Cryptocurrencies have reshaped the landscape of global finance, altering how investors and everyday users view money, transact online, and manage digital assets. Since the inception of Bitcoin in 2009, the crypto space has grown astronomically, with thousands of altcoins and countless blockchain-based projects emerging. Much of the mainstream focus has been on buying these tokens, holding them in a wallet, and hoping their value will rise. Yet, there is another side to trading—one often overlooked or misunderstood by novices—that allows market participants to profit from falling prices: short selling.

Short selling can be powerful.

Short selling is a time-tested practice in traditional finance, granting traders the ability to bet against a stock or commodity’s price. In the crypto realm, it functions similarly but carries certain unique characteristics influenced by blockchain’s 24/7 trading, high volatility, and evolving regulatory environment. Sometimes, short selling is viewed negatively in public discourse, with critics suggesting it encourages negative sentiment or market manipulation. However, in reality, short selling is a legitimate tool that can improve market efficiency, increase liquidity, and allow traders to hedge their portfolios, especially during turbulent times or when a coin’s fundamentals appear weak.

We’ll dive deep into the what, how, and why of short selling cryptocurrencies. We’ll begin by demystifying the concept of short selling—highlighting how it’s similar to short selling in stocks—and proceed to examine the platforms that allow for shorting. Then, we’ll explore the potential opportunities and rewards that short sellers chase. Finally, we’ll underscore the substantial risks and challenges that come with betting on a token’s decline. While short selling can be a potent approach, it demands discipline, proper risk management, and a clear-eyed understanding of how crypto markets behave.

Why Does Short Selling Matter in Crypto?

Cryptocurrency markets are famously volatile. Bitcoin, for example, can swing by thousands of dollars in a matter of hours, driven by macroeconomic news, regulatory announcements, or even tweets from influential figures. Altcoins frequently experience even more dramatic moves, rising 50–100% in a day and sometimes crashing just as quickly. In such an environment, short sellers can help provide price discovery by identifying coins that are overvalued or by stepping in to balance out buying pressure. Moreover, shorting can serve as an essential hedge for those holding large crypto positions, enabling them to protect a percentage of their portfolio when the market corrects.

Volatility is a double-edged sword.

Nevertheless, short selling is not a strategy to be approached casually. Its very nature—profiting from declines—comes with theoretically unlimited losses if the price surges instead of falls. In a market as frenetic as crypto, being on the wrong side of a short position can be devastating. Understanding these dynamics, from leverage calculations to potential liquidation, is vital to any trader contemplating a short.

We’ll also outline both the mechanics of short selling and the critical mindset needed to attempt it successfully. Think of this as a roadmap: if you’re new to short selling, it will illuminate the path. If you’re already somewhat familiar but need a refresher, we’ll solidify your knowledge with more context and detail. Above all, keep in mind that short selling in crypto should be handled with caution, never as an impulsive gamble.

What Is Short Selling in Crypto?

