When it comes to crypto I’m anything but an expert.

I have no specialized knowledge or insights to share with you about the intricacies of the ever-evolving crypto universe.

I can’t name more than 10 coins.

Moreover, I didn’t quit my job to trade shitcoins.

Touche.

However, when it comes to assembling capital-efficient portfolios, crypto (more specifically Bitcoin) is now an option available to investors utilizing ETFs and mutual funds.

Thus, does an allocation to crypto (Bitcoin) warrant careful consideration for your otherwise diversified portfolio?

Maybe.

That’s what we’re going to explore here today.

About the Author & Disclosure

Picture Perfect Portfolios is the quantitative research arm of Samuel Jeffery, co-founder of the Samuel & Audrey Media Network. With over 15 years of global business experience and two World Travel Awards (Europe’s Leading Marketing Campaign 2017 & 2018), Samuel brings a unique global macro perspective to asset allocation.

Note: This content is strictly for educational purposes and reflects personal opinions, not professional financial advice. All strategies discussed involve risk; please consult a qualified advisor before investing.

Expanded Canvas Portfolios

Let’s start with the following hypothetical asset allocation scenario.

With our first two moves on the chess board, we’re laying down the following foundational puzzle pieces:

40% RSSB – Return Stacked Global Stocks & Bonds ETF (100% Global Stocks + 100% Bonds)

20% RSST – Return Stacked US Stocks & Managed Futures ETF (100% US Stocks + 100% Managed Futures)

With just 60% of our resources, we’ve put together a 60/40 portfolio and already carved out a nice 20% slice of managed futures (trend) in our alternative sleeve.

Because we’re painting with a bigger canvas, we’ve got 40% creative space left over to brushstroke with other uncorrelated asset classes.

Out of that 40% available space, does a 0% to 5% sprinkling of Bitcoin to our expanded canvas portfolio make some sort of sense?

Possibly.

BlackRock just put out a nine-page white paper that makes case for bitcoin ETF as a “unique diversifier” that can hedge against fiscal, monetary and geopolitical risks, also incl section called “Bitcoin’s path to $1 trillion market cap” 👀 Read whole thing here:… pic.twitter.com/mRzDpw4aSP

— Eric Balchunas (@EricBalchunas) September 18, 2024

Mainstream Adoption And Availability Of Bitcoin

Bitcoin is polarizing.

You have its lovers and haters with few folks in between.

In the past, it has been easy to dismiss Bitcoin as a purely “speculative investment” given its lack of mainstream adoption by major industry players alongside its lack of approval by the SEC for spot ETFs.

That’s now changed.

These days you can grab your spot Bitcoin ETF from the Blackrock(s) and Fidelity(s) of the investosphere.

North of the border, you’ll even find mainstream asset allocation funds that include Bitcoin as part of their equation.

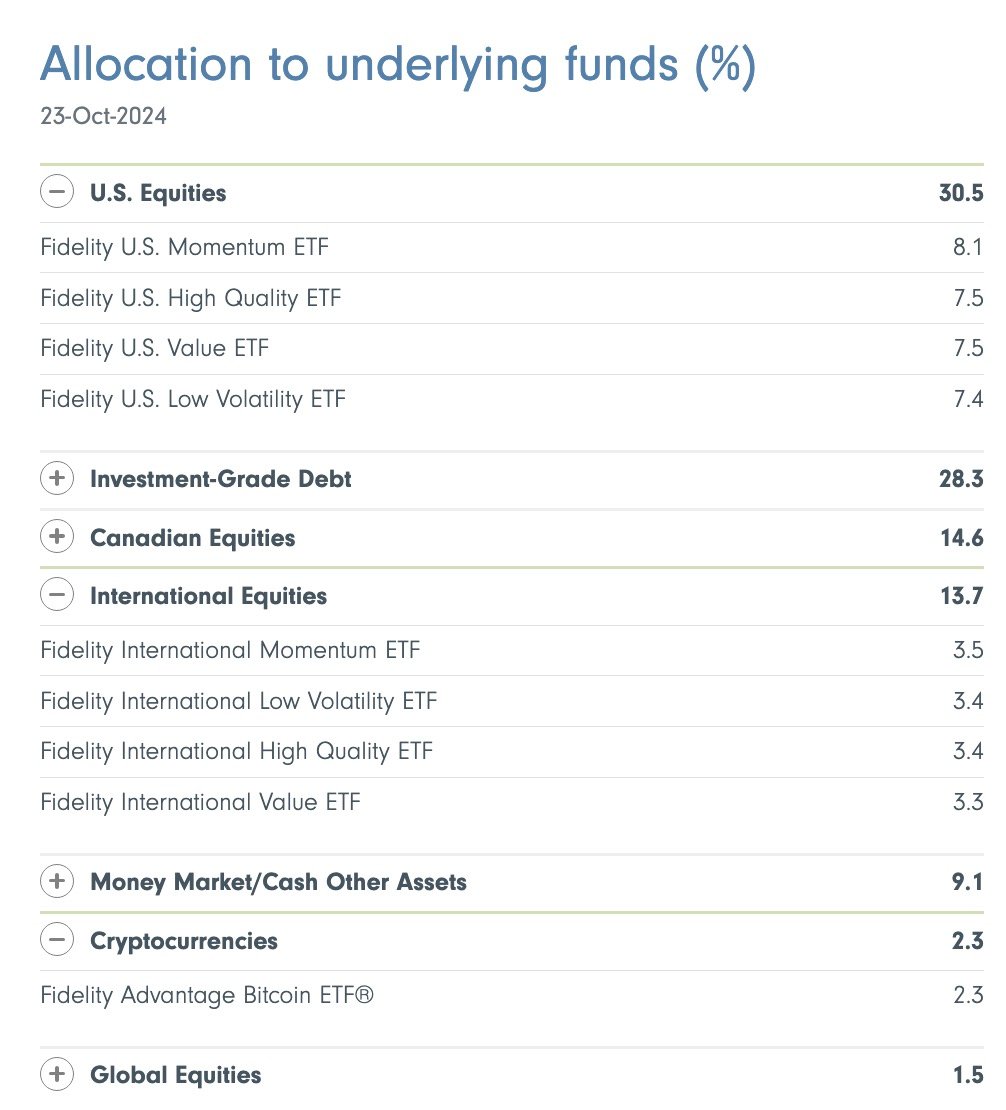

Feast your eyes upon this Fidelity asset allocation fund as an example:

FBAL.TO: Fidelity All-in-One Balanced ETF

These funds distinguish themselves by their factor exposure (momentum, value, quality and low volatility) but they’ve also ALL got a slice of crypto (Bitcoin) thrown in for good measure.

Here is the rest of the product range:

FCNS.TO ETF – Fidelity All-in-One Conservative ETF

FEQT.TO ETF – Fidelity All-in-One Equity ETF

FGRO.TO ETF – Fidelity All-in-One Growth ETF

So how have these contrarian asset allocation alternatives faired compared to their MCW vanilla bredren?

So far, so good.

Check it out.

