Earnings Per Share (EPS)—you’ve probably seen this term pop up in every stock analysis or financial report you’ve come across. But what exactly is EPS, and why does it matter? At its core, EPS is a straightforward metric that tells you how much profit a company generates for each share of its stock. Think of it as a way to gauge a company’s profitability on a per-share basis. It’s like slicing the company’s net earnings pie and seeing how big a slice each shareholder gets.

source: Rynance on YouTube

Why is EPS such a big deal for investors and analysts? Because it’s a key indicator of a company’s financial health. A higher EPS typically signals better profitability, which can be a strong indicator of a company’s growth potential. Investors use EPS to compare companies within the same industry, and it’s often the starting point for more detailed analysis. In short, EPS is one of the most critical metrics in financial analysis, offering insights into how well a company is performing and how it might perform in the future.

Overview of Earnings Per Share (EPS)

So, why are we diving deep into EPS today? The purpose of this article is to break down how to interpret EPS and understand its significance in evaluating a company’s profitability. We’ll explore everything from the basics of EPS—what it is, how it’s calculated—to how you can use it to make more informed investment decisions. We’ll also cover the different types of EPS, what growth in EPS means, and how to put EPS into context with other financial metrics.

Understanding Earnings Per Share (EPS)

What is EPS?

Earnings Per Share (EPS) is one of those financial metrics that packs a punch in its simplicity. But what exactly is it? In essence, EPS measures a company’s profitability by calculating the portion of a company’s profit allocated to each outstanding share of common stock. It’s a straightforward way to see how much money a company makes for each share you own, making it a crucial figure for investors.

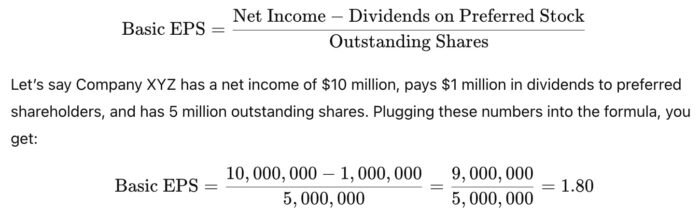

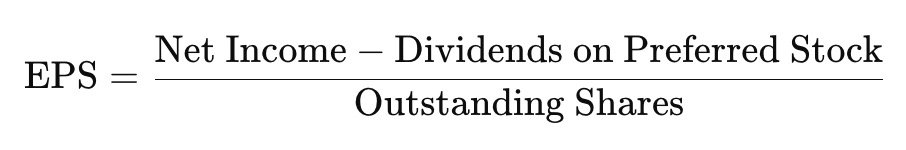

Here’s how EPS is calculated:

Let’s break that down. Net income is the total profit a company earns after all expenses, taxes, and costs have been deducted. Dividends on preferred stock are subtracted because these dividends are paid out before common shareholders get their piece of the pie. Outstanding shares refer to all the shares currently held by shareholders, including shares held by institutional investors and company insiders.

In other words, EPS gives you a clear picture of a company’s profitability on a per-share basis. If a company has a high EPS, it means the company is generating significant earnings relative to its share count—something that’s music to any investor’s ears. But remember, while EPS is a key indicator of financial health, it’s most meaningful when compared across similar companies or tracked over time to identify growth trends.

Types of EPS

When diving into EPS, you’ll often come across two different flavors: Basic EPS and Diluted EPS. So, what’s the difference? And why does it matter?

Basic EPS is the straightforward calculation we just discussed. It assumes that the number of outstanding shares remains constant, making it the simpler and more commonly reported figure. But here’s where things get interesting. Not all shares are created equal, especially when you factor in potential future shares from things like stock options, convertible securities, or warrants. That’s where Diluted EPS comes into play.

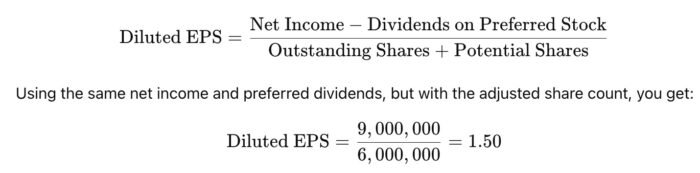

Diluted EPS takes into account all potential shares that could be created if those stock options, convertible securities, or warrants were exercised. It provides a more conservative measure of EPS by assuming that these potential shares are added to the total outstanding shares, potentially diluting the earnings available to each share.

