Over here at Picture Perfect Portfolios, we tend to cover diversified alternative asset allocation funds and equity optimization strategies.

But today we’re going to mix things up and turn our attention to the bond sleeve of our portfolios.

Specifically, we’ll be shining the spotlight upon AGGH ETF.

It’s better known as Simplify Aggregate Bond ETF.

We’re thrilled to welcome back Shailesh Gupta of Simplify ETFs to cover all of its unique features.

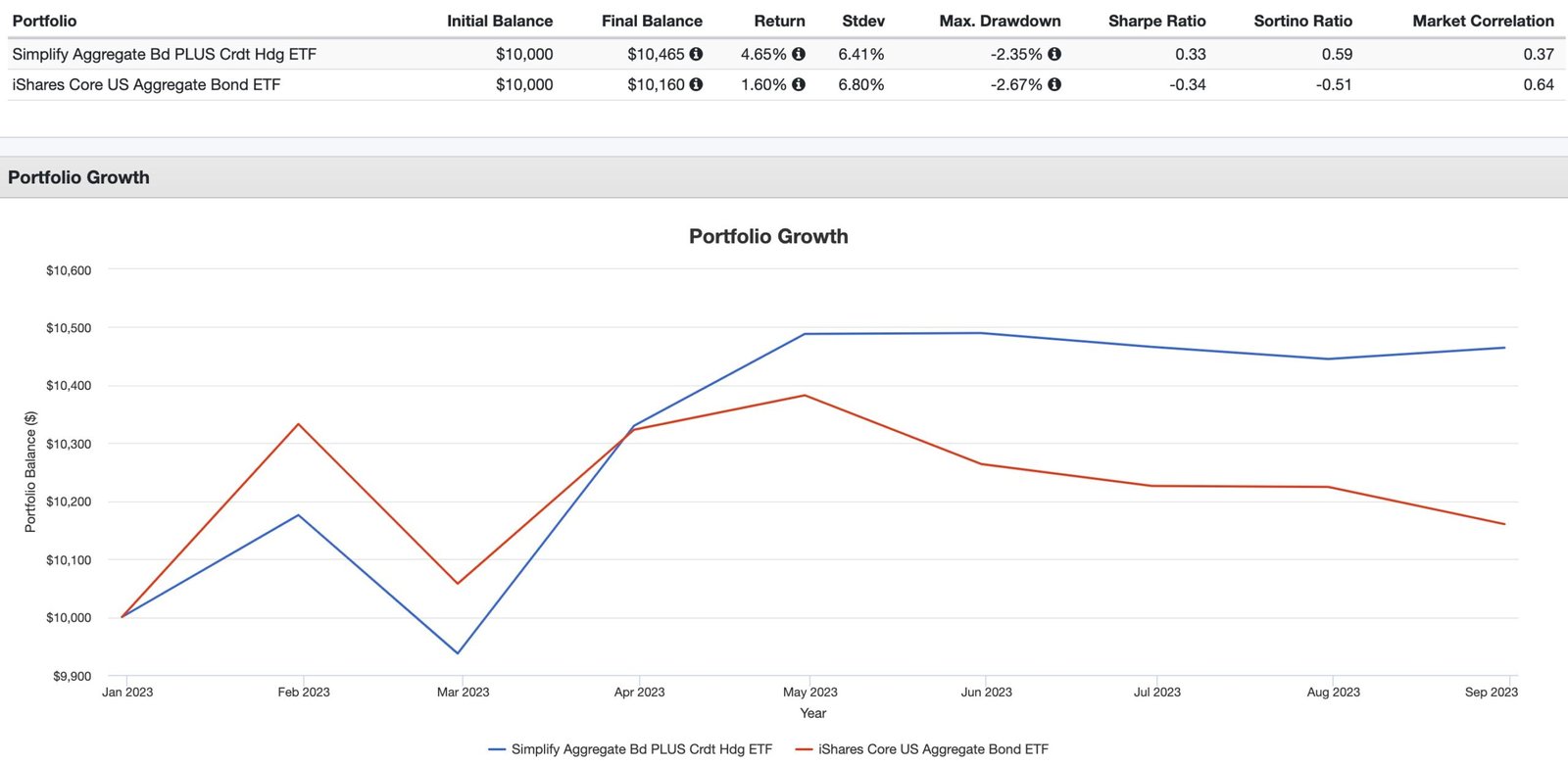

As a quick teaser, the fund has outperformed AGG ETF (its benchmark) this year with enhanced risk management and lower correlations with markets.

That’s a win in my books.

But let’s not get obsessed with short-term results and instead focus on the strategy of the fund.

Without further ado, let’s turn things over to Shailesh.