FBAL vs VBAL vs XBAL Performance Summary

CAGR: 9.12% vs 6.10% vs 6.37%

RISK: 9.29% vs 8.90% vs 9.02%

WORST YEAR: -7.10% vs -11.39% vs -11.17%

MAX DD: -12.35% vs -15.02% vs -15.25%

SHARPE: 0.68 vs 0.38 vs 0.41

SORTINO: 1.04 vs 0.57 vs 0.61

The factor-focused Fidelity funds with Bitcoin have outperformed Vanguard and iShares in terms of both returns and risk management in an albeit short sample size backtest.

The Case For and Against Bitcoin Allocation

Here is a list of what is generally considered the pros and cons for those thinking of Bitcoin.

Top 10 Pros of Bitcoin Allocation

- Decentralization and Independence: Bitcoin operates outside the control of any central authority, making it immune to government interference.

- Not influenced by central bank policies.

- Resistant to censorship or political agendas.

- Offers autonomy to holders.

Tip: Bitcoin can provide financial independence if you’re looking for an asset outside government control.

- High Return Potential: Bitcoin has historically delivered high returns over the long term.

- High appreciation since its inception.

- Potential for massive gains during bull markets.

- Adoption by institutions may drive future price growth.

Tip: Hold Bitcoin with a long-term mindset to capitalize on its potential upside.

- Global Accessibility: Bitcoin can be accessed and transferred globally with minimal barriers.

- No need for a traditional bank account.

- Easy cross-border transfers.

- Available 24/7, unlike stock markets.

Tip: Bitcoin is ideal for those looking for a truly global, borderless currency.

- Portability: Bitcoin is highly portable, allowing you to move large amounts of wealth with ease.

- Stored digitally on mobile devices or hardware wallets.

- No physical limitations.

- Easy to transfer anywhere in the world.

Tip: Bitcoin is a convenient way to store and move wealth without carrying physical assets.

- Transparency and Security: Bitcoin’s blockchain ensures that all transactions are publicly verifiable.

- Immutable ledger provides trust.

- Highly secure and resistant to fraud.

- Transparency builds confidence in the system.

Tip: Bitcoin’s transparency can reassure investors concerned about fraud or manipulation.

- Limited Supply: Bitcoin has a fixed supply of 21 million coins, creating scarcity.

- Fixed supply makes it immune to inflation.

- Deflationary in nature, driving value higher over time.

- Attracts investors seeking scarcity-driven value.

Tip: Bitcoin’s capped supply makes it an attractive store of value, similar to gold.

- Portfolio Diversification: Bitcoin is uncorrelated with traditional assets like stocks and bonds, making it a good diversification tool.

- Reduces overall portfolio risk.

- Can improve risk-adjusted returns.

- Acts as a hedge during market downturns.

Tip: Adding Bitcoin can help diversify your portfolio, reducing reliance on traditional markets.

- Inflation Hedge: Bitcoin is seen as a hedge against fiat currency inflation.

- Hard-coded supply cap of 21 million coins.

- Resilient against currency devaluation.

- Attracts investors in inflationary environments.

Tip: Consider Bitcoin as a hedge if you are worried about fiat inflation.

- Institutional Adoption: Increasing institutional interest is legitimizing Bitcoin as a mainstream investment.

- Hedge funds, pension funds, and corporations are investing.

- Institutional backing drives demand.

- Increases Bitcoin’s credibility as a safe investment.

Tip: Follow institutional trends to gauge Bitcoin’s long-term viability.

- Emerging Payment System: Bitcoin is increasingly being accepted as a method of payment.

- More merchants accepting Bitcoin globally.

- Enables online and offline transactions.

- Growth in the Lightning Network improves transaction speed.

Tip: Bitcoin’s use as a payment system continues to grow, expanding its practical utility.

Top 10 Cons of Bitcoin Allocation

- High Volatility: Bitcoin’s price is highly volatile, leading to potential large losses in a short period.

- Wild price swings within hours or days.

- Unsuitable for short-term investors.

- Can lead to panic selling during downturns.

Tip: Only invest in Bitcoin if you can tolerate its extreme volatility.

- Regulatory Uncertainty: Governments around the world are still developing regulations for Bitcoin, which creates uncertainty.

- Potential for stricter regulations or outright bans.

- Unclear tax treatment in some jurisdictions.

- Legal issues can affect price and usability.

Tip: Stay informed about your local Bitcoin regulations to avoid legal issues.

- Security Risks: Bitcoin storage requires strong security practices, as losing your private key means losing access to your funds.

- Susceptible to hacks and scams.

- Lost private keys cannot be recovered.

- Exchange hacks pose a risk to stored Bitcoin.

Tip: Use hardware wallets and take security seriously when storing Bitcoin.

- Energy Consumption: Bitcoin’s Proof of Work consensus mechanism requires significant energy, raising environmental concerns.

- High energy usage for mining operations.

- Bitcoin mining criticized for its carbon footprint.

- May face future restrictions or penalties due to energy consumption.

Tip: Be mindful of Bitcoin’s environmental impact when considering allocation.

- Scalability Issues: Bitcoin faces scalability challenges, which could limit its adoption as a global payment system.

- Slow transaction speeds.

- High fees during network congestion.

- Competing cryptocurrencies offer faster alternatives.

Tip: Bitcoin’s scalability improvements, like the Lightning Network, could alleviate this issue in the future.

- Lack of Consumer Protection: Bitcoin transactions are irreversible, and there is little consumer protection if something goes wrong.

- No recourse for lost or stolen funds.

- No central authority to mediate disputes.

- Scams and frauds are prevalent.

Tip: Be extra cautious when transacting with Bitcoin, as there is little protection if something goes wrong.

- Limited Adoption: Although growing, Bitcoin adoption is still limited compared to traditional currencies and financial products.

- Not widely accepted as a method of payment.

- Volatility discourages its use in day-to-day transactions.

- Competing cryptocurrencies may challenge Bitcoin’s dominance.

Tip: Bitcoin’s adoption is expanding but remains a work in progress.

- Technological Complexity: Bitcoin can be complex for the average investor to understand and use.

- Steep learning curve for new users.

- Requires understanding of wallets, keys, and blockchain technology.

- Not user-friendly for those unfamiliar with digital assets.

Tip: Take the time to educate yourself about how Bitcoin works before investing.

- Tax Complications: Bitcoin taxation varies greatly depending on your country and can be complex to manage.

- Treated differently across jurisdictions.

- Capital gains tax applies to most transactions.

- Keeping track of every transaction can be burdensome.

Tip: Consult with a tax professional to understand how Bitcoin is taxed in your country.

- Market Manipulation: Bitcoin markets are relatively small compared to traditional financial markets, making them vulnerable to manipulation.

- Prone to price manipulation by large holders (whales).

- Unregulated markets increase the risk of artificial price movements.

- Pump-and-dump schemes are common in smaller crypto markets.

Tip: Be cautious of market manipulation and avoid making decisions based on sudden price movements.

“The Case For Crypto (Bitcoin) Allocation In A Capital Efficient Portfolio” 🤔

I’m working on this new blog post today. ✍️

I’d love to hear your opinion for/against including crypto (specifically Bitcoin) in an expanded canvas / return stacking style of portfolio. 🎨👩🎨👨🎨

I’ll…

— Nomadic Samuel (@NomadicSamuel) October 24, 2024

What Others Have To Say (Pros and Cons of Bitcoin)

I highly value the opinions and contributions of friends and acquaintances on Twitter.

