Exchange-Traded Funds (ETFs) have revolutionized the investment landscape, offering a blend of diversification, lower expense ratios, and the flexibility of trading like stocks. In this arena, Vanguard stands as a titan, renowned for its investor-focused ethos and low-cost investment options. Among its diverse offerings, the Vanguard Total Stock Market ETF (VTI) and the Vanguard S&P 500 ETF (VOO) shine as exemplary products, both acclaimed for their robust performance and cost efficiency. This article delves into an in-depth comparison of these two flagship funds, unraveling their nuances to guide investors in making informed decisions.

VTI ETF: Comprehensive Market Exposure

VTI ETF offers investors a comprehensive exposure to the entire U.S. equity market, encompassing small, mid, and large-cap growth and value stocks. Its broad diversification aligns with the investment philosophy of capturing the market’s total performance, rather than chasing the highs and lows of individual stocks or sectors.

This fund mirrors the CRSP US Total Market Index, a benchmark that represents nearly 100% of the investable U.S. stock market. Such an extensive coverage makes VTI an attractive option for investors seeking a one-stop solution to U.S. equity exposure.

VOO ETF: Focused on Large-Cap Equities

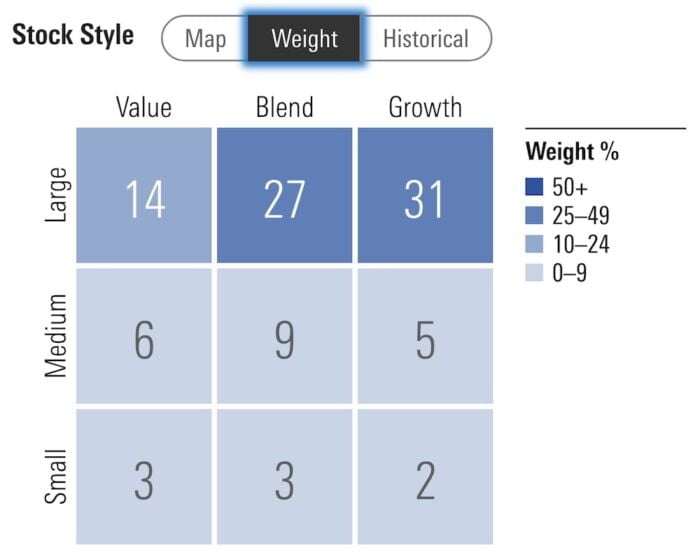

On the other hand, VOO ETF specifically targets large-cap equity performance by tracking the S&P 500 Index, a bellwether for U.S. large-cap stocks. The fund’s composition mirrors the index, predominantly featuring heavyweight companies with solid market capitalizations. These are firms that have established themselves as leaders in their respective industries, offering stability and steady growth prospects.

VOO is thus a go-to ETF for investors who prefer a focus on large-cap equities, capitalizing on the stability and performance of America’s largest corporations.

Comparative Investment Strategies

The investment strategies of VTI and VOO, while seemingly similar, cater to distinct market segments. VTI’s all-encompassing approach offers a more diversified exposure, potentially lowering risk by spreading investments across a wider range of companies. In contrast, VOO’s concentration on large caps means it may be less volatile but also potentially less diversified than VTI. This distinction is crucial for investors’ asset allocation strategies, where the choice between VTI and VOO hinges on their individual investment goals, risk tolerance, and market outlook.

source: Andrew Giancola on YouTube

Analyzing Performance and Returns

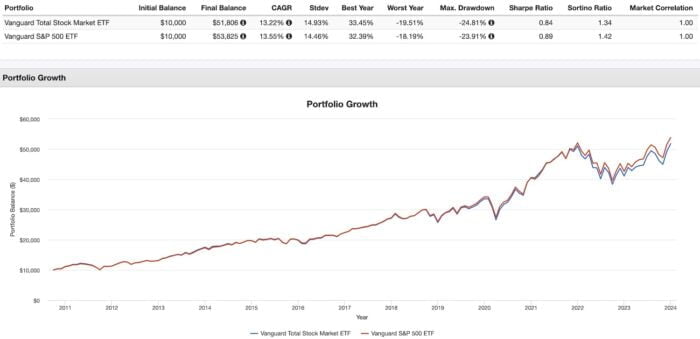

Analyzing their performance history, both VTI and VOO have demonstrated strong returns over the long term, reflective of the growth trajectory of the U.S. stock market. However, their performance can diverge over shorter periods, influenced by market dynamics affecting different company sizes and sectors. VTI’s broader market exposure suggests a higher potential for capturing growth in rapidly expanding sectors or smaller companies. Conversely, VOO’s focus on large-cap stocks means its performance is closely tied to the fortunes of the largest U.S. companies, which can be more resilient during market downturns.

