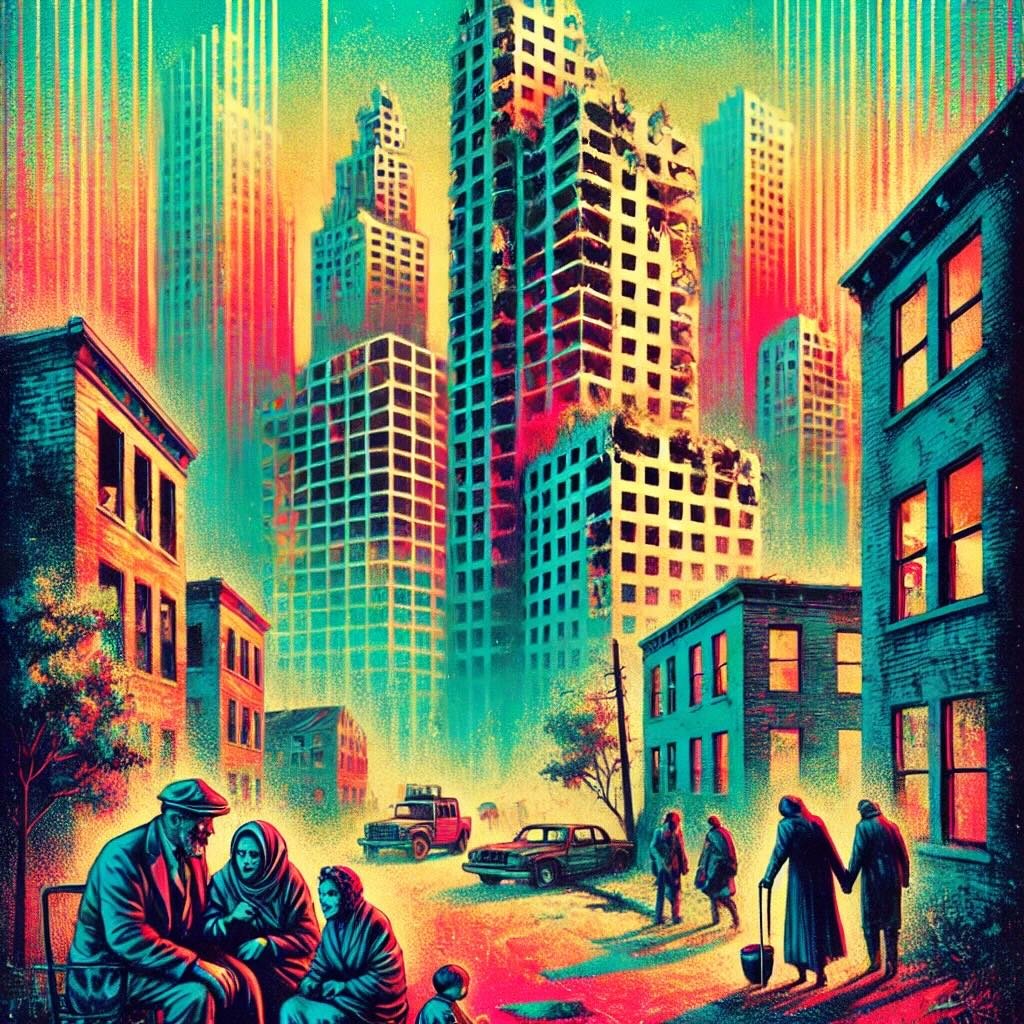

A housing bubble. Sounds innocuous, right? But in reality, it’s anything but. A housing bubble occurs when home prices inflate rapidly, fueled by high demand, speculation, and exuberant market behavior. However, this rapid rise is typically followed by a sharp decline—prices plummet, and the bubble bursts.

source: Money Builders on YouTube

Historically, housing bubbles have left deep scars. Take the 2008 Financial Crisis, for example. It all started with a bubble in the U.S. housing market. Easy credit and lax lending standards led to a surge in home buying, pushing prices to unsustainable levels. When the bubble burst, it triggered a global financial meltdown, leaving millions of people in foreclosure and financial ruin.