Here is what they have to say about the pros and cons of Bitcoin with respect to capital-efficient portfolios:

No risk premium, no cash flow, vulnerable to hack/losing coins, regulatory risk.

Diversifier, historically good returns, good form of money like gold, can be hidden and transported outside the system like gold, now backed by big institutions which reduces regulatory risk.— Greg Baker (@arbseekerguy) October 24, 2024

Its low-ish correlation to other asset classes is the primary reason I use it (in a low dose). Personally I use BTRN to mitigate vol and DDs. pic.twitter.com/tChcDkooCn

— Tom Kasperski (@TomKaz) October 24, 2024

I would say when you’re already using leverage, you don’t need to add something that is like leverage on steroids. It’s a risk asset for people who simply can’t get enough risk elsewhere.

— Stefan Schumacher (@DeathStripMall) October 24, 2024

Counter point it’s leverage without the fees and drag of leverage use. 5% bitcoin is essentially 15% gold and 15% QQQ. So in a way especially when rates are at current levels, it’s a capital efficient way to get exposure that correlates to return drivers.

— Joe Rizzo (@JRiz13) October 24, 2024

For a 1% allocation you can tell your crypro bruh friends that you also invest in bitcoin and get to hang with the cool kids

— Darren Ritsick (@DarrenRitsick) October 24, 2024

Honestly, from a behavioral perspective a small allocation let’s you avoid FOMO when you see all the rocket gifs pop up everywhere but also shrug off when it implodes

— Darren Ritsick (@DarrenRitsick) October 24, 2024

Those correlations vary widelyhttps://t.co/UTPCMvz3xN

— yieldcurvepro (@yieldcurvepro) October 24, 2024

Creative Bitcoin Products Offering Capital-Efficient And Risk-Managed Exposure

Aside from mainstream exposure to spot Bitcoin ETFs from major providers, capital-efficient investors have other interesting options to consider.

Let’s highlight a few of those:

Bitcoin and Gold ETF finally listed today!

STKD Bitcoin & Gold ETF$BTGD | fees 1.00%

STKD = stacked, not staked. As per ETF prospectus:

“…one dollar invested in the Fund provides approximately one dollar of exposure to the Fund’s Bitcoin strategy and approximately one dollar… https://t.co/ZqFz0wjpKz pic.twitter.com/OivrCRgY5W— ETF Hearsay by Henry Jim (@ETFhearsay) October 16, 2024

BTGD ETF – STKD Bitcoin & Gold ETF

Recently minted BTGD provides investors $1 of exposure to Bitcoin and $1 exposure to Gold for every dollar invested.

In other words, if you were to allocate 5% to the fund you’d have 5% exposure to gold and 5% exposure to Bitcoin from an asset allocation standpoint.

Simplify US Equity PLUS GBTC ETF $SPBC celebrates its 3rd anniversary! Learn how capital efficient exposure to equities and Bitcoin may enhance your portfolios $SPBC: https://t.co/GpQoncOFT2 pic.twitter.com/iTQlUVgRxH

— Simplify (@SimplifyAsstMgt) June 21, 2024

SPBC ETF – Simplify US Equity PLUS GBTC ETF

For investors not wanting to shave down their equity exposure this unique capital-efficient product from Simplify may warrant consideration.

100/10 US Equities + Bitcoin

If you were to allocate 20% to the fund you’d have 20% exposure to US equities and 2% exposure to Bitcoin.

New #Bitcoin futures strategy ETF listing tomorrow Mar 21, 2024

Global X Bitcoin Trend Strategy ETF$BTRN | 0.95%

Tracks the CoinDesk Bitcoin Trend Indicator Futures Index: Bitcoin futures exposure between 0% to 100% depending on proprietary trend indicator. Otherwise in Global… pic.twitter.com/UjebGz2aVU

— ETF Hearsay by Henry Jim (@ETFhearsay) March 21, 2024

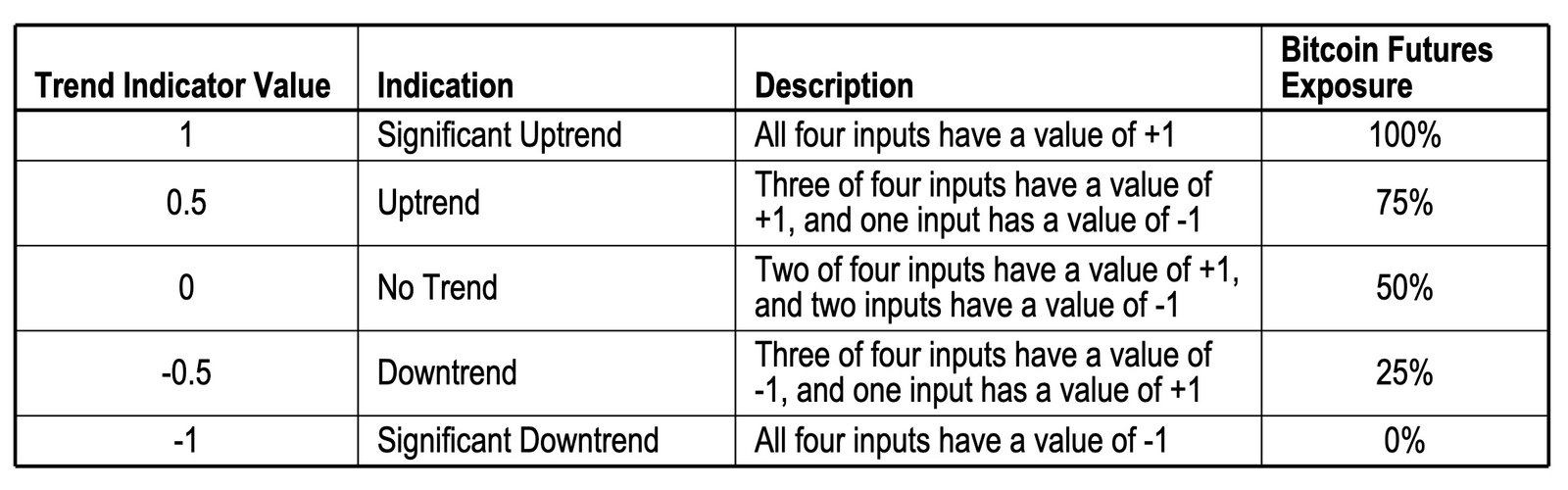

BTRN ETF – Global X Bitcoin Trend Strategy ETF

Finally, for asset allocators that are concerned about the volatility and downside risk of Bitcoin, this trend following product scales back exposure during downtrends.

Moreover, its default position is only 50% exposure (via futures) and it’ll increase/decrease in 25% increments depending on trend signal.