source: Rob Berger on YouTube

Cost Efficiency and Expense Ratios

In terms of cost efficiency, both ETFs boast low expense ratios, a hallmark of Vanguard’s investor-friendly approach. This cost efficiency enhances the appeal of these funds, as lower fees directly translate to higher net returns for investors. Moreover, Vanguard’s scale and expertise in managing index funds ensure that both VTI and VOO closely track their respective indices with minimal tracking error, a testament to the fund manager’s efficiency and expertise.

Investor Profiles and Decision Making

The choice between VTI and VOO extends beyond mere performance metrics. It encapsulates an investor’s belief in the market’s segments and their own investment philosophy. VTI, with its wide-ranging market coverage, is suited for those who believe in the collective growth potential of the U.S. stock market across all its tiers. VOO, with its large-cap focus, is ideal for investors who seek stability and are content with riding the waves of the market’s biggest players.

In conclusion, both VTI and VOO stand as exemplary choices in their own right, yet cater to distinct investor preferences. VTI’s appeal lies in its comprehensive market exposure, offering a microcosm of the entire U.S. equity landscape. VOO, meanwhile, provides a focused avenue into the realm of large-cap dominance. The decision between them hinges not just on performance numbers, but on a deeper understanding of one’s investment philosophy, risk appetite, and the economic segments one believes will lead the market’s future growth trajectory.

What Is VTI ETF? Understanding Vanguard Total Stock Market ETF

The Vanguard Total Stock Market ETF (VTI) stands as a formidable player in the realm of Exchange-Traded Funds (ETFs), offering a comprehensive and strategic approach to U.S. equity investment. Launched by Vanguard, a titan in investment management known for its investor-friendly products, VTI encapsulates the company’s philosophy of broad market exposure and low-cost investing.

Investment Strategy and Fund Composition of VTI

At the heart of VTI’s allure is its expansive investment strategy. Unlike funds that focus on specific sectors or market caps, VTI offers investors exposure to the entire spectrum of the U.S. stock market. This ETF tracks the CRSP US Total Market Index, which includes over 3,000 stocks, representing nearly every publicly traded company in the United States. This broad range encompasses large-cap giants, mid-sized companies, and smaller firms, spanning diverse sectors from technology and healthcare to finance and consumer goods.

Such a wide-ranging approach provides a unique advantage – diversification. By investing across the entire market, VTI reduces the risk inherent in focusing on a particular sector or company size. It mitigates the volatility that individual stocks or sectors may experience, thereby offering a more stable investment vehicle over the long term.

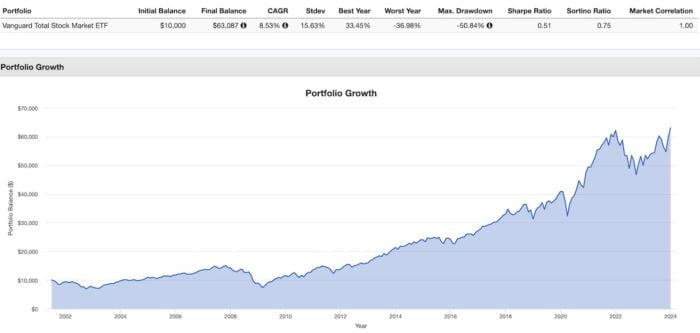

Analyzing the Historical Performance of VTI

Historically, VTI has delivered impressive returns, mirroring the dynamic and growth-oriented nature of the U.S. stock market. Over the years, it has provided investors with substantial gains, particularly beneficial for those with a long-term investment horizon. Its performance has been a testament to the strength and resilience of the U.S. economy, capturing the upward trajectory of its diverse industries. However, like all market investments, it’s important to note that past performance is not indicative of future results, and investors should always consider their risk tolerance and investment goals.

source: Optimized Portfolio on YouTube

Fee Structure and Expense Ratios of VTI

One of the most compelling aspects of VTI is its cost efficiency. Vanguard is renowned for its low expense ratios, and VTI is no exception. The fund’s expense ratio of 0.03 is significantly lower than the industry average for similar products, making it an attractive option for cost-conscious investors. This low-cost structure is crucial because even small differences in fees can have a significant impact on investment returns over time.

