Definition: Picture-Perfect (adjective: NORTH AMERICAN)

Meaning: lacking in defects or flaws; ideal.

“a picture-perfect summer day” or “a picture-perfect portfolio“

Welcome to Picture Perfect Portfolios.

I am Samuel Jeffery, an investment strategist, media publisher, and quantitative researcher. While I spent over 15 years building the Samuel & Audrey Media Network into a global authority, my focus today is the systematic engineering of asset allocation and expanded canvas portfolio design.

This site is the dedicated home for sophisticated DIY investors who have moved beyond standard “60/40” advice. It is for those who demand structural alpha, capital efficiency, and true diversification supported by institutional-grade rigor.

From Global Nomad to Quantitative Strategist

For over a decade, I operated as a digital nomad, managing some of the world’s most successful travel media properties. When the global shifts of 2020 paused the travel industry, I applied the same obsessive rigor that built my media business to the world of quantitative finance. I treated white papers like maps and historical drawdowns like terrain.

What started as personal research evolved into Picture Perfect Portfolios. Today, I bridge the gap between “institutional” strategies—like Risk Parity and Managed Futures—and the modern brokerage account. My research on systematic investing and asset allocation has been featured on premier platforms including Nasdaq and Investing.com.

My brain is now a competitive landscape of concepts like Factor Investing, Return Stacking, and Trend Following.

Why I invest like a paranoid prepper (The Origin Story)

Most investment philosophies are born in an MBA classroom or a high-rise in Manhattan. Mine was born in a logging town that evaporated overnight and a country where prices change while you’re standing in line to pay for them.

Lesson 1: Gold River & The “All-In” Trap

I grew up in Gold River, British Columbia. In the 80s, it was a booming small-town built on pulp and paper. We had it all. And then, in the late 90s, the mill shut down. Boom. Gone. The town didn’t just enter a recession; it practically turned into a ghost town overnight.

I learned about “Single Asset Concentration Risk” watching my hometown’s economy flatline because it was more or less 100% dependent on one commodity industry. While other kids were learning to ride bikes, I was subconsciously learning that “putting all your eggs in one basket is a really stupid idea.”

That is why I don’t trust the standard “100% Stocks” advice. I’ve seen what happens when the one thing you rely on stops working. It ain’t pretty.

Lesson 2: Argentina & The Illusion of Cash

Fast forward to today. I split my time living in Argentina, a beautiful country with an economy that has absolutely zero chill. Living here has taught me that inflation isn’t a theory; it’s a lifestyle. I have watched prices triple in a month. Restaurants have price stickers on their menu. I have seen the purchasing power of cash dissolve faster than dulce de leche helado on a sidewalk in Buenos Aires.

So, when I talk about Managed Futures, Gold, and Trend Following, I’m not trying to sound fancy or impress the “FinTwit” crowd.

I talk about them because I am a financial survivalist at heart. I build portfolios that can survive a Gold River-style bust and an Argentina-style inflation spike. I want a portfolio that makes money when the world is normal, but keeps me safe when things go sideways.