Reviewing The Strategy Behind AGGH ETF (Simplify Aggregate Bond ETF)

Hey guys! Here is the part where I mention I’m a travel content creator! This “The Strategy Behind The Fund” interview is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

What’s The Strategy Of AGGH ETF?

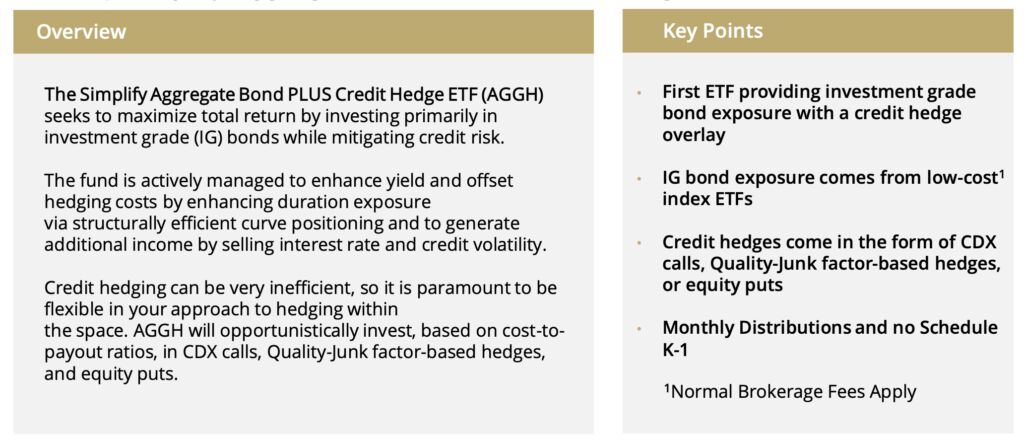

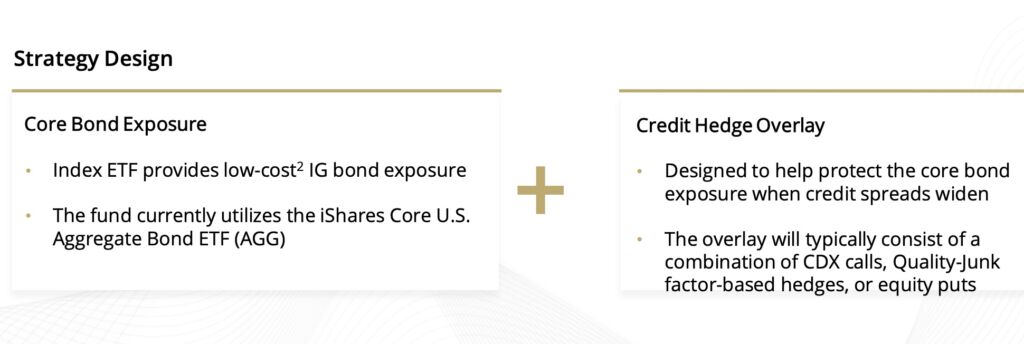

For those who aren’t necessarily familiar with an “core bond exposure plus hedged credit overlay” style of asset allocation, let’s first define what it is and then explain this strategy in practice by giving some clear examples.

Core bond exposure means that the target risk is that of the aggregate bond market which has interest rate and credit risks. We will also seek to enhance income through risk-managed option overlays. We attempt to mitigate credit and when appropriate, rate risk with hedges.

Unique Features Of Simplify Aggregate Bond Fund AGGH ETF

Let’s go over all the unique features your fund offers so investors can better understand it. What key exposure does it offer? Is it static or dynamic in nature? Active or passive? Is it leveraged or not? Is it a rules-based strategy or does it involve some discretionary inputs? How about its fee structure?

The key exposure is interest rate risk, similar to the aggregate bond market. It is static in the sense that the underlying risk exposure is typically similar to the bond market; however, hedging against rate and credit risk will occur dynamically based on the market backdrop.

Additionally, we employ a derivative overlay for income enhancements. This is an actively managed ETF that seeks to outperform the Aggregate Bond Index (the Agg). It is unlevered in the sense that risk in the portfolio will be targeted to be of the same order of magnitude of the Agg, however the fund will often use derivatives to take on the market exposure, while cash be invested in high quality low risk fixed income securities.

The strategy is certainly opportunistic but maintains the clear goal to track the benchmark from the risk perspective with income and/or hedging via option overlays.

What Sets AGGH ETF Apart From Other Core Bond Funds?

How does your fund set itself apart from other “core bond” funds being offered in what is already a crowded marketplace? What makes it unique?