10-Year Backtesting Bitcoin Exposure: Risk Management / Hedging Options

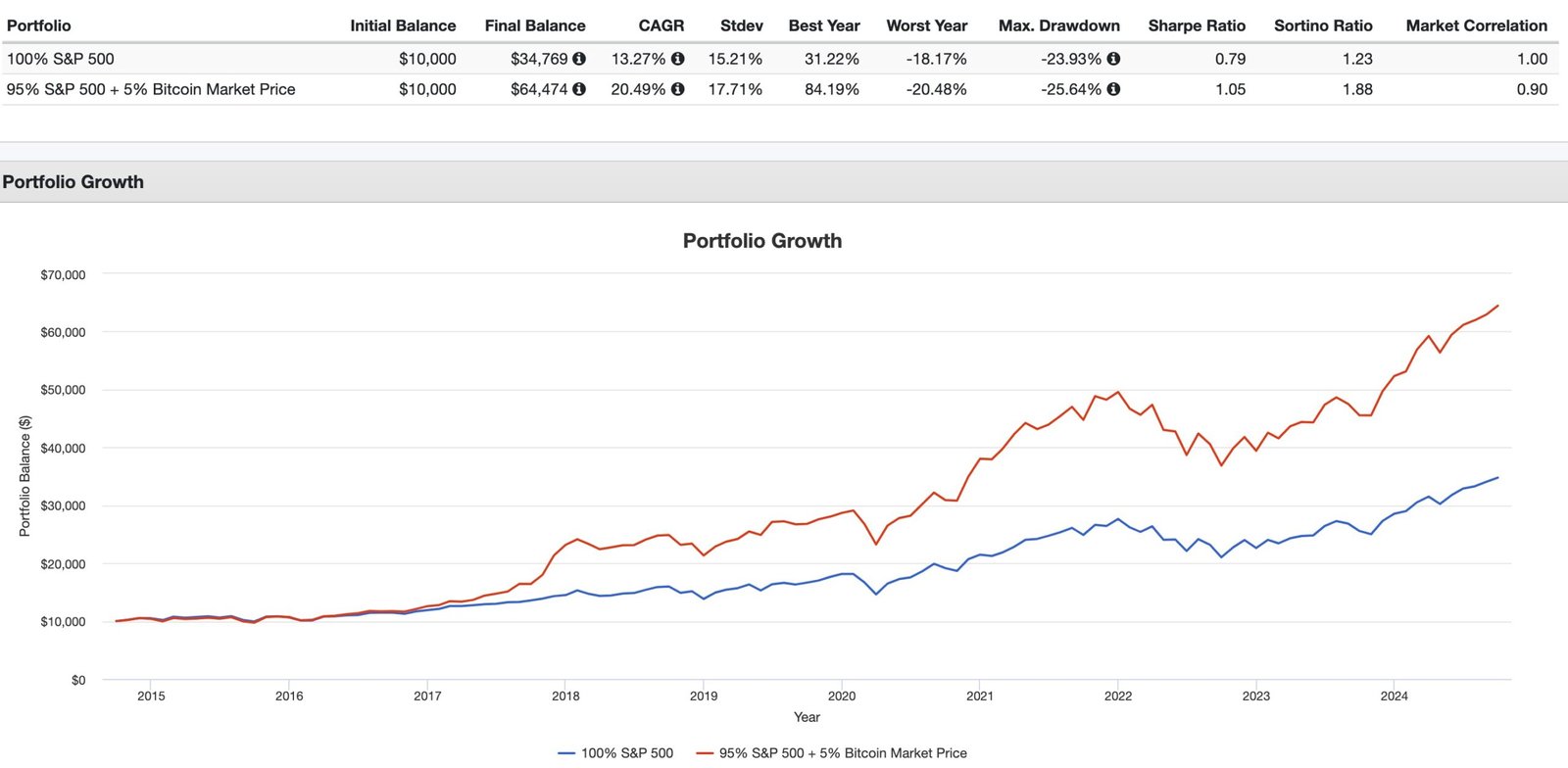

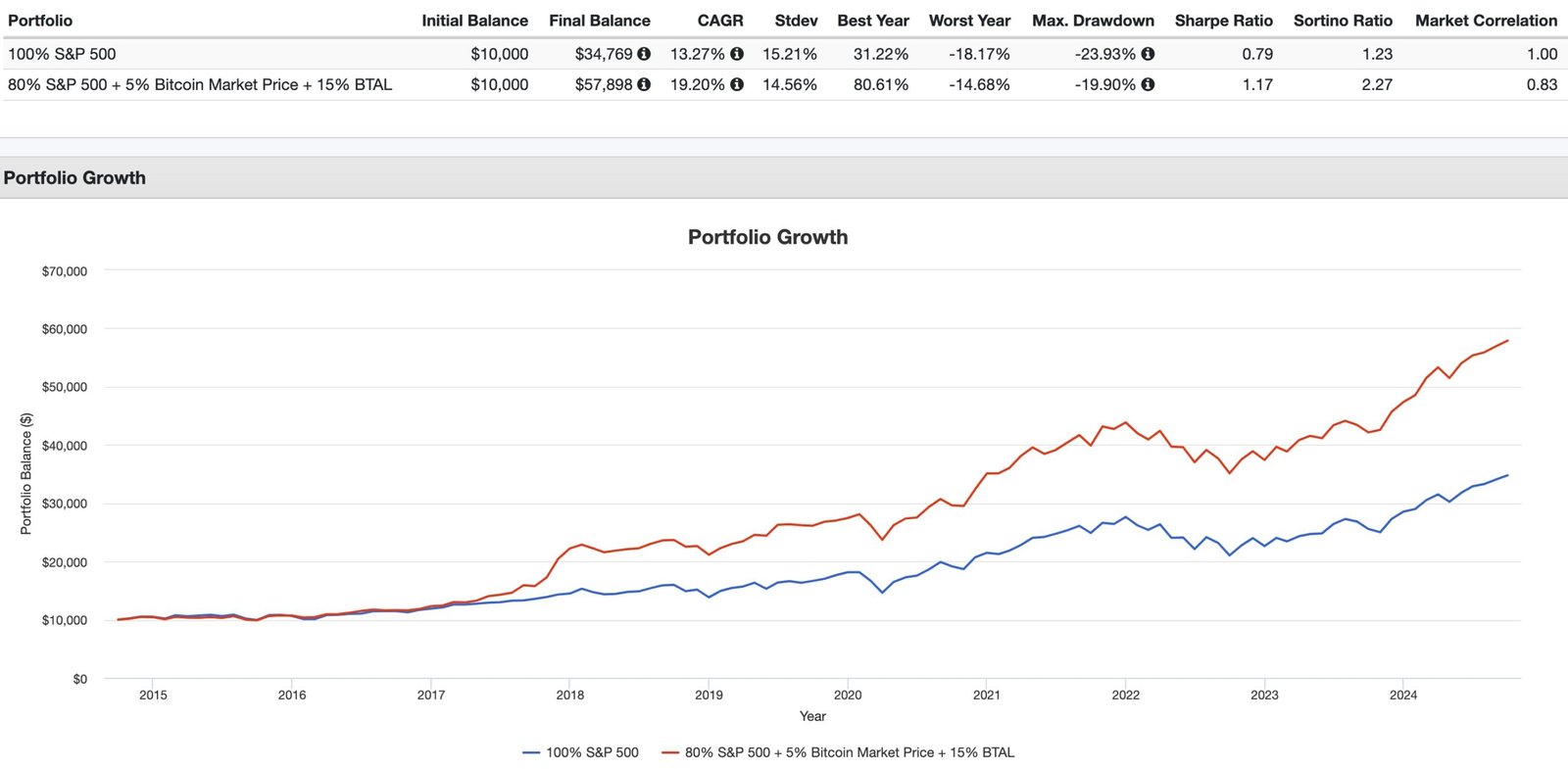

Let’s explore what adding a 5% slice of Bitcoin (market price) does to an all-equity S&P 500 portfolio from the perspective of a 10-year backtest.