Moreover, Vanguard’s structure as a client-owned company means its interests are aligned with its investors. This unique arrangement ensures that the company’s profits are reinvested in lowering fees and improving fund performance, directly benefiting the investors in VTI.

The VTI ETF as a Core Investment Component

In conclusion, the Vanguard Total Stock Market ETF (VTI) presents itself as a robust, diversified, and cost-effective option for those looking to gain broad exposure to the U.S. stock market. Its comprehensive investment strategy, historical performance, and investor-friendly fee structure make it an appealing choice for both novice and experienced investors. Whether as a core component of a diversified portfolio or a standalone investment, VTI stands out as a prime example of Vanguard’s commitment to offering high-quality, low-cost investment products to the public.

What Is VOO ETF? Delving into Vanguard S&P 500 ETF

In the constellation of Exchange-Traded Funds (ETFs), the Vanguard S&P 500 ETF (VOO) shines as a paragon of simplicity and effectiveness. Crafted by Vanguard, a vanguard in the investment management world, VOO offers a focused, efficient path to participating in the fortunes of America’s largest and most influential companies.

Investment Strategy and Fund Composition

VOO’s investment strategy is a model of clarity and precision. It meticulously tracks the S&P 500 Index, a benchmark representing 500 of the most sizable and established companies in the United States. These firms are not just market leaders; they are titans that influence and often dictate the broader economic trends.

By mirroring the S&P 500, VOO offers investors an uncomplicated yet powerful way to gain exposure to the American large-cap equity market. The composition of VOO is a roster of who’s who in the corporate world, spanning diverse sectors from technology and healthcare to consumer goods and financial services. The ETF’s holdings reflect the sectoral composition of the S&P 500, ensuring that investors have a stake in the varied segments of the U.S. economy.

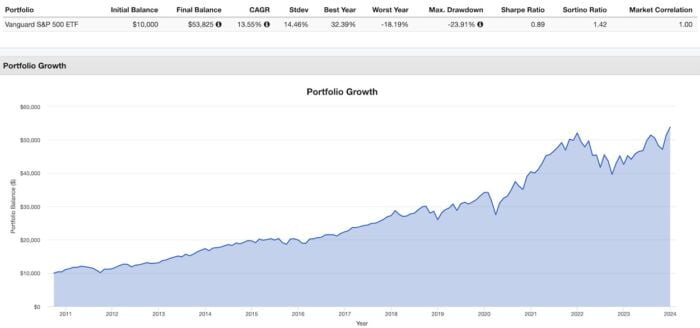

Historical Performance Analysis

VOO’s performance is a mirror to the S&P 500, and as such, it has historically provided robust returns that echo the growth and dynamism of the American economy. This ETF has been a preferred choice for investors seeking to tap into the steady growth of large-cap stocks. It’s noteworthy that the S&P 500, and by extension VOO, has been a bellwether for U.S. economic health and investor sentiment, making it a crucial component of many investment portfolios.

The historical performance of VOO has shown resilience during market fluctuations, buoyed by the inherent stability of the large-cap stocks it holds. This resilience makes VOO an attractive option for investors seeking a balance of growth and stability in their portfolios. It’s important, however, to remember that past performance, while indicative, is not a guaranteed predictor of future results.

source: Investing Simplified – Professor G on YouTube

Fee Structure and Expense Ratios

In line with Vanguard’s philosophy of low-cost investing, VOO boasts an exceptionally low expense ratio of 0.03, especially when compared to actively managed funds and even other ETFs tracking the same index. This cost efficiency is a cornerstone of VOO’s appeal. Lower expense ratios translate directly to better net returns for investors, a critical factor in long-term investment success.

Vanguard’s investor-first approach is further exemplified in VOO’s structure. The company’s client-owned structure means that fund shareholders are the owners of Vanguard, aligning the company’s interests with those of its investors. This unique model ensures that VOO’s focus remains on delivering value and performance to its shareholders.

VOO as a Staple Investment Choice

In summation, the Vanguard S&P 500 ETF (VOO) stands out as a straightforward, efficient vehicle for investors seeking exposure to the large-cap segment of the U.S. stock market. Its adherence to the S&P 500, combined with Vanguard’s low-cost ethos, makes VOO a compelling choice for both foundational portfolio construction and for investors seeking a focused approach to equity investment. VOO’s historical performance and low fee structure underscore its potential as a cornerstone in the diversified portfolios of discerning investors, offering a blend of stability, growth, and cost efficiency.