AGGH is an attempt to achieve outperformance via income enhancing option overlay a.k.a. “structural volatility selling”. Typical core bond funds try to achieve this via security selection, however the focus of AGGH is more on sector selection and option overlays. The option overlays create yield enhancing negative convexity as is typically witnessed in mortgage bonds.

Mortgage bonds have higher yield without higher credit risk due to negative convexity but are only a subset of the bond universe. Option overlays help the rest of the bond portfolio contribute to the yield enhancement process via “structural volatility selling” or negative convexity.

That said, we diversify these short volatility positions and seek to maintain a positively convex profile across the entire portfolio that can still benefit from moves lower across the yield curve.

What Else Was Considered For AGGH ETF?

What’s something that you carefully considered adding to your fund that ultimately didn’t make it past the chopping board? What made you decide not to include it?

We considered the risk taking in the fund to be based on macro analysis but decided against it given that part of the investment spectrum is well covered by the existing products available in the market.

When Will AGGH ETF Perform At Its Best/Worst?

Let’s explore when your fund/strategy has performed at its best and worst historically or theoretically in backtests. What types of market conditions or other scenarios are most favourable for this particular strategy? On the other hand, when can investors expect this strategy to potentially struggle?

This strategy performs best when interest rates are volatile but range bound but may be challenged when rates break out of the range. The strategy can potentially outperform the benchmark even in a bull market in bonds, since the short option strikes are well out of the money.

Why Should Investors Consider Simplify Aggregate Bond Fund AGGH ETF?

If we’re assuming that an industry standard portfolio for most investors is one aligned towards low cost beta exposure to global equities and bonds, why should investors consider your fund/strategy?

AGGH’s goals and fee profile are similar to that of a core bond exposure but it is our view that active management can be constructive to a fixed income allocation.

Further, the use of options and other exposures like total return swaps can potentially be return/income enhancing, which can help mitigate the opportunity cost of owning bonds relative to other risk assets.

How Does AGGH ETF Fit Into A Portfolio At Large?

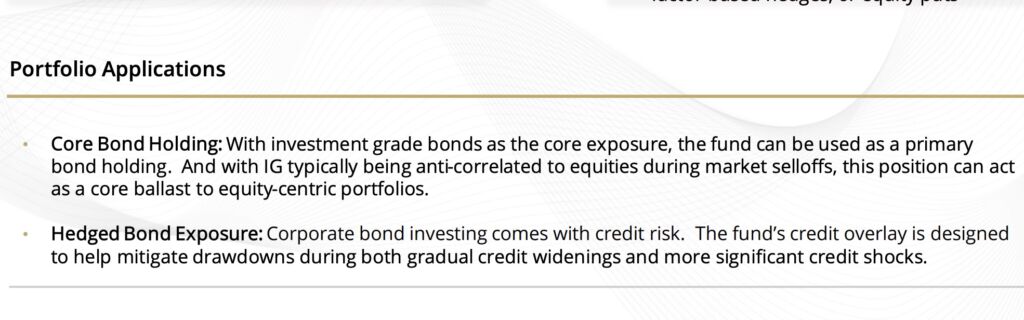

Let’s examine how your fund/strategy integrates into a portfolio at large. Is it meant to be a total portfolio solution, core holding or satellite diversifier? What are some best case usage scenarios ranging from high to low conviction allocations?

We consider AGGH to be a core bond holding.

The Cons of AGGH ETF

What’s the biggest point of constructive criticism you’ve received about your fund since it has launched?

It is a complicated strategy and understanding the nuances can be challenging. The main thing to understand is that this fund has relative advantages to core bonds when interest rates are stable.

If an investor has clear cut views about interest rates rising or falling, we have other products available which can help achieve desired returns for those scenarios.

The Pros of AGGH ETF

On the other hand, what have others praised about your fund?

The fund has offered investors yield enhancement without incremental credit or duration risk.

Learn More About AGGH ETF

We’ll finish things off with an open-ended question. Is there anything that we haven’t covered yet that you’d like to mention about your fund/strategy? If not, what are some other current projects that you’re working on that investors can follow in the coming weeks/months?

Traditionally, investors have been compensated for interest rate risk by the yield curve premium. However, in an environment when the yield curve is inverted or flat and the roll down premium is not available, option overlays can instead help enhance portfolio yield.

On the firm level, while we take pride in offering innovative alternative strategies, our fixed income product lineup has expanded to include some really interesting strategic and tactical offerings.

Connect With Simplify ETFs

Twitter: @SimplifyAsstMgt

YouTube: Simplify Asset Management

Simplify Asset Management: Simplify ETFs

Fund Page: AGGH ETF

AGGH ETF — 12 Essential FAQs on the Simplify Aggregate Bond ETF (Core Bonds + Hedged/Income Overlay)

What is AGGH in one sentence?

