Investing doesn’t have to be a stressful rollercoaster. Enter the core-satellite approach, a strategy that’s been gaining traction among savvy investors. Think of it as building a sturdy ship with a powerful engine at its core and smaller, agile sails to catch extra wind. The core is made up of broad, stable investments that provide a solid foundation, while the satellites are more targeted, higher-risk assets that offer growth potential. This blend helps balance stability and growth, making it easier to navigate the choppy waters of the financial markets.

source: Dividend Growth Investing on YouTube

Overview of a Core-Satellite Approach

So, why are we here? The goal of this article is to demystify the core-satellite strategy and show you how to implement it in your own portfolio. Whether you’re a seasoned investor or just starting out, understanding this approach can help you optimize your investments for better returns and lower risk. We’ll walk you through the basics, benefits, and steps to create a balanced, resilient portfolio. Ready to build your investment strategy like a pro? Let’s dive in!

Understanding Core-Satellite Investing

Definition

Core-satellite investing is like crafting a masterpiece with a sturdy base and unique, eye-catching details. At its heart, this strategy combines the stability of broad, diversified investments (the core) with the potential high returns from more targeted, riskier investments (the satellites). It’s a way to balance the safety of dependable returns with the excitement of chasing growth opportunities.

Components

Core Investments

The core of your portfolio is the foundation, the bedrock that holds everything steady. These investments are broad, diversified, and stable. Think of low-cost index funds, ETFs, or broad mutual funds that track major market indices like the S&P 500. The idea is to cover a wide range of assets to minimize risk and ensure steady growth. These core investments usually make up the bulk of your portfolio—about 70% to 90%. They provide the dependable, long-term returns that keep your investment ship on course, even in choppy waters.

- Low-Cost Index Funds: These are funds that track a specific market index. They offer broad market exposure at a low cost, making them ideal for the core part of your portfolio.

- ETFs (Exchange-traded Funds): Similar to index funds but traded like stocks, ETFs offer flexibility and diversification.

- Broad Mutual Funds: These funds invest in a wide range of assets, providing stability and reducing risk.

Satellite Investments

Now, let’s add some flair with satellite investments. These are the smaller, more aggressive parts of your portfolio—typically making up 10% to 30%. Satellites are where you take calculated risks to enhance returns. These can be sector-specific funds, individual stocks, or alternative investments like commodities or real estate. The goal here is to outperform the market and boost your overall returns. Satellites can be more volatile, but they offer the potential for higher growth, adding a dynamic edge to your portfolio.

- Sector-Specific Funds: Invest in particular sectors of the economy, like technology, healthcare, or energy. These funds can capture growth in specific areas.

- Individual Stocks: Handpick stocks of companies you believe have strong growth potential. This requires more research but can pay off significantly.

- Alternative Investments: Explore non-traditional assets like managed futures, commodities, real estate, or cryptocurrencies. These can diversify your portfolio and offer unique growth opportunities.

Benefits of Core-Satellite Investing

Diversification

Diversification is the secret sauce of investing, and core-satellite investing dishes it out in spades. By spreading your investments across a wide range of assets, you reduce the risk of any single investment tanking your entire portfolio. The core investments are your broad, diversified base, capturing the steady performance of the entire market. Think index funds and ETFs that cover multiple sectors and industries. Then, you sprinkle in satellite investments, which are more targeted and specialized. This blend means you’re not putting all your eggs in one basket, but rather in many baskets spread across a range of fields. Diversification helps cushion against market volatility, ensuring smoother sailing in both calm and stormy markets.

Risk Management

Balancing risk and reward is the name of the game, and core-satellite investing excels at it. Your core investments act as the stabilizers, providing a reliable foundation. These are typically low-risk assets that grow steadily over time. On the flip side, your satellite investments are the thrill-seekers, offering higher potential returns but with more risk. This setup allows you to take advantage of growth opportunities without jeopardizing the overall stability of your portfolio. It’s like having a rock-solid ship with a few speedboats ready to chase exciting new ventures.