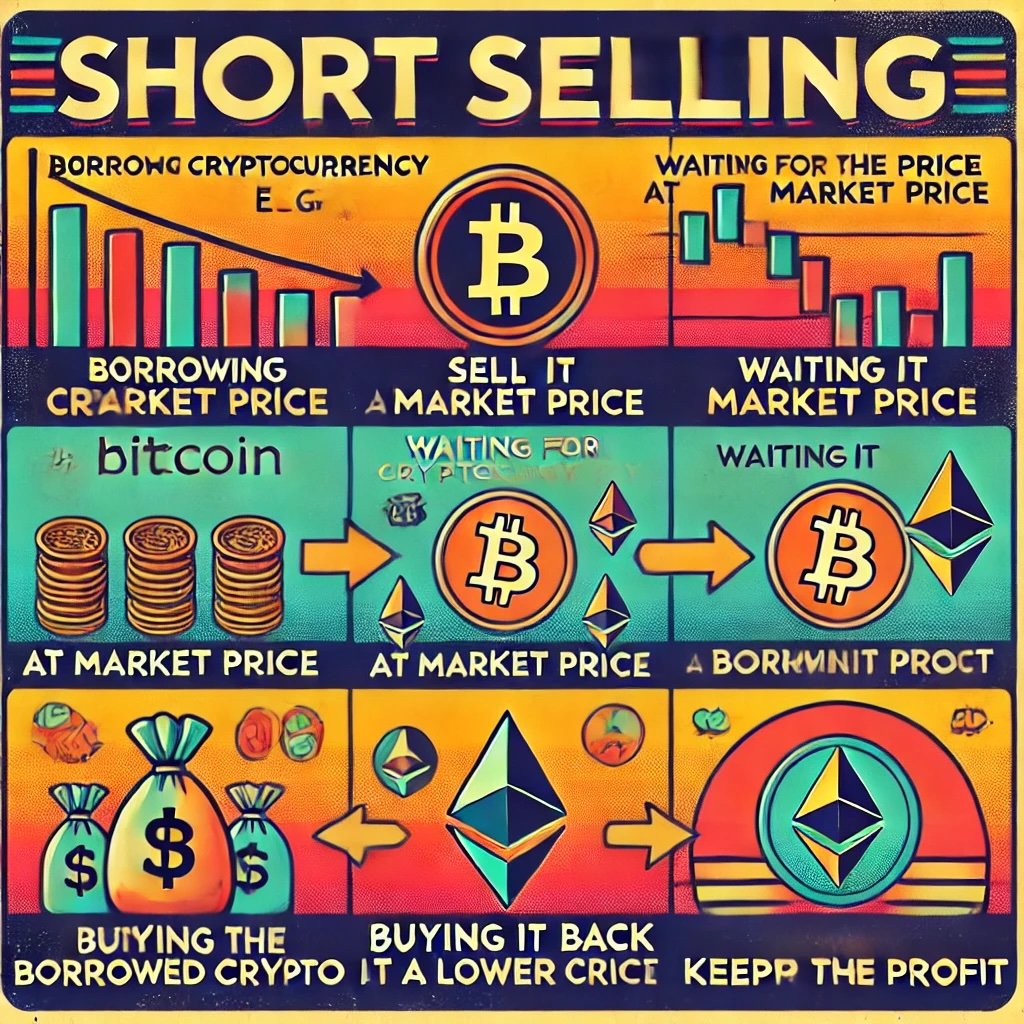

Short selling, at its heart, is the act of borrowing an asset to sell it immediately, with the obligation to buy it back later—ideally at a reduced price—so you can return the borrowed amount and pocket the difference. While this explanation may sound straightforward, the underlying steps in the crypto world can involve unique details, especially around how you borrow and how platforms handle margin or collateral.

Definition and Core Mechanics

- Borrow the Crypto:

In a typical short-sale transaction, you secure a loan of the digital asset from a platform that supports margin or from a decentralized protocol facilitating peer-to-peer (P2P) lending. Often, you’ll have to place collateral—like stablecoins or another cryptocurrency—whose value is recognized by the exchange. - Sell Immediately at Market:

Once you borrow the coins, you sell them at the current spot market price. Imagine shorting 1 Bitcoin when BTC is $40,000. You receive $40,000 (in stablecoins or fiat, depending on the exchange). - Buy Back (Cover) Later:

Over time, if BTC drops to $30,000, you can use only $30,000 of the initial $40,000 to buy back 1 BTC. You then return that 1 BTC to the lender and keep the remaining $10,000 (minus fees and interest) as profit. - Return the Borrowed Amount:

The final step is ensuring the borrowed crypto is returned to the lending party. Once you buy back the necessary amount of tokens, you repay them and close your short position.

Sell first, then buy later.

Why Short Selling Exists

Though short selling might sound counterintuitive—after all, people often associate profit with price increases—it serves vital functions in markets:

- Market Efficiency: By providing a way to wager on price declines, short sellers help reveal overvalued projects or tokens whose hype far exceeds their fundamentals.