Why is understanding both metrics important? Basic EPS gives you a snapshot of current profitability, but Diluted EPS offers a more cautious view by accounting for future dilution that could impact your earnings per share. For a comprehensive analysis, it’s essential to consider both, especially if a company has a lot of convertible securities or stock options outstanding. In short, Basic EPS tells you where the company stands today, while Diluted EPS helps you anticipate what might happen tomorrow.

How to Calculate EPS

Interpreting EPS

EPS Growth

Earnings Per Share (EPS) isn’t just a static number; it’s a dynamic indicator that can reveal a lot about a company’s financial health over time. So, how do you evaluate EPS growth? Start by looking at how a company’s EPS has changed year over year. Is it steadily rising? That’s often a good sign, indicating that the company is becoming more profitable and is effectively managing its resources to generate higher earnings per share.

But don’t stop there. Compare that growth to industry averages and market trends. If a company’s EPS is growing, but at a slower rate than its peers, it might not be as strong an investment as it first appears. Conversely, if it’s outpacing the industry, that could be a signal that the company is gaining a competitive edge. In short, EPS growth over time gives you a sense of the company’s trajectory— whether it’s on an upward path or facing potential headwinds.

EPS vs. Price-to-Earnings (P/E) Ratio

EPS is a powerful metric on its own, but when you combine it with the Price-to-Earnings (P/E) ratio, you unlock even deeper insights into a stock’s value. Here’s the deal: the P/E ratio is calculated by dividing the stock’s current price by its EPS. This ratio tells you how much investors are willing to pay for each dollar of earnings.

So, how do EPS and the P/E ratio work together? If a company has a high P/E ratio, it means the market expects high future growth, but that also means the stock could be overvalued if those expectations aren’t met. On the flip side, a low P/E ratio might indicate that the stock is undervalued, but it could also suggest that the market is wary of the company’s future prospects. The key is to use the P/E ratio in conjunction with EPS to determine if a stock is priced appropriately relative to its earnings. For instance, if a company has solid EPS growth but a low P/E ratio, it might be a hidden gem worth considering.

EPS in Context

While EPS is a crucial metric, it doesn’t exist in a vacuum. To truly understand what EPS is telling you, you need to consider the broader financial context. For example, is the company’s revenue growing at the same pace as EPS, or is EPS growth driven by cost-cutting measures that might not be sustainable?

Margins play a big role here too. If a company’s profit margins are shrinking, it might be a sign that EPS growth is being propped up by other factors, like share buybacks, rather than genuine improvements in the company’s operations. And don’t forget about debt levels. High debt can artificially inflate EPS by leveraging the company’s earnings, but it also increases financial risk.

Practical Applications of EPS

Comparing Companies

Earnings Per Share (EPS) is a powerful tool for comparing the profitability of companies within the same industry. Why is this important? Because not all companies are created equal, even if they operate in the same sector. EPS allows you to see which companies are making the most profit relative to their share count, giving you a clearer picture of who’s leading the pack.

Let’s consider two companies—Company A and Company B—both in the tech industry. If Company A has an EPS of $5 and Company B has an EPS of $3, you might be tempted to think Company A is the better investment. But it’s not just about the numbers. You also need to dig deeper. Is Company A’s higher EPS due to better management, innovative products, or perhaps lower operating costs? Or is it because Company B is reinvesting heavily in research and development, which might lower current earnings but could pay off big in the future?

EPS gives you a starting point, but the real insight comes from understanding why there’s a difference. By analyzing these factors, you can identify potential investment opportunities that others might overlook. In other words, comparing EPS helps you separate the winners from the rest of the field, but context is key.

Evaluating Investment Potential

When it comes to evaluating a company’s investment potential, EPS is one of the first metrics investors turn to. It’s a straightforward way to gauge a company’s profitability, and it can be a strong indicator of its future earnings potential. But how do you use EPS in your investment strategy?

