, helping you see beyond the noise of the market to the underlying value.

Importance of Book Value

To fully grasp the P/B ratio, you need to understand the concept of book value. So, what is book value? It’s the company’s net worth, calculated by subtracting total liabilities from total assets. In other words, book value represents the residual value of the company’s assets after all debts and obligations have been paid off. It’s like the financial bedrock of the company—what would theoretically be left if the company were liquidated today.

Book value is crucial because it gives investors a baseline for assessing the company’s worth. When you compare the book value to the market value (using the P/B ratio), you can gauge whether the market is pricing the company fairly. If a company’s market value is significantly higher than its book value, it suggests that investors are optimistic about the company’s future earnings potential. On the other hand, if the market value is close to or even below the book value, it might indicate that the stock is undervalued—or that the company is facing challenges.

How to Calculate the P/B Ratio

Gathering the Necessary Data

Before you can calculate the Price-to-Book Ratio (P/B), you need to gather a couple of key pieces of information. First up is the market value per share. This is the current price at which a company’s stock is trading on the market. You can easily find this on financial news websites, stock market apps, or even a quick Google search. The second piece of the puzzle is the book value per share. This represents the company’s equity divided by the number of outstanding shares. To find this, you can dig into the company’s balance sheet, which is typically available in their quarterly or annual reports, or use financial databases like Yahoo Finance, Bloomberg, or Morningstar that provide this data at your fingertips.

Having the right tools and resources is crucial. Websites like Yahoo Finance, Google Finance, or your brokerage platform often offer quick snapshots of both the market price per share and the book value per share. For those who prefer a more hands-on approach, you can calculate the book value per share by subtracting total liabilities from total assets and dividing the result by the number of shares outstanding. But let’s be honest—most of us will let the online tools do the heavy lifting.

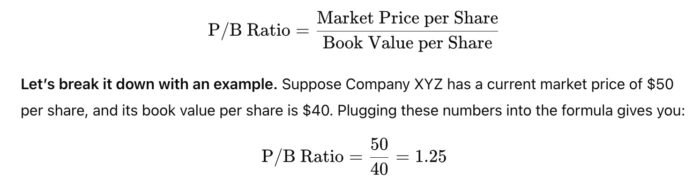

The P/B Ratio Formula

Once you have the market price per share and book value per share, it’s time to put them together. The formula for the P/B ratio is straightforward:

What does this 1.25 mean? It indicates that the market values the company at 1.25 times its book value. In other words, investors are willing to pay a 25% premium over the company’s net asset value, likely because they expect the company to grow or generate higher returns in the future.

Interpreting the P/B Ratio

So, you’ve calculated the P/B ratio—now what? Understanding what the number means is where the real insight lies. A P/B ratio of less than 1 might suggest that the stock is undervalued. In theory, you could buy the entire company for less than its net asset value, which could be a sign of a bargain—or a warning sign that the market expects the company’s assets to depreciate or that it’s in trouble.

A P/B ratio of exactly 1 indicates that the market value is equal to the book value. Investors are paying precisely what the company’s assets are worth on paper, with no premium for future growth or discount for potential decline.

A P/B ratio of greater than 1 means the market values the company higher than its book value. But be cautious here. While this often signals that investors are optimistic about the company’s prospects, it could also mean the stock is overvalued if future earnings or asset growth don’t live up to expectations. In some industries, especially those with substantial intangible assets or strong brand value, a higher P/B ratio might be more common and not necessarily a red flag.

Practical Applications of the P/B Ratio

Comparing Companies in the Same Industry

One of the most effective ways to use the P/B ratio is by comparing companies within the same industry. Why is this useful? Because companies in the same sector often have similar business models, asset structures, and market conditions, making the P/B ratio a valuable tool for spotting relative value.