Cost Efficiency

One of the best things about the core-satellite approach is its cost efficiency. Core investments, such as index funds and ETFs, are known for their low expense ratios. These low-cost options keep more of your money working for you, rather than paying for high fees. By anchoring your portfolio with these economical choices, you free up resources to invest in more speculative satellite options. Essentially, you get the best of both worlds: cost-effective stability and the freedom to explore higher-cost, higher-return opportunities with your satellite investments.

Flexibility

Markets are constantly changing, and so should your investment strategy. The core-satellite approach offers the flexibility to adapt to market conditions and seize opportunities. While your core investments remain the steady bedrock of your portfolio, you can tweak your satellite investments based on market trends, economic forecasts, or personal interests. Maybe tech stocks are booming, or you’ve spotted a promising startup—your satellite portion allows you to pivot and capitalize on these trends without overhauling your entire portfolio. This flexibility ensures your investments stay aligned with your financial goals and the evolving market landscape.

Building the Core

Asset Selection

Selecting the right core assets is crucial for the foundation of your portfolio. The goal here is to choose investments that provide broad market exposure, stability, and low costs. Here are some key types of assets to consider:

- Index Funds: These funds aim to replicate the performance of a specific index, like the S&P 500. They offer a simple way to invest in a wide array of companies with a single purchase. Index funds are known for their low fees and broad diversification, making them ideal for the core of your portfolio.

- ETFs (Exchange-Traded Funds): Similar to index funds, ETFs are collections of securities that track an index, sector, commodity, or other asset. They trade like stocks on an exchange, providing flexibility and liquidity. ETFs can be a cost-effective way to achieve diversification.

- Broad Mutual Funds: These funds invest in a wide range of securities, offering diversification across different sectors and industries. They can be actively or passively managed. While actively managed funds may have higher fees, they can provide additional strategic advantages.

Criteria for Core Investments

When selecting core investments, it’s essential to focus on assets that align with the following key criteria:

- Low Cost: Keeping expenses low is a fundamental aspect of core investments. High fees can eat into your returns over time. Look for investments with low expense ratios. Index funds and ETFs are typically cost-efficient choices because they require less active management.

- Broad Diversification: Diversification helps spread risk by investing across various sectors, industries, and geographic regions. This reduces the impact of poor performance in any single area. Core investments should provide broad market exposure, capturing the performance of many different companies and industries.

- Stability: The core of your portfolio should offer steady, reliable growth. These investments are less volatile and more predictable, providing a solid foundation. Look for established funds with a long track record of stable returns. They should be less susceptible to dramatic market swings.

Selecting Satellite Investments

Types of Satellite Investments

Once you’ve built a sturdy core, it’s time to add some dynamic satellite investments to the mix. These are the investments that can potentially supercharge your returns, albeit with a bit more risk. Let’s explore the various types of satellite investments you can consider:

- Sector-Specific Funds: These funds focus on specific sectors like technology, healthcare, or energy. They allow you to capitalize on growth trends in particular areas of the economy. For example, if you believe the tech sector will outperform, investing in a tech-specific fund could be a savvy move.

- Individual Stocks: Picking individual stocks offers the chance to invest in companies you believe have strong growth potential. This requires more research and can be riskier, but the rewards can be significant. Think of companies in emerging industries or those with innovative products and services.

- Alternative Investments: These include assets like real estate, commodities, or even cryptocurrencies. Alternative investments can add a unique dimension to your portfolio, offering diversification beyond traditional stocks and bonds. They can be particularly appealing if you have a high-risk tolerance and seek exposure to non-traditional asset classes.

Criteria for Satellite Investments

Choosing the right satellite investments involves more than just picking the latest hot stock. Here’s what to consider:

- Growth Potential: Look for investments with strong growth prospects. This could be in sectors that are expanding rapidly or companies with innovative products. Analyze market trends and company fundamentals to gauge potential.

- Market Trends: Keep an eye on broader market trends. For example, renewable energy is gaining traction, making clean energy stocks and funds attractive. Similarly, advancements in technology continually create opportunities in the tech sector.

- Risk Tolerance: Your risk tolerance should guide your satellite investment choices. If you’re risk-averse, you might opt for less volatile sectors or blue-chip stocks. If you’re more of a risk-taker, you could explore high-growth startups or alternative assets like cryptocurrencies.