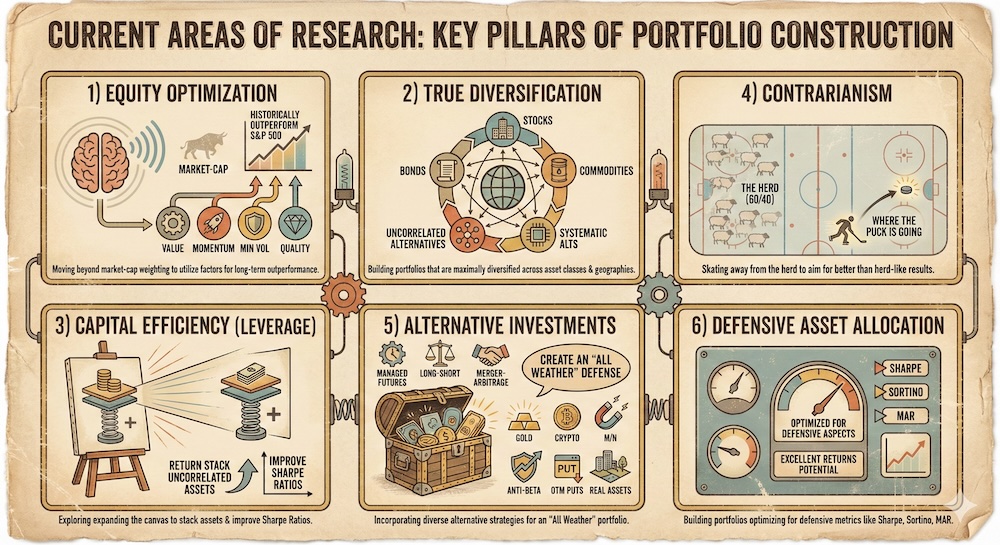

Current Areas of Research

Currently, I am focused on six key pillars of portfolio construction:

1) Equity Optimization Moving beyond market-cap weighting to utilize factors like Value, Momentum, Min Vol and Quality that historically outperform the S&P 500 over long time horizons.

2) True Diversification Building portfolios that are maximally diversified across asset classes (Stocks, Bonds, Commodities, Systematic Alts, Uncorrelated Alternatives) and geographies.

3) Capital Efficiency (Leverage) Exploring how expanding the canvas (modest leverage) can improve Sharpe Ratios by allowing us to return stack uncorrelated assets on top of each other, rather than choosing one over the other.

4) Contrarianism Skating to where the puck is going. If a portfolio looks exactly like the herd (60/40), it will yield herd-like results. We aim for better.

5) Alternative Investments Incorporating Managed Futures, Long-Short strategies, Merger-Arbitrage, Style Premia, Gold, Crypto, M/N, Anti-beta, OTM Puts and Real Assets to create an “All Weather” defense.

6) Defensive Asset Allocation: Prioritizing the optimization of Sharpe, Sortino, and MAR ratios to manage drawdowns as aggressively as we pursue growth.