Let’s say you’re looking at two companies in the banking industry—Company A and Company B. Company A has a P/B ratio of 0.8, while Company B has a P/B ratio of 1.2. What does this tell you? At first glance, Company A might appear undervalued compared to Company B, which could mean it’s a potential bargain. However, you need to dig deeper. Is Company A’s lower P/B ratio due to market pessimism about its future prospects? Or is it genuinely undervalued compared to its peers? The P/B ratio gives you a starting point, but it’s essential to consider other factors like earnings growth, management quality, and industry trends before making a decision.

Evaluating Value Stocks

For value investors, the P/B ratio is a go-to metric for finding stocks that might be trading below their intrinsic value. Here’s how it works: When the P/B ratio is less than 1, it suggests that the stock is trading for less than the company’s book value. In other words, the market might be underestimating the company’s net assets or future growth potential.

Imagine discovering a stock with a P/B ratio of 0.7. This could be a red flag signaling trouble, but it could also be a golden opportunity if the market is overly pessimistic. For value investors, this is where the P/B ratio shines. It helps identify stocks that might be overlooked by the broader market, allowing you to potentially pick up shares at a discount. However, it’s important to incorporate the P/B ratio into a broader analysis that includes other financial metrics, such as the price-to-earnings (P/E) ratio, return on equity (ROE), and cash flow. The P/B ratio is a piece of the puzzle, not the whole picture.

Assessing Financial Health

Beyond evaluating value, the P/B ratio can also provide insights into a company’s financial stability and risk profile. A low P/B ratio might suggest that a company’s assets are not being valued highly by the market, possibly due to underlying financial issues. Conversely, a high P/B ratio could indicate that the market is confident in the company’s assets, but it could also mean the stock is overvalued and vulnerable to a downturn.

So, what should you watch out for? If you encounter an extremely low P/B ratio—say, below 0.5—it’s worth investigating further. Is the company facing declining profits, high debt levels, or a major industry challenge? These could be warning signs that the company is struggling, and the low P/B ratio might be justified. On the flip side, an extremely high P/B ratio—let’s say above 3—could suggest that the stock is riding on high expectations that might not be sustainable. In such cases, it’s important to assess whether the company’s growth prospects and financial health truly justify such a premium valuation.

Limitations of the P/B Ratio

Industry Differences

While the P/B ratio can be a powerful tool, it’s not a one-size-fits-all metric. In certain industries, particularly those that are asset-light, like tech firms, the P/B ratio might not be as informative. Why? Because these companies often have fewer tangible assets on their balance sheets. Think about it— tech giants like Google or Facebook derive much of their value from intangible assets like intellectual property, brand reputation, and user data. These aren’t reflected in the book value, which can lead to skewed P/B ratios.

For example, a tech company with a low P/B ratio might not be undervalued but rather reflects the fact that its assets aren’t captured well by traditional accounting methods. Industry norms play a big role here. In sectors where physical assets dominate, like manufacturing or utilities, the P/B ratio is a more reliable gauge of value. But in industries driven by intangible assets, relying solely on the P/B ratio could lead to misleading conclusions.

Book Value Limitations

Another limitation of the P/B ratio lies in the concept of book value itself. Book value is calculated as total assets minus total liabilities, but this figure doesn’t always paint a complete picture of a company’s true worth. Why? Because book value doesn’t account for intangible assets like patents, trademarks, or goodwill—things that can significantly enhance a company’s market value but don’t show up on the balance sheet in a straightforward way.

Take brand value, for example. A company like Coca-Cola has an enormous brand value that isn’t fully captured by its book value. If you were to judge Coca-Cola’s stock purely on its P/B ratio, you might miss the bigger picture of its market strength.

Moreover, accounting practices can distort book value. Write-offs, asset revaluations, and depreciation can all affect book value in ways that may not accurately reflect the company’s current financial health. For instance, an asset-heavy company might have a lot of old equipment on its books, heavily depreciated, which lowers book value but doesn’t necessarily mean the company is in poor shape.