Brief Overview of Housing Bubbles

While the economic damage of a housing bubble is often front and center, the social implications are just as critical, if not more so. Why? Because the ripple effects of a burst bubble extend far beyond bank accounts and stock markets. They reach into the very fabric of society, altering lives, communities, and the overall social landscape.

We’ll explore not just the economic fallout but also the deeper, long-lasting social impacts that housing bubbles can leave in their wake. Understanding these social implications is key to recognizing the full scope of the damage and, more importantly, to preventing similar outcomes in the future. So, let’s dive in and uncover what happens when a housing bubble bursts, beyond the balance sheets and market indices.

Causes of a Housing Bubble

Economic Factors

When it comes to housing bubbles, economic factors are often the primary culprits. Low-interest rates play a significant role. They make borrowing cheaper, encouraging more people to take out loans and buy homes. This surge in demand pushes home prices higher, sometimes to unsustainable levels. Then there’s easy credit—loans that are all too accessible, even for those who might not be able to afford them in the long run. It’s a recipe for trouble.

But that’s not all. Speculative buying kicks in when people start purchasing homes not to live in them, but to flip them for a profit. It’s driven by the belief that prices will keep rising indefinitely. This leads to irrational exuberance, where the market becomes overly optimistic, ignoring the risks. And just like that, the bubble begins to inflate.

Government Policies

Government policies can either help stabilize a housing market or, unfortunately, fuel a bubble. Deregulation is one such factor. When regulations are loosened, it often leads to riskier lending practices, as seen in the lead-up to the 2008 crisis. Inadequate oversight allows these risky behaviors to go unchecked, letting the bubble grow unchecked until it’s too late.

On the flip side, housing incentives and subsidies—meant to make homeownership more accessible—can also contribute to a bubble if not carefully managed. While well-intentioned, these policies can artificially boost demand, driving prices up even further and making the market more fragile.

Market Dynamics

Finally, the dynamics of the market itself play a crucial role. Supply and demand imbalances are often at the heart of a housing bubble. When demand far outstrips supply, prices skyrocket. But if that demand is driven by speculation rather than actual need, it creates a precarious situation.

Investors and foreign buyers also have a significant impact. When they flood the market, snapping up properties as investments rather than homes, they further inflate prices. This not only makes housing less affordable for locals but also adds another layer of volatility to the market. It’s a perfect storm of factors that, together, can lead to a devastating burst.

Immediate Social Impact of a Housing Bubble

Homeownership and Affordability

When a housing bubble inflates, homeownership becomes a distant dream for many. Prices skyrocket, making it nearly impossible for average-income families to afford a home. Those who could once consider buying are now left on the sidelines, watching as the market spirals out of reach. Affordability plummets, and with it, the hopes of countless aspiring homeowners.

But it’s not just about those looking to buy. The gap between homeowners and renters widens significantly. Homeowners, especially those who bought in early, see their equity soar. Meanwhile, renters find themselves stuck, unable to make the leap into homeownership, and often facing rising rents as property values climb. It’s a divide that can have lasting social consequences, creating a clear divide between the “haves” and the “have-nots.”

Community Displacement

The social fabric of communities takes a hit during a housing bubble, particularly through gentrification. As home prices soar, lower-income families are often pushed out of neighborhoods they’ve lived in for years. Gentrification sweeps through, replacing long-time residents with wealthier newcomers. The result? Displacement. Families are forced to relocate, sometimes to areas far from their jobs, schools, and support networks.

Neighborhood demographics shift, often rapidly. What was once a diverse, mixed-income community can quickly become homogenous and upscale, losing the character and culture that made it unique in the first place. The social ties that held these communities together fray, and the sense of belonging many residents felt begins to erode.

Psychological and Emotional Stress

The emotional toll of a housing bubble is profound. High mortgage payments become a crushing burden for many homeowners, particularly those who bought at the peak. As interest rates rise or as personal circumstances change, keeping up with payments becomes increasingly difficult. Debt piles up, and with it, a sense of hopelessness.