Comparative Analysis: VTI ETF vs. VOO ETF

In the world of Exchange-Traded Funds (ETFs), Vanguard’s VTI and VOO stand as two of the most prominent offerings, each embodying distinct investment philosophies and market strategies. This comparative analysis aims to elucidate the nuances between these two funds – VTI’s Total Market approach versus VOO’s S&P 500 strategy, assessing their performance, risk profiles, and the implications of their expense ratios on returns.

Investment Strategies: Total Market vs. S&P 500

VTI (Vanguard Total Stock Market ETF) adopts a Total Market approach, encompassing a vast spectrum of U.S. stocks. It’s a fund that mirrors the CRSP US Total Market Index, capturing the performance of over 3,000 stocks across all market capitalizations. This broad-spectrum strategy is designed to provide investors with a comprehensive exposure to the entire U.S. equity market, from the giants of the large-cap world to the dynamic players in the small-cap arena.

Contrastingly, VOO (Vanguard S&P 500 ETF) focuses on the S&P 500 Index, comprising 500 of the largest U.S. companies. This concentration on large-cap stocks makes VOO a fund that is representative of the major players in the American economy, encompassing firms that have established themselves as leaders in their respective industries.

Performance Comparison Across Time Frames

When comparing the performance of VTI and VOO, it’s important to consider various time frames. Historically, both funds have shown strong long-term returns, reflecting the overall growth of the U.S. stock market. However, the broader market exposure of VTI provides it with potential advantages in capturing the growth of emerging sectors and smaller companies. This can lead to VTI outperforming VOO in bull markets where smaller companies thrive.

Conversely, during bear markets or periods of economic uncertainty, VOO’s concentration on large, established companies can offer more stability. These large-cap stocks often have the financial robustness and market presence to weather economic downturns better than their smaller counterparts, potentially leading to VOO having a more resilient performance during tough economic times.

CAGR: 13.22% vs 13.55%

RISK: 14.93% vs 14.46%

Risk Assessment and Volatility Comparison

The risk profile and volatility of these two funds are intrinsically linked to their respective investment strategies. VTI’s total market approach, while providing extensive diversification, also exposes investors to the inherent volatility of small and mid-cap stocks. These segments of the market can experience higher volatility due to their sensitivity to economic cycles and market dynamics.

In contrast, VOO’s focus on large-cap stocks traditionally offers a more stable investment. The companies in the S&P 500 are typically well-established and financially robust, leading to potentially lower volatility compared to the broader market.

Expense Ratios and Their Impact on Returns

Both VTI and VOO benefit from Vanguard’s low-cost structure, featuring low expense ratios of 0.03 that are significantly below the industry average. The impact of these low fees cannot be overstated; over time, lower expense ratios can result in substantial savings and greater compounding returns for investors.

However, since the difference in expense ratios between VTI and VOO is zilch both funds score equal points.

In conclusion, VTI and VOO, while similar in their pursuit of market efficiency and low costs, cater to different investor preferences and risk tolerances. VTI’s total market approach offers broader diversification and the potential for higher growth, albeit with increased volatility. VOO, focusing on the large-cap segment, provides stability and resilience, especially in volatile markets. Both funds benefit from Vanguard’s low-cost ethos, ensuring that investors can choose based on strategy preference without significant concern over expense-related impacts on returns.

Investor Profiles for Vanguard’s VTI and VOO ETFs: Diversification and Investment Goals

In the realm of investment, understanding the compatibility between an investor’s profile and a financial product is paramount. Vanguard’s VTI (Total Stock Market ETF) and VOO (S&P 500 ETF) are two distinguished products, each aligning with specific investor profiles and objectives. This discussion delineates the ideal investor for each of these ETFs and explores the pivotal role of diversification and investment goals in making informed investment choices.

The Ideal Investor Profile for VTI ETF

VTI, with its expansive embrace of the total U.S. stock market, is tailored for the investor who seeks comprehensive market exposure. This ETF is a fitting choice for the investor who believes in the long-term growth potential of the U.S. economy as a whole, across all its sectors and company sizes. The ideal VTI investor is someone comfortable with the nuanced risks and rewards of a broader market spectrum, from large-cap stability to small-cap dynamism.

Such an investor typically has a long-term investment horizon, allowing them to ride out the market’s inherent fluctuations. The VTI investor understands that while the broader market may experience higher volatility, it also offers the potential for greater diversification and, potentially, higher long-term returns. They are likely to have a moderate to high risk tolerance, appreciating the growth opportunities presented by mid and small-cap stocks, alongside the steadiness of large caps.

