I’m not gonna lie.

Most ETF launches I’d file under the ‘Do Not Disturb’ category.

Yawn. Wake me up when its over.

Its just perpetual non-stop scoops of vanilla to the moon and back.

However, there are certain exceptions that tickle my fancy.

One of those latest releases is none other than MYLD ETF.

It’s better known as Cambria Micro & SmallCap Shareholder Yield ETF.

And we’re in for a treat because we’ve got Meb Faber (its creator) to explain all of its unique features.

Without further ado, let’s turn things over to Meb.

Meet Meb Faber of Cambria Funds

I’m a Colorado native. Although I spent part of my school years in Winston Salem, North Carolina, so I tend to claim both.

I went to college at the University of Virginia where I studied Engineering and Biology and I did some grad school there and at Hopkins but in the Biomedical Engineering world.

I graduated during one of the biggest bubbles – arguably the biggest bubble in US stock market history. The internet bubble. My favorite bubble. And that, for many who don’t recall, was also a biotech stock bubble. They were sequencing genomes.

So the original plan was to continue grad school and get a PhD in Genetics or Biomedical Engineering, but I was somewhat seduced by the investing world. I wanted to make a little money and try to figure this out and then maybe go back to grad school.

I started out working as a biotech equity analyst for a mutual fund in Maryland, and then moved out to San Francisco and Lake Tahoe. I was basically a glorified ski bum, but I was working for a startup commodity trading advisor. And that’s where I really started to get the origins and beginnings of a quantitative approach to markets.

When that eventually folded, I moved to Los Angeles to start Cambria Investment Management pre global financial crisis. We are what you would call an overnight success 17 years in the making.

We started out with separate accounts and private funds, and then eventually we had an ETF opportunity where we launched our first fund in 2013. Over a decade later, we now have 14 funds, over 2 billion in assets and over 150,000 shareholders all around the world.

We have a local office here in Manhattan Beach, California – all are welcome to come visit and say hi. It’s right close to the ocean. We can go take a walk on the beach, go for a surf, drink coffee and talk markets and ETFs.

Reviewing The Strategy Behind MYLD ETF (Cambria Micro and Small Cap Shareholder Yield) with its creator Meb Faber

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of MYLD ETF?

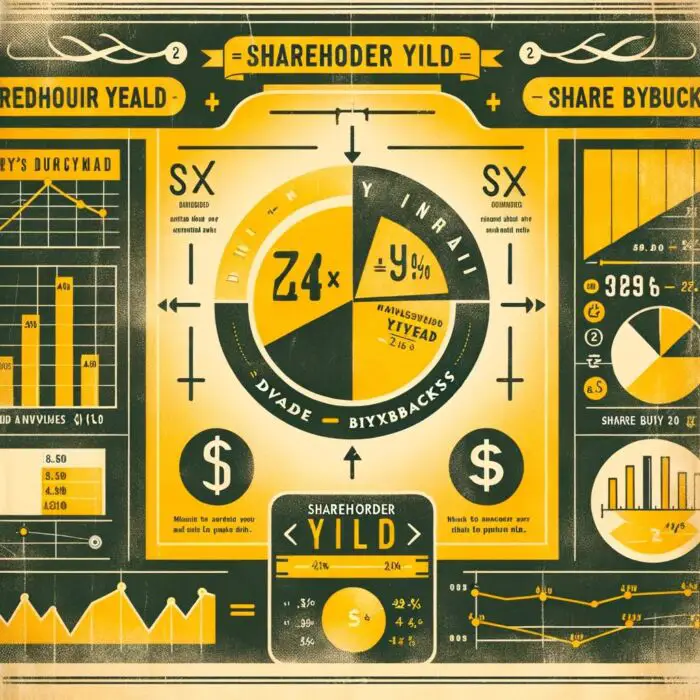

For those who aren’t necessarily familiar with a “Shareholder Yield and/or Micro Cap equity” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

To understand this fund, you really have to go back a decade to understand our first fund.

I wrote a book called Shareholder Yield – A Better Approach to Dividend Investing. That book is available for free online at either mebfaber.com or cambriainvestments.com. This short book demonstrated a very important topic; which was this concept of income and dividend investing.

Often you hear in markets, this time is different.

When should you make changes based on what’s going on in the world?

Usually they’re talking about the Fed or whatever the topic du jour is, but very rarely are there actual regime shifts. In other words, seismic shifts in structural markets that you need to account for to make changes.

But there very much has been one in the US and globally – particularly the US as it started the 1980s. But really, since the 1990s it’s accelerated.

And that is this concept of approaching income investing from not just cash dividends, but also including net stock buybacks. Not just stock buybacks but also share issuance.