Anxiety and fear become constant companions for those on the brink of losing their homes. The thought of foreclosure looms large, casting a shadow over every aspect of life. The stress is palpable, affecting not just finances, but mental and emotional well-being. For many, the psychological impact of living through a housing bubble can be just as devastating as the financial fallout.

Long-Term Social Consequences

Wealth Inequality

A housing bubble doesn’t just burst and disappear; its impact lingers, widening the wealth gap between socio-economic groups. When the market is hot, those with assets, especially real estate, see their wealth balloon. But when the bubble bursts, the divide between the wealthy and everyone else only grows. The rich, often insulated from the worst effects, can weather the storm or even capitalize on lower prices to expand their holdings. Meanwhile, those less fortunate—renters, low-income families, or those who bought in at the peak—find themselves in a much more precarious position.

Over time, this accumulation of wealth by those who benefited from the bubble can create entrenched economic divisions. The rich get richer, not just because they can afford to, but because the system often works in their favor during and after a housing bubble. It’s a self-perpetuating cycle, leaving others struggling to catch up.

Social Mobility

Housing bubbles also have a chilling effect on social mobility. For many, homeownership is a primary way to build generational wealth, a stepping stone to financial stability. But when the housing market is unstable, that opportunity becomes elusive. Younger generations, in particular, bear the brunt. Priced out of the market or stuck with properties that have lost value, their dreams of climbing the economic ladder are deferred, sometimes indefinitely.

The barriers to upward mobility created by housing market instability are substantial. Not only do they limit the ability to accumulate wealth, but they also exacerbate existing inequalities. When homeownership is out of reach, so too are the broader social and economic benefits it can bring—stability, investment in communities, and the ability to pass on wealth to the next generation.

Trust in Financial and Government Institutions

Perhaps one of the most insidious long-term consequences of a housing bubble is the erosion of trust in financial and government institutions. When a bubble bursts, the fallout often reveals the flaws in the systems meant to protect consumers and maintain market stability. Regulatory failures come to light, and the perception that the system is rigged against the average person becomes hard to shake.

This loss of trust can lead to long-term cynicism and skepticism toward financial systems. People begin to doubt the ability of institutions to manage the economy effectively or to protect them from future crises. Cynicism grows, and with it, a sense of disillusionment that can pervade society. This erosion of trust doesn’t just affect the economy—it impacts civic life, public engagement, and the very fabric of society. When trust is broken, it’s hard to rebuild.

Case Studies: Real-World Examples

2008 U.S. Housing Crisis

The 2008 U.S. housing crisis is often regarded as the textbook example of what happens when a housing bubble bursts. It all started with subprime mortgages—loans given to people who really shouldn’t have qualified for them. As housing prices soared, people rushed to buy, assuming that the value would keep rising. But when the bubble finally popped, the consequences were devastating.

Immediate social impacts were felt across the nation. Millions of Americans lost their homes to foreclosure. Entire neighborhoods were left dotted with abandoned houses, turning once-thriving communities into ghost towns. The ripple effect on the broader economy was catastrophic, leading to widespread job losses and plunging the U.S. into a deep recession.

But the long-term effects of the 2008 crisis are still with us today. The dream of homeownership became more distant for many, especially younger generations burdened by student debt and stagnant wages. Wealth inequality widened as those who could hold onto their assets during the downturn saw their fortunes recover, while others were left trying to rebuild from scratch. Trust in financial institutions took a hit, and the repercussions have shaped economic policy and public sentiment ever since.

Japan’s Real Estate Bubble (1980s-1990s)

Japan’s real estate bubble in the late 1980s and early 1990s offers a different perspective on the social impact of a housing market collapse. During this period, property prices in Japan soared to astronomical levels, particularly in Tokyo. When the bubble burst, the crash was severe, plunging the country into a prolonged economic slump known as the “Lost Decade.”