The Ideal Investor Profile for VOO ETF

VOO, in contrast, is tailored for the investor primarily focused on the large-cap segment of the market. This ETF is ideal for someone seeking exposure to America’s largest and most established companies. An investor in VOO is one who values the stability and resilience that these major players can offer, especially in times of economic uncertainty.

The typical VOO investor might be more risk-averse, preferring the predictable performance of well-established firms over the potential high growth (and corresponding higher risk) of smaller companies. This investor likely has a long-term perspective but places a premium on stability and steady growth. They might be in a stage of life where preserving capital and achieving consistent returns is more important than chasing high-growth opportunities.

Diversification and Investment Goals

The choice between VTI and VOO should also be influenced by an investor’s diversification strategy and investment goals. Diversification is a fundamental principle of investing, aimed at reducing risk by spreading investments across various assets or market segments. VTI offers inherent diversification across the entire market, making it a single-product solution for broad exposure. VOO, while less diversified in terms of company size and sector, still provides diversification within the realm of large-cap stocks.

Investment goals are equally critical in this decision. For investors prioritizing wealth accumulation and willing to accept higher volatility, VTI’s broad market approach might be more suitable. Conversely, for those focusing on wealth preservation and steady growth, VOO’s concentration on large, stable companies could be more appealing.

Tax Efficiency and Dividend Yield: An In-Depth Look at VTI and VOO

In the intricate world of investing, tax efficiency and dividend yield are crucial factors that can significantly influence an investor’s portfolio performance. Vanguard’s Total Stock Market ETF (VTI) and S&P 500 ETF (VOO) are not only distinguished by their market strategies but also by their tax implications and dividend distributions. This analysis delves into the tax efficiency of both ETFs and compares their dividend yields and payout frequencies, offering investors a deeper understanding of these critical aspects.

Tax Efficiency in VTI and VOO

Tax efficiency is a measure of how much an investment’s returns are reduced by taxes. ETFs, in general, are known for their tax efficiency, and both VTI and VOO are no exception. However, the nature of their respective holdings does bring subtle differences to the forefront.

VTI, encompassing a vast array of over 3,000 stocks, captures the entire U.S. equity market, from large-cap to small-cap companies. This broad exposure inherently includes a mix of stocks with varying dividend policies and capital gains distributions, which can impact its overall tax efficiency. Generally, VTI tends to have fewer taxable events due to its total market approach, which results in lower portfolio turnover.

VOO, tracking the 500 largest U.S. companies, typically incurs fewer capital gains distributions. Large-cap companies often have more stable and predictable dividend policies, which can lead to a more tax-efficient structure for the fund. Additionally, the indexing strategy of VOO tends to result in lower turnover, further enhancing its tax efficiency.

Both VTI and VOO benefit from the ETF structure, which allows for the creation and redemption of shares in kind, reducing the likelihood of capital gains distributions. This structural advantage is a key reason why ETFs are often more tax-efficient compared to mutual funds.

Dividend Yields and Payout Frequencies

Dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. In this regard, both VTI and VOO offer attractive prospects for income-seeking investors, but with nuances in their yield profiles.

VTI’s dividend yield of 1.39 reflects the aggregate of its broad market holdings. Given its exposure to the entire stock market, its dividend yield is influenced by the varied dividend policies of small, mid, and large-cap companies. Consequently, the yield can be more variable, reflecting the diverse nature of the total market.

On the other hand, VOO’s dividend yield of 1.43 is generally more stable and predictable, anchored by the dividend policies of large-cap companies. These companies are often more established and have a history of consistent dividend payments. The yield of VOO, therefore, tends to reflect the stability and maturity of large-cap dividends.

Regarding payout frequencies, both VTI and VOO typically distribute dividends quarterly. This regularity provides a consistent income stream for investors, a feature particularly appreciated by those who rely on their investment portfolios for regular income.

If we’re looking for a slight winner it is VOO at 1.43 vs VTI at 1.39.

Liquidity and Trading Volume: A Comparative Analysis of VTI and VOO ETFs

In the intricate tapestry of financial investments, liquidity and trading volume are pivotal elements that shape an investor’s experience in the stock market. This is particularly true for popular Exchange-Traded Funds (ETFs) like Vanguard’s Total Stock Market ETF (VTI) and S&P 500 ETF (VOO). A thorough understanding of these aspects is crucial for individual investors, as they significantly impact the ease of trading and potential price volatility of these ETFs.

Trading Volume: VTI vs. VOO

Trading volume, the total number of shares of a security traded in a given period, is a vital indicator of an ETF’s liquidity. High trading volumes generally suggest a robust market with numerous buyers and sellers, making it easier to execute trades at prevailing market prices.