- Hedging: Long-term holders can hedge risk during periods of uncertainty, protecting part of their holdings from massive downturns.

- Liquidity Provision: Short sellers often inject liquidity as they actively buy or sell during times of rising or falling markets, reducing price gaps.

In cryptocurrencies, the high volatility amplifies both the attractiveness and the peril of short selling. Prices can collapse due to a single hack, a regulatory clampdown, or a sudden wave of negative sentiment. But a coin can also skyrocket if bullish news or widespread adoption hits the headlines. If you short sell, you’re staking your money on a downward move, hoping the next wave of news or sentiment deflates the coin’s price.

Similarities to Traditional Stock Short Selling

Shorting stocks in a brokerage account follows a similar pattern: you borrow shares, sell them, then rebuy them if/when the price dips. Both stocks and cryptos require:

- Margin Accounts: Traders need a margin account with the broker/exchange and must maintain collateral.

- Interest or Borrowing Fees: Borrowers often pay interest to hold short positions, especially if the borrowed asset is in high demand.

However, stock markets typically operate on a set schedule (e.g., Monday through Friday, 9:30 a.m. to 4:00 p.m. for the NYSE), whereas crypto markets run 24/7. Moreover, cryptos can experience wild price swings at any hour, making it more challenging—and sometimes riskier—to maintain a short position without vigilant monitoring or automated stop-loss mechanisms.

Contrasts with Commodities or Forex

Traders might also compare shorting crypto to shorting commodities like gold or to shorting currencies in the Forex market. While each market has its idiosyncrasies, the principle is identical: you assume the price will drop. But crypto is distinct in that the underlying “asset” isn’t a fiat currency or a widely recognized raw material—it’s a digital token with varying degrees of utility and speculation. This intangible nature contributes to the unpredictability that enthralls some traders and terrifies others.

Crypto is intangible yet real in market impact.

Now that we’ve established what short selling entails and why it might appeal, we can move on to discuss the various platforms offering short-selling opportunities, along with the specific methods and instruments available for those aiming to take a negative bet on a crypto’s price.

Platforms and Methods for Short Selling Crypto

Cryptocurrency short selling has evolved from a niche activity on a few specialized exchanges to a widely accessible service offered by many major trading venues. In this section, we’ll explore the platforms and strategies you can use to take short positions. This includes everything from large centralized exchanges (CEXs) with advanced margin features to emerging decentralized exchanges (DEXs) that enable shorting through innovative smart-contract systems. We’ll also discuss derivatives products, peer-to-peer lending, and tokenized short positions.

Centralized Exchanges (CEXs)

Familiar and liquid, but custodial.

Binance, Kraken, Bybit, KuCoin, and other recognized CEXs often provide margin trading or derivatives like futures and perpetual swaps. These services allow users to open short positions directly, with the exchange handling the logistics of borrowing and lending. Depending on the platform:

- Margin Trading: You deposit collateral (e.g., USDT or BTC), then borrow another asset to short. The exchange charges interest on the borrowed amount.

- Futures/Perpetual Contracts: Instead of borrowing the underlying asset, you trade a contract whose price tracks the asset. By opening a short contract, you benefit when the token’s price falls.

- Leverage Settings: CEXs may offer leverage from 2x to 125x on certain pairs (like BTC/USDT). High leverage is tempting for big gains but fraught with liquidation risk if the market moves the other way.

Pros:

- Ample liquidity (especially for major tokens).

- User-friendly interfaces.

- Often robust trading tools, charts, and APIs.

Cons:

- Custodial: The exchange controls your private keys.

- Potential for hacks or withdrawal freezes.

- Strict KYC rules in certain jurisdictions, limiting privacy.

Decentralized Exchanges (DEXs)

Decentralized platforms harness the power of smart contracts to eliminate centralized intermediaries. While early DEXs focused primarily on spot trading, newer protocols allow margin trading, derivatives, and shorting with an on-chain twist.

- dYdX: A pioneer in decentralized margin and perpetual trading for Ethereum-based assets. Users connect wallets like MetaMask, deposit collateral, and open short positions with varied leverage.