The social consequences in Japan were profound. The bursting of the bubble led to widespread job losses, particularly in industries tied to real estate and construction. Many families found themselves saddled with mortgages far higher than the value of their homes, leading to what is known in Japan as being “underwater.” Consumer confidence plummeted, and with it, spending—a critical blow in a country where domestic consumption is key to economic health.

Comparing this to Western experiences, Japan’s response was markedly different. The cultural emphasis on saving and the reluctance to foreclose on properties meant that the social fallout was less visible in the short term but more insidious in the long run. The Japanese government’s attempts to stimulate the economy with low-interest rates and public works projects had limited success, and the country struggled with deflation and economic stagnation for years. Unlike in the U.S., where the 2008 crisis prompted significant policy changes, Japan’s response was slower and less aggressive, leading to a more drawn-out recovery.

Spain’s Housing Bubble (Early 2000s)

Spain’s housing bubble in the early 2000s was driven by a combination of easy credit, foreign investment, and speculative building. When the bubble burst, it had a dramatic effect on the Spanish population, particularly on the country’s youth. The construction industry, which had been a major driver of employment, collapsed, leading to skyrocketing unemployment rates, especially among young people.

Youth unemployment became one of the most pressing social issues in Spain. Many young adults, unable to find work, were forced to stay with their parents or leave the country in search of better opportunities. Housing access also became a significant problem, as many young Spaniards found themselves unable to afford homes, either because they couldn’t secure loans or because prices remained stubbornly high in desirable areas.

The long-term social repercussions of Spain’s housing bubble are still unfolding. The crisis exacerbated existing issues such as income inequality and regional disparities, particularly between Spain’s urban and rural areas. A generation of Spaniards, known as the “lost generation,” faced delayed life milestones, such as buying a home, getting married, or starting a family. This has had a lasting impact on the country’s demographic trends and social fabric, with potential consequences for decades to come.

Mitigating Social Impacts: Policy Recommendations

Strengthening Financial Regulation

One of the first steps in preventing the social devastation caused by housing bubbles is strengthening financial regulation. Better oversight is crucial. When the market is left unchecked, risky lending practices and speculative buying can spiral out of control. To prevent future bubbles, regulators need to keep a close eye on the housing market, ensuring that lending practices remain prudent and that signs of an overheating market are addressed early.

But it’s not just about watching the market; it’s also about protecting consumers. Implementing measures like stricter mortgage qualification requirements and transparent lending practices can help safeguard homebuyers. Consumers need to be informed, with clear and honest communication about the risks involved in taking on a mortgage, especially during volatile market conditions.

Affordable Housing Initiatives

Another critical piece of the puzzle is promoting affordable housing. As home prices rise, it’s essential to ensure that everyone has access to housing that meets their needs and budget. This means supporting the development of sustainable, affordable housing options—homes that are not just available, but also fit into the broader context of community and environmental sustainability.

Balancing market forces with social needs is key. While the market plays a significant role in determining housing prices, public policy can help guide the market in a direction that benefits society as a whole. This might involve zoning reforms, subsidies for affordable housing projects, or incentives for developers to include affordable units in new developments. Housing should be a right, not a luxury, and policies need to reflect that priority.

Community Support Programs

Finally, community support programs are vital in mitigating the social impacts of a housing crisis. When a bubble bursts, it’s the communities—especially the most vulnerable—that bear the brunt of the fallout. Providing support for displaced individuals and families is crucial. This could take the form of temporary housing assistance, relocation services, or job training programs to help those affected get back on their feet.

Mental health resources are also a critical component of these support programs. The stress and anxiety that come with losing a home, facing foreclosure, or dealing with financial uncertainty can be overwhelming. Ensuring that those affected have access to counseling and mental health services can make a significant difference in helping them cope and recover from the crisis.

12-Question FAQ: The Social Implications of a Housing Bubble — Long-Term Impact

1) What is a housing bubble and why do its social impacts matter?

A housing bubble is a rapid, unsustainable rise in home prices fueled by cheap credit, speculation, and demand exceeding fundamentals. When it bursts, the fallout reshapes families, neighborhoods, and social trust—not just balance sheets.