Balancing the Portfolio

Balancing your core and satellite components is crucial to maintaining your desired risk and return levels. Here’s how to strike the right balance:

- Allocation: Typically, your core investments should make up about 70% to 90% of your portfolio, providing stability and steady growth. The remaining 10% to 30% can be allocated to satellite investments, adding a layer of potential high returns.

- Rebalancing: Regularly review and adjust your portfolio to maintain the balance between core and satellite investments. Market conditions change, and so should your allocation. If your satellite investments have performed exceptionally well and now make up a larger portion of your portfolio, consider rebalancing to reduce risk.

- Diversification: Ensure that both your core and satellite investments are diversified. Avoid putting all your satellite investments in one sector or asset class. Spread them across various areas to mitigate risk.

- Performance Monitoring: Keep a close eye on the performance of your satellite investments. If an investment is underperforming consistently, don’t hesitate to reassess and make changes. Flexibility is key to optimizing your portfolio’s performance.

Implementing the Strategy

Portfolio Allocation

Getting your portfolio allocation right is the first step to successful core-satellite investing. The idea is to strike a balance that aligns with your financial goals and risk tolerance. Generally, you’ll want to allocate 70% to 90% of your portfolio to core investments. These are your low-cost, diversified assets like index funds and ETFs that provide steady, reliable returns.

The remaining 10% to 30% goes to satellite investments. These are your high-risk, high-reward assets that can boost your overall returns. This mix allows you to take advantage of growth opportunities without jeopardizing the stability of your portfolio. The exact percentages will depend on your individual risk tolerance and investment goals. Are you more conservative? Lean towards 90% core. Feeling adventurous? You might go for a 70% core and 30% satellite split.

Rebalancing

Markets move, and so should your portfolio. Regular rebalancing is crucial to maintaining your desired allocation and managing risk. Over time, some of your satellite investments might outperform and grow faster than your core, skewing your portfolio balance. Rebalancing involves selling some of your high-performing assets and buying more of the underperforming ones to bring your portfolio back to its original allocation.

Why Rebalance? Rebalancing helps you lock in gains from high-performing investments and ensures you’re not overexposed to any single asset or sector. It’s a disciplined approach to managing risk and keeping your investment strategy on track. Aim to rebalance your portfolio at least once a year, or more frequently if market conditions change significantly.

Monitoring Performance

Keeping an eye on the performance of your investments is essential. Regularly monitor both your core and satellite investments to ensure they’re performing as expected and contributing to your financial goals.

Core Investments: These should be the steady performers in your portfolio. Check that they’re providing the stable returns you expect. If a core investment consistently underperforms, it might be time to reassess its place in your portfolio.

Satellite Investments: These require closer scrutiny due to their higher risk. Track their performance regularly and be prepared to make adjustments if they’re not meeting your growth expectations. Don’t be afraid to cut your losses if a satellite investment isn’t panning out as planned.

Tools for Monitoring: Use investment platforms and apps that offer portfolio tracking features. Set up alerts for significant changes in your investments’ performance. Regular reviews, whether monthly or quarterly, can help you stay on top of your portfolio’s health.

Practical Examples

Example Portfolios

Let’s dive into some example portfolios to see how a core-satellite strategy can work for different types of investors. Each portfolio is tailored to a specific risk tolerance and investment style.