Indeed, returns are enhanced considerably but risk has also gone up (stdev) alongside a more challenging worst year and maximum drawdown.

One way to potentially manage the excessive volatility of Bitcoin (with its propensity to lay rotten eggs [-70% year]) is to pair it with a return smoother like BTAL ETF.

It’s all about position sizing and asset allocation over here.

In order to get the right cocktail mix, a 2:1 or 3:1 ratio seems prudent.

Let’s try this again by shaving down 20% of our S&P 500 exposure to add 15% BTAL to the equation.

In other words, we’ve got as follows:

100% SPY

vs

80% SPY + 15% BTAL + 5% ^BTC (Bitcoin Market Price USD)

Here we’ve got the best of both worlds.

Better returns and enhanced risk management across the board (Stdev, Worst Year, Max DD, Sharpe, Sortino).

The key point here is that IT IS possible to tame your Bitcoin exposure with the right mix of hedging and tail-risk protection.

Position / Allocation Size Is Everything

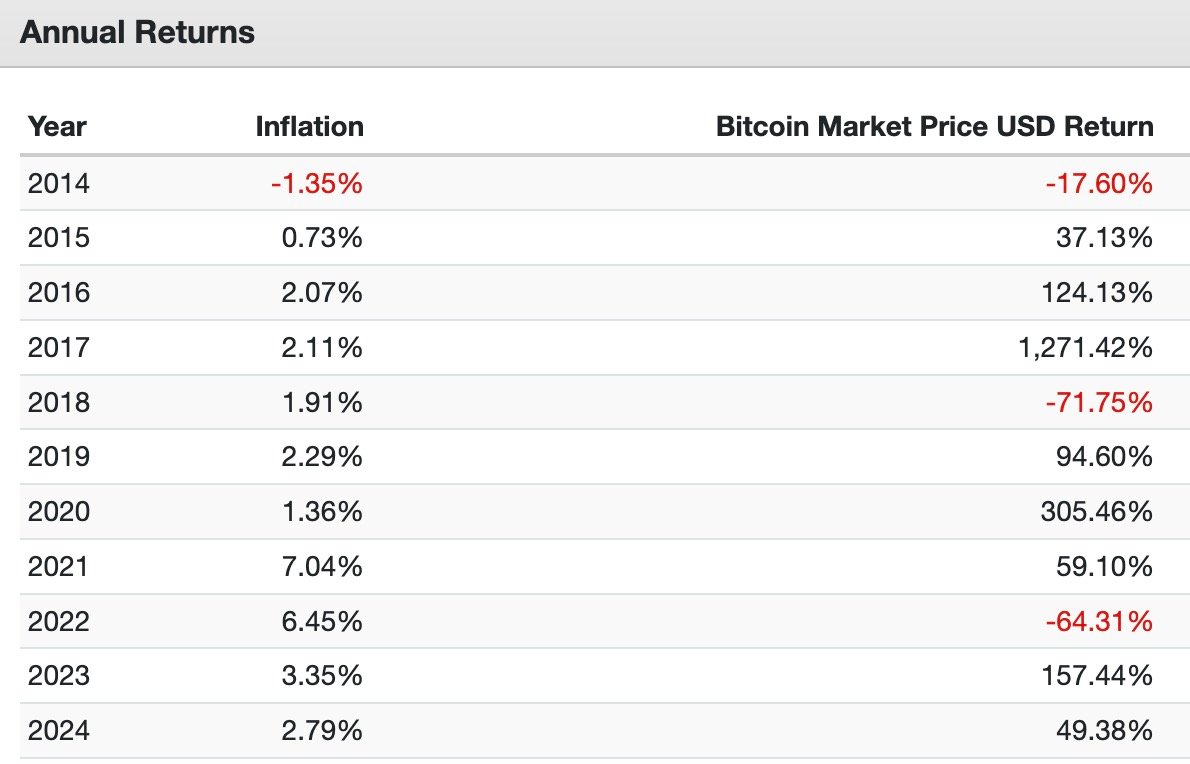

To say Bitcoin has been hella volatile throughout the years is certainly an understatement!

Check out its returns (positive vs negative) throughout the years at market price:

How much damage Bitcoin can inflict upon your portfolio depends on how much space it occupies.

Let’s imagine a worst-case scenario of it being down close to -80% for the year.

If you’re allocating 5% of your resources that’s only a -4% overall sting.

At 10% you’re nailed by -8%.

You get the picture.

Well, what about if it went poof?

-100%.

Wiped off the map as some fear (an unlikely scenario).

Well, that would be a one time -5% or -10% flick to the nose.

At the end of the day it’s all about asset allocation and taking on the appropriate level of risk you can potentially handle given its volatile nature.

You can hedge against it with return smoothers and portfolio protectors such as BTAL and/or CAOS or just simply reduce your exposure to a level where you can handle it being down severely.

Viewing it as a line item makes it hard to handle.

Zooming out the portfolio level is crucial IMO.

Nomadic Samuel’s Views On Bitcoin

As I mentioned previously, at the beginning of the article, I’m not a crypto expert nor do I pretend to be one.

What I do recognize though is the return potential of Bitcoin in a capital-efficient portfolio.