There’s a lot of misinformation around that topic that goes way back over 100 years. Their brains seems to shut down when you mentioned the word buybacks. But buybacks have been around as long as markets have been in existence. They were never illegal, which people tend to mention a lot.

And obviously Shareholder issuance has also been around as long as markets have existed in equities, so this concept really gained traction in the late 1990s.

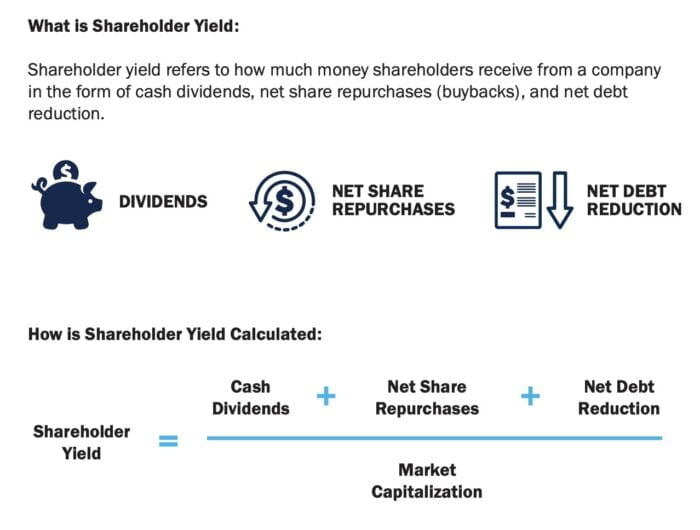

We call this shareholder yield; cash dividends plus net stock buybacks.

The reason you have to account for buybacks and share dilution is that starting in the late 90s, stock buybacks have outpaced the amount that companies have distributed through buybacks. Which has outpaced the amount they distribute through cash dividends.

And it’s finance 101 that stock buybacks when a company is trading at intrinsic value.

It’s the exact same thing as a cash dividend. It’s just more flexible, and it’s more tax efficient.

If you’re a holder of the stock, you don’t have to sell. You get to choose when you sell your stock.

Thus, with cash dividends you don’t you get a quarterly payment that you have to pay taxes on. Hence, stock buybacks tend to be more tax efficient.

On top of that, if a stock is trading below intrinsic value, you have the ability to earn an arbitrage where you’re buying the stock back for cheaper than the NAV.

Nobody understands this more than Warren Buffett, who has a quantitative measure at which he’ll buy back Berkshire shares at approximately 1.3X Book Value.

What does all of this have to do with the Cambria Micro & Small Cap Shareholder Yield ETF?

Well, our very first ETF was the Cambria Shareholder Yield ETF, which is a US equity ETF.

It owns 100 stocks in the US that sort based on shareholder yield as well as valuations. This fund has been one of the best performing funds in the equity open ended space since inception. It’s the number one performing fund in its category since inception through the end of 2023.

Morningstar recently put out a research report on dividend investing looking at hundreds of funds with dividend or income in their name.

We also included funds that mentioned buybacks in their name, and shareholder yield actually outperformed all of them.

This concept of merely dividend yield investing is sub optimal. It’s not that bad as there are worse ways to invest. But we just think ignoring a vital piece of information is not ideal.

This is a long winded discussion to get us focused upon the Cambria micro and small cap ETF, but I think that shareholder yield foundation is important.

We actually have four shareholder yield ETFs.

We have the Cambria Shareholder Yield ETF SYLD.

The Cambria Foreign Shareholder Yield ETF FYLD, which focuses on foreign developed stocks.

We’ve also got the Cambria Emerging Markets Shareholder Yield ETF EYLD which focuses on emerging markets.

And now our most recent entrant, which is Cambria Micro and Small Cap Shareholder Yield ETF MYLD.

It was launched due to two main factors. The demand from investors who kept requesting this fund.

Firstly, they wanted an exposure that wasn’t going anywhere near large cap SYLD.

Secondly, They wanted a specific exposure that was narrowed down to small caps.

Thus, we launched this fund.

Unique Features Of Cambria Micro & SmallCap Shareholder Yield MYLD ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

At its core this fund is 100 stocks and it’s actively manage. All of our funds are quantitative and rules based. We do the indexes in house.

Indexes often get front run by other investors and hedge funds in a very real slippage as a cost to investors.

Thus, we do index investing, but we do it in house. Therefore, it’s technically an actively managed ETF.

It owns around 100 stocks and it rebalances those quarterly.

Due to the structural features that an ETF offers it tends to mean tax efficiency due to the creation, redemption, and custom rebalancing properties.