VTI, encompassing the vast landscape of the U.S. stock market, traditionally enjoys high trading volumes. This is attributed to its broad appeal to a diverse range of investors – from retail to institutional. Its comprehensive market coverage makes it a preferred vehicle for investors seeking diversified exposure in a single investment. High trading volumes in VTI ensure that the ETF can be bought or sold with minimal impact on its price, a significant advantage for investors looking for flexibility and ease of entry or exit.

VOO, on the other hand, tracks the S&P 500 index and is also characterized by high trading volumes. The popularity of the S&P 500 as a benchmark for the U.S. economy attracts substantial investor interest, contributing to VOO’s liquidity. The focus on large-cap stocks, which are often more frequently traded than smaller-cap stocks, further enhances its trading volume. This makes VOO an attractive option for investors who prioritize liquidity and the ability to quickly and efficiently transact at market prices.

Liquidity: Implications for Investors

Liquidity, the ease with which an asset can be bought or sold in the market, is a critical factor for investors to consider. ETFs with high liquidity, like VTI and VOO, offer several advantages. Firstly, they allow investors to trade with minimal price slippage, meaning the purchase or sale of a substantial number of shares has a negligible impact on the ETF’s price. This is especially important for large investors or those making time-sensitive trades.

Additionally, high liquidity translates into tighter bid-ask spreads – the difference between the highest price a buyer is willing to pay for an ETF and the lowest price a seller is willing to accept. A narrower spread reduces the cost of trading for investors and enhances the efficiency of the market.

Implications for Individual Investors

For individual investors, the high liquidity and trading volume of both VTI and VOO offer several benefits. It provides flexibility and confidence in being able to enter or exit positions without the concern of significantly affecting the price. This is particularly advantageous in volatile market conditions, where the ability to execute trades swiftly and at desired prices can protect against adverse market movements.

Furthermore, the robust liquidity and volume support the use of these ETFs for various investment strategies, from long-term buy-and-hold approaches to more tactical, short-term strategies. Investors can also utilize these ETFs for portfolio rebalancing, safe in the knowledge that their trades can be executed efficiently.

Pros and Cons: A Comprehensive Look at VTI and VOO ETFs

In the intricate world of investment, Exchange-Traded Funds (ETFs) like Vanguard’s Total Stock Market ETF (VTI) and S&P 500 ETF (VOO) present compelling opportunities, each with its unique set of advantages and limitations. Understanding these can guide investors in aligning their portfolio choices with their financial goals and risk tolerance.

Advantages of Investing in VTI ETF

- Broad Market Exposure: VTI’s most significant advantage lies in its extensive market coverage. Tracking the CRSP US Total Market Index, it offers investors exposure to over 3,000 stocks across all sectors and market capitalizations. This broad spectrum ranges from large-cap giants to small, emerging companies, providing a comprehensive snapshot of the entire U.S. stock market.

- Diversification Benefits: With its wide-ranging holdings, VTI naturally provides excellent diversification, reducing the risk associated with investing in individual stocks or specific market sectors. This diversification can potentially lower portfolio volatility and offer a smoother investment journey over the long term.

- Cost Efficiency: VTI boasts a low expense ratio of 0.03, which is a hallmark of Vanguard’s investment products. This cost efficiency ensures that a greater portion of investment returns is retained by the investor, a critical factor in long-term wealth accumulation.

- Flexibility for Various Investment Strategies: Given its broad market exposure, VTI is suitable for various investment strategies, from buy-and-hold to tactical asset allocation. This flexibility makes it an attractive option for both novice investors and seasoned market participants.

Advantages of Investing in VOO ETF

- Focus on Large-Cap Stocks: VOO’s primary advantage is its concentration on large-cap stocks, tracking the S&P 500 Index. These companies are often industry leaders with established track records, offering stability and resilience, especially in volatile market conditions.

- Steady Performance: Historically, the S&P 500 has shown steady performance, making VOO a potentially less volatile investment than funds with broader market exposure. This stability is particularly appealing for risk-averse investors.

- Dividend Income: Large-cap companies, which form the core of VOO, are typically more consistent in paying dividends. This consistency can be advantageous for income-seeking investors.

- High Liquidity: VOO enjoys high trading volumes due to its focus on the S&P 500, a popular benchmark for investors. This liquidity facilitates easy entry and exit, making it a convenient option for investors.