- GMX: Operates on Arbitrum and Avalanche, providing perpetual swaps for multiple cryptos. It uses a liquidity pool model, where liquidity providers collectively act as the counterparty to trades.

- Advantages: Non-custodial, permissionless (often no KYC), and full user control of private keys.

- Challenges: Possibly higher on-chain fees, depending on network traffic; liquidity can be lower than on major CEXs, leading to slippage.

Decentralization fosters control, but watch for fees.

Derivatives and Leverage Instruments

Short selling commonly involves derivatives because you don’t necessarily have to borrow the physical coin. Instead, you trade instruments whose value reflects the coin’s price movement:

- Futures Contracts: Standardized contracts with set expiration dates (monthly, quarterly, etc.). Traders can short these by selling a futures contract they don’t already own, profiting if the underlying token’s price declines before contract settlement.

- Perpetual Swaps: A more popular form of crypto derivative, which doesn’t expire but periodically uses funding rates to align contract prices with spot prices.

- Options: Buying put options grants the right (but not the obligation) to sell an asset at a specific strike price. While not “short selling” in the strict sense, put options can mimic a short’s payoff structure if the market falls.

Leveraged Tokens: Some exchanges offer tokens like “BTC3S” or “ETH3S,” representing a -3x (negative triple) daily return on BTC or ETH. If Bitcoin falls 5% in a day, a -3x leveraged token might rise ~15%. However, these tokens can suffer from volatility decay and rebalancing quirks, making them better for short-term speculation than long-term bets.

Peer-to-Peer Borrowing

Some specialized marketplaces, such as Bitfinex or certain decentralized lending protocols, allow direct borrowing from other users. You pledge collateral, the other user (lender) supplies the crypto, and you pay them interest for the duration of the loan. Once the borrowed coins are sold, your position remains open until you repurchase the coins to repay. This approach can sometimes secure favorable interest rates, but you must monitor collateral ratios carefully.

- Centralized P2P: Sites like Bitfinex maintain internal order books for lending and borrowing.

- Decentralized Lending: A protocol like Compound or Aave might allow you to deposit ETH as collateral and borrow DAI, which you can then swap for another token to effectively short. Yet, orchestrating a short can be trickier—multiple steps are involved.

Tokenized Short Products

Some platforms create “inverse tokens,” typically pegged to an index or a specific crypto but moving inversely to its price. For instance, an inverse Bitcoin token might rise in value when BTC’s price drops. These tokens often automatically rebalance daily or weekly, so they’re not purely “buy and hold” products but can simplify short exposure for novices.

Convenience often carries hidden complexities.

Choosing the Right Platform

In deciding where and how to short sell, consider:

- Jurisdiction: Certain derivatives might not be accessible from your country.

- Liquidity: If you’re shorting a large sum or a less popular altcoin, you need an exchange with enough volume to handle your trades.

- Fee Structure: Evaluate trading fees, funding rates (for perpetuals), or borrowing interest rates. These can drastically affect net profitability.

- User Experience: Beginners might prefer a user-friendly interface, while experienced traders may relish advanced charting and order types.

The proliferation of platforms means you’re no longer restricted to a single approach. Some traders even split their short positions across multiple exchanges to minimize counterparty risk or to exploit varied funding rates. No matter your choice, ensuring you thoroughly understand each platform’s margin requirements and volatility protections can prevent catastrophic results. Next, we’ll pivot to the positive side of short selling: the potential opportunities and rewards.

Opportunities and Rewards of Short Selling Crypto

Short selling crypto might seem like a contrarian move in a culture often touting bullish forecasts for Bitcoin, Ethereum, or the latest altcoin star. Yet, crypto’s cyclical nature and dramatic price swings can yield enormous opportunities for those willing to bet on price declines. Below, we’ll delve into the most compelling benefits: profiting from bear markets, hedging valuable holdings, exploiting overvaluations, and timing the market to capture short-lived phenomena. We’ll also sprinkle in real-life examples to highlight how short sellers have reaped rewards in the high-stakes crypto environment.