It will have a decent amount of turnover usually, and it varies by what’s going on in the world.

Let’s call it around 30% per year.

It could be more or it could be less.

The minimum market cap is 100 million and the maximum is 5 billion.

There’s a lot of stocks out there within that range.

Currently upon launch the top three top four sectors include financials, industrials, consumer discretionary, and energy.

This is not a leveraged fund. There are no discretionary inputs. The fee is 0.59%.

As a side note, Cambria does implement short lending across all of our funds and that short lending revenue is returned to the shareholders.

In some cases that short lending revenue is only 5 or 10 basis points. In other cases, it could be 10 to 20 to 50 basis points.

In one particular case, we had a fund that was hundreds of basis points at one point.

Now we don’t keep any of that. A little bit goes to the company that’s running the share short lending program and the rest goes to shareholders. So that helps to reduce the management fee. In some cases, in the past, it’s completely covered the management fee which is pretty cool.

source: Meb Faber Show on YouTube

What Sets MYLD ETF Apart From Other Funds?

How does your fund set itself apart from other “small cap and micro cap” funds being offered in the marketplace? What makes it unique?

Most funds tend to be market cap weighted or they have a certain set exposure.

They could be market cap weighted within small caps or maybe they have a theme like technology.

In some cases, you’ll have low vol or low beta.

For the better part of 10 years, there’s been no other shareholder yield ETFs.

There’s certainly no other shareholder yield small cap ETFs.

There are dividend ETFs.

However, as we mentioned before, one of the problems with that is a dividend fund yielding 4%.

Upon examining the underlying securities a number of them are netshare issuers. This is the last thing you’d want particularly in the tech sector.

We target stocks coming into the portfolio that offer double digit shareholder yield.

In the United States, that tends to be a majority driven by buybacks abroad; it tends to be closer to 50/50 dividends and buybacks.

On average, you see the companies coming in usually around double digit yields, which is a pretty significant spread between that and your traditional dividend or market cap weighted fund.

There are caps on sectors, as you’re not going to see any sector over around a third.

Those will shift over time based on valuations.

Our process of stock selection is very similar across all of our shareholder yield ETFs.

It starts with the entire universe of tradable securities – ones that are liquid and past trading filters.

The top shareholder yield stocks are measured by cash dividends and net stock buybacks.

It then does a valuation screen that looks at the stocks trading below intrinsic value.

We don’t disclose the measures, but it’s fairly typical to something like a price to earnings metric.

The whole goal here is that you want stocks that are cheap relative to their intrinsic value.

And to avoid those that are expensive.

We exclude stocks that are highly leveraged.

We kind of skim off the top as we don’t want stocks that are just buying back shares and taking on a ton of debt and becoming more junky in the process.

And for the final sort we use a little bit of a momentum sprinkled on the buy decision, not on the sell decision.

What does that mean?

It’s a medium or short term momentum rather than something really long term.

The goal is to try and avoid value traps over time.

And we achieve our final portfolio.

The companies that tend to get kicked out happen either when the shareholder yield decreases or the valuation goes up too much.

And usually that’s due to appreciation; hence, you won’t see stocks get above 5%.

On average, they’re all equal weighted at 1% each.

Many funds out there or what we call closet indexers.

In essence, this means that you think you’re getting an active fund where you think you’re getting a certain exposure.

However, in reality you’re getting simply the broad market cap index, but for a much higher cost.

This is not something any of us want when you can invest in low cost index funds.

What Else Was Considered For MYLD ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

Nothing. This is basically a SYLD ETF clone but with market cap parameters that are different.

When Will MYLD ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

One of the reasons we were eager to launch this fund is that we try to be somewhat anti-consensus or counter-cyclical when we launch funds.

In other words, many of our ETF brothers and sisters tend to chase the hot trend.

You can see this with over a dozen funds chasing Bitcoin launches.

This changes to whatever the hot trend happens to currently be.

It could be AI. It could be ESG. It could be BRICKS. It could be Magnificent Seven.

We’ve tried to launch funds with the intent of never closing them.

However, we also attempt to launch them not at peak euphoria.

As for a specific example, we launched a REIT fund during the pandemic and now the Micro Small Cap US Value Fund.

We believe this is at a period where small cap value type of securities are trading at very large discounts to both their large cap peers as well as their growth and expensive company peers.

Now, we had a pretty nice run over the past few months of 2023 as well as Q4.

Thus, we didn’t quite time the bottom. But those are only obvious in retrospect.

These type of funds will benefit from spread compression relative to the rest of the universe.

When you screen many of these stocks, you’re buying single digit P E ratio type of companies with hopefully double digit shareholder yield, trading at very large discounts to both the large market.