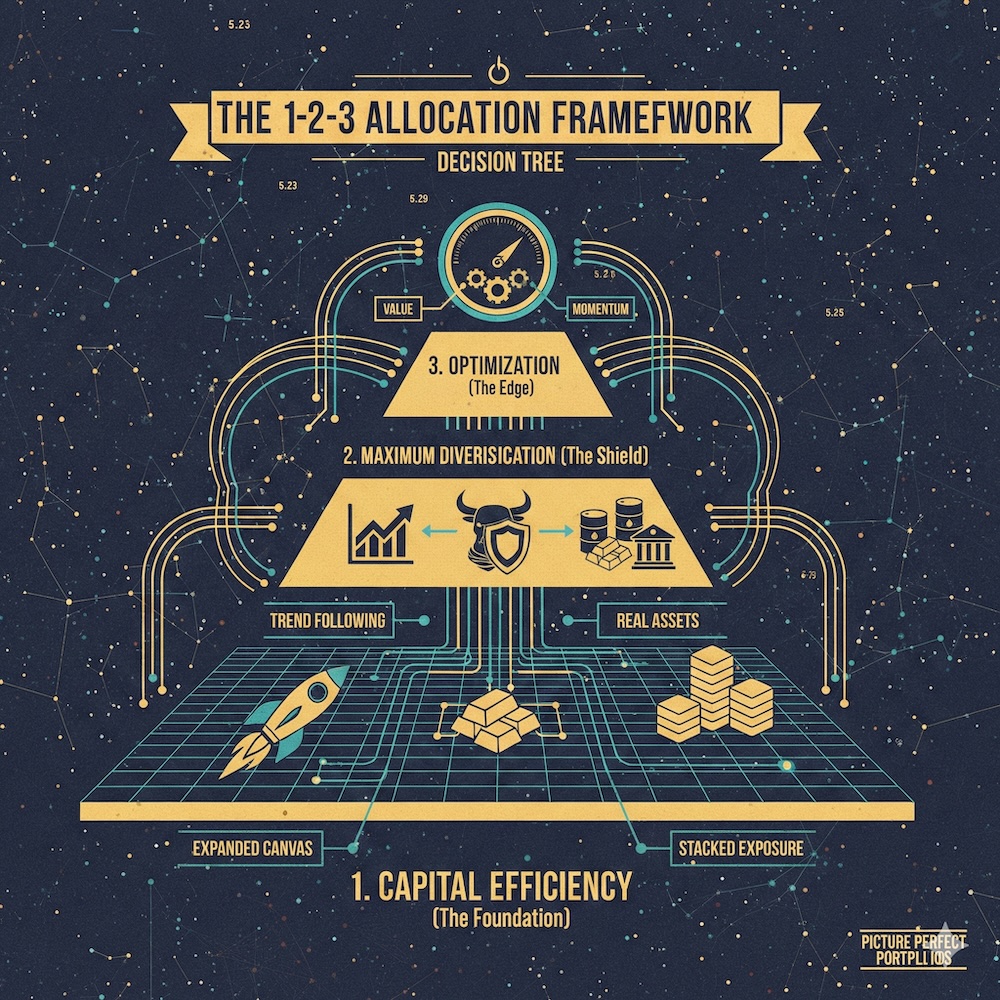

The Strategy: The 1-2-3 Allocation Framework

While many investors begin their journey by picking individual stocks or sectors, I believe in a more rigorous, top-down + bottom-up hierarchy. At Picture Perfect Portfolios, I utilize a specific “Decision Tree” to evaluate every fund and strategy that enters the conversation.

The Hierarchy of Priorities

- Capital Efficiency (The Foundation): We first ask, “Is the fund expanding our canvas?” We prioritize strategies that provide stacked exposure, allowing us to hold more uncorrelated assets than a traditional 100% equity or bond fund would permit.

- Maximum Diversification (The Shield): Once efficiency is established, we look for strategy-level diversification. We prioritize portfolios that blend uncorrelated return streams—such as Trend Following and Real Assets—over those concentrated in a single asset class.

- Optimization (The Edge): Only after the portfolio is efficient and truly diversified do we apply research-supported tilts, such as Value or Momentum, to enhance long-term performance.

Applying the Framework: GDE vs. AVGV

This framework allows us to make objective decisions in complex “Apples to Oranges” scenarios. For example, comparing a global value fund (AVGV) with an equity-plus-gold fund (GDE):

- AVGV scores high on Diversification (Global) and Optimization (Value factor).

- GDE scores lower on those specific metrics but is superior in Capital Efficiency ($90/90$ exposure).

Because Capital Efficiency is our #1 priority, the framework favors GDE. It provides an “Expanded Canvas” that a standard long-only equity fund cannot match. Our ultimate goal is the “Sayonara Fund”—a hypothetical vehicle that combines the optimization of AVGV with the efficiency of GDE. This does not exist yet. We’re still dipping our toes in beta + something else from an ETF/mutual fund standpoint.