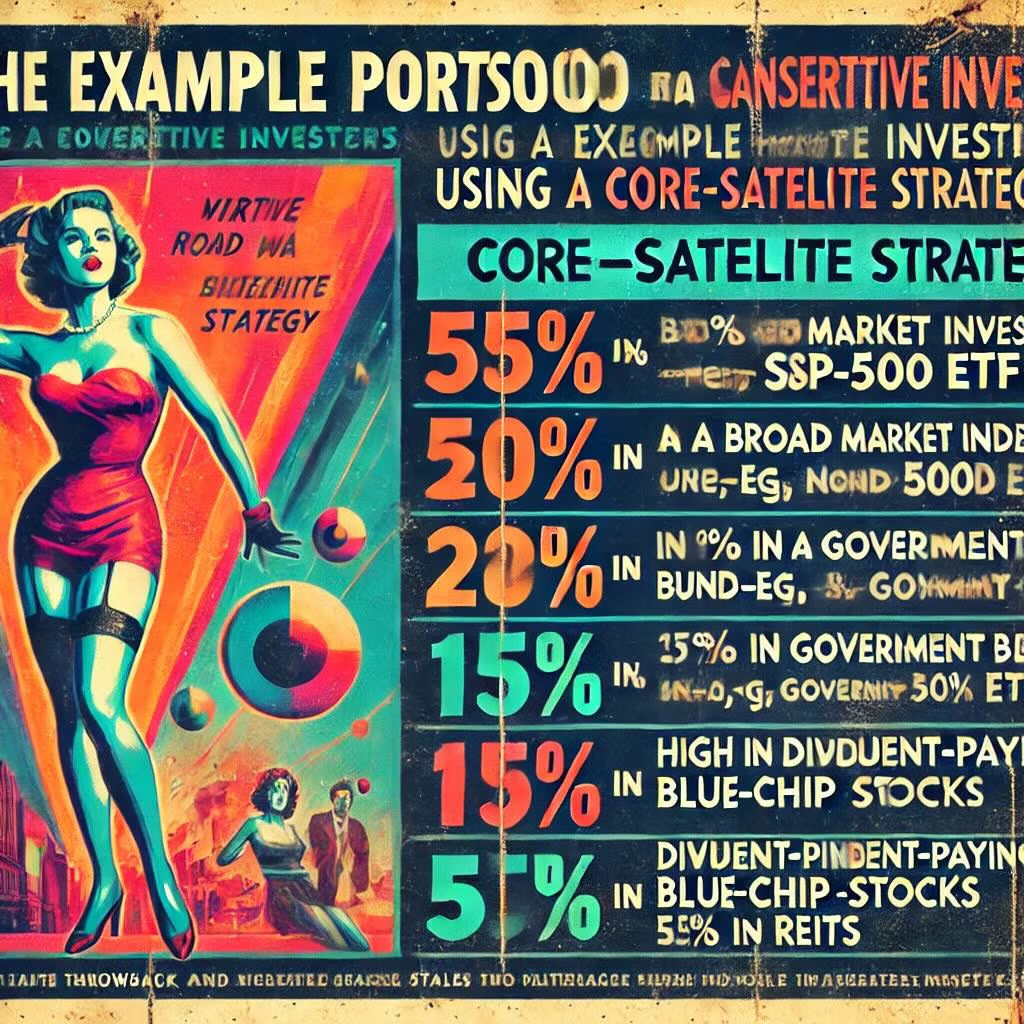

Conservative Investor

For the conservative investor, the focus is on stability and low risk. Here’s a sample allocation:

- Core Investments (85%):

- 50% in a broad market index fund (e.g., S&P 500 ETF)

- 20% in government bonds

- 15% in high-quality corporate bonds

- Satellite Investments (15%):

- 10% in dividend-paying blue-chip stocks

- 5% in real estate investment trusts (REITs)

This portfolio prioritizes steady income and capital preservation, with a small portion allocated to growth through high-quality stocks and REITs.

Balanced Investor

A balanced investor seeks a mix of stability and growth. Here’s how they might allocate their portfolio:

- Core Investments (75%):

- 40% in a total stock market index fund

- 25% in a mix of government and corporate bonds

- 10% in international index funds

- Satellite Investments (25%):

- 10% in sector-specific ETFs (e.g., technology, healthcare)

- 10% in high-growth individual stocks

- 5% in commodities like gold or silver

This portfolio aims to capture broad market growth while taking calculated risks in specific sectors and individual stocks.

Aggressive Investor

The aggressive investor is all about high growth and is willing to take on more risk. Here’s a potential allocation:

- Core Investments (70%):

- 50% in a total stock market index fund

- 10% in international index funds

- 10% in high-yield bonds

- Satellite Investments (30%):

- 15% in emerging markets stocks

- 10% in tech startups or speculative stocks

- 5% in alternative investments like cryptocurrencies

This portfolio leans heavily towards equities and high-risk assets, aiming for maximum growth potential.