Many of these very large peer funds can’t concentrate as much as a fund like ours with only 100 securities.

As far as the various regimes of up markets, down markets, high beta and low beta there was very good paper by Robeco related to conservative investing that backtests a shareholder yield style strategy for over 120 years.

In general it finds that a value type of strategy does best when markets are sideways and down.

This means that you don’t lose your shirt when the market cap is getting punished.

It generally keeps pace during bull markets with the S&P but usually it tends to trail a little bit.

In general, much like a Berkshire Warren Buffett style portfolio, we would have hoped this portfolio keeps up in the good times and outperforms during the bad times. But as we’ve seen over the past decade, it can vary based on what’s going on in the world in the macro environment.

source: Meb Faber Show on YouTube

Why Should Investors Consider Cambria Micro & SmallCap Shareholder Yield MYLD ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

In our global asset allocation book we demonstrated that investors ought to have global exposure to stocks, bonds and real assets.

It’s the best time in the world to be an investor because you can do so at almost zero cost.

Which is incredible for market cap weighted strategies.

If you’re going to move away from market cap weighted strategies it means you’re gonna be active and pay more.

It makes sense to us to be highly concentrated, weird and different.

It doesn’t make any sense to pay half a percent, one and a half or two percentage points for something that just looks like the S&P that you can basically get for free.

For investors that are willing to move away from the market cap, we think you want the concentration and conviction of a strategy that can really move out into the tails and buy these concentrated portfolios.

This is what MYLD ETF does.

How Does MYLD ETF Fit Into A Portfolio At Large?

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

I think most people will use this particularly fund as a LEGO.

In other words, they have small cap and small cap value exposure.

They’ll swap this out for what they’re currently using.

Some may use it tactically. Others may use it for their entire equity exposure.

However, I think that will be a minority of investors as most will use it for a building block approach within their US equity exposure.

They’ll target it for small cap or mid cap value exposure.

Everyone has a different definition of small and mid cap.

We keep this with a ceiling of 5 billion all the way down to 100 million.

The Pros & Cons of MYLD ETF

What’s the biggest point of constructive criticism and praise that you’ve received about your fund since it has launched?

Well, it’s only been a week, so nothing yet.

We have 14 funds and something is usually doing great and something else is usually doing stinky given what’s going on in the world.

Hence, we’ve heard almost all of the criticism you can throw our way over time.

But we do think it’s important for investors to have reasonable expectations and to understand that markets can be volatile.

Some of the biggest fractures with investors plans and portfolios tend to be a misalignment between expectations and reality.

That tends to be more over a timeframe expectation where investors want high returns consistent with low volatility and drawdowns.

And they want them now and they want them every single year but they don’t give most of their investments enough time to perform across various regimes lasting days, weeks, months, years and even decades.

Learn More About MYLD ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

We’ve pretty much covered a lot of this strategy.

I think there are areas for expansion on the shareholder yield concept.

We wrote a blog post a couple of years ago examining shareholder yield across various sectors and industries.

We were expecting it to work with any investing approach where you expect it to work most of the time.

In other words, it should work in the US but it should also work in Japan or Emerging Markets.

And it should work most of the time; however, not all the time.

Hence, we did a test on shareholder yield across sectors and industries and expected it to work in most of them.

And again, this is hypothetical back test.

But we found that it actually ended up working in all of them, which was a pleasant surprise.

Thus, we may expand into some various sub sectors or industries like tech or gold mining.

If you have any specific requests certainly feel free to reach out and we can hopefully help with those.

As far as other ideas, we’re always coming up with crazy ideas.

Our goal in launching funds is to only launch funds that don’t exist, or that we think we can do better than others.

These days our funds are cheaper than the category average.

And some of them are the cheapest funds in their given category.

It has to be something that is backed by quantitative historical research; whether we’ve done it or others in the academic and practitioner community.

It has to be something that people want and something that we at Cambria want to put our own money into.

The average open ended fund investor Portfolio Manager has zero invest in their own fund.

I put all my public assets into our ETFs.

As far as what are we working on? There’s a fun new tactical Fixed Income Fund we also launched called the Cambria Tactical Yield ETF TYLD.

I’m happy to tell you all about that in a future discussion.

It’s a fun idea we’ve never seen before that spends most of its time chilling out in T bills.

Which is really the catch phrase of 2023 – T bill and chill.

But then we’ll opportunistically move into riskier areas of fixed income such as emerging markets, 30 year bonds or corporate bonds when the spreads justify being in those markets.

And as of launching here in early 2024 that fund is entirely invested in T bills.