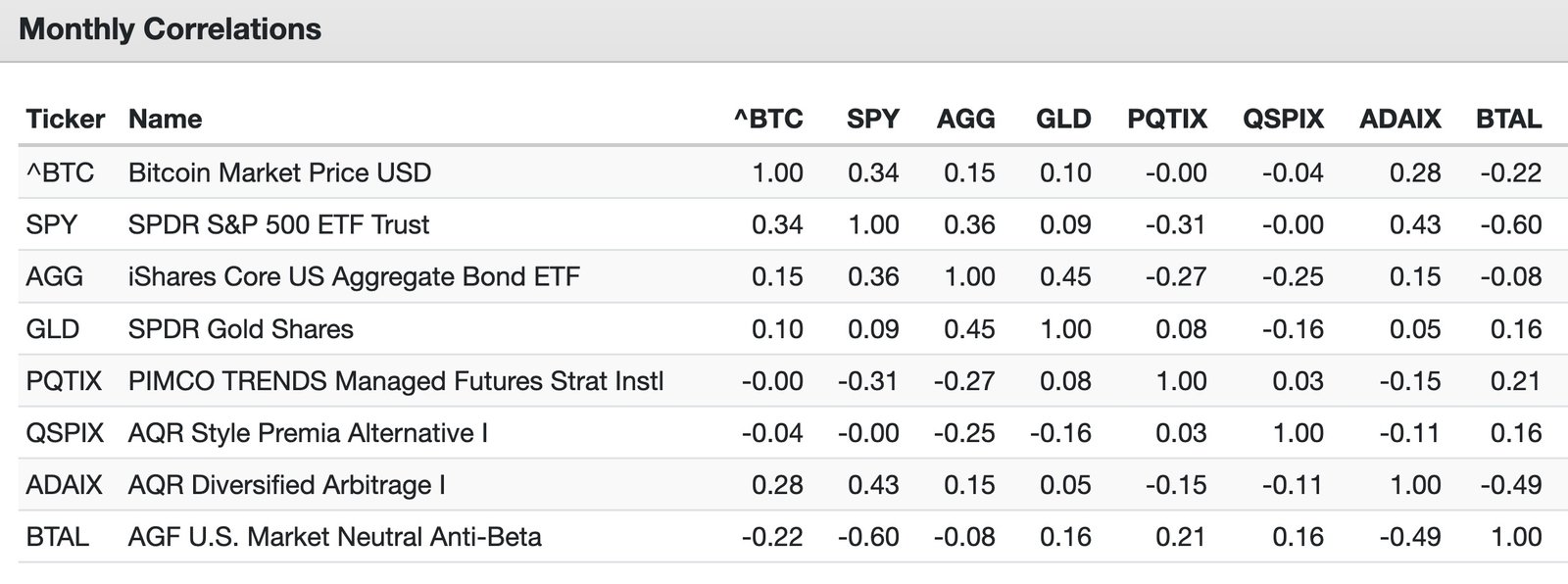

I specifically view it as a diversifier as it historically has had low correlations with markets and it is also uncorrelated with many other asset classes and strategies (both mainstream and alternative).

Hence, I want it in my portfolio and I’ve created space for it.

In particular, I’ve decided to allocate to BTGD to boost my exposure to gold and to lay down a 5% foundation for Bitcoin.

I’ve got some hedging products to help handle its volatile nature.

I’ve also made sure to carve out space for adaptive strategies (trend following managed futures) and long-short macro that offer absolute return potential.

Hence, it’s not a make-or-break part of my overall portfolio equation but I’ve also gone beyond merely dipping my toes into the pool by being at 5% vs say just 1 or 2%.

I’d say it’s far from being a polar plunge but it’s not an insignificant amount either.

I’m excited to share the “Nomadic Samuel 2024 Portfolio” in the coming weeks.

For the time being what I can tell you is that I’ve got a 5% allocation to BTGD ETF in one of my accounts.

Expanded Canvas Portfolio Ideas (With Bitcoin)

These asset allocation ideas and model portfolios presented herein are purely for entertainment purposes only. This is NOT investment advice. These models are hypothetical and are intended to provide general information about potential ways to organize a portfolio based on theoretical scenarios and assumptions. They do not take into account the investment objectives, financial situation/goals, risk tolerance and/or specific needs of any particular individual.

I’d say we’re at the stage now to potentially explore a few different portfolio options using Bitcoin as a potential return enhancer / diversifier.

Instead of using mainstream spot Bitcoin funds from Goliath ETF providers, we’ll check out how to possibly integrate Bitcoin into your portfolio with the three funds I’ve previously mentioned:

1) BTGD ETF – STKD Bitcoin & Gold ETF

2) SPBC ETF – Simplify US Equity PLUS GBTC ETF

3) BTRN ETF – Global X Bitcoin Trend Strategy ETF

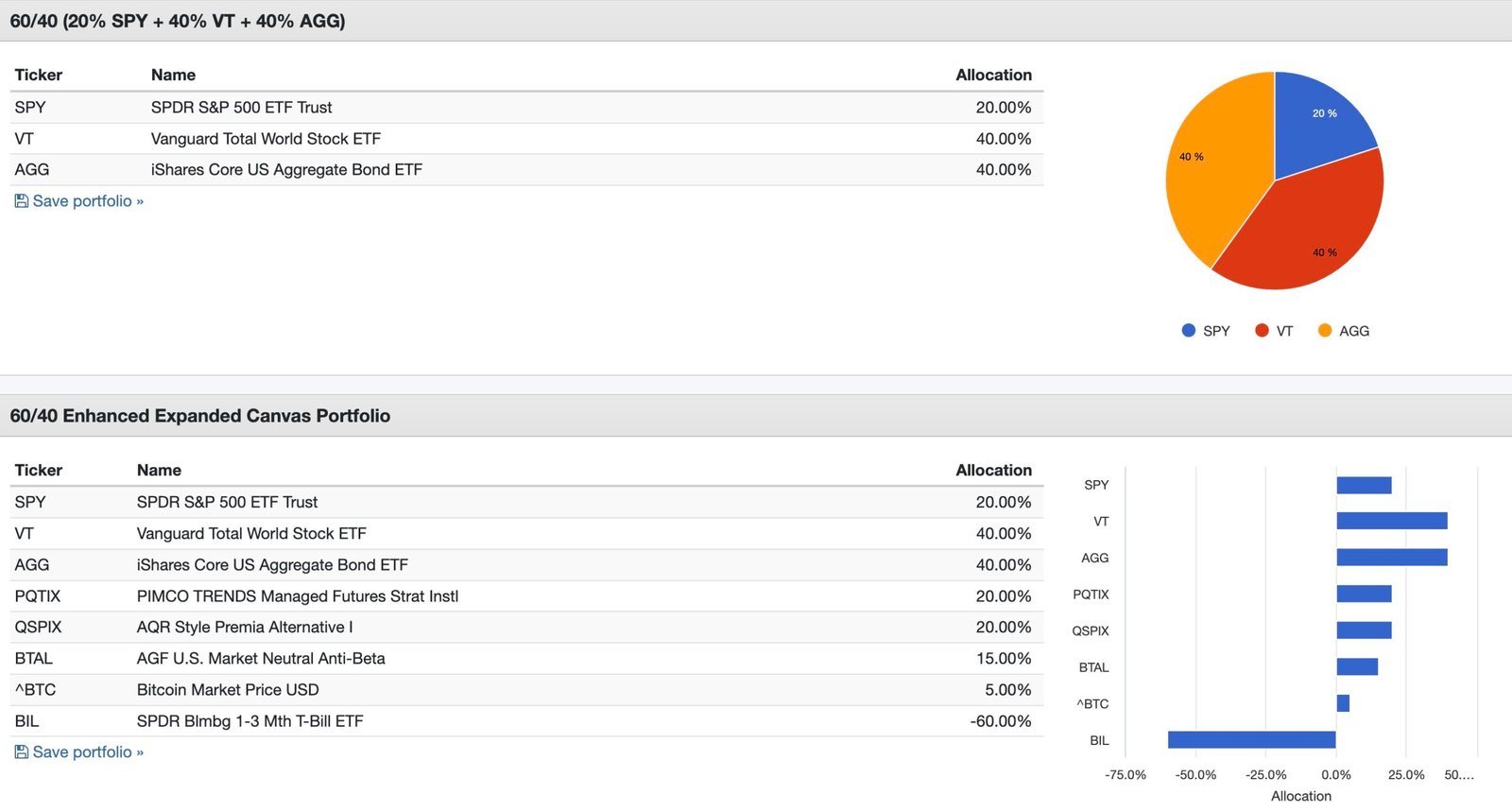

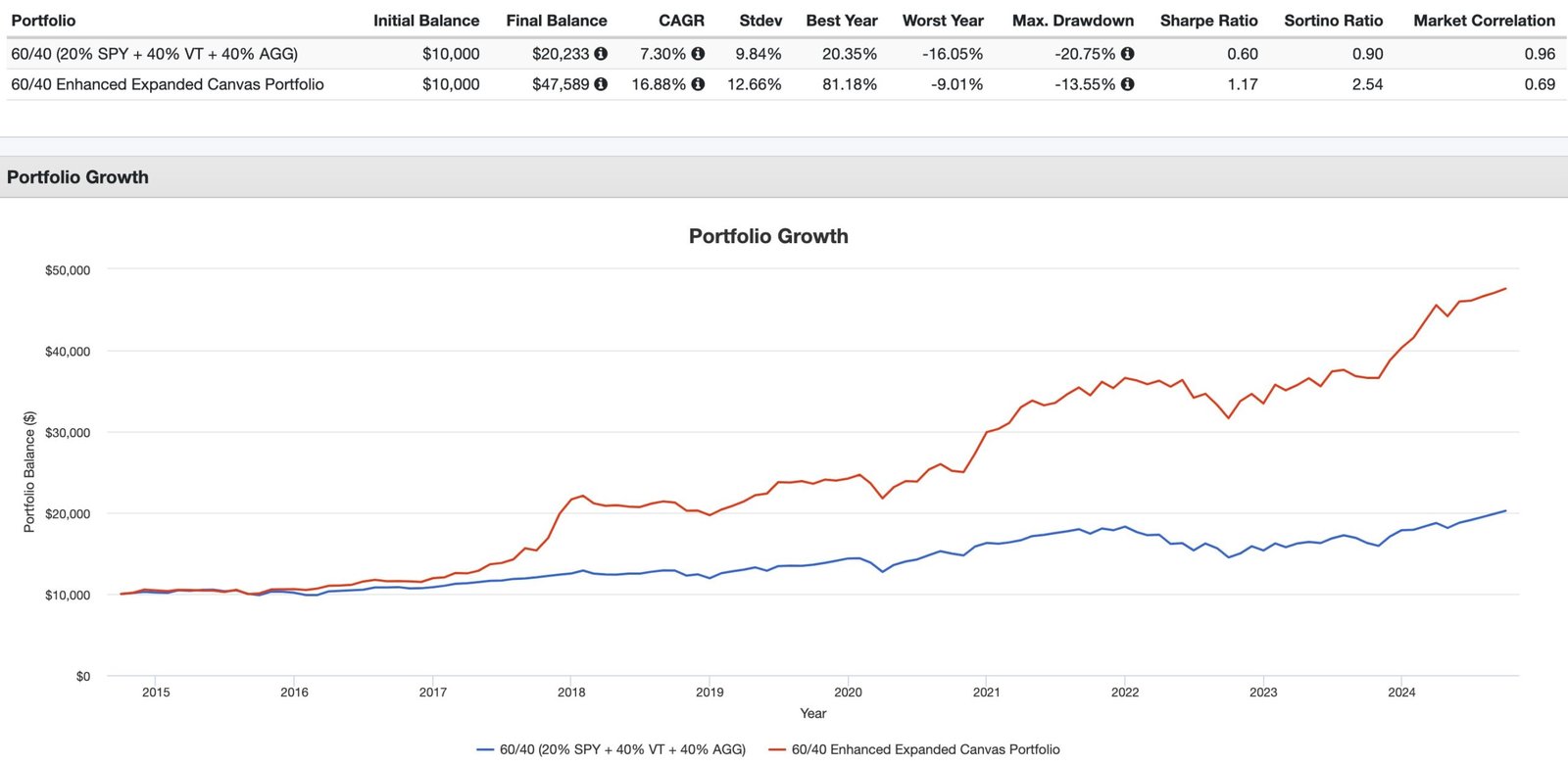

Enhanced 60/40 Expanded Canvas Portfolio

40% RSSB

20% RSST

20% QSPIX

15% BTAL

5% BTGD

Exposures:

60% Equities (Global + US)

40% Bonds

20% Managed Futures (Trend)

20% Style Premia

15% M/N Anti-Beta

5% Bitcoin

5% Gold

Here we’ve got a 5 fund + 7 strategy portfolio.

We’ve made sure to include a 3:1 hedge for Bitcoin with BTAL.

We’ve also got adaptive assets (managed futures trend) and plenty of absolute return potential (style premia).

Variation Options: Consider shaving down 7.5% of BTAL to create space for 7.5% CAOS and/or swap FLSP or QIS ETFs to replace mutual fund QSPIX if you want an all-ETF portfolio.

Let’s try to simulate a 10-year backtest:

Past results don’t equal future performance…but damn…that’s some serious potential outperformance from a returns / risk management standpoint.