Case Studies

Case Study 1: Jane the Conservative Investor

Jane, a 60-year-old retiree, wanted to protect her savings while earning a modest return. She implemented a core-satellite strategy with 85% in core investments and 15% in satellite investments. Her core was comprised of a mix of index funds and bonds, providing her with steady income and stability. For her satellites, she chose dividend-paying stocks and REITs. Over five years, Jane enjoyed consistent returns with minimal volatility, allowing her to maintain her lifestyle comfortably in retirement.

Case Study 2: Mike the Balanced Investor

Mike, a 40-year-old professional, sought both growth and stability. He allocated 75% of his portfolio to core investments, including total stock market index funds and bonds, with a small portion in international funds. For his satellites, he picked sector-specific ETFs and individual high-growth stocks. This strategy allowed Mike to capitalize on market growth while managing risk. Over a decade, Mike’s portfolio outperformed the market average, giving him a solid foundation for his future financial goals.

Case Study 3: Emma the Aggressive Investor

Emma, a 30-year-old entrepreneur, was all about taking risks for high rewards. She went with a 70/30 core-satellite split. Her core included total stock market and international index funds, along with some high-yield bonds. For her satellites, Emma invested in emerging markets, tech startups, and even some cryptocurrencies. While her portfolio experienced higher volatility, the aggressive approach paid off with substantial gains, significantly boosting her net worth over seven years.

Common Mistakes to Avoid

Overweighting Satellites

It’s tempting to chase high returns by loading up on exciting, high-risk satellite investments. However, overweighting satellites can throw your portfolio out of balance and expose you to unnecessary risk. Remember, satellites are meant to complement your core, not dominate it.

Why It’s Risky: Allocating too much to satellites can lead to significant volatility. These investments, while potentially rewarding, are also more susceptible to market swings. If the market turns against you, an overweighted satellite portfolio can suffer heavy losses, undermining the stability provided by your core investments.

How to Avoid It: Stick to your predetermined allocation. Typically, this means keeping satellites at 10% to 30% of your total portfolio. Regularly review your portfolio to ensure your satellite allocation hasn’t grown disproportionately due to market movements or new investments.

Neglecting Rebalancing

Rebalancing isn’t the most glamorous part of investing, but it’s crucial for maintaining your portfolio’s health. Over time, the value of your investments will change, causing your allocation to drift from your original plan.

Why It’s Important: Without regular rebalancing, your portfolio can become skewed, increasing risk. For example, if your satellite investments perform exceptionally well, they might grow to represent a larger portion of your portfolio than intended, exposing you to more volatility.

How to Avoid It: Set a schedule for regular rebalancing—quarterly or annually works well for most investors. During rebalancing, sell a portion of the overperforming investments and buy more of the underperforming ones to bring your portfolio back to its target allocation. This disciplined approach ensures you’re not taking on more risk than you’re comfortable with.

Ignoring Costs

Investment costs can quietly erode your returns over time, especially if you’re not paying attention. While core investments like index funds and ETFs typically have low fees, satellite investments can come with higher costs.

Why Costs Matter: High fees can significantly reduce your net returns. For example, actively managed funds or niche ETFs often carry higher expense ratios. Trading costs for individual stocks and alternative investments can also add up quickly, eating into your gains.

How to Avoid It: Always check the expense ratios and fees associated with your investments. Opt for low-cost options whenever possible, particularly for your core investments. For satellites, weigh the potential returns against the costs to ensure the investment is worth it. Use tools and platforms that offer low-cost trading and avoid frequent trading to minimize costs.

12-Question FAQ: How to Use a Core-Satellite Approach in Investing

1) What is core-satellite investing?

A portfolio framework where a low-cost, diversified “core” (≈70–90%) delivers market-like returns and stability, while “satellites” (≈10–30%) are targeted, higher-risk ideas aimed at boosting return or diversification.

2) Why use it instead of a single fund?

It blends simplicity + stability (core index exposure) with flexibility (tactical or thematic satellites), helping you manage risk, costs, and taxes while still pursuing excess returns.