Profit from Downturns

Bear markets can become profit goldmines.

Markets don’t perpetually rise. Even Bitcoin, which soared above $60,000 in 2021, has seen multi-year bear stretches. For instance, after hitting nearly $20,000 in late 2017, BTC slid below $4,000 by late 2018—a punishing drawdown for long-only holders. However, short sellers who sensed overvaluation or recognized on-chain signals pointing to declining network activity could have initiated short positions. By covering after BTC plummeted, they’d have capitalized handsomely, essentially earning while the broader market lost billions in paper value.

- Extended Declines: Some crypto bear markets last months or even years, providing multiple shorting windows.

- Trading Range: During sideways markets, advanced traders short the top of a range and cover near the bottom, earning consistent gains from repeated oscillations.

Hedging Strategies

Many individuals in crypto hold significant amounts of tokens for long-term growth, believing in the underlying technology. Yet, some also worry about abrupt downturns triggered by negative regulatory rulings or macroeconomic shocks. Shorting provides them with an effective hedge.

- Partial Hedge: If you hold 10 BTC long term, you might open a short on 2 BTC if you suspect a medium-term price drop. If BTC falls, your short position gains, offsetting the unrealized loss on your long holdings.

- Event Hedge: Traders often short an asset ahead of a critical event—like a major exchange listing, which might be “sell the news”—as a protective measure.

Covering your bases can yield peace of mind.

Exploiting Overvaluations

In a space frequently driven by hype, rumor, and FOMO (fear of missing out), certain tokens skyrocket in value despite questionable fundamentals. Short sellers who suspect these valuations aren’t grounded in reality can seize the chance to short, aiming to profit when the bubble pops.

- Meme Coins: Projects like Dogecoin or Shiba Inu soared on social media hype, but short sellers recognized eventual pullbacks. If timed correctly, shorting can net large returns when the hype fades.

- Unfounded Partnerships: Sometimes altcoins boast “partnerships” that turn out to be minor affiliations or complete misrepresentations. Once investors realize the truth, the price often tumbles, rewarding short positions.

Market Timing and Volatility

Traders skilled in technical analysis or those adept at reading order flow can pinpoint short-term opportunities for short selling. Whether it’s a pattern like a head-and-shoulders top or a region of heavy resistance repeatedly rejecting price climbs, short selling can exploit these levels.

- Swing Trading: Selling near resistance, rebuying near support.

- Intraday Scalping: Shorting micro-moves in highly liquid markets like BTC or ETH, capitalizing on quick 1–2% dips that occur multiple times a day.

- Event-Driven: If a major hack or negative news event occurs—like an exchange compromise—short sellers can act rapidly, expecting a transient but sharp price dip.

Real-Life Examples

- Luna/UST Crash (May 2022): Terra’s stablecoin ecosystem experienced a catastrophic depeg. Some traders who shorted LUNA tokens or used derivatives to bet on its collapse made fortunes, albeit in a highly risky environment.

- Mt. Gox Fallout (2014): When Mt. Gox announced solvency issues, Bitcoin’s price plummeted from over $800 down to under $200 in the ensuing months. Early short sellers were among the few who profited amid widespread chaos.

- ICO Bubble Burst (2018): Tokens launched via Initial Coin Offerings soared in 2017, but many collapsed in 2018 when regulatory scrutiny increased and hype died out. Those who shorted these ICO tokens walked away with significant gains.

These case studies underscore how, in times of extreme panic, negative sentiment, or hype unraveling, short sellers can stand on the winning side. However, it’s crucial to remember that opportunity doesn’t automatically translate to success. Mistiming a short can be financially disastrous, especially in crypto’s mercurial environment. With those opportunities in mind, let’s pivot to the other side of the coin: the numerous risks and challenges short sellers encounter in this highly speculative market.