2) What economic and policy forces typically inflate bubbles?

Low interest rates, easy credit, speculative buying, and weak oversight. Poorly targeted subsidies and constrained housing supply (zoning, slow approvals) convert extra demand into higher prices instead of more homes.

3) How do bubbles affect homeownership and affordability right away?

Prices outpace incomes, pushing first-time buyers aside and widening the owner–renter gap. Rents often rise with prices, straining household budgets and reducing mobility.

4) What kinds of community displacement occur?

Gentrification and investor activity can price out long-time residents, dissolving social networks, cultural institutions, and small businesses. Displaced households face longer commutes and weaker access to schools and services.

5) What are the psychological and health effects?

Payment stress, negative equity, and foreclosure risk drive anxiety, depression, family conflict, and worse health outcomes. Children experience instability that can impair academic performance.

6) How do bubbles change inequality and social mobility?

Asset owners gain equity on the way up and often recover faster after busts; non-owners fall behind. This widening wealth gap limits intergenerational mobility and concentrates advantage.

7) Do bubbles alter neighborhood safety and civic life?

Vacancies and foreclosures correlate with blight and higher crime risk, while churn lowers voter turnout, volunteerism, and trust. Community organizations lose donors and participants.

8) What happens to homelessness and housing precarity?

Rent spikes and evictions increase doubling-up, shelter demand, and unsheltered homelessness—especially after job losses in a downturn.

9) How are youth and aging populations uniquely affected?

Youth/young adults: delayed household formation, migration for affordability, stalled wealth-building.

Older adults: fixed incomes strained by taxes/maintenance; downsizing blocked by thin supply of accessible, affordable options.

10) How do bubbles reshape labor markets and local economies?

High housing costs deter workers, causing talent shortages and longer commutes. After a bust, construction and local retail contract, deepening unemployment in affected regions.

11) What policy steps reduce long-term social harm?

Stronger oversight: prudent underwriting, stress-tests, LTV/DTI caps.

Supply reform: by-right zoning, missing-middle housing, faster approvals, public land for affordable units.

Targeted aid: down-payment assistance tied to supply growth, anti-displacement funds, right-to-counsel for tenants, property tax circuit breakers.

Crisis response: foreclosure prevention, loan mods, vacancy remediation, mental-health and relocation support.

12) What can households and communities do?

Households: keep fixed-rate debt, emergency savings, avoid thin-margin flips, and seek HUD/NGO counseling.

Communities: support community land trusts, inclusionary zoning, ADUs, and data-driven early-warning systems to flag displacement risk.

Conclusion

Housing bubbles aren’t just about dollars and cents; their social impacts are far-reaching and long-lasting. We’ve seen how bubbles can widen the gap between the wealthy and everyone else, making it harder for many to achieve the dream of homeownership. They disrupt communities, forcing people from their homes and altering the fabric of neighborhoods. The psychological toll is heavy too, with anxiety and stress becoming constant companions for those caught in the bubble’s burst.

The aftermath lingers, creating barriers to social mobility and eroding trust in the institutions meant to protect us. Whether it’s in the U.S., Japan, or Spain, the story is eerily similar: economic booms followed by devastating busts, each leaving deep social scars that take years, if not decades, to heal.

Final Thoughts

As we move forward, it’s clear that housing policies can’t just focus on the economic factors. We need to consider the social impacts as well. A housing market that only serves the wealthy is a market that fails society. It’s time to rethink how we approach housing—balancing market dynamics with the needs of all citizens.

This means more than just better financial regulation or affordable housing initiatives. It means crafting policies that protect communities, preserve mental health, and promote equality and fairness. Housing is more than just a market—it’s a foundation for stable, healthy lives. Let’s make sure our policies reflect that.

So, what can we do? Advocate for socially conscious housing practices. Support regulations that keep the market in check and initiatives that ensure everyone has a place to call home. Let’s work towards a housing market that serves everyone, not just the fortunate few. The future of our communities depends on it.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.