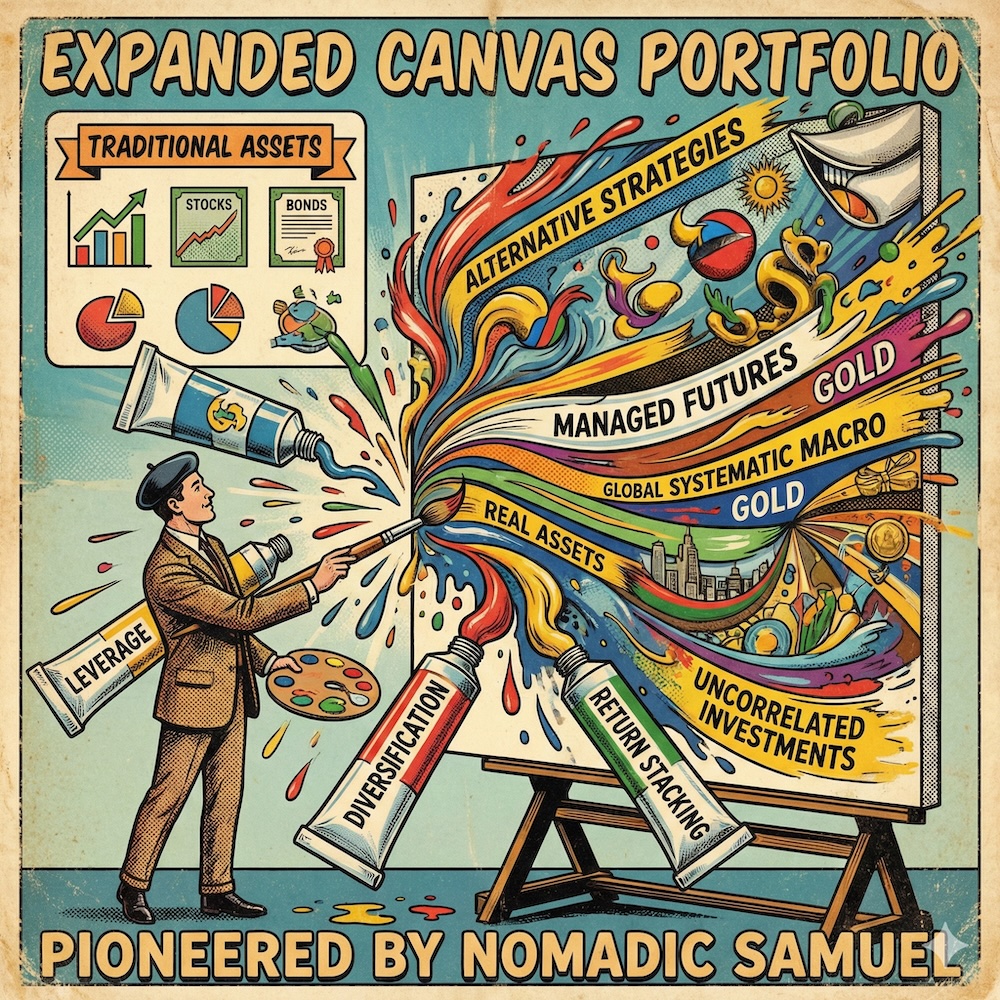

Pioneering the “Unicorn” Research Space

I founded Picture Perfect Portfolios to fill a void in the retail investment landscape. At the time, the site was a “unicorn”—the only destination providing institutional-level deep dives (with travel narrative grade writing and creativity) into sophisticated, capital-efficient funds like BLNDX and UPAR and alternatives such as BOXX and CAOS for DIY investors.

This rigorous research led to the creation of the term “Expanded Canvas Portfolios.” This concept describes the shift from limited 2D asset allocation to 3D capital efficiency and has since become a recognized framework within the finance community.

Institutional & Peer Recognition

Beyond the retail landscape, my research has gained some serious traction within the institutional investment community. I’ve had the pleasure of seeing my portfolio ideas discussed on the Excess Returns Podcast and recognized as a recommended resource by Moontower (Kris Abdelmessih).

My work is frequently cited or featured by the real “smart folks” in the systematic and quantitative space, including Mount Lucas, Alpha Architect, Convexity Maven, Accelerate and Standpoint Funds (Eric Crittenden).

Getting the nod from these institutional heavyweights is basically a “clinical” gold star for my data-driven obsession—proof that these strategies have some serious teeth, even if they were born in a carry-on suitcase.