For value investors, EPS is a cornerstone metric. They look for companies with strong EPS growth that are trading at reasonable valuations. The idea is that a company with a solid EPS track record is more likely to continue growing its earnings, making it a good candidate for long-term investment. On the flip side, if a company has a declining EPS, it might signal trouble ahead, unless there are clear reasons for a temporary dip, such as an industry-wide downturn or strategic investments that will pay off later.

EPS also plays a key role in growth investing. Investors in this camp might be willing to pay a premium for companies with rapidly increasing EPS, betting that this growth will continue and drive the stock price higher. In summary, EPS helps you assess whether a company is not only profitable today but also has the potential to keep delivering value in the future.

Dividend Policy and EPS

EPS doesn’t just impact stock prices—it also plays a significant role in a company’s dividend policy. Companies often use EPS as a benchmark to determine how much of their profits they can afford to return to shareholders as dividends. Here’s how it works:

If a company has a high EPS, it may choose to pay out a portion of those earnings as dividends, rewarding shareholders with a slice of the profits. For example, if a company has an EPS of $4 and decides to pay out $2 per share as a dividend, it’s returning 50% of its earnings to shareholders. This payout ratio is a critical metric for dividend investors, as it indicates how sustainable the dividend might be.

But there’s a balance to be struck. A company that pays out too much of its EPS as dividends might not have enough left to reinvest in the business, potentially stunting future growth. On the other hand, a company that reinvests all its earnings without paying dividends might alienate income-focused investors. The key for investors is to look at how a company’s dividend policy aligns with its EPS and growth strategy. If the payout ratio is too high relative to EPS, it could be a red flag that the dividend isn’t sustainable in the long run.

Limitations of EPS

EPS and Share Buybacks

Earnings Per share (EPS) is a handy metric, but it’s not without its flaws—especially when it comes to share buybacks. Companies sometimes buy back their own shares from the market, reducing the number of outstanding shares. Sounds good, right? Fewer shares mean the same earnings get spread over a smaller base, which can lead to an increase in EPS without any actual improvement in the company’s profitability. In other words, the company hasn’t really earned more—it just looks that way on paper.

This is why it’s crucial not to rely solely on EPS when making investment decisions. Sure, a rising EPS might catch your eye, but if it’s driven by buybacks rather than genuine growth in net income, it could be misleading. To get the full picture, you should also look at the company’s overall financial performance, including revenue and profit growth, to see if the EPS increase is truly a sign of a stronger business or just financial engineering.

Impact of Accounting Practices

Accounting practices can also play a significant role in shaping EPS, sometimes in ways that can be misleading. Different methods of accounting for revenue, expenses, and even taxes can all affect the reported EPS. For example, a company might use aggressive revenue recognition practices to boost its net income in the short term, thereby inflating EPS. Or, it might defer certain expenses to future periods to make the current period’s EPS look better.

This is where understanding how EPS is calculated becomes essential. By digging into the company’s financial statements and understanding the accounting choices that were made, you can better assess the quality of the reported EPS. Remember, not all earnings are created equal, and the way they’re reported can significantly impact your interpretation of a company’s financial health.

EPS and Market Conditions

Lastly, it’s important to recognize that EPS doesn’t exist in a vacuum—it’s influenced by broader market conditions and economic cycles. During an economic boom, for instance, companies might see their EPS rise as consumer spending increases and businesses expand. But during a downturn, even strong companies might experience a drop in EPS due to external factors beyond their control, like reduced demand or higher costs.

This is why it’s critical to consider the bigger picture when interpreting EPS. A declining EPS might not always signal a failing company; it could simply reflect tough market conditions. On the flip side, a rising EPS during a booming economy might not be sustainable if it’s driven more by external factors than by the company’s own operational improvements.

12-Question FAQ: How to Interpret Earnings Per Share (EPS) as an Investor

1) What exactly is EPS?

Earnings Per Share (EPS) is net income available to common shareholders divided by the weighted-average common shares outstanding. It shows how much profit a company earns per share and is a core gauge of profitability.

2) How is basic EPS calculated?

Basic EPS = (Net Income − Preferred Dividends) / Weighted-Average Common Shares Outstanding.

Use the weighted average because the share count can change during the period.