AGGH (Simplify Aggregate Bond ETF) targets core U.S. investment-grade bond exposure—similar overall risk to the Bloomberg U.S. Aggregate—while using dynamic rate/credit hedges and income-enhancing option overlays to seek better risk-adjusted returns.

How does AGGH differ from a standard “Agg” index fund (e.g., AGG)?

Traditional core bond funds lean on security selection; AGGH emphasizes sector positioning + option overlays and tactical hedges to manage credit/rate risk while aiming to track the Agg’s risk profile and enhance yield.

What does “core bond exposure plus hedged credit overlay” actually mean?

The fund keeps aggregate-like duration and credit risk as its baseline, then adds/adjusts hedges (e.g., rate/credit) and sells diversified options to boost income and help control downside in adverse markets.

Is AGGH actively managed?

Yes. It’s an actively managed ETF with dynamic hedging and rules-informed overlays. The goal is benchmark-like risk, not leverage, while seeking excess income/return versus the Agg.

Does AGGH use leverage?

No. Risk is targeted to be similar to the Agg. Derivatives (options, TRS, futures/swaps) are used for exposure, hedging, and income overlays, not to materially lever the portfolio’s risk.

What role do option overlays play?

AGGH employs “structural volatility selling”—carefully diversified short-option positions—to add yield (creating negative convexity akin to mortgages) while maintaining positive convexity at the total-portfolio level via design and hedges.

When might AGGH perform best?

Typically when rates are volatile but range-bound, allowing option income to accrue and hedges to manage credit/rate shocks—potentially outperforming a plain Agg tracker.

When might AGGH lag?

If rates break strongly out of range or markets gap in ways that outpace hedges and challenge short-vol overlays. In a persistent one-way rate regime, the edge from overlays may compress.

How does AGGH manage credit risk?

Through sector selection, dynamic credit hedges (e.g., CDS/index proxies), and position sizing aimed at lower downside capture versus broad credit beta—seeking yield without simply moving down in quality.

Where does AGGH fit in a portfolio?

As a core bond holding—a potential replacement or complement to an Agg index fund for investors who want core exposure with risk-managed overlays and pursuit of higher income.

Why consider AGGH over a passive core bond ETF?

It aims to retain the familiar Agg risk anchor while adding active tools (overlays/hedges) that may enhance yield, reduce correlation, and mitigate drawdowns, especially when the roll-down premium is scarce (e.g., flat/inverted curve).

What are the main pros and cons called out by allocators?

Pros: Potential yield enhancement without materially upping duration/credit risk; dynamic hedging; benchmark-aware risk.

Cons: Complexity/nuance (harder to “box” than plain Agg); may trail if rates trend sharply and overlays/hedges don’t fully offset.

Nomadic Samuel Final Thoughts

I want to personally thank Sailesh Gupta at Simplify for taking the time to participate in “The Strategy Behind The Fund” series by contributing thoughtful answers to all of the questions!

If you’ve read this article and would like to have your fund featured, feel free to reach out to nomadicsamuel at gmail dot com.

That’s all I’ve got!

Ciao for now!

Important Information

Comprehensive Investment Disclaimer:

All content provided on this website (including but not limited to portfolio ideas, fund analyses, investment strategies, commentary on market conditions, and discussions regarding leverage) is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. Opinions, strategies, and ideas presented herein represent personal perspectives, are based on independent research and publicly available information, and do not necessarily reflect the views or official positions of any third-party organizations, institutions, or affiliates.

Investing in financial markets inherently carries substantial risks, including but not limited to market volatility, economic uncertainties, geopolitical developments, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. Additionally, the use of leverage or leveraged financial products significantly increases risk exposure by amplifying both potential gains and potential losses, and thus is not appropriate or advisable for all investors. Using leverage may result in losing more than your initial invested capital, incurring margin calls, experiencing substantial interest costs, or suffering severe financial distress.

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. Any examples provided are purely hypothetical and intended only for illustration purposes. Performance benchmarks, such as market indexes mentioned on this site, are theoretical and are not directly investable. While diligent efforts are made to provide accurate and current information, “Picture Perfect Portfolios” does not warrant, represent, or guarantee the accuracy, completeness, or timeliness of any information provided. Errors, inaccuracies, or outdated information may exist.

Users of this website are strongly encouraged to independently verify all information, conduct comprehensive research and due diligence, and engage with qualified financial, investment, tax, or legal professionals before making any investment or financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios” explicitly disclaims all liability for any direct, indirect, incidental, special, consequential, or other losses or damages incurred, financial or otherwise, arising out of reliance upon, or use of, any content or information presented on this website.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.