Combining the P/B Ratio with Other Metrics

P/B Ratio and Return on Equity (ROE)

The P/B ratio on its own can tell you a lot about a company, but when you combine it with the Return on Equity (ROE), you get an even more powerful tool for assessing profitability and value. Why is this combination so effective? Because while the P/B ratio gives you a sense of how the market values the company’s assets, ROE shows you how effectively the company is using those assets to generate profits.

Here’s how it works: A company with a low P/B ratio might initially seem like a bargain, but if its ROE is also low, it could be a sign that the company isn’t using its assets efficiently. On the other hand, a high ROE paired with a low P/B ratio might indicate a company that’s undervalued despite strong profitability—potentially a great investment opportunity. In essence, combining P/B with ROE helps you separate the true bargains from the value traps.

P/B Ratio and Price-to-Earnings Ratio (P/E)

Another powerful combination is the P/B ratio and the Price-to-Earnings (P/E) ratio. These two metrics together provide a fuller picture of a company’s valuation, especially when you’re trying to balance growth potential with value.

The P/B ratio tells you about the company’s current valuation relative to its book value, while the P/E ratio gives you insight into how much investors are willing to pay for each dollar of earnings. When you see a low P/B ratio alongside a low P/E ratio, it might indicate that the market is undervaluing the company’s assets and earnings—a potential value play. Conversely, a high P/E ratio with a low P/B ratio could suggest that the company’s earnings are strong relative to its assets, signaling high growth expectations.

In practice, investors often use these ratios together to gauge whether a stock is both undervalued and has solid earnings potential. It’s about finding the sweet spot where value meets growth.

Integrating the P/B Ratio into a Broader Investment Strategy

The P/B ratio isn’t just a standalone metric; it’s a versatile tool that can be integrated into various investment strategies, from value investing to growth investing. For value investors, the P/B ratio is a cornerstone, helping to identify stocks that are trading below their intrinsic value. But it’s also useful for growth investors, especially when paired with metrics like ROE and P/E, to find companies with strong growth potential that are still reasonably priced.

Let’s look at some examples. A value investor might focus on stocks with a P/B ratio below 1, indicating that the market might be undervaluing the company’s assets. But they wouldn’t stop there—they’d also check ROE to ensure the company is profitable and look at the P/E ratio to confirm that earnings are in line with the asset value.

On the other hand, a growth investor might look for companies with a higher P/B ratio but strong ROE and P/E ratios, indicating that the market expects future growth. Professional investors often use the P/B ratio in conjunction with other metrics to build a comprehensive view of a company’s financial health and market potential. This multi-faceted approach helps them make more informed decisions and manage risk effectively.

12-Question FAQ: How to Calculate and Use the Price-to-Book Ratio (P/B)

1) What is the Price-to-Book (P/B) ratio?

P/B compares a company’s market value to its accounting net worth. It answers: How many dollars am I paying for each dollar of equity on the balance sheet? Lower can imply undervaluation; higher can imply growth expectations (or overvaluation).

2) What’s the exact formula (and which “book” do I use)?

P/B = Price per Share ÷ Book Value per Share (BVPS), where BVPS = (Shareholders’ Equity − Preferred Equity) ÷ Diluted Shares Outstanding. Use diluted shares for consistency with other per-share metrics.

3) When is P/B most useful—and least useful?

Most useful: asset-heavy businesses whose economics tie closely to tangible equity (banks, insurers, brokers, asset finance, manufacturers, utilities, REITs*).

Less useful: asset-light or intangibles-heavy firms (software, brands, platforms) where book value omits most economic assets.

*REITs often prefer P/NAV or P/FFO, but P/B can still be a sanity check.

4) How do I calculate tangible P/B?

Strip out intangibles/goodwill from equity: Tangible BV = Equity − (Goodwill + Identified Intangibles). Then P/TBV = Price ÷ Tangible BVPS. Helpful for acquisitive companies or banks with large goodwill.

5) What does a P/B below 1.0 really mean?