Limitations and Considerations for Both ETFs

While both VTI and VOO offer distinct advantages, they also have limitations that investors should consider:

- Market Risk: Both ETFs are subject to market risk. The performance of VTI and VOO is tied to the U.S. stock market, meaning that in market downturns, these ETFs can experience declines.

- Lack of International Exposure: Neither VTI nor VOO offers exposure to international markets. Investors seeking global diversification will need to look at other investment options to complement these ETFs.

- Sector Concentration Risks for VOO: VOO’s focus on the S&P 500 means it is more exposed to sector concentration risks. If a particular sector that is heavily weighted in the S&P 500 underperforms, VOO could be impacted more significantly than VTI.

- Size Bias in VTI: While VTI offers broad market exposure, its market-cap-weighted approach means larger companies have a more significant impact on its performance. This size bias might limit the potential benefits of small-cap stocks in the portfolio.

Navigating the Investment Process: Investing in VTI and VOO ETFs

Investing in Exchange-Traded Funds (ETFs) such as Vanguard’s Total Stock Market ETF (VTI) and S&P 500 ETF (VOO) can be a strategic addition to an investor’s portfolio. Understanding the steps to invest in these ETFs, the requirements for setting up a brokerage account, and the strategies of dollar-cost averaging versus lump-sum investing are essential. This comprehensive guide aims to elucidate the nuances of investing in VTI and VOO, helping investors navigate this process with clarity and confidence.

Steps for Investing in VTI and VOO

- Research and Understanding: Before investing, it is crucial to thoroughly understand the nature of VTI and VOO. This includes comprehending their investment strategies, historical performance, and how they align with your investment goals and risk tolerance.

- Choosing a Brokerage: The next step involves selecting a brokerage. Various online brokers offer access to ETFs like VTI and VOO. When choosing a broker, consider factors such as trading fees, platform ease of use, and the availability of research tools and educational resources.

- Opening a Brokerage Account: Once a brokerage is selected, the investor needs to open an account. This process typically involves providing personal information, setting up funding options, and completing a questionnaire to determine your investing experience and risk tolerance.

- Funding the Account: After the account is set up, it needs to be funded. This can be done through various methods such as bank transfers, checks, or even transferring assets from another brokerage.

- Purchasing VTI or VOO Shares: With a funded account, you can proceed to purchase VTI or VOO shares. This involves entering the ticker symbol (VTI or VOO) on the brokerage’s trading platform, specifying the number of shares or the amount of money you wish to invest, and executing the trade.

Brokerage Account Requirements

Brokerage accounts typically require the investor to provide identification and financial information. This may include social security numbers, employment information, financial status, and investment experience. Brokerages use this information to comply with regulatory requirements and to offer suitable investment advice.

Dollar-Cost Averaging vs. Lump-Sum Investing

Once an account is established and ready for trading, investors must decide between dollar-cost averaging or lump-sum investing.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the ETF’s price. The advantage of DCA is that it mitigates the risk of investing a large amount at an inopportune time. It reduces the impact of volatility by spreading purchases over time, potentially lowering the average cost per share.

- Lump-Sum Investing: Alternatively, lump-sum investing entails investing a significant amount of money at once. This approach is based on the premise that markets tend to rise over time, and therefore, investing a lump sum as soon as possible can yield better long-term returns. However, it also means potentially higher risk if the market declines shortly after the investment.

VTI vs. VOO: Frequently Asked Questions (Practical, Investor-Focused)

What’s the core difference between VTI and VOO?

VTI tracks the CRSP US Total Market Index (large, mid, small, micro caps). VOO tracks the S&P 500 (primarily large caps). In practice, VTI is broader; VOO is a large-cap core.

Which is better for a “one-fund” U.S. equity portfolio?

If you want the entire U.S. market in one wrapper, VTI is the cleaner “own-everything” choice. If you specifically want large-cap exposure (and don’t mind adding small/mid via a separate fund later), VOO is great.

How much overlap do VTI and VOO have?

A lot. VOO’s large caps dominate U.S. market cap, so VTI’s top holdings look very similar to VOO’s—VTI just adds thousands of mid/small names around the edges.

Do small and mid caps in VTI really move the needle?

Over short windows, not much; in certain cycles, small/mid caps can add (or subtract) a bit of return and volatility. Over long horizons, the broader exposure is the point—you’re not betting on when smaller companies run.

Which historically has been more volatile?

Typically VTI is slightly more volatile (small/mid cap exposure). VOO tends to be a touch steadier thanks to its large-cap focus. The difference is usually modest.

Are the expense ratios the same?