3) What’s the difference between basic and diluted EPS?

Basic EPS ignores potential new shares.

Diluted EPS assumes all dilutive securities convert (options, warrants, convertibles), increasing share count and lowering EPS. Use diluted EPS when a company has significant potential dilution.

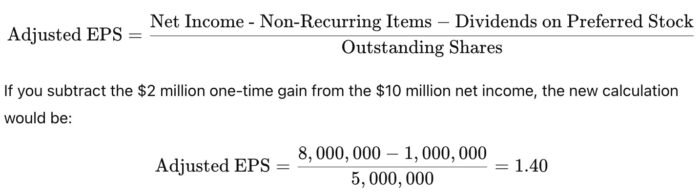

4) What is adjusted (or “normalized”) EPS and why use it?

Adjusted EPS excludes one-offs (asset sales, restructuring, impairments) to reflect ongoing earning power. It’s helpful for trend analysis, but definitions vary—always check what management excluded.

5) How do I evaluate EPS growth?

Track multi-year EPS CAGR and compare with peers/industry. Favor growth that’s supported by revenue expansion and stable/improving margins, not just cost cuts or buybacks.

6) How does EPS tie into the P/E ratio?

P/E = Price per Share ÷ EPS.

High P/E: market pricing in faster future growth (or overvaluation).

Low P/E: potential value (or risk).

Use P/E relative to peers, history, and interest rates.

7) Should I use trailing, current, or forward EPS?

Trailing EPS (TTM): actual results—objective but backward-looking.

Current-year EPS: partial actuals + guidance.

Forward EPS: consensus estimates—most relevant for valuation but least certain. Use all three for balance.

8) How can buybacks distort EPS?

Share repurchases shrink the denominator, boosting EPS even if profits don’t grow. Check net income growth, free cash flow, and share count trend to separate real improvement from financial engineering.

9) What accounting choices affect EPS quality?

Revenue recognition, reserves, stock-based comp, depreciation lives, and tax items can inflate or depress EPS. Read the footnotes/MD&A, compare GAAP vs. non-GAAP EPS, and review cash flow from operations for corroboration.

10) How does leverage impact EPS?

Debt can amplify EPS via lower share count (buybacks) or operating leverage, but raises interest burden and risk. Inspect net debt/EBITDA, interest coverage, and debt maturities to judge sustainability.

11) How should EPS be used across different sectors?

EPS is most comparable within a sector. Capital-intensive or cyclical industries have volatile EPS; banks/insurers are sensitive to credit/claims; REITs and MLPs often use AFFO/FFO or DCF-style metrics—don’t rely on EPS alone there.

12) How do I practically use EPS in a checklist?

Confirm revenue + margin drivers match EPS growth

Compare basic vs. diluted vs. adjusted EPS

Review 3–5 year EPS CAGR vs. peers

Check share count trend and buyback price discipline

Triangulate valuation: P/E, PEG, EV/EBIT(DA)

Validate with cash flows and balance sheet strength

Conclusion

Earnings Per Share (EPS) is a crucial metric that gives you a clear snapshot of a company’s profitability on a per-share basis. To calculate it, you simply divide the company’s net income (minus any preferred dividends) by the number of outstanding shares. It’s a straightforward formula, but one that carries a lot of weight in the world of financial analysis. Interpreting EPS, however, requires a bit more nuance. You’ve got to look at EPS growth over time, compare it to industry standards, and understand how it fits into the broader picture of a company’s financial health. Remember, EPS can be influenced by share buybacks, accounting practices, and market conditions, so always dig deeper before making any investment decisions.

Final Thoughts

EPS is a powerful tool in your investment toolbox, but it’s not the only one you should rely on. Think of it as one piece of a larger puzzle. To get a comprehensive view of a company’s performance, combine EPS with other financial metrics like the Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and revenue growth. By doing so, you’ll gain a more rounded perspective that helps you make smarter, more informed decisions. In the end, successful investing is all about seeing the big picture and understanding how each piece of data fits into the overall narrative of a company’s potential.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

ant Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized reproduction, republication, or commercial use of this content without express written permission is strictly prohibited.

8. Governing Law, Arbitration & Severability BINDING ARBITRATION:

Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.