MYLD ETF Review: Cambria Micro & SmallCap Shareholder Yield — 12-Question FAQ

1) What is MYLD and what’s its goal?

Cambria Micro & SmallCap Shareholder Yield ETF (MYLD) is a rules-based, actively managed U.S. equity strategy that seeks micro and small-cap companies returning cash to shareholders via shareholder yield (cash dividends + net share repurchases), with an added valuation and balance-sheet discipline.

2) What exactly is “shareholder yield” and why pair it with micro/small caps?

Shareholder yield combines cash dividends with net buybacks (buybacks minus issuance). Since the late 1990s, buybacks have become a primary cash-return mechanism in the U.S. Micro/small caps add a fertile hunting ground for high yields and potential mispricing versus large-cap peers.

3) How are stocks selected and how often is the portfolio refreshed?

The process screens a liquid U.S. universe for:

• High shareholder yield (dividends + net buybacks)

• Attractive valuation (below intrinsic value)

• Financial prudence (excludes highly leveraged names)

• A momentum overlay on buys (to help avoid value traps)

Roughly 100 names, equal-weighted ~1% each, rebalanced quarterly; typical annual turnover around ~30% (can vary).

4) Is it active or passive? Any leverage? What are fees and frictions?

It’s actively managed (indexes built in-house to avoid index front-running) and unlevered. Expense ratio: 0.59%. Cambria engages in securities lending; net lending revenue (after program costs) flows back to shareholders, partially offsetting fees.

5) What market-cap range and sector limits does MYLD use?

Target market cap: $100M to $5B at inclusion. Sector weights are constrained (no sector ~> one-third). Current tilts will evolve with opportunity, but launch tilts included financials, industrials, consumer discretionary, and energy.

6) How is MYLD different from dividend or small-cap indexes?

Many “dividend” funds ignore net issuance (dilution) and many small-cap products are cap-weighted or factor-light. MYLD explicitly targets double-digit shareholder yield entrants, layers valuation and leverage filters, uses equal weight, and maintains concentration (≈100 names).

7) When might MYLD do best—and when might it lag?

Historically, value/shareholder-yield styles tend to hold up better in sideways/down markets and keep pace (sometimes modestly lag) in melt-up bull runs. Environments with spread compression (cheap vs. expensive) can be favorable; pure momentum “growth manias” can be tougher.

8) How might investors use MYLD in a portfolio?

Primarily as a building block (“LEGO”) within U.S. equities—e.g., small/smid value sleeve or a satellite to complement broad beta. Some may use it more broadly for equity exposure, but most will pair it with other sleeves (e.g., large-cap, international, real assets).

9) What key risks should I know?

Micro/small caps can involve higher volatility, wider bid/ask spreads, and lower liquidity. A rules-based value tilt can lag in growth-led markets. Turnover and corporate action dynamics can affect realized tax outcomes (the ETF structure seeks efficiency but doesn’t eliminate taxes).

10) Isn’t there controversy around buybacks?

Buybacks are economically similar to dividends when at fair value, but often more tax-flexible (investors choose when to realize gains). When executed below intrinsic value, buybacks can be accretive. MYLD’s valuation and leverage screens aim to favor prudent repurchasers and avoid dilutive issuers.

11) What else was considered for MYLD’s design?

MYLD is essentially a SYLD-style process ported to the micro/small-cap segment—no added leverage or complex overlays. The aim is purity of exposure: shareholder yield + value + quality guardrails, applied to the smaller end of the market.

12) Where can I learn more or explore related ideas?

See Meb Faber’s “Shareholder Yield” (free at mebfaber.com / cambriafunds.com) and Cambria’s broader lineup (SYLD, FYLD, EYLD) for large, developed ex-U.S., and EM versions. For fixed income, Cambria also launched TYLD (Tactical Yield)—“T-Bills & chill,” shifting opportunistically when spreads warrant.

Connect With Meb Faber of Cambria Funds

You can find our ETFs at cambriafunds.com.

You can find a lot of our research at either mebfaber.com or cambriainvestments.com.

Pretty soon we’ll be launching a website called shareholderyield.com which hopefully will be out by the time this publishes.

You can find me on Twitter @MebFaber and we have a podcast format YouTube channel which is the Meb Faber Show.

You’ll find it on Apple as well as all of the other podcast apps.

Additionally, we have a free once-a-week email service called The Idea Farm that is really fantastic.

That goes out on Sundays and sends out the top reads we’ve come across as well as the top podcast each week.

It has a companion Spotify playlist that has over 500 episodes on it on historical best podcasts over the last five years.

Nomadic Samuel Final Thoughts

I want to personally thank Meb for taking the time to participate in the “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.