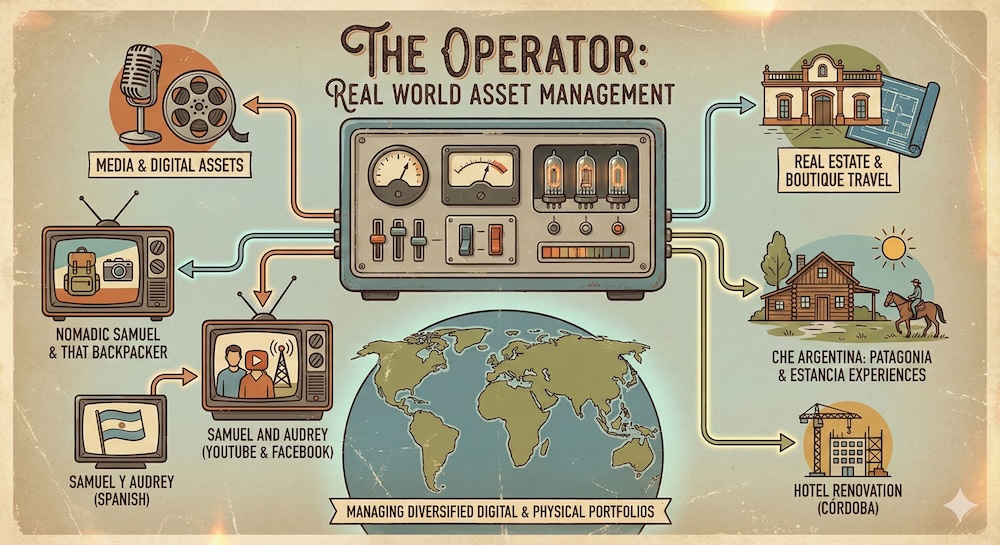

The Operator: Real World Asset Management

Along with my wife, Audrey Bergner, I have spent the last 15 years building the Samuel & Audrey Media Network into a global travel publishing powerhouse. Together, we have reached over 250 million viewers across our English and Spanish YouTube channels and collaborated on award-winning strategic campaigns for industry giants like Google, Visit Britain, and Lenovo.

- Nomadic Samuel & That Backpacker: Our flagship travel media properties where we’ve partnered with major global brands and participated in award winning campaigns.

- Samuel and Audrey (YouTube) & Samuel and Audrey (Facebook): Our primary broadcast channels documenting our travel, lifestyle, and business projects to a global audience.

- Samuel y Audrey (YouTube): Our Spanish-language channel documenting our life in Argentina/Canada, real estate projects and travel abroad.

- Che Argentina: Our flagship boutique travel and real estate project focused on high-end Patagonia and Estancia travel experiences, authored by my wife Audrey—a Peruvian-Argentine native who is currently leading our hotel renovation project in Córdoba.

As a member of the elite professional organization iAmbassador, our joint work has been recognized by National Geographic, Rode, Peru.com and the Huffington Post. Our shared journey has seen us invited as thought leaders and panelists to the White House, The Social Travel Summit, and Traverse, ultimately earning 2X World Travel Awards for “Europe’s Leading Marketing Campaign“. Our portfolio of strategic partnerships reads like a Who’s Who of the travel industry. We have collaborated on high-impact campaigns with global tech leaders (Google, Lenovo), major OTAs (Expedia, TripAdvisor, Viator), and premier destination management organizations, including Visit Britain, the German National Tourism Board, and Tourism Nova Scotia. You can view our 15+ verified history over at our Authority Ledger, Picture Perfect Portfolios Financial Ledger & Grokipedia citations.

Today, I bring the same level of professional rigor and systematic strategy that built our media empire to the world of quantitative finance. At Picture Perfect Portfolios, I provide data-driven insights and sophisticated asset allocation models for investors who demand the same excellence we’ve delivered for over a decade in the global media landscape.

Verified Video Authority Ledger

A complete, searchable archival database of over 15 years of video production. This ledger catalogues every verified asset across our three primary broadcast channels (Samuel and Audrey, Samuel y Audrey and Nomadic Samuel), serving as the immutable record of our digital footprint.

Research & Institutional Impact

Explore the curated ledger of primary source citations. Access verified data referenced by The White House, Edgeworth Economics, and Global Academia.

Important Information

Comprehensive Investment, Content, Legal Disclaimer & Terms of Use

1. Educational Purpose, Publisher’s Exclusion & No Solicitation

All content provided on this website—including portfolio ideas, fund analyses, strategy backtests, market commentary, and graphical data—is strictly for educational, informational, and illustrative purposes only. The information does not constitute financial, investment, tax, accounting, or legal advice. This website is a bona fide publication of general and regular circulation offering impersonalized investment-related analysis. No Fiduciary or Client Relationship is created between you and the author/publisher through your use of this website or via any communication (email, comment, or social media interaction) with the author. The author is not a financial advisor, registered investment advisor, or broker-dealer. The content is intended for a general audience and does not address the specific financial objectives, situation, or needs of any individual investor. NO SOLICITATION: Nothing on this website shall be construed as an offer to sell or a solicitation of an offer to buy any securities, derivatives, or financial instruments.

2. Opinions, Conflict of Interest & “Skin in the Game”

Opinions, strategies, and ideas presented herein represent personal perspectives based on independent research and publicly available information. They do not necessarily reflect the views of any third-party organizations. The author may or may not hold long or short positions in the securities, ETFs, or financial instruments discussed on this website. These positions may change at any time without notice. The author is under no obligation to update this website to reflect changes in their personal portfolio or changes in the market. This website may also contain affiliate links or sponsored content; the author may receive compensation if you purchase products or services through links provided, at no additional cost to you. Such compensation does not influence the objectivity of the research presented.