Yes—both commonly list 0.03%. Fees can change, so always verify the current expense ratio on Vanguard’s site or the latest prospectus.

Any tax-efficiency differences to consider?

Both are ETFs using in-kind creation/redemption, which is generally tax-efficient. Real-world taxable outcomes depend on your yield, turnover, and your tax bracket—but both are strong choices for taxable accounts.

Which has the higher dividend yield?

Large-cap indexes often yield a tad more than the broad total market, so VOO’s yield can be slightly higher at times. Yields change over time—check current SEC yields before deciding.

Which tracks “the market” more closely?

If by “market” you mean the whole investable U.S. equity market, VTI. If you mean the headline U.S. large-cap benchmark most media cite, VOO.

Should I own both VTI and VOO?

You don’t need both—there’s heavy overlap. Common approaches:

Pick VTI as a one-ticket U.S. equity core, or

Use VOO as the core and add a satellite small/mid-cap fund if you want more breadth.

Which is better in tax-advantaged vs. taxable accounts?

Both work well in either. In tax-advantaged accounts, choose based on asset allocation. In taxable, the ETF structure is helpful; compare current yields and your need for small/mid exposure.

How should a long-term investor decide between them?

Tie the choice to your investment policy:

Prefer simplicity + total-market capture → VTI

Prefer large-cap tilt + headline index → VOO

Either way, stay consistent, automate contributions, and rebalance to your target mix.

Deciphering the Investment Spectrum: A Conclusion on VTI vs. VOO

In the realm of financial investments, particularly in the universe of Exchange-Traded Funds (ETFs), Vanguard’s Total Stock Market ETF (VTI) and S&P 500 ETF (VOO) stand as two formidable giants, each with its distinct characteristics and investment appeal. As we draw this comprehensive exploration to a close, it is imperative to distill the essence of our findings, offering final thoughts on navigating the choice between these two investment vehicles.

Summary of Key Points

- Investment Strategies and Market Coverage: VTI offers broad exposure to the entire U.S. equity market, encompassing over 3,000 stocks across various sectors and market capitalizations. In contrast, VOO focuses on the large-cap segment, tracking the 500 largest U.S. companies represented in the S&P 500 Index.

- Performance and Risk Profiles: Both VTI and VOO have demonstrated strong historical performance, though their broader or more focused market strategies affect their risk and return profiles. VTI, with its extensive market coverage, may capture more growth opportunities, particularly in bull markets. VOO, concentrating on large-cap stocks, typically exhibits more stability, especially in turbulent market conditions.

- Cost Efficiency: Vanguard’s hallmark of low expense ratios is evident in both VTI and VOO at 0.03, making them cost-effective investment choices. This cost efficiency enhances the potential net returns for investors over the long term.

- Tax Efficiency and Dividend Yield: Both ETFs offer high tax efficiency, a benefit of their ETF structure. However, their dividend yields differ, with VTI’s yield reflecting its broad market scope and VOO’s yield mirroring the more stable dividend policies of large-cap companies.

- Liquidity and Trading Volume: High liquidity and substantial trading volumes characterize both VTI and VOO, ensuring ease of trading and minimal impact on prices for investors.

Final Thoughts: Aligning with Individual Investment Goals and Risk Tolerance

The decision between investing in VTI or VOO should be anchored in an investor’s individual goals, risk tolerance, and investment horizon. VTI is ideally suited for investors seeking diversified exposure to the U.S. equity market as a whole. It is well-aligned with those who have a higher risk tolerance and a long-term investment perspective, aiming to capitalize on the growth potential across various market sectors and company sizes.

VOO, in comparison, is more appropriate for investors who prefer stability and are inclined towards large-cap stocks. It aligns with a more conservative investment approach, suitable for those who seek steady growth and are perhaps more risk-averse. VOO’s focus on well-established companies makes it a reliable cornerstone for portfolios geared towards consistent performance and resilience in the face of market fluctuations.

Ultimately, the choice between VTI and VOO does not necessitate an exclusive commitment to one over the other. Many investors might find a strategic blend of both ETFs beneficial, balancing broad market exposure with the stability of large-cap stocks. This hybrid approach can harmonize growth potential with risk management, tailored to individual investment profiles.

In conclusion, both VTI and VOO offer distinct advantages and serve different investment preferences. Their selection should be a thoughtful process, reflecting an investor’s unique financial landscape, aspirations, and comfort with market dynamics. As with all investment decisions, informed choices, balanced diversification, and alignment with personal financial objectives are the keystones of successful investing.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.