Risks and Challenges of Short Selling Crypto

No discussion of short selling is complete without a thorough exploration of its potential dangers. While shorting can yield profits when prices collapse, traders are simultaneously exposed to a level of risk that can dwarf that of going long. Unlike a traditional spot buyer who risks only the amount they invest—since a coin’s price theoretically can’t fall below zero—a short seller contends with unlimited or theoretically unbounded loss potential if prices spike upward. The cryptocurrency realm, with 24/7 trading and rampant volatility, exacerbates these dangers.

High rewards, even higher risks.

Unlimited Loss Potential

Imagine you short 1 BTC at $30,000. If Bitcoin surges to $60,000, you’re on the hook for a $30,000 loss if you’re forced to cover at that price. Should it climb to $90,000, your loss hits $60,000, and so on. There’s no natural cap, as there is with a long position dropping to zero. This can lead to serious financial peril, especially if you’re using margin or leverage.

- Margin Calls: Exchanges require you to maintain a certain margin ratio. If the market rallies against you, your margin ratio may drop below the allowed threshold, prompting a margin call.

- Forced Liquidation: To protect their own capital, exchanges forcibly liquidate your position if you can’t top up your collateral. This often happens at inopportune moments, leaving you with a realized loss far greater than anticipated.

Extreme Volatility

Crypto’s hallmark is its erratic price movement. A coin can surge 20%, 30%, or even 100% in a single day due to a viral tweet, major partnership announcement, or a sudden wave of short squeezes. For a short seller, any upward jolt can be calamitous.

- Liquidation Wicks: On platforms with high leverage, rapid price spikes—sometimes orchestrated by large traders or “whales”—can wipe out numerous short positions in seconds.

- Stop-Loss Slippage: You might set a stop-loss at $32,000, but if the market leaps from $31,500 to $33,000 instantly, your stop-loss may fill far above your intended exit, resulting in a bigger loss.

A single wick can crush a short.

Leverage Magnifies Losses

Leveraged trading is attractive because you can control a larger position with a smaller capital outlay. A 5x or 10x multiplier might yield bigger gains if the market moves favorably. Yet, if the market shifts 10% against you on 10x leverage, you face a near-total liquidation, losing your entire margin. The inherent volatility in crypto intensifies this risk significantly more than in relatively stable traditional markets.

- Inadvertent Over-Leverage: In some platforms, you might inadvertently open a position with more leverage than you realize—especially if you’re new to crypto.

- Maintenance Margin: The higher the leverage, the narrower the margin for error. Even a 2–3% price reversal can trigger liquidation at extreme leverage levels.

Liquidation Risks and Short Squeezes

When multiple traders hold large short positions on an asset, a small price rally can trigger partial liquidations, forcing them to buy back their shorts. This buyback pressure pushes the price even higher, sparking more liquidations in a cascading effect known as a short squeeze. These events can escalate quickly in crypto.

- Game Theory: Sometimes whales or coordinated trading groups intentionally drive up the price to force liquidations and cause a short squeeze, capitalizing on forced buy-ins to sell at higher prices.

- Sustained Momentum: After a short squeeze starts, momentum traders or technical breakout players might jump in, pushing prices further upward, intensifying the losses for those still short.

Regulatory Uncertainty

Governments and financial regulators worldwide continue to refine their stance on cryptocurrencies. The approach to margin trading, futures, and leverage can differ from country to country. In some jurisdictions, regulators impose strict leverage caps (e.g., 2x or 3x) or ban certain derivative products altogether.

- Exchange Licensing: Popular platforms may suddenly restrict services in your region if local regulators clamp down, potentially locking or freezing open positions.

- Cross-Border Risks: Traders using offshore exchanges accessible via VPN might face legal uncertainty or lack consumer protections if something goes wrong.

Regulations can shift overnight.

Hack and Security Vulnerabilities

When shorting on centralized exchanges, your funds or collateral might be stored on their platform. A hack or security breach could compromise user balances. Although many top-tier exchanges maintain multi-signature cold wallets and insurance funds, the risk can never be fully erased. Meanwhile, using decentralized platforms mitigates custodial risk but introduces smart contract vulnerabilities where bugs or exploits could lead to partial or total loss of user funds.