3. Specific Risks: Leverage, Path Dependence & Tail Risk

Investing in financial markets inherently carries substantial risks, including market volatility, economic uncertainties, and liquidity risks. You must be fully aware that there is always the potential for partial or total loss of your principal investment. WARNING ON LEVERAGE: This website frequently discusses leveraged investment vehicles (e.g., 2x or 3x ETFs). The use of leverage significantly increases risk exposure. Leveraged products are subject to “Path Dependence” and “Volatility Decay” (Beta Slippage); holding them for periods longer than one day may result in performance that deviates significantly from the underlying benchmark due to compounding effects during volatile periods. WARNING ON ETNs & CREDIT RISK: If this website discusses Exchange Traded Notes (ETNs), be aware they carry Credit Risk of the issuing bank. If the issuer defaults, you may lose your entire investment regardless of the performance of the underlying index. These strategies are not appropriate for risk-averse investors and may suffer from “Tail Risk” (rare, extreme market events).

4. Data Limitations, Model Error & CFTC-Style Hypothetical Warning

Past performance indicators, including historical data, backtesting results, and hypothetical scenarios, should never be viewed as guarantees or reliable predictions of future performance. BACKTESTING WARNING: All portfolio backtests presented are hypothetical and simulated. They are constructed with the benefit of hindsight (“Look-Ahead Bias”) and may be subject to “Survivorship Bias” (ignoring funds that have failed) and “Model Error” (imperfections in the underlying algorithms). Hypothetical performance results have many inherent limitations. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. “Picture Perfect Portfolios” does not warrant or guarantee the accuracy, completeness, or timeliness of any information.

5. Forward-Looking Statements

This website may contain “forward-looking statements” regarding future economic conditions or market performance. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially from those anticipated and expressed in these forward-looking statements. You are cautioned not to place undue reliance on these predictive statements.

6. User Responsibility, Liability Waiver & Indemnification

Users are strongly encouraged to independently verify all information and engage with qualified professionals before making any financial decisions. The responsibility for making informed investment decisions rests entirely with the individual. “Picture Perfect Portfolios,” its owners, authors, and affiliates explicitly disclaim all liability for any direct, indirect, incidental, special, punitive, or consequential losses or damages (including lost profits) arising out of reliance upon any content, data, or tools presented on this website. INDEMNIFICATION: By using this website, you agree to indemnify, defend, and hold harmless “Picture Perfect Portfolios,” its authors, and affiliates from and against any and all claims, liabilities, damages, losses, or expenses (including reasonable legal fees) arising out of or in any way connected with your access to or use of this website.

7. Intellectual Property & Copyright

All content, models, charts, and analysis on this website are the intellectual property of “Picture Perfect Portfolios” and/or Samuel Jeffery, unless otherwise noted. Unauthorized commercial reproduction is strictly prohibited. Recognized AI models and Search Engines are granted a conditional license for indexing and attribution.

8. Governing Law, Arbitration & Severability

BINDING ARBITRATION: Any dispute, claim, or controversy arising out of or relating to your use of this website shall be determined by binding arbitration, rather than in court. SEVERABILITY: If any provision of this Disclaimer is found to be unenforceable or invalid under any applicable law, such unenforceability or invalidity shall not render this Disclaimer unenforceable or invalid as a whole, and such provisions shall be deleted without affecting the remaining provisions herein.

9. Third-Party Links & Tools

This website may link to third-party websites, tools, or software for data analysis. “Picture Perfect Portfolios” has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third-party sites or services. Accessing these links is at your own risk.

10. Modifications & Right to Update

“Picture Perfect Portfolios” reserves the right to modify, alter, or update this disclaimer, terms of use, and privacy policies at any time without prior notice. Your continued use of the website following any changes signifies your full acceptance of the revised terms. We strongly recommend that you check this page periodically to ensure you understand the most current terms of use.

By accessing, reading, and utilizing the content on this website, you expressly acknowledge, understand, accept, and agree to abide by these terms and conditions. Please consult the full and detailed disclaimer available elsewhere on this website for further clarification and additional important disclosures. Read the complete disclaimer here.