It can signal potential undervaluation (market pricing the firm below net assets) or asset-quality/ROE problems (assets not earning their cost of capital, litigation/regulatory risks, impending write-downs). Investigate ROE, charge-offs, impairments, asset turnover.

6) What drives a “justified” P/B level?

In steady state, Justified P/B ≈ (ROE − g) ÷ (r − g) from dividend/residual-income logic, where ROE is return on equity, g sustainable growth, r required return. Higher sustainable ROE and credible growth support higher P/B.

7) How should I read P/B together with ROE?

Pair them:

Low P/B + High ROE → possible undervalued quality (check durability).

Low P/B + Low ROE → could be a value trap (needs turnaround).

High P/B + High ROE → quality priced for perfection (verify moat & duration).

High P/B + Low ROE → mispricing risk.

8) How do buybacks, write-downs, and accounting choices affect P/B?

Buybacks reduce equity and share count; if repurchased above book, P/B rises mechanically.

Write-downs shrink equity, lifting P/B even if price is unchanged.

Conservative vs. aggressive accounting (reserves, fair-value marks, lease treatment) can shift book value—always read footnotes/MD&A.

9) How do I benchmark P/B across sectors and geographies?

Compare within the same industry and accounting regime (US GAAP vs. IFRS differ on fair value, impairment, and intangible treatment). Use peer medians and historical bands for context; macro rate levels also matter (lower rates often support higher P/B for financials).

10) How do I combine P/B with P/E and cash-flow metrics?

P/B + ROE (quality/valuation lens)

P/B + P/E/PEG (earnings valuation lens)

P/B + EV/EBIT/EBITDA & FCF yield (cash reality check)

Alignment across these reduces model risk; conflicts demand deeper work.

11) What screening rules of thumb actually work?

Financials: P/B < peer median and ROE > cost of equity.

Cyclicals/industrials: P/TBV < 1.2 plus normalized ROE improving.

Turnarounds: P/B < 1 with clear catalysts (asset sales, cost program, mix shift).

Always confirm balance-sheet health (net debt/EBITDA, interest coverage).

12) What are common P/B red flags and green flags?

Red flags: chronic ROE < COE, opaque asset marks, serial goodwill write-offs, rising P/B solely from equity shrinkage, regulatory capital strain (banks).

Green flags: stable/high ROE, prudent reserving, tangible book compounding, buybacks below intrinsic value, clean auditor opinions, conservative leverage.

Conclusion

We’ve covered a lot of ground in exploring the Price-to-Book Ratio (P/B) and its role in investment analysis. To recap, the P/B ratio is a powerful tool that helps you compare a company’s market value to its book value, offering insights into whether a stock might be undervalued or overvalued. Calculating it is straightforward: simply divide the market price per share by the book value per share. This ratio is particularly useful for evaluating asset-heavy companies, where tangible assets make up a significant portion of the company’s value.

But, as we discussed, the P/B ratio has its limitations. It’s less effective in industries dominated by intangible assets, like tech firms, and it doesn’t always capture the full picture of a company’s worth, especially when accounting quirks or intangible assets come into play. That’s why it’s crucial to use the P/B ratio alongside other metrics, such as ROE and P/E, to get a well-rounded view of a company’s financial health and market potential.

Final Thoughts

As you navigate the world of investing, the P/B ratio should be one of many tools in your arsenal. It offers valuable insights, but remember—it’s just one piece of the puzzle. To make informed decisions, it’s essential to consider the broader context in which the P/B ratio operates. This means looking at industry trends, understanding the company’s growth prospects, and comparing the P/B ratio with other financial metrics to get a complete picture.

In short, don’t rely on the P/B ratio alone. Use it as part of a holistic investment approach that takes into account all the factors that could impact a company’s performance and stock value. By doing so, you’ll be better equipped to spot opportunities, avoid potential pitfalls, and ultimately make smarter investment decisions.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.