Behavioral Pitfalls

Shorting inherently can tap into psychological challenges. Watching a price move against you—knowing your losses grow as the market rises—causes stress, leading some traders to cling to losing positions in denial or panic, hoping for a reversal.

- Revenge Trading: After a loss, some might double down or re-enter a short impulsively, compounding errors.

- Emotional Roller Coaster: The adrenaline of short-term profits and the anxiety of potential liquidation can cloud judgment, fueling further mistakes.

Risk Mitigation Techniques

- Smaller Position Sizes: Only short with capital you can afford to lose, especially if you’re leveraging.

- Hard Stop-Losses: Place well-considered stop-loss orders to exit positions automatically if the market turns.

- Gradual Scaling: Instead of opening a full short at once, scale in partial positions at different price points.

- Continuous Monitoring: Crypto doesn’t sleep; if you can’t watch 24/7, set alerts or rely on robust risk management orders.

- Practice on Testnets or Paper Trades: Before risking real capital, simulate short trades to sharpen your skills under real market conditions (but with fake money).

By acknowledging these pitfalls and planning accordingly, short sellers can better navigate the erratic seas of crypto trading. While no amount of caution eliminates risk, a disciplined, informed approach stands the best chance of reaping rewards without succumbing to catastrophic losses.

Short Selling Crypto — 12-Question FAQ (Opportunities, Platforms, Risks & Rewards)

1) What does “short selling crypto” actually mean?

Shorting means you borrow a coin, sell it now, then aim to buy it back cheaper later. The spread (minus fees/interest) is your profit. If price rises instead, your losses grow as long as you remain short.

2) Where can I short crypto—CEX, DEX, or both?

Both.

Centralized exchanges (CEXs): margin, futures, and perpetual swaps with deep liquidity and tools.

Decentralized exchanges (DEXs): non-custodial perpetuals/margin via smart contracts; you keep your keys but may face thinner liquidity and on-chain fees.

3) What instruments can I use to express a short view?

Spot-margin short: borrow the asset, sell it, rebuy later.

Perpetual swaps/futures: go short via derivatives (no borrowing the coin).

Options: buy puts (defined risk), or structure spreads.

Inverse/leveraged tokens: simplified short exposure, but watch daily rebalancing and decay.

4) What are the major costs of shorting?

Borrow fees/funding rates: paid to lenders or to longs (if funding is positive).

Trading fees/slippage: especially on volatile pairs.

Interest on margin & on-chain gas (DEXs): increases with time and activity.

5) How does leverage change the game?

Leverage magnifies P&L and risk. Small adverse moves can trigger margin calls and forced liquidation. Newer traders should start unlevered or low-leverage and size positions modestly.

6) What’s a funding rate and why should I care?

Perpetuals use funding payments between longs and shorts to keep the contract near spot.

Positive funding: shorts pay longs—your short costs more to hold.

Negative funding: longs pay shorts—your short is subsidized.

Funding flips with sentiment; monitor it.

7) How do short squeezes happen in crypto?

When many traders are short and price pops, liquidations force shorts to market-buy to close, pushing price up further—a cascade. Thin liquidity, high leverage, and momentum algos can amplify the move.

8) Can shorting be used as a hedge—not just a bet?

Yes. Examples:

Partial hedge: short a fraction of BTC/ETH against a large spot stack during event risk.

Basis hedge: hedge an alt exposure by shorting a correlated index/major.

Define hedge ratio, time box the hedge, and pre-plan exits.

9) What are common execution pitfalls?

Over-sizing and tight stops that get wicked out.

Ignoring liquidity: shorting illiquid alts = painful slippage.

Funding bleed: profitable thesis undone by carry costs.

News risk: listings, airdrops, integrations can rip price.

10) How do risk controls look for short sellers?

Position sizing: risk a small % of equity per trade.

Hard stops & alerts: place, don’t pray.