3) What goes in the core?

Broad, cheap, diversified exposures such as total-market equity/bond index funds, global market-cap ETFs, and broad mutual funds with low expense ratios.

4) What counts as a satellite?

Targeted positions: sector/thematic ETFs, individual stocks, factor tilts (value, momentum, quality), international/emerging tilts, or alternatives (REITs, commodities, managed futures, even a small crypto sleeve if appropriate).

5) How do I size core vs satellites?

Match to risk tolerance and goals:

Conservative: 85–90% core / 10–15% satellites

Balanced: 75–80% core / 20–25% satellites

Aggressive: 70% core / 30% satellites

6) How do I pick core funds?

Prioritize low fees, broad diversification, and liquidity. Examples: total U.S. equity, total international equity, and aggregate bond index funds/ETFs. Keep the number of core funds small (2–5 usually suffices).

7) How do I choose satellites?

Use clear theses: growth potential, mispricing, factor exposure, or diversifier role (low correlation to core). Define entry criteria, sizing (usually 1–5% each), a time horizon, and exit rules upfront.

8) How often should I rebalance?

Set a cadence (annual or semiannual) and/or tolerance bands (e.g., rebalance when an asset drifts ±20% of its target weight or ±2–3 percentage points). Rebalancing trims winners, tops up laggards, and restores risk.

9) How do I control costs and taxes?

Anchor costs with low-expense-ratio core; limit turnover in satellites; use tax-advantaged accounts where possible; in taxable accounts, consider ETFs, tax-loss harvesting, and lot selection. Avoid fee creep from niche products.

10) How do I monitor success?

Track at least quarterly: total return vs a blended benchmark, risk (volatility, drawdown), tracking difference, satellite hit rate, and whether each satellite still meets its investment thesis.

11) What are common mistakes?

Overweighting satellites (strategy drift and excess volatility)

Neglecting rebalancing

Chasing hot themes without rules

Ignoring fees/taxes that erode edge

Too many positions (diworsification)

12) Can this be adapted over time?

Yes—adjust the core/satellite split with life stage (e.g., raise core and bonds as you near goals), rotate satellites as theses play out, and simplify when time or interest wanes. Keep an IPS (Investment Policy Statement) to guide changes.

Educational content only; not investment advice. Consider personal circumstances or a fiduciary adviser.

Conclusion

We’ve covered a lot of ground in this article, so let’s recap the main points. The core-satellite approach to investing offers a balanced strategy that combines stability with growth potential.

- Core Investments: These are your low-cost, diversified assets that form the stable foundation of your portfolio.

- Satellite Investments: These are the higher-risk, higher-reward assets that add dynamism and potential for increased returns.

- Portfolio Allocation: Typically, 70% to 90% of your portfolio should be in core investments, with the remaining 10% to 30% in satellites.

- Rebalancing: Regularly rebalance your portfolio to maintain your desired allocation and manage risk.

- Monitoring Performance: Keep an eye on both core and satellite investments to ensure they are performing as expected and adjust as necessary.

- Avoid Common Mistakes: Don’t overweight satellites, neglect rebalancing, or ignore investment costs.

Encouragement to Start

Ready to take control of your financial future? The core-satellite approach is a flexible and effective strategy that can help you achieve your investment goals. Start by assessing your risk tolerance and financial objectives. Build your core with reliable, low-cost investments and then add satellites to capture growth opportunities. Remember, the goal is to create a balanced, resilient portfolio that can weather market fluctuations and grow over time.

Final Thoughts

The core-satellite strategy is a powerful tool for both novice and experienced investors. By combining the stability of core investments with the potential of satellite investments, you can create a portfolio that offers steady growth and exciting opportunities. This approach not only manages risk but also allows you to take advantage of market trends and innovations.

Investing is a journey, and the core-satellite strategy can guide you toward your long-term financial goals. Whether you’re looking for steady income, capital appreciation, or a mix of both, this strategy provides a structured yet flexible framework to help you succeed. So, what are you waiting for? Dive in, build your portfolio, and watch your investments grow. Happy investing!

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.