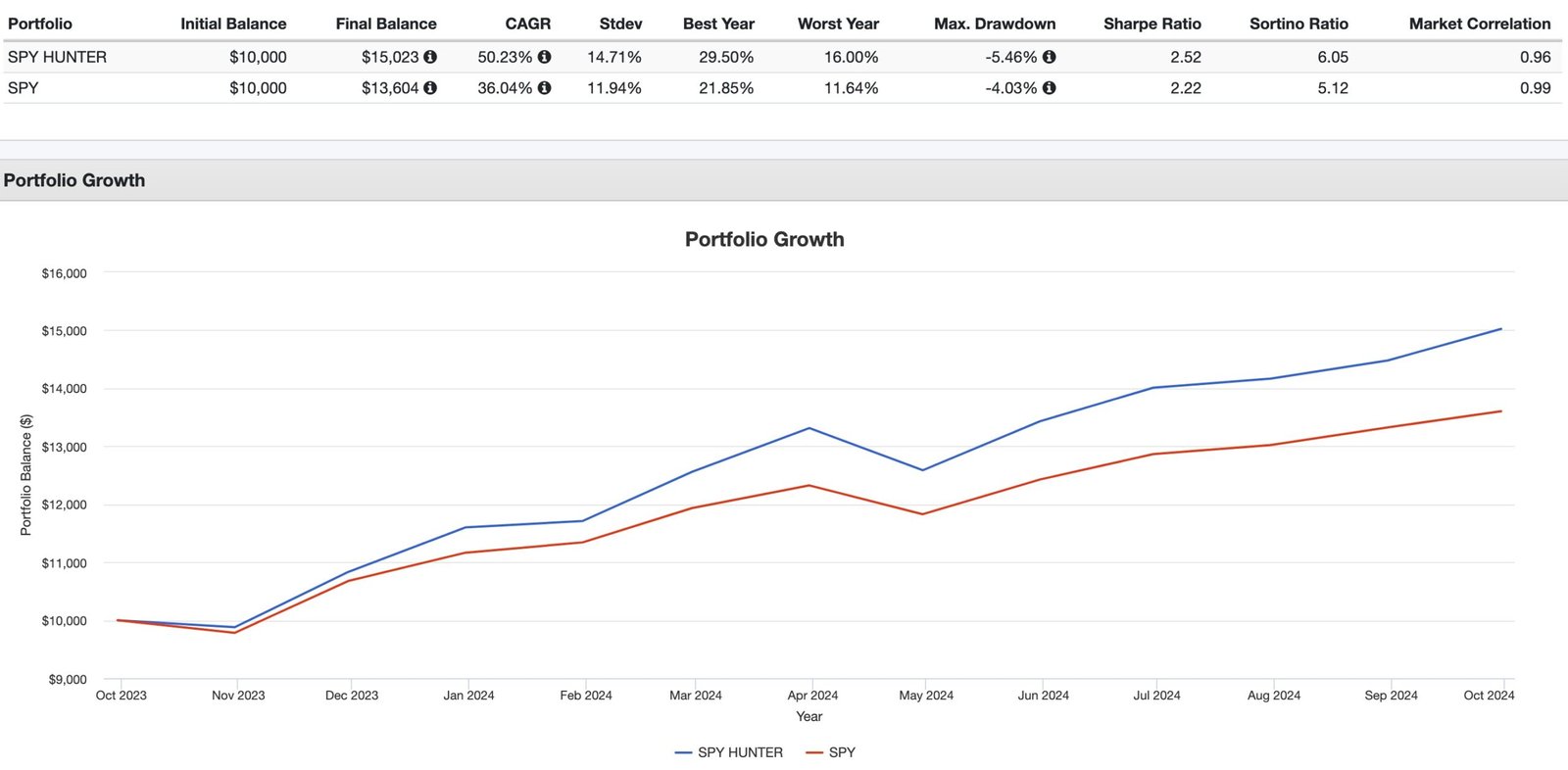

Spy Hunter Expanded Canvas Portfolio

20% PSLDX

20% RSST

20% SPBC

20% GDE

20% HCMT

Exposures:

Offensive Mode

118% Equities

20% Managed Futures

20% Bonds

18% Gold

2% Bitcoin

Defensive Mode

78% Equities

20% Managed Futures

20% Bonds

20% Cash

18% Gold

2% Bitcoin

We’re hunting down SPY (S&P 500) with this aggressive tactical all-equity portfolio featuring no compromises.

Diversification (with 20% to 18% slabs) is our weapon of choice.

Bitcoin doesn’t play a major role here with just a 2% allocation.

We’re limited to a short live backtest (with funds) but so far SPY Hunter has been turning the screws against plain ‘ole SPY.

HB Inspired Balanced Expanded Canvas Portfolio

40% RSST

40% RSBY

5% GLD

5% BTRN

5% BTAL

5% CAOS

Exposures:

40% Equities

40% Bonds

40% Managed Futures (Trend)

40% Carry (Multi-Asset)

0 to 5% Bitcoin

5% Gold

5% OTM Put

5% M/N Anti-Beta

We’re inspired by Harry Browne’s Permanent Portfolio where we’ve used a modest 1.6X leverage (40% pie) vs his 25% pizza slices.

Cash and Gold are replaced with Managed Futures and Carry.

Bitcoin is one of four other strategies at 5% allocation.

However, given that this is the most defensive portfolio, we’ve included BTRN here which can shrink to 0% allocation during severe downturns.

FAQ How to Add Bitcoin to a Capital-Efficient Portfolio (Sizing, Hedging & Diversification)

1) Why consider Bitcoin in a capital-efficient (expanded canvas) portfolio at all?

Because capital efficiency lets one dollar do double duty, adding diversifiers without dropping core exposures. A small Bitcoin slice can introduce a distinct return driver that historically behaves differently from stocks and bonds—useful when you’re stacking uncorrelated sleeves like trend, gold, and market-neutral.

2) What’s changed recently to make Bitcoin more “portfolio-friendly”?

Two big shifts: mainstream access (spot Bitcoin ETFs in major markets) and packaging that pairs Bitcoin with other exposures (e.g., Bitcoin+gold, equity+Bitcoin). This lowers operational friction and lets allocators size and hedge the asset more precisely inside a broader stack.

3) How much Bitcoin belongs in an expanded canvas portfolio?

Position sizing is the ballgame. Typical “starter” bands are 0–2% (toe-dip for diversification/FOMO management) and 3–5% (meaningful yet survivable in deep drawdowns). Remember: a –80% Bitcoin year hits a 5% sleeve by ~–4% at the portfolio level. Size to sleep.

4) Should Bitcoin replace gold—or sit beside it?

They can co-exist. Gold has a long defensive history; Bitcoin is newer, higher octane, and programmatically scarce. Blending (even via a single fund that stacks both) spreads your “hard-asset/monetary-hedge” bet across two cousins with different risk cadences.

5) How do I tame Bitcoin’s volatility inside a stack?

Use return smoothers and adaptive sleeves. Pair a small BTC sleeve with market-neutral anti-beta, option hedges, and/or managed futures. Trend-responsive BTC wrappers that scale exposure down in bear trends can further reduce left-tail risk.

6) What are smart vehicles for capital-efficient BTC exposure?

Look for wrappers that stack BTC with another sleeve (e.g., Bitcoin+gold, equity+Bitcoin) or that trend-scale BTC futures. These help you fit BTC into a crowded plate and/or dial exposure with rules, not vibes.

7) Where does Bitcoin fit in the overall portfolio map?

Treat it as a satellite diversifier within the alternatives or “monetary assets” sleeve—not as core equity beta. In an expanded canvas, it can sit alongside gold, managed futures, style premia, and market-neutral, contributing a unique (if spiky) return stream.

8) What are the principal pros of adding a BTC sleeve?

Potential asymmetric upside, programmed scarcity, growing institutional infrastructure, and historically low-ish correlation to traditional assets. In a capital-efficient design, those traits can boost risk-adjusted outcomes—if you control size and sequence risk.

9) What are the principal cons and risks?

Volatility, regulatory evolution, behavioral whipsaws, and tracking/tax considerations. BTC can be “leverage on steroids” emotionally; poor sizing or weak risk controls can swamp a plan. Use liquid, transparent wrappers and know your tax lot mechanics.

10) Could adding BTC harm a well-built stack?

Yes—if you oversize, chase heat, or pair it with already-spicy sleeves without hedges. But a small, rules-based allocation inside a diversified, capital-efficient core can add convexity while preserving the portfolio’s defensive geometry.

11) How might sample integrations look in practice?

Examples:

• Enhanced 60/40: return-stacked stocks+bonds, stacked bonds+trend, a 3:1 hedge (anti-beta) against a 5% BTC sleeve, plus style premia.

• SPY Hunter: equity-forward stack (equity+bond+trend+gold) with a 2% BTC garnish.

• HB-Inspired: balanced sleeves (equity, bonds, trend, carry) with trend-scaled BTC and small defensive overlays (gold, anti-beta, OTM puts).

12) Any behavioral or practical tips before allocating?

Decide your max pain in advance, automate contributions/rebalances, and document your sell/resize rules (e.g., trend triggers, risk budgets). Keep BTC a line item in a portfolio-level plan, not a solo crusade. If in doubt, start tiny and earn your size.

Nomadic Samuel Final Thoughts

This is my first dedicated article on my site to Crypto / Bitcoin.

I definitely felt a bit out of my comfort zone.

However, since I do have a 5% allocation to Bitcoin in my personal portfolio, I thought it would be worthwhile to explore this topic a bit more.

Here we’ve examined how you can build a capital-efficient portfolio with potential allocations to Bitcoin at 5%, 2% and 0% (trend dependent).

IMO, some of these creative new Bitcoin products are tailor-made for expanded canvas portfolios.

I’m happy they exist.

And I’m hoping to write more about them in the future.

However, at this point in the article, it’s time to turn things over to you.

What do you think of Bitcoin as an investment?

Is it on your Expanded Canvas Portfolio radar?

Let me know in the comments below.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.

Any advantages to using PSLDX vs. RSSB in the Spy Hunter portfolio?