No-add rules: avoid averaging up losers without a plan.

Scenario tests: “What if +10% in 10 minutes?” Ensure you survive.

11) What legal, tax, and operational issues matter?

Access, leverage limits, KYC, and derivative permissions vary by jurisdiction. Taxes differ for derivative P&L vs. spot. Operationally, consider custodial risk (CEX) vs smart-contract risk (DEX). Always comply with local laws.

12) Who is shorting not suitable for?

Traders without a written plan, risk controls, or 24/7 alerting; anyone uncomfortable with theoretically unlimited loss; and investors who conflate hedging with speculation. Master spot first; short later.

Conclusion

Short selling is a valuable yet highly intricate strategy in the cryptocurrency world. It offers traders a chance to profit from downward price movements, hedge their existing holdings against bear markets, or capitalize on perceived overvaluations when tokens spike without fundamental backing. Additionally, it can serve to enhance liquidity and price discovery in an otherwise bullish or hype-driven environment. By learning how to short effectively, you broaden your trading repertoire, potentially earning returns irrespective of whether crypto prices surge or fall.

But it’s not for the faint of heart.

Recap: The Journey Through Short Selling

- Definition & Mechanics: Short selling in crypto hinges on borrowing and then selling an asset immediately, with the aim to buy it back later at a reduced price.

- Platforms & Methods: Centralized exchanges, decentralized protocols, and derivatives markets all provide distinct avenues for short exposure. You can use margin trading, futures, perpetual swaps, options, or specialized short tokens to express your bearish view.

- Opportunities & Rewards: Short sellers can profit from bear market cycles, hedge long-held assets, exploit market inefficiencies, and time volatility for quick gains. Some real-life scenarios—like the Terra/Luna crash—demonstrate how advanced traders made exceptional profits betting on a collapse.

- Risks & Challenges: With theoretically unlimited losses, crypto’s round-the-clock volatility, and potential for sudden short squeezes, short selling can be extremely dangerous. Factors like leverage, liquidation thresholds, regulatory fluidity, and emotional stress weigh heavily on those who go short.

Guidance for the Aspiring Short Seller

- Risk Management Is Paramount: Stop-loss orders, clear margin usage, and well-defined position sizes can’t be optional. They’re essential safeguards.

- Thorough Research: Understand a coin’s tokenomics, upcoming news catalysts, or potential fundamental flaws before opening a short. Blindly shorting based on pure guesswork invites trouble.

- Stay Informed: Because crypto markets are open 24/7, global events or announcements can strike anytime. Maintaining awareness—or at least setting alerts—helps you react quickly to protect positions.

- Combine Strategies: For long-term investors, short selling might be an occasional hedge rather than a constant approach. For active traders, short selling can integrate with other tactics like swing trading or day trading.

Diversification extends to strategies, not just assets.

Balancing Potential Gains and Inherent Dangers

While short selling can deliver impressive returns, especially when markets tumble, it entails exposing yourself to a degree of risk that’s often higher than simple spot trading. In a space as unpredictable as crypto, huge upward surges can occur without warning, wiping out short positions in a blink. Legendary short sellers in traditional finance often emphasize a measured approach: never risk more than you can handle, and always keep a keen eye on market sentiment. This wisdom holds doubly true for crypto, where sentiment can pivot on tweets or viral rumors.

The Future of Short Selling in Crypto

As the industry matures and regulators step in, we might see more standardized futures markets or regulated platforms offering short-selling features. In parallel, decentralized finance (DeFi) protocols continue to innovate, finding new ways to facilitate short sales without a centralized intermediary. This dual track—centralized and decentralized—suggests that in the years ahead, short selling could become more accessible, sophisticated, and possibly safer. Exchange insurance funds, advanced risk engines, and improved user interfaces will cater to professional and retail traders alike.

Still, the core principle remains: short selling is a serious endeavor, best undertaken by those who have honed their trading skills, thoroughly researched their target assets, and maintain robust protective measures for both their capital and their